Bank Reconciliation Statement - 2 Chapter Notes | Accounting for CA Foundation PDF Download

Procedure for Reconciling the Cash Book Balance with the Pass Book Balance

Before proceeding further, students must understand that ‘Dr. balance as per cash book’ means deposits in the bank or cash at bank or Cr. balance as per pass book. Similarly, ‘Cr. balance as per cash book’ means excess amount over deposits withdrawn by the account holder or overdraft balance or Dr. balance as per pass book. It means that students can be required to start bank reconciliation from any of the following four balances as may be given in the question:

While doing reconciliation, the following types of problems can be given:-

When causes of differences are known then students can start reconciliation by taking any of the balance stated above and proceed further with the causes. Given the causes of disagreement, the balance of the other book can be either more or less on account of the said causes. If the balance of the other book is more on account of the said causes, then add the amount. If the balance of the other book is less on account of the said causes, then subtract the amount.

For example, if the reconciliation is initiated with Dr. balance as per the cash book and there is a cheque deposited in the bank but not yet cleared, then on account of non-clearance of the cheque, the Cr. balance of the pass book would be less. In this case, the amount of cheque should be subtracted from the cash book balance to arrive at the balance as per the pass book. Similarly, after making all the adjustments the balance as per the other book is obtained. It is necessary to note here that if a student starts from debit balance of cash book and after all adjustments the balance arrived is positive then it is known as Cr. balance as per the pass book and if the balance is negative then it is said to be Dr. balance as per the pass book and vice-versa.

But if causes of differences are not known then one has to compare the debit entries of cash book with the credit entries of the pass-book and vice-versa. The entries, which do not tally in the course, are the causes of difference in the balances of both the books. Once the causes are located their effects on both the books are analysed and then reconciliation statement is prepared to arrive at the actual bank balance.

In this procedure students, should also take into care that whether opening balance of both the books at particular point of time from where the books are compared, tallies or not. If opening balances are not same then unticked items are divided into two categories i.e., one relating to reconciliation of opening balance and other relating to reconciliation of closing balance.

Example 8: Jolly Ltd has following entries in its cash book and pass book: Here when we compare Cash Book and Pass Book we found that following 2 entries remain unticked in pass book i.e. they don’t appear in cash book:Cheque to Mr. A - ₹ 30,000Bank Charges - ₹ 2,000

Here when we compare Cash Book and Pass Book we found that following 2 entries remain unticked in pass book i.e. they don’t appear in cash book:Cheque to Mr. A - ₹ 30,000Bank Charges - ₹ 2,000

Excess withdrawals as per pass book - ₹ 32,000

However if we notice that difference between closing balances of two books is only ₹ 2,000 but at the same time there is a difference of ₹30,000 in opening balances as well. Thus, we need to bifurcate the unticked items as:

Methods of Bank Reconciliation

There are following two methods of reconciling the bank balances:

Bank Reconciliation Statement without Preparation of adjusted Cash-Book

For reconciliation purposes students can take any of the four balances as the starting point and can proceed further with the causes of differences.

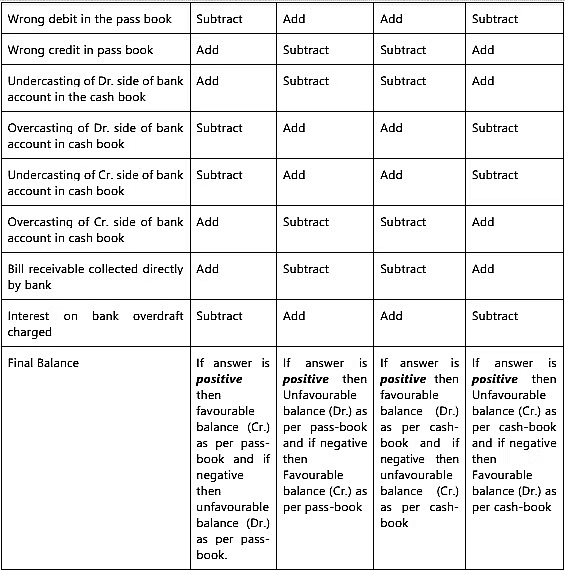

Based on the earlier explanation the following table has been prepared for student’s ready reference when reconciliation is done on the basis of ‘Balance’ presentation. The final balance, which will come after addition and subtraction, will be the balance as per the other book (on the opposite side).

