Year 11 Exam > Year 11 Notes > Accounting for GCSE/IGCSE > Accounting Procedures

Accounting Procedures | Accounting for GCSE/IGCSE - Year 11 PDF Download

Capital and Revenue Expenditure and Receipts

Capital and Revenue Expenditure

- Purchasing a non-current asset is considered as capital expenditure. Therefore, its cost is not immediately expensed in the purchases ledger but recorded in the non-current assets account. The total cost of the non-current asset is not treated as an expense in the year of purchase, as it provides benefits to the business over several years. This practice involves matching the capital expenditure against the revenue it generates, spreading the cost of the asset over its useful life—a process known as depreciation, which is a form of revenue expenditure.

- Capital expenditure encompasses various costs, including the purchase cost of the non-current asset, legal expenses associated with the acquisition, transportation costs, and installation charges.

- Misclassifying capital expenditure as revenue expenditure or vice versa can distort the profit reported in the income statement and impact the value of the non-current asset, thereby affecting the accounting equation.

- Revenue expenditure constitutes expenses necessary for the day-to-day operations of the business, such as maintenance costs for non-current assets, general operational expenses, or transportation expenses. These costs are matched against the revenue generated in the income statement.

Capital and Revenue Receipt

- Capital receipt pertains to the income derived from the sales of Non-Current Assets (NCA). This should not be included in the Income Statement (IS). However, any resulting profit or loss from the sale of an NCA must be reflected in the Income statement.

- When a non-current asset is disposed of, the receipt is classified as a capital receipt and is documented in the non-current asset disposal account, not the sales account.

- On the other hand, revenue receipt encompasses income generated from the daily operations of the business, such as commissions received, rent collected, sales revenue, and similar sources.

Accounting for Depreciation and Disposal of Non-Current Assets

- Depreciation is an adjustment made at the end of the year to reduce the value of non-current assets over time, reflecting the gradual loss in their worth during their useful life. This practice is rooted in the principle of prudence, aiming to prevent potential overstatement of a business's profit by ensuring assets are not portrayed at their original cost, which could mislead stakeholders. Land typically does not depreciate unless it's subject to extraction activities like mining or drilling, in which case it's termed as depletion. Buildings, on the other hand, do depreciate.

- When a non-current asset is acquired, it's considered a capital expenditure, and the entire cost is not expensed in the year of purchase. Instead, the cost is spread over the asset's useful life to match the expenditure against the revenue it generates. This approach aligns with the principle of matching expenses with revenues. Additionally, assets are presented in the statement of financial position at their net book value rather than their historical cost, demonstrating the application of the principle of prudence.

- Depreciation can result from physical wear and tear, economic factors, or the passage of time. Various methods of depreciation exist, but it's essential to select the most suitable one consistently to ensure fair distribution of costs.

- Refer to Table for a comparison of different depreciation methods:

- Factors to consider when selecting a depreciation method include:

- Life expectancy of the asset.

- Residual value, or the value the asset retains at the end of its useful life.

- Estimated benefit derived from utilizing the asset.

- Under the straight-line depreciation method, the depreciation amount remains consistent over time.

- Businesses have the flexibility to decide when to commence depreciating an asset. For instance, they may opt to charge only a portion of the depreciation based on the months of ownership until the financial year end, or choose to record a full year of depreciation, or even defer depreciation entirely in the year of purchase. The same flexibility applies to the sale of a non-current asset.

- When employing the revaluation method of depreciation, no separate depreciation account is established. Instead, the same asset account is utilized to calculate depreciation.

- Depreciation, when debited into the income statement, diminishes the year's net profit through the provision for depreciation.

- In the statement of financial position, the accumulated depreciation up to the current financial year, along with the depreciation for the current year, is deducted from the cost price to ascertain the net book value, which decreases over time.

- Asset A/C Format:

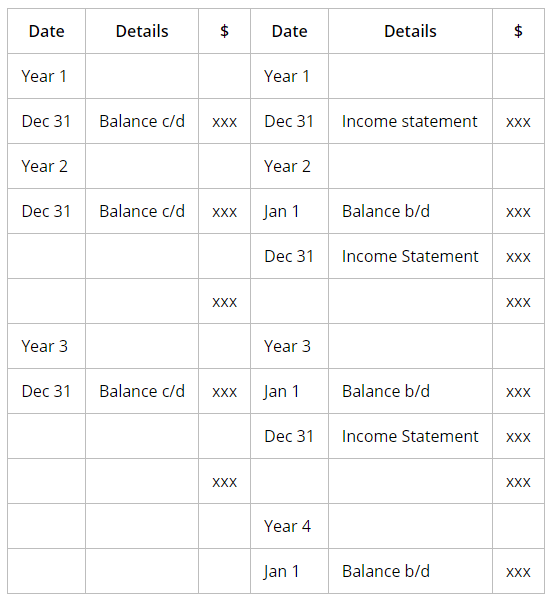

- Provision for depreciation A/C Format:

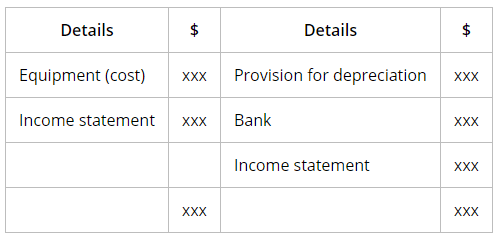

- Asset Disposal A/C Format:

- Similar entries for depreciation and the sale of a non-current asset will be recorded in the prime books, specifically in the general or nominal journal.

