Amalgamation Summary Notes | Advanced Accounting for CA Intermediate PDF Download

Introduction

In today's rapidly evolving business landscape, new business ideas emerge frequently, intensifying competition. Some astute businesses manage to thrive amid this fierce competition, while others are swept away by its dynamics.

Beyond merely establishing businesses, there is a growing recognition of the need to sustain them through challenging market conditions. Consequently, the importance of business-saving strategies has surged.

Various strategies exist to ensure business continuity, enhance market share by outmaneuvering competitors, or recover from financial crises by restructuring capital. These strategies are often referred to as "corporate marriages," "strategic alliances," "business partnering," and similar terms, as outlined in Accounting Standard 14 (AS 14).

Meaning of Amalgamation

Amalgamation involves the merger of two or more companies into a single entity or the outright purchase of one company by another. This process encompasses two primary activities:

- Two or more companies join to form a new company (commonly known as Amalgamation), or

- One company absorbs and blends with another (commonly known as Absorption).

Companies pursue amalgamation for various benefits, such as achieving economies of scale, avoiding competition, enhancing efficiency, expanding operations, and increasing market share.

In amalgamation, we typically refer to two companies: 1) the vendor or Transferor Company and 2) the vendee or Transferee Company. Let's illustrate these concepts with the following examples:

Example 1: Company A and Company B amalgamate to form Company C. Here, Company A and Company B are the transferor companies, and Company C is the transferee company. This process is termed AMALGAMATION.

Example 2: Company A is acquired by Company B. In this case, Company A is the Transferor Company, and Company B is the Transferee Company. This process is termed ABSORPTION.

Example 3: Company A has been incurring losses for the past five years, and a new Company B is established to take over Company A. In this scenario, Company A is the Transferor Company, and Company B is the Transferee Company.

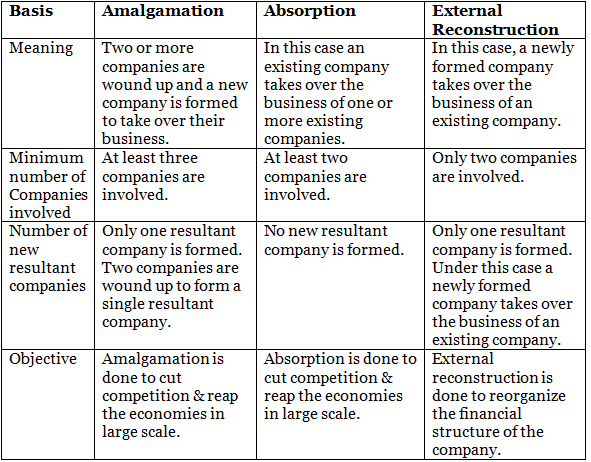

The concept of the examples given above can be understood from the following table of differences-

In each type of amalgamation, the assets and liabilities of the transferor company are combined with or transferred to the transferee company. The accounting treatment for this process in the books of both the transferor and transferee companies will be discussed in the following sections.

Types of Amalgamation

The Institute of Chartered Accountants of India has introduced Accounting Standard 14 (AS 14) on 'Accounting for Amalgamations,' which identifies two types of amalgamation:

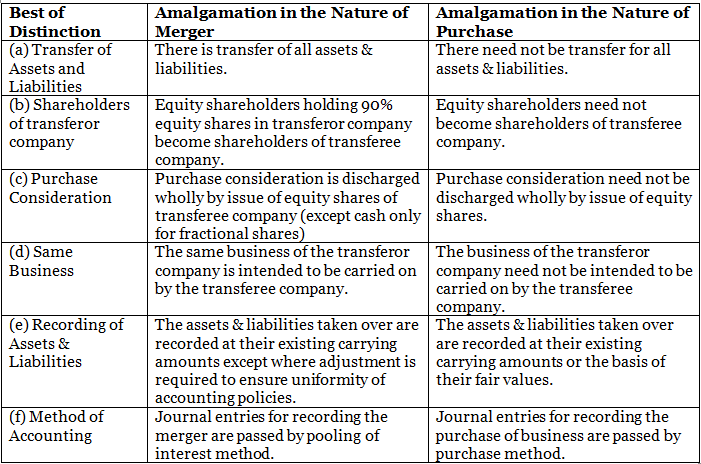

Amalgamation in the Nature of Merger: This type of amalgamation involves a genuine pooling of the assets, liabilities, shareholders’ interests, and businesses of both the transferor and transferee companies. The accounting treatment for such amalgamations ensures that the combined figures of assets, liabilities, capital, and reserves approximate the sum of the respective figures of both companies.

