Nature, Objective and Scope of Audit | Auditing and Ethics for CA Intermediate PDF Download

Meaning of Audit

- Audit is an independent examination of Financial Information of an Entity which may be profit oriented or not; irrespective of its size and legal structure. The objective of such an examination is to express an opinion on the Financial Statements.

Points to be Considered while Conducting an Audit

- The Person carrying out the Audit (Auditor) should at all times ensure that the Financial Statements and their Audit thereof should not mislead anybody;

- Auditor should be an independent person. In other words, one can say that he should not have any bias in his approach;

- He should not have any direct or indirect relationship or connection with the Client;

- The Financial Statements have been prepared by using acceptable accounting policies and adhering to prevalent regulations;

- The books of accounts maintained by the Client represent a true and fair view and are adequately backed up by sufficient and appropriate audit evidence;

- The information conveyed by the statements is clear and unequivocal.

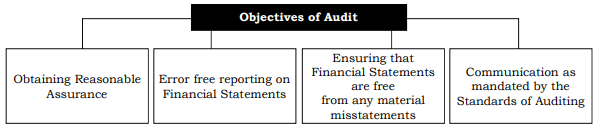

Objectives of Audit

- As per SA 200 'Overall Objectives of the Independent Audit and the Conduct of an Audit in accordance with SAs'

- The purpose of an audit is to provide an objective independent examination of the financial statements.

- This process increases the value and credibility of the financial statements produced by management.

- It aims to increase user confidence in the financial statements and reduce investor risk.

Scope of Audit

- The audit should cover all aspects of the financial statements of an entity being audited.

- The auditor must obtain reasonable assurance regarding the reliability and sufficiency of information in the accounting records for preparing financial statements.

- When forming an opinion, the auditor must ensure that relevant information is properly communicated in the financial statements.

- Reliability and sufficiency of information are assessed by studying the accounting system and internal controls.

- The auditor compares financial statements with accounting records to verify proper communication and disclosure.

- Auditors should not undertake responsibilities beyond their competence.

Principal Aspects Covered in Audit

- Examination of accounting and internal control structures to ensure proper recording of transactions.

- Reviewing systems to identify inadequacies that could lead to unnoticed errors or fraud.

- Verification of arithmetical accuracy in books of account.

- Validating transactions by examining entries with supporting documents.

- Distinguishing between capital and revenue items and adjusting amounts accordingly.

- Comparing financial statements with underlying records for accuracy.

- Verifying assets' title, existence, and value.

- Validating liabilities stated in the balance sheet.

- Ensuring the truth and fairness of profit and loss results.

- Confirming statutory compliance for corporate audits.

- Reporting to appropriate entities on the accuracy and fairness of financial statements.

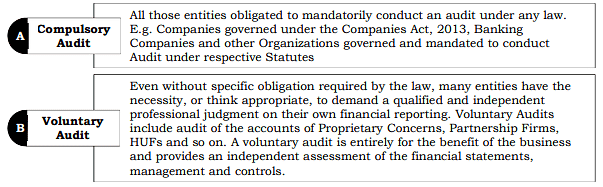

Types of Audit

Audit is not a legal obligatory function or process to be followed strictly by all the entities.

Advantages of Audit of Financial Statements

The aim of the audit is to verify that the financial statements have been made properly and meet the criteria set out under various Statutes. The auditing of financial statements provides so many benefits that it can be worthwhile even if the entity has no legal obligation to do so.

- Safeguarding the financial interest of the persons who are not directly associated with the management and administration of the entity;

- Audit activity acts as a moral check on the employees thereby preventing them from indulging in fraudulent activities like embezzlement, defalcations etc.;

- Helps in settling liability or claims for taxes and other statutory payments;

- Useful for settling trade disputes regarding claims related to wages, bonus or some other calamity;

- Helps in the detection of wastages and losses especially those occurring due to inadequacy of internal checks and control measures;

- Audit helps in ensuring that necessary books of account and auxiliary records have been properly kept and maintained;

- Audit function assists in reviewing the operations of various control measures;

- Audit functions are of great help at the time of settlement of accounts at the time of entry and exit of Partner(s);

- Various authorities most of the time require audited and certified statement before issuing licenses or permissions.

