Mutual Funds & Pension Funds | Crash Course for UGC NET Commerce PDF Download

What are Mutual Funds?

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of securities such as stocks, bonds, or money market instruments. This pooling of funds allows individual investors to access a professionally managed and diversified investment portfolio that they may not be able to create on their own.

- Mutual funds enable small investors to start investing even with a small amount of money.

- These funds are managed by professional money managers or large financial institutions who make decisions on which securities to buy or sell.

- Mutual funds have specific investment objectives that cater to the needs of investors, ranging from capital appreciation to regular dividend income.

- Investors need to assess the different types of mutual funds available to choose the ones that align with their investment goals and risk tolerance.

- Fund managers can invest in a variety of assets, including stocks, bonds, and sometimes physical assets, depending on the fund's investment strategy.

- Investors in mutual funds share the gains or losses of the fund proportionally to their investments.

Features of Mutual Fund

Read below the integral features of mutual funds instruments.

- Convenience: Mutual funds provide investors with ease and simplicity. Investors can manage their investments directly from their laptops, following straightforward payment steps. They are relieved from the need to compare various securities on their own.

- Investment Flexibility: Mutual funds offer individuals the choice to invest a lump sum amount or make monthly contributions. This flexibility allows investors to select a fund that aligns with their financial capacity, enhancing payment convenience.

- Liquidity: Mutual funds are characterized by their liquidity. Investors can easily withdraw their funds, halt regular contributions, and typically receive their money within a few days, providing them with quick access to their investments.

- Charges: Mutual funds entail a minimal expense ratio fee that investors need to pay to the fund company, ensuring cost-effectiveness in managing investments.

- Regulation: Mutual funds operate under the monitoring of SEBI, which oversees the activities of different fund companies. Companies are required to register with SEBI before initiating their operations, ensuring regulatory compliance and investor protection.

- Diversification: Mutual funds play a crucial role in reducing investment risks by diversifying across various securities. This strategy aims to enhance investment returns by spreading out the investment across different asset classes.

Functions of Mutual Funds

Mutual funds have specific roles and objectives in India. Let's explore their primary functions in detail:

- Investment management: Mutual funds oversee investors' funds, pooling them into various investment avenues.

- Professional expertise: Mutual funds offer expert guidance, employing professionals for portfolio management to enhance investment choices.

- Transparency: Mutual funds disclose portfolio details to investors, enabling them to comprehend how their finances are invested.

- Risk management: Mutual fund companies mitigate risks by diversifying investments across multiple securities, reducing risks for investors.

- Easy investments: Mutual funds provide convenient investment options, allowing investors to easily select suitable funds with hassle-free online processes for payments and registrations.

Objectives of Mutual Funds

Mutual fund companies often have various objectives, but there are some general ones common to all funds. Let's delve into them below:

Mutual Fund Asset Diversification

- Mutual funds aim to diversify investments by allowing investors to choose from a variety of securities. Investors only need to invest a set amount, and the fund takes care of diversifying the rest of the assets. This strategy helps in earning from different investment domains.

Income Generation

- Mutual funds assist investors in generating income by providing regular dividends. Some companies offer high dividends, creating a stable additional income source for investors.

Safeguarding Capital

- Mutual funds offer a low-risk option by spreading investments across multiple securities, making them a safer choice for investors. This diversification helps in safeguarding capital.

Initiating Growth

- Capital gains in mutual funds facilitate growth for investors, enabling long-term savings and wealth accumulation.

Promoting Investments

- Mutual funds provide a convenient platform for investors to manage their investments from the comfort of their homes. This accessibility encourages the development of a saving and investment habit among individuals.

Structure of Mutual Funds

Mutual funds come in three primary types based on their structure. Let's delve into each of them:

Open-Ended Mutual Funds

- Open-ended mutual funds allow investors to buy or sell units at any time. The flexibility is high, with unit capital constantly changing due to buying back and selling of existing units by the company. Investors enjoy greater convenience matching their financial needs, enhancing liquidity.

Close-Ended Mutual Funds

- Close-ended mutual funds operate for a fixed duration, often spanning a few years. Investors can only invest during the new fund offer period and cannot buy or sell units afterward. However, some funds might be traded on stock exchanges, providing a limited trading window.

Interval Schemes

- Interval schemes combine characteristics of both open and close-ended funds. Trading is restricted to specific time frames, offering moderate liquidity. These funds may also feature on stock exchanges.

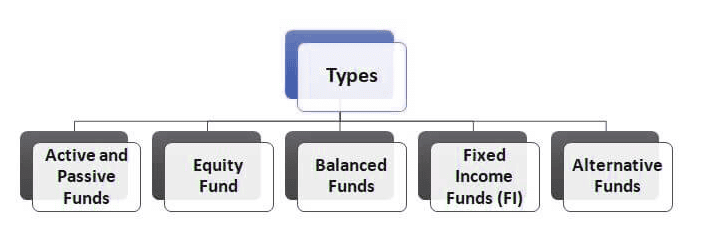

Types of Mutual Funds

The investment market in India offers various types of mutual funds to cater to different budgets and financial goals of investors.

