Fund Flow Analysis | Crash Course for UGC NET Commerce PDF Download

What is Fund Flow Analysis?

- Fund flow analysis is a financial tool used by investors and analysts to understand the movement of money within a company. It focuses on tracking the inflow and outflow of funds over a specific period.

- This analysis is crucial for making informed investment decisions, as it helps determine if a company is financially stable and capable of sustaining operations.

- When investing in a Real Estate Investment Trust (REIT), fund flow analysis can reveal how money is being managed within the REIT.

- A REIT generates income from renting out properties like apartments or stores.

- The analysis shows how much money the REIT earns from these rentals and how it uses this money, such as for repairs or debt repayment.

- This information helps investors decide whether the REIT is a good investment, based on its financial performance.

- If you're an investor looking into a manufacturing company, you might want to assess whether the company is purchasing new equipment, increasing production, or paying off debts.

- By examining financial statements such as the cash flow statement, balance sheet, and income statement, fund flow analysis allows you to identify patterns and trends over time.

- It provides insight into the company's financial health.

- If a company consistently generates more cash than it spends, it may present a strong investment opportunity.

- A company that spends more than it generates could be experiencing financial difficulties.

Problems and Solutions in Fund Flow Analysis

Fund flow analysis is a critical aspect of financial management, helping businesses monitor and analyze cash flow. However, several challenges can affect the accuracy of this analysis. Fortunately, there are solutions to address these issues:

Problem: Incomplete or inaccurate information can lead to incorrect conclusions and decisions.

- Solution: Ensure that all data used in the analysis is accurate, complete, and up-to-date. Proper data collection methods and regular updates are essential.

Problem: Understanding how cash flows through a business can be complex, making fund flow analysis challenging.

- Solution: Businesses should prepare a clear and detailed cash flow statement that accurately reflects the inflows and outflows of funds.

Objectives of Fund Flow Analysis

Fund flow analysis serves several key objectives for businesses:

Understanding Sources and Uses of Funds: The analysis identifies and tracks the sources of funds (cash inflows) and how these funds are utilized (cash outflows) within the organization. It provides insights into where the money comes from (e.g., equity issuance, debt financing, operating activities) and how it is spent (e.g., investments, debt repayment, dividends).

Assessing Financial Health and Stability: By examining net changes in funds over specific periods, fund flow analysis helps assess an organization's financial health and stability. Positive fund flows indicate strong financial management, while negative flows may suggest liquidity issues or overspending.

Monitoring Capital Structure Changes: The analysis tracks changes in the organization’s capital structure, including equity, debt, and retained earnings. It helps ensure an optimal mix of funding sources and effective management of financial risk by analyzing how funds are allocated between equity and debt.

Identifying Financial Trends and Patterns: Fund flow analysis reveals trends and patterns in cash flows and fund movements. By analyzing historical data, it helps identify cyclical patterns, seasonal variations, and long-term trends, aiding in budgeting, forecasting, and resource allocation.

Facilitating Financial Planning and Decision Making: The analysis supports strategic financial planning and decision-making by providing insights into funding requirements, cash flow projections, and capital allocation. By forecasting future fund flows, organizations can better plan for contingencies, evaluate investment opportunities, and optimize financial resources.

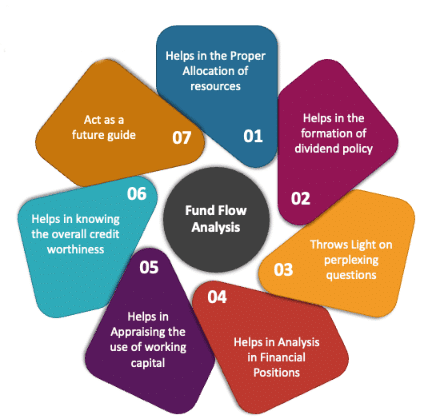

Importance of Fund Flow Analysis

Fund flow analysis is a vital component of financial management, used to track the movement of funds within an organization over a specific period. By examining both the inflow and outflow of funds, it provides valuable insights into the financial stability of the organization. Here are some key managerial applications of fund flow analysis that are critical to an organization's financial health:

Assessing Financial Health and Solvency:

- Fund flow analysis helps organizations evaluate their financial health and solvency by monitoring the net movement of funds over time. It provides insights into whether the organization is generating enough funds from operations and other sources to cover its expenses and meet its financial obligations. This assessment is crucial for maintaining liquidity, ensuring operational continuity, and preventing financial distress.

