Unit 3: Admission of a New Partner Chapter Notes | Accounting for CA Foundation PDF Download

| Table of contents |

|

| Unit Overview |

|

| Introduction |

|

| Revaluation Account or Profit and Loss Adjustment Account |

|

| Reserves in the Balance Sheet |

|

| Computation of New Profit Sharing Ratio |

|

| Hidden Goodwill |

|

Unit Overview

Introduction

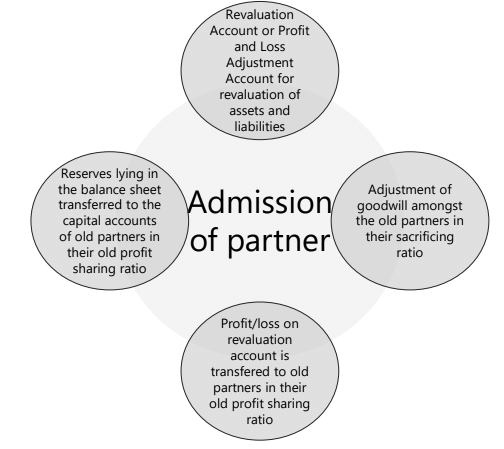

When a new partner joins a partnership firm, it is often to benefit the firm by either increasing its capital or enhancing its management. At the time of admission, it is important to update the accounts to reflect any changes in the value of assets, liabilities, and profits or losses that have occurred but not yet been recorded. This ensures that the Balance Sheet is accurate and up-to-date. Additionally, the value of goodwill must be assessed and properly accounted for in the books.

[Intext Question]

Revaluation Account or Profit and Loss Adjustment Account

When a new partner joins a partnership, the assets and liabilities of the firm are revalued to reflect their current worth. A Revaluation Account, also known as a Profit and Loss Adjustment Account, is created to record these changes.Purpose of the Revaluation Account:

- The Revaluation Account is used to track the differences in the value of assets and liabilities before and after the admission of the new partner.

- It helps in determining whether there is a profit or loss from the revaluation, which is then distributed among the old partners.

How the Revaluation Account Works:

- Debits: The account is debited with the following:

- Reduction in the value of assets: If any asset's value has decreased, the amount of decrease is recorded as a debit.

- Increase in liabilities: If any liability's value has increased, the amount of increase is recorded as a debit.

- Credits: The account is credited with the following:

- Increase in the value of assets: If any asset's value has increased, the amount of increase is recorded as a credit.

- Decrease in liabilities: If any liability's value has decreased, the amount of decrease is recorded as a credit.

Determining Profit or Loss:

- The difference between the total debits and credits in the Revaluation Account indicates whether there is a profit or loss from the revaluation.

- This profit or loss is then transferred to the Capital Accounts of the old partners.

Sharing of Profit or Loss:

- The profit or loss from the Revaluation Account is distributed among the old partners in their old profit-sharing ratio.

Entries to be Passed:

- Revaluation Account: Debit with reduction in the value of assets and increase in liabilities.

- Assets Account: Debit with increase in the value of assets.

- Liabilities Account: Debit with reduction in the amount of liabilities.

- Capital Accounts of Old Partners: Debit with profit or credit with loss from the Revaluation Account.

When Revised Values are Not Recognized:

- In some cases, all partners may agree to keep the assets and liabilities at their old values, even if they have been revalued.

- A Memorandum Revaluation Account is opened to record this agreement.

Parts of Memorandum Revaluation Account:

- First Part: Entries for revaluation are made as usual, and the resulting profit or loss is transferred to the capital accounts of old partners only.

- Second Part: Entries made in the first part are reversed to keep the values of assets and liabilities unchanged. The balance is transferred to the capital accounts of all partners, including the new partner.

Alternative Approach:

- Partners may agree not to show revalued figures in the Balance Sheet, keeping assets and liabilities at their old values.

Journal Entries:

- Increase in Assets or Decrease in Liabilities: Debit the respective accounts and credit Memorandum Revaluation Account.

- Decrease in Assets or Increase in Liabilities: Debit Memorandum Revaluation Account and credit the respective accounts.

If the credit side of the Memorandum Revaluation Account is greater than the debit side, it indicates a profit. This profit should be allocated to the old Partner’s Capital Accounts based on the old profit sharing ratio. The journal entry for this is:

- Memorandum Revaluation Account Dr.

- To Old Partners’ Capital Accounts

If the debit side of the Memorandum Revaluation Account is higher than the credit side, it signifies a loss. This loss should also be transferred to the old Partner’s Capital Accounts according to the old profit sharing ratio. The journal entry will be:

- Old Partners’ Capital Accounts Dr.

- To Memorandum Revaluation Account

After completing the above steps, reverse entries are needed for:

- Increases in asset values and/or decreases in liabilities

- Decreases in asset values and/or increases in liabilities

The profit from revaluation should be allocated to all Partners’ Capital Accounts using the new profit sharing ratio. The journal entry for this is:

- Memorandum Revaluation Account Dr.

- To All Partners’ Capital Accounts

Similarly, any loss from revaluation should also be transferred to all Partners’ Capital Accounts based on the new profit sharing ratio. The journal entry will be:

- All Partners’ Capital Accounts Dr.

- To Memorandum Revaluation Account

It is important to remember that if there is a profit shown in the first half of the Memorandum Revaluation Account, the second half must reflect a loss. Conversely, if the first half shows a loss, then the second half must show a profit.

When preparing a Memorandum Revaluation Account, the book values of assets and liabilities remain unchanged. Instead, the resulting profit or loss from the revaluation is adjusted through the Partners’ Capital Accounts. This process allows the capital invested by the incoming partner to represent the current fair value of the partnership, despite the book values remaining the same in the accounts.

If partners prefer to display assets and liabilities in the balance sheet at their original values without creating a Revaluation Account, any changes (increases or decreases) in asset and liability values may be directly adjusted through the Partners’ Capital Accounts.

Difference Between Revaluation Account and Memorandum Revaluation Account

1. Purpose:

- Revaluation Account: Used to determine the profit or loss from the revaluation of assets and liabilities, which are reflected in the new balance sheet at their revised values.

- Memorandum Revaluation Account: Also records the revaluation of assets and liabilities, but these are shown at their old values in the new balance sheet.

2. Structure:

- Revaluation Account: This account is straightforward and not divided into sections.

- Memorandum Revaluation Account:Divided into two parts:

- First Part: Records revaluation effects for old partners.

