Class 10 Exam > Class 10 Notes > Economics for GCSE/IGCSE > Government Intervention to Address Market Failure

Government Intervention to Address Market Failure | Economics for GCSE/IGCSE - Class 10 PDF Download

Intervention to Address Market Failure

- Four of the frequently employed strategies to tackle market failure in markets consist of indirect taxation, subsidies, price ceilings, and price floors.

- Additional intervention methods encompass regulation, government ownership, transferring ownership to private entities, and the state's provision of public goods.

Maximum Prices

- A maximum price, established by the government, is set below the prevailing free market equilibrium price. Sellers are prohibited from selling the goods or services above this price point.

- Governments commonly implement maximum prices to benefit consumers. These price controls may be enforced over extended periods, such as in housing rental markets, or as short-term measures to address sudden price surges, like those seen in the petrol market.

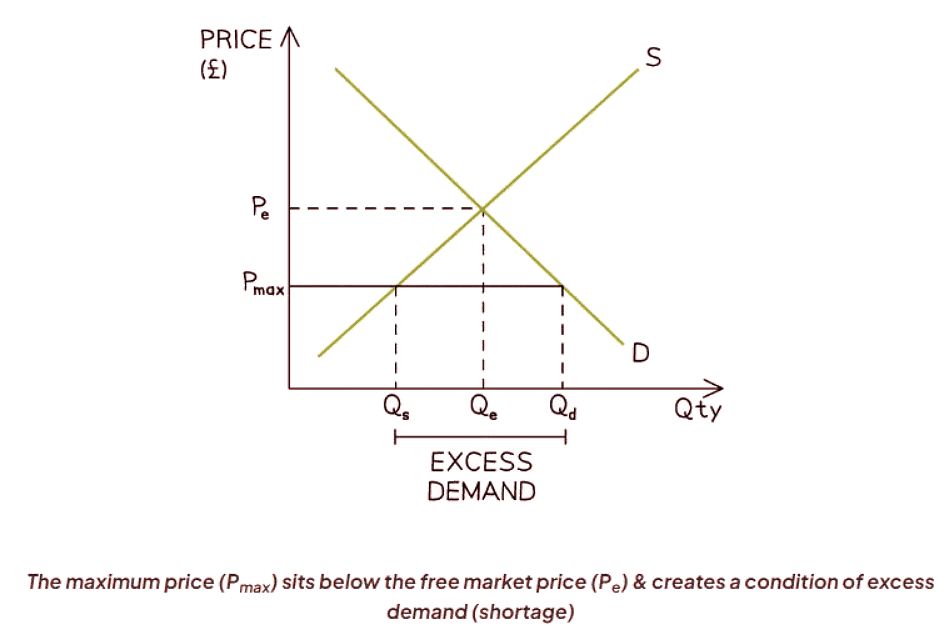

Diagram Analysis:

- The market equilibrium initially stands at Pe and Qe.

- Introduction of a maximum price at Pmax alters the equilibrium:

- Reduced supply incentive causes QS to contract from Qe to Qs.

- Increased demand incentive leads to an extension in QD from Qe to Qd.

- This mismatch results in excess demand (Qs< />d).

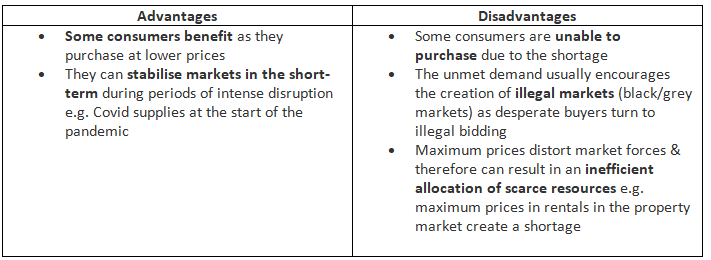

The Advantages & Disadvantages of Using Maximum Prices

Question for Government Intervention to Address Market FailureTry yourself: What is the purpose of implementing maximum prices in a market?View Solution

Minimum Prices

- A minimum price is established by the government above the current free market equilibrium price. Sellers are prohibited from selling the good/service at a lower price.

- Governments often implement minimum prices to support producers or reduce the consumption of demerit goods such as alcohol.