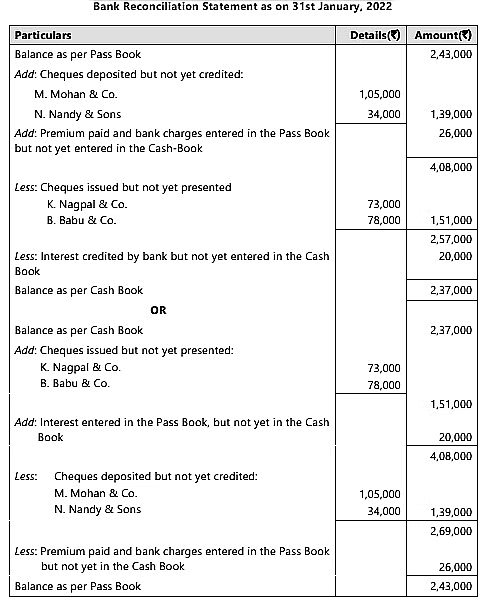

It is proper to prepare a neat statement showing the reconciliation of the two balances. Taking the example given in the illustration 1, the statement may be prepared as follows:

- ‘Balance’ presentation.

- ‘Plus & Minus’ presentation.

1. As per Balance Presentation:

2. As per Plus-Minus Presentation

Illustration 2: From the following particulars, prepare a Bank Reconciliation Statement for Jindal offset Ltd.

- Balance as per cash book is ₹ 2,40,000

- Cheques issued but not presented in the bank amounts to ₹ 1,36,000.

- Cheques deposited in bank but not yet cleared amounts to ₹ 90,000.

- Bank charges amounts to ₹ 300.

- Interest credited by bank amounts to ₹ 1,250.

- The balance as per pass book is ₹ 2,86,950.

Sol:

Illustration 3: On 31st March 2022, the Bank Pass Book of Namrata showed a balance of ₹ 1,50,000 to her credit while balance as per cash book was ₹ 1,12,050. On scrutiny of the two books, she ascertained the following causes of difference:

i) She has issued cheques amounting to ₹ 80,000 out of which only ₹ 32,000 were presented for payment.

ii) She received a cheque of ₹ 5,000 which she recorded in her cash book but forgot to deposit in the bank.

iii) A cheque of ₹ 22,000 deposited by her has not been cleared yet.

iv) Mr. Gupta deposited an amount of ₹ 15,700 in her bank which has not been recorded by her in Cash Book yet.

v) Bank has credited an interest of ₹ 1,500 while charging ₹ 250 as bank charges. Prepare a bank reconciliation statement.

Sol:

Bank Reconciliation Statement as on 31st March, 2022

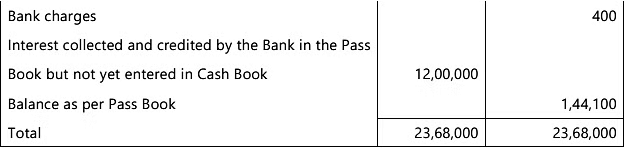

Illustration 4: From the following particulars ascertain the balance that would appear in the Bank Pass Book of A on 31st December, 2022.

- The bank overdraft as per Cash Book on 31st December, 2022 ₹ 6,340.

- Interest on overdraft for 6 months ending 31st December, 2022 ₹ 160 is entered in Pass Book.

- Bank charges of ₹ 400 are debited in the Pass Book only.

- Cheques issued but not cashed prior to 31st December, 2022, amounted to ₹ 11,68,000.

- Cheques paid into bank but not cleared before 31st December, 2022 were for ₹ 22,17,000.

- Interest on investments collected by the bank and credited in the Pass Book ₹ 12,00,000.

Sol:

The above illustration can also be presented with the column for “Plus” and “Minus.”

Bank Reconciliation Statement after the Preparation of adjusted Cash-Book

Meaning of adjusted cash book

When the balance in the cash book is first adjusted for certain adjustments before taking it to the bank reconciliation statement, then it is known as adjusted cash book balance. Adjusting the cash-book before preparing the bank reconciliation statement is completely optional, if reconciliation is done during different months. But if reconciliation is done at the end of the accounting year or financial year, the cash-book must be adjusted so as to reflect the correct bank balance in the balance sheet.