- Second Part: Records revaluation effects for all partners, including the new partner.

3. Distribution of Profits/Losses:

- Revaluation Account: The net result of revaluation is distributed to old partners’ capital accounts in their original profit-sharing ratio.

- Memorandum Revaluation Account:

- First Part: The balance is transferred to old partners’ capital accounts in their original profit-sharing ratio.

- Second Part: The balance is transferred to all partners, including the new partner, in the new profit-sharing ratio.

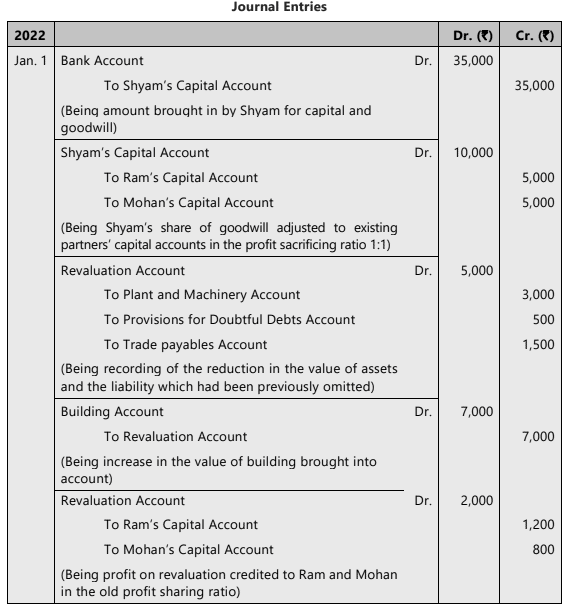

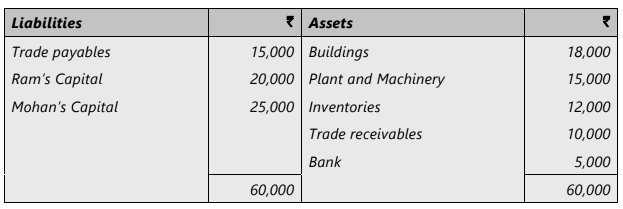

ILLUSTRATION 1

The following is the Balance Sheet of Ram and Mohan, who share profits in the ratio of 3:2 as on 1st January, 2022:

On this date Shyam was admitted on the following:

1. He is to pay ₹ 25,000 as his capital and ₹ 10,000 as his share of goodwill for one fifth share in profits.

2. The new profits sharing ratio will be 5:3:2.

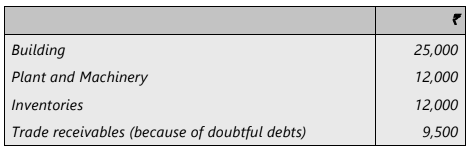

3. The assets are to be revalued as under:

4. It was found that there was a liability for ` 1,500 for goods received but not recorded in books.

Give journal entries to record the above. Also, give the Balance Sheet of the partnership firm after Shyam’s admission.

SOLUTION

Working Note:

Profit sacrificing ratio:

Ram = 3/5 - 1/2 = 1/10

Mohan = 2/5 - 3/10 = 1/10

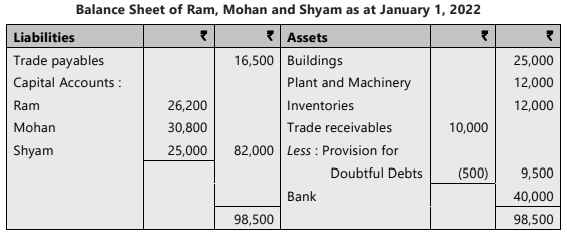

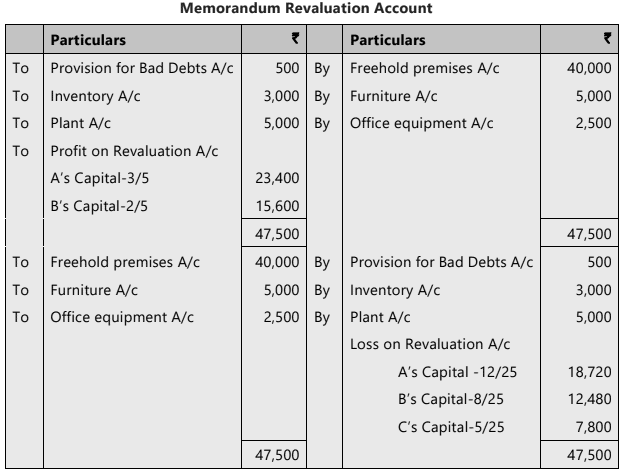

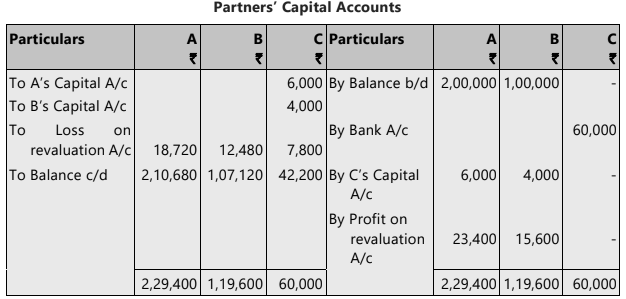

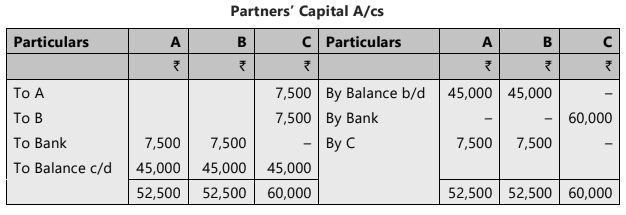

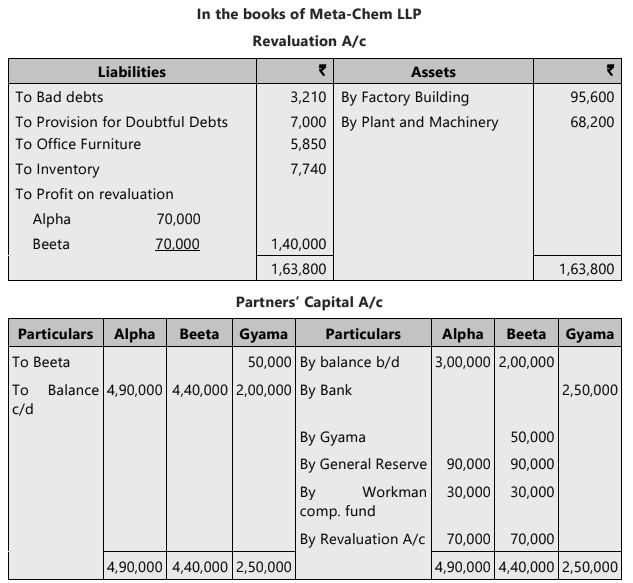

ILLUSTRATION 2

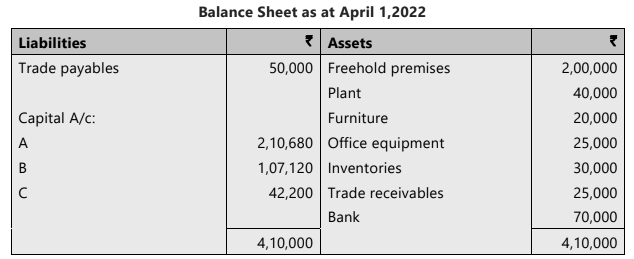

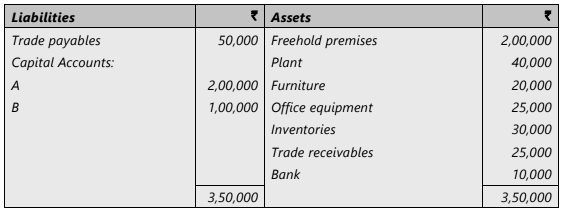

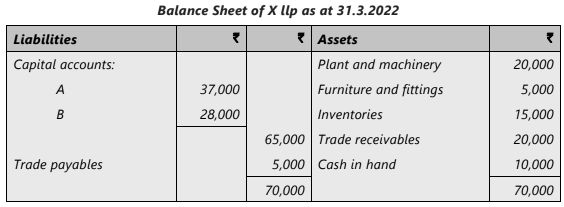

A and B are partners sharing profits and losses in the ratio of 3:2. Their Balance Sheet as on 31.3.2022 is given below:

On 1.4.2022 they admit C on the following terms:

(1) C will bring ₹ 50,000 as a capital and ₹ 10,000 for goodwill for 1/5 share;

(2) Provision for doubtful debts is to be made on Trade receivables @ 2%

(3) Inventory to be written down by 10%.

(4) Freehold premises is to be revalued at ₹ 2,40,000, plant at ₹ 35,000, furniture ₹ 25,000 and office equipment ₹ 27,500.

(5) Partners agreed that the values of the assets and liabilities remain the same and, as such, there should not be any change in their book values as a result of the above mentioned adjustments.

You are required to make necessary adjustment in the Capital Accounts of the partners and show the Balance Sheet of the New Firm.

SOLUTION

Note: Amount brought in by new partner shall be distributed among the old partner's in their profit sacrificing ratio, which is same as old profit sharing ratio in this case.

ILLUSTRATION 3

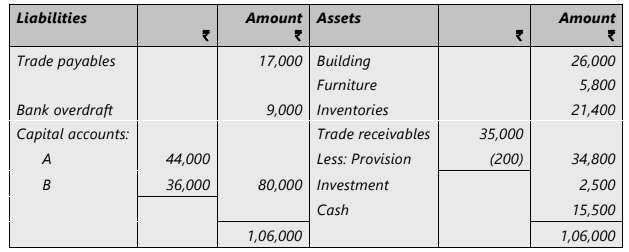

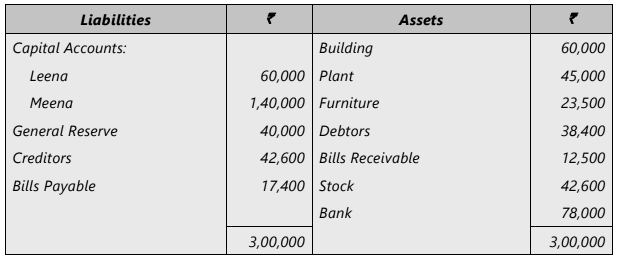

A and B are partners in a firm, sharing profits and losses in the ratio of 3:2. The Balance Sheet of A and B as on 1.1.2022 was as follows:

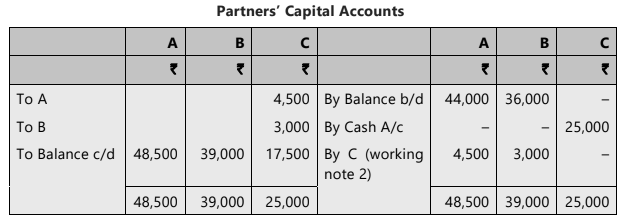

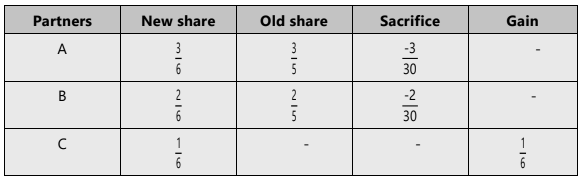

‘C’ was admitted to the firm on the above date on the following terms:

(i) C is admitted for 1/6 share in the future profits and to introduce a capital of ₹25,000.

(ii) The new profit sharing ratio of A, B and C will be 3:2:1 respectively.

(iii) ‘C’ is unable to bring in cash for his share of goodwill, they decide to calculate goodwill on the basis of C’s share in the profits and the capital contribution made by him to the firm.

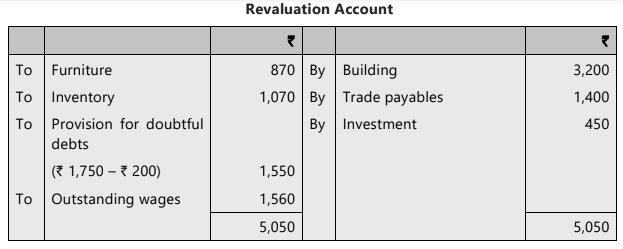

(iv) Furniture is to be written down by ₹ 870 and Inventory to be depreciated by 5%. A provision is required for trade receivables @ 5% for bad debts. A provision would also be made for outstanding wages for ₹ 1,560. The value of buildings having appreciated be brought upto₹ 29,200. The value of investments is increased by ₹ 450.