According to paragraph 3(e) of AS-14, an amalgamation in the nature of merger must satisfy the following conditions:

- All assets and liabilities of the transferor company become the assets and liabilities of the transferee company post-amalgamation.

- Shareholders holding at least 90% of the face value of the equity shares of the transferor company (excluding shares already held by the transferee company, its subsidiaries, or their nominees) become equity shareholders of the transferee company.

- The consideration for the amalgamation to equity shareholders of the transferor company is discharged entirely by the issue of equity shares in the transferee company, with the exception of cash payments for fractional shares.

- The business of the transferor company continues to be carried on by the transferee company after the amalgamation.

- No adjustments are made to the book values of the transferor company’s assets and liabilities in the financial statements of the transferee company, except to ensure uniformity of accounting policies. For instance, if the transferor company uses the weighted average method for inventory valuation and the transferee company uses the FIFO method, the inventory value will be revised accordingly.

Amalgamation in the Nature of Purchase: If any one or more of the conditions mentioned above are not satisfied, the amalgamation is classified as an amalgamation in the nature of purchase.

Difference between amalgamation in the nature of merger and amalgamation in the nature of purchase

Purchase Consideration

For the purpose of accounting for amalgamations, AS 14 'Accounting for Amalgamations' guides us. According to paragraph 3(g) of AS 14, purchase consideration is defined as the “aggregate of the shares and other securities issued and the payment made in the form of cash or other assets by the transferee company to the shareholders of the transferor company.”

In simple terms, it is the price payable by the transferee company to the transferor company for taking over its business.

It is important to note that only amounts paid to equity shareholders and preference shareholders are considered as part of the purchase consideration as per AS 14. Therefore, payments made directly to debenture-holders or creditors of the transferor company are not included. If certain liabilities of the transferor company are not taken over by the transferee company, they will be discharged by the transferor company.

The purchase consideration can be computed using the following methods:

Lump Sum Method: The transferee company agrees to pay a fixed amount to the shareholders of the transferor company.

Net Payment Method: The transferee company makes individual payments to equity shareholders and preference shareholders through cash, issue of shares, or debentures.

Net Assets Method: The purchase consideration is based on the value of the assets minus the outside liabilities (excluding share capital and reserves) taken over by the transferee company. As per AS 14, the value of the assets and liabilities is as agreed between the two parties. If no value is agreed, then book value is used.

The purchase consideration depends on the fair value of its elements. For instance, when the consideration includes securities, the value fixed by the statutory authority may be taken as the fair value. For other assets, the fair value may be determined by market value or net book value (cost less accumulated depreciation).Intrinsic Value or Share Exchange Method: The purchase consideration is calculated based on the intrinsic value of shares of the transferor or transferee company. The ratio of shares to be issued is computed and multiplied by the intrinsic value. The total share capital of the transferor company is divided by the total number of shares.

Sometimes, adjustments may need to be made to the purchase consideration in light of future events. If additional payment is probable and can be reasonably estimated, it is included in the calculation of purchase consideration.

Companies can use any of the methods or a combination to calculate the purchase consideration, which can be recorded at issue price or par value.

Methods of Accounting for Amalgamations

There are two main methods of accounting for amalgamations:

Pooling of Interests Method: This method is used for amalgamations in the nature of merger where conditions specified in paragraph 3(e) of AS 14 are fulfilled.

Purchase Method: This method is used for amalgamations in the nature of purchase.

Pooling of Interests Method

Under this method, the transferee company takes over the assets, liabilities, and reserves of the transferor company at their existing carrying amounts, unless adjustments are needed due to different accounting policies. The difference between the amount recorded as share capital issued (plus any additional consideration in the form of cash or other assets) and the amount of the share capital of the transferor company is adjusted in the reserves of the transferee company’s financial statements.

To compute the amount to be adjusted against the reserves:

Step I: Add equity share capital, preference share capital issued, and any additional consideration (cash and other assets) provided by the transferee company.

Step II: Add the existing equity share capital and preference share capital in the books of the transferor company.

Step III: Subtract Step II from Step I to get the amount to be adjusted from the reserves of the transferee company.

Purchase Method

Under this method, the transferee company incorporates the assets and liabilities of the transferor company at their existing carrying amounts or allocates the purchase consideration to individual identifiable assets and liabilities based on their fair values at the date of amalgamation.

To compute the amount to be transferred to capital reserve or recorded as goodwill:

Step I: Calculate the net assets amount using the formula: Total assets - Outside liabilities (non-current and current liabilities).

Step II: Compute the purchase consideration using any of the methods mentioned above.

Step III:

- If Step I minus Step II is positive, it is capital reserve.