Monitoring Cash Flow Trends and Patterns:

- By analyzing fund flow statements, organizations can identify cash flow trends and patterns over time. This includes understanding seasonal variations, cyclical patterns, and the impact of economic factors on cash generation and utilization. This information is essential for effective cash flow management, ensuring adequate liquidity to support daily operations, seize investment opportunities, and execute strategic initiatives.

Supporting Strategic Decision Making:

- Fund flow analysis offers valuable insights that support strategic decision-making within organizations. It helps management prioritize investments, allocate resources effectively, and determine the optimal capital structure. By understanding the sources and uses of funds, organizations can make informed decisions regarding financing options, capital expenditures, dividend policies, and business expansion strategies.

Detecting Financial Mismanagement or Irregularities:

- Fund flow analysis can be used to detect financial mismanagement, irregularities, or potential fraud within an organization. Discrepancies between expected and actual fund flows can indicate issues such as misappropriation of funds, unauthorized expenditures, or inefficiencies in financial operations. Early detection through fund flow analysis allows for prompt corrective actions, mitigating risks and maintaining financial integrity.

Facilitating Budgeting and Financial Planning:

- Fund flow analysis plays a crucial role in budgeting and financial planning. It provides a foundation for forecasting future fund flows based on historical data and anticipated business activities. This helps in developing realistic budgets, cash flow projections, and financial forecasts that align with strategic objectives. Effective financial planning, supported by fund flow analysis, enables organizations to anticipate funding needs, manage capital resources efficiently, and adapt to changing market conditions.

Limitations of Fund Flow Analysis

While fund flow analysis is an essential financial management tool, it does have some limitations:

- Focus on Non-Cash Items: Fund flow analysis primarily focuses on cash flows, which means that non-cash items like depreciation, amortization, and changes in working capital are not directly reflected. This can distort the true financial position of the organization, particularly in industries where non-cash items are significant, such as technology or manufacturing.

- Timing Differences: Fund flow analysis records cash inflows and outflows when they occur, which may not always align with when revenue is recognized or expenses are incurred (accrual basis). This can lead to discrepancies between cash flow movements and the actual economic activities of the organization, making it challenging to assess profitability accurately.

- Limited Historical Context: Fund flow analysis relies on historical data and may not effectively capture real-time financial conditions or future trends. Economic changes, market fluctuations, and unforeseen events may not be reflected in historical fund flow statements, limiting its predictive capability for future financial performance.

- Complexity in Interpretation: Interpreting fund flow statements requires a deep understanding of accounting principles and financial analysis techniques. The complexity of reconciling cash flows with changes in operating, investing, and financing activities can make it challenging for non-financial professionals to derive meaningful insights from fund flow analysis.

- Lack of Standardization: Unlike cash flow statements, which are standardized under accounting principles (such as GAAP or IFRS), fund flow analysis lacks uniformity in reporting formats and methodologies. This lack of standardization can result in inconsistencies across organizations and industries, making comparisons and benchmarking difficult.

- Inability to Reflect Future Prospects: Fund flow analysis is primarily backward-looking and focuses on historical data. While it provides insights into past financial performance and trends, it may not adequately capture future growth prospects, strategic initiatives, or changes in market dynamics that could impact the organization's financial health.

Uses of Fund Flow Analysis

Fund flow analysis is a powerful tool for assessing a company's financial position. Below are some of its various applications:

Assessing Sources and Uses of Funds:

- Fund flow analysis helps identify and analyze the sources from which funds are generated (inflows) and how these funds are utilized (outflows) within an organization. It provides insights into whether funds are derived from operating activities, financing (such as equity or debt issuance), investing (such as asset sales or acquisitions), or other sources. Similarly, it tracks how these funds are allocated toward investments, debt repayment, dividends, working capital, and other expenditures.