(v) It is found that the trade payables included a sum of ₹ 1,400, which is not to be paid off. Prepare the following:

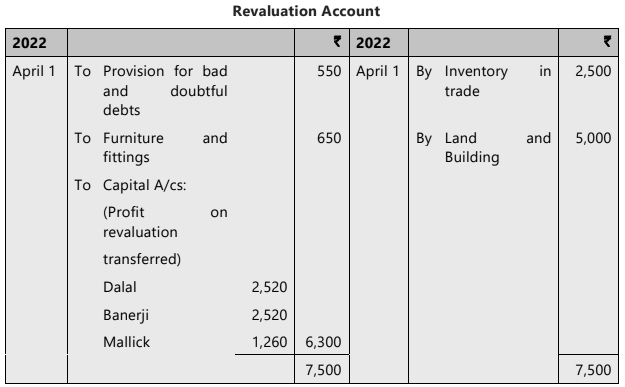

(i) Revaluation account.

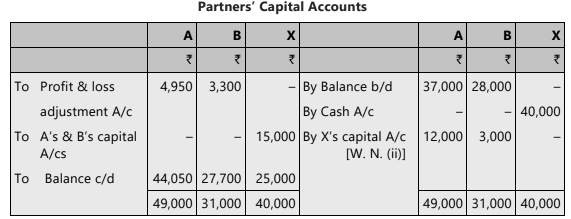

(ii) Partners’ capital accounts.

SOLUTION

Working Notes:

1. Calculation of goodwill:

C’s contribution of ₹ 25,000 consists of only 1/6th of capital.

Therefore, total capital of firm should be ₹ 25,000 x 6 = ₹ 1,50,000

But combined capital of A, B and C amounts ₹ 44,000 + 36,000 + 25,000 = ₹ 1,05,000

Thus, the hidden goodwill of the firm is ₹ 45,000 (` 1,50,000- ₹ 1,05,000).

C's share 1/6th = 7,500

Goodwill will be shared by A & B in their sacrificing ratio.2. Calculation of sacrificing ratio

Therefore,

A will get = ₹ 45,000 × 3 /30 = ₹ 4,500;

B will get = ₹ 45,000 × 2 /30 = ₹ 3,000; and

C will be debited on account of goodwill = ₹45,000 × 1/6 = ₹ 7,500

Reserves in the Balance Sheet

When a new partner joins a partnership, any reserves or similar items shown in the Balance Sheet should be distributed to the capital accounts of the old partners. This distribution is done according to the old profit-sharing ratio.

Journal Entry for Reserves Transfer

- Debit: Reserves or Profit and Loss Account

- Credit: Old Partners’ Capital Accounts (in the old profit-sharing ratio)

ILLUSTRATION 4

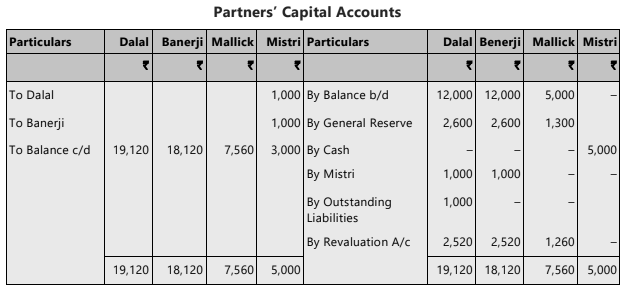

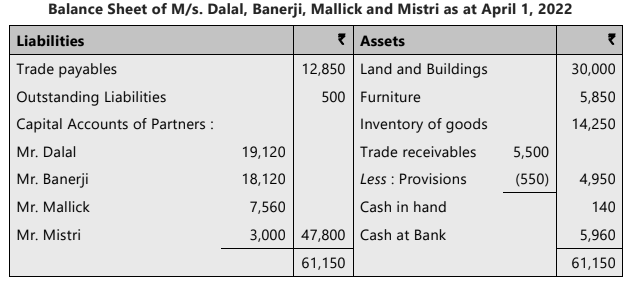

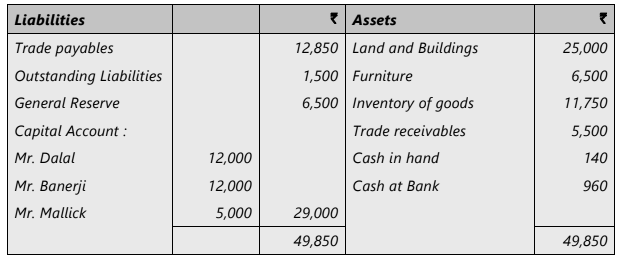

Dalal, Banerji and Mallick are partners in a firm sharing profits and losses in the ratio 2:2:1. Their Balance Sheet as on 31st March, 2022 is as below:

The partners have agreed to take Mr. Mistri as a partner with effect from 1st April, 2022 on the following terms:

(1) Mr. Mistri shall bring ₹ 5,000 towards his capital.

(2) The value of Inventory should be increased by ₹ 2,500 and Furniture should be depreciated by 10%.

(3) Reserve for bad and doubtful debts should be provided at 10% of the Trade receivables.

(4) The value of land and buildings should be enhanced by 20%.

(5) The value of the goodwill be fixed at ₹ 15,000.

(6) General Reserve will be transferred to the Partners’ Capital Accounts.

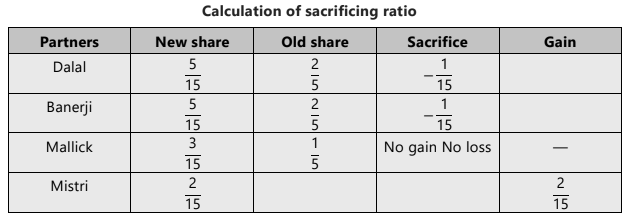

(7) The new profit sharing ratio shall be: Mr. Dalal 5/15, Mr. Banerji 5/15, Mr. Mallick 3/15 and Mr. Mistri 2/15.

The outstanding liabilities include ₹ 1,000 due to Mr. Sen which has been paid by Mr. Dalal. Necessary entries were not made in the books.

Prepare (i) Revaluation Account, (ii) The Capital Accounts of the partners, (iii) Balance Sheet of the firm after admission of Mr. Mistri.

SOLUTION

Working Note:

Calculation of sacrificing ratio

Sacrifice by Mr. Dalal and Mr. Banerji= ₹ 15,000× 1/20 = ₹ 1,000 each

Computation of New Profit Sharing Ratio

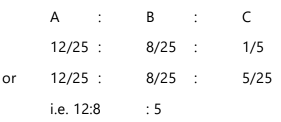

When a new partner is admitted and there is no agreement to the contrary, it is supposed that old partners will continue to have inter se at the old profit sharing ratio.For example, A and B are in partnership sharing profits and losses at the ratio of 3:2. They admitted C as 1/5 partner. For computation of new profit sharing ratio.

