Bills of Exchange and Promissory Notes Chapter Notes | Accounting for CA Foundation PDF Download

Chapter Overview

Bills of Exchange

When goods are sold or services are rendered, it is common for the seller to offer a credit period to the buyer. However, there are situations where the seller cannot offer credit, and the buyer cannot pay immediately. In such cases, the seller prefers a written promise from the buyer to pay for the goods by a specific date, which can be used to secure immediate funds. Written promises, when made in the proper form and duly stamped, are considered valuable credit instruments in commercial practice. These promises are expected to be fulfilled, allowing the seller to receive payment. Banks often accept these written promises, providing funds against them. Additionally, they can be endorsed, meaning they can be transferred from one person to another. A written promise can take the form of a Bill of Exchange or a promissory note. A Bill of Exchange is defined as a written instrument containing an unconditional order signed by the maker, directing a specific person to pay a certain sum of money to a designated individual or to the bearer of the instrument. When such an order is accepted in writing on the face of the order, it becomes a valid bill of exchange. For example, if A orders B to pay ₹50,000 three months from the date of the order, and B accepts it by signing, it constitutes a bill of exchange.Characteristics of a Bill of Exchange

- Writing: The bill must be in written form.

- Date: It should be dated.

- Order to Pay: The bill must contain an order to pay a specific sum of money.

- Unconditional Promise: The promise to pay should be unconditional.

- Payee: The money must be payable to a specific person, their order, or the bearer.

- Acceptance: The draft must be accepted for payment by the party to whom the order is made.

- Stamping: It should be properly stamped, except in cases of bills payable on demand.

- Legal Currency: Payment must be in the legal currency of the country.

Parties Involved:

- Drawer: The party making the order.

- Acceptor: The party accepting the order.

- Payee: The party to whom the amount is to be paid. The drawer and payee can be the same person.

Endorsement and Liability

- Endorsement:. Bill of Exchange can be transferred to another person by endorsement, similar to a cheque.

- Primary Liability: The acceptor holds primary liability on a Bill of Exchange. If the acceptor fails to pay, the holder can recover the amount from previous endorsers or the drawee.

Foreign Bills of Exchange

- Definition:. Foreign Bill of Exchange is drawn in one country and payable in another.

- Triplicate: It is typically drawn in triplicate, with each copy sent by separate post to ensure at least one reaches the intended party.

- Payment: Payment is made on only one copy, rendering the others useless.

- Legal Provision: Section 12 of the Negotiable Instruments Act states that all instruments not inland instruments are considered foreign.

Examples of Foreign Bills of Exchange:

- A bill drawn in India on a person residing outside India and made payable outside India.

- A bill drawn outside India on a person residing outside India.

- A bill drawn outside India and made payable in India.

- A bill drawn outside India and made payable outside India.

Promissory Notes

- A promissory note is a written financial instrument, distinct from bank notes or currency notes. It features an unconditional promise, signed by the maker, to pay a specific sum of money to a designated person or their order.

- According to Section 31(2) of the Reserve Bank of India Act, promissory notes cannot be made payable to the bearer.

Characteristics of a Promissory Note:

- Written Document:. promissory note must be in writing.

- Clear Promise: It should contain a clear promise to pay; simply acknowledging a debt is insufficient.

- Unconditional Promise: The promise to pay must be unconditional. For instance, saying, “I promise to pay `50,000 as soon as I can” is not unconditional.

- Signature: The promiser or maker must sign the promissory note.

- Certain Maker: The maker of the note must be a certain person.

- Certain Payee: The payee, or the person to whom payment is promised, must also be certain.

- Certain Amount: The sum payable must be certain. For example, “I promise to pay `50,000 plus all fines” is not certain.

- Legal Currency: Payment must be made in the legal currency of the country.

- Non-Bearer: The note should not be made payable to the bearer.

- Proper Stamping: It should be properly stamped.

