Service Costing (Transport) | Cost Accounting - B Com PDF Download

| Table of contents |

|

| Service Costing |

|

| Meaning of Transport Costing |

|

| Determination of Cost Unit in Transport Costing |

|

| Solved Examples |

|

Service Costing

Service costing, also referred to as operating costing, is a cost determination method used by organizations that provide services. Examples include transport companies, electricity companies, hospitals, cinemas, schools, and colleges. These entities use service costing to calculate the cost per unit of service provided.

According to the Chartered Institute of Management Accountants (CIMA) in London, "Operating costing is that form of operation costing which applies where standardized services are rendered either by an undertaking or by a service center within an organization."

Characteristics of Service Costing

- Services provided are standardized i.e. similar type of services are provided to all customers.

- Services are produced on a uninterrupted/regular basis.

- Capital is invested more in fixed assets (e.g. buying buses for a transport company) in comparison to investment in working capital (e.g. day-to-day expenses in running buses).

- Some part of operating costs of these undertakings is fixed cost and the other part is the variable cost.

Meaning of Transport Costing

Transport Costing is a type of service costing which is employed in transport undertakings. The basic objectives of transport costing are:

- To determine the cost of carrying passengers or goods.

- To determine the price/freight/fare to be charged from users of such service.

- To help the management in decision-making.

Determination of Cost Unit in Transport Costing

- Absolute tonne-km: cost units between two stations are separately calculated tonnes kms and then totalled up.

- Commercial tonne-km: the trip is considered as a whole and cost units are calculated by multiplying total distance in km by average load quantity.

Format of Operating Cost Sheet of a Transport Company

Solved Examples

Q1: From the following information, calculate (i) total kilomeres, and (ii) total passenger kilometres. Sol:

Sol:

(i) Total Kms:

4 X 30 X 2 X 100 = 48,000 kms

(we will multiply first four factors as 4 buses operate for 30 days for 2 trips each for every trip of 100 kms. This is the example of simple cost unit)

(ii) Total Passenger Kms:

48,000 X (40 X 75%) = 14,40,000 passenger kms

(we will multiply total kms calculated above with the no. of passengers actually travelling. This is the example of composite cost unit)

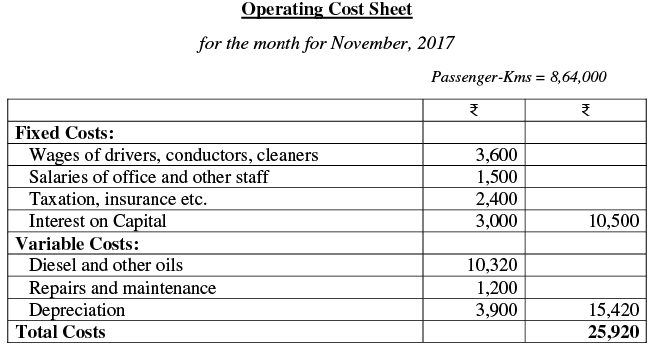

Q2: A transport company, is running a fleet of six buses between two towns 75 km apart. Seating apacity of each bus is 40 passengers. The following particulars are available for the month of fov. 2017.  Actual passengers carried were 80 per cent of the seating capacity. All the buses ran on all days of tie month. Each bus made one round trip per day.

Actual passengers carried were 80 per cent of the seating capacity. All the buses ran on all days of tie month. Each bus made one round trip per day.

Find out the cost per passenger-kilometre.

Sol:

First of all, calculate total passenger kms:

6 buses X 75 kms distance each side X 2 (coming and going i.e. round trip) X 30 days in a month X (40 X 80%) (actual passengers travelling)

= 8,64,000 passenger kms

Now, we will make an Operating Cost Sheet to calculate total cost of the transport company: Cost per passenger kms = Total Cost / Total passenger-kms

Cost per passenger kms = Total Cost / Total passenger-kms

= ₹ 25,920 / 8,64000

= ₹ 0.03 or 3 paise per passenger-kms

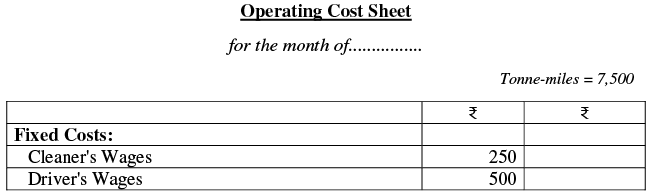

Q3: Union Transport Company supplies the following details in respect of a truck of 5-tonne capacity: The truck carries goods to and from city covering a distance of 50 miles each way.

The truck carries goods to and from city covering a distance of 50 miles each way.

While going to the city, freight is available to the extent of full capacity and on return 20% of capacity.

Assuming that the truck run on an average 25 days a month, work out —

(i) Operating cost per tonne-mile, and

(ii) Rate per trip that the company should charge if profit of 50% on freightage is to be earned.

Sol:

First of all, calculate total tonne-miles:

1 Truck X 25 working days X [(50 miles X 5tonne)(while going) + (50 miles X 1tonne)(while coming back, freight is available for only 20% capacity i.e. (5X 20%))]

= 7,500 tonne-miles

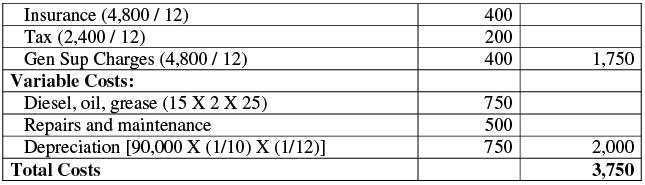

Now, we will make an Operating Cost Sheet to calculate total cost of the transport company:

(i) Operating Cost per Tonne-mile = Total Cost / Total Tonne-miles

= ₹ 3,750 / 7,500

= ₹ 0.50 or 50 paise per tonne-mile

(ii) Rate per trip to be charged by the company: (Freightage means cost plus profit; just like selling price)

So, Cost per tonne-mile = ₹ 0.50

Profit per tonne-mile = ₹ 0.50 (profit is 50 % on freightage that means 100 % on cost)

Thus, Freight rate per tonne-mile = ₹ 1 (by adding cost and profit)

Now, we will calculate total tonne-miles in one trip: (50 X 5) + (50 X 1) = 300 tonne-miles

So, Freight rate per trip both ways = ₹ 1 X 300 tonne-miles

= ₹ 300

|

106 videos|173 docs|18 tests

|

|

Explore Courses for B Com exam

|

|