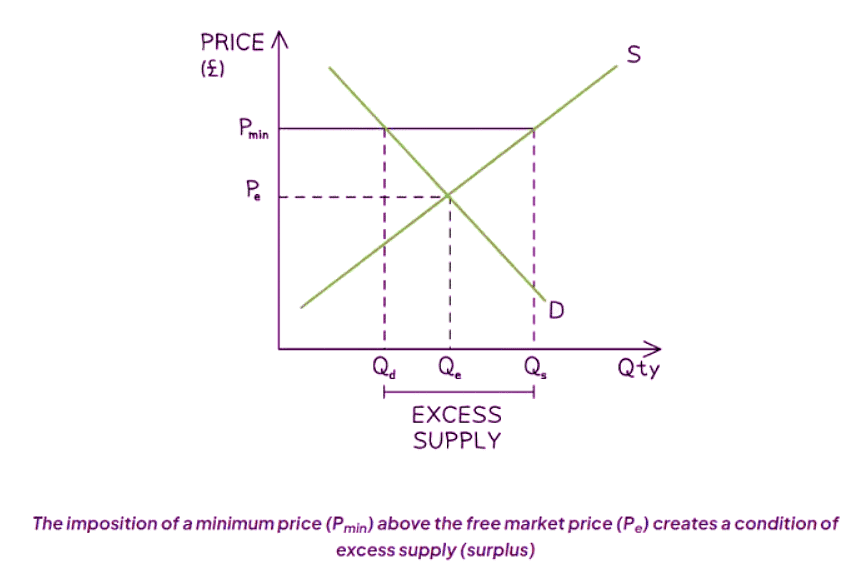

Diagram Analysis:

- The market initially balances at price Pe and quantity Qe.

- When a minimum price (Pmin) is enforced:

- Higher prices incentivize suppliers, increasing quantity supplied from Qe to Qs.

- Higher prices discourage consumers, decreasing quantity demanded from Qe to Qd.

- This discrepancy leads to excess supply (Qd > Qs).

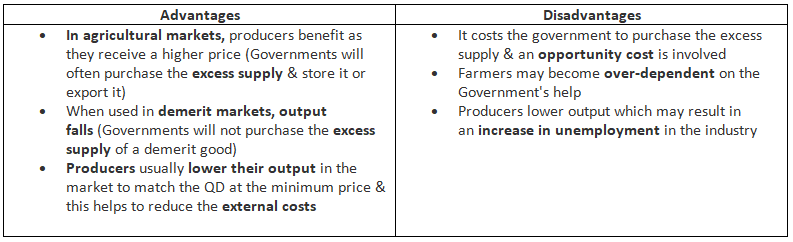

The Advantages & Disadvantages of Using Minimum Prices In Product Markets

Minimum Prices in Labour Markets

- Minimum prices are applied in the labor market to safeguard workers against wage exploitation, termed as national minimum wages (NMW).

- NMW denotes a legally mandated wage floor that employers are obligated to remunerate their employees, set higher than the prevailing market rate.

- The hourly minimum wage varies depending on the worker's age.

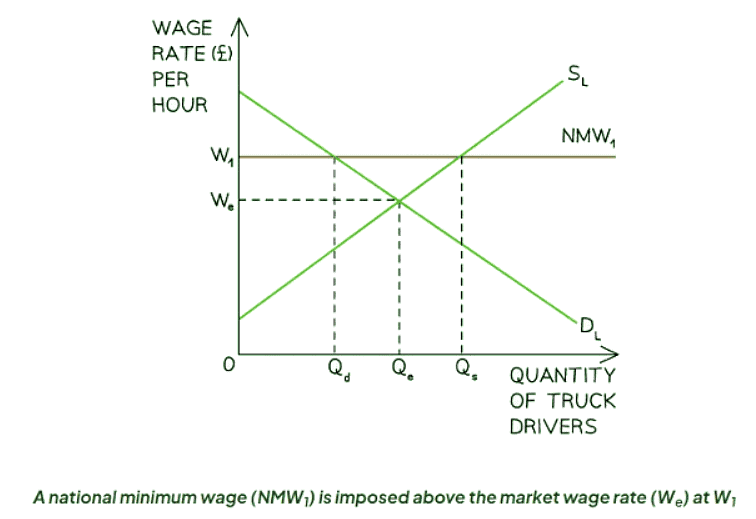

Diagram Analysis:

- The Concept of Labour Market Equilibrium:

- The demand for labor (DL) signifies the necessity for workers as indicated by firms.

