Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI) | Crash Course for UGC NET Commerce PDF Download

What is Foreign Direct Investment (FDI)?

Foreign Direct Investment (FDI) occurs when a company or entity from one country invests in business interests within another country. This typically involves establishing manufacturing plants, acquiring assets like companies or property, or creating other business functions in the foreign country. Essentially, FDI represents a significant investment by a firm from one nation into the economy of another.

Why Do Governments Seek to Attract More Foreign Investment?

When foreign companies invest by setting up factories, acquiring local assets, or establishing businesses, they generate employment opportunities for the local population, helping to reduce unemployment rates. Moreover, foreign investors contribute to government revenues through various taxes, such as income and corporate taxes, thereby boosting the country’s fiscal resources.

The influx of foreign capital improves the nation’s balance of payments, while the introduction of new technologies and management practices enhances the productivity of local firms. Additionally, domestic suppliers gain access to international supply chains, expanding their market opportunities. The presence of foreign competitors also pushes local companies to become more efficient, thus improving overall economic competitiveness.

Over time, the cumulative effect of job creation, skill development, technology transfer, and increased competitiveness can lead to sustained economic growth. In some cases, foreign investment also contributes to the development of critical infrastructure needed for economic expansion.

Impact of Foreign Direct Investment on Economic Growth

The impact of FDI on economic growth can be summarized as follows:

- Job Creation: FDI results in the establishment of new businesses and the expansion of existing ones, leading to increased employment and reduced unemployment rates.

- Increased Tax Revenues: Foreign companies pay taxes, which enhances government revenues and supports public spending.

- Capital Inflows: FDI brings foreign capital into the country, which can be used for infrastructure development and broader economic progress.

- Technology and Skills Transfer: Foreign companies introduce new technologies, management practices, and expertise, boosting the productivity of local firms.

- Access to Global Supply Chains: Local suppliers can integrate into the global supply chains of foreign investors, opening up new export opportunities.

- Increased Competitiveness: The presence of foreign investors encourages local firms to improve their efficiency and competitiveness on a global scale.

- Economic Diversification: FDI in new sectors helps diversify the economy, reducing reliance on traditional industries and spreading risk.

- Infrastructure Development: Some FDI is directed towards building infrastructure such as roads, airports, and power plants, which enhances the overall investment climate.

- Spillover Effects on Local Firms: Local companies can learn and grow by observing and interacting with foreign investors, leading to positive outcomes for the domestic economy.

Impact of Foreign Direct Investment on the Indian Economy

FDI has had a significant impact on the Indian economy in several ways:

- Job Creation: FDI has created millions of jobs in India, particularly in labor-intensive manufacturing and service sectors, thereby helping to reduce unemployment.

- Technology and Skills Transfer: Foreign investors have introduced new technologies and management practices, greatly benefiting Indian companies.

- Increased Tax Revenues: Taxes paid by foreign companies contribute substantially to government revenues, which support welfare and development programs.

- Capital Inflows: FDI provides a vital source of foreign capital, which is used for infrastructure development and economic growth in India.

- Increased Competitiveness: The entry of foreign companies has driven Indian firms to upgrade their technology, improve quality, and streamline operations, making the economy more efficient.

- Industrial Growth: FDI has fueled the growth of key industries, including automobiles, textiles, pharmaceuticals, and food processing.

- Infrastructure Development: FDI has also contributed to the development of essential infrastructure, such as roads, ports, and power plants, benefiting the wider economy.

- Access to Global Markets: By integrating into the global supply chains of foreign investors, Indian companies have gained new export opportunities.

- Driver of Economic Reforms: FDI has acted as a catalyst for economic reforms in India, pushing the government to further open up and liberalize the economy.

- R&D Investments: Some foreign investors have established research centers in India, promoting innovation and the development of new products.

Regulation of Foreign Direct Investment in India

The regulation of Foreign Direct Investment (FDI) in India is outlined below:

FDI Policy: The Department for Promotion of Industry and Internal Trade (DPIIT), under the Ministry of Commerce and Industry, is responsible for formulating India’s FDI policy. This policy is published annually in a comprehensive document.

Types of FDI: Most sectors in India allow 100% FDI through the automatic route, meaning no prior approval from the government is needed. However, certain sectors require approval through the Foreign Investment Promotion Board (FIPB) route.

