Unit 4: Accounting for Bonus Issue and Right Issue Chapter Notes | Accounting for CA Foundation PDF Download

| Table of contents |

|

| Unit Overview |

|

| Introduction |

|

| Right Issue |

|

| Accounting for Rights Issue |

|

| Advantages and Disadvantages of Right Issue |

|

Unit Overview

Introduction

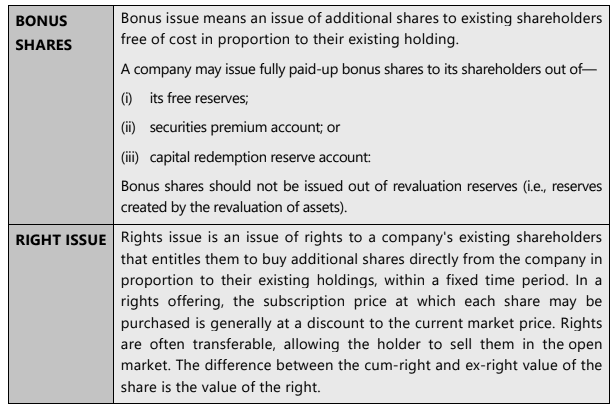

Bonus shares are additional shares given to current shareholders at no extra cost, based on the number of shares they already own. This process does not raise new funds for the company and only increases the number of shares without affecting the company's net worth. While the total number of issued shares goes up, the proportion of shares each shareholder holds remains the same.Bonus issues are also called "capitalisation of profits," which involves converting profits or reserves into paid-up capital. Companies can issue fully paid bonus shares to their members by capitalising profits or reserves that are otherwise available for distribution as dividends.

If a bonus issue causes the subscribed and paid-up capital to exceed the authorised share capital, the company must pass a resolution in its general body meeting to increase the authorised capital. Additionally, a return of the bonus issue along with a copy of the resolution authorising the issue must be filed with the Registrar of Companies.

Example 1. Alpha Company announced a bonus issue to its shareholders in the ratio of 2:3, meaning 2 shares for every 3 shares held. Shareholder X has 6,000 shares before the announcement of the bonus issue. How many shares would he have after the bonus issue?

Solution.

- The company announced a bonus issue in the ratio of 2:3.

- Shareholder X will be entitled to receive 4,000 bonus shares, calculated as (6,000 shares / 3 x 2).

- Therefore, the total number of shares X will have after the bonus issue is 10,000 (6,000 + 4,000).

Provisions of the Companies Act, 2013

Section 63 of the Companies Act, 2013 governs the issue of bonus shares. According to this section:

- A company can issue fully paid-up bonus shares to its members from its free reserves, securities premium account, or capital redemption reserve account.

- However, reserves created by the revaluation of assets cannot be capitalised for issuing bonus shares.

Free Reserves

- Free reserves are defined as reserves available for distribution as dividends, excluding unrealised gains, notional gains, or asset revaluation, as per Section 2(43) of the Companies Act, 2013.

- Any unrealised gains, notional gains, or asset revaluation, whether shown as a reserve or not, shall not be treated as free reserves.

Conditions for Capitalisation

- Bonus shares can only be issued if it is authorised by the company's articles, recommended by the Board, and approved in the general meeting.

- The company should not have defaulted in payment of interest or principal on fixed deposits or debt securities, statutory dues of employees, and any partly paid-up shares on the date of allotment should be made fully paid-up.

- The company should also comply with any prescribed conditions.

Withdrawal of Bonus Issue

- Once a company announces a bonus issue, it cannot withdraw the decision.

Bonus Shares and Dividends

- Bonus shares cannot be issued in lieu of dividends.

Application of Securities Premium and Capital Redemption Reserve

- Securities premium account and capital redemption reserve account can only be applied towards paying up unissued shares as fully paid bonus shares.

- These accounts cannot be used for paying unpaid amounts on shares held by existing shareholders.

Use of Free Reserves

- Free reserves can be used for paying unpaid amounts on shares held by existing shareholders, while securities premium account and capital redemption reserve cannot be used for this purpose.

