Working of Dual GST | Crash Course for UGC NET Commerce PDF Download

| Table of contents |

|

| Dual GST Model |

|

| What Is the Dual GST Model? |

|

| Types of Dual GST Model |

|

| Features of Dual GST Model |

|

| Benefits of Dual GST Model |

|

| Limitations of Dual GST |

|

| Impact and Implications: Dual GST |

|

Dual GST Model

Countries around the world adopt either a federal or unified system for governance. In a federal structure, powers and responsibilities are divided between states and the central government, whereas a unified system centralizes these aspects. This distinction is crucial in understanding the functioning of a dual Goods and Services Tax (GST) system in India, which operates under a federal structure. In this system, taxation laws and duties are shared between the state and central governments.

What Is the Dual GST Model?

As per the name, dual GST is the system where both the central and state governments levy taxes. This implies that both levels of government collect revenue on every goods and service transaction. In the case of India, which follows a federal structure, the dual GST system involves simultaneous taxation by the state and central governments.

- In India, dual GST implementation is a notable example due to the country's federal structure where both state and central governments possess distinct responsibilities and powers.

- Previously, the taxation system was more complex, with separate taxes imposed by both state and central governments. Taxpayers had to comply with multiple tax obligations, involving various processes, forms, and filings.

- The introduction of the dual GST system unified the taxation process, combining state and central taxes into a single tax structure.

- One of the significant advantages of the dual GST model is that it ensures states are not solely dependent on the central government for revenue. Tax proceeds are shared between the state and central governments based on their economic activities.

Dual GST Model In India

The Indian dual GST model operates under a federal structure, where CGST represents the central GST and SGST represents the state GST.

Transactions can be either intra-state or inter-state, and the dual GST system addresses both scenarios. For intra-state transactions, both CGST and SGST are applied, with the central and state governments each receiving their respective shares. For inter-state transactions, IGST, or integrated GST, is applied. The central government collects this charge, and the state is subsequently given its share.

This dual GST model reduces conflicts between governments and simplifies the tax process. The previous system involved varying charges from both governments, which was more complex and time-consuming for taxpayers.

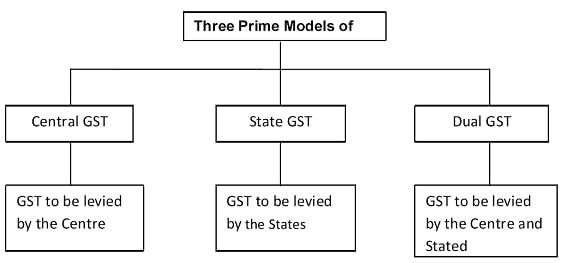

Types of Dual GST Model

There are different types of Dual GST models that are structured to handle taxation in India. Let's explore these models:

Overview of Dual GST Models

Destination-Based Dual GST (India, Canada, and others):

- Both the central and state governments levy GST on the supply of goods and services with separate GST laws.

- GST is collected at the point of consumption, where the final consumer is situated.

- Businesses can claim Input Tax Credit (ITC) for the GST paid on inputs and services used in production.

State-Level GST and Federal-Level VAT (Australia):

- Australia employs a dual taxation system with states imposing Goods and Services Tax (GST) and the federal government levying a Value Added Tax (VAT), both under the umbrella term Goods and Services Tax.

- State-level GST covers a broader range of goods and services compared to the more limited federal-level VAT.

Other Dual GST Models

Provincial and Federal GST (Canada):

- The federal government enforces Goods and Services Tax (GST), while certain provinces have their own Provincial Sales Taxes (PST), distinct from the GST.

- In some provinces, the PST is combined with the federal GST to create a Harmonized Sales Tax (HST).

Subnational GST (Brazil):

- Brazil operates a dual-level VAT system with both federal and state VATs known as ICMS, each state setting its rates and regulations.

Regional Dual GST (Nigeria):

- Nigeria follows a dual GST model where the federal government imposes Value Added Tax (VAT) and states can enforce Sales Tax.

- VAT applies broadly to goods and services, while sales taxes at the state level typically target specific items.

Features of Dual GST Model

The dual GST system in India comprises both state GST and central GST, ensuring that both entities collect tax revenues independently. Let's delve into the key features of the dual GST model:

Main Features:

- The dual GST model involves two components: state GST and central GST. Each operates separately to collect taxes.

- CGST and SGST are levied on every supply of goods and services. The collected amounts are segregated into respective state and central accounts to prevent conflicts.

- State and central GST are distinct and should be handled separately. CGST paid within a state can be used as Input Tax Credit (ITC) for IGST in inter-state transactions.

- Cross-utilization of input tax credit between central and state GST is not permitted except for inter-state transactions.

Additional Features:

- Accumulation of ITC due to GST refunds should be avoided by both state and central authorities, with exceptions for exports, inverted tax structures, and purchase of capital goods.

- Uniform procedures for CGST and SGST must be established through legislation for tax collection from taxpayers.

