Unit 1: Introduction to Partnership Accounts Chapter Notes | Accounting for CA Foundation PDF Download

Unit Overview

Introduction: Why Partnership?

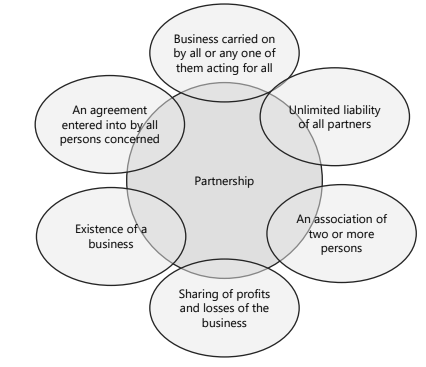

A sole proprietor may struggle to meet the financial and managerial demands of today's business world. Therefore, two or more individuals may choose to pool their resources to conduct a business. This chapter will discuss the final accounts of partnership firms, including the basic concepts of accounting for the admission, retirement, and death of a partner.Definition and Features of Partnership

According to the Partnership Act of 1932, a partnership is defined as the relationship between individuals who have agreed to share the profits of a business carried out by all or any of them acting on behalf of everyone.(i) Existence of an Agreement:. partnership arises from a contract between parties, not from status, as in the case of a Hindu Undivided Family (HUF). A formal written agreement is not necessary to establish a partnership.

(ii) Business:. partnership can only exist in the context of a business. It is not just the agreement that creates a partnership; it comes into existence when partners start conducting business according to their agreement. Business, as defined in the Indian Partnership Act, includes all forms of trade, occupation, and profession.

(iii) Sharing of Profit: The individuals involved must agree to share the profits of the business. A person is not considered a partner unless they have the right to share in the profits. The Indian Partnership Act does not require sharing of losses for partnership.

(iv) Mutual Agency: Mutual agency means that the business is to be carried on by all or any of the partners acting for all. If a person acting in the business represents not only themselves but also others, they are considered partners.

(v) Minor as a Partner:. minor can be admitted to a partnership firm but can only share in the profits, not the losses. If the firm incurs a loss, it is borne by the other major partners in accordance with their profit-sharing ratio.

(vi) Number of Partners:Minimum Partners: Two Maximum Partners: As per the Companies Act, 2013, no partnership consisting of more than 100 persons shall be formed for carrying on any business. Rule 10 of the Companies (Incorporation) Rules, 2014, specifies the limit as 50, making the maximum number of partners in a partnership firm 50.

Introduction to Limited Liability Partnership (LLP)

- The Indian Partnership Act of 1932 has a basic form of partnership that comes with the drawback of unlimited liability for all partners. This means that all partners are responsible for business debts and legal issues, no matter their share or profit ratio, because the firm is not considered a legal entity.

- General partners are also responsible for the wrongful actions of their co-partners. In case the firm goes bankrupt, the personal assets of the partners can be used to pay off the firm’s debts.

- As the Indian economy has grown, the contribution of entrepreneurs and skilled professionals has been recognized globally. There is a need to combine entrepreneurship, knowledge, risk, and capital to further boost India’s economic development.

- In this context, a new corporate structure was necessary, offering an alternative to traditional partnerships that have unlimited personal liability, while also providing the governance framework seen in limited liability companies. This new structure would allow professional expertise and entrepreneurial efforts to work together in a flexible and efficient way.

- The government recognized that Indian professionals dealing with multinational companies in international business could face significant liability risks. To encourage these professionals to engage in global business without the fear of excessive liability, the Limited Liability Partnership (LLP) structure was introduced. This move aligns with global practices and was formalized through the Limited Liability Partnership Act in 2008.

- An LLP is seen as a modern corporate business model that offers limited liability benefits while giving members the flexibility to organize their internal structure like a partnership based on a mutual agreement.

- Legal Status and Liability: The LLP is recognized as a separate legal entity, responsible for its assets. Partners’ liability is limited to their agreed contributions, which can be tangible, intangible, or both. Partners are not liable for each other’s actions unless there’s intent to defraud.

- Taxation and Legal Personality: LLPs are taxed like partnerships but enjoy the benefits of being a corporate entity with limited liability. They have a distinct legal personality separate from their partners.

- Benefits of LLP: LLPs are governed by agreements, allowing for innovative collaboration between professionals and financial risk-takers. They offer limited liability, flexibility, lower registration costs, and do not always require audits.

- Challenges of LLP: LLPs face public disclosure of financial statements, lack of equity investment options, and strict penalties for non-compliance.

