Financial Management Explained: Scope, Objectives & Importance | Financial Management & Strategic Management for CA Intermediate PDF Download

What is Financial Management?

In the realm of business, financial management involves the strategic handling of a company's finances to ensure both success and adherence to regulatory standards. This process requires a combination of overarching planning and meticulous execution.

Financial management, at its core, revolves around crafting a comprehensive business strategy and then overseeing the various departments to guarantee alignment with the established plan. A robust financial management framework empowers the CFO or VP of finance to furnish data that aids in shaping a long-term vision, determining investment avenues, and offering insights into financing these ventures, liquidity, profitability, cash flow sustainability, and more.

Role of ERP Software

- Enterprise Resource Planning (ERP) software plays a pivotal role in assisting finance teams in accomplishing their objectives. A financial management system amalgamates multiple financial functions, including accounting, fixed-asset management, revenue recognition, and payment processing. Through the integration of these critical components, a financial management system ensures real-time visibility into a company's financial health while streamlining day-to-day operations, such as period-end closing procedures.

Objectives of Financial Management

Financial managers play a crucial role in various aspects of a company's financial operations. They contribute significantly by:

- Maximizing Profits: This involves offering valuable insights such as identifying cost increases in raw materials that could lead to higher costs of goods sold.

- Tracking Liquidity and Cash Flow: Ensuring that the company maintains sufficient funds to meet its financial obligations.

- Ensuring Compliance: Staying updated with regulations at the state, federal, and industry levels to maintain legal and ethical standards.

- Developing Financial Scenarios: Creating projections based on the current state of the business and forecasting various outcomes considering different market conditions.

- Managing Relationships: Effectively engaging with investors, as well as boards of directors, to foster positive relationships and support the company's financial goals.

Scope of Financial Management

Planning

- Financial planning involves estimating the company's financial needs to ensure positive cash flow. It includes allocating funds for growth, new products, handling unexpected events, and communicating this data with colleagues. Planning can cover various categories such as capital expenses, travel and entertainment, workforce expenses, as well as indirect and operational costs.

Budgeting

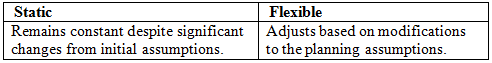

- Budgeting is about distributing the available funds to cover expenses like rent, salaries, raw materials, employee expenses, and other financial obligations. Ideally, funds should be set aside for emergencies and seizing new business opportunities. Companies typically have a master budget with additional documents for areas like cash flow and operations. Budgets can be static or flexible, with static budgets remaining unchanged despite alterations in assumptions made during planning, while flexible budgets adjust based on changes in initial assumptions.

- Budgeting involves the strategic allocation of a company's available funds to cover various expenses like mortgages, salaries, raw materials, and more. The aim is to have funds left for emergencies and to seize new business opportunities.

- Typically, companies maintain a master budget along with additional documents focusing on aspects such as cash flow and operations. Budgets can either be static, remaining fixed, or flexible, adjusting to changes.

Static vs. Flexible Budgeting:

Managing and Assessing Risk

Financial managers play a crucial role in evaluating and mitigating various risks that may impact the company's operations and financial health. Some key risks include:

Market Risk:

- Market risk influences investments and can affect stock performance, especially for publicly traded companies. Specific financial risks tied to the industry, like a pandemic's impact on restaurants, also fall under this category.

Credit Risk:

- This pertains to the possibility of customers failing to pay invoices promptly, leading to a cash flow crunch. It can harm credit ratings and borrowing capabilities if not managed effectively.

Liquidity Risk:

- Finance teams must monitor cash flow, predict future cash requirements, and ensure sufficient working capital is available when needed.

Operational Risk:

- Operational risks encompass a range of potential threats, including cyber-attacks, the need for cybersecurity insurance, disaster recovery plans, and crisis management protocols in case of executive misconduct allegations.

Procedures

- The financial manager establishes guidelines for processing and disbursing financial information within the finance team, such as invoices, payments, and reports, ensuring both security and accuracy. These documented procedures also specify the individuals accountable for financial decision-making within the company and those authorized to approve these decisions.

- Organizations can utilize pre-existing policy and procedure templates tailored to various types of entities, like nonprofits, instead of creating protocols from scratch.

Functions of Financial Management

- Financial management involves various key functions that are crucial for the success of a business.

- One vital aspect is planning and forecasting, which helps in setting financial goals and strategies for the future.

- Controlling expenditures is another critical function that ensures resources are utilized efficiently.

- Financial Planning and Analysis (FP&A) play a significant role in evaluating profitability, maintaining budgets, and forecasting financial performance.

- Managing cash flow is essential to ensure there is enough liquidity for day-to-day operations and strategic investments.

- Revenue recognition is a fundamental part of financial management, involving reporting income according to accounting standards.

- Balancing accounts receivable turnover ratios is crucial for effective cash management and financial stability.

