Class 10 Exam > Class 10 Notes > Business Studies for GCSE/IGCSE > Choosing the best type of Finance

Choosing the best type of Finance | Business Studies for GCSE/IGCSE - Class 10 PDF Download

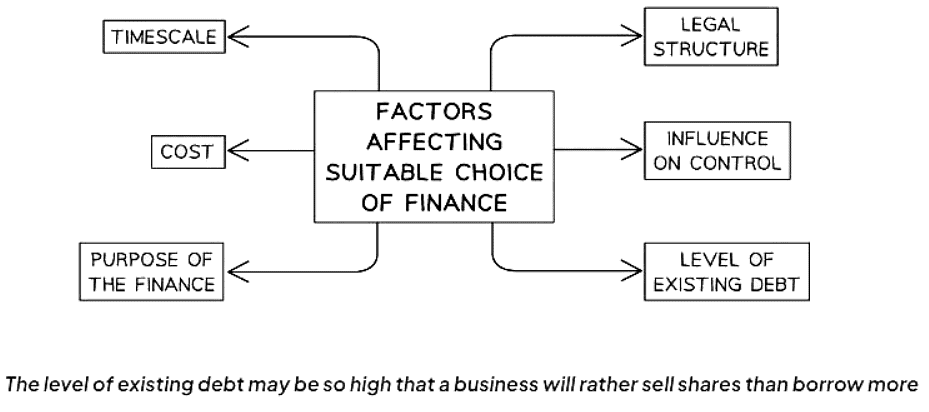

Factors to Consider when Choosing a Source of Finance

- There are numerous factors that managers need to evaluate before determining the type and source of finance required.

- They may even need to utilize multiple sources of finance simultaneously.

Diagram: Factors Affecting the Suitable Choice of Finance

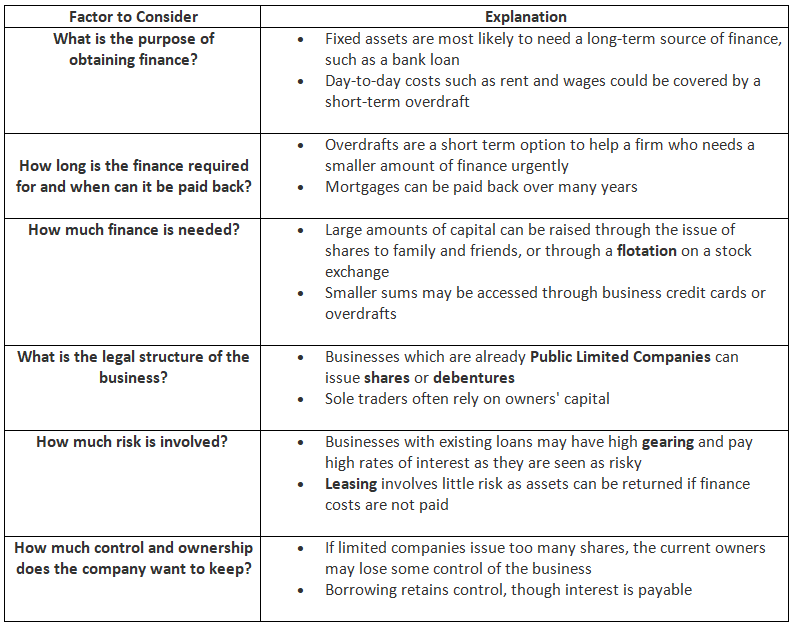

An Explanation of the Factors Affecting the Choice of Finance

Reducing the risk of being unable to raise finance

- This risk of not being able to raise finance can be mitigated through various strategies.

- Bank loans are more likely to be approved under certain conditions:

- A business should present a compelling business plan, complete with a cash-flow statement and income statement from the previous period.

- External sources of finance should be minimal and effectively managed.

- The business should possess collateral to lower the risk for the bank.

- Shareholder investment is more probable when:

- The share price shows improvement.

- Generous dividends are being offered.

- The company demonstrates good profit potential and has plans for growth.

- Alternative investments are less appealing.

Recommending an Appropriate Source of Finance

- Finance managers often need to advise their CEOs on the best financing options to utilize. This decision is typically made after conducting a thorough analysis based on the questions outlined in the table above.

- Determining the most suitable form of financing involves analyzing the questions provided in the table.

Example 1

- Successful private limited company specializing in wooden furniture seeks additional funding to expand into new markets, after 15 years of established operations and a strong reputation.

Key Considerations:

- As a limited company, the option of selling shares to family and friends exists, albeit with limitations on the amount raised.

- With a track record of 15 years, the company poses lower risk compared to a new startup, making it a viable candidate for a bank loan.

- Reinvestment of profits alone may not suffice to fuel expansion plans.

Recommendation:

- A bank loan presents a viable option, leveraging the company's successful track record. Repayments can be spread out over several years, although interest payments are required.

- Issuing new shares to existing shareholders is another avenue, potentially attracting increased investment from those familiar with the company's success and eager to participate in its growth.

- However, the decision hinges on the owner's willingness to cede control and ownership by issuing additional shares.

- Overall, finance managers are likely to advocate for securing a bank loan, given its potential to preserve ownership and a share of future profits.

Example 2

A fashion trainer retail store experiences a surge in sales following promotion by an influencer on TikTok and Instagram, necessitating swift replenishment of stock. Sole trader Toby contemplates utilizing his existing overdraft or trade credit.

Key Considerations:

- Replenishing stock urgently favors leveraging the existing overdraft facility, providing instant access to finance.

- Opting for trade credit allows Toby to defer immediate payment for stock, mitigating potential cash flow challenges as sales can be made before payment to the supplier is due.

Recommendation:

- An overdraft, being a short-term finance solution, entails interest payments on the utilized amount.

- Trade credit offers relief on financial strain as stock is replenished, possibly accompanied by discounts upon agreement setup.

- Most finance managers would advise Toby to prioritize seeking trade credit initially. Should this option prove unattainable, utilizing the overdraft facility becomes a viable alternative.

Question for Choosing the best type of FinanceTry yourself: What factors should be considered when choosing a source of finance?View Solution

The document Choosing the best type of Finance | Business Studies for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Business Studies for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

70 videos|93 docs|26 tests

|

FAQs on Choosing the best type of Finance - Business Studies for GCSE/IGCSE - Class 10

| 1. What are some factors to consider when choosing a source of finance? |  |

Ans. Some factors to consider when choosing a source of finance include the cost of the finance, the flexibility of repayment terms, the speed of approval, the amount of funding required, and the impact on the company's ownership structure.

| 2. How can one recommend an appropriate source of finance? |  |

Ans. One can recommend an appropriate source of finance by analyzing the company's financial needs, considering the various options available, evaluating the pros and cons of each source, and selecting the one that best aligns with the company's goals and financial situation.

| 3. What are some tips for choosing the best type of finance for a business? |  |

Ans. Some tips for choosing the best type of finance for a business include understanding the different types of finance available, assessing the company's financial position and needs, seeking professional advice if necessary, comparing the terms and conditions of various sources, and considering the long-term implications of the financing decision.

| 4. How can one determine the most suitable source of finance for a specific project or investment? |  |

Ans. One can determine the most suitable source of finance for a specific project or investment by conducting a thorough feasibility study, evaluating the risks and rewards associated with each source, considering the timeline for the project, and choosing the option that offers the best balance of cost and flexibility.

| 5. What are some common challenges businesses face when selecting a source of finance? |  |

Ans. Some common challenges businesses face when selecting a source of finance include determining the appropriate amount of funding needed, negotiating favorable terms with lenders or investors, managing the impact on the company's cash flow, and balancing the desire for growth with the need to maintain financial stability.

Related Searches