Equity/Growth Schemes

- These mutual funds primarily invest in equity or stock market securities of different companies, making them higher risk investments with the potential for better growth.

Money Market/Liquid Funds

- Money Market/Liquid Funds invest in short-term debt securities, offering reasonable growth potential over a shorter period while carrying lower risk.

Fixed/Debt Funds

- Fixed/Debt Funds invest in debt instruments such as bonds, government securities, and debentures, providing investors with a steady interest income and lower risk.

Balanced Funds

- Balanced Funds maintain a portfolio that includes investments in both equity and debt, adjusting to market conditions. They offer moderate risk levels and the potential for steady returns and growth.

How are Mutual Funds Priced?

Most mutual funds determine their prices using the Net Asset Value (NAV) method. This method enables them to assess the daily value of the fund because the prices of the fund's underlying shares and securities can fluctuate. Daily trades can have an impact on the mutual fund's price.

Mutual Funds

- NAV, which stands for Net Asset Value, signifies the price of the mutual fund. It is calculated by adding up the value of the fund's cash and securities and then subtracting any liabilities. The resulting amount is divided by the total number of outstanding shares.

- Changes in NAV directly affect the fund's returns. The mutual fund price can either decrease or increase within a day based on the performance of its underlying securities.

- Some mutual funds may opt to calculate the NAV by averaging the prices over a period, often three days, depending on the fund's specific methodology.

Pros of Mutual Fund Investing

- Advanced Management: Mutual funds are overseen by experienced managers who curate the portfolio, selecting optimal investment opportunities.

- Reinvestment: Mutual funds frequently reinvest dividends, allowing investors to generate additional income from their initial investments.

- Safety: By pooling various investment options, mutual funds offer enhanced safety through diversification, reducing individual risk.

- Convenience: Mutual funds provide a convenient investment option, sparing investors from the need to extensively research individual securities.

- Fair Prices: Mutual funds regularly calculate daily values, aiding investors in understanding the true value of their investments.

Cons of Mutual Fund Investing

Below are the drawbacks associated with investing in mutual funds:

Disadvantages of Mutual Funds

- High Expense: Investors need to be cautious of high expense ratios, as fund companies may charge significant fees.

- Management Abuses: Mutual funds are often subject to the discretion of management, who may manipulate fund performance for a more favorable appearance.

- Tax Inefficiency: Gains from fund value or other sources of income may not provide tax benefits to investors.

- No Guarantees: Mutual funds do not assure safety guarantees; even low-risk funds can lead to monetary losses for investors.

- Cash Drags: Mutual funds frequently hold a higher proportion of cash to meet sales and redemptions, which often remains unutilized and does not generate income.

Examples

There are various instances of mutual funds in India that can help understand how they work:

- HDFC Equity Fund: Managed by HDFC Bank, this fund primarily invests in stocks (equities).

- SBI Equity Hybrid Fund: This fund is a mix of investments in both debt instruments and the stock market.

- HDFC Liquid Funds: These funds mainly invest in debt securities, offering stability and liquidity.

Summary

In summary, mutual funds in India, such as HDFC Equity Fund, SBI Equity Hybrid Fund, and HDFC Liquid Funds, showcase different investment strategies and objectives. Each fund serves a specific purpose, be it equity investments, a mix of debt and equity, or a focus on debt securities, catering to various risk appetites and financial goals.

Employees' Provident Fund Organization Pension Scheme

- The Employees' Provident Fund Organization (EPFO) administers a pension scheme for private sector employees under the Employees' Provident Funds (EPF) Act, providing financial security after retirement.

- Both employers and employees contribute monthly to the pension fund, with part of the overall EPF contribution allocated toward building the pension corpus.

- Contributions are based on a capped pensionable salary of Rs 15,000 per month, regardless of the employee's actual earnings.

- The accumulated pension fund serves as a source of income post-retirement.

- Upon reaching 58 years of age, employees are eligible to receive a lifetime monthly pension from the EPFO, with the payout depending on the corpus size and the employee's final salary.

- Notable features of the scheme include early pension options starting at 50 years of age, survivor benefits for spouses, and family pensions.

- The pension scheme is Aadhaar-linked and portable, enabling pensioners to continue receiving benefits even when switching jobs or relocating.

- It covers workers across more than 190 industries throughout India under the Employees' Provident Funds and Miscellaneous Provisions Act, 1952, ensuring long-term financial protection for employees in private establishments.

Pension Fund Regulatory and Development Authority (PFRDA)

The Pension Fund Regulatory and Development Authority (PFRDA) is a statutory body set up by the Indian government in 2003 under the PFRDA Act to promote retirement income security and regulate pension funds. Its primary objectives are to protect the interests of pension subscribers and ensure the sound management of pension funds.

