AS 21 Consolidated Financial Statements | Advanced Accounting for CA Intermediate PDF Download

Introduction

AS 21 focuses on creating consolidated financial statements for a group of companies controlled by a parent entity. These statements provide a comprehensive view of the financial health of the entire group.

Applicability of AS 21 Consolidated Financial Statements

This guideline is essential when managing the accounts of subsidiaries within a parent's distinct financial report.

It's crucial to recognize that while compiling a consolidated financial statement, other standards hold significance much like they do for individual statements.

This standard does not cover:

- Methods of accounting for mergers and their impact on consolidation, encompassing the goodwill resulting from a merger

- Handling investments in JVs (joint ventures)

- Managing investments in associates

Presentation of Consolidated Financial Statements

When a parent company presents its consolidated financial statements, it must also include its standalone financial statements. This is crucial for providing a comprehensive view of the financial health of the company.

The users of a parent company's financial statements are interested not only in the company's individual performance but also in the overall performance of the entire group. They need to understand how the group is faring as a whole.

To meet this requirement, the financial statements must include:

- Standalone financial statements of the parent company

- Consolidated financial statements that show the financial position of the business group as a single entity, disregarding the legal boundaries of individual entities within the group

Scope of Consolidated Financial Statements

- A parent company must include all its subsidiaries, both foreign and domestic, in its consolidated financial statements.

- If a company lacks subsidiaries but has associates and/or joint ventures, it still needs to prepare consolidated financial statements following Accounting Standard 23 and Accounting Standard 27.

Exclusion of Subsidiaries

Subsidiaries should be excluded from consolidation under certain circumstances:

- When control is intended to be temporary, such as when a subsidiary is acquired solely for imminent disposal.

- If the subsidiary operates under significant and enduring restrictions that greatly hinder its ability to transfer funds to the parent company.

Investments in excluded subsidiaries in consolidated financial statements should be handled in accordance with AS 13 - Accounting for Investments.

Reasons for excluding a subsidiary from consolidation must be disclosed in the consolidated financial statements.

Consolidation Procedures

When preparing consolidated financial statements, the financial statements of the parent company and its subsidiaries must be combined line by line by totaling similar items such as assets, liabilities, income, and expenses.

To present financial information about a group as if it were a single entity, the following steps must be taken:

Eliminate the Parent's Investment Cost:

- Eliminate the cost to the parent of its investment in each subsidiary and the parent’s equity portion of each subsidiary as of the investment date.

Recognize Goodwill:

- If the parent’s investment cost exceeds its share of the subsidiary’s equity at the investment date, the excess should be recognized as goodwill and treated as an asset in the consolidated financial statements.

Recognize Capital Reserve:

- If the parent’s investment cost is less than its share of the subsidiary’s equity at the investment date, the difference should be recognized as a capital reserve in the consolidated financial statements.

Adjust for Minority Interests in Net Income:

- Recognize and adjust the minority interests' share of the consolidated subsidiary’s net income for the reporting period against the group's income to determine the net income attributable to the parent company’s owners.

Recognize Minority Interests in Net Assets:

- Recognize and provide for the minority interests' share of the consolidated subsidiaries' net assets in the consolidated balance sheet, distinct from the parent company’s equity and liabilities.

Minority interests in net assets include:

- The amount of equity attributable to minorities at the investment date.

- The minorities’ share of equity movements from the date the parent-subsidiary relationship was established.

If the carrying amount of the investment in a subsidiary differs from its cost, use the carrying amount for the above calculations.

Accounting for Investments in Subsidiaries in the Separate Financial Statements of the Parent

Within the standalone financial statements of a parent company, investments made in subsidiaries need to be handled in accordance with Accounting Standard 13 - Accounting for Investments.

Disclosures in the Financial Statements

When preparing consolidated financial statements in accordance with AS 21, certain disclosures are mandated to provide a comprehensive overview of the financial status and relationships within the business structure.

List of Subsidiaries

- The consolidated financial statements should include a detailed list of all subsidiary companies owned by the parent corporation. This list should encompass essential information such as the subsidiary names, their countries of residence or incorporation, the percentage of ownership interest, and if applicable, the share of voting power held.

- For instance, if a parent company owns 80% of a subsidiary named XYZ Inc., this information should be clearly articulated in the consolidated financial statements.