(i) Firstly, deduct the share offered to new partner from 1.

1 – 1/5 = 4/5

(ii) Divide the balance of share between A and B in the ratio of 3:2.

A = 4/5 x 3/5 = 12/25

B = 4/5 × 2/5 = 8/25

(iii) New profit sharing ratio is

Computation of New profit sharing ratio- Cases

Case I: When new partner’s share is given but the question is silent about the sacrifice made by the old partners: In this case it is assumed that the old partner will share the remaining share in their old profit sharing ratio.

Example: A and B are partners sharing profits in the ratio 3:2. They admit C for 1/3 share in future profits. Calculate the new ratio.

Solution

Share in Firm = 1

C’s Share = 1/3

Remaining Profit = 1 - 1/3 = 2/3

This remaining share of 2/3 is divided between A and B in the ratio 3:2

So A’s share = 2/3 × 3/5 = 6/15

B’s share = 2/3 × 2/5 = 4/15

C’s share = 1/3 × 5/5 = 5/15

New ratio = 6/15: 4/15: 5/15 = 6:4:5

Case II: When new partner purchases his share from old partner’s in a particular ratio: In this case the new ratio of the old partners will be calculated by deducted the proportion given to the new partner from the shares of old partner.

Example: A and B are partners sharing in the ratio 3:2. They admit C as a new partner for 1/3rd share in future profits which he gets 1/9 from A and 2/9 from B. Calculate the new ratio.

Solution

A’s old share = 3/5; A sacrifice in favour of C = 1/9

So A’s new share = 3/5 – 1/9 = 22/45

B’s old share = 2/5; B sacrifice in favour of C = 2/9

So B’s new share = 2/5 – 2/9 = 8/45

C’s new share = 3/9 x 5/15 = 15/45

New ratio = 22: 8: 15

Case III: When the old partners surrender a particular fraction of their share in favour of new partner: In this case following steps are followed:

1. Determine the share surrendered by the old partners.

2. Find the new share of the old partners by deducting share surrendered from their old share.

3. Calculate share of the new partner by taking the sum of surrendered share of old partners.

4. Calculate the new ratio.

Example: A and B are partners sharing in the ratio 3:2. They admit C as the new partner. A surrenders 1/3rd of his share and B surrenders 2/3rd of his share in favour of C. calculate the new ratio.

Solution

A’s old share = 3/5; A surrender in favour of C = 3/5 x 1/3 = 3/15

A’s new share = 3/5 - 3/15 = 6/15

B’s old share = 2/5; B surrender in favour of C = 2/5 x 2/3 = 4/15

B’s new share = 2/5 - 4/15 = 2/15

C’s share = 3/15 + 4/15 = 7/15

New ratio = 6:2:7

Case IV: When the new partner acquires his share entirely from any one partner: In this case the sacrificing partner share is calculated by deducting his sacrifice from his old share.

Example: A and B are partners sharing in the ratio 3:2. They admit C for 1/5th share in profits which he acquires entirely from A. Calculate the new ratio.

Solution

A’s old share = 3/5; Sacrifice in favour of C = 1/5

A’s new share = 3/5 - 1/5 = 2/5

B’s share = 2/5

C’s share = 1/5

New ratio = 2:2:1

Case V: When the new partner acquires his share from the old partners in the certain ratio: In this the sacrifice of each partner is deducted from their old shares.

Example: A and B are partners sharing profits in the ratio 3:2. C is admitted for 1/5th share which he acquires from A and B in the ratio of 2:1. Calculate the new ratio.

Solution

A’s old share = 3/5, A’s sacrifice = 1/5 × 2/3 = 2/15

A’s new share = 3/5 - 2/15 = 7/15

B’s old share = 2/5, B’s sacrifice = 1/5 × 1/3 = 1/15

B’s new share = 2/5 - 1/15 = 5/15

C’s share = 1/5 × 3/3 = 3/15

New ratio = 7:5:3

Sacrificing Partners

- Sacrificing partners are those whose shares have decreased due to a change in the partnership agreement.

Sacrificing Ratio

- The sacrificing ratio is the ratio in which old partners give up their share in favor of a new partner.

- It is calculated by finding the difference between the old profit shares and the new profit shares.

- Sacrificing ratio = Old Profit Sharing Ratio - New Profit Sharing Ratio

Gaining Partners

- Gaining partners are those whose shares have increased as a result of the change in the partnership agreement.

Gaining Ratio

The ratio in which the partners have agreed to gain their shares in profit from the other partner or partners, is known as gaining ratio. This ratio is calculated by taking out the difference between new profit shares and old profit shares

Example: X and Y are partners in a firm sharing profits and losses in the ratio 5:3. They admit Z into partnership. The new ratio 3:2:1. Calculate the Sacrificing Ratio.

Solution

X’s sacrifice = X’s old share - X’s new ratio = 5/8 – 3/6 = 6/48

Y’s sacrifice = Y’s old share - Y’s new ratio = 3/8 – 2/6 = 2/48

Thus, sacrificing ratio = 6:2 or 3:1

Example: A, B and C are sharing profits and losses in the ratio of 5:3:2. Calculate the new profit sharing ratio and the sacrificing ratio in each of the following alternative cases:

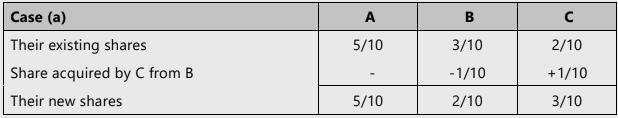

Case (a) If C acquires 1/10th share from B

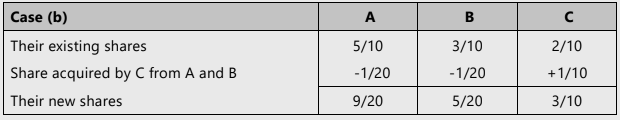

Case (b) If C acquired 1/10th share equally from A and B

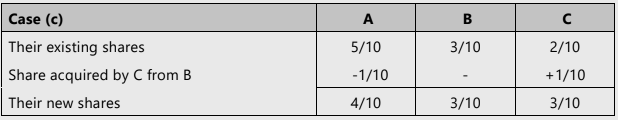

Case (c) If C’s share is increased by 1/10th share by acquiring from A.

