Class 10 Exam > Class 10 Notes > Business Studies for GCSE/IGCSE > Different Types of Costs

Different Types of Costs | Business Studies for GCSE/IGCSE - Class 10 PDF Download

Different Types of Business Costs

- Businesses face various expenses, such as purchasing raw materials, compensating employees, and covering utility bills like electricity.

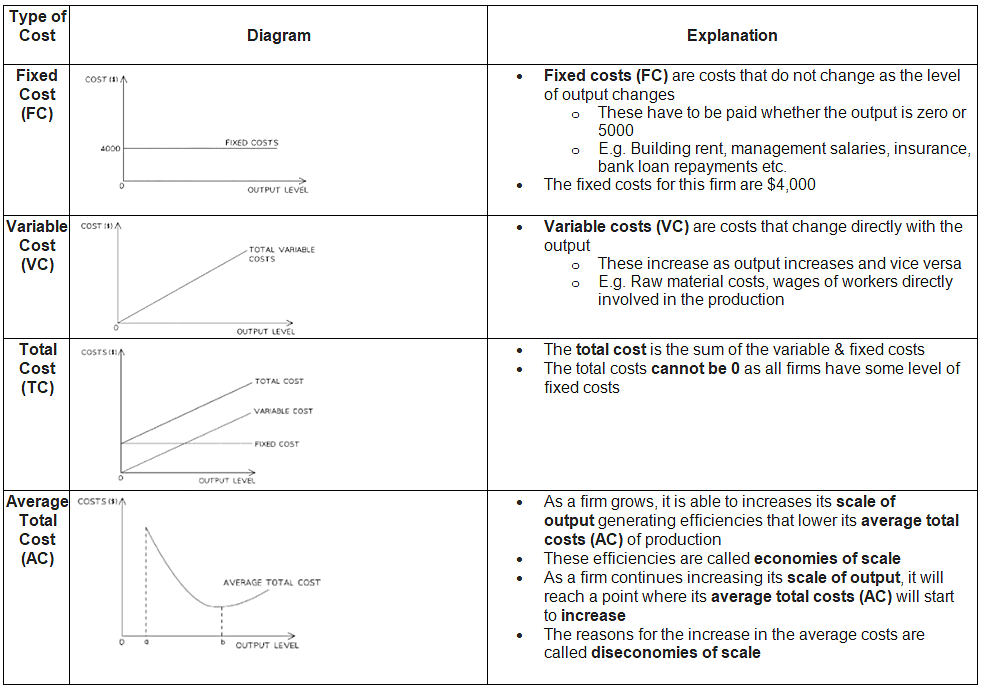

- These expenses are typically categorized as follows:

- Fixed Costs

- Variable Costs

- Total Costs

- Average Costs

An Explanation of the Different Costs of a Business

Cost Calculations

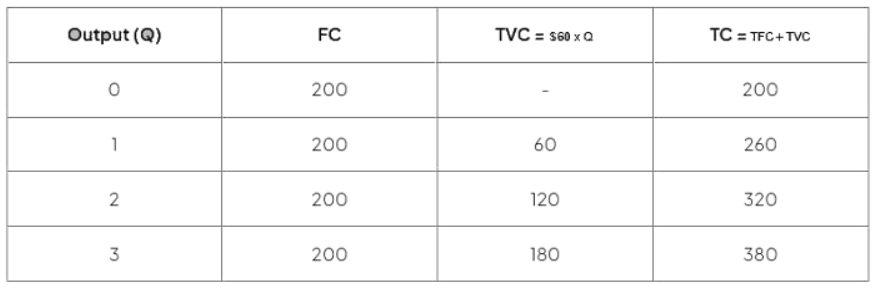

Business costs can be computed in various ways based on specific definitions.