Sectoral Caps: Some sectors have a maximum limit on the FDI allowed. For instance, up to 74% FDI is permitted in the insurance sector, and 100% in single-brand retail.

Prohibited Sectors: FDI is not permitted in specific sectors such as gambling, lotteries, and atomic energy.

Conditions for FDI: The government may impose specific requirements for FDI in sensitive sectors, such as local sourcing obligations or export targets.

RBI Regulations: The Reserve Bank of India (RBI) oversees the implementation of FDI policy and monitors FDI inflows. It also issues notifications regarding any changes in the FDI policy.

SEBI Regulations: The Securities and Exchange Board of India (SEBI) sets the rules and regulations governing FDI in listed Indian companies.

FEMA Regulations: The Foreign Exchange Management Act (FEMA) governs cross-border investments in India, including investments by Non-Resident Indians (NRIs) and Overseas Citizens of India (OCIs).

Tax Laws: Indian tax laws regulate the taxation of foreign companies operating in India and the taxation of income derived from foreign investments.

Investment Promotion Agencies: Agencies like Invest India and state governments serve as single points of contact for foreign investors looking to invest in India.

Advantages and Disadvantages of Foreign Direct Investment

Advantages of Foreign Direct Investment

Job Creation: FDI leads to the establishment of new businesses, creating jobs for the local workforce and reducing unemployment.

Capital Inflows: FDI brings in foreign capital, which can be utilized for development and infrastructure projects.

Technology and Skills Transfer: Foreign firms often introduce new technologies, management techniques, and expertise, benefiting the local economy.

Access to Global Supply Chains: Local suppliers have opportunities to become part of foreign investors' supply chains, opening up export markets.

Increased Competitiveness: The entry of foreign investors forces local firms to enhance their efficiency, making the economy more competitive.

Economic Growth: These factors collectively contribute to the overall growth of the economy in the long term.

Disadvantages of Foreign Direct Investment

Loss of Control: Allowing foreign ownership of local assets can result in a partial loss of national control over those assets.

Risk of Capital Flight: There is a risk that foreign investors may withdraw their funds during economic downturns or crises.

Cultural Issues: The operations and practices of foreign investors may not always align with local cultural norms and values.

Environmental Issues: Some foreign investors may not adhere to the same stringent environmental standards required locally.

Uneven Development: FDI tends to concentrate in a few urban centers, often neglecting rural regions and smaller towns.

Dependency Risks: Over-reliance on FDI can make an economy dependent on foreign capital for its growth.

Example of Foreign Direct Investment

Consider a multinational automobile company based in Germany called "AutoSpeed." The company decides to expand its operations into India to access a new market and take advantage of lower labor costs.

To achieve this, AutoSpeed invests in building a new car manufacturing plant in Chennai, India. The company funds the construction, hires local employees, establishes supply lines, and begins producing cars for the Indian market. For the Indian government, this investment contributes to economic development, job creation, and technological advancement.

The investment made by AutoSpeed in establishing its new production facility in India is an example of Foreign Direct Investment (FDI). It is considered "foreign" because AutoSpeed is based in another country and "direct" because the company is investing directly in productive assets (the manufacturing plant) rather than through indirect methods like purchasing stocks in local companies.

Role of Foreign Direct Investment

The role of Foreign Direct Investment in an economy includes:

Economic Growth: FDI injects capital into the economy, stimulating economic growth, increasing GDP, and boosting economic output.

Job Creation: FDI often results in the creation of new businesses or the expansion of existing ones, which reduces unemployment rates in the host country.

Transfer of Skills and Technology: Companies from developed countries bring advanced technology and management skills to the host country, aiding in the development and modernization of the local economy.

Promotion of Competition: FDI stimulates competition in the domestic market, leading to improvements in production processes, product quality, and innovation.

Enhancement of International Trade: FDI often involves some form of export, increasing a country's participation in the global market, improving the trade balance, and bringing in foreign currency.

Infrastructural Development: Multinational corporations may invest in infrastructure, such as roads, power facilities, and telecommunications, which aids the overall development of the host nation’s infrastructure.