- The supply of labor (SL) denotes the availability of labor provided by workers.

- Market equilibrium for truck drivers in the UK is observed at a wage rate of We and quantity Qe.

- National Minimum Wage Impact:

- The UK government enforces a national minimum wage (NMW) set at W1.

- Due to higher wages, the supply of labor escalates from Qe to Qs.

- Facing increased production costs, firms' demand for labor diminishes from Qe to Qd.

- Resultingly, at wage rate W1, there exists an excess supply of labor leading to potential unemployment, quantified at Qd to Qs.

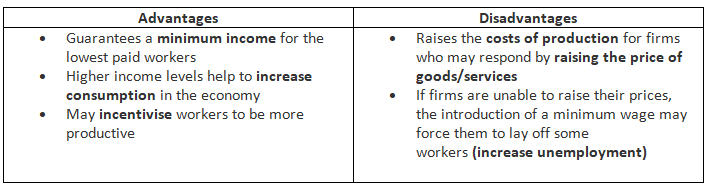

The Advantages & Disadvantages of a Minimum Wage In Labour Markets

Indirect Taxation

- An indirect tax is a type of tax imposed on the consumption of goods and services. It is paid by consumers when they make a purchase.

- Typically, governments levy indirect taxes on demerit goods to decrease the quantity demanded (QD) and/or to increase government revenue. The revenue generated is then utilized to finance public services such as education.

- These taxes are imposed on producers, leading to shifts in the supply curve. Both producers and consumers bear a portion of the tax burden, known as the tax incidence.

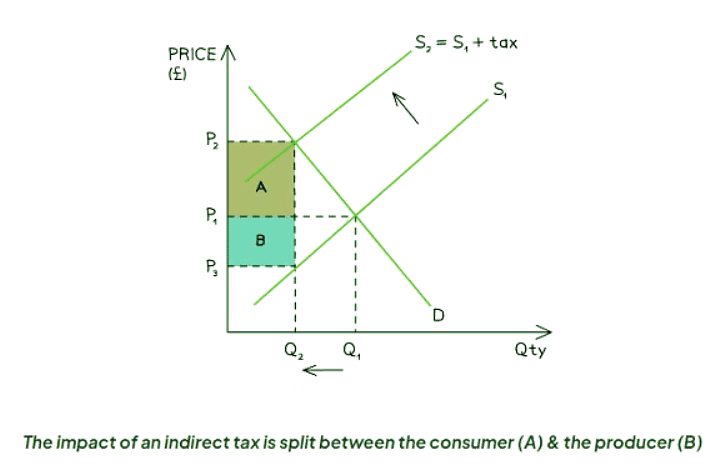

Diagram Analysis:

- The government imposes a specific tax on a demerit good, causing the supply curve to shift from S1 to S2 by the amount of the tax.

- The consumer's price increases from P1 to P2 after the tax.

- The producer's price decreases from P1 to P3 post-tax.

- The government's tax revenue is calculated as (P2 - P3) x Q2.

- Consumer incidence of the tax (area A) is (P2 - P1) x Q2.

- Producer incidence of the tax (area B) is (P1 - P3) x Q2.

- The quantity demanded (QD) decreases from Q1 to Q2, potentially leading to worker layoffs if significant enough.

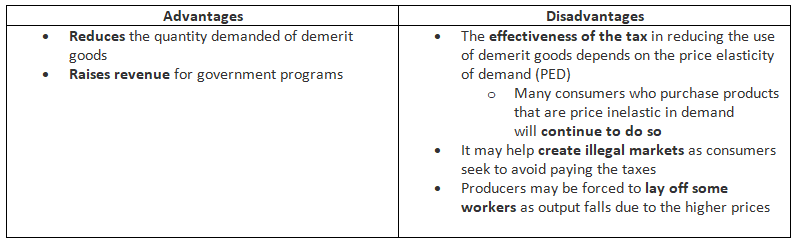

The Advantages & Disadvantages Of Indirect Taxes

Question for Government Intervention to Address Market FailureTry yourself: What is the purpose of implementing minimum prices in product markets?View Solution

Producer Subsidies

- A producer subsidy is a monetary incentive provided by the government to firms with the aim of boosting production and promoting the provision of goods that are considered beneficial to society.

- These subsidies are implemented to encourage firms to increase their output and to support the production of goods that have positive externalities, such as merit goods like education or healthcare.

