AS 12 Accounting for Government Grants | Advanced Accounting for CA Intermediate PDF Download

| Table of contents |

|

| Introduction |

|

| Meaning of Government Grant |

|

| Methods of Accounting for Government Grants |

|

| Capital Approach |

|

| Income Approach |

|

| Refund of Government Grants |

|

Introduction

- Government's role involves supporting businesses through promotional activities and providing various forms of grants such as subsidies, incentives, and duty drawbacks.

- AS 12 focuses on government grants but excludes accounting for grants affected by price changes, government assistance beyond grants like tax exemptions, and government ownership participation.

Meaning of Government Grant

- A government grant refers to assistance provided by the government in cash or kind with specific conditions attached.

- Grants that cannot be reasonably measured or transactions indistinguishable from normal business activities are not considered government grants.

- For example, when 'Bisleri' receives cash from selling packaged drinking water to railways, it does not qualify as a government grant.

Methods of Accounting for Government Grants

- Capital Approach

- Income / Revenue Approach

The accounting methods for government grants are based on the nature of the grant received, ensuring certainty in meeting conditions and collecting the grants.

Capital Approach

Simply put, these grants are treated as part of capital or shareholder's funds. These grants are provided as a proportion of the total investment in a business, and typically, the government does not expect repayment. As a result, these grants are credited to the capital or shareholder's funds. They are primarily divided into three types:

- Non-monetary grants

- Proportion of capital in a business

- Grants for specific fixed assets

3.I.A. Accounting of Non-monetary Grants

- Non-monetary grants are given in the form of resources such as land or buildings, usually at a concessional rate or for free. These grants should be accounted for at the acquisition cost or nominal value if provided free of cost.

3.I.B. Accounting of Grants as a Proportion of Total Capital in a Business

- Grants that are treated as a proportion of the total capital in a business are considered Capital Reserves and shown as such in the Balance Sheet. This means the amount received does not affect the Income Statement or the carrying amount of Fixed Assets, and cannot be distributed as a dividend to shareholders or considered deferred income.

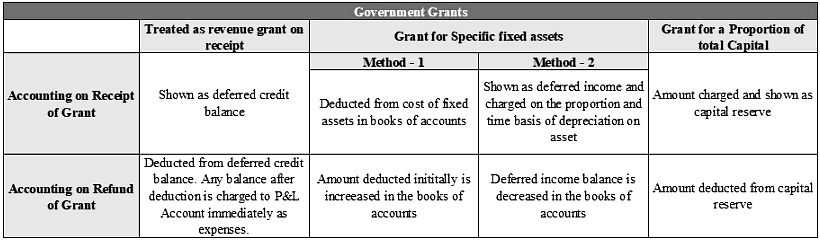

3.I.C. Accounting of Grants for Specific Fixed Assets

- These grants come with conditions, such as the requirement for the recipient organization to construct, acquire, or purchase specific fixed assets. Other conditions may include the type of assets, location, and period of acquisition. There are two methods prescribed for recognizing grants for specific fixed assets:

Method 1: The grant amount is deducted from the gross amount of the asset to calculate its book value. This method recognizes the grant in the profit and loss account as a reduced depreciation charge over the asset's life.

Illustration: ABC Ltd. Purchases a machinery for Rs. 30 lakhs with a useful life of 5 years and ‘Nil’ salvage value. It gets Rs. 10 lakhs as a grant from the government for this machinery.

a) The gross value of machinery will be shown as Rs. 20 lakhs (30 lakhs – 10 lakhs) in the balance sheet

b) Rs. 4 lakhs (20 lakhs / Useful life i.e. 5 years) will be charged to profit and loss account each year as a depreciation on this machinery.

Method 2: The grants are treated as a deferred income in the financial statements. This income is recognized gradually in the profit and loss account over the useful life of an asset or say in the proportion of depreciation on such asset.

Illustration: ABC Ltd. Purchases a machinery for Rs. 30 lakhs with a useful life of 5 years and ‘Nil’ salvage value. It gets Rs. 10 lakhs as a grant from the government for this machinery.

a) The Gross value of machinery will be shown as Rs. 30 lakhs in the balance sheet along with Rs. 10 lakhs as ‘Deferred Government Grant’.

b) Rs. 6 lakhs (30 lakhs / Useful life i.e. 5 years) will be charged to profit and loss account each year as a depreciation along with an income of Rs. 2 lakhs (10 lakhs / Useful life i.e. 5 years).

Income Approach

Refund of Government Grants

Government grants might need to be given back in cases where certain conditions are not met. When this happens, the process of accounting for the refund of grants is as follows:

Disclosure Requirements

- Accounting Policy: The strategy followed for accounting, including how it's presented.

- Nature and Extent: Detailing the government grant acknowledged in financial statements.

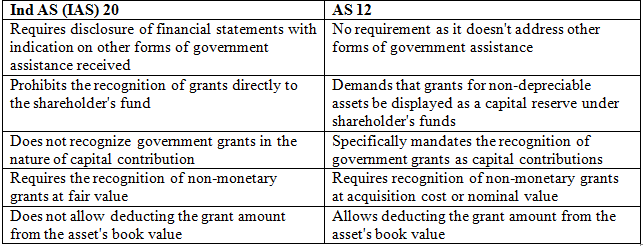

Major Differences between Ind AS (IAS) 20 and AS 12

|

53 videos|134 docs|6 tests

|