- The Limited Liability Partnership Act, 2008, governs the formation and regulation of LLPs in India. Amendments to this Act were made in 2021 by the Ministry of Law and Justice.

Definition of Limited Liability Partnership (LLP)

As per Section 2 of the Limited Liability Partnership (LLPs) Act, 2008: (a). Limited Liability Partnership (LLP) is defined as a partnership that is formed and registered under this Act. (b). Limited Liability Partnership Agreement refers to any written agreement between the partners of the LLP or between the LLP and its partners, outlining their mutual rights and duties. (c). "Small Limited Liability Partnership" is an LLP where: (i) The contribution does not exceed twenty-five lakh rupees (or a higher amount not exceeding five crore rupees, as prescribed). (ii) The turnover, as per the Statement of Accounts and Solvency for the previous financial year, does not exceed forty lakh rupees (or a higher amount not exceeding fifty crore rupees, as prescribed).

Nature of Limited Liability Partnership

- A Limited Liability Partnership (LLP) is a corporate body established and registered under the LLP Act, 2008. It is distinct legal entity, separate from its partners.

- LLPs enjoy perpetual succession, meaning their existence is not affected by changes in partners.

- Changes in partners do not impact the LLP's existence, rights, or obligations.

Non-applicability of the Indian Partnership Act, 1932

- The provisions of the Indian Partnership Act, 1932, do not apply to Limited Liability Partnerships (LLPs), unless explicitly stated otherwise.

Minimum number of partners in case of LLP

- Any individual or body corporate can be a partner in a Limited Liability Partnership (LLP). However, an individual cannot become a partner if:

- (a). court has declared them of unsound mind, and the ruling is currently in effect.

- (b) They are an undischarged insolvent.

- (c) They have applied to be adjudicated as an insolvent, and their application is still pending.

- Every LLP must have a minimum of two partners. If the number of partners falls below two and the LLP continues to operate for more than six months, the sole partner during that period becomes personally liable for the LLP's obligations incurred during that time.

Designated partners

- Minimum Designated Partners: Every Limited Liability Partnership (LLP) must have at least two designated partners who are individuals.

- Residency Requirement: At least one designated partner must be a resident of India. A "resident in India" is defined as someone who has stayed in India for a minimum of 120 days during the preceding year.

- Designated Partners in Corporate LLPs: In LLPs where all partners are bodies corporate, or where partners include both individuals and bodies corporate, at least two individuals who are partners or nominees of the body corporate will act as designated partners.

- Designation Process: The incorporation document can specify designated partners. If it states that all partners are designated partners, then each partner will be a designated partner. Any partner can become a designated partner as per the LLP agreement.

- Consent Requirement: An individual cannot be a designated partner unless they have given prior consent to the LLP in a prescribed manner.

- Filing Requirement: LLPs must file details of designated partners with the registrar within thirty days of their appointment.

- Eligibility Criteria: Designated partners must meet certain conditions and requirements as prescribed.

Liabilities of designated partners

- Responsibilities: Designated partners are responsible for ensuring that the LLP complies with the provisions of the LLP Act. This includes filing necessary documents, returns, and statements as required by the Act and the LLP agreement.

- Penalties: Designated partners are liable for any penalties imposed on the LLP for contraventions of the Act's provisions.

Limitation of Liability of an LLP and its partners

- Obligations: Obligations arising from contracts or otherwise are solely the responsibility of the LLP.

- Assets: Liabilities of the LLP are to be met from its properties.

- Partner Liability:. partner is not personally liable for an obligation just by being a partner, unless specified otherwise.

- Partner Authority: An LLP is not bound by actions of a partner if the partner lacks authority and the other party is aware of this.

- Fraudulent Dealings: Liability is unlimited for fraudulent dealings by partners or the LLP. Partners are liable to the same extent as the LLP unless proven otherwise.

- Partner Liability: The LLP is liable if a partner is liable due to wrongful acts or omissions in the course of business or with authority.

Financial Disclosures & Returns

- Every LLP is required to maintain proper books of accounts relating to its affairs for each year of its existence. The accounts can be maintained on either cash basis or accrual basis and must adhere to the double-entry system of accounting. These records should be kept at the registered office of the LLP for a prescribed period.

- Within six months of the end of each financial year, every LLP must prepare a Statement of Account and Solvency for that financial year, as of the last day of the financial year. This statement should be signed by the designated partners of the LLP.

