DK Goel Solutions: Admission of a Partner | DK Goel Solutions - Class 12 Accountancy - Commerce PDF Download

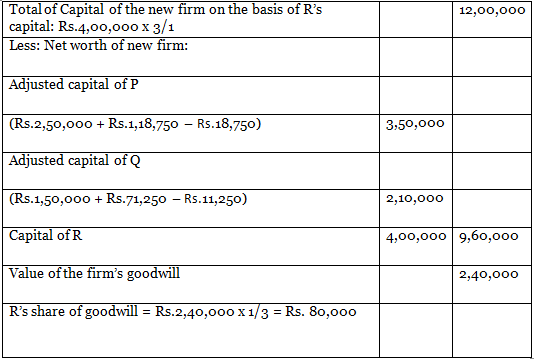

Q1: A and B are partners sharing profits in the ratio of 3:2. They admit C into the company for 1/4th share in profit which he takes 1/6th from A and 1/12th from B. However, C brings Rs. 50,000 as goodwill out of his share of Rs. 90,000. No goodwill account appears in the books of the company. Pass necessary journal entries to record this arrangement.

Ans:

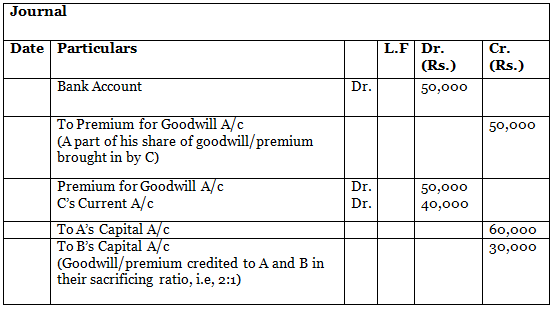

Q2: A and B are partners sharing profits equally. They admit C into partnership, C paying only Rs. 60,000 for premium out of his share of a premium of Rs. 1,80,000 for a 1/4th share of profit. Goodwill account appears in the book at Rs. 3,00,000. Give the necessary journal entries.

Ans:

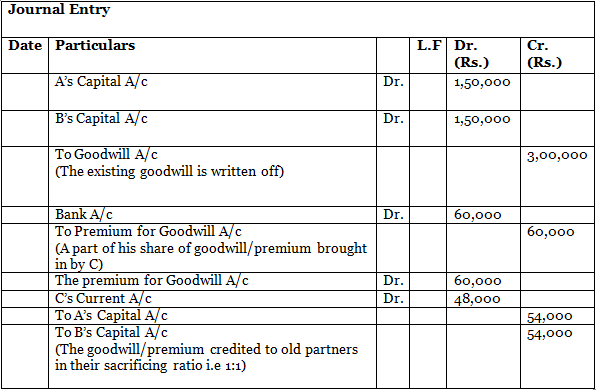

Q3: X and Y are partners in a company. Their profit sharing ratio is 5:3. They admit Z into a partnership for 1/4th share. As between themselves, A and B decide to share profits equally in the future. C brings in Rs. 1,20,000 as his capital and Rs. 60,000 as premium. Calculate the sacrificing ratio and record the necessary journal entries on the assumption that the amount of premium brought in by C is retained in the business.

Ans: Calculation of new profit sharing ratio: C takes a 1/4th share out of 1.

Calculation of new profit sharing ratio: C takes a 1/4th share out of 1.

Thus, the remaining profit is 3/4; This is divided equally between A and B

X’s new share = 3/4 x 1/2 = 3/8

Y’s new share = 3/4 x 1/2 = 3/8

Sacrificed made by X = 5/8 – 3/8 =2/8

Sacrificed made by Y = 3/8 – 3/8 =0

Hence, X alone has sacrificed and as such he alone will be entitled to the full amount of goodwill premium brought in by Z.

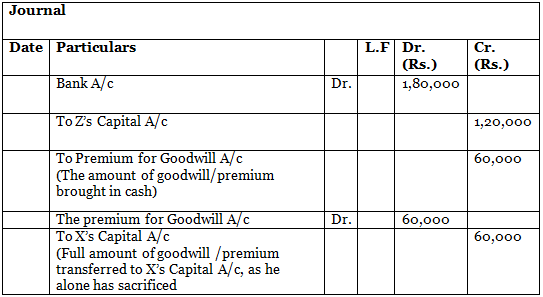

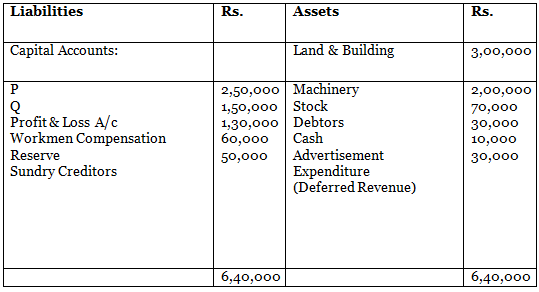

Q4: Balance Sheet of P and Q who share profits and losses in the ratio of 5:3 as at 31st March, 2018 was a follows.

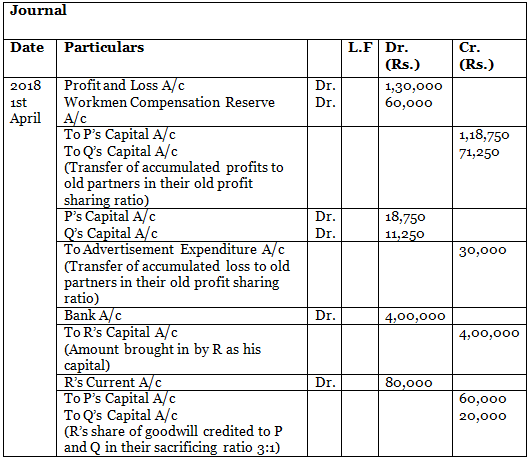

They admit R as a partner for 1/3 rd share in the profits of the firm which he acquires from P and Q in the ratio of 3:1. R brings in Rs. 4,00,000 as his capital. Ascertain the amount of goodwill and pass journal entries on the admission of R.

Ans:

Working Note:

Calculation of hidden goodwill