Unit 3: The Process of Budget Making: Sources of Revenue, Expenditure & Public Debt Chapter Notes | Business Economics for CA Foundation PDF Download

| Table of contents |

|

| Introduction |

|

| The Process of Budget Making |

|

| Sources of Revenue |

|

| Public Expenditure Management |

|

| Public Debt Management |

|

| Budget Concepts: Types of Budgets |

|

Introduction

- Governments worldwide have various responsibilities, including protecting their territories, maintaining law and order, providing public goods, and implementing plans for the economic and social welfare of their citizens. To carry out these functions effectively, governments need sufficient financial resources. The budget serves as a crucial policy tool for governments to regulate and reshape a country's economic priorities.

- Budgeting is necessary to allocate limited resources efficiently and ensure maximum social welfare. It also allows governments to reallocate resources according to their priorities, redistribute income and wealth, reduce economic fluctuations, achieve stable increases in real GDP, and minimize regional disparities.

- In simple terms, a budget outlines "where the money comes from" and "where the money goes." The government budget is a document submitted for approval and legislation, detailing estimated expenditures and funding sources for a specified period, usually a year. It includes projections for various sectors of the economy, such as agriculture, industry, and services, as well as budgeted estimates for government accounts in the upcoming fiscal year. As the most comprehensive report of government finances, the budget consolidates revenues from all sources and outlines expenditures for all activities.

- While the focus here is on the union budget, it's important to note that state and local bodies also have their own budgetary processes for the upcoming financial year.

The Process of Budget Making

The budgetary process involves the collaboration between the executive and legislative branches to create a set of proposals for taxation and spending. In India, the Ministry of Finance traditionally oversees government finances. The Ministry of Finance prepares the budget in consultation with NITI Aayog and other relevant ministries. Before the fiscal year begins (April 1 to March 31), both houses of Parliament must approve the budget.

Although the term "budget" is not explicitly mentioned in the Indian Constitution, the process is commonly referred to as budgeting. Article 112 of the Constitution states that the President shall present an "Annual Financial Statement" to Parliament, detailing the estimated receipts and expenditure for the financial year.

The budgetary procedures include:

(i) Preparation of the budget

(ii) Presentation and enactment of the budget

(iii) Execution of the budget

The budget process involves:

- Administrative Process: Budget preparation in consultation with stakeholders.

- Legislative Process: Parliament's approval after discussions.

Although the union budget is presented on February 1 (or another suitable date), preparation begins in August-September of the previous year. The Budget Division of the Ministry of Finance creates a schedule for budget preparation activities.

The process starts with the Budget Division issuing a circular with instructions and formats for estimates to ministries, states, union territories, and autonomous bodies. Ministries prepare detailed expenditure estimates based on their needs for the upcoming year, separately estimating receipts and expenditure.

Pre-budget consultations are conducted by the union finance minister with state finance ministers, chief ministers, and various stakeholders, including industry associations, agriculture and social welfare representatives, labor organizations, NITI Aayog experts, and economists, to gather suggestions for the proposed budget.

Presentation of the Budget:

- The budget is presented in Parliament in a format decided by the Finance Ministry, considering any suggestions from the Estimates Committee.

- The budget documents provide information on receipts and expenditure for two years, including:

- Budget Estimates (BE) for the current and upcoming financial year.

- Revised Estimates (RE) for the current year.

- Actual figures for the year preceding the current one.

Budget Speech:

- The budget speech, delivered by the finance minister, is primarily a policy document outlining proposed government policies and programs.

- It is usually divided into two parts:

- Part A. Discusses the current macroeconomic situation and budget estimates for the next financial year, including government priorities, expected revenue from taxes and borrowings, and proposed expenditure allocations.

- Part B. Details the government’s progress on various development measures, future policy directions, and tax proposals for the upcoming financial year.