- If Step I minus Step II is negative, it is recorded as goodwill (an intangible asset), as the amount paid to acquire the business exceeds the net assets, representing its goodwill.

Treatment of Reserves under Purchase Method

No reserves, other than statutory reserves, of the transferor company should be incorporated in the financial statements of the transferee company. The balance of the profit and loss account and general reserves of the transferor company are not recorded.

An exception is made for statutory reserves, which retain their identity in the financial statements of the transferee company in the same form as they appeared in the financial statements of the transferor company, until they are no longer required to comply with the relevant statute.

This exception is made only in those amalgamations where the requirements of the relevant statute for recording the statutory reserves in the books of the transferee company are complied with. Statutory reserves of the transferor company should be incorporated in the balance sheet of transferee company by way of the following journal entry.

Amalgamation Adjustment Reserve A/c Dr.

To Statutory Reserves

‘Amalgamation Adjustment Reserve’ is debited to bring in the statutory reserves of the transferor company. This is represented as deduction from the reserves of the transferee company after amalgamation.

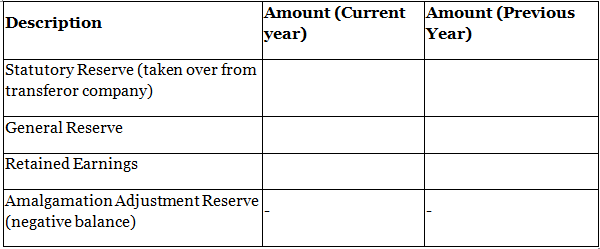

Once after the time period to show such statutory reserves is over, both the reserves and the aforesaid account are reversed. 'Amalgamation Adjustment Reserve’ has to be shown as a separate line item - which implies, that this debit "cannot be set off against Statutory reserve taken over" and therefore, the presentation will be as follows:

Reserves

Journal Entries to Close the Books of the Vendor Company

When an amalgamation occurs under any of the aforementioned methods, there is a specific accounting treatment in both the vendor (transferor) and vendee (transferee) companies.

Let's delve into the treatment in the vendor's books in this section. Since the vendor's books are closed upon amalgamation, the assets and liabilities at their book values are transferred to a distinct account known as the “Realization account.”

The purchase consideration receivable is credited to the Realization account. Upon receipt of the purchase consideration, it is debited to the equity shareholders' and preference shareholders' accounts. The balance of the realization account (either profit or loss) is then transferred to the equity shareholders' account.

Assets and liabilities not taken over by the vendee company but settled by the vendor company are also reflected only in the vendor's books.

Entries in the Books of the Purchasing Company

In the books of the purchasing (vendee, transferee) company, the assets and liabilities taken over are recorded at agreed values, and if there's no agreed value, then at the book values.

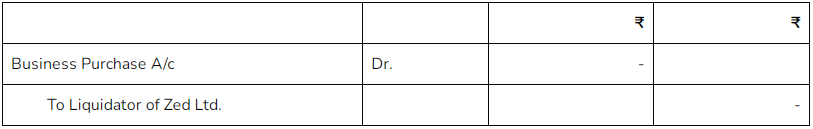

1. Debit Business Purchase Account and Credit Liquidator of the vendor company with the account of the purchase consideration. Thus -

(Amount payable to Zed Ltd. as per agreement dated....)

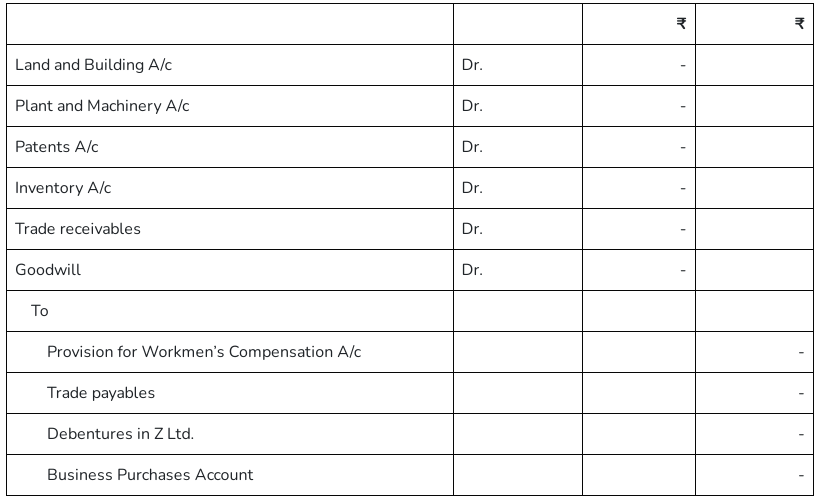

2.

