Solved Questions: Cost Accounting Records, Ledgers and Cost Statements | Cost Accounting - B Com PDF Download

Q1: Following data is available from the cost records of a company for the month of March 2017:

(1) Opening stock of job as on 1st March 2017

Job no. A 99: Direct Material ₹80, Direct Wages ₹150 and Factory Overheads ₹200

Job no. A 77: Direct Material ₹420, Direct Wages ₹450 and Factory Overheads ₹400

(2) Direct material issued during the month of February 2017 was:

Job no A 99 ₹120

Job no A 77 ₹280

Job no A 66 ₹225

Job no A 55 ₹300

(3) Direct labour details for March 2017 were:

(4) Factory Overheads are applied to jobs on production according to direct labour hour rate which is ₹2 per hour.

(5) Factory Overhead incurred in March 2017 were ₹2100.

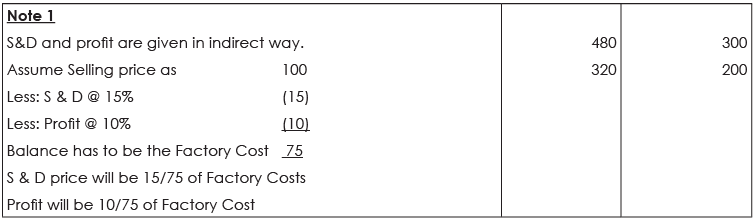

(6) Job numbers A 99 & A 77 were completed during the month. They were billed to the customers at a price which included 15% of the price of the job for Selling & Distribution expenses and another 10% of the price for Profit.

Prepare:

(a) Job cost sheet for job number A 77 and A 99.

(b) Determine the selling price for the jobs.

(c) Calculate the value of work in process.

Sol:

(1) The Factory Overheads actually incurred are ₹ 2100. This amount to be apportioned on the basis of labour hours. So the rate to be considered as ₹ 2.1per unit = (2100/1000) and not ₹2 per unit. If we consider the above mentioned point the calculations for Job Sheets & for the work in progress will change accordingly.

(2) Work in progress is to be calculated for the incomplete jobs hence job no. A 66 and A 55 should only be included in the calculations of work in progress.

Another way to calculate WIP is

Job A 66 and A 55 are in progress & WIP includes only incomplete Jobs.

Q2: Prepare Cost Sheet for an engineering company which produces standard components in batches of 1000 pieces each. A batch passes through three processes viz. Foundry, Machining & Assembly.

The materials used for a batch number 001 were: Foundry 1300 tonnes @ ₹50 per tonne of which 50 tonnes were sent back to stores.

A comparison of actual costs with estimated cost discloses that material and overheads have exceeded the estimates by 20% whereas the estimated labour cost is 10% more than the actual. Show the variances with respect to the estimates.

Sol:

Cost sheets for the Batch number 001

Standard batch size 1000 pieces

Q3: An advertising agency has received an enquiry for which you are supposed to submit the quotation. Bill of material prepared by the production department for the job states the following requirement of material:

Some photography is required for the job. The agency does not have a photographer as an employee. It decides to hire one by paying ₹10000 to him. Estimated job card prepared by production department specifies that service of following employees will be required for this job:

The primary packing material will be required to the tune of ₹4000. Production Overheads 40% of direct cost, while the S & D Overheads are likely to be 25% on Production Cost. The agency expects a profit of 20% on the quoted price. The agency works 25 days in a month and 6 hours a day.

Sol:

Quotation for a Printing Job

Q4: The following figures were extracted from the Trial Balance of a company as on 31st December 2016.

Further details are given as follows:

Closing inventories are Material ₹180000, WIP ₹192000 & FG ₹115000.

Accrued expenses are Direct Labour ₹8000, Indirect Labour ₹1200 & interest ₹2000.

Depreciation should be provided as 5% on Office Appliances, 10% on Machinery and 4% on Buildings.

Heat, light and power are to be distributed in the ratio of 8:1:1 among factory, office and distribution respectively.

Rates & taxes apply as 2/3rd to the factory and 1/3rd to office.

Depreciation on building to be distributed in the ratio of 8:1:1 among factory, office and distribution respectively

Prepare a Cost Sheet showing all important components and also a condensed P & L Account for the year.

Sol:

Q5: PR Ltd. manufactures and sells a typical brand of Tiffin Boxes under its on brand name. The installed capacity of the plant is 1,20,000 units per year distributable evenly over each month of calendar year. The Cost Accountant of the company has informed the following cost structure of the product, which is as follows:

Raw Material ₹ 20 per unit.

Direct Labour ₹ 12 per unit

Direct Expenses ₹ 2 per unit

Variable Overheads ₹ 16 per unit.

Fixed Overhead ₹ 3,00,000.

Semi-variable Overheads are as follows: ₹ 7,500 per month upto 50% capacity & Additional ₹ 2,500 per month for every additional 25% capacity utilization or part thereof.

The plant was operating at 50% capacity during the first seven months of the calendar year 2016, at 100% capacity in the remaining months of the year.

The selling price for the period from 1st Jan, 2016 to 31st July, 2016 was fixed at ₹ 69 per unit. The firm has been monitoring the profitability and revising the selling price to meet its annual profit target of ₹8,00,000. You are required to suggest the selling price per unit for the period from 1st August 2016 to 31st December 2016.

Prepare Cost Sheet clearly showing the total and per unit cost and also profit for the period. 1. from 1st Jan. to 31st July, 2016

2. from 1st Aug. to 31st Dec, 2016.

Sol:

|

106 videos|173 docs|18 tests

|

|

Explore Courses for B Com exam

|

|