Annual Financial Statement:

- The Annual Financial Statement (AFS) presents government receipts and expenditure under three parts:

- Consolidated Fund of India

- Contingency Fund of India

- Public Account

Budget Documents:

- Besides the budget speech, several documents are presented to Parliament, including:

- Annual Financial Statement (AFS)

- Demands for Grants (DG)

- Finance Bill

- Statements mandated under the Fiscal Responsibility and Budget Management (FRBM) Act, such as:

- Macro-Economic Framework Statement

- Medium-Term Fiscal Policy cum Fiscal Policy Strategy Statement

Additional Documents:

- Nine other explanatory documents supporting the mandated documents are also presented alongside.

Constitutional Provisions for Budget

- Article 112 of the Constitution provides for the Annual Financial Statement to be laid before the Parliament.

- The Union Budget consists of the Revenue Budget (for day-to-day expenses) and the Capital Budget (for long-term investments).

- The Finance Minister presents the budget in the Lok Sabha, and it is discussed and approved by Parliament.

- The budget includes estimated revenue and expenditure, along with details of taxes and other sources of income.

Budgetary Process

Preparation of the Budget

- The budget preparation begins with the Finance Ministry issuing guidelines to all ministries and departments.

- Ministries and departments submit their expenditure proposals based on these guidelines.

- The Finance Ministry reviews these proposals and prepares a draft budget.

Presentation of the Budget

- The budget is usually presented in the Lok Sabha on the last working day of February.

- The Finance Minister delivers a speech outlining the government’s financial plans and policies.

Approval Process

- After the presentation, the budget is discussed in the Lok Sabha.

- The discussion is divided into two stages: general discussion and detailed examination of demands for grants.

- The Lok Sabha has the power to modify, reject, or approve the budget proposals.

Role of Rajya Sabha

- The budget is laid before the Rajya Sabha after the Lok Sabha’s approval.

- The Rajya Sabha can discuss the budget but cannot vote on the demands for grants.

Appropriation Bill and Finance Bill

- After the Lok Sabha approves the budget, the Appropriation Bill is introduced.

- The Appropriation Bill authorizes the government to incur expenditure from the Consolidated Fund of India.

- The Finance Bill is introduced to implement the government’s taxation proposals and must be passed within 75 days.

Budget at a Glance is a concise document that provides an overview of the Union Budget. It includes key information such as the estimated revenue and expenditure for the upcoming financial year, major tax proposals, and highlights of the government’s fiscal policy. This document is useful for getting a quick understanding of the budgetary priorities and financial plans of the government.

- Budget Speech is delivered by the Finance Minister in the Lok Sabha, outlining the government’s financial plans and policy priorities for the upcoming year. It includes details on revenue projections, expenditure plans, and key policy initiatives. The speech is an important part of the budget process as it sets the tone and direction for government spending and taxation.

- Demand for Grants is a request by the government to the Parliament for approval to spend money on specific items or services. Each demand outlines the purpose of the expenditure and the amount required. The Parliament can approve, modify, or reject these demands, playing a crucial role in controlling government spending.

- Union Budget 2023 Highlights focus on sustainable growth, infrastructure development, and social welfare. Key highlights include increased allocation for health, education, and rural development, along with tax incentives for green energy and technology sectors. The budget aims to boost economic recovery and ensure long-term fiscal stability.

- Guillotine is a procedure used in the Lok Sabha to conclude discussions on outstanding demands for grants within a specified time frame. On the final day allocated for discussing these demands, the Speaker puts all remaining demands to a vote. This mechanism ensures that financial proposals are debated and decided upon in a timely manner.

- After the Lok Sabha passes the Finance Bill, it is sent to the Rajya Sabha for its recommendations. Since the Finance Bill is a money bill, the Rajya Sabha must return it within 14 days, with or without recommendations. The Lok Sabha has the authority to accept or reject these recommendations.

- Starting from the 2017-18 budget, the presentation date for the budget was moved up to February 1st. Additionally, an important reform was made by merging the railway budget with the general budget beginning from the 2017-18 financial year.

Sources of Revenue

The Department of Revenue, part of the Ministry of Finance, oversees matters related to both direct and indirect union taxes. This department is responsible for the administration and enforcement of regulatory measures concerning the Goods and Services Tax (GST), Central Sales Tax, Stamp Duties, and other relevant fiscal statutes.