Key functions of the PFRDA include

- Registering and regulating pension funds operating under the National Pension System (NPS).

- Overseeing NPS intermediaries like the Central Recordkeeping Agency and Pension Fund Advisors.

- Ensuring transparency and compliance within the NPS structure, while protecting subscriber interests.

- Promoting pension coverage, particularly among economically disadvantaged groups, and fostering awareness of retirement planning.

- Spearheading reforms to expand the pension sector and enhance its regulatory framework.

- Handling grievances related to NPS subscribers and maintaining relevant data.

Section 80CCC: Pension Fund Contributions

A pension fund is a retirement plan in which both employees and employers contribute throughout the employee's working years. These contributions, made via payroll deductions, grow through investments and are tax-deferred, providing income after retirement.

Key points include:

- Employees contribute a portion of their salary to the fund, with employers matching contributions. These funds are invested in assets like stocks, bonds, or mutual funds, aimed at generating returns.

- Employees can select from various investment options depending on their risk tolerance and financial goals. High-risk options may offer higher returns but with greater volatility.

- Employer contributions typically "vest" over time, meaning the employee must meet certain service requirements before fully owning the employer’s contributions.

- Employees can maximize contributions up to IRS-set limits to gain tax advantages. There are annual limits on both employee and employer contributions.

- Upon retirement, employees can access the accumulated pension fund through options such as annuities, lump sum withdrawals, or regular payments to generate a steady post-retirement income.

Pension Funds in India

A pension fund is a retirement savings plan that collects contributions from both employees and employers, investing these funds to provide income post-retirement. In India, pension funds are regulated by the Pension Fund Regulatory and Development Authority (PFRDA).

There are two primary types of pension funds in India:

National Pension System (NPS):

- Open to employees of the central and state governments, as well as those in the private sector.

- Employees can contribute up to 10% of their salary, with employers either matching or exceeding that amount.

- Employees have the option to choose from various investment categories called "asset classes."

- Funds are managed by professional fund managers.

Employees' Provident Fund (EPF):

- Applicable to employees in the private sector.

- Employees contribute 12% of their salary, with employers contributing 13.16%.

- EPF includes pension-like features such as partial withdrawals and annuity options.

- Cost-Effective and Transparent: Offers low-cost investment options with transparency in operations.

- Flexible Contributions: Both employees and employers can adjust their contribution amounts.

- Investment Choice: Employees can select investment options based on their risk tolerance.

- Retirement Benefits: Provides options for annuities and lump sum withdrawals upon retirement.

- Tax Benefits: Contributions are eligible for tax deductions under Section 80C.

- Retirement Income: Pension funds can provide 40-80% of an individual's final salary as pension income.

- Professional Management: Investments are handled by professional fund managers for optimal returns.

- Market and Investment Risks: Investments are subject to market fluctuations.

- Low Returns for Early Exit: Exiting the pension fund before retirement may result in lower returns.

Employees' Pension Scheme (EPS)

- Objective: The primary goal of the Employees' Pension Scheme (EPS) is to provide a pension to employees who are members of the Employees' Provident Fund (EPF).

- Eligibility: Employees who are members of the EPF and have met the required service criteria are eligible for the pension. The pensionable service is based on the number of contributory years.

- Contributions: Both employers and employees contribute to the EPS, with the contribution rate determined as a percentage of the employee's basic wages and dearness allowance.

- Pension Calculation: The pension is calculated based on factors such as the employee's pensionable service, average monthly pensionable salary, and a fixed pensionable salary factor.

- Service Criteria: Employees must typically complete a minimum of 10 years of service to qualify for a monthly pension. For some categories, the service period may extend to 20 years.

- Types of Pension: The EPS provides various pensions, including superannuation pension, early retirement pension, and a family pension in case of the member's death.

- Withdrawal Options: Employees with less than 10 years of service who do not qualify for a monthly pension may withdraw the full amount in their EPS account.

- Nomination Facility: Employees can nominate a family member to receive benefits in case of their death.

- Government Subsidy: The EPS is partly subsidized by the government and funded through employer contributions.

- Changes and Amendments: The rules governing the EPS are subject to periodic amendments by the government. Employers and employees are encouraged to stay updated on changes to the scheme.

Conclusion

Pension funds provide an effective means for individuals to save for retirement in a tax-efficient way with the added advantage of professional fund management. While some risks are inherent, consistent contributions throughout one's career can result in a significant retirement income. Pension funds offer an organized and efficient approach to retirement savings, aiming to provide a stable income stream after retirement to complement other financial resources.

|

157 videos|236 docs|166 tests

|

FAQs on Mutual Funds & Pension Funds - Crash Course for UGC NET Commerce

| 1. What are Mutual Funds? |  |

| 2. How are Mutual Funds Priced? |  |

| 3. What are the types of Mutual Funds? |  |

| 4. What are the cons of Mutual Fund investing? |  |

| 5. What is the Employees' Provident Fund Organization Pension Scheme? |  |