Treatment of Normal and Abnormal Loss of Materials | Cost Accounting - B Com PDF Download

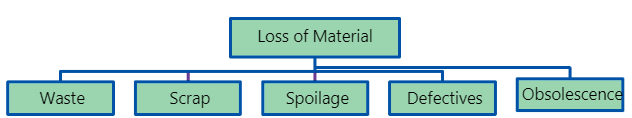

Loss of Material

Materials may incur losses in various forms during handling, storage, or the processing stages, including:

Waste

The portion of raw material lost during storage or production and subsequently discarded. This waste may or may not have any value.

Treatment of Waste:

- Normal: The cost of normal waste is absorbed by efficient production units.

- Abnormal: The cost of abnormal loss is transferred to the Costing Profit and Loss Account.

Scrap

Materials that are discarded and disposed of without further treatment. Scrap generally has little to no value, and sometimes it may be reintroduced into the process as raw material.

Treatment of Scrap:

- Normal: The cost of scrap is borne by proficient units, and income arises when the realizable value is deducted from the cost.

- Abnormal: The scrap account should be charged with the full cost, with credit given to the relevant job or process. Any profit or loss on realization in the scrap account is transferred to the Costing Profit and Loss Account.

Spoilage

Materials badly damaged in manufacturing operations that cannot be economically rectified and are removed from the process for disposal without further processing.

Treatment of Spoilage:

- Normal: The cost of normal spoilage (inherent in the operation) is included in costs by either charging the loss due to spoilage to the production order or charging it to production overhead to spread it over all products. Any value realized from spoilage is credited to the production order or production overhead account, as applicable.

- Abnormal: The cost of abnormal spoilage (arising from causes not inherent in the manufacturing process) is charged to the Costing Profit and Loss Account. If spoiled work results from rigid specifications, the cost of spoiled work is absorbed by good production, while the cost of disposal is charged to production overhead.

Defectives

Units or portions of production that do not meet quality standards. Defectives result from sub-standard materials, poor supervision, inadequate planning, shoddy workmanship, insufficient equipment, and careless inspection.

Defectives that can be remade to meet quality standards using additional materials are known as reworks. Reworks include repairs, reconditioning, and refurbishing. Defectives that cannot be brought up to quality standards are known as rejects. Rejects may be either disposed of or recycled for the production process.

Treatment of Defectives:

- Normal: The cost, less the realizable value on the sale of defectives, is charged to the material cost of good production.

- Abnormal: The material cost of abnormal defectives is not included in the material cost but treated as a loss after giving credit to the realizable value of such defectives. The material cost of abnormal loss is transferred to the Costing Profit and Loss Account.

Reclamation of loss from defective units:

When dealing with spoiled articles, it is crucial to initiate measures to recover as much of the incurred loss as possible. To achieve this objective:

(i) Send all defective units to a designated location;

(ii) Dismantle the defective units;

(iii) Separate goods and serviceable parts, incorporating them into the inventory;

(iv) Isolate parts that can be restored through additional work, sending them to the workshop for necessary procedures, and incorporating them into the inventory after defects have been rectified; and

(v) Assemble parts that cannot be restored into a designated location for melting or sale. Utilize printed forms to record quantities for all the aforementioned purposes.

Difference between Waste and Scrap

Difference between Scrap and Defectives

Distinguishing between spoilage and defectives lies in the fact that spoilage cannot be repaired or reconditioned, whereas defectives can be rectified and subsequently transferred either back to standard production or designated as seconds. The challenge in accounting for defective work revolves around the costs associated with rectification or rework.

Obsolescence

Obsolescence is defined as "the decline in the intrinsic value of an asset due to its supersession."

Treatment: Materials may become obsolete under any of the following circumstances:

(i) If it is a spare part or a component of machinery used in manufacturing, and that machinery becomes obsolete;

(ii) If it is used in the manufacture of a product that has become obsolete;

(iii) If the material itself is replaced by another material due to either improved quality or a fall in price.

In all three cases, the value of the obsolete material held in stock represents a total loss, and immediate steps should be taken to dispose of it at the best available price. The loss resulting from obsolete materials as an abnormal loss does not constitute part of the cost of manufacture.

|

106 videos|173 docs|18 tests

|

FAQs on Treatment of Normal and Abnormal Loss of Materials - Cost Accounting - B Com

| 1. What is the concept of material treatment in the context of business? |  |

| 2. What is the difference between normal loss and abnormal loss of materials? |  |

| 3. How are normal losses of materials accounted for in business? |  |

| 4. How are abnormal losses of materials treated in business accounting? |  |

| 5. What are some measures that businesses can take to minimize material losses? |  |

|

Explore Courses for B Com exam

|

|