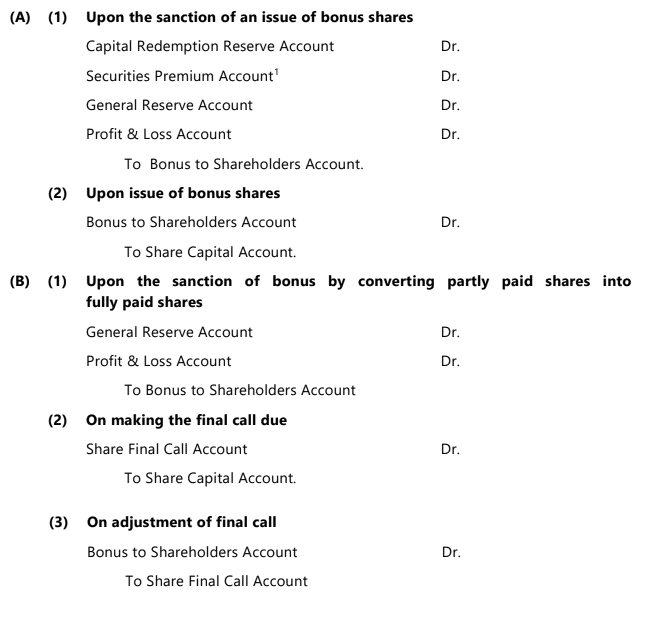

Journal Entries

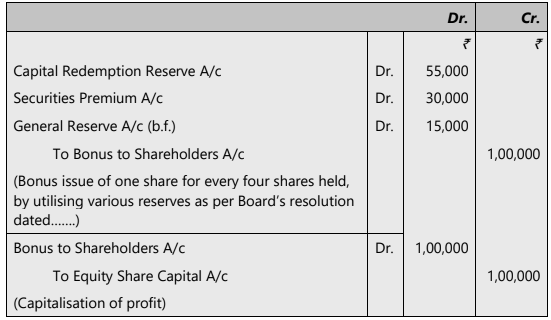

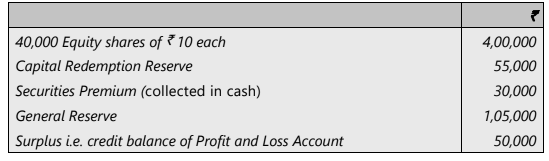

ILLUSTRATION 1

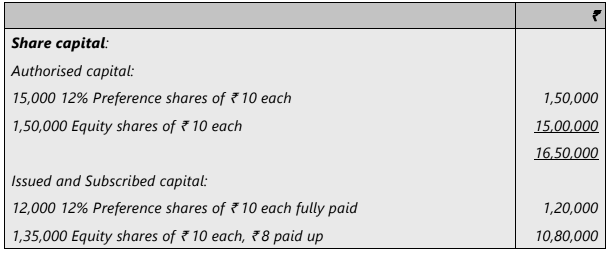

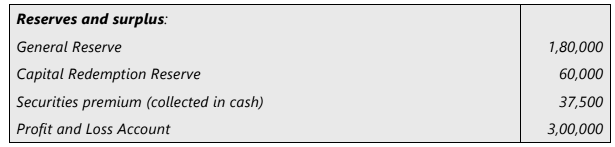

Following items appear in the trial balance of Bharat Ltd. (a listed company) as on 31st March, 2022:

The company decided to issue to equity shareholders bonus shares at the rate of 1 share for every 4 shares held and for this purpose, it decided that there should be the minimum reduction in free reserves. Pass necessary journal entries.

SOLUTION

Journal Entries in the books of Bharat Ltd.

Working Note-

Number of Bonus shares to be issued- (40,000 shares / 4) X 1 = 10,000 shares

Value of Bonus shares- 10,000 shares of ₹ 10 each = ₹ 1,00,000

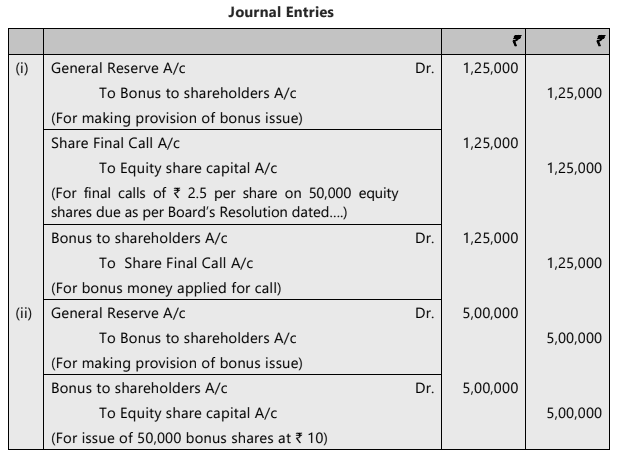

ILLUSTRATION 2

Pass Journal Entries in the following circumstances:

(i) A Limited company with subscribed capital of ₹ 5,00,000 consisting of 50,000 Equity shares of ₹ 10 each; called up capital ₹ 7.50 per share. A bonus of ₹ 1,25,000 declared out of General Reserve to be applied in making the existing shares fully paid up.