While adjusting the cash-book the following adjustments are considered:-

1. All the errors (like incorrect amount recorded in the cash-book, entry posted twice in the cash-book, over/undercasting of the balance etc.) and

2. Omissions (like bank charges recorded in the pass-book only, interest debited by the bank, direct receipt or payment by the bank, dishonour of cheques/bills etc.) by the cash-book are taken into care Only above transactions are considered for adjusting cash book. Apart from this, any delay in recording in the pass-book due to difference in timing (like cheque issued but not presented for payment, cheque deposited but not cleared) is taken to bank reconciliation statement. This adjusted cash-book balance is taken to bank reconciliation statement.

Errors occurring in the pass-book are not to be adjusted in the cash book. All the adjustments considered in the adjusted cash-book are not carried again to the Bank Reconciliation Statement.

Illustration 5: On 30th September, 2022, the bank account of X, according to the bank column of the CashBook, was overdrawn to the extent of ₹ 4,062. On the same date the bank statement showed a credit balance of ₹ 20,758 in favour of X. An examination of the Cash Book and Bank Statement reveals the following:

- A cheque for ₹ 13,14,000 deposited on 29th September, 2022 was credited by the bank only on 3rd October, 2022.

- A payment by cheque for ₹ 16,000 has been entered twice in the Cash Book.

- On 29th September, 2022, the bank credited an amount of ₹ 1,17,400 received from a customer of X, but the advice was not received by X until 1st October, 2022.

- Bank charges amounting to ₹ 580 had not been entered in the Cash Book.

- On 6th September, 2022, the bank credited ₹ 20,000 to X in error.

- A bill of exchange for ₹ 1,40,000 was discounted by X with his bank. This bill was dishonoured on 28th September, 2022 but no entry had been made in the books of X.

- Cheques issued upto 30th September, 2022 but not presented for payment upto that date totalled ₹ 13,26,000.

You are required:

(a) to show the appropriate rectifications required in the Cash Book of X, to arrive at the correct balance on 30th September, 2022 and

(b) to prepare a bank reconciliation statement as on that date.

Sol:

(a)

(b)

Note: Bank has credited X by 20,000 in error on 6th September, 2022. If this mistake is rectified in the bank statement, then this will not be deducted in the above statement along with ₹ 13,26,000 resulting in credit balance of ₹ 758 as per pass-book.

Illustration 6: On 30th December, 2022 the bank column of A. Philip’s cash book showed a debit balance of ₹ 4,610. On examination of the cash book and bank statement you find that:

- Cheques amounting to ₹ 6,30,000 which were issued to trade payables and entered in the cash book before 30th December, 2022 were not presented for payment until that date.

- Cheques amounting to ₹ 2,50,000 had been recorded in the cash book as having been paid into the bank on 30th December, 2022, but were entered in the bank statement on1st January, 2023.

- A cheque received for ₹ 73,000 had been dishonoured prior to 30th December, 2022, but no record of this fact appeared in the cash book.

- A dividend of ₹ 3,80,000, paid direct to the bank had not been recorded in the cash book.

- Bank interest and charges amounting to ₹ 4,200 had been charged in the bank statement but not entered in the cash book.

- No entry had been made in the cash book for a trade subscription of ₹ 10,000 paid vide banker’s order in November, 2022.

- A cheque for ₹ 27,000 drawn by B. Philip had been charged to A. Philip’s bank account by mistake in December, 2022.

You are required:

(a) to make appropriate adjustments in the cash book bringing down the correct balance, and

(b) to prepare a statement reconciling the adjusted balance in the cash book with the balance shown in the bank statement.

Sol:

(a)

(b)

Illustration 7: From the following information, prepare a Bank reconciliation statement as at 31st December, 2022 for Messrs New Steel Limited:

Sol:

Illustration 8: The Cash Book of Mr. Gadbadwala shows ₹ 8,36,400 as the balance at Bank as on 31st December, 2022, but you find that it does not agree with the balance as per the Bank Pass Book. On scrutiny, you find the following discrepancies:

- On 15th December, 2022 the payment side of the Cash Book was undercast by ₹ 10,000.