Inherent Limitations of Audit

Inherent limitations are features of an audit that constrain the auditor from obtaining absolute assurance. These limitations prevent auditors from guaranteeing users of financial statements that the statements are completely free from material misstatements. Here are the reasons for the inherent limitations of an audit:

- Management often uses estimations in financial reporting, introducing inaccuracies.

- The judgment and decisions made by management in preparing financial statements can lead to uncertainties and inaccuracies.

- Management may intentionally or unintentionally withhold relevant information from the auditor, resulting in faulty reporting.

- Auditors lack the investigative powers to search and probe beyond the provided information.

- Time and cost constraints, while not justifying shortcuts in audit procedures, are inherent limitations.

- The relevance and adequacy of information significantly impact the effectiveness of an audit.

- Frauds are challenging to detect as they are often well-planned to evade ordinary audit procedures.

- Non-compliance with laws, whether statutory or non-statutory, poses a serious threat to the efficiency of an audit.

International Auditing and Assurance Standard Board

In the International Federation of Accountants (IFAC) was set up with a view to bringing harmony in the profession of accountancy on an international scale. For achieving this purpose, the IFAC Board has established International Auditing and Assurance Standard Board (IAASB). ISSAB is an independent body which issued standards, like the International Standards on Auditing, Quality Control Guidelines and other services, to support the international auditing of financial statements.

Ways ISSAB Achieves Its Objectives:

- Establishing the high quality standards and guidance for financial audits that are in adherence to applicable laws and regulations;

- Establishing the high quality standards and guidance for other types of assurance services inclusive of financial and non-financial matters;

- Establishing the high quality standards and guidance for related services;

- Establishing the high quality standards for quality control;

- Publishing pronouncements on auditing and assurance matters.

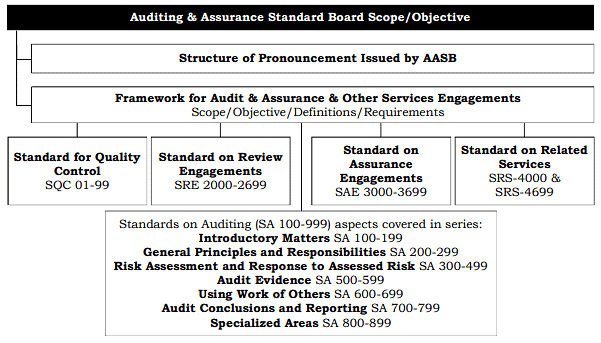

Categorization of Auditing and Assurance

Categorization of Auditing and Assurance

Structure of Standards

Structure of Standards

Qualities of an Auditor

- An auditor is responsible for judging the validity and reliability of a company or organization's financial statements.

- An auditor accumulates and evaluates evidence to report on the degree a company’s assertions that they comply with an established set of procedures or standards.

- An auditor is not bound to approach his work only with suspicion but should work objectively.

Qualities an Auditor Should Have:

- Having a well-versed command over the basics and fundamental principles of all branches of accounting, finance, statutory as well as non-statutory laws.

- Having a good knowledge and understanding of special kinds of organizations with peculiar features.

- Must have the highest degree of integrity, discipline, firmness, judgment, patience backed up with sufficient independence.

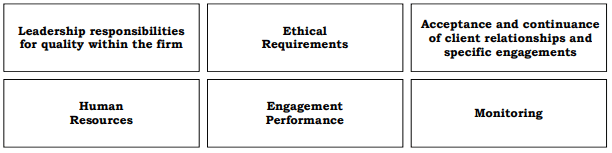

Quality Control System

Elements of a System of Quality Control

Elements of a System of Quality Control

Elements of a System of Quality Control

Leadership Responsibilities for Quality on Audits:

- Perform work complying with professional standards and legal requirements

- Comply with the firm's quality control policies

- Issue an appropriate and correct Auditor's Report

- Ability of the engagement team to raise concerns without reprisals

Ethical Requirements During the Conduct of an Audit

Fundamental principles of Professional Ethics:

- Integrity

- Professional Competence

- Professional Behavior

- Confidentiality

- Objectivity

Independence:

- Independence as to Mind

- Independence as to Appearance

Threats to Independence:

- Self-review Threats

- Self-interest Threats

- Advocacy Threats

- Relationship Threats/Familiarity Threats

- Intimidation Threats

Safeguards to Independence

Guiding principles:

- Ensure accounting services are not performed by an audit team member

- Discuss independence issues with the board of directors or audit committee

- Require source data for accounting entries to be provided by the client

- If unable to implement safeguards, do not accept the work

Professional Skepticism

Definition and Importance:

- State of mind ready to identify errors and question financial events

- Includes audit evidence contradictions and indications of possible fraud

- Maintaining professional skepticism throughout an audit

Client Relationships and Audit Engagements

- Client acceptance and continuance procedures

- Focus on independence, conflicts of interest, and firm's competence

Human Resources

Policies and procedures for personnel issues:

- Recruitment

- Competence

- Eligibility and Capability

- Compensation

- Promotion

- Personnel Needs

Engagement Performance

- Policies and procedures for quality engagement performance

- Includes briefing of engagement team, compliance with standards, supervision, and documentation

Monitoring

- Policies and procedures for monitoring compliance with quality control

- Ensuring compliance with standards and legal requirements

- Applying quality control policies appropriately

Preconditions for an Audit

Once the audit engagement is finalized, SA 210 "Agreeing the Terms of Audit Engagements" comes into picture. SA 210 defines preconditions for an audit as follows,

"The use by management of an acceptable financial reporting framework in the preparation of the financial statements and the agreement of management and, where appropriate, those charged with governance to the premise on which an audit is conducted."

Key Preconditions:

- Confirming whether the financial reporting framework is acceptable;

- Confirmation from the management regarding the acknowledgement and understanding of responsibilities for:

- Preparation of the financial statements

- Internal Control Mechanism

- Providing the auditor with necessary data, records, documentation, additional information for the purpose of conduct of an Audit;

- Providing auditor access to persons from whom the necessary audit evidences could be procured.

Audit Engagement Terms

Objective:

- Both auditor and client need to understand the nature of the engagement. Engagement terms must be in writing, clearly defining the scope of work.

Partnerships Note:

- In partnerships, caution is necessary as the appointment of an auditor is governed by the Partnership Deed.

Required Contents of Audit Engagement:

- Objective and scope of the Audit Engagement

- Responsibilities of the Auditor

- Responsibilities of the Management

- Applicable Financial Reporting Framework

- Valid reference to the expected form and content of the report to be issued by an Auditor

Recurring Audits

Recurring Audits: In recurring audits, the auditor evaluates the circumstances necessitating a revision in the terms of the audit engagement or reminding of the existing terms. Factors leading to the need for recurring audits include:

- Indications that the entity misunderstands the objective and scope of the audit.

- Revision or existence of any special terms.

- Changes in top-level/senior management.

- Significant change in ownership structure.

- Changes in legal/statutory or regulatory frameworks.

- Changes in the financial reporting framework.

- Changes in any other reporting requirements.

Limitation on Scope Prior to Audit Engagement Acceptance

- If Management or Those Changed With Governance (TCWG) imposes a limitation on the scope of the auditor's work in such a manner that it results into disclaimer of opinion by an Auditor, then the Auditor shall not accept such a limited engagement until and unless required by law.

Acceptance of a Change in Engagement

There are situations that may require a modification in the terms of the audit engagement. This adjustment occurs following a thorough discussion and careful consideration by both the auditor and the client. If deemed necessary, the audit engagement is then appropriately altered and approved by the Auditor.

Reasons for requesting a change in the engagement may include:

- Change in circumstances

- Misunderstanding

- Restriction on the scope of the engagement

- It is important to note that a change in the audit engagement is only deemed acceptable when there are justifiable grounds for doing so.

If an Auditor is unwilling to accept the revised terms of the audit engagement, they should:

- Either withdraw from the audit engagement

- Or report the circumstances to other relevant parties or authorities/regulators

|

31 videos|58 docs

|