The Department of Revenue manages all direct and indirect union tax matters through two statutory boards:

- Central Board of Direct Taxes (CBDT). Handles the levy and collection of all direct taxes.

- Central Board of Indirect Taxes and Customs (CBIC). Responsible for GST, Customs and Central Excise Duties, Service Tax, and other indirect taxes.

Government receipts are categorized into:

- Revenue Receipts:

a. Tax Revenue

b. Non-Tax Revenue - Capital Receipts:

a. Debt Receipts

b. Non-Debt Capital Receipts

Broad Sources of Revenue Include:

- Corporation Tax

- Taxes on Income

- Wealth Tax

- Customs Duties

- Union Excise Duties

- Goods and Services Tax (including GST Compensation Cess)

- Taxes on Union Territories

Centre’s Net Tax Revenue is calculated by deducting the states’ share and the National Calamity Contingent Duty (NCCD) from the total tax revenue.

Non-Tax Revenues Include:

- Interest Receipts

- Dividends and Profits from Public Sector Enterprises

- Surplus Transfers from the Reserve Bank of India

- Other Non-Tax Revenues

- Receipts from Union Territories

Revenue is also generated from various social services and economic services provided by the government, such as:

- Medical Services and Public Health

- Broadcasting, Education, Sports, Art, and Culture

- Housing

- Communication, Energy, Transport, Science, Technology, and Environment

- Railways and General Administrative Services

Capital Receipts Include:

1. Non-Debt Capital Receipts:

a. Recoveries of Loans and Advances

b. Miscellaneous Capital Receipts (e.g., Disinvestments)

2. Debt Capital Receipts:

(a) Market Loans for Various Purposes

(b) Short-Term/Treasury Bill Borrowings

(c) Securities issued against small savings,

(d) State provident fund (Net)

(e) Net external debts

(f) Other receipts (Net)

In short, non debt receipts include recoveries of loans advanced by the government to PSEs, state governments, foreign governments and union territories and sale proceeds of government assets, including those realized from divestment of government equity in public sector undertakings (PSUs). Debt capital receipts comprise of market loans and short term borrowings by the government, borrowing from the Reserve Bank of India and loans taken from foreign governments/institutions. Examples of ‘Other receipts’ include Sovereign Gold Bond Scheme, receipts from international financial institutions and saving bonds.

Public Expenditure Management

Introduction: Public Expenditure Management is crucial for governments, especially in developing economies like India, where resources are limited. It ensures that public spending is aligned with a sustainable macroeconomic framework. Effective management of public expenditure is necessary to initiate and accelerate economic growth and to create employment opportunities.

Importance of Public Expenditure Management

- Public expenditure management is essential for fiscal responsibility.

- It helps in designing and implementing expenditure programmes at minimum cost to achieve specific objectives.

- Unproductive public expenditures can lead to larger deficits, higher taxation, lower economic growth, and greater future debt burdens.

Role of the Department of Expenditure

- The Department of Expenditure, under the Ministry of Finance, oversees the public financial management system in the central government and state finances.

- It implements recommendations from the Finance Commission and the Central Pay Commission, monitors audit comments, and prepares central government accounts.

- The department also assists central ministries in controlling costs and prices of public services and reviewing systems to optimize public expenditure outcomes.

Pre-Budget Meetings and Expenditure Estimates

- Pre-budget meetings chaired by the Secretary (Expenditure) discuss the fund requirements for various categories of expenditure and receipts from departments.

- Expenditure estimates are provisionally finalized and communicated to ministries after the Finance Minister's approval.

Expenditure Profile

- The 'Expenditure Profile,' formerly known as the expenditure budget, is an explanatory document in the budget.

- It provides relevant data across all ministries to outline the financial performance of the Government of India, aggregating various types of expenditure.

The total expenditure outlined in the budget (including both current and capital) for various ministries and departments consists of central expenditure and transfers. Within the Expenditure budget, central government expenditure is categorized into six broad groups:

A. Centre’s Expenditure:

- Establishment Expenditure of the Centre: This includes the costs associated with the establishment of the central government, covering salaries, administrative expenses, and other related costs.