Question for Accounting ProceduresTry yourself: Which of the following is an example of capital expenditure?View Solution

Other Payables and Other Receivables

- Year-end adjustments, also known as accruals, are made in financial statements to ensure a more accurate representation of a business's profit or loss.

- It's common to encounter expenses or income incurred in one financial year but pertaining to other periods.

- The income statement should only include items relevant to the specified reporting period, regardless of the timing of actual payments or receipts, reflecting the accruals principle.

- Adjusting the income statement for prepaid or accrued amounts enhances the accuracy of the profit or loss figure, facilitating meaningful comparisons across different periods and businesses.

- Accrued expenses represent amounts due in an accounting period but remain unpaid by its end, indicating that the benefit or service has been received but not yet paid for.

- Prepaid expenses denote amounts paid in advance for benefits or services to be received in future accounting periods.

- When adjusting for accrued expenses, the outstanding amount is added to the respective expense, while prepaid amounts are subtracted.

- In cases where multiple expenses are accrued, a collective figure is often presented instead of individual entries.

- For expenses to be paid or accrued expenses, the total expenses incurred in the trading period, including those not due for payment in the current year, are calculated, and any opening credit balance is subtracted to determine the amount to be transferred to the income statement.

- Accrued income occurs when a beneficiary receives a benefit or service from the business during the accounting period but has not yet paid for it.

- Prepaid income arises when a person pays for a benefit or service from the business, but the business has not provided it by the end of the financial year. The accruals principle dictates that any amount for which legal ownership of goods or services has not been transferred to the buyer must be deducted from the total income transferred to the income statement and recorded as a liability in the statement of financial position.

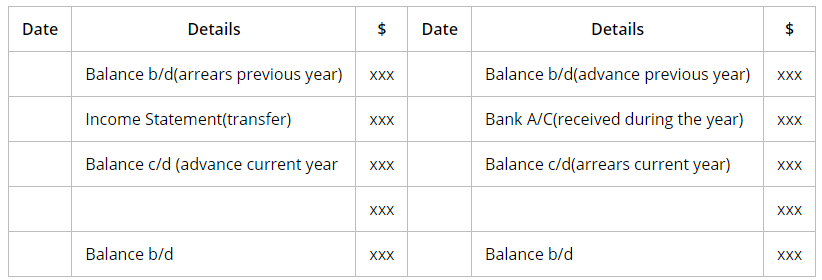

Income Account Format

Expense Account Format

Irrecoverable Debts and Provision for Doubtful Debts

When debts become uncollectible, they are termed as irrecoverable debts. To account for this, businesses create a provision for doubtful debts to anticipate potential losses.

Here are the key points:

- Irrecoverable Debts

- Debts that are impossible to recover due to various reasons such as bankruptcy or disappearance of the debtor.

- Example: A company writes off a debt after numerous unsuccessful attempts to collect it.

- Provision for Doubtful Debts

- An estimated amount set aside by a business to cover potential losses from uncollectible debts.

- Example: A company sets aside $10,000 as a provision for doubtful debts based on past trends and experiences.

- When goods are sold on credit, it is common that not all debts are fully recovered. The portion not paid by the debtor is termed as bad debt. This risk exists due to various reasons such as the debtor's inability to pay or unfortunate events like their passing. If all efforts to retrieve the debt prove futile, it is considered uncollectible. The debtor's account is closed by debiting the bad debts account and crediting the debtor's account with the outstanding amount. At the year-end, this amount is accounted for as a loss or expense in the Income Statement.

- Writing off such debts is a practice rooted in prudence, ensuring that one's profit is not inflated by overestimating assets.

- Bad debts that are subsequently recovered involve debiting the cash book when a debtor pays some or all of the previously written-off debt. The amount paid is credited to the Bad Debts Recovered account. Alternatively, the debt can be reinstated by reversing the initial write-off entry, followed by debiting the cash book and crediting the debtor's account.

- In cases where specific names and dates are unavailable, the entry in the bad debts account can be recorded as "debtors written off" on the final day of the accounting period.

- The most certain method to prevent bad debts is to avoid selling goods on credit altogether, although this is often impractical. Practical strategies to mitigate the risk of bad debts include seeking credit references from banks and other suppliers for potential debtors, setting credit limits per debtor, and implementing credit control measures. Businesses should regularly issue invoices, month-end statements, and reminders to debtors regarding outstanding amounts. Legal action, while an option, is usually expensive and may not be cost-effective.