Evaluating Financial Health and Liquidity:

- Fund flow analysis evaluates the overall financial health and liquidity of the organization. By examining the net changes in funds over specific periods, it assesses the organization's ability to generate sufficient cash flows to meet its financial obligations and operational needs. Positive fund flows indicate healthy financial management, while negative flows may signal liquidity challenges or excessive spending.

Supporting Strategic Decision Making:

- Fund flow analysis supports strategic decision-making processes within organizations. It provides critical insights into funding requirements, cash flow projections, and capital allocation decisions. This information helps management prioritize investments, allocate resources effectively, determine optimal financing options, and plan for future growth and expansion initiatives based on historical fund flow trends.

Detecting Financial Irregularities or Mismanagement:

- Fund flow analysis serves as a tool to detect financial irregularities, potential fraud, or mismanagement within an organization. Discrepancies between expected and actual fund flows can indicate issues such as misappropriation of funds, unauthorized expenditures, or inefficiencies in financial operations. Early detection through fund flow analysis enables management to take corrective actions promptly, mitigate risks, and safeguard financial integrity.

Facilitating Budgeting and Forecasting:

- Fund flow analysis facilitates the development of budgets, financial forecasts, and cash flow projections. By analyzing historical fund flow statements, organizations can forecast future fund flows based on anticipated business activities and economic conditions. This helps in preparing realistic budgets, monitoring cash flow trends, identifying potential funding gaps, and aligning financial planning with strategic objectives.

Advantages of Fund Flow Analysis

Fund flow analysis is a valuable tool for examining the movement of money within a company over a specified period. While it has its own set of advantages and disadvantages, the benefits are significant. Here’s a look at some key advantages of fund flow analysis:

- Understanding Fund Sources and Uses: Fund flow analysis provides a clear view of where funds are generated and how they are used within the organization. By tracking cash inflows and outflows, it helps identify the main sources of funds (such as operating activities, financing, or investing) and how these funds are allocated (e.g., investments, debt repayment, dividends). This understanding allows organizations to optimize fund utilization, allocate resources more effectively, and align financial strategies with organizational goals.

- Assessing Financial Health and Stability: This analysis is instrumental in evaluating an organization’s financial health and stability. It helps determine if the organization is generating enough cash to meet operational needs, debt obligations, and growth initiatives. Positive fund flows reflect good financial management and sufficient liquidity, while negative fund flows may signal liquidity issues or inefficiencies. Such assessments guide management in making decisions to improve financial stability and reduce financial risks.

- Supporting Strategic Decision Making: Fund flow analysis aids strategic decision-making by offering insights into historical fund flow trends and projections. It helps management prioritize investments, allocate resources efficiently, and choose the best financing options. This information supports strategic planning for business expansion, acquisitions, capital expenditures, and other long-term initiatives. Fund flow analysis ensures that financial decisions are based on reliable data and informed assessments of funding needs.

- Detecting Financial Irregularities and Fraud: Fund flow analysis can be used to uncover financial irregularities, potential fraud, or mismanagement. Discrepancies between expected and actual fund flows may indicate unauthorized transactions, misappropriation of funds, or operational inefficiencies. Early detection through fund flow analysis allows management to implement controls, investigate anomalies, and take corrective actions, helping to maintain financial integrity and build trust with stakeholders.

- Facilitating Budgeting and Forecasting: This analysis supports the creation of accurate budgets, financial forecasts, and cash flow projections. By analyzing historical fund flow data, organizations can predict future fund flows based on expected business activities and economic conditions. This helps in anticipating funding needs, planning for capital expenditures, and aligning financial resources with operational requirements. Effective budgeting and forecasting, supported by fund flow analysis, enhance financial planning accuracy and optimize financial performance.