- Specific upper and lower limits for tax rates are set based on annual turnover for compounding or composition schemes under dual GST.

- Taxpayers are mandated to submit periodic returns, adhering to prescribed rules and formats while filing returns to relevant state and central authorities.

- Each taxpayer is assigned a unique GSTIN number derived from their PAN, aiding in identification and compliance within the dual GST framework.

In summary, adherence to the regulations and formats specified for compliance is crucial for taxpayers under the dual GST system, ensuring accurate filing and returns.

Benefits of Dual GST Model

- Fewer taxes: The implementation of the dual GST model has significantly reduced the tax burden on taxpayers. Previously, individuals had to deal with overlapping taxes from both state and central governments, resulting in a cascading effect. With dual GST, the overall tax rates have decreased, providing relief to all taxpayers.

- Effective tax rate: Dual GST offers the benefit of tax deductions, which ultimately lower the total tax liability for businesses and individuals. These deductions contribute to higher disposable income, benefiting taxpayers.

- Simplified compliance: Under the dual GST system, there is a consolidation of taxes into a single tax structure, eliminating the complexities associated with VAT and service charges. This simplification has reduced the compliance costs for taxpayers, making it easier for them to meet their tax obligations.

- Increase in tax collections: The inclusion of e-commerce and the unorganized sector within the purview of dual GST has expanded the tax base, leading to higher tax revenues for the government. These additional funds play a crucial role in financing infrastructure development projects.

- Online procedure: Dual GST has facilitated online processes for tax returns and registration, enabling individuals to complete these tasks conveniently from their homes. This digitalization has streamlined the tax filing process, making it more accessible and encouraging greater participation.

Limitations of Dual GST

The dual GST method has several limitations that need to be considered. Below are the key drawbacks explained in detail:

- Increasing Business Costs: Dual GST implementation necessitates companies to embrace a new operational model. This involves hiring new personnel, providing training to staff, and adjusting operations to adhere to GST regulations, resulting in an overall increase in business costs. Many businesses also had to invest in upgrading their tax software, adding to the financial burden, particularly for small businesses and startups.

- Impact on Small and Medium Businesses: Previously, businesses with turnovers below ₹1 crore were exempt from excise duty. However, under the dual GST system, this threshold was reduced to turnovers of ₹20 lakhs. Consequently, small and medium enterprises are now required to pay taxes. While there are compliance schemes designed for their benefit, these businesses often have to forgo input tax credits, affecting their financial dynamics.

- Portal Challenges: Dual GST mandates registration on all state portals, but the online infrastructure readiness varies across states. Many states are still not fully prepared for the digital transition, leading to frequent filing issues. This elongates the process and raises operational costs for businesses. The shift to online processes has particularly strained small and medium enterprises, escalating the expenses associated with adopting the new system.

- Hurried Implementation: The introduction of the dual GST system was rushed, allowing firms limited time to adapt. This hurried implementation also necessitated hiring additional staff for compliance purposes, further burdening businesses in terms of operational adjustments and costs.

Impact and Implications: Dual GST

The dual GST model revolutionized the taxation system in India, bringing about a unified and straightforward compliance structure. Let's delve into the various effects of the dual GST:

Lowered Logistics and Operational Costs:

- By eliminating state entry taxes, the dual GST significantly reduced logistics and operational expenses.

- Businesses were no longer required to establish warehouses in every state, further cutting down costs.

Reduced Product Prices and Increased Profits:

- The decreased operational costs led to lower product prices, benefiting end consumers by offering reduced rates.

- Moreover, companies experienced a boost in profits due to these cost reductions.

Lower Overall Taxes and Tax Credits:

- The dual GST amalgamated various taxes, resulting in an overall reduction in tax burdens for businesses.

- Introduction of tax credits further alleviated the tax obligations of taxpayers, leading to reduced tax payments.

Dispute Resolution Mechanism:

- Issues arising from the dual GST setup between states and the central government are addressed through the GST Council.

- The GST Council plays a crucial role in resolving conflicts and providing solutions for disputes that may arise.

Promotion of Digital Governance:

- The implementation of GST has fostered digital governance, encouraging the adoption of online methods for tax compliance.

- This shift to digital processes has streamlined operations for both taxpayers and the government, making the tax system more efficient and accessible.

Conclusion

In conclusion, the dual GST system has offered numerous advantages to businesses and taxpayers, simplifying compliance, which can now be done from home. While there are certain limitations to this system, these challenges are likely to be addressed over time. As businesses adapt, the system will pave the way for more efficient taxation practices. Therefore, adopting the dual GST system is ultimately beneficial for India.

|

157 videos|236 docs|166 tests

|

FAQs on Working of Dual GST - Crash Course for UGC NET Commerce

| 1. What is the Dual GST Model? |  |

| 2. What are the types of Dual GST Model? |  |

| 3. What are the key features of the Dual GST Model? |  |

| 4. What are the benefits of the Dual GST Model? |  |

| 5. What are the limitations of the Dual GST Model? |  |