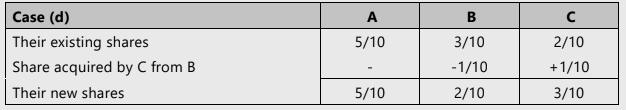

Case (d) If C’s share is increased to 3/10th by acquiring from B.

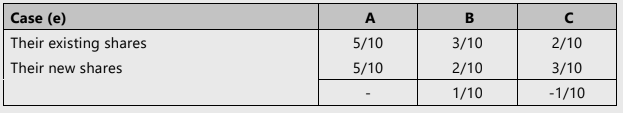

Case (e) if A, B and C decide to share future profits and losses in the ratio of 5:2:3.

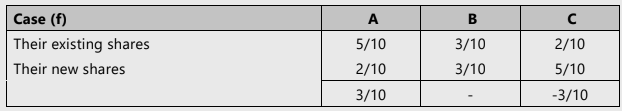

Case (f) if A, B and C decide to share future profits and losses in the ratio of 2:3:5.

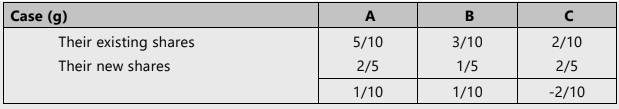

Case (g) if A, B and C decide to share future profits and losses in the ratio of 2:1:2.

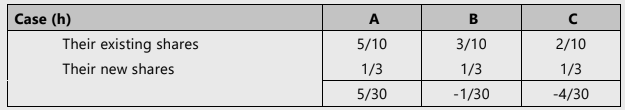

Case (h) if A, B and C decide to share future profits and losses equally.

Case(i) If A , B and C decide that the future profit sharing ratio between B and C shall be the same as existing between A and B

Solution

New Profit sharing ratio of A, B and C = 5 : 2 : 3

Share sacrificed by B = 1/10

New Profit sharing ratio of A, B and C = 9 : 5 : 6

Sacrificing ratio of A and B = 1 : 1

New Profit sharing ratio of A, B and C = 4 : 3 : 3

Share sacrificed by A = 1/10

Share acquired by C = New Share – Old share = 3/10 -2/10 = 1/10

New Profit sharing ratio of A, B and C = 5 : 2 : 3

Share sacrificed by B = 1/10

C gains by 1/10th share and B sacrifice 1/10th Share

C gains by 3/10th share and A sacrifice 3/10th Share

[Intext Question]

C gains by 2/10th share and A sacrifices 1/10th Share &B sacrifices 1/10th share.

B gains by 1/30th share, C gains by 4/30th share and A sacrifices by 5/30th Share

Case (i)

Ratio of A and B= 5 : 3

Ratio of B and C should be 5 : 3

Since B’s share in relation to A is 3/5 or 60% of A’s share, C’s share should also be 60% of B’s share

Thus C’s share (60% of 3) = 1.8

New ratio of A, B and C = 5 : 3 : 1.8 or 25 : 15 : 9

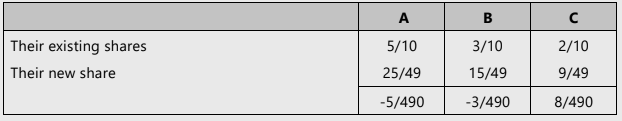

C sacrifices by 8/490 and A gains by 5/490 and B gains by 3/490

ILLUSTRATION 5

A and B are in partnership sharing profits and losses at the ratio 3:2. They take C as a new partner. Calculate the new profit sharing ratio if -

(i) C purchases 1/10 share from A

(ii) A and B agree to sacrifice 1/10th share to C in the ratio of 2: 3

(iii) Simply gets 1/10th share of profit.

SOLUTION

(i) New profit sharing ratio:

A = 3/5 – 1/10 = 5/10

B = 2/5 i.e. 4/10

C = 1/10

i.e. 5:4: 1(ii) A’s sacrifice 1/10× 2/5 = 2/50

B’s sacrifice 1/10 × 3/5 = 3/50New profit sharing ratio

A = 3/5 – 2/50 = 28/50

B = 2/5 – 3/50 = 17/50

C = 1/10 i.e. 5/50

i.e. 28:17: 5

(iii) Let total share be 1

C’s share=1/10

Remaining share=1-1/10=9/10

Distribution:

A = 9/10 × 3/5 = 27/50

B = 9/10 × 2/5 = 18/50

C = 1/10. i.e. = 5/50

i.e. 27:18: 5

ILLUSTRATION 6

A and B are in the partnership sharing profits and losses in the proportion of three-fourth and one-fourth respectively. Their balance sheet as on 31st March, 2022 was as follows:

Cash ₹1,000; trade receivables ₹ 25,000; Inventory ₹ 22,000; plant and machinery ₹ 4,000; trade payables ₹ 12,000; bank overdraft ₹ 15,000; A’s capital ₹ 15,000; B’s capital ₹ 10,000.

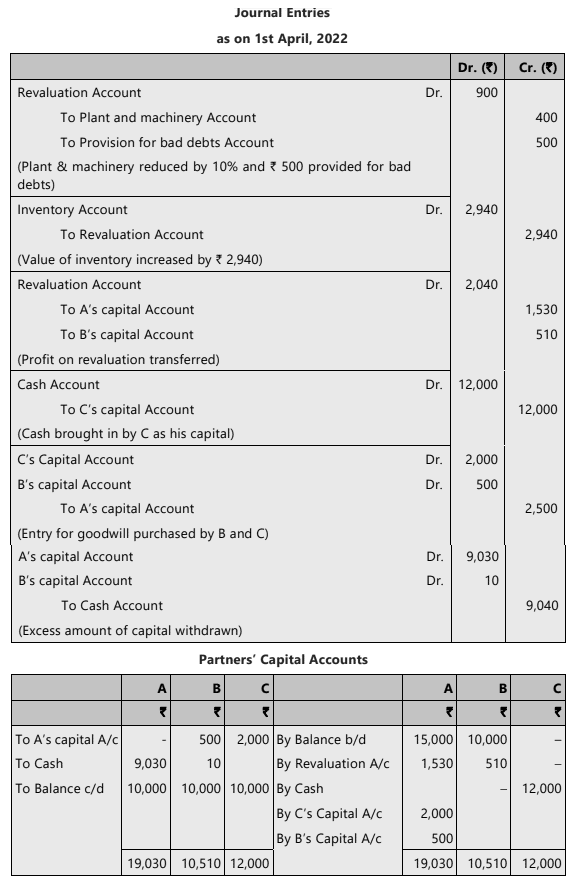

On 1st April, 2022, they admitted C into partnership on the following terms:

(i) C to purchase one–third of the goodwill for ₹ 2,000 and provide ₹ 10,000 as capital. Goodwill not to appear in books.