Disadvantages of Fund Flow Analysis

Despite its benefits, fund flow analysis has several limitations:

- Focus on Historical Data: Fund flow analysis relies on historical data and may not provide real-time insights into current financial conditions. As it primarily looks backward, it may not capture recent developments, economic changes, or unforeseen events affecting the organization’s current financial position. This can limit timely decision-making and responsiveness to changing market conditions.

- Complexity and Interpretation: Interpreting fund flow analysis can be complex, particularly for those without a financial background. Understanding fund flow statements requires knowledge of accounting principles and financial analysis techniques. Reconciling cash flows with changes in operating, investing, and financing activities can be intricate, making it challenging to derive actionable insights without specialized expertise.

- Limited Focus on Non-Cash Transactions: Fund flow analysis mainly focuses on cash flows and may overlook significant non-cash transactions and adjustments. Non-cash items like depreciation, amortization, and changes in working capital are critical for assessing overall profitability and financial performance. Since fund flow statements do not account for these items directly, they may provide an incomplete picture of the organization’s financial health and operational efficiency.

- Inability to Predict Future Performance: Fund flow analysis does not predict future financial performance or anticipate changes in market dynamics. While it provides insights into past fund movements, it does not forecast future cash flows, profitability, or growth prospects. This limits its usefulness in strategic planning, budgeting, and forecasting future funding needs.

- Lack of Standardization: Fund flow analysis lacks standardized reporting formats compared to cash flow statements governed by accounting standards. Different organizations may prepare fund flow statements using varying approaches, leading to inconsistencies in reporting practices and difficulty in comparing financial performance across companies or industries. This lack of standardization can hinder benchmarking and transparency.

Key Benefits of Fund Flow Analysis

Fund flow analysis offers several key benefits for businesses:

Understanding Cash Flow Dynamics:

- This analysis provides a thorough understanding of how cash flows within an organization. By tracking the sources and uses of funds, it helps management recognize patterns in cash inflows and outflows, seasonal variations, and the timing of major transactions. This knowledge is crucial for effective liquidity management, maintaining adequate cash reserves, and optimizing working capital.

Assessing Financial Health and Stability:

- Fund flow analysis evaluates whether an organization generates positive cash flows from its core activities and other sources. Positive fund flows indicate effective financial management, adequate liquidity, and the ability to cover expenses, debt repayments, and dividends. This assessment supports strategic decision-making and financial planning to maintain stability and resilience.

Supporting Strategic Decision Making:

- Fund flow analysis aids in strategic decision-making by providing insights into historical fund flow trends and future projections. It helps management prioritize investments, allocate resources efficiently, and select optimal financing options. This information supports strategic planning for growth, acquisitions, and capital expenditures, ensuring financial decisions are data-driven.

Detecting Financial Irregularities and Fraud:

- Fund flow analysis helps detect financial irregularities, potential fraud, or mismanagement by identifying discrepancies between expected and actual fund flows. This early detection allows management to implement controls, investigate anomalies, and take corrective actions, safeguarding financial integrity and maintaining stakeholder trust.

Facilitating Budgeting and Forecasting:

- Fund flow analysis is crucial for developing accurate budgets, forecasts, and cash flow projections. By analyzing historical data, organizations can anticipate future fund flows, plan for capital expenditures, and align financial resources with operational needs. This improves budgeting accuracy, mitigates cash flow risks, and enhances overall financial performance.

Conclusion

Fund flow analysis is a valuable tool for both businesses and investors. It provides insights into the flow of money within an organization, helping to understand financial health and identify opportunities for growth. Whether you’re managing a business or investing in one, knowledge of fund flow analysis is essential for making informed financial decisions.

|

145 videos|236 docs|166 tests

|

FAQs on Fund Flow Analysis - Crash Course for UGC NET Commerce

| 1. What is Fund Flow Analysis? |  |

| 2. What are some key benefits of Fund Flow Analysis? |  |

| 3. What are the limitations of Fund Flow Analysis? |  |

| 4. How can Fund Flow Analysis be used in financial management? |  |

| 5. Why is Fund Flow Analysis important in financial reporting? |  |