- No Acceptance Required:. promissory note does not require acceptance.

Specimen of a Promissory Note:

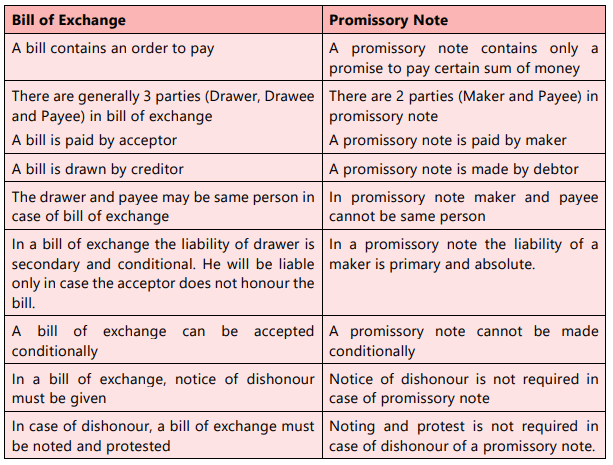

Differences - Bill of Exchange and Promissory Note

Bills of Exchange and Promissory Notes

Introduction

- Promissory notes and bills of exchange are financial instruments used in commercial transactions.

- When a party receives a promissory note or an accepted bill of exchange, it is recorded as a new asset under "Bills Receivable."

- Conversely, when a party issues a promissory note or accepts a bill of exchange, it is recorded as a new liability under "Bills Payable."

Entries in the Books of the Party Receiving Promissory Notes or Bills

- When a party receives a bill, whether it’s a promissory note or a bill of exchange, the entry in their books is as follows:

- Bills Receivable Account (Debit)

- To Drawee/Maker of the Note

Example Scenarios

- Scenario 1: A Accepts a Bill from B

- In the books of B:

- Bills Receivable Account (Debit)

- To A

- Scenario 2: B Receives Acceptance from A

- In the books of B:

- Bills Receivable Account (Debit)

- To A

Options for the Bill Receiver

- Holding the Bill: The receiver can keep the bill until its maturity date. No further entries are made until the maturity date arrives.

- Endorsing the Bill: The bill can be endorsed to another party, such as Z. The entry for this transaction would involve debiting the party receiving the bill and crediting the Bills Receivable Account. For example:

- Z (Debited)

- To Bills Receivable Account (Credited)

- Discounting the Bill with a Bank: The bill can be discounted with a bank. The bank will deduct a discount fee and pay the remaining amount. The entries for this transaction would include:

- Bank Account (Debited with the amount received)

- Discount Account (Debited with the discount amount)

- To Bills Receivable Account (Credited)

Entries on Maturity Date

1. If the Bill is Paid (Honoured)

- If the Bill was Kept: The original holder receives the payment, and the entry is:

- Bank Account (Debit)

- To Bills Receivable Account (Credit)

- If the Bill was Endorsed or Discounted: No entry is made by the original holder. The creditor or bank receives the payment.

2. If the Bill is Dishonoured

- If the Bill was Kept: The entry is:

Drawee/Maker Account (Debit)

To Bills Receivable Account (Credit) - If the Bill was Endorsed: The entry is:

Drawee/Maker Account (Debit)

To Creditor Account (Credit) - If the Bill was Discounted: The entry is:

Drawee/Maker Account (Debit)

To Bank Account (Credit)

Summary

- The party who receives the bill initially is responsible for the payment in case of dishonour.

- The credit entry varies based on the action taken with the bill (retained, endorsed, or discounted).

Term of a Bill of Exchange

- Duration: The term of a bill of exchange can vary in duration and is usually within 90 days from the date the bill is issued.

- Bill Drawn After Sight: When a bill is drawn after it has been sighted, the term begins from the date of sighting, which is when the bill is accepted.

- Bill Drawn After Date: If a bill is drawn after its date, the term starts from the date the bill is drawn.