- Central Sector Schemes: These are schemes that are fully funded and implemented by central agencies under the Union government’s ministries and departments.

- Other Central Expenditures: This category includes expenditures on Central Public Sector Enterprises (CPSEs) and Autonomous Bodies, as well as other miscellaneous central expenditures.

B. Centrally Sponsored Schemes and Other Transfers:

- Centrally Sponsored Schemes: These are schemes where the central government provides financial assistance to state governments for specific purposes.

- Finance Commission Transfers: These are transfers made to states as recommended by the Finance Commission, aimed at ensuring a balanced distribution of resources.

- Other Transfers to States: This includes various other transfers made to state governments for different purposes.

Establishment expenditure encompasses the costs related to the establishment of ministries, departments, and their attached and subordinate offices. Central Sector Schemes refer to initiatives that are entirely funded and implemented by central agencies under the Union government’s ministries and departments.

Public Debt Management

- Definition: Public debt refers to the money borrowed by the government from the public, both domestically and internationally, through various instruments like bonds. This debt is raised to cover the fiscal deficit, which is the gap between the government's expenditures and its revenues.

- Debt Servicing: This is the process of repaying the borrowed money. Since a portion of the debt is due every month, the government typically does not cut spending or raise taxes to pay off these debts. Instead, it refinances the debt by issuing new bonds to pay off the old ones. This makes public debt management a crucial task for the government.

- Importance of Public Debt: When used productively, public debt can contribute to economic growth and societal welfare. The sustainability of sovereign debt is a key indicator of a country’s macroeconomic health. It depends on the level of debt and the government’s ability to service this debt.

- Role of Fiscal and Monetary Authorities: These authorities are responsible for determining the size and composition of the debt, the maturity pattern, interest rates, and the redemption of the debt. They set and implement the strategy for managing public debt to raise the required funds at desired risk and cost levels.

- Objectives of Debt Management Policy: The central government’s debt management policy aims to meet financing needs at the lowest possible long-term borrowing costs while keeping the total debt within sustainable limits. It also aims to support the development of a vibrant domestic bond market.

- Pillars of Debt Management Strategy: The strategy is based on three pillars:

Low Cost of Borrowing: Ensuring that the cost of borrowing is minimized.

Risk Mitigation: Reducing the risks associated with public debt.

Market Development: Supporting the development of a robust market for public debt instruments.

Institutions Responsible for Public Debt Management

- Reserve Bank of India (RBI): Manages domestic marketable debt, including dated securities, treasury bills, and cash management bills.

- Ministry of Finance (MoF): Responsible for external debt.

- Ministry of Finance (MoF) and Reserve Bank of India (RBI): Handle other liabilities such as small savings, deposits, and reserve funds.

Internal Debt Management

- The Internal Debt Management Department (IDMD) of the Reserve Bank of India is responsible for managing the domestic debt of the central government, 28 state governments, and two union territories.

- The RBI acts as the debt manager for marketable internal debt.

- Treasury bills are issued to meet short-term cash requirements, while dated securities are issued to mobilize long-term resources to finance the fiscal deficit.

- Since 1997, the Reserve Bank has also provided short-term credit to state governments in the form of Ways and Means Advances (WMA) to bridge temporary cash flow mismatches.

External Debt Management

- Managed by the Department of Economic Affairs in the Ministry of Finance.

- Most external debt is sourced from multilateral agencies such as the International Bank for Reconstruction and Development and the Asian Development Bank.

- There is no sovereign borrowing from international capital markets, and external debt is primarily long-term with fixed interest rates.

- The main risk associated with external debt is the depreciation of the domestic currency, which can increase debt servicing costs.

Fiscal Responsibility and Budget Management (FRBM) Act

- Passed in 2003 to provide a legislative framework for reducing the central government’s deficit and debt to a sustainable level.

- Objectives include:

- Inter-generational equity in fiscal management

- Long-term macroeconomic stability

- Better coordination between fiscal and monetary policy

- Transparency in the fiscal operations of the government

Public Debt Management Cell (PDMC)

- Established in 2016 under the Department of Economic Affairs.

