India's FDI Policy | Crash Course for UGC NET Commerce PDF Download

| Table of contents |

|

| FDI Policy in India: An Overview |

|

| FDI Routes in India |

|

| Prohibited Sectors |

|

| New FDI Policy for Bordering Countries |

|

FDI Policy in India: An Overview

Foreign direct investment (FDI) refers to an investment where a foreign entity acquires controlling ownership in a business operating in another country.

- Unlike foreign portfolio investment, FDI is characterized by direct control over the business.

- FDI plays a crucial role in India's economic development, providing essential funds that help stimulate growth and employment.

- In response to India's dynamic economic landscape and competitive labor costs, many foreign companies have chosen to invest directly in the country's rapidly expanding private sector.

- India began liberalizing its economy following the 1991 economic crisis, leading to a steady increase in FDI, which has contributed to the creation of over 10 million jobs.

- On April 17, 2020, in light of the COVID-19 pandemic, the Indian government revised its FDI policy to prevent "opportunistic takeovers/acquisitions" of Indian companies.

- This revised policy ensures that all FDI is now subject to scrutiny by the Ministry of Commerce and Industry, although it does not impose new market restrictions.

FDI Routes in India

Automatic Route: Under this route, foreign investors do not need prior approval from the Indian government or the Reserve Bank of India (RBI). Sectors like medical devices, thermal power, and civil aviation projects are open to 100% FDI through the automatic route. Other sectors, such as insurance and pension funds, allow FDI up to 49%.

Government Route: For investments requiring government approval, applications must be submitted through the Foreign Investment Facilitation Portal (FIFP). The relevant ministry, in consultation with the Department for Promotion of Industry and Internal Trade (DPIIT), will decide on the approval. Sectors under this route include multi-brand retail trading, satellite operations, and print media.

