AS 9 Revenue Recognition | Advanced Accounting for CA Intermediate PDF Download

| Table of contents |

|

| Introduction of AS 9 Revenue Recognition |

|

| Applicability of AS 9 Revenue Recognition |

|

| Rendering of Services |

|

| Interest, Royalties & Dividends |

|

Introduction of AS 9 Revenue Recognition

Revenue Recognition under AS 9 is a key concept in accounting standards. It outlines that revenue represents the total inflow of cash, receivables, or any other form of consideration from regular business operations. This includes revenue generated from selling goods, providing services, as well as income from sources such as interest, royalties, and dividends.

- AS 9 introduces guidelines on how to recognize revenue in financial statements.

- It ensures that revenue is recorded when it is earned and realizable.

Applicability of AS 9 Revenue Recognition

- This accounting standard was introduced by ICAI in 1985. Initially, it was recommended for Level I enterprises only. However, from April 01, 1993, it became mandatory for all enterprises.

- According to ICAI, an "Enterprise" refers to a company as defined in section 3 of the Companies Act, 1956.

- Level I enterprises are those whose turnover in the previous accounting year exceeded 50 crores, excluding other income. This criterion applies to both holding and subsidiary companies.

Explanation

- Revenue recognition focuses on when revenue is recorded in a company's profit and loss statement.

- The revenue amount from a transaction is typically determined through an agreement between the parties involved.

- Uncertainties regarding the revenue amount or associated costs can impact the timing of revenue recognition.

Sale of Goods

One crucial factor in revenue recognition for goods sales is the transfer of property from the seller to the buyer for a consideration. Usually, this transfer aligns with the transfer of significant risks and rewards of owning the goods. However, there are exceptions where revenue recognition occurs when significant risks and rewards are transferred, even if the goods haven't been handed over to the buyer yet.

For instance, goods sent to a consignee on an approval basis highlight a scenario where revenue recognition differs. In specific industries, revenue might be recognized before the actual transaction due to various reasons like government guarantees, forward contracts, or existing markets with minimal selling risks. Examples include harvesting agricultural crops or extracting mineral ores.

Rendering of Services

Revenue recognition for services is based on when the service is performed.

There are two main methods for revenue recognition:

- Proportionate Completion Method: This approach recognizes revenue in the profit & loss statement in proportion to the completion of each service. It is applied when a service involves multiple acts, with revenue recognized after the completion of each act.

- Completed Service Contract Method: This method acknowledges revenue in the profit & loss statement only when the service under a contract is fully or substantially completed.

Interest, Royalties & Dividends

When others utilize a company's resources, various types of income are generated:

- Interest

- Royalties

- Dividends

Interest:

- Revenue from interest is recognized based on the time proportion principle, considering the outstanding amount and the applicable rate. For instance, if interest on a Fixed Deposit (FD) is due on June 30th and December 31st, and the books are closed on March 31st, revenue for the period of January to March needs to be recognized in March itself, even if the actual payment is received in June.

Royalties:

- Royalty represents charges for utilizing patents, know-how, trademarks, and copyrights. Revenue recognition follows the accrual basis and the terms of the relevant agreement. For example, if royalties are based on the number of book copies sold, revenue must be recognized accordingly.

Dividends:

- Dividend revenue should be acknowledged when the owner's right to receive payment is confirmed. It becomes certain when the company officially declares dividends on shares and the directors decide to distribute dividends to shareholders.

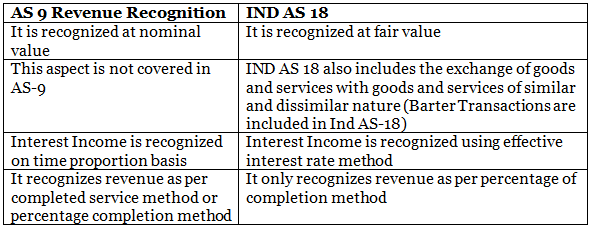

Difference between IND AS -18 & AS -9

|

53 videos|134 docs|6 tests

|

FAQs on AS 9 Revenue Recognition - Advanced Accounting for CA Intermediate

| 1. What is AS 9 Revenue Recognition? |  |

| 2. When is AS 9 Revenue Recognition applicable? |  |

| 3. How does AS 9 Revenue Recognition impact the recognition of revenue from rendering services? |  |

| 4. What is the difference between IND AS -18 and AS -9 in terms of revenue recognition? |  |

| 5. How can Clear GST Software and Certification Course help with tax filing related to revenue recognition under AS 9? |  |