AS 18 – Related Party Disclosures | Advanced Accounting for CA Intermediate PDF Download

AS 18 – Related Party Disclosures

Related party disclosures are essential for a company to provide transparency regarding its associations and transactions with related parties. Here's a detailed breakdown:

- What is the meaning of Related party?

- Who is covered under Related party relationships?

- Why do we need Related party disclosures?

- What needs to be disclosed under AS 18?

- Cases when disclosure is not required

- Examples of Related party transactions

- Case studies on AS 18

- Comparison between AS 18 and Ind AS 24

This accounting standard mandates the disclosure of related party relationships and transactions between a reporting enterprise and its related parties. It applies to the financial statements of individual reporting enterprises and consolidated financial statements of holding companies.

What is the meaning of Related party

As per AS 18, a related party is defined as a situation where, at any point during the year, one party possesses the ability to:

- Control the other party

- Exercise significant influence over the other party in making financial and/or operating decisions

Control means

- Ownership, whether direct or indirect, of more than 50% of the voting power of an enterprise

- In the case of a company - control of the composition of the board of directors; in the case of any other enterprise - control of the composition of the corresponding governing body

- Possession of a substantial interest in voting power and authority to direct the financial and/or operating policies of the enterprise

Who is covered under Related party relationships

- Holding companies, subsidiaries, and fellow subsidiaries;

- Associates and joint ventures of the reporting enterprise;

- Investors in respect of which the reporting enterprise is an associate or a joint venture;

- Individuals owning direct or indirect interest in the voting power of the reporting enterprise that gives them control or significant influence over the enterprise, and relatives of any such individual;

- Key management personnel and their relatives;

- Enterprises over which any person, who is a key management personnel or has direct and indirect interest in voting power, can exercise significant influence.

Why Related Party Disclosures are Essential

- Statutory Requirements: Companies are often mandated by law to disclose related party transactions in their financial statements.

- Ensuring Fair Transaction Prices: Without related party disclosures, there's an assumption that transactions are at arm's length, i.e., between unrelated parties. Such disclosures help reveal any potential conflicts of interest or non-market pricing.

- Impact on Financial Standing: Related party relationships can influence a company's financial position and performance, even when specific transactions with related parties don't occur. The mere existence of such relationships can impact dealings with other entities.

- Comprehensive Transaction Recording: Disclosing related party transactions is crucial as some dealings might not have occurred if not for the existing relationships. This ensures transparency and completeness in financial reporting.

What needs to be disclosed under AS 18

The following information must be disclosed according to AS 18:

- The identity of the related party involved in the transaction;

- A detailed explanation of the relationship between the involved parties;

- A description of the type of transactions taking place;

- The extent of the transactions, either in monetary terms or as a proportion;

- Any specific aspects of related party dealings crucial for understanding the financial statements;

- The outstanding sum owed to or by related parties as of the balance sheet date;

- Provisions made for doubtful debts owed by related parties as of the balance sheet date;

- Amounts that have been either written off or written back related to debts between the parties.

Cases when disclosure is not required

- Intra-group transactions: Refers to transactions between companies within the same group or parent company.

- Enterprises with statutory confidentiality requirements: Companies that are legally obligated to maintain confidentiality may not need to disclose certain transactions.

- Related party relationships of State-controlled enterprises with other state-controlled enterprises: Transactions between government-controlled entities may not always require disclosure.

Examples of Related party transactions

Related party transactions are interactions between entities that have a close relationship. Here are some examples where disclosure may be necessary:

- Purchases or sales of goods (finished or unfinished): Buying or selling products between related parties.

- Purchases or sales of fixed assets: Transactions involving the exchange of property or equipment.

- Rendering or receiving of services: Providing or receiving services between related parties.

- Agency arrangements: Agreements where one party acts on behalf of another.

- Leasing or hire purchase arrangements: Leasing assets or acquiring them through hire purchase from related parties.

- Transfer of research and development: Sharing or transferring research and development projects.

- License agreements: Granting or obtaining licenses from related parties.

- Finance (including loans and equity contributions): Providing financial support such as loans or equity investments.

- Guarantees and collaterals: Providing guarantees or collateral for related parties.

- Management contracts including for deputation of employees: Contracts related to the management or delegation of employees within related entities.

Case studies on AS 18

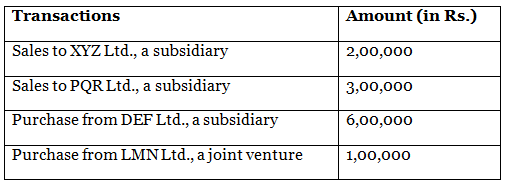

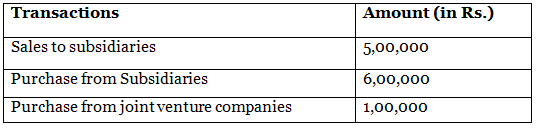

Case Study 1: ABC Ltd.

Sol: Disclosure required as per AS 18

Sol: Disclosure required as per AS 18

Case Study 2: A Ltd holds 75% of voting power of B Ltd and B Ltd owns 50% voting interest in C Ltd. Further, A Ltd also holds 25% of the voting interest in C Ltd. Would A Ltd deem to have control over C Ltd or would it only be considered as exercising significant influence?

Sol:

A Ltd would be considered to control C Ltd. As per AS 18, control includes ownership, directly or indirectly, of more than 50% of the voting power of another enterprise. As A Ltd is a majority shareholder B Ltd, therefore, it has control over it.

Further, as A Ltd and B Ltd together are majority shareholders (i.e. 50% + 25%) in C Ltd. A Ltd has indirect control over it. Accordingly, A Ltd has the ability to control C Ltd, indirectly via the share ownership in B Ltd apart from its individual shareholding in C Ltd.

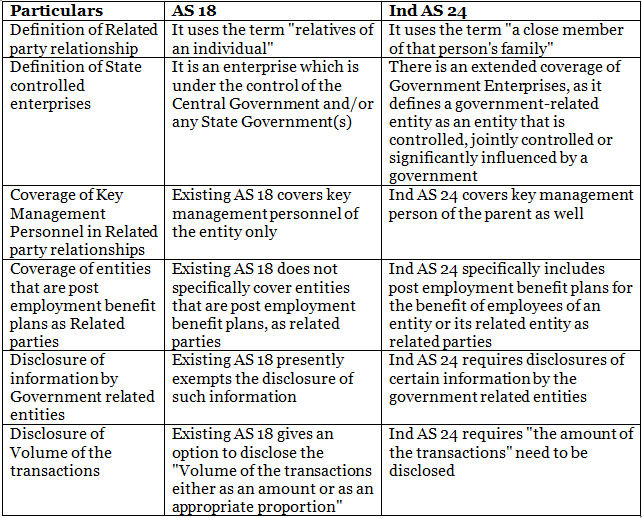

Comparison between AS 18 and Ind AS 24

|

53 videos|134 docs|6 tests

|

FAQs on AS 18 – Related Party Disclosures - Advanced Accounting for CA Intermediate

| 1. What is the meaning of Related party? |  |

| 2. Who is covered under Related party relationships? |  |

| 3. Why are Related Party Disclosures essential? |  |

| 4. What needs to be disclosed under AS 18? |  |

| 5. Can you provide examples of Related party transactions? |  |