- When a subsidy is granted, the division of its benefits between producers and consumers is influenced by the price elasticity of demand (PED) for the specific product.

- Producers typically retain a portion of the subsidy and pass on the remainder to consumers through reduced prices, aiming to stimulate demand for their products.

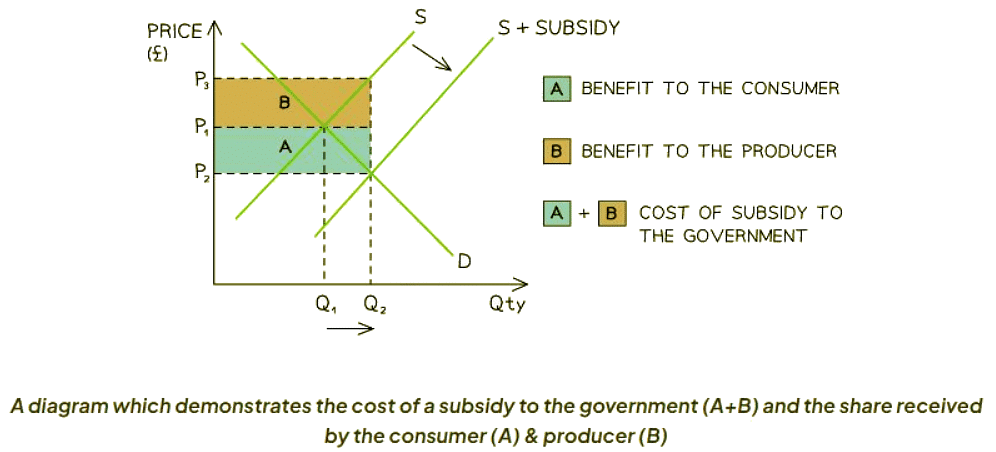

Diagram Analysis:

- The original equilibrium price and quantity are denoted by P1 and Q1.

- Introducing a subsidy causes the supply curve to shift, resulting in an increase in quantity demanded from Q1 to Q2. This change leads to a new market equilibrium at price P2 and quantity Q2.

- This shift in equilibrium signifies a reduction in price and an increase in quantity demanded within the market.

- Producers receive a price of P2 from the consumer along with a subsidy per unit from the government. This results in the producer revenue being P3 x Q2. The portion of the subsidy that goes to the producer is denoted as B in the diagram.

- The subsidy effectively reduces the price consumers pay from P1 to P2. The consumer's share of the subsidy is represented as A in the diagram.

- The total cost incurred by the government due to the subsidy amounts to (P3 - P2) x Q2, which is visually indicated by the area A + B.

- Producers receive P2 from consumers in addition to a subsidy per unit from the government. Consequently, the producer's revenue equals P3 x Q2. The section of the subsidy allocated to the producer is identified as A in the diagram.