- Adhering to the principle of prudence, businesses estimate potential losses from bad debts, aligning with the principle of accruals. Estimated bad debts from sales are recorded in the year of the sale rather than when the debts are officially deemed uncollectible, portraying a more realistic depiction of the business's assets.

- Estimating the amount of bad debts can be approached in several ways, such as evaluating individual debtor accounts, drawing from past experiences with debtors, devising a percentage of estimated uncollectible debts, or utilizing an aging schedule that assigns higher probabilities of non-payment to older debts. An example could be setting aside 5% of the total trade receivables as a provision for bad debts, a common practice in examinations.

- Creating a provision for doubtful debts involves debiting the Income Statement and crediting the Provision for Doubtful Debts account. In the Balance Sheet or Statement of Financial Position, the balance in the Provision for Doubtful Debts account is deducted from the trade receivables. In the Income Statement, bad debts are accounted for as expenses alongside the provision for doubtful debts. The adjustment of the provision may be necessary if there are changes in the level of debts or if adjustments are warranted for specific reasons, typically done at the end of the financial year.

- Adjusting the provision for doubtful debts entails subtracting any increase in the provision from the Income Statement or adding any decrease. In the Balance Sheet or Statement of Financial Position, the new provision for doubtful debts is deducted from the total trade receivables.

- Dr IS and Cr provision for doubtful debts A/C

- In the Balance Sheet (BS) or Statement of Financial Position (SOFP), deduct the balance in the provision for doubtful debts A/C from the trade receivables.

- In the Income Statement (IS), bad debts are shown along with the provision for doubtful debts as expenses. In the BS/SOFP, the deduction of the provision for doubtful debts is shown on the total trade receivables, which is already reduced by any bad debts.

- The provision for doubtful debts may need adjustment if, for instance, the debts have increased or decreased, or if a specific amount has been designated for any reason. This adjustment is typically done at the conclusion of the financial year.

- Adjusting a provision for doubtful debts: If an increase is necessary, subtract the increment in the IS, and vice versa for a decrease. In the BS/SOFP, deduct the new provision for doubtful debts from the total trade receivables.

- If the provision needs to be increased, subtract the difference in the IS. Similarly, if it needs to be decreased, do the opposite. In the BS/SOFP, deduct the new provision for doubtful debts from the total trade receivables.

- Only the amount by which the provision for doubtful debts has increased or decreased is displayed in the IS, as the remainder has been adjusted for in prior accounting periods. If there is a decrease, the variance is recorded in the Income Statement as a reduction in provision for doubtful debts, treated as income. Conversely, an increase is handled oppositely.

Provision for Doubtful Debts format

Valuation of Inventory

- Inventory valuation is crucial at the end of the financial year and is based on the lower of cost and net realizable value.

- The cost of inventory comprises the actual price and additional expenses like Carriage inwards that bring the inventory to its current state.

- The net realizable value represents the estimated revenue from the sale of inventory.

- Typically, the net realizable value exceeds the cost of inventory.

- An example can be illustrated with ABC business's inventory valuation at DD/MM/YYY:

- Type X - 50 units at $10 per unit - $500

- Type Y - 30 units at $5 per unit - $150

- Total: $650

Question for Accounting ProceduresTry yourself: How are year-end adjustments, also known as accruals, beneficial in financial statements?View Solution

The document Accounting Procedures | Accounting for GCSE/IGCSE - Year 11 is a part of the Year 11 Course Accounting for GCSE/IGCSE.

All you need of Year 11 at this link: Year 11

|

22 videos|29 docs|12 tests

|

FAQs on Accounting Procedures - Accounting for GCSE/IGCSE - Year 11

| 1. What is the difference between capital and revenue expenditure? |  |

Ans. Capital expenditure refers to expenses incurred on acquiring or improving a long-term asset, while revenue expenditure is the cost of running the day-to-day operations of a business.

| 2. How is depreciation calculated for an asset? |  |

Ans. Depreciation is calculated by dividing the cost of the asset by its useful life. The result is then allocated as an expense over the useful life of the asset.

| 3. What is the purpose of a Provision for Depreciation Account? |  |

Ans. The Provision for Depreciation Account is used to accumulate the total depreciation expense on an asset over time, ensuring that the asset's value is accurately reflected on the balance sheet.

| 4. How is an Asset Disposal Account formatted? |  |

Ans. An Asset Disposal Account typically includes the original cost of the asset, accumulated depreciation, proceeds from the sale, and any gain or loss on disposal.

| 5. How are Irrecoverable Debts and Provision for Doubtful Debts related? |  |

Ans. Irrecoverable debts are those that cannot be collected from customers, while the Provision for Doubtful Debts is an estimate of potential bad debts that may arise in the future.

|

Explore Courses for Year 11 exam

|

|

Signup for Free!

Signup to see your scores go up within 7 days! Learn & Practice with 1000+ FREE Notes, Videos & Tests.

Related Searches