Previous Year Short and Long Questions with Answers: Financial Management | Business Studies (BST) Class 12 - Commerce PDF Download

Very Short Questions and Answers

Q1: 'Reliable Transport Services Ltd.' specializes in transporting fruits and vegetables. It has a good reputation in the market as it delivers the fruits and vegetables at the right time and at the right place." State with reason whether the working capital requirements of 'Reliable Transport Services" will be high or low.

Ans: Reliable Transport Services Ltd.'s working capital requirements will be minimal. Because fruits and vegetables are perishable by nature, there will be no need to have a big amount of stock on hand.

Q2: How do 'Floatation costs" affect the choice of capital structure of a company? State.

Ans: The cost of obtaining cash is known as the flotation cost. The floatation cost for issuing debt is normally lesser than that of issuing equity, hence in such cases a higher ratio of debt in the capital structure can be preferred by the companies.

Q3: What is meant by 'financial management'?

Ans: Financial management encompasses all business activities including the acquisition and preservation of capital funds in order to achieve a company's financial demands and overall objectives.

Q4: Besides the investment decision the finance function is concerned with two other broad decisions. Name these decisions.

Ans: The decision other than investment decision are:

- Financing Decision: This refers to the decision regarding the amount of finance to be raised, choosing from the various long term and short term sources of finance, as well as the decisions regarding choosing the most optimum source of finance.

- Dividend Decision: A dividend is a portion of a company's profit that is delivered to stockholders. The stockholders receive current income as a result of this. The financial choice concerns the distribution of profits to investors who provided cash to the company. The amount of earnings to be distributed among the shareholders is the subject of the dividend decision.

- It must be decided that,

- If all profits are to be dispersed,

- Whether all earnings will be retained in the business, or

- Whether a portion of profits will be retained in the business and the remainder distributed among shareholders.

Q5: A textile company is diversifying and starting a steel manufacturing plant. State with reason the effect of diversification on the fixed capital requirements of the company.

Ans: Due to diversification, the investment will increase thus leading to increased fixed capital requirements.

Q6: Rizul Bhattacharya after leaving his job wanted to start a Private Limited Company with his son. His son was keen that the company may start manufacturing Mobile-phones with some unique features. Rizul Bhattacharya felt that the mobile phones are prone to quick obsolescence and a heavy fixed capital investment would be required regularly in this business. Therefore, he convinced his son to start a furniture business.

Identify the factor affecting fixed capital requirements, which made Rizul Bhattacharya choose furniture business over mobile phones.

Ans: "Technology Upgrade” because mobile phones are more prone to get obsolete due to technology upgradation.

Q7: The size of assets, the profitability and competitiveness are affected by one of the financial decisions. Name and state the decision.

Ans: Capital budgeting/investment decisions have an impact on asset size, profitability, and competitiveness.

Q8: Why does financial risk arise?

Ans: Regardless of whether the company makes a profit, interest on borrowed funds must be paid. Furthermore, borrowed funds must be repaid after a defined period of time, and they are subject to a charge on assets. This gives rise to financial risk.

Q9: How does the production cycle affect working capital?

Ans: The longer the production cycle, the longer the capital will be stuck in raw materials and semi-manufactured products. As a result, more working capital will be required when the production cycle is long, whereas less working capital will be required when the cycle is short.

Q10: Enumerate two objectives of financial management?

Ans: The two objectives of financial management are:

- Profit Maximization: The primary objective is concerned with the increasing earning per share (EPS) of the company. It is also the traditional objectives of the financial management that focuses on the fact that all the financial efforts should be made to increase the overall profit of the company,

- Wealth Maximization: This objective focuses on increasing the overall shareholder wealth of the company, by directing the financing efforts on increasing the share price of the company. Higher the share price, higher the wealth. The goal of financial management in this is to optimize the current value of the company's equity shares.

- Other Objectives: There can be other objectives such as optimum utilisation of financial resources, choosing the most appropriate source, ensuring easy availability of funds at reasonable costs etc.

Q11: Radhika and Vani who are young fashion designers left their job with a famous fashion designer chain to set-up a company "Fashionate Pvt. Ltd.' They decided to run a boutique during the day and coaching classes for entrance examinations of National Institute of Fashion Designing in the evening. For the coaching centre they hired the first floor of a nearby building. Their major expense was money spent on photocopying of notes for their students. They thought of buying a photocopier knowing fully that their scale of operations was not sufficient to make full use of the photocopier.

In the basement of the building of 'Fashionate Pvt. Ltd.' Praveen and Ramesh were carrying on a printing and stationery business in the name of 'Neo Prints Pvt. Ltd.' Radhika approached Praveen with the proposal to buy a photocopier jointly which could be used by both of them without making separate investment, Praveen agreed to this.

Identify the factors affecting fixed capital requirements of 'Fashionate Put. Ltd."

Ans: The level of collaboration has an impact on "Fashionate Pvt. Ltd. fixed capital requirements. Occasionally, business organizations would collaborate and develop certain facilities together. In such cases, an individual organization's requirement for fixed capital reduces.

Q12: What is meant by 'Capital Structure'?

Ans: The term "capital structure" refers to a company's prudent use of debt and equity. One of the most essential considerations in financial management is the financing pattern, or the proportion of funds raised from various sources.

Q13: Name & state the aspect of financial management that provides a link between investment and financing decisions.

Ans: Financial Planning provides a link between investment and financing decisions. Financial Planning involves designing the blueprint of the financial operations of a firm.

Q14: Name and state the aspect of financial management that enables to foresee the fund requirements both in terms of "the quantum' and 'in terms of the timings".

Ans: "Financial Planning" is the component of financial management that provides foresight of fund requirements both in terms of "quantity" and "timings." Financial planning is creating a blueprint for a company's entire financial operations so that the appropriate quantity of funds are available for various operations at the appropriate time.

Short Questions and Answers

Q1: State any four factors which affect the requirements of working capital requirements of a company.

Ans: Working capital requirements are influenced by the following factors:

- Nature of Business: A company's basic nature has an impact on the quantity of working capital it requires. A trading firm, for example, requires less working capital than a manufacturing organization.

- Scale of Operations: A large-scale operation will require more inventory since its working capital requirements are higher than a small-scale operation.

- Business Cycle: When the economy is booming, more manufacturing is undertaken, and thus more working capital is required, as opposed to when the economy is in a slump.

- Seasonal Factors: Demand for a product will be greater during peak season, necessitating more working capital than during lean season.

Q2: 'Best Bulbs Pvt. Ltd. was manufacturing good quality LED bulbs and catering to the local market. The current production of the company is 800 bulbs a day. Sumit, the marketing manager of the company surveyed the market and decided to supply the bulbs to five-star-hotels also. He anticipated the higher demand in future and decided to buy a sophisticated machine to further improve the quality and quantity of the bulbs produced.

Identify the factors affecting fixed capital requirements of the company.

Ans: The factor determining a company's fixed capital requirements is 'Growth Prospects’. Higher output, more sales, more inputs, and so on are all related to a company's expansion and growth. This necessitates the use of more advanced machinery. As a result, organizations with strong growth potential require more fixed capital, and vice versa. High growth prospects lead to Large fixed capital requirements, whereas low growth prospects lead to low fixed capital requirements.

Q3: Every manager has to take three major decisions while performing the finance function. Explain them.

Ans: A management must make three main decisions:

- Financing Decision: This refers to the decision regarding the amount of finance to be raised, choosing from the various long term and short term sources of finance, as well as the decisions regarding choosing the most optimum source of finance.

- Investment Decision: Investment decision refers to the prudent allocation of a firm's resources among various alternative offers, with the minimum cost, maximum return.

- Dividend Decision: Dividend decision is whether to distribute earnings to shareholders as dividends or to retain earnings to finance long-term projects of the firm.

Long Questions and Answers

Q1: Sakshi Ltd. is a company manufacturing electronic goods. It has a share capital of Rs. 120 lakhs. The earning per share in the previous years was Rs 0.5. For diversification the company requires additional capital of Rs 80 lakhs. The company raised funds by issuing 10 % debentures for the same. During the current year the company earned profit of Rs 16 lakhs on capital employed, It paid tax of 40%.

(a) State whether the shareholders gained or lost in respect of earning per share on diversification. Show your calculations clearly.

Ans:

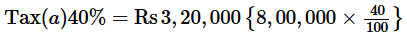

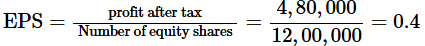

(a) Profit before Interest &Tax=Rs16,00,000 (given)

Interest on 10% debenture = Rs. 8,00,000

Profit before Tax =Profit before Interest and Tax

Interest =16,00,000−8,00,000=Rs8,00,000.

Hence, the number of equity shares is 12,00,000.

Ans: The following are three characteristics that favour the corporation issuing debentures as part of its capital structure.

- Tax Deductibility: The company's interest payments on its debentures are tax deductible. In the above scenario, the company is paying tax 40 %. Thus, it is beneficial for the company to issue debentures.

- Say in Management: Issuing more shares will dilute management's control. Thus, companies who aren’t willing to dilute the control may opt for more debt and less equity.

- Relatively Low Cost: For a company, the cost of raising capital through debentures is relatively lower than that through equity. Debenture investors require a lower rate of return due to the assurance (of rate of return) and guaranteed repayment (of debenture amount at maturity). Aside from that, interest paid to debenture holders is a tax-deductible expense. This means that after deducting interest from the company's earnings, the net amount is utilised to calculate tax liabilities. As a result, corporations prefer debentures since a higher usage of debt decreases the overall cost of capital while leaving the cost of equity the same.

- Business Type: Companies that provide services or trade (and have a short operational cycle) require less working capital than companies that manufacture goods.

The raw materials are generally the same as the final outputs and the sales transaction takes place immediately in service and trading organization, thus leading to low working capital requirements.. A manufacturing firm, on the other hand, has a long operational cycle, and raw resources must be turned into completed goods before they can be sold, thus leading to large working capital needs.

Small working capital needs are for service or trading businesses, while manufacturing companies have a high need for working capital. - Credit Extends to the Firm's Ability: When a corporation has a generous credit policy, the number of borrowers grows. This, in turn, raises the company's working capital requirements. A strict credit strategy, on the other hand, decreases the need for working capital. Large working capital is required with a company having a liberal credit policy. Whereas, a strict credit policy leads to low working capital needs.

- Extent of Availability of Raw Material: If the raw materials required by the company can be availed easily, then the firm need not maintain a large stock of inventories of raw material. In such circumstances, the company's working capital requirements are reduced.

If on the other hand, raw materials aren't readily available or their supply isn't consistent, the company will need to keep a significant stock of raw materials on hand to assure uninterrupted operations, necessitating a substantial amount of working capital. Hence if raw materials are readily available, then working capital requirements are minimal. But if obtaining raw materials is difficult then it will result in a high working capital demand. - Scale of Operations: Companies operating on a large scale require large working capital. This is due to the fact that such businesses must keep a large stock of merchandise and debtors. When the scope of operations is limited, however, the amount of working capital required is lower. Hence, large-scale operations necessitate a large amount of working capital. Operating on a small scale necessitates a low level of working capital.

Ans: The following seven elements are used to establish a company's capital structure:-

- Cash Flow Position: The cash position at the end of the month on a cash flow statement represents the amount of cash the company has in hand at that point in time. This cash position reflects the company's financial strength and liquidity, indicating the company's capacity to satisfy its existing obligations. Hence, a company with high liquidity and a good cash flow position can issue debt capital, as the company will have less chances of facing financial risk than the company with a low cash position.

- Tax Rate: Higher the tax rate, more preference for debt capital in the capital structure, as interest on debt capital being a tax deductible expense makes the debt cheaper.

- Cost of Debt: Lower the cost of debt, higher will be the preference for debt capital in the equity share as against equity capital.

- Control: If the existing shareholders want to maintain the control in the firm, the company may prefer more debt over equity in the capital structure, as issuing debt will not affect the control stake of existing shareholders.

- Stock Market Situations: If the stock market is flourishing, and there is a condition of boom then the companies may prefer more equity over debt in the capital structure. However, in the case of a bear market, to avoid any more risks, the companies will prefer more debt over equity in the capital structure.

- Return on Investment (ROI): It is a performance metric used to assess an investment's efficiency or profitability, as well as to compare the efficiency of many investments. A higher ROI over the rate of interest will make the companies prefer debt capital because of lower cost and higher returns. While in the case of ROI being less than rate of interest, equity would be preferred, as in this case debt would be more costly affair for the company

- Size of Business: Small businesses generally go for retained earnings, and equity capital, as if they go for debt or borrowed capital, the company has to face a fixed interest burden. However in the case of large companies, issuing debt is not a big issue, and they can raise long term finance from borrowed sources cheaper than that of small firms.

Ans: The company can raise necessary finance for the purpose of expansion through the following function.

- Issue of Shares: The technique through which businesses distribute additional shares to shareholders is known as the issue of shares. Individuals or corporations can be shareholders. While circulating the shares, the company adheres to the rules set forth by the Companies Act of 2013. The three major fundamental steps in the process of issuing shares are the distribution of prospectuses, the receipt of applications, and the allocation of shares.

- Issue of Debentures: The term "issuing debentures" refers to the company's issuance of a certificate under its seal that serves as an acknowledgement of the company's debt. The process of a firm issuing debentures is similar to that of issuing shares. A prospectus is published, applications are accepted, and allotment letters are sent out.

- Loans from Banks and Financial Institutions: Banks are the main actors in all areas of the financial markets, including credit, cash, securities, foreign exchange, and derivatives, due to their vast monetary holdings. The growth of the business sector determines a country's economic development. By making funds available to businesses, a well-developed financial system aids their growth.

- Retained Earnings: Accounting's idea of retained earnings is crucial. The word refers to a company's previous profits, less whatever dividends it has paid in the past. The term "retained" refers to the fact that the earnings were not distributed to shareholders as dividends, but rather were kept by the corporation.

Ans: Factors affecting an organization's fixed capital requirements include:

- Nature of Business: the type of business is a factor in determining the fixed capital requirements. The type of fixed asset used in manufacturing business (namely plant machinery etc., whereas in trading its merely sale and purchase. For e.g. manufacturing businesses necessitate a large capital investment in fixed assets such as plant and machinery etc., whereas trade concerns necessitate a smaller capital investment in fixed assets.

- Scale of Operations: A larger organization operating on a large scale requires more fixed capital investment as compared to an organization operating on a small scale. Large firm has more people, more products to produce, more land space, thus fixed expenses increase in terms of salaries, rent, etc.

- Choice of Technique: An organization using capital-intensive techniques requires more investment in fixed assets as compared to an organization using labour intensive techniques. on the other hand the capital intensive as it uses machinery etc .,which is costly.

- Technology Upgrade: When compared to other businesses, a company with obsolete techniques and assets needs to revamp their assets and techniques time and again.

- Growth Prospects: In order to expand their production capacity, companies with stronger growth prospects require larger fixed capital investments.

- Diversification: If a corporation diversifies, it will need to invest more fixed capital in plant and machinery, among other things.

- Alternatives to Outright Buying: A well-developed financial sector might offer leasing options as an alternative to outright purchase and more of the alternatives available, lesser the fixed capital required.

- Collaboration Level: If companies are collaborating, forming a joint venture, and so forth, then they need less fixed capital as they share plants and machinery with their collaborators.

- Stable Earnings: A company's earnings are used to determine the amount of dividends it will pay out. A company with stable and smooth earnings can pay higher dividends to shareholders than a company which has unstable and uneven earnings.

Quotation: “It has been consistently earning good profits for many years”. - Future Growth Prospects: Companies with better future growth prospects tend to save more of their earnings for future reinvestment. As a result, they pay lower dividends.

Quotation: “There is availability of enough cash in the company and good prospects for growth in future”. - Shareholder Preferences: When deciding on dividends, shareholders' preferences must be taken into account. If shareholders, for example, want a specified minimum amount of dividends paid, the corporation can proclaim that.

Quotation: “It has many shareholders who prefer to receive a regular income from their investments.” - Legal Restrictions: The extent of dividend payment also depends on the legal restrictions a company faces from the external environment. The company has to provide a dividend in accordance with the restrictions and rules and regulations it is bound in.

Quotation: “It has taken a loan of more than 60 lakhs from SBI Bank and is bound by certain restrictions on the payment of dividend according to the terms of the loan agreement.”

|

51 videos|324 docs|74 tests

|

FAQs on Previous Year Short and Long Questions with Answers: Financial Management - Business Studies (BST) Class 12 - Commerce

| 1. What are the key objectives of financial management? |  |

| 2. What is the difference between short-term and long-term financial management? |  |

| 3. How do financial ratios help in financial management? |  |

| 4. What role does budgeting play in financial management? |  |

| 5. Why is risk management important in financial management? |  |