AS 7 – Construction Contracts | Advanced Accounting for CA Intermediate PDF Download

Introduction

AS 7 Construction Contract outlines the accounting treatment for revenue and costs associated with construction contracts. This standard is intended for use in the accounting of construction contracts in the financial statements of contractors.

Types of Contracts

Construction Contract Overview: A construction contract pertains to agreements specifically tailored for constructing assets closely linked in technology, design, or function.

Fixed Price Contract

- Definition: This contract type involves a set contract price agreed upon by the parties.

- Cost Escalation Clause Example: For instance, parties may include a clause allowing adjustments to the contract price based on raw material cost increases.

Cost-plus Contract

- Explanation: In a cost-plus contract, the contractor is reimbursed for incurred costs or agreed-upon expenses, along with a percentage of these costs or a fixed fee.

Combining and Segmenting of Construction Contracts

Combining of Construction Contracts

- A group of contracts, whether with one or more customers, is treated as a single construction contract when they are negotiated together as a unified package, are interconnected, constitute part of a single project, and are executed in a continuous sequence.

Example: A contract for the construction of three identical buildings on a single plot, all negotiated simultaneously.

Segmenting of Construction Contracts

- When a contract involves more than one asset, the construction of each asset should be considered a distinct construction contract if separate proposals have been made for each asset, each asset has been negotiated separately, and the costs and revenues of each asset can be individually identified.

Example: A contract for building three different structures on the same plot with varying specifications, where each building is separately negotiated with the contractor.

Revenue Recognition in a Contract

The revenue recognized from a contract encompasses the following aspects, provided there is a high likelihood of revenue generation and it can be reliably measured:

- The initial sum of revenue outlined in the contract agreement;

- Claims and bonuses due to deviations in contract work;

Contractual Costs Breakdown

The costs associated with a contract are itemized as follows:

- Direct costs directly linked to the particular contract;

- Expenses that are generally related to and apportioned among contract activities;

- Additional costs that are explicitly billable to the client as per the contract terms;

Recognition of Revenue and Cost from a Contract

Fixed Price Contract

- The total revenue from the contract should be easily measurable.

- Economic benefits from the contract should be evident for the organization.

- Both contract costs and the stage of completion must be measurable.

- Contract costs should be identifiable for comparison with actual costs and prior estimates.

Cost-Plus Contract

The estimate of the outcome should be reliable.

Conditions to be satisfied:

- The total revenue from the contract should be easily measurable.

- Economic benefits from the contract should be evident for the organization.

- Both contract costs and the stage of completion must be measurable.

- Contract costs should be identifiable for comparison with actual costs and prior estimates.

Understanding Contract Economics:

- Organizational Benefits from Contracts

- Identification and Measurement of Contract Costs

Percentage of Completion Method

- Recognition of Revenue and Cost based on Contract Progress

- Revenue and Cost Recognition in Profit and Loss Statements

- Recognition of Work Completion Stages

Contract Work-in-Progress

- Recognition of Future Activity Costs

- Treatment of Future Activity Costs as Assets

- Conditions for Recognizing Future Activity Costs

Determination of the stage of completion

The stage of completion in a contract can be identified using various methods:

- Calculating the proportion of contract cost incurred compared to the total estimated cost of the contract. For example, if a contract's total cost is Rs. 30 lakhs and the cost incurred so far is Rs. 15 lakhs, the completion stage is considered as 50%, i.e., 15 lakhs / 30 lakhs.

- Conducting surveys to assess the work completed. For instance, in a bridge construction contract, a site inspector can survey the progress and provide insights into the completed work based on project specifications.

- Evaluating the physical completion of a portion of the contract work. For example, in a contract for a five-story building, if three stories are finished, the completion stage is seen as 60%, i.e., 3 stories out of 5 stories.

When it is impossible to estimate the outcome of a construction contract, revenue and costs should only be recognized up to the extent of incurred contract costs that are likely to be recovered.

Recognition of Expected Losses

In cases where it is anticipated that the total expenses of a contract will surpass the total revenue generated from that contract, the expected losses must be recognized immediately as expenses. This recognition is not influenced by:

- The commencement status of work on the contract.

- The stage of completion of the contract.

- The expected profits from other contracts that may be segmented, as previously explained.

Disclosures Required in Financial Statements

An organization is obligated to make certain disclosures, including:

- Contract revenue that has been acknowledged during the accounting period.

- The methodologies adopted for determining the contract revenue recognized within the period.

- The methodologies employed to ascertain the stage of completion of contracts that are still in progress.

At the reporting date, the following disclosures regarding contracts in progress should be provided:

- An aggregate of costs incurred and net profits recognized.

- The amount received as advances.

- The amount of retentions held.

Note:

- Advances denote payments received by the contractor before the associated work is executed.

Retention:

- Retention represents amounts that are disbursed only after meeting the specified conditions in the contract for payment of such sums.

An organization must display:

- The total amount owed by customers for contract work as an asset.

- The total amount owed to customers for contract work as a liability.

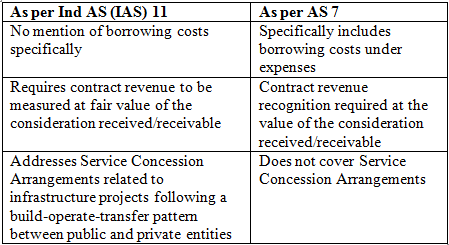

Major Differences between Ind AS (IAS) 11 and AS 7

|

53 videos|134 docs|6 tests

|

FAQs on AS 7 – Construction Contracts - Advanced Accounting for CA Intermediate

| 1. What are the different types of contracts in construction projects? |  |

| 2. How is revenue and cost recognition done in construction contracts? |  |

| 3. What is the significance of expected losses recognition in construction contracts? |  |

| 4. How are fixed price contracts different from cost-plus contracts in construction projects? |  |

| 5. What are the key financial disclosures required for construction contracts under AS 7? |  |