- Every LLP is obligated to file the Statement of Account and Solvency with the Registrar within the prescribed time frame. The filing must be done in the specified form and manner and accompanied by the prescribed fee.

- The accounts of an LLP are subject to audit in accordance with the rules prescribed by the authorities. However, the Central Government has the discretion to exempt certain classes of LLPs from the audit requirement through a notification in the Official Gazette.

Distinction Between an Ordinary Partnership Firm and an LLP

Main Clauses in a Partnership Deed

A partnership deed is a mutual agreement that governs the relationship between partners in a business. To prevent future disputes, it is crucial for the deed to be comprehensive. While the deed may or may not be registered, it typically includes the following clauses:- Name of the Firm and Partners: The official name of the partnership and the names of the partners involved.

- Commencement and Duration of Business: The starting date and the expected duration of the partnership.

- Capital Contributions: The specific amount of capital each partner is required to contribute.

- Drawings: The amount and timing of drawings allowed for each partner.

- Interest on Capital, Loans, and Drawings: The rates of interest applicable to each partner’s capital, loans to the firm, and drawings.

- Profit and Loss Sharing Ratio: The ratio in which profits and losses will be shared among partners.

- Partner Salary: Whether a partner is entitled to draw a salary.

- Variations in Rights and Duties: Any changes to the mutual rights and duties of partners.

- Goodwill Valuation: The method for valuing goodwill during changes in the firm’s constitution.

- Partner Retirement: The procedure for a partner’s retirement and the method of settling their dues.

- Deceased Partner’s Executors: The basis for determining the executors of a deceased partner and the payment method.

- Insolvency of a Partner: The treatment of losses arising from a partner’s insolvency.

- Dispute Settlement: The procedure for resolving disputes among partners.

- Accounts Preparation and Audit: The process of preparing accounts and conducting audits.

While registering the firm is not mandatory, non-registration limits the partners’ legal actions. In cases where there is no written partnership deed or it is silent on specific points, the relevant sections of the Partnership Act will apply. If the partnership deed includes a specific clause, it will take precedence; otherwise, the provisions of the Act will govern the matter.

Rules for Partners Without a Partnership Deed

- Salary: No partner is entitled to a salary.

- Interest on Capital: No interest is allowed on the capital contributed by partners.

- Interest on Drawings: No interest is charged on the drawings made by partners.

- Interest on Loans: Interest at the rate of 6% per annum is allowed on a partner's loan to the firm.

- Profit and Loss Sharing: Profits and losses are to be shared equally among the partners.

Note: In the absence of an agreement, the interest and salary may be paid to a partner only if there is profit.

Example:

A and B commenced business in partnership on 1 January 2022. No partnership agreement was made either oral or written. They contributed ₹ 40,000 and ₹ 10,000 respectively as capital. In addition, A also advanced ₹20,000 on 1 July 2022. A met with an accident on 1 April 2022 and could not attend to the partnership business upto 30 June 2022. The profits for the year ended on 31 December 2022 amounted to₹50,600. Disputes having been arisen between them for sharing the profits.

A claims: (i) He should be given interest at 10% p.a. on capital and loan (ii) Profit should be distributed in proportion of capital.

B claims: (i) Net profit should be shared equally. (ii) He should be allowed remuneration of ₹1,000 p.m. during the period of A’s illness. (iii) Interest on capital and loan should be given @ 6% p.a. You are required to settle the dispute between them and distribute the profits according to law. State reasons for your answer.

Answer:

Since there is no written or oral partnership agreement, allowing rules are applicable as per Indian partnership act 1932(a) No interest is allowed on capital.

(b) 6% p.a. interest is allowed on the loan advanced.

(c) Profits and losses shall be shared equally.

(d) No remuneration is allowed to any partner for taking part in the conduct of the business.

Thus

a) neither of A nor B will be allowed interest on capital

b) 6% interest will be allowed to both A and B

c) Profit and losses shall be shared equally between A and B

d) No remuneration shall be allowed to B.

Net profit for the year = 50,600

Less: Int. on A's loan 20,000 × 6% × 6/12 = 600

Net Profit = 50,000

A's 50% 25,000

B's 50% 25.000

Example:

A, B and C are partners in a firm sharing profits and losses in the ratio of 2:3:5. Their fixed capitals were ₹15,00,000, ₹ 30,00,000 and ₹ 60,00,000 respectively. For the year 2022 interest on capital was credited to them @ 12% instead of 10%. Pass the necessary adjustment entry.