5 Tips to Improve Your Accounts Receivable Turnover Ratio

Always state payment terms.

- You can’t enforce policies that you haven’t communicated to clients. If you make changes, call them out.

Offer Multiple Ways to Pay

- Provide diverse payment options to customers, including online payment gateways.

- Explore new B2B payment solutions to cater to evolving business needs.

Set Follow-up Reminders

- Initiate reminders for payments before they become overdue to encourage timely settlements.

- Maintain a proactive approach in collections without being overly persistent.

Consider Offering Discounts for Cash and Prepayments

- Encourage early payments by providing incentives such as discounts for cash transactions.

- Reduce accounts receivable costs by promoting upfront payments instead of extended credit terms.

Strategic and Tactical Financial Management

- Tactical Financial Management: Involves overseeing day-to-day financial transactions, conducting monthly financial closures, comparing actual expenditures with budgeted amounts, and ensuring compliance with auditing and tax regulations.

- Strategic Financial Management: Plays a crucial role in financial planning and analysis (FP&A) activities, aiding finance leaders in using data to assist business units in planning future investments, identifying opportunities, and fostering resilient business operations.

Importance of Financial Management

- Strategic Financial Planning: This involves outlining the financial steps necessary for a company to achieve both short-term objectives and long-term goals. Leaders must analyze current performance to prepare for various scenarios. For instance, understanding market trends can aid in making informed decisions regarding investments and expenditures.

- Decision-making Support: Effective financial management aids business leaders in determining the most optimal strategies to implement plans. By furnishing real-time financial data and reports on key performance indicators (KPIs), managers can make well-informed choices. For example, through financial reports, a company can decide whether to expand operations or invest in new technology.

- Monitoring and Control: This aspect ensures that each department functions in line with the organization's vision, adheres to allocated budgets, and aligns with the overall strategy. By overseeing budgets and operational performance, companies can identify areas for improvement and ensure resources are allocated efficiently. For instance, regular financial audits help in detecting discrepancies and maintaining financial health.

Efficient financial management fosters transparency within the organization, enabling employees to understand the company's direction and monitor progress effectively. It empowers individuals across all levels to contribute meaningfully towards achieving common objectives.

What are the three types of Financial Management?

The functions above can be grouped into three broader types of financial management:

- Capital budgeting: Involves determining where capital funds should be allocated to support the company's short- and long-term goals for growth. This process helps in making strategic financial decisions.

- Capital structure: Focuses on how to finance operations and expansion. It involves deciding whether to use debt, equity, or other financial instruments to fund activities. For instance, a company may choose to take on debt when interest rates are favorable or seek funding from external sources like private equity firms.

- Working capital management: Ensures that the company maintains sufficient liquid assets to meet its day-to-day operational needs. This includes managing cash flow to cover expenses such as payroll, inventory purchases, and other immediate financial obligations.

What is an Example of Financial Management?

We've covered some examples of financial management in the "functions" section above. Now, let's cover how they all work together:

Say the CEO of a toothpaste company wants to introduce a new product: toothbrushes. She'll call on her team to estimate the cost of producing the toothbrushes and the financial manager to determine where those funds should come from - for example, a bank loan.

The financial manager will acquire those funds and ensure they're allocated to manufacture toothbrushes in the most cost-effective way possible. Assuming the toothbrushes sell well, the financial manager will gather data to help the management team decide whether to put the profits toward producing more toothbrushes, start a line of mouthwashes, pay a dividend to shareholders, or take some other action.

Throughout the process, the financial manager will ensure the company has enough cash on hand to pay the new workers producing the toothbrushes. She'll also analyze whether the company is spending and generating as much money as she estimated when she budgeted for the project.

NetSuite: Financial Management for Startups and Beyond

Financial management in a startup begins with creating and adhering to a budget aligned with the business plan, managing profits, ensuring timely payments, and monitoring customer receipts. As the company grows and hires finance and accounting professionals, responsibilities expand to include accurate payroll, tax filing, financial statement preparation, and fraud prevention.

Balancing strategic and tactical decisions is crucial, addressing questions about profitability, feasibility of new ventures, and future projections. Effective financial management establishes systems to answer these questions.

However, managing finances can be complex, especially for startups and growing businesses. NetSuite's financial management software offers cloud-based solutions that ensure accurate, real-time data accessibility from anywhere. From automating processes to providing performance insights, NetSuite supports seamless integration and efficient operations, scaling with your company's growth for informed decision-making. Choose NetSuite for a secure financial future for your business.

FAQs on Financial Management Explained: Scope, Objectives & Importance - Financial Management & Strategic Management for CA Intermediate

| 1. What is the scope of financial management? |  |

| 2. What are the objectives of financial management? |  |

| 3. What is the importance of financial management? |  |

| 4. What is the difference between static and flexible budgeting in financial management? |  |

| 5. How does financial management help in managing and assessing risk? |  |