- A cheque for ₹ 1,31,000 issued on 25th December, 2022 was not taken in the bank column.

- One deposit of ₹ 1,50,000 was recorded in the Cash Book as if there is no bank column therein.

- On 18th December, 2022 the debit balance of ₹ 15,260 as on the previous day, was brought forward as credit balance in the Cash book.

- Of the total cheques amounting to ₹ 11,514 drawn in the last week of December, 2022, cheques aggregating ₹ 7,815 were encashed in December.

- Dividends of ₹ 25,000 collected by the Bank and subscription of ₹ 1,000 paid by it were not recorded in the Cash Book.

- One out-going Cheque of ₹ 3,50,000 was recorded twice in the Cash Book. Prepare a Reconciliation Statement.

Sol: (If the books are not closed on 31st December, 2022)

If the books are to be closed on 31st December, then adjusted cash book will be prepared as given below:

If the books are to be closed on 31st December, then adjusted cash book will be prepared as given below:

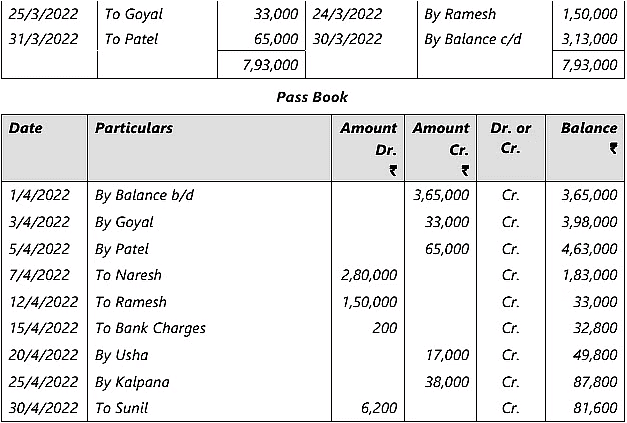

Illustration 9: The following are the Cash Book (bank column) and Pass Book of Jain for the months of March, 2022 and April, 2022:

Reconcile the balance of cash book on 31/3/2022.

Sol:

- On scrutiny of the debit side of the Cash Book of March 2022 and receipt side of the Pass Book of April, 2022 reveals that two cheques deposited in Bank (Goyal ₹ 33,000 and Patel ₹ 65,000) in March were not credited by the Bank till 31/3/2022.

- On scrutiny of the credit side of the cash book and payment side of the Pass Book reveals that a cheque issued to Ramesh for ₹ 1,50,000 in March 2022, had not been presented for payment in Bank till 31/3/2022. Therefore the Bank Reconciliation statement on 31/3/2022 will appear as follows:

Illustration 10: When Nikki & Co. received a Bank Statement showing a favourable balance of ₹ 10,39,200 for the period ended on 30th June, 2022, this did not agree with the balance in the cash book. An examination of the Cash Book and Bank Statement disclosed the following :

- A deposit of ₹ 3,09,200 paid on 29th June, 2022 had not been credited by the Bank until 1st July, 2022.

- On 30th March, 2022 the company had entered into hire purchase agreement to pay by bank order a sum of ₹ 3,00,000 on the 10th of each month, commencing from April, 2022. No entries had been made in Cash Book.

- A customer of the firm, who received a cash discount of 4% on his account of ₹ 4,00,000 paid the firm a cheque on 12th June. The cashier erroneously entered the gross amount in the bank column of the Cash Book.

- Bank charges amounting to ₹ 3,000 had not been entered in Cash-Book.

- On 28th June, a customer of the company directly deposited the amount in the bank ₹ 4,00,000, but no entry had been made in the Cash Book.

- ₹ 11,200 paid into the bank had been entered twice in the Cash Book.

- A debit of ₹ 11,00,000 appeared in the Bank Statement for an unpaid cheque, which had been returned marked ‘out of date’. The cheque had been re-dated by the customer and paid into Bank again on 5th July, 2022.

Prepare Bank Reconciliation Statement on 30 June, 2022.