The necessary journal entry will be:

Powers of Partners

- Partners have the authority to act in certain matters on behalf of the partnership, but there are also situations where their powers are limited.

- Unless a public notice indicates otherwise, certain contracts made by a partner on behalf of the partnership are binding, even without consulting the other partners.

Implied Powers of Partners in a Trading Firm

- Buying and Selling Goods: Partners can buy and sell goods on behalf of the firm.

- Receiving Payments: Partners have the authority to receive payments and provide valid receipts on behalf of the firm.

- Financial Instruments: Partners can draw, accept, and endorse cheques, bills of exchange, and promissory notes in the firm’s name.

- Borrowing Money: Partners can borrow money on behalf of the firm, with or without pledging inventory.

- Engaging Employees: Partners have the power to hire employees for the firm’s business.

Limitations on Individual Partner's Authority

- In certain cases, an individual partner does not have the authority to bind the firm. These cases include:

- Arbitration: Submitting a dispute involving the firm to arbitration.

- Bank Accounts: Opening a bank account in the name of the firm under a partner’s name.

- Compromise: Compromising or relinquishing any part of a claim by the firm.

- Withdrawal: Withdrawing a lawsuit or legal proceeding filed on behalf of the firm.

- Admission of Liability: Admitting any liability in a lawsuit or proceeding against the firm.

- Acquisition of Property: Acquiring immovable property belonging to the firm.

- New Partnerships: Entering into a partnership on behalf of the firm.

Changes to Rights, Duties, and Powers

- The rights, duties, and powers of partners can be modified by mutual consent among the partners.

Accounts in a Partnership Firm

- The Partnership Act does not prescribe a specific format for preparing accounts of a partnership firm. Therefore, accounts are prepared based on the basic rules of accounting.

- There is not much difference between the accounts of a partnership firm and that of a sole proprietorship, provided there is no change in the firm itself.

- The only difference is that instead of one Capital Account, there will be as many Capital Accounts as there are partners.

- For example, if there are three partners A, B, and C, there will be a Capital Account for each partner. A's Capital Account will be credited with the amount he contributes as capital, and similarly for B and C.

- When a partner withdraws money from the firm for personal use, either his Capital Account can be debited, or a separate account called the Drawings Account can be opened in his name and debited.

- In the trial balance of a partnership firm, one may find both Capital Accounts and Drawings Accounts of partners. The Drawings Account of a partner may be transferred to his Capital Account to provide a net figure. However, the Drawings Account, also known as the Current Account, often remains separate.

Profit and Loss Appropriation Account

In a partnership firm, the end-of-year accounts include the Trading Account and the Profit and Loss Account. These accounts are prepared in the same way for both sole proprietorships and partnership firms. The Profit and Loss Account indicates whether the firm made a profit or a loss, and this figure needs to be transferred to the partners' Capital Accounts.

- The transfer is done according to the terms set out in the Partnership Deed or, if there is no Deed or it is silent on a point, according to the Indian Partnership Act.

- For instance, if a Profit and Loss Account shows a profit of ₹90,000 and there are two partners, A and B, the profit needs to be divided between them. If there is no Partnership Deed, the profit will be split equally, regardless of the amount of work each partner does or their capital contributions.

- However, if the Partnership Deed specifies that one partner (A) should receive a salary and that interest should be paid on both partners' capital, these amounts are deducted from the profit before it is divided. After these deductions, the remaining profit is split according to the terms of the Deed.

For example, if the Deed states that A should receive three-fourths of the profit and B one-fourth, this ratio must be followed. Profit and Loss Appropriation Account

In a partnership, profits must be divided among the partners according to a specific profit-sharing ratio. This division occurs after making necessary adjustments, as outlined in the partnership deed. These adjustments may include items such as:

- Interest on capitals

- Drawings and loans

- Salaries or commissions to partners

To facilitate this process, an additional account called the Profit and Loss Appropriation Account is prepared. The net profit from the Profit and Loss Account is transferred to the credit side of this new account. Before dividing the profit among the partners, it is essential to record the aforementioned adjustments in the Profit and Loss Appropriation Account.

For example, if a partner is entitled to a salary, the Profit and Loss Appropriation Account will be debited, and the Partner's Capital Account will be credited. Similarly, if interest is to be allowed on capital, the Profit and Loss Appropriation Account will be debited, and the respective Capital Accounts will be credited.

Let's Illustrate

Problem

X, Y, and Z are partners in a firm. The partnership deed states that:

- X is entitled to a salary of ₹3,000 per month.

- Y is entitled to a commission of 5% on the net profits.