Expiry / Due Date of a Bill

The day when the bill's term ends is referred to as the "Expiry/Due Date of the bill."

Days of Grace

- Instruments that are payable on a specific date, such as promissory notes or cheques, are entitled to three days of grace.

- This means that if the due date falls on a holiday or non-business day, the instrument can be presented for payment on the next business day without any penalty.

Date of Maturity of Bill

- Date of Maturity: The date of maturity for a bill is determined by adding three days of grace to its expiry or due date.

- Definition: The maturity of a promissory note or bill of exchange refers to the date on which it is due for payment. Generally, these financial instruments mature on the third day after they are expressed to be payable.

- Exceptions: The maturity period is different when the instrument is expressed to be payable:

- On Demand: The instrument is payable as soon as it is presented for payment.

- At Sight: The instrument is payable immediately upon being sighted.

- On Presentment: The instrument is payable when it is presented for payment.

Bill at Sight

A Bill at Sight refers to financial instruments where no specific time for payment is indicated. For instance:

- Cheques are always payable on demand.

- Promissory notes and bills of exchange are also payable on demand in the following situations:

- When no time for payment is specified.

- When it is explicitly stated to be payable on demand, at sight, or on presentment.

Notes:

(i) "At sight" and "presentment" means on demand.

(ii) An instrument payable on demand may be presented for payment at any time.

(iii) Days of grace is not to be added to calculate maturity for such types of bill.

Bill After Date

Bill after date refers to a financial instrument where the time for payment is clearly specified. A promissory note or bill of exchange is considered a time instrument when it is payable:

- after a specified period,

- on a specific day,

- after sight, or

- upon the occurrence of an event that is certain to happen.

Notes:

(i) The expression ‘after sight’ means-

(a) in a promissory note, after presentment for sight

(b) in a bill of exchange, after acceptance or noting for non-acceptance or protest for non-acceptance.(ii) A cheque cannot be a time instrument because the cheque is always payable on demand. Though a cheque can be post dated and which can be presented on or after such date. A cheque has validity of 90 days from its date after that it becomes void, normally termed as ‘Stale Cheque’ as bank will not honour such cheque.

How to Calculate Date of a Bill

The due date of each bill is calculated as follows:

Note: The term of a Bill after sight commences from the date of acceptance of the bill whereas the term of a Bill after date commences from the date of drawing of bill.

Noting Charges

Noting charges refer to the fees charged by a Notary Public for their services in presenting a dishonoured bill for payment. When a bill is dishonoured or there is a risk of dishonour, it is given to a Notary Public who presents it for payment. If the payment is received, the Notary Public hands over the money to the original party. However, if the bill is dishonoured, the Notary Public notes the fact and the reasons for dishonour and returns the bill to their client.

The amount of noting charges is recoverable from the party responsible for the dishonour. For example, if X receives a bill from Y for ₹1,000 and it is dishonoured with ₹10 as noting charges, the entry would be:

Example with Noting Charges

When X Receives a Bill from Y:

- Dr. Y: ₹1,010 (to record the total amount due from Y)

- Cr. Bills Receivable Account: ₹1,000 (to record the bill receivable)

- Cr. Bank A/c: ₹10 (to record the noting charges)

When X Endorses the Bill in Favour of Z:

- Dr. Y: ₹1,010 (Z claims ₹1,010 from X)

- Cr. Z: ₹1,010 (to record the amount payable to Z)

If the Bill has been Discounted with a Bank:

- Dr. Y: ₹1,010 (to record the amount due from Y)

- Cr. Bank A/c: ₹1,010 (to record the amount payable to the bank)

Renewal of Bill

- When the acceptor of a bill is unable to pay the amount on the due date, he may request an extension of time to settle the payment. In such cases, the acceptor agrees to pay interest for the additional time period, which is calculated from the maturity date of the old bill to the new settlement date.

- A new bill will be drawn to replace the old one, and the old bill will be cancelled.