(ii) A Limited company having fully paid up capital of ₹ 50,00,000 consisting of Equity shares of ₹10 each, had General Reserve of ₹ 9,00,000. It was resolved to capitalize ₹ 5,00,000 out of General Reserve by issuing 50,000 fully paid bonus shares of ` 10 each, each shareholder to get one such share for every ten shares held by him in the company.

SOLUTION

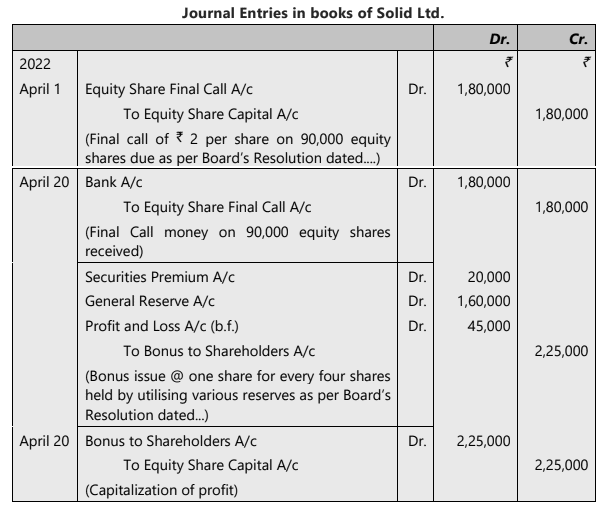

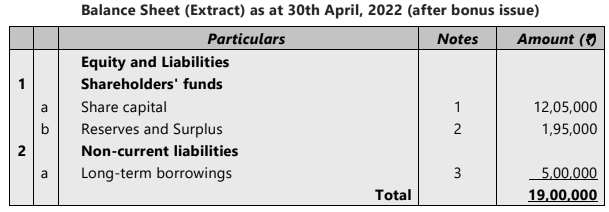

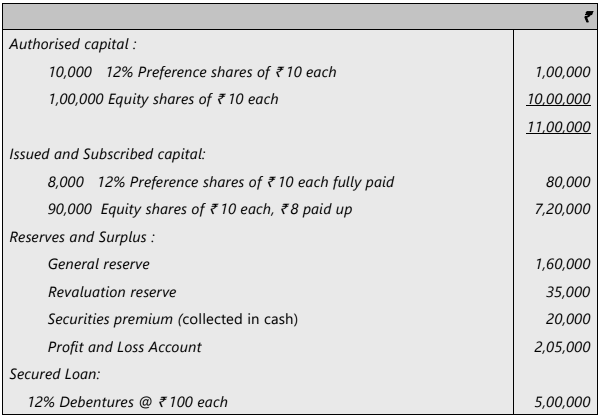

ILLUSTRATION 3

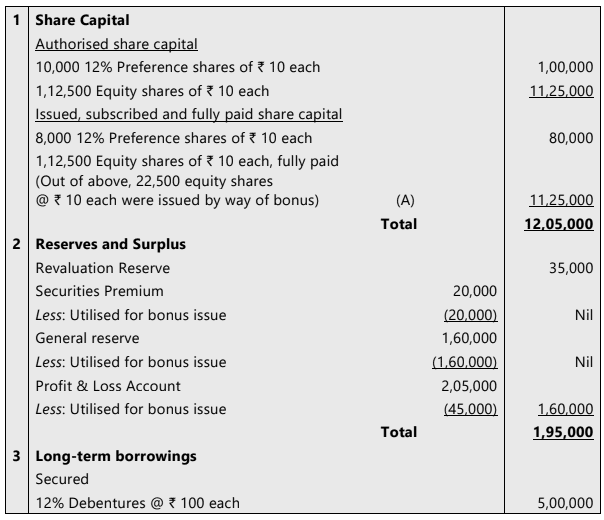

Following notes pertain to the Balance Sheet of Solid Ltd. as at 31st March, 2022:

On 1st April, 2022 the Company has made final call @ ₹2 each on 90,000 equity shares. The call money was received by 20th April, 2022. Thereafter the company decided to capitalise its reserves by way of bonus at the rate of one share for every four shares held. Show necessary entries in the books of the company and prepare the extract of the Balance Sheet immediately after bonus issue assuming that the company has passed necessary resolution at its general body meeting for increasing the authorised capital.

SOLUTION

Notes to Accounts

The authorised capital has been increased by sufficient number of shares. (11,25,000 – 10,00,000)

Working Note-

Number of Bonus shares to be issued (90,000 shares / 4 ) X 1 = 22,500 shares

Note: It has to be ensured that the authorized capital after bonus issue should not be less than the issued share capital (including bonus issue) in all the practical problems. The authorized capital may either be increased by the amount of bonus issue or the value of additional shares [value of bonus shares issued less unused authorized capital (excess of authorized capital in comparison to the issued shares before bonus issue)].