- Interest on capital is to be paid at 10% per annum.

- Profits are to be divided in the ratio of 2:2:1.

The net profit for the year is ₹1,50,000.

Solution

Steps to Solve the Problem

- Calculate the total amount to be deducted from the profit for salaries and interest on capital.

- Calculate the total interest on capital for each partner.

- Calculate the amount of profit to be distributed after deducting salaries and interest on capital.

- Calculate Y's commission based on the remaining profit.

- Calculate the final profit distribution among partners based on the agreed ratio.

1. Calculate the total amount to be deducted for salaries and interest on capital

Salary to Partner

- X. ₹3,000/month × 12 months = ₹36,000

Total Salary. ₹36,000

Interest on Capital

- Y. ₹50,000 × 10% = ₹5,000

Total Interest on Capital. ₹5,000 (assuming no interest for X and Z)

Total Deduction. ₹36,000 (salary) + ₹5,000 (interest) = ₹41,000

2. Calculate the total interest on capital for each partner

Interest on Capital

- X. ₹50,000 × 10% = ₹5,000

- Y. ₹50,000 × 10% = ₹5,000

- Z. ₹50,000 × 10% = ₹5,000

Total Interest on Capital. ₹15,000

3. Calculate the amount of profit to be distributed after deducting salaries and interest on capital

Profit After Deductions

Net Profit. ₹1,50,000

Deductions. ₹41,000

Remaining Profit. ₹1,50,000 - ₹41,000 = ₹1,09,000

4. Calculate Y's commission based on the remaining profit

Y's Commission

Commission Rate. 5%

Commission Amount. ₹1,09,000 × 5% = ₹5,450

5. Calculate the final profit distribution among partners based on the agreed ratio

Profit Distribution

X. 2/5 × ₹1,09,000 = ₹43,600

Y. 2/5 × ₹1,09,000 + ₹5,450 = ₹50,850

Z. 1/5 × ₹1,09,000 = ₹21,800

Summary of Final Distribution

- X: ₹43,600

- Y: ₹50,850

- Z: ₹21,800

ILLUSTRATION 1

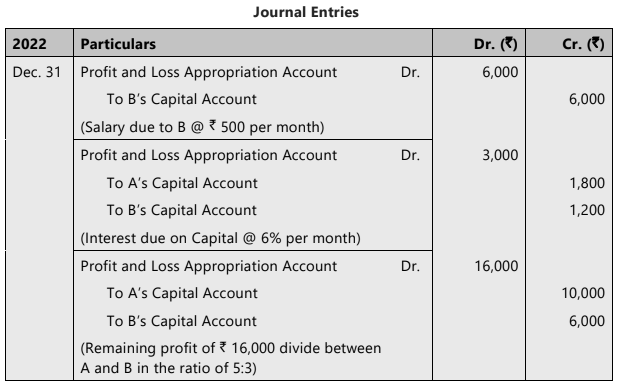

A and B start business on 1st January, 2022, with capitals of ₹ 30,000 and ₹ 20,000. According to the Partnership Deed, B is entitled to a salary of ₹500 per month and interest is to be allowed on capitals at 6% per annum. The remaining profits are to be distributed amongst the partners in the ratio of 5:3. During 2022 the firm earned a profit, before charging salary to B and interest on capital amounting to ₹25,000. During the year A withdrew ₹8,000 and B withdrew ₹10,000 for domestic purposes.

Give journal entries relating to division of profit.

SOLUTION

Now, let us learn the preparation of profit and loss appropriation account with the help of same illustration of partnership firm consisting of partners A and B.

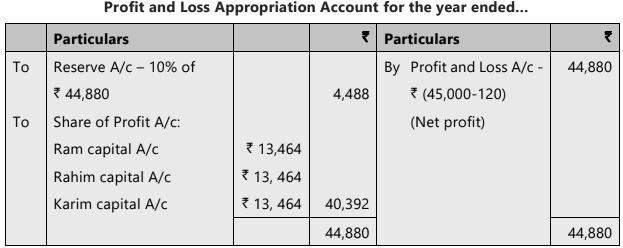

ILLUSTRATION 2

Ram, Rahim and Karim are partners in a firm. They have no agreement in respect of profit-sharing ratio, interest on capital, interest on loan advanced by partners and remuneration payable to partners. In the matter of distribution of profits they have put forward the following claims:

(i) Ram, who has contributed maximum capital demands interest on capital at 10% p.a. and share of profit in the capital ratio. But Rahim and Karim do not agree.

