AS 20 – Earnings Per Share | Advanced Accounting for CA Intermediate PDF Download

| Table of contents |

|

| AS 20: Earnings Per Share (EPS) |

|

| Weighted Average Number of Shares |

|

| Calculation of Diluted Earnings per Share |

|

| Comparison between Ind AS33 and AS 20 |

|

AS 20: Earnings Per Share (EPS)

- Earnings per share (EPS) is a financial metric that reveals the earnings available for each equity share in a company. This ratio is crucial for enhancing comparability between different companies and accounting periods.

- AS 20 focuses on the computation of Earnings per share and mandates reporting two types of EPS on the statement of profit & loss account, even if the values are negative (indicating a loss per share).

Basic EPS

Basic EPS is calculated as Net profit or loss attributable to equity shareholders divided by the Weighted average number of outstanding equity shares.

Earnings - Basic (Numerator)

*The preference dividend subtracted for the period comprises the preference dividends on non-cumulative preference shares and the total required preference dividends for cumulative preference shares.

*The preference dividend subtracted for the period comprises the preference dividends on non-cumulative preference shares and the total required preference dividends for cumulative preference shares.

- Per share - Basic (Denominator)

- To compute basic EPS, the weighted average number of equity shares outstanding during the period is used. The time-weighting factor is determined by the number of days a specific share is held divided by the total days in the period.

Weighted Average Number of Shares

Example 1: Number of shares outstanding as on 01-01-2010 are 2000. Fresh issue of 600 shares for cash on 31-05-2010. Buy back of 300 shares on 01-11-2010.

Sol:

The weighted average outstanding number of shares = (2000 x 12/12) + (600 x 7/12) – (300 x 2/12) = 2300 shares

Example 2: Opening balance of shares as on 01-01-2010 is 2000 shares. On 31-10-2010, issue of 600 shares of Rs. 10 each, Rs. 5 paid up.

Sol:

As per AS 20, partly paid up equity shares should be calculated in the ratio of amount paid up to face value (amount paid / face value). The weighted average outstanding number of shares = (2000 x 12/12) + (600 x 5/10 x 2/12) = 2050 shares

Example 3: On 01-01-2010, 2 Lac equity shares of Rs. 10 each fully paid up. On 30-06-2010, fresh issue of 2 lac equity shares of Rs. 5 each fully paid up.

Sol:

The weighted average outstanding number of shares = (2,00,000 x 12/12) + (2,00,000 x 5/10 x 6/12) = 2,50,000 shares

Example 4: Net profit for the year 2010 is Rs. 18 lacs. Net profit for the year 2011 is Rs. 60 lacs. Number of equity shares outstanding till 30-09-2010 is 20 lacs. Bonus issue on 01-10-2011 = 2 (new): 1(old). Calculate EPS for the year 2011 and adjusted EPS for the year 2010.

Sol:

As per AS 20, when bonus shares are issued during the year, it should be calculated in the weighted average from the beginning of reporting period irrespective of issue date. Therefore, the bonus issue is treated as if it had occurred prior to the beginning of the year 2010, the earliest period reported.

Example 5: Net profit for the year 2010 is Rs. 11,00,000 and for the year 2011 is Rs. 15,00,000. Number of shares outstanding prior to right are 5,00,000 shares. Right issue of one new share for each five outstanding at right issue price of Rs. 15. Last date to exercise rights is 01-03-2011. Fair value of one equity share immediately prior to exercise of rights on 01-03-2011 is Rs. 21. Compute basic EPS for the year 2011 and adjusted EPS for the year 2010.

Sol:

As per Para 22, Theoretical ex-rights fair value per share = (Fair value of all shares prior to rights + Right issue proceeds) / Number of shares outstanding post right issue = {(Rs. 21 x 5,00,000 shares) + (Rs. 15 x 1,00,000 shares)} / 5,00,000 shares + 1,00,000 shares = Rs. 20 Bonus element = Fair value per share prior to exercise of rights / Theoretical ex-rights value per share = 20 / 21 = 1.05

Computation of Earnings Per Share

Diluted EPS

For the calculation of diluted earnings per share, it is essential to adjust the net profit or loss for the period attributable to equity shareholders and the weighted average number of shares outstanding during the period to consider the effects of all dilutive potential equity shares. The earnings should be adjusted for any attributable changes in tax expenses for the period.

Adjusted Earnings Per Share (EPS)

Adjusted Earnings Per Share is a metric that reflects the company's earnings per share after accounting for certain adjustments such as bonus issues, rights issues, or other financial events that impact the number of outstanding shares. This calculation provides a more accurate picture of the company's profitability on a per-share basis.

Basic EPS vs. Diluted EPS

Basic EPS represents earnings per share calculated without considering the effects of potentially dilutive securities, while Diluted EPS takes into account all dilutive securities that could potentially be converted into common stock. Diluted EPS is usually lower than Basic EPS as it accounts for the potential dilution of existing shares.

Importance of EPS Calculation

EPS calculation is crucial for investors as it helps in evaluating a company's profitability on a per-share basis. It enables investors to compare the earnings performance of different companies and make informed investment decisions based on the company's ability to generate profits for its shareholders.

Calculation of Diluted Earnings per Share

For calculating diluted earnings per share, several factors need to be considered:

Adjustments for Diluted Earnings

- Any dividends on dilutive potential equity shares are added back to the numerator of basic EPS.

- Interest related to dilutive potential equity shares is accounted for in the period.

- Any changes in expenses or income resulting from the conversion of dilutive potential equity shares are included.

Calculation of Diluted Earnings per Share (Denominator)

When determining the denominator for diluted EPS:

- The weighted average number of equity shares issued on conversion of all dilutive potential equity shares is considered.

- Diluted EPS is calculated for potential equity shares like convertible debentures, convertible preference shares, options, etc.

- If the conversion of potential equity shares reduces EPS, they are considered diluted; otherwise, they are anti-dilutive.

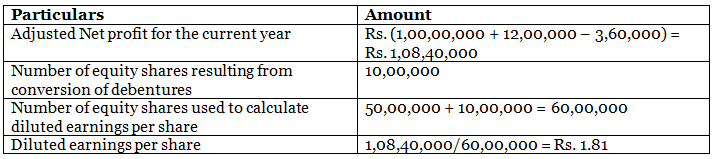

Example Illustration

Let's consider an example:

Comparison between Ind AS33 and AS 20

|

52 videos|121 docs|6 tests

|

FAQs on AS 20 – Earnings Per Share - Advanced Accounting for CA Intermediate

| 1. What is the importance of calculating Earnings Per Share (EPS) in financial reporting? |  |

| 2. How is the Weighted Average Number of Shares calculated in determining EPS? |  |

| 3. What is the significance of Diluted Earnings per Share calculation? |  |

| 4. Can you explain the key differences between Ind AS33 and AS 20 in calculating Earnings Per Share? |  |

| 5. How can understanding Earnings Per Share (EPS) benefit investors in making informed investment decisions? |  |

|

52 videos|121 docs|6 tests

|

|

Explore Courses for CA Intermediate exam

|

|