Class 10 Exam > Class 10 Notes > Business Studies for GCSE/IGCSE > Deciding on the Business Ownership Model

Deciding on the Business Ownership Model | Business Studies for GCSE/IGCSE - Class 10 PDF Download

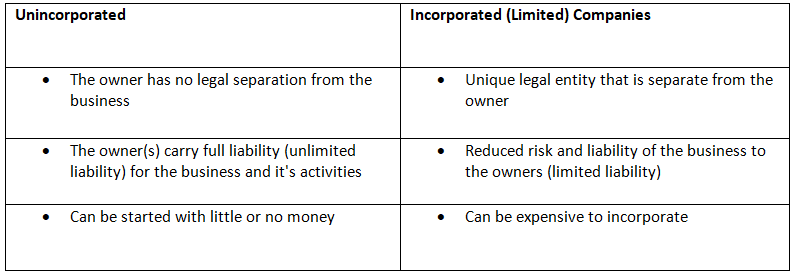

Unincorporated Businesses and Limited Companies

- The distinction between unincorporated and incorporated businesses is closely associated with the concepts of limited liability and unlimited liability.

- Unincorporated Businesses:

- Unincorporated businesses, like sole traders and partnerships, lack a separate legal identity from their owners. This means that the owners are personally liable for the business's obligations, risking their personal assets in case of legal disputes.

- For instance, if an unincorporated business faces a lawsuit, the owner(s) must cover legal expenses with their own funds.

- Incorporated Businesses:

- In contrast, incorporated businesses, known as companies, possess a distinct legal identity from their owners. This separation ensures that the owners' liability is limited to their initial investments.

- If an incorporated business, such as private limited companies (Ltd) or public limited companies (PLC), faces financial turmoil, the shareholders are not personally accountable for the debts beyond the amount they invested in the company.

A Comparison of Unincorporated and Incorporated Companies

Question for Deciding on the Business Ownership ModelTry yourself: What is the main difference between unincorporated businesses and incorporated businesses?View Solution

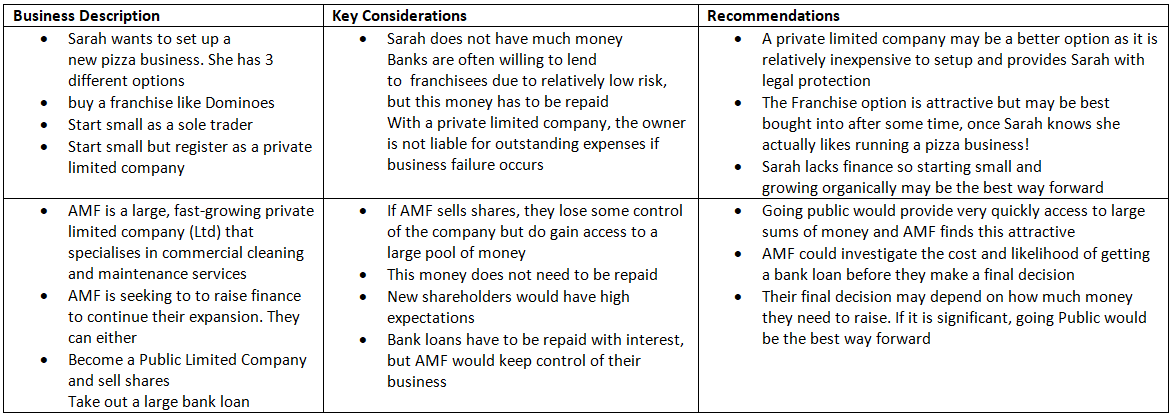

Recommending a form of Business Ownership

- An entrepreneur should select a business structure that aligns with the business requirements, specific circumstances, and the extent of personal liability.

- Choosing the optimal legal ownership form necessitates contemplating various factors.

Ownership Structure

- Which liability model, limited or unlimited, is most suitable?

- Is the business built on an original concept or a franchise?

Control and Privacy Preferences

- What level of direct decision-making control does the owner(s) seek?

- Does the owner(s) wish to distribute the workload?

- Is the owner(s) comfortable with making financial accounts publicly accessible?

Financial Considerations

- How much initial capital is necessary for startup?

- How might the choice of financing impact the breakeven point and profits?

- What approach will be used to manage finances?

Business Objectives and Growth Stage

- Is the business in its nascent or established phase?

- Does the owner aspire for business expansion?

Examples of Recommendations for Business Ownership

The document Deciding on the Business Ownership Model | Business Studies for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Business Studies for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

70 videos|93 docs|26 tests

|

FAQs on Deciding on the Business Ownership Model - Business Studies for GCSE/IGCSE - Class 10

| 1. What is the difference between an unincorporated business and a limited company? |  |

Ans. An unincorporated business is not a separate legal entity from its owner, meaning the owner is personally liable for the business's debts. On the other hand, a limited company is a separate legal entity, providing limited liability protection to its owners (shareholders).

| 2. What factors should I consider when deciding on the form of business ownership for my company? |  |

Ans. When deciding on the form of business ownership, you should consider factors such as liability protection, tax implications, ease of formation, and the level of control you want to maintain over the business.

| 3. What are the main advantages of operating as a limited company rather than an unincorporated business? |  |

Ans. Operating as a limited company provides limited liability protection to the owners, potentially lower tax rates, credibility in the eyes of suppliers and customers, and easier access to funding through the sale of shares.

| 4. Can an unincorporated business later become a limited company? |  |

Ans. Yes, an unincorporated business can later choose to incorporate and become a limited company. This process involves registering the company with the appropriate government authorities and issuing shares to the owners.

| 5. Are there any disadvantages to operating as a limited company compared to an unincorporated business? |  |

Ans. Some disadvantages of operating as a limited company include higher administrative and compliance requirements, costlier formation process, less privacy as company information is publicly available, and potentially more complex tax obligations.

Related Searches