(ii) Rahim has devoted full time for running the business and demands salary at the rate of ₹ 500 p.m. But Ram and Karim do not agree.

(iii) Karim demands interest on loan of ₹ 2,000 advanced by him at the market rate of interest which is 12% p.a.

How shall you settle the dispute and prepare Profit and Loss Appropriation Account after transferring 10% of the divisible profit to Reserve. Net profit before taking into account any of the above claims amounted to ₹ 45,000 at the end of the first year of their business.

SOLUTION

There is no partnership deed. Therefore, the following provisions of the Indian Partnership Act are to be applied for settling the dispute.

(i) No interest on capital is payable to any partner. Therefore, Ram is not entitled to interest on capital.

(ii) No remuneration is payable to any partner. Therefore, Rahim is not entitled to any salary.

(iii) Since interest on loan payable to partner is not an appropriation of profit. It will be charged to Profit and Loss Account.

(iv) The profits should be distributed equally.

ILLUSTRATION 3

A and B start business on 1st January, 2022, with capitals of ₹ 30,000 and ` 20,000. According to the Partnership Deed, B is entitled to a salary of ₹ 500 per month and interest is to be allowed on opening capitals at 6% per annum. The remaining profits are to be distributed amongst the partners in the ratio of 5:3. During 2022 the firm earned a profit, before charging salary to B and interest on capital amounting to ₹ 25,000. During the year A withdrew ` 8,000 and B withdrew ₹ 10,000 for domestic purposes.

Prepare Profit and Loss Appropriation Account.

SOLUTION

NOTE: Since date of drawing & rate of interest on drawing is not given, it is assumed drawings are made on last day of year.

Let us also learn the preparation of capital accounts of partners with the help of same illustration of partnership firm consisting of partners A and B.

ILLUSTRATION 4

A and B start business on 1st January, 2022, with capitals of ₹ 30,000 and ₹ 20,000. According to the Partnership Deed, B is entitled to a salary of ₹500 per month and interest is to be allowed on opening capitals at 6% per annum. The remaining profits are to be distributed amongst the partners in the ratio of 5:3. During 2022, the firm earned a profit, before charging salary to B and interest on capital amounting to ₹ 25,000. During the year A withdrew ₹ 8,000 and B withdrew ₹ 10,000 for domestic purposes.

Prepare Capital Accounts of Partners A and B.

SOLUTION

Fixed and Fluctuating Capital

Fixed Capital Method: In this approach, the initial capital contributions made by the partners are credited to their capital accounts. These accounts remain unchanged unless a decision is made to alter them. All subsequent transactions and events, such as interest on capital, salary, profit, and drawings, are recorded in separate current accounts. The fixed capital balance is maintained over time, providing stability to the capital accounts.Fluctuating Capital Method: Under this method, no separate current account is maintained. Instead, all transactions and events are recorded in the capital accounts of the partners. This means that the capital account balances fluctuate with each transaction, reflecting the current status of each partner's capital. The capital accounts can change frequently based on the activities of the partnership.

Key Differences:

- Fixed Capital: Initial capital remains stable, and changes are made only when necessary.

- Fluctuating Capital: Capital accounts vary with every transaction, reflecting real-time changes.

Example:

- Fixed Capital:. partnership with fixed capital might have partners contributing Rs. 30,000 and Rs. 20,000 initially, and these amounts remain unchanged. Subsequent profits and drawings are recorded in current accounts.

- Fluctuating Capital: In a fluctuating capital scenario, the same partners' contributions could change frequently. For instance, if partner A withdraws Rs. 5,000, their capital account would reflect this change immediately.

Interest on Capital in Partnership Accounts

Interest on capital is a concept in partnership accounting that refers to the interest payable to partners on the capital they have invested in the business. However, it's important to note that a partner is not automatically entitled to interest on their capital. Here are the key points regarding interest on capital:Entitlement to Interest on Capital

- A partner is not entitled to interest on their capital as a matter of right.

- If there is an agreement among partners, interest on capital can be paid at the agreed rate, but only out of profits.

Calculation of Interest on Capital

- Interest on capital is typically calculated on the opening balance of capital.

- Adjustments are made for any additions to capital or withdrawals during the accounting period.

- For example, if a partner has an opening capital balance of ₹30,000 and introduces an additional ₹10,000 during the year, interest is calculated on both amounts based on the period of utilization.

Accounting Treatment

- If capital accounts are fluctuating, the amount of interest is debited to interest on capital accounts and credited to the capital accounts.