- The Medium Term Debt Management Strategy (MTDS) 2021-24 is a framework aimed at determining the appropriate composition of the debt portfolio.

- The objective is to raise debt efficiently at the lowest possible cost in the medium term while ensuring financing requirements are met without disruption.

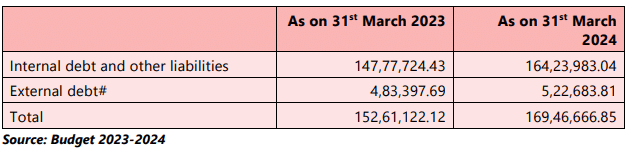

Debt Position of the Government of India

The onset of the pandemic necessitated a significant increase in government expenditure, particularly in the health and social sectors, to address the urgent challenges posed by the crisis. Simultaneously, the pandemic adversely affected economic activities, leading to a substantial decline in revenue receipts. This combination of increased expenditure and decreased revenue resulted in a widening fiscal deficit. In response to this situation, the government had to significantly expand its borrowing programme during 2020-21 and 2021-22. This was essential to implement a counter-cyclical fiscal policy aimed at stabilizing the economy and providing targeted support to sectors that were disproportionately affected by the pandemic. The Reserve Bank of India (RBI) has been actively involved in developing the government securities (G-sec) market, aiming to broaden investor participation. One of the initiatives to enhance retail participation in G-sec is the ‘RBI Retail Direct’ facility, announced on February 5, 2021. This facility is designed to:

- Improve Accessibility: It allows retail investors to easily access the primary and secondary government securities market online.

- Open Retail Direct Accounts: Retail investors can open their government securities accounts (‘Retail Direct’) with the Reserve Bank, facilitating their investment in G-secs. This initiative is part of the RBI's ongoing efforts to increase retail participation in government securities, making it easier for individual investors to invest in these instruments.

Budget Concepts: Types of Budgets

- Balanced Budget:. balanced budget occurs when the government's revenues are equal to its expenditures. In this scenario, there is neither a budget deficit nor a budget surplus. This means that the government's income matches its spending exactly, with revenues equaling expenditures (Revenue = Expenditure).

- Unbalanced Budget: An unbalanced budget can be either a surplus or a deficit.

- Surplus Budget:. surplus budget happens when the estimated government receipts exceed the estimated government expenditure. In this case, the government spends less than it receives, resulting in a surplus. This means that public revenue is greater than public expenditure (R > E).

- Deficit Budget:. deficit budget occurs when the estimated government receipts are less than the estimated government expenditure. This type of budget increases the government's liabilities or decreases its reserves. In many modern economies, deficit budgeting is a common practice.

- Capital Receipts: Capital receipts are funds that lead to a reduction in the government's assets or an increase in its liabilities. Examples of capital receipts include the recovery of loans, earnings from disinvestment, and the incurring of debt.

- Revenue Receipts: Revenue receipts are funds that do not create any liability or cause a reduction in the government's assets. There are two main sources of revenue receipts for the government: tax revenues and non-tax revenues.

- Revenue Expenditure: Revenue expenditure refers to spending for purposes other than the creation of physical or financial assets for the central government. This type of expenditure is related to the normal functioning of government departments and various services, interest payments on government debt, and grants given to state governments and other parties (even though some grants may be intended for asset creation).

- Capital Expenditure: Capital expenditure includes government spending that results in the creation of physical or financial assets or a reduction in financial liabilities. This category encompasses expenditure on the acquisition of land, buildings, machinery, and equipment, as well as investments in shares and loans and advances made by the central government to state and union territory governments, public sector undertakings (PSUs), and other parties.

Budgetary Deficit or Overall Deficit

Budgetary Deficit refers to the situation where the total estimated expenditure exceeds the total estimated revenue. It represents the difference between all receipts and expenditure, including both revenue and capital.

1. Revenue Deficit

- The revenue deficit occurs when the government’s revenue expenditure surpasses its revenue receipts.

- It indicates a shortfall in the government’s current receipts compared to its current expenditure.

- This situation implies that the government’s revenue is insufficient to cover regular expenses necessary for its normal operations.

- Alternatively, it may suggest that the government is reallocating resources from other sectors to finance its current expenditures.

- Formula: Revenue Deficit = Revenue Expenditure – Revenue Receipts

2. Fiscal Deficit

- A fiscal deficit occurs when the government’s non-borrowed receipts are inadequate to cover its total expenditure.

- In such cases, the government needs to borrow funds from the public to bridge the gap.

- Fiscal deficit represents the excess of total expenditure over total receipts, excluding borrowings, within a fiscal year.

- It is often expressed as a percentage of the gross domestic product (GDP).

- Total Receipts Excluding Borrowing: Revenue Receipts + Capital Receipts Excluding Borrowing (Non-debt Creating Capital Receipts)

- Non-debt Creating Capital Receipts: Includes recoveries of loans advanced by the government and sale proceeds of government assets, such as divestment of government equity in public sector undertakings (PSUs).

- Formula: Fiscal Deficit = Total Expenditure – Total Receipts Excluding Borrowing

3. Primary Deficit

- The primary deficit is calculated by subtracting interest payments on previous borrowings from the fiscal deficit of the current year.

- While fiscal deficit includes interest payments, primary deficit focuses on the borrowing requirement excluding these payments.

- This metric indicates how much of the government’s borrowings are allocated to expenses other than interest payments.

- Primary deficit provides an estimate of borrowings due to current expenditure exceeding current revenues.

- The purpose of measuring primary deficit is to highlight present fiscal imbalances.

- Primary deficit = Fiscal deficit – Net Interest liabilities

Budget Terminologies

- Primary Deficit: This is calculated by subtracting net interest liabilities from the fiscal deficit.

- Net Interest Liabilities: These are the interest payments made by the government minus the interest receipts it earns on domestic lending.

- Finance Bill: This bill is introduced right after the Union Budget is presented. It outlines the government's proposals for imposing, abolishing, altering, or regulating taxes.

- Outcome Budget: The outcome budget creates a clear connection between the budgetary allocations for various schemes and their annual performance targets. These targets are measured using specific output and outcome indicators. Essentially, the outcome budget serves as a report card, showing what different ministries and departments have achieved with the funds allocated in the previous budget. It assesses the development results of government programs and ensures that the money has been spent for the intended purposes, along with evaluating the impact of the fund usage.

- Guillotine: Due to limited time for the Parliament to review the expenditure demands of all ministries, the Speaker of the Lok Sabha puts all outstanding demands for grants to a vote once the discussion period is over. This process is known as "Guillotine."

- Cut Motions: These are motions aimed at reducing the amounts sought by the government in various demands for grants. Cut motions are used to express concerns about economy, policy differences, or to voice grievances.

- Consolidated Fund of India: This fund includes all revenues received, loans raised, and money received by the government in repayment of loans. All government expenditures are incurred from this fund, which is further divided into 'revenue' and 'capital' divisions. Money can only be spent from this fund if it is appropriated by Parliament.

- Contingency Fund: This fund is at the disposal of the President to make advances to the government for urgent unforeseen expenditures. Unlike the Consolidated Fund, the Contingency Fund does not require prior legislative approval for such expenditures. Advances from this fund are subsequently reported to Parliament for recoupment from the Consolidated Fund of India.

- Public Account: As per Article 266(1) of the Indian Constitution, the Public Account is used for fund flows where the government acts as a banker. Examples include Provident Funds and Small Savings. This money does not belong to the government but is to be returned to the depositors. Expenditure from this fund does not require parliamentary approval.

|

86 videos|255 docs|58 tests

|

FAQs on Unit 3: The Process of Budget Making: Sources of Revenue, Expenditure & Public Debt Chapter Notes - Business Economics for CA Foundation

| 1. What are the main sources of revenue for a government? |  |

| 2. What is the difference between revenue expenditure and capital expenditure? |  |

| 3. What is a budgetary deficit, and how does it impact the economy? |  |

| 4. How do revenue deficits and fiscal deficits differ? |  |

| 5. What are the key steps in the budget-making process? |  |