Exclusion of Subsidiaries

- If a subsidiary is not consolidated as per the prescribed criteria outlined in the accounting standards, the reasons behind this omission must be disclosed in the financial statements. This transparency ensures that stakeholders understand why certain subsidiaries are not included in the consolidation process.

- For example, if a subsidiary does not meet the criteria for consolidation due to temporary control issues, such as pending regulatory approvals, these reasons should be explicitly stated in the financial disclosures.

Nature of Parent-Subsidiary Relationships

- The type of relationship between a parent company and its subsidiaries must be clearly elucidated in the consolidated financial statements. This includes specifying whether the control is direct or indirect through other subsidiary entities.

- For instance, if a parent company exercises control over its subsidiaries through intermediary holding companies, this indirect control mechanism should be outlined for better transparency.

Impact of Acquisition and Disposal

- It is essential to disclose the effects of both acquisitions and disposals of subsidiaries on the financial position of the parent company. This information helps stakeholders understand how these transactions impact the overall financial health and performance of the organization.

- For example, if a parent company acquires a new subsidiary during the reporting period, the financial implications of this acquisition on the parent company's balance sheet and income statement should be clearly articulated.

Differential Reporting Dates

- In cases where subsidiaries have reporting dates different from that of the parent company, it is crucial to disclose these differences in the financial statements. This ensures that stakeholders are aware of any discrepancies in reporting timelines that may affect the overall understanding of the financial data.

- For instance, if a subsidiary follows a fiscal year-end that differs from the parent company's fiscal year-end, this discrepancy should be disclosed to avoid confusion regarding the timing of financial information.

Type of Relationship between a Parent and its Subsidiary:

- Explains the direct or indirect control relationship between a parent company and its subsidiaries. It also covers the impact of acquiring or disposing of subsidiaries on the financial standing for reporting periods and mentions subsidiaries with different reporting dates.

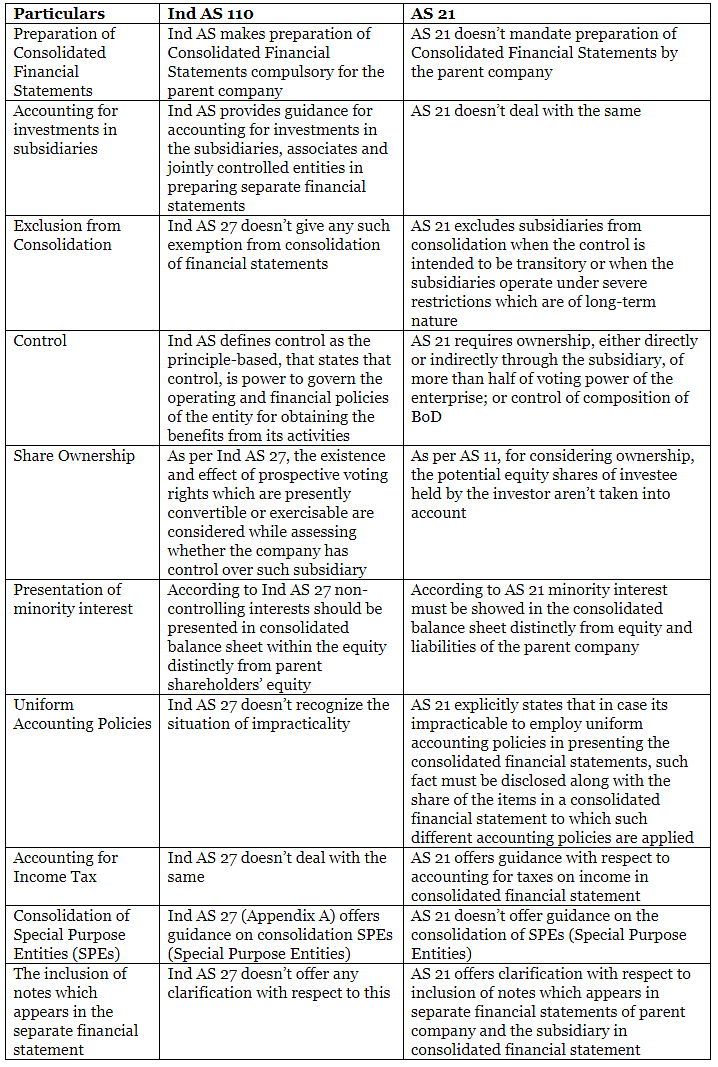

Major Differences between AS 21 and Ind AS 110

|

53 videos|134 docs|6 tests

|