- If capital accounts are fixed, interest is credited to the current accounts of partners.

- Interest on capital accounts is then closed by transferring the amounts to the profit and loss appropriation account.

- Alternatively, interest can be credited directly to the capital or current account of the partner concerned, with a corresponding debit to the profit and loss appropriation account.

Example Calculation

To illustrate the calculation of interest on capital, consider the following example:

- Partner A has an opening capital of ₹30,000 and introduces an additional ₹10,000 during the year.

- The rate of interest on capital is 20% per annum.

- Interest on Partner A's capital is calculated as follows:

- For the initial capital of ₹30,000 for the whole year: ₹30,000 × 20% = ₹6,000

- For the additional capital of ₹10,000 for 6 months: ₹10,000 × 20% × 6/12 = ₹1,000

- Total interest on Partner A's capital: ₹6,000 + ₹1,000 = ₹7,000

Fixed Capital Accounts

- In the case of fixed capital accounts, interest is calculated only on the balance of capital accounts.

- No interest is payable or chargeable on the balance of current accounts.

Net Loss and Interest on Capital

- Interest on capitals can only be provided out of profits, subject to the contract between partners.

- In the case of a net loss, no interest on capital is provided.

- If profits are insufficient (i.e., net profit is less than the amount of interest on capital), the profit is distributed in the ratio of capital, as partners receive profit through interest on capital only.

Example: Shilpa and Sanju are partners with a capital of `1,00,000 and `1,60,000 on January 1,2022 respectively. Shilpa introduced additional capital of `30,000 on July 1, 2022 and another `20,000 on October 31,2022. Calculate interest on capital for the year ending 2022. The rate of interest is 9% p.a.

Solution

Interest on Capital (Shilpa):On ₹1,00,000 for 12 month @ 9% = 1,00,000 × 9/100 × 12/12 = ₹ 9,000

On ₹30,000 for 6 month @ 9% = 30,000 × 9/100 × 6/12 = ₹1,350

On₹20,000 for 2 month @ 9% = 20,000 × 9/100 × 2/12 = ₹300

Total interest on shilpa capital = ₹ 9,000 + ₹ 1350 +₹ 300

= ₹10,650By product method

Interest on capital 14,20,000 × 09/100 × 1/12 = ₹ 10,650

Interest on Capital (Sanju):

On ₹1,60,000 for 12 month @ 9% = 1,60,000 × 9/100 × 12/12 = ₹14,400

By product method: = 1,60,000 × 12 = 19,20,000 = 19,20,000 x 9/10 x 1/12 = 14,400

Interest on Drawings

Sometimes interest is not only allowed on the capitals, but is also charged on drawings. In such a case, interest will be charged according to the time that elapses between the taking out of the money and the end of the year.Method 1: Product Method: When Unequal amount is withdrawn at different time period.

Suppose X, a partner, has drawn the following sum of money –

Accounts are closed on 31st December every year. Interest is chargeable on drawings at 6% per annum. The interest on X’s drawings will be calculated as shown below:

Alternatively, it can be calculated as follows:

Interest on ₹13,800 for one month at 6% per annum is ₹ 69.

If the dates on which amounts are drawn are not given, the student will do well to charge interest for six months on the whole of the amount on the assumption that the money was drawn evenly through out the year. In the above example, the total drawings come to₹ 2,300; and at 6% for 6 months, the interest comes to ₹ 69. The entry to record interest on drawings is- debit the Capital Account of the partner concerned (or his Current Account if the capital is fixed) and credit the Profit and Loss Appropriation Account.

If withdrawals are made evenly in the beginning of each month, interest can be calculated easily for the whole of the amount of 6-1/2 months; if withdrawals are made at the end of each month, interest should be calculated for 5-1/2 months. If withdrawals are mode at the beginning of each quarter, interest can be calculated by Total drawings × Rate × 100 × 7.5/12.

However, if withdrawals are at end of each quarter, the formula : Total drawings × Rate × 100 × 4.5/12 will apply.

Guarantee of Minimum Profit

- Sometimes, one partner in a partnership can have a right to receive a minimum amount of profit for the year as stated in the partnership agreement.

- If the share of the partner with the guaranteed minimum profit is greater than this guaranteed amount, the normal profit allocation process is followed.

- However, if the partner's share is less than the guaranteed profit, they will receive the minimum profit. Any difference between the guaranteed profit and the actual share will be covered by the other partners according to the agreement.