Cost Calculations Using the Above Formulas Where VC is £60

Question for Different Types of CostsTry yourself: What are fixed costs in a business?View Solution

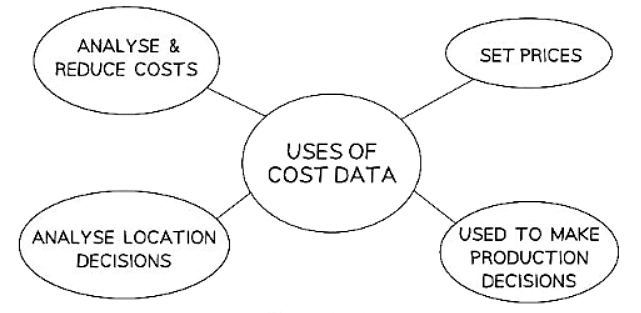

Using Cost Data to Make Decisions

- Businesses benefit from utilizing cost data to drive their decision-making processes.

What Decisions cost data Influences

- Reducing Costs:

- To enhance profitability, businesses often focus on reducing costs, which can be identified through accurate cost analysis.

- Fixed costs can be minimized by relocating to more affordable premises, cutting employee salaries, reducing promotional expenses, or seeking cheaper utility providers.

- Variable costs can be decreased by sourcing less expensive materials, purchasing raw materials in bulk, or outsourcing distribution to third-party firms.

- For instance, many businesses opt to sell products through Amazon, which handles packaging and shipping at a lower cost than the business could manage independently.

- However, businesses must carefully weigh the repercussions of cost reductions on customer service, quality, and delivery speed.

- Reducing staff salaries may result in diminished customer service skills or experience among employees.

- Using cheaper materials and components may compromise product quality.

- To enhance profitability, businesses often focus on reducing costs, which can be identified through accurate cost analysis.

- Price Setting:

- Costs are integral to determining selling prices and are crucial for profit generation.

- For instance, if the average cost of producing a cake is $3 and the business aims for a $1 profit per cake, the selling price needs to be set at $4.

- Production Decisions:

- If production costs exceed revenue, the business will incur a loss, prompting the decision to either continue production or cease.

- Factors influencing this decision include the product's market launch status and whether fixed costs remain payable.

- Location Selection:

- Property expenses, whether in rent or purchase, constitute a significant monthly expenditure.

- Businesses must evaluate location costs alongside factors like transportation accessibility, proximity to customers, and workforce availability.

The document Different Types of Costs | Business Studies for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Business Studies for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

70 videos|93 docs|26 tests

|

FAQs on Different Types of Costs - Business Studies for GCSE/IGCSE - Class 10

| 1. What are the different types of business costs that a company may incur? |  |

Ans. The different types of business costs include fixed costs (such as rent and salaries), variable costs (like raw materials and utilities), semi-variable costs (such as commissions), direct costs (related to producing goods or services), and indirect costs (not directly tied to production).

| 2. How can businesses use cost data to make decisions? |  |

Ans. Businesses can use cost data to analyze profitability, set prices, make budgeting decisions, evaluate performance, identify cost-saving opportunities, and make strategic decisions regarding investments and expansions.

| 3. What is the importance of understanding different types of business costs for entrepreneurs and small business owners? |  |

Ans. Understanding different types of business costs helps entrepreneurs and small business owners effectively manage their finances, improve profitability, make informed decisions, and plan for future growth and sustainability.

| 4. How do businesses differentiate between fixed and variable costs? |  |

Ans. Fixed costs remain constant regardless of production levels (e.g., rent), while variable costs fluctuate with production levels (e.g., raw materials). By analyzing cost behavior, businesses can better understand cost structures and make informed decisions.

| 5. Can you provide examples of how businesses can reduce costs based on the different types of business costs discussed in the article? |  |

Ans. Businesses can reduce costs by renegotiating contracts for fixed costs, optimizing production processes to lower variable costs, outsourcing non-core activities to reduce indirect costs, implementing cost-effective marketing strategies, and investing in technology to automate tasks and reduce labor costs.

Related Searches