(ii) Further profits and losses are to be shared by A, B and C equally.

(iii) Plant and machinery is to be reduced by 10% and ₹ 500 is to be provided for estimated bad debts. Inventory is to be taken at a valuation of ₹ 24,940.

(iv) By bringing in or withdrawing cash, the capitals of A and B are to be made proportionate to that of C on their profit-sharing basis.

Set out entries to the above arrangement in the firm’s journal and give the partners’ capital accounts in tabular form.

SOLUTION

Working Note:

Calculation of goodwill

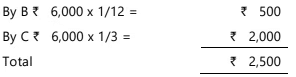

C pays ₹ 2,000 on account of goodwill for 1/3rd share of profit/loss. Total goodwill is ₹ 2,000 x 3 =₹ 6,000.Gaining ratio:

B: 1/3-1/4 = 1/12

C: 1/3

Goodwill to be paid to A:

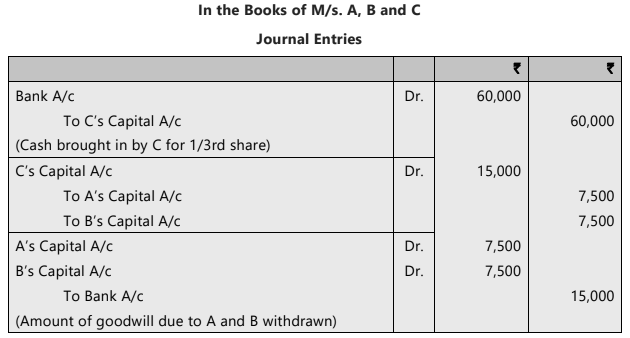

ILLUSTRATION 7

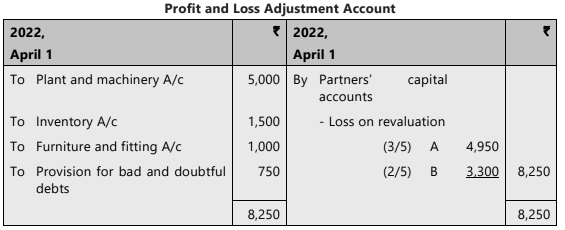

A and B are partners of X llp. sharing profits and losses in 3:2 ratio between themselves. On 31st March, 2022, the balance sheet of the firm was as follows:

X agrees to join the business on the following conditions as and from 1.4.2022:

(a) He will introduce ₹ 25,000 as his capital and pay ₹ 15,000 to the partners as premium for goodwill for 1/3rd share of the future profits of the firm.

(b) A revaluation of assets of the firm will be made by reducing the value of plant and machinery to ₹ 15,000, Inventory by 10%, furniture and fitting by ₹ 1,000 and by making a provision of bad and doubtful debts at ` 750 on trade receivables.

Prepare profit and loss adjustment account, capital accounts of partners including the incoming partner X assuming that the relative ratios of the old partners will be in equal proportion after admission.

SOLUTION

Working Notes:

(i) New profit sharing ratio:

On admission of X who will be entitled to 1/3rd share of the future profits of the firm. A and B would share the remaining 2/3rd share in equal proportion i.e. 1:1.

A: 2/3 x 1/2 = 1/3

B: 2/3 x 1/2 = 1/3

X:1/3

A, B and X would share profits and losses in equal ratio.

(ii) Adjustment of goodwill:

X pays ` 15,000 as premium for goodwill for 1/3rd share of the future profits.

Thus, total value of goodwill is ` 15,000 x 3 i.e. ` 45,000

Sacrificing ratio:

A: 3/5 - 1/3 = 4/15

A: 2/5 - 1/3 = 1/15

Hence, sacrificing ratio is 4:1

Adjustment of X’s share of goodwill through existing partners’ capital accounts in the profit sacrificing ratio:

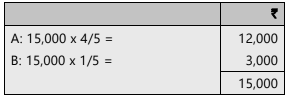

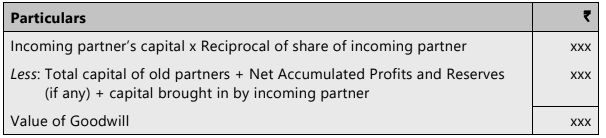

Hidden Goodwill

When the value of the goodwill of the firm is not specifically given, the value of goodwill has to be inferred as follows:

ILLUSTRATION 8

A and B are partners with capitals of ₹ 7,000 each. They admit C as a partner with 1/4th share in the profits of the firm. C brings ₹ 8,000 as his share of capital. Give the necessary journal entry to record goodwill.

SOLUTION

Note: Hidden Goodwill= 8,000 1 ⋅ 4/1 - (₹ 7,000 + ₹ 7,000+8,000) = ₹ 10,000

ILLUSTRATION 9

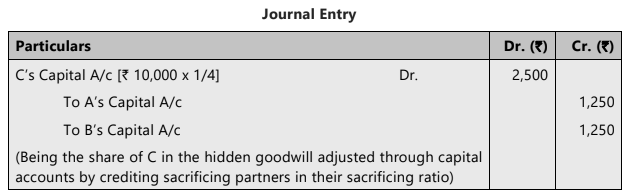

A and B are in partnership sharing profits and losses equally. The Balance Sheet M/s. A and B as on 31.12.2022, was as follows:

On 1.1.2023 they agreed to take C as 1/3rd partner to increase the capital base to ₹ 1,35,000. C agrees to pay ₹ 60,000. Show the necessary journal entries and prepare partners’ capital accounts.

SOLUTION

Workings:

(1) Old Profit Sharing Ratio:1: 1

(2) New Profit Sharing Ratio: 1:1:1

(3) C’s share of capital ₹ 1,35,000 × 1/3 = ₹ 45,000

(4) Goodwill ₹ 60,000 – ₹ 45,000 = ₹ 15,000 for 1/3rd share.

Total Goodwill: ₹15,000 × 3 = ₹ 45,000

Note : In this problem it is mentioned that total capital should be at ₹ 1,35,000 hence excess capital is to be withdrawn by partners hence third entry is passed.