- The entries for cancelling the old bill should be passed in the same manner as for a dishonour.

- When the new bill is received, the entries for its receipt will be repeated.

The amount of the new bill can represent different scenarios:

- If the drawee pays nothing: The total of the original bill amount plus the interest for the extended period.

- If the drawee pays the interest amount at the time of renewal: The amount of the original bill.

- If the drawee makes a part payment of the original bill, interest amount, or both: The unpaid portion of the total of the original bill and the interest for the extended period.

Retirement of Bills of Exchange

- Definition: Retirement of a bill of exchange occurs when the acceptor pays the amount due before the maturity date.

- Process: The acceptor, having sufficient funds, approaches the payee to offer early payment.

- Rebate/Discount: The payee may agree to this early payment in exchange for a rebate, discount, or interest. This rebate is the income for the acceptor and an expense for the payee.

- Example: If a bill is due in 30 days for ₹10,000 and the acceptor pays it in 20 days with a ₹500 rebate, the acceptor saves ₹500, and the payee incurs a ₹500 loss.

Rebate on Premature Payment

- Concept: When the acceptor of a bill of exchange pays off the bill before its due date, he is entitled to a rebate or discount for the early payment.

- Income and Expense: The rebate becomes income for the acceptor and an expense for the payee. It reflects the consideration for premature payment.

ILLUSTRATION 1

Ms. Sujata receives two bills from Ms. Aruna dated 1st January 2022 for 2 months. The first bill is for 10,200 and the second bill is for ₹ 15,000. The First bill is discounted immediately with the bank for ₹ 10,000 and the second bill was endorsed in favour or Mr. Sree on 3rd January 2022. Pass the necessary journal entries in the books of Ms. Sujata.

SOLUTION

ILLUSTRATION 2

Vijay sold goods to Pritam on 1st September, 2022 for ₹1,06,000. Pritam immediately accepted a three months bill. On due date Pritam requested that the bill be renewed for a fresh period of two months. Vijay agrees provided interest at 9% p.a. was paid immediately in cash. To this Pritam was agreeable. The second bill was met on due date. Give Journal entries in the books of Vijay and Pritam.

SOLUTION

ILLUSTRATION 3

On 1st January, 2022, Ankita sells goods for ₹5,00,000 to Bhavika and draws a bill at three months for the amount. Bhavika accepts it and returns it to Ankita. On 1st March, 2022, Bhavika retires her acceptance under rebate of 12% per annum. Record these transactions in the journals of Ankita and Bhavika.

SOLUTION

ILLUSTRATION 4

Journalise the following transactions in K. Katrak’s books:

(i) Katrak’s acceptance to Basu for ₹ 2,500 discharged by a cash payment of ₹ 1,000 and a new bill for the balance plus ₹ 50 for interest.

(ii) G. Gupta’s acceptance for ₹ 4,000 which was endorsed by Katrak to M. Mehta was dishonoured. Mehta paid ₹20 noting charges. Bill withdrawn against cheque.

(iii) D. Dalal retires a bill for ₹ 2,000 drawn on him by Katrak for ₹10 discount.

(iv) Katrak’s acceptance to Patel for ₹5,000 was discharged by endorsing Mody’s acceptance to Katrak for a similar amount.

SOLUTION

ILLUSTRATION 5

On 1st January, 2022, Vilas draws a bill of exchange for ₹10,000 due for payment after 3 months on Eknath. Eknath accepts to this bill of exchange. On 4th March, 2022 Eknath retires the bill of exchange at a discount of 12% p.a. You are asked to show the journal entries in the books of Eknath.

SOLUTION

ILLUSTRATION 6

On 1st January, 2022, Vilas draws a Bill of Exchange for ₹10,000 due for payment after 3 months on Eknath. Eknath accepts to this bill of exchange. On 4th March, 2022. Eknath retires the bill of exchange at a discount of 12% p.a. You are asked to show the journal entries in the books of Vilas.

