Class 10 Exam > Class 10 Notes > Economics for GCSE/IGCSE > Central & Commercial Banks

Central & Commercial Banks | Economics for GCSE/IGCSE - Class 10 PDF Download

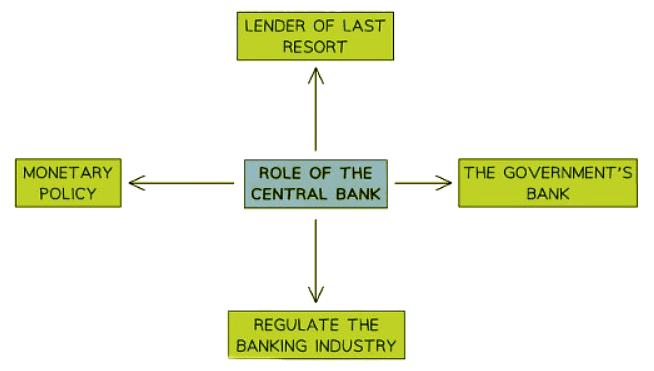

The Functions of Central Banks

Central banks are crucial for ensuring stability in the financial system and for implementing policy measures to achieve government economic goals and stimulate economic growth.

Central Banks play four significant roles in the economy

- Role 1: Implementation of Monetary Policy: Central Banks execute monetary policies which are crucial for managing economic stability. For example, adjusting interest rates to control inflation.

- Role 2: Banker to the Government: Central Banks handle government finances, including managing tax revenues and payments. In the UK, for instance, they oversee the payment of millions of public sector workers each month based on the government's budget.

- Role 3: Banker to the Banks – Lender of Last Resort: Central Banks act as lenders of last resort for commercial banks facing short-term liquidity issues. This prevents bank failures that could destabilize the financial system and endanger people's savings.

- Role 4: Regulation of the Banking Industry: Due to information imbalances in financial markets, commercial banks require regulation to safeguard consumers' interests. This oversight ensures fair practices and protects individuals' savings and investments.

Question for Central & Commercial BanksTry yourself: What is one of the roles of central banks in the economy?View Solution

The Functions of Commercial Banks

- Financial markets encompass systems enabling the exchange of goods, services, and financial instruments like loans, bonds, equities, and currencies.

- Commercial Banks are pivotal within financial markets, facilitating various crucial functions:

- Savings Facilitation: Commercial Banks aid in storing money for future needs, crucial for both households and firms. Savings are subsequently lent out by financial institutions, illustrating the cycle of saving and borrowing.

- Credit Provision: They extend credit to businesses and individuals, essential for economic progress. Borrowings accelerate consumption and investment, enabling purchases like homes through mortgages.

- Facilitating Transactions: Commercial Banks streamline the exchange of goods and services, offering diverse methods such as digital apps, debit/credit cards, and bank transfers.

- Forward Markets: They provide platforms for trading in currencies and commodities, offering price stability and opportunities for profit through speculation on future prices.

- Equities Market: Commercial Banks facilitate trading in shares of public companies on stock exchanges worldwide, supporting both long-term investments and speculative activities through buyer-seller connections.

The document Central & Commercial Banks | Economics for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Economics for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

56 videos|97 docs|38 tests

|

FAQs on Central & Commercial Banks - Economics for GCSE/IGCSE - Class 10

| 1. What are the main functions of central banks? |  |

Ans. Central banks perform various functions, including conducting monetary policy, issuing currency, serving as a lender of last resort, regulating and supervising financial institutions, and managing foreign exchange reserves.

| 2. How do central banks conduct monetary policy? |  |

Ans. Central banks conduct monetary policy by influencing interest rates, controlling the money supply, and using tools such as open market operations, reserve requirements, and discount rates to achieve their desired economic objectives.

| 3. What role do central banks play in regulating financial institutions? |  |

Ans. Central banks regulate and supervise financial institutions to ensure stability in the financial system, protect consumers, maintain confidence in the banking sector, and prevent systemic risks that could lead to financial crises.

| 4. Why are central banks considered the lender of last resort? |  |

Ans. Central banks act as the lender of last resort by providing emergency liquidity to financial institutions facing liquidity shortages, preventing bank runs, and stabilizing the financial system during times of crisis.

| 5. How do central banks manage foreign exchange reserves? |  |

Ans. Central banks manage foreign exchange reserves to maintain stability in the foreign exchange market, support their domestic currency, and meet international obligations. They may intervene in the foreign exchange market to influence exchange rates and protect their currency's value.

Related Searches