- There are three possible ways that the other partners can handle the excess payment:

- The excess is paid by one of the remaining partners.

- The excess is divided among at least two or all partners in a mutually agreed ratio.

- The excess is shared by the remaining partners according to their existing profit-sharing ratio.

- If the partnership agreement does not specify how the guarantee should be handled, the remaining partners will share the burden of the guarantee based on their mutual profit-sharing ratio.

Capital ratio

Partners can choose to share profits and losses according to their capital contributions. If the capitals are fixed, profits will be distributed based on the capital ratio. However, if capitals vary due to partners introducing or withdrawing funds during the year, the profit-sharing ratio will be calculated using the weighted average method, which considers the time each partner's capital was invested.Example : A and B formed a partnership with a capital contribution of ₹50,000 and ₹30,000 respectively on 1st January 2022. The profits were to be shared in the capital ratio. Calculate the capital ratio on the basis of following details:

Answer

On the basis of products of both the partners, the capital ratio between A and B is 64: 40 or 8 : 5.

ILLUSTRATION 5

A and B are partners sharing profits and losses in the ratio of their effective capital. They had ₹ 1,00,000 and ₹ 60,000 respectively in their Capital Accounts as on 1st January, 2022.

A introduced a further capital of ₹ 10,000 on 1st April, 2022 and another ₹ 5,000 on 1st July, 2022. On 30th September, 2022 A withdrew ₹ 40,000.

On 1st July, 2022, B introduced further capital of ₹ 30,000.

The partners drew the following amounts in anticipation of profit.

A drew ₹ 1,000 per month at the end of each month beginning from January, 2022. B drew ₹ 1,000 on 30th June, and ₹ 5,000 on 30th September, 2022.

12% p.a. interest on capital is allowable and 10% p.a. interest on drawings is chargeable. Date

of closing 31.12.2022. Calculate: (a) Profit-sharing ratio; (b) Interest on capital; and (c) Interest on drawings.

SOLUTION

(a) Calculation of Effective Capital

(b) Calculation of Interest on Capital

A = ₹12,00,000 x 12/100 x 1/12 =₹ 12,000 B = ₹ 9,00,000 x 12/100 x 1/12 = ₹ 9,000

(c) Calculation of Interest on Drawings

A =₹ 12,000 x 10/100 x 5.5/12 =₹ 550

B = ₹ 1,000 x 10/100 x 6/12 = ₹ 50

₹ 5,000 x 10/100 x 3/12 = ₹ 125Effective capital is in the ratio 12 : 9 therefore profit sharing ratio is 12 : 9 i.e. 4 : 3.

ILLUSTRATION 6

Ram and Rahim start business with capital of ₹ 50,000 and₹ 30,000 on 1st January, 2022. Rahim is entitled to a salary of ₹400 per month. Interest is allowed on capitals and is charged on drawings at 6% per annum. Profits are to be distributed equally after the above noted adjustments. During the year, Ram withdrew ₹ 8,000 and Rahim withdrew ₹ 10,000. The profit for the year before allowing for the terms of the Partnership Deed came to ₹ 30,000. Assuming the capitals to be fixed, prepare the Profit and Loss Appropriation Account and the Capital and Current Accounts relating to the partners.

SOLUTION

ILLUSTRATION 7

With the help of same information given in illustration 6, let us prepare the Capital and Current Accounts of Ram and Rahim.

SOLUTION

ILLUSTRATION 8

A and B were partners in a firm sharing profits and losses in the ratio of 3:2. They admit C for 1/6th share in profits and guaranteed that his share of profits will not be less than ₹ 250,00,000. Total profits of the firm for the year ended 31st March, 2022 were ₹900,00,000. Calculate share of profits for each partner when:

1. Guarantee is given by firm.

2. Guarantee is given by A

3. Guarantee is given by A and B equally.

SOLUTION

Case1. When Guarantee is given by firm.

Case2. When Guarantee is given by A

Case3. When Guarantee is given by A and B equally.

|

68 videos|160 docs|83 tests

|

FAQs on Unit 1: Introduction to Partnership Accounts Chapter Notes - Accounting for CA Foundation

| 1. What is the main purpose of forming a partnership? |  |

| 2. What are the key features of a Limited Liability Partnership (LLP)? |  |

| 3. How does an Ordinary Partnership differ from a Limited Liability Partnership? |  |

| 4. What are the main clauses that should be included in a Partnership Deed? |  |

| 5. How is profit shared among partners in a Partnership Firm? |  |

|

Explore Courses for CA Foundation exam

|

|