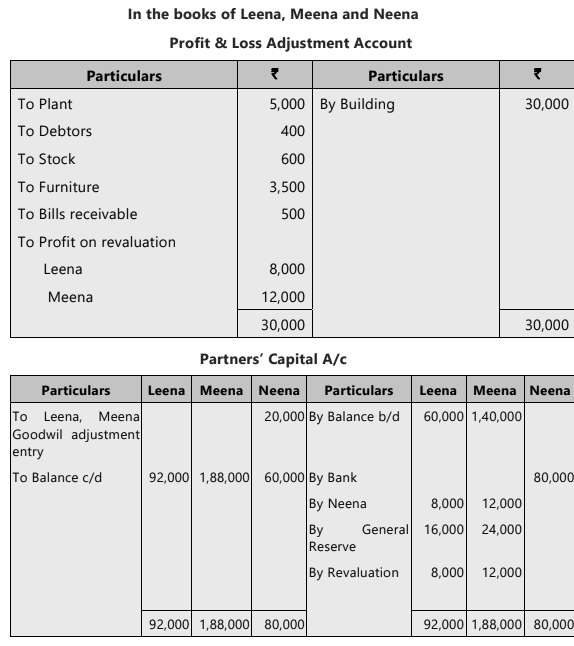

ILLUSTRATION 10

Leena and Meena were in business sharing profits and losses in the ratio of 2:3

Their Balance Sheet as on 31st March, 2022 was as follows:

On 1st April, 2022, they decided to admit Neena into the partnership giving her a 1/5th share in future profits. She brings in ₹ 80,000 as her share of capital. Goodwill was valued at ₹ 1,00,000 at the time of admission of Neena. The partners decided to revalue the Assets as follows:

Plant ₹ 40,000, Debtors ` 38,000, Stock ₹ 42,000, Building ₹ 90,000, Furniture ` 20,000, Bills Receivable ₹ 12,000.

You are required to show the following accounts in the books of the firm:-

(a) Profit & Loss Adjustment Account

(b) Partners’ Capital Accounts

(c) The Balance Sheet of the new firm.

SOLUTION

(a)

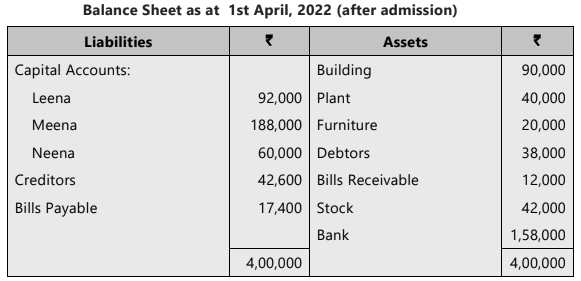

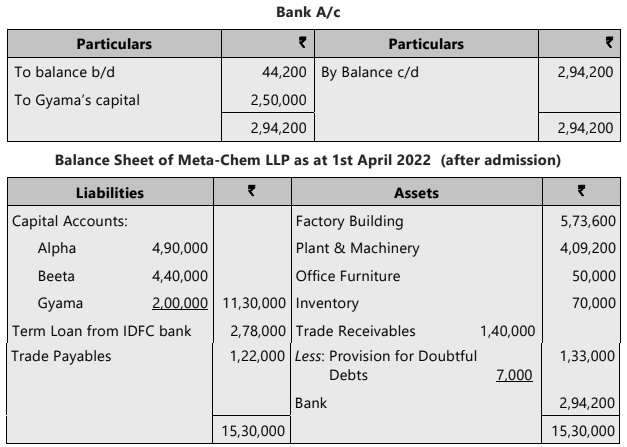

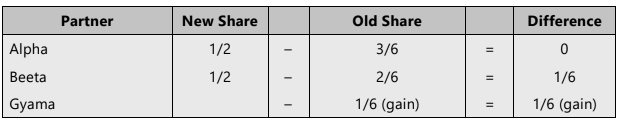

ILLUSTRATION 11

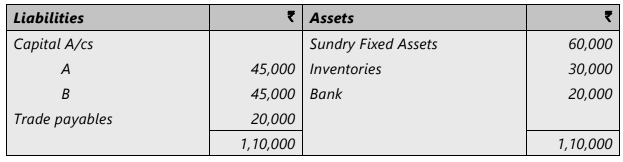

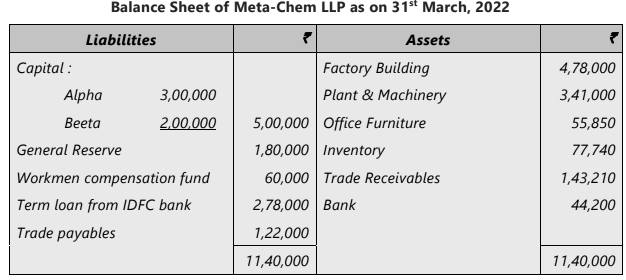

Alpha and Beeta were partners in a LLP namely Meta-Chem LLP sharing profits and losses equally.

They agreed to admit Gyama as partner from 1st April 2022 on the following terms:

1. He shall have one-sixth share in future profits.

2. New profit sharing ratio would be 3:2:1

3. He shall bring ₹ 2,50,000 as his capital.

4. Goodwill of the firm is valued at ` 3,00,000

5. Factory Building is to be appreciated by 20% and inventory is revalued at ₹ 70,000.

6. Machinery to be appreciated by 20%.and Office furniture to be revalued at ₹ 50,000

7. Of the trade receivables ₹ 3,210 are bad and 5% be provided for bad & doubtful debts.

8. There is no actual liability towards workman.

You are required to prepare:

1. Revaluation account

2. Partners’ capital accounts.

3. Bank account.

4. Balance Sheet after admission.

SOLUTION

Working Note:

|

68 videos|375 docs|83 tests

|

FAQs on Unit 3: Admission of a New Partner Chapter Notes - Accounting for CA Foundation

| 1. What is a Revaluation Account in the context of partnership admission? |  |

| 2. How do you compute the New Profit Sharing Ratio when a new partner is admitted? |  |

| 3. What is meant by Hidden Goodwill in the admission of a new partner? |  |

| 4. How do reserves in the balance sheet affect the admission of a new partner? |  |

| 5. What is the significance of preparing a Profit and Loss Adjustment Account during a new partner's admission? |  |