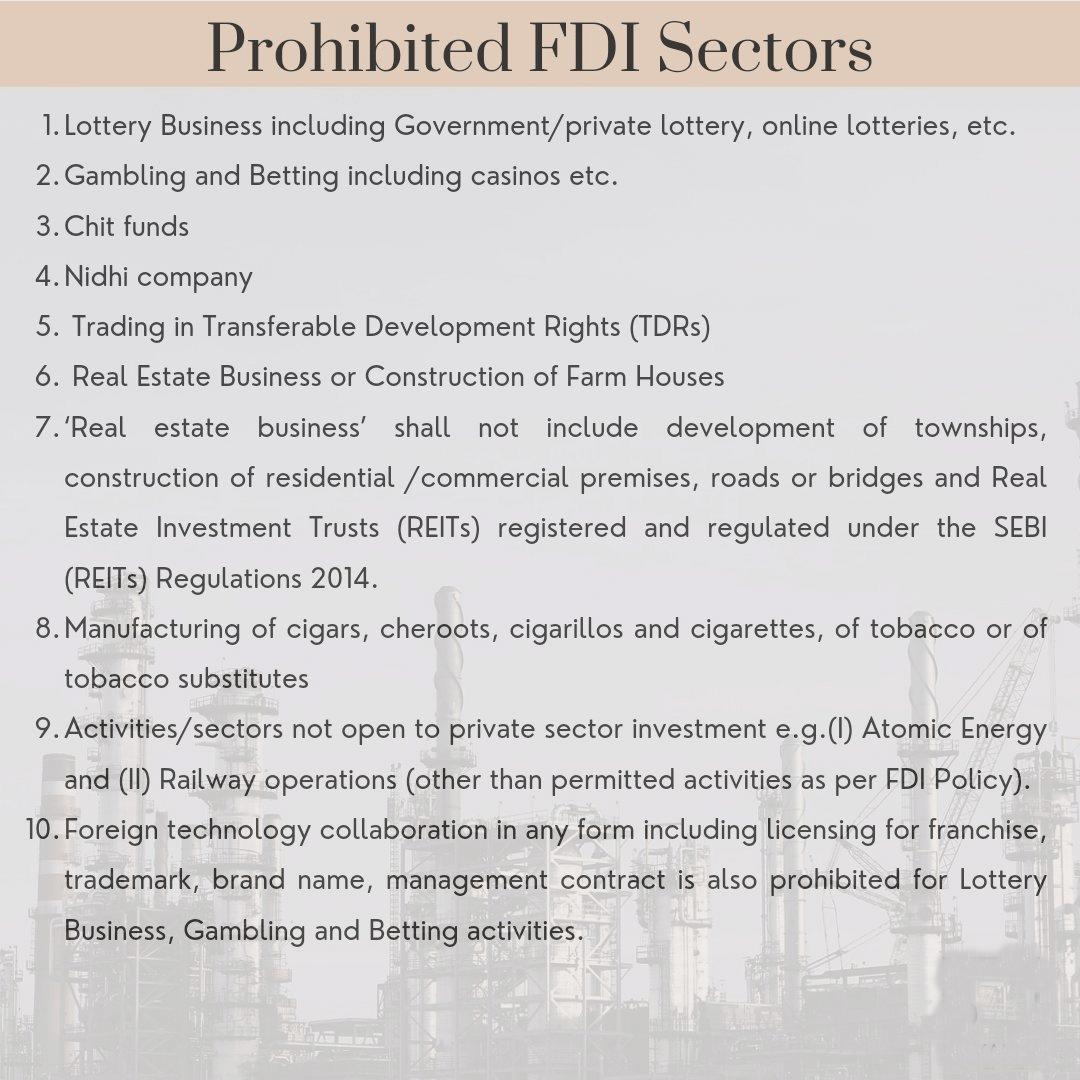

Prohibited Sectors

Certain sectors are off-limits for FDI in India, including:

- Lottery businesses (government and private)

- Gambling and betting (including casinos)

- Chit funds and Nidhi companies

- Trading in transferable development rights (TDRs)

- Manufacturing of cigars, cheroots, cigarillos, and cigarettes containing tobacco or tobacco substitutes

- Activities related to atomic energy and railway operations (not open to private sector investment)

Recent FDI Policy Reforms (2020-2021)

Insurance Sector: The FDI cap in the insurance sector was raised from 49% to 74% under the automatic route, allowing foreign ownership and control with safeguards. This reform aims to attract long-term capital, global technology, and international best practices to boost India's insurance sector.

Petroleum and Natural Gas: FDI up to 100% is allowed through the automatic route in cases where the government has given "in-principle" approval for the strategic disinvestment of a public sector undertaking (PSU) in this sector.

Telecom Sector: The FDI cap in the telecom services sector was increased to 100% under the automatic route.

New FDI Policy for Bordering Countries

The new FDI policy stipulates that entities or beneficial owners from countries sharing a land border with India can only invest through the government route. Any transfer of ownership in an FDI deal that benefits such countries also requires government approval. Previously, this restriction applied only to Bangladesh and Pakistan, but the revised policy now includes Chinese companies under this filter.

Benefits of FDI Policy

FDI enhances a country's financial services by extending beyond traditional banking to include merchant banking, portfolio investment, and other financial activities. It also fosters the growth of new businesses and strengthens the capital market. India's FDI policy has consistently supported the development of its capital market.

Conclusion

FDI is a key driver of economic growth in India and a vital source of non-debt financing. To sustain this momentum, a stable and accessible FDI policy is essential. India's large market and post-pandemic economic recovery are expected to continue attracting market-seeking investors.

|

157 videos|236 docs|166 tests

|

FAQs on India's FDI Policy - Crash Course for UGC NET Commerce

| 1. What are the different routes for Foreign Direct Investment (FDI) in India? |  |

| 2. Which sectors are prohibited for FDI in India? |  |

| 3. What is the new FDI policy for bordering countries in India? |  |

| 4. What is the role of the UGC NET in regulating FDI policy in India? |  |

| 5. How can one stay updated with the latest changes in India's FDI policy? |  |