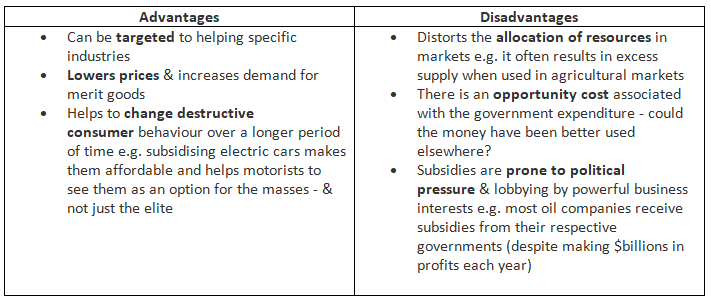

The Advantages & Disadvantages Of Producer Subsidies

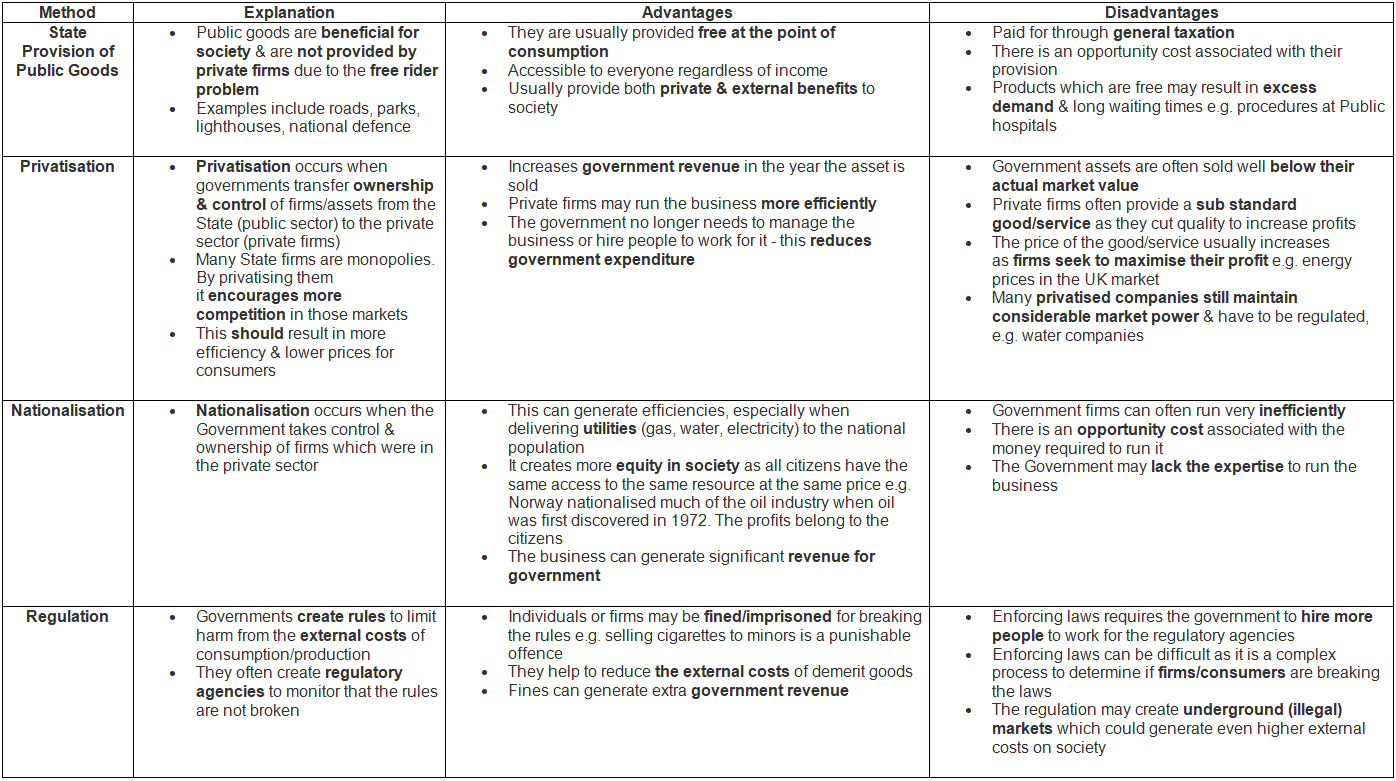

Other Government Policy Measures to Address Market Failure

Other Methods Used to Address Market Failure

The document Government Intervention to Address Market Failure | Economics for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Economics for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

56 videos|97 docs|38 tests

|

FAQs on Government Intervention to Address Market Failure - Economics for GCSE/IGCSE - Class 10

| 1. What is the purpose of government intervention to address market failure? |  |

Ans. Government intervention is necessary to address market failure when the free market system does not allocate resources efficiently, leading to negative externalities or inadequate provision of public goods. This intervention aims to correct market outcomes and ensure economic welfare.

| 2. How does a maximum price work in addressing market failure? |  |

Ans. A maximum price set by the government below the market equilibrium price can prevent prices from rising too high, making goods more affordable for consumers. However, it can also lead to shortages and black markets if the price is set below the equilibrium.

| 3. What are the advantages of using maximum prices to address market failure? |  |

Ans. Maximum prices can prevent price gouging, protect consumers from high prices, and ensure that essential goods and services are accessible to all. They can also help control inflation and reduce income inequality.

| 4. What are the disadvantages of using maximum prices to address market failure? |  |

Ans. Setting maximum prices can lead to shortages, decrease quality, and create inefficiencies in the market. It can also discourage producers from supplying goods at lower prices, leading to a decrease in supply.

| 5. How do minimum prices impact the market and address market failure? |  |

Ans. Minimum prices set by the government above the market equilibrium price can ensure that producers receive a fair income for their goods, prevent oversupply, and stabilize prices. However, they can also lead to surpluses and waste if the price is set too high.

Related Searches