(i) Debit assets acquired (except goodwill) at the value placed on them by the purchasing company;

(ii) Credit liabilities taken over at agreed values and credit Business Purchase Account with the amount of purchase consideration; and

(iii) If the credits as per (ii) above exceed debits as per (i) above, the difference should be debited to Goodwill Account, in the reverse case, the difference should be credited to Capital Reserve.

Note: The amount of Goodwill or Capital Reserve that shall be included will be the amount as has been arrived at only in foregoing manner.

In the above case the entry to be passed shall be:

(Various assets and liabilities taken over from Zed Ltd.Goodwill ascertained as a balancing figure)

3. On the payment to the vendor company the balance at its credit, the entry to be made by Wye Ltd. shall be:

(Payment of cash and issue of shares in satisfaction of purchase consideration)

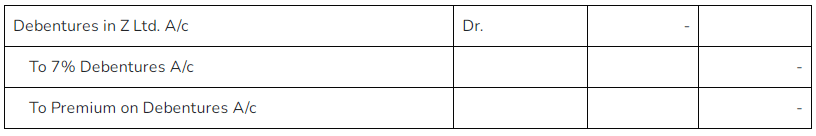

4.

(Debentures issued)

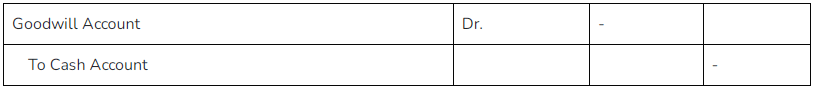

5. If the purchasing company is required to pay the expenses of liquidation of the vendor company, the amount should be debited to the Goodwill or Capital Reserve Account, as the case may be. In the instant case, the entry shall be:

(Amount paid towards liquidation expenses on Zed Ltd.)

Typical adjustments which shall be noted while working out the problems

Entries at par value - The students will note that purchasing company is left with a large debit in the Goodwill Account (Step No. 2) accompanied by quite a large amount in the Securities Premium Account (Step No. 3). The two cannot be adjusted. However, it would be permissible to negotiate on the basis to the market value of the shares but to make entries only on the basis of par of shares of purchasing company. This will mean that Goodwill Account (or Capital Reserve) will be automatically adjusted for the securities premium.

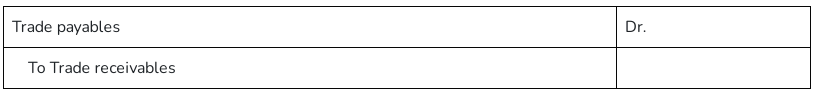

Inter Company-owing - Should the purchasing company owe an amount to the vendor company or vice versa, the amount will be included in the book debts of one company and trade payables of the other. This should be adjusted by the entry:

The entry should occur after the standard acquisition entries have been recorded. When preparing the Realization Account and recording the purchase of a business, there's no need to consider any mutual debts between the two companies involved.

Regarding stock valuation adjustments, inter-company obligations typically arise from the buying and selling of goods. Therefore, it's probable that during the business sale, the debtor company also holds inventory purchased from the creditor company, with the debtor company's cost including the profit made by the creditor company. It's crucial to eliminate such profit after the business takeover, and the purchasing company should make the necessary entry for this adjustment. If the vendor company holds such stock at the time of acquisition entries, its value should be reduced to its cost to the acquiring company, automatically adjusting goodwill or capital reserve accordingly. However, if the original sale was made by the vendor company and the stock is now with the acquiring company, the acquiring company must debit Goodwill (or Capital Reserve) and credit stock for the amount of profit included in the stock.

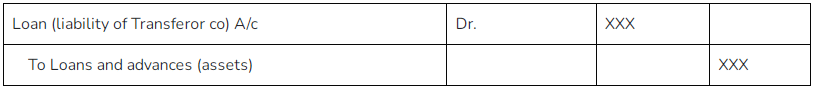

Regarding inter-company loans, if the transferor company has borrowed from the transferee company, the transferee company should take over the loan amount, and the adjustment entry should be passed as follows:

(Elimination of the inter-company loans taken by the transferor from transferee company).

|

65 videos|214 docs|6 tests

|

FAQs on Amalgamation Summary Notes - Advanced Accounting for CA Intermediate

| 1. What are the methods of accounting for amalgamations? |  |

| 2. What journal entries are recorded to close the books of the vendor company in an amalgamation? |  |

| 3. How are entries recorded in the books of the purchasing company in an amalgamation? |  |

| 4. What is the importance of purchase consideration in an amalgamation? |  |

| 5. How are amalgamations summarized in the notes of CA Intermediate exams? |  |