What are the 5 Heads of Income Tax? | Taxation for CA Intermediate PDF Download

| Table of contents |

|

| Introduction |

|

| What are the 5 types of income tax? |

|

| Heads of Income vs. Sources of Income |

|

| What are the Five Features of Tax? |

|

Introduction

Under the Income Tax Act, a taxpayer’s earnings are categorized into five distinct heads of income. At the end of each financial year, it is crucial to accurately classify your earnings under these categories to ensure correct tax calculation.

Understanding which of your earnings falls under each category is essential. Continue reading to gain a clear understanding of these income heads.

ITR Filing Last Date 2024

The last date to file Income Tax Return (ITR) for FY 2023-24 (AY 2024-25) without a late fee is 31st July 2024.

What are the 5 types of income tax?

The 5 heads of income tax are:

- Income from salary

- Income from house property

- Income from profits and gains from business or profession

- Income from capital gains

- Income from other sources

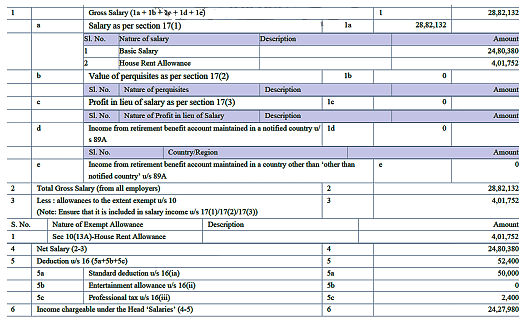

Income from salary

Any income you receive for services provided under a contract of employment is subject to taxation under this category. This includes salary, advance salary, perquisites, gratuity, commission, annual bonus, and pension.

The following sections govern income from salary:

- Section 15 describes the taxability of salary income.

- Section 16 explains deductions available under salaries.

- Section 17 details the components of salary, such as monetary compensation and perquisites.

This tax head also includes some exemptions:

- House Rent Allowance (HRA): If you are a salaried individual living in a rented house, you can claim HRA for partial or complete tax exemptions.

- Transport Allowance: Employees who are blind, deaf and dumb, or orthopedically handicapped can claim an allowance of Rs 1,600 per month.

The tax calculation structure for salary income needs to be filled in Schedule S of your ITR form.

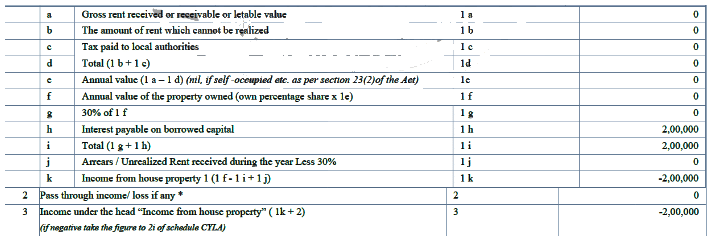

Income from House Property

Income from an individual's house property or the land appurtenant to such property is taxable under the head "Income from House Property." Essentially, this category includes the policy for calculating tax on rental income received from properties.

Income from House Property is broadly classified into three sub-categories:

- Self-Occupied Property

- Let-Out Property

- Deemed Let-Out Property

If you own more than two self-occupied houses, only two of them are considered self-occupied, while the rest are deemed let-out. Taxation applies to income received from both commercial and residential properties.

Details of such house property need to be declared in Schedule HP of your ITR in the following format.

Income from Profits and Gains from Business or Profession

Profits earned from any business or profession are taxable under this category. You can deduct your expenses from the total income to determine the taxable amount.

The types of income chargeable under this head include:

- Profits from the sale of certain licenses

- Gains earned by an individual during an assessment year

- Profits made by an organization on its income

- Cash received from the export of a government scheme

- Benefits received by a business

- Gains, bonuses, or salary received by an individual due to a partnership with a firm

Individuals or HUFs earning income from business or profession must file ITR-3 or ITR-4.

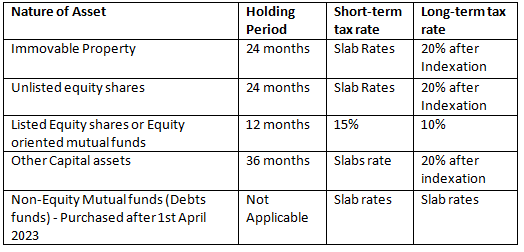

Income from Capital Gains

Profits earned from transferring or selling an asset held as an investment are taxable under the head of income from capital gains. Various assets, such as gold, bonds, mutual funds, real estate, and stocks, fall under capital assets.

Capital gains can be subdivided into:

- Short-term capital gains

- Long-term capital gains

Below is a table showing the holding period and tax rates for different asset classes:

Details of capital gains need to be disclosed in Schedule CG of your ITR form. If you are an individual, you will have to opt for ITR 2 or 3

Income from Other Sources

This category encompasses any income not covered by the other four heads of income tax. According to Section 56 sub-section (2) of the Income-tax Act, it includes income from dividends, interest, rent on plant and machinery, lottery winnings, bank deposits, gambling, card games, sports rewards, and more.

Heads of Income vs. Sources of Income

Heads of income are classifications of an individual's earnings or gains during a given year as per the Income Tax Act. This classification is necessary for taxation purposes. The heads of income include:

- Income from Salaries

- Income from House Property

- Profits and Gains from Profession or Business

- Capital Gains

- Income from Other Sources

On the other hand, sources of income refer to the monetary origins from which a person or business earns income. For individuals, these sources include:

- Salary

- Interest

- Commission, etc.

For businesses, the sources include:

- Returns on investments

- Profits

- Grants from the government, and more

What are the Five Features of Tax?

The five key features of tax are:

- Types of Taxes: Taxes can be categorized into four types: Direct tax, Indirect tax, Business tax, and Property and Sales Tax. Income tax is one of the most common types in the country.

- Compulsory Payment: It is mandatory for all liable citizens to pay taxes. Refusal to do so is a punishable offense.

- Periodic Payment: Taxes must be paid periodically and regularly as determined by the tax authority.

- Purpose of Taxation: Taxes are levied to fund government public expenditures.

- No Direct Quid-Pro-Quo: There is no direct exchange or quid-pro-quo between the public authority and taxpayers.

Now that you know the five heads of income and their corresponding sections, you can easily classify your income under the proper categories. To calculate your net tax accurately and avoid unnecessary penalties, consider consulting a tax professional.

|

38 videos|118 docs|12 tests

|

FAQs on What are the 5 Heads of Income Tax? - Taxation for CA Intermediate

| 1. What are the 5 types of income tax? |  |

| 2. What are the 5 Heads of Income Tax? |  |

| 3. What are the Five Features of Tax? |  |

| 4. What is the difference between Heads of Income and Sources of Income? |  |

| 5. What are some common deductions available under income tax laws? |  |