Sol:

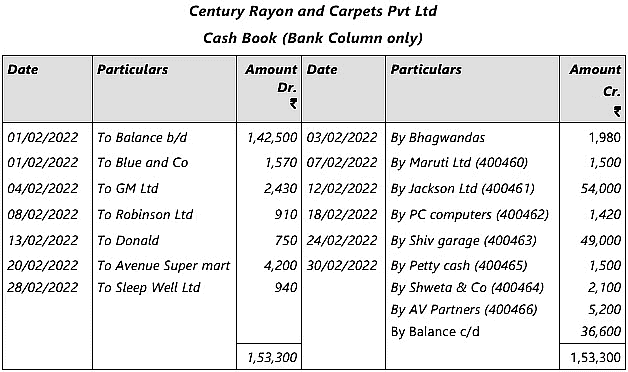

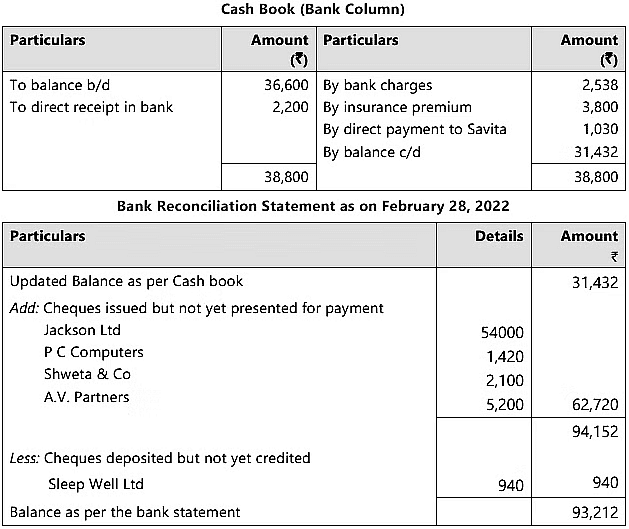

Illustration 11: Mr. Manoj is employed by Century Rayon and Carpets Pvt Ltd. as their cashier. The main responsibility of Mr. Manoj is to maintain the company’s cash book and prepare a bank reconciliation statement at the end of each month. The cash book (only bank column) is set out below together with a copy of the bank statement for the month of February 2022. You are required to :

a) Reconcile the cash book with the bank statement.

b) Make necessary entries to update the cash book.

c) Start with the balance as per cash book, list any unpresented cheques and sub-total on the reconcliation statement.

Sol:

In the books of Century Rayon and Carpets Pvt Ltd

a) Journal entries to be posted:

After posting above entries, following will be the updated book of the company.

Summary

- Bank pass book is merely a copy of the customer’s account in the books of bank.

- Bank reconciliation statement is a statement which reconciles the balance as per cash book with the balance as per bank pass book by showing all causes of difference between the two.

- The salient features of bank reconciliation statement:

- The reconciliation will bring out any errors that may have been committed either in the cash book or in the pass book;

- Any undue delay in the clearance of cheques will be shown up by the reconciliation;

- A regular reconciliation discourages the accountant of the bank from embezzlement. There have been many cases when the cashiers merely made entries in the cash book but never deposited the cash in the bank; they were able to get away with it only because of lack of reconciliation.

- It helps in finding out the actual position of the bank balance.

- The difference in the balances of both the books can be because of the following reasons:

- Timing differences,

- Transactions;

- Errors.

- Bank reconciliation can be started from any of the following four balances given in the question:

- Dr. balance as per cash book

- Cr. balance as per cash book

- Dr. balance as per pass book

- Cr. balance as per pass book

- There are two methods of reconciling the bank balances:

- Bank reconciliation statement without preparation of adjusted cash-book.

- Bank reconciliation statement after the preparation of adjusted cash-book.

|

68 videos|160 docs|83 tests

|

FAQs on Bank Reconciliation Statement - 2 Chapter Notes - Accounting for CA Foundation

| 1. What is the purpose of reconciling the cash book balance with the pass book balance? |  |

| 2. What are the common methods used for bank reconciliation? |  |

| 3. How is a bank reconciliation statement prepared after adjusting the cash book? |  |

| 4. What are the key items to look for when reconciling a cash book and pass book? |  |

| 5. Why is it important to maintain an adjusted cash book? |  |

|

Explore Courses for CA Foundation exam

|

|