Tax Revenue: Governments can increase their revenue through taxes on profits generated by foreign-owned entities, which can be used to finance public services and investments.

Portfolio Investor

A portfolio investor is an individual or institution that diversifies their investments across various financial assets, typically creating a portfolio that includes securities like stocks, bonds, mutual funds, exchange-traded funds (ETFs), and other investment instruments. The primary objective of a portfolio investor is to mitigate risk by spreading investments across different assets and asset classes, aiming to achieve a balanced and potentially more stable return on investment.

Introduction to Foreign Portfolio Investment

Foreign portfolio investment refers to the practice of foreign investors purchasing stocks, bonds, and other financial assets issued by companies in another country. Unlike foreign direct investment (FDI), foreign portfolio investors do not gain control or management rights over the companies in which they invest. Instead, they invest in financial securities, not in the actual assets or operations of those firms. Their involvement is limited to financial returns, which are influenced by dividends, interest income, and capital gains. Portfolio investors do not have any influence over the companies they invest in and are considered passive owners of financial assets.

Foreign portfolio investments are typically liquid and short-term, as investors can buy and sell financial assets quickly. The returns from these investments depend on the performance of the underlying financial assets. Portfolio trends are often influenced by market conditions and may involve an element of chance rather than strategic planning and analysis.

While foreign portfolio investments can provide capital and stimulate the growth of financial markets, they can also introduce risks, such as increased market volatility. As a result, governments manage these investments through measures like capital controls and taxes to balance the benefits of stable portfolio inflows with the potential risks. When effectively managed, foreign portfolio investment can contribute to the growth of financial and economic markets.

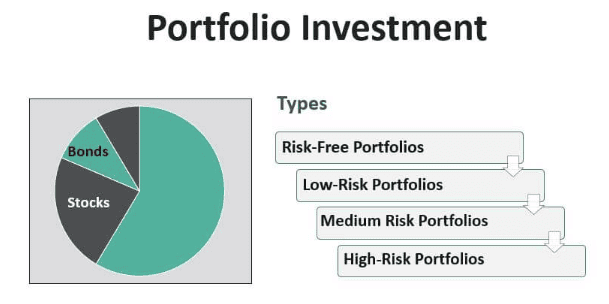

Types of Foreign Portfolio Investment (FPI)

Foreign portfolio investments can take several forms:

Equity Investment: Involves purchasing shares of foreign companies listed on a stock exchange. Equity investments provide investors with a share in the profits and growth potential of the companies.

Bond Investment: Involves buying bonds issued by foreign governments or companies. Bondholders receive periodic interest payments and the principal amount upon maturity.

Money Market Investment: Refers to investments in highly liquid, safe, and short-term securities like Treasury bills, bank certificates of deposit (CDs), and commercial paper.

Factors Affecting Foreign Portfolio Investment

Several factors influence foreign portfolio investments:

Economic Growth Prospects: Higher growth opportunities in a country attract more investors.

Interest Rates: Higher and more stable returns make a country more attractive to investors.

Risk-Return Tradeoff: Investors evaluate potential returns relative to the risks involved when deciding on foreign portfolio investments.

Currency Movements: Depreciation of the local currency can make investments cheaper for foreign investors and improve future repatriation of returns, boosting inflows.

Political Stability: Countries with stable political environments are more attractive for investments, while political instability can deter inflows.

Regulatory Environment: Strict regulations can act as barriers to foreign investment, while more relaxed regulations encourage investment.

Macroeconomic Stability: A stable macroeconomic environment, including low inflation and sustainable fiscal policies, is attractive to investors.

Financial Market Development: Well-developed financial markets are more likely to attract foreign investments.

Size of Local Capital Markets: Larger and more liquid domestic capital markets offer greater opportunities for foreign investors.

Volatility of Returns: High volatility in returns can make foreign investors cautious, affecting the inflow of portfolio capital.

Corruption Levels: High levels of corruption can deter foreign portfolio investors due to the risks of delays and lack of transparency.

Capital Controls: Restrictions on capital transactions, such as bans, quotas, and taxes, can limit the inflow of foreign portfolio investments.

Benefits of Foreign Portfolio Investment

Foreign portfolio investment offers several benefits:

Provides Capital for Economic Growth: It channels foreign savings into the domestic economy, financing corporate growth and government debt, thus supporting economic growth.

Develops Capital Markets: Increased foreign participation in local stock and bond markets leads to higher trading volumes, liquidity, and sophistication in these markets.

Increases Competition: The entry of foreign investors increases competition in domestic financial markets, driving local players to improve efficiency and services.

Transfers Skills and Technology: Foreign portfolio investors bring global experience, technical know-how, and market insights, which can benefit local capital market participants.

Risk Diversification: Portfolio investors can diversify risks by investing in a wider range of assets across multiple markets, reducing the volatility of their returns.

Higher Returns for Locals: Foreign interest in local assets tends to drive up their prices in the short term, providing gains to existing local investors.

Improves Corporate Governance: The scrutiny of foreign investors can encourage companies to adopt better governance practices and transparency to attract more portfolio inflows.

Offers Exit Options for Locals: Foreign portfolio investment provides local investors with an avenue to exit their investments by selling to foreign investors, enhancing liquidity.

Macroeconomic Benefits: Stable foreign portfolio inflows can help manage current account deficits, stabilize currency values, and build foreign reserves.

Limitations of Foreign Portfolio Investment

Foreign portfolio investment also has several limitations, including:

- Foreign Ownership Limits

- Sectoral Restrictions

- Regulatory Approval Requirements

- Currency Controls

- Taxation Policies

- Trading Restrictions

- Disclosure Requirements

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations

- Political and Economic Stability

- Repatriation Restrictions

Examples of Foreign Portfolio Investment

Here are some examples of foreign portfolio investments:

Equity Investments: Foreign investors purchase stocks listed on domestic stock exchanges, such as the NSE or BSE in India. For instance, foreign institutional investors in India hold over 20% of the total market capitalization of listed companies.

Bond Investments: Foreign mutual funds and pension funds invest in bonds issued by governments and companies in the local market. For example, about 35% of outstanding government bonds in Japan are held by foreign investors.

Money Market Investments: Foreign hedge funds and wealth funds allocate a portion of their portfolios to money market instruments in the domestic market, such as Treasury bills.

Factors Affecting International Portfolio Investment

Several factors influence international portfolio investments:

Expected Returns: Investors allocate capital to countries where they anticipate the highest returns for the level of risk involved. Higher expected returns attract more portfolio flows.

Risk Level: Factors like political instability, currency risks, and default risks affect portfolio investments. Lower risk levels and more stable environments attract more funds.

Interest Rates: Higher domestic interest rates relative to global rates make an economy more attractive to fixed-income portfolio investors.

Macroeconomic Stability: Economies with low and stable inflation, sustainable fiscal deficits, and prudent monetary policies are preferred by portfolio investors seeking stability.

Regulatory Environment: Strict investment rules, restrictions, and taxes reduce portfolio inflows, while less stringent regulations encourage more foreign participation.

Financial Market Development: More developed and sophisticated banking and capital markets are better equipped to attract and manage global portfolio flows.

Currency Stability: Stable currencies are more attractive to portfolio investors, while volatile and depreciating currencies can deter capital inflows.

Political Stability: Political unrest and risks deter portfolio investments, while stable environments with inclusive institutions are preferred.

Market Liquidity: More liquid and less volatile financial markets are better able to absorb portfolio flows without major disruptions.

Global Liquidity: Abundant global liquidity and the search for higher yields benefit economies that can tap into such funds through portfolio investments.

Conclusion

International portfolio investments are influenced by a combination of economic, financial, institutional, and political factors that shape the risk-return dynamics for investors in different economies. No single factor is decisive on its own. Foreign portfolio investment involves acquiring financial instruments issued by domestic firms by foreign investors. The examples provided illustrate common ways in which such portfolio flows occur globally.

|

157 videos|236 docs|166 tests

|

FAQs on Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI) - Crash Course for UGC NET Commerce

| 1. What is Foreign Direct Investment (FDI)? |  |

| 2. Why do governments seek to attract more foreign investment? |  |

| 3. What is the impact of Foreign Direct Investment on economic growth? |  |

| 4. How is Foreign Direct Investment regulated in India? |  |

| 5. What is the difference between Foreign Direct Investment (FDI) and Foreign Portfolio Investment (FPI)? |  |