SOLUTION

Insolvency

- Insolvency refers to a situation where a person is unable to meet their financial obligations and pay off their liabilities. This means that any bills or debts accepted by them will be dishonored.

- When it becomes known that a person has gone insolvent, it is necessary to make an entry for the dishonor of their acceptance in the financial records.

- At a later time, there may be a possibility of receiving something from the insolvent's estate. When and if an amount is received, the cash account will be debited, and the personal account of the debtor will be credited.

- However, a portion of the amount will be irrecoverable and must be written off as bad debt. It is important for students to calculate the amount actually received from the insolvent's estate and the amount to be written off only after preparing the insolvent's account.

- In the books of the drawee of the bill, any amount not ultimately paid due to insolvency should be credited to the Deficiency Account.

ILLUSTRATION 7

Mr. David draws two bills of exchange on 1.1.2022 for ₹6,000 and ₹10,000. The bills of exchange for ₹6,000 is for two months while the bill of exchange for ₹10,000 is for three months. These bills are accepted by Mr. Thomas. On 4.3.2022, Mr. Thomas requests Mr. David to renew the first bill with interest at 18% p.a. for a period of two months. Mr. David agrees to this proposal. On 20.3.2022, Mr. Thomas retires the acceptance for ₹10,000, the interest rebate i.e. discount being ₹100. Before the due date of the renewed bill, Mr. Thomas becomes insolvent and only 50 paise in a rupee could be recovered from his estate.

You are to give the journal entries in the books of Mr. David.

SOLUTION

ILLUSTRATION 8

Rita owed ₹1,00,000 to Siriman. On 1st October, 2021, Rita accepted a bill drawn by Siriman for the amount at 3 months. Siriman got the bill discounted with his bank for ₹99,000 on 3rd October, 2021. Before the due date, Rita approached Siriman for renewal of the bill. Siriman agreed on the conditions that ₹50,000 be paid immediately together with interest on the remaining amount at 12% per annum for 3 months and for the balance, Rita should accept a new bill at three months. These arrangements were carried out. But afterwards, Rita became insolvent and 40% of the amount could be recovered from his estate.

Pass journal entries (with narration) in the books of Siriman.

SOLUTION

Accommodation Bills

Accommodation bills are a financial tool used to raise funds, similar to bills of exchange, which are typically meant to facilitate trade. In an accommodation bill, one party (the acceptor) agrees to pay a certain amount to another party (the drawer) at a future date, providing a short-term loan.

For instance, if Boss needs finance for three months, he can persuade his friend Kapoor to accept his draft. Boss can then take the bill of exchange to his bank and get it discounted, allowing him to access funds immediately. When the three-month period expires, Boss will repay Kapoor, who will then meet the bill.

- If both Boss and Kapoor need money, either party can accept a bill of exchange, which will be discounted with the bank. The proceeds will be divided according to their mutual agreement, and the discounting charges will be shared in the same ratio. On the due date, the acceptor will receive their share, and the bill will be settled.

- When bills are used for such purposes, they are referred to as accommodation bills.

- In cases where the drawer cannot remit the proceeds to the drawee on the due date, the drawee may draw a new bill on the drawer and get it discounted with the bank to honor the first bill. The proportion of discount to be borne by the new drawee will depend on the proceeds remitted and the benefit obtained from the first bill.

- Entries for accommodation bills are recorded in the books of both parties similarly to ordinary bills, with the additional entry for sending remittance and sharing the discount amount.

ILLUSTRATION 9

On 1st July, 2022 Gorge drew a bill for ₹1,80,000 for 3 months on Harry for mutual accommodation. Harry accepted the bill of exchange. Gorge had purchased goods worth ₹1,81,000 from Jack on the same date. Gorge endorsed Harry’s acceptance to Jack in full settlement. On 1st September, 2022, Jack purchased goods worth ₹1,90,000 from Harry. Jack endorsed the bill of exchange received from Gorge to Harry and paid ₹ 9,000 in full settlement of the amount due to Harry. On 1st October, 2022, Harry purchased goods worth ₹2,00,000 from Gorge. Harry paid the amount due to Gorge by cheque. Give the necessary Journal Entries in the books of Harry , Gorge and Jack.

SOLUTION

ILLUSTRATION 10

X draws on Y a bill of exchange for ₹ 30,000 on 1st April, 2022 for 3 months. Y accepts the bill and sends it to X who gets it discounted for ₹ 28,800. X immediately remits ₹ 9,600 to Y. On the due date, X, being unable to remit the amount due, accepts a bill for ₹ 42,000 for three months which is discounted by Y for ₹ 40,110. Y sends 6,740 to X. Before the maturity of the bill, X becomes bankrupt, his estate paying fifty paise in the rupee. Give the journal entries in the books of X and Y.

SOLUTION

ILLUSTRATION 11

For the mutual accommodation of ‘X’ and ‘Y’ on 1st April, 2022, ‘X’ drew a four months’ bill on ‘Y’ for ₹ 4,000. ‘Y’ returned the bill after acceptance of the same date. ‘X’ discounts the bill from his bankers @ 6% per annum and remit 50% of the proceeds to ‘Y’. On due date, ‘X’ is unable to send the amount due and therefore ‘Y’ draws a bill for ₹ 7,000, which is duly accepted by ‘X’.

‘Y’ discounts the bill for ₹ 6,600 and sends ₹ 1,300 to ‘X’. Before the bill is due for payment ‘X’ becomes insolvent. Later 25 paise in a rupee received from his estate.

Record Journal entries in the books of ‘X’.

SOLUTION

Bills of Collection

When a person receives a bill of exchange, they have the option to hold onto it until the maturity date. However, for safety reasons, they might choose to send it to the bank with specific instructions to retain it until maturity and to realize the payment on that date. This process is known as "Bill sent for collection" and does not involve discounting because the bank will not credit the client until the amount is actually collected.Recording Bills for Collection

When a bill is sent for collection, it is advisable to make a record in the books by passing the following entry:

- Bills for Collection Account

- To Bills Receivable Account

Realizing the Amount

When the amount is realized, the following entry will be made:

- Debit: Bank Account

- To: Bills for Collection Account

Handling Dishonored Bills

If the bill is not honored, the entry will be:

- Debit: Drawee’s Account (from whom the bill was received)

- To: Bills for Collection Account

Bills Receivable and Bills Payable Books

- Bills receivable and bills payable books are used to record the details of bills received and bills paid in chronological order. These books are maintained when there are a large number of bill transactions in an organization, as it makes it easier to keep track of them.

- When a bill transaction occurs, it is first entered into the Day Books. From there, postings are made to individual debtors or creditors accounts. Periodically, the totals of bills received or accepted are posted to the Bills Receivable Account and Bills Payable Account, respectively.

Bills receivable book and bills payable book are very useful for following up the status of outstanding bills. When there are large number of bills and these bills fall due on different dates, some of these bills may not be honoured on maturity due to varied reasons. It is possible from these Day Books to trace the details of the outstanding bills and to identify the reasons for not honouring the bills. Given below are forms of Day Books for both bills receivable and bills payable:

|

68 videos|160 docs|83 tests

|

FAQs on Bills of Exchange and Promissory Notes Chapter Notes - Accounting for CA Foundation

| 1. What is a bill of exchange and how does it work? |  |

| 2. What is a promissory note and how is it different from a bill of exchange? |  |

| 3. How do you calculate the maturity date of a bill of exchange? |  |

| 4. What are noting charges in the context of bills of exchange? |  |

| 5. What is the process for renewing a bill of exchange? |  |

|

Explore Courses for CA Foundation exam

|

|