Class 10 Exam > Class 10 Notes > Business Studies for GCSE/IGCSE > Tariffs & Quotas

Tariffs & Quotas | Business Studies for GCSE/IGCSE - Class 10 PDF Download

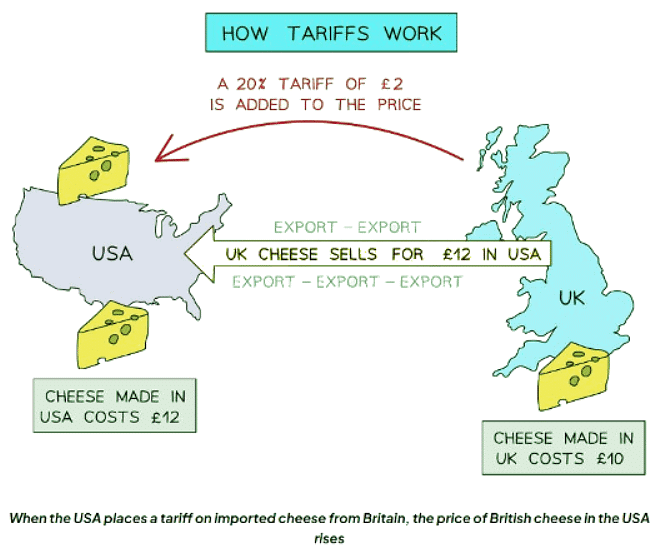

Import Tariffs

- Definition: An import tariff is a tax imposed on goods brought into a country from abroad.

- Example: For instance, consider tennis rackets being imported from China into the UK, facing a tariff rate of 4.7%.

- Impact: Import tariffs lead to a rise in the cost of imported items, influencing consumers to prefer domestic products over foreign alternatives.

- American consumers are increasingly inclined to buy American cheese due to tariffs, which have raised the prices of British cheese.

The Benefits of Tariffs

- They safeguard emerging industries during their early stages to foster eventual global competitiveness.

- Leads to a rise in government tax income.

- Mitigates dumping by foreign enterprises by preventing them from selling below market price.

The Drawbacks of Tariffs

- Raises the expenses of imported raw materials, impacting businesses reliant on these inputs for production, resulting in elevated prices for consumers.

- Diminishes competition for domestic enterprises, potentially fostering inefficiency and the production of subpar products for consumers.

- Constrains consumer options by elevating import costs, rendering certain goods unaffordable to some customers.

Question for Tariffs & QuotasTry yourself: What is the impact of import tariffs on consumer behavior?View Solution

Quotas

- An import quota is a restriction set by the government on the amount of a specific product that can be brought into a country. For instance, China has imposed an import quota on Cambodian rice, limiting it to about 5.32 million tonnes annually.

- Implementing import quotas helps local businesses by reducing external competition, allowing them to capture more of the market share. This means that a greater portion of the demand is satisfied by domestic producers.

The Benefits of Import Quotas

- To meet additional demand, local businesses may need to expand their workforce, leading to lower unemployment rates and overall economic advantages.

- The increased prices resulting from quotas can incentivize the establishment of new businesses within the industry.

- Nations have the flexibility to adjust import quotas according to evolving market conditions.

- Foreign countries tend to perceive quotas as less contentious compared to tariffs, allowing their exporters to sell goods domestically at higher prices, albeit within restricted quantities.

Disadvantages of Import Quotas

- Import quotas restrict the supply of a product, leading to an increase in its price due to limited availability.

- Implementing quotas may strain relationships with trading partners.

- Domestic firms could experience decreased efficiency over time as competition levels drop with quota usage.

Question for Tariffs & QuotasTry yourself: What is the purpose of implementing import quotas?View Solution

The document Tariffs & Quotas | Business Studies for GCSE/IGCSE - Class 10 is a part of the Class 10 Course Business Studies for GCSE/IGCSE.

All you need of Class 10 at this link: Class 10

|

70 videos|93 docs|26 tests

|

FAQs on Tariffs & Quotas - Business Studies for GCSE/IGCSE - Class 10

| 1. What is the difference between import tariffs and quotas? |  |

Ans. Import tariffs are taxes imposed on imported goods, while quotas are limits set on the quantity of goods that can be imported into a country.

| 2. How do import tariffs and quotas affect consumers? |  |

Ans. Import tariffs can lead to higher prices for imported goods, while quotas can result in limited availability of certain products, leading to higher prices as well.

| 3. Why do governments impose import tariffs and quotas? |  |

Ans. Governments may impose import tariffs and quotas to protect domestic industries, reduce trade deficits, or address national security concerns.

| 4. Can import tariffs and quotas be used as a tool for diplomacy? |  |

Ans. Yes, import tariffs and quotas can be used as leverage in trade negotiations or to address diplomatic issues between countries.

| 5. How do import tariffs and quotas impact international trade relationships? |  |

Ans. Import tariffs and quotas can create tensions between trading partners and lead to trade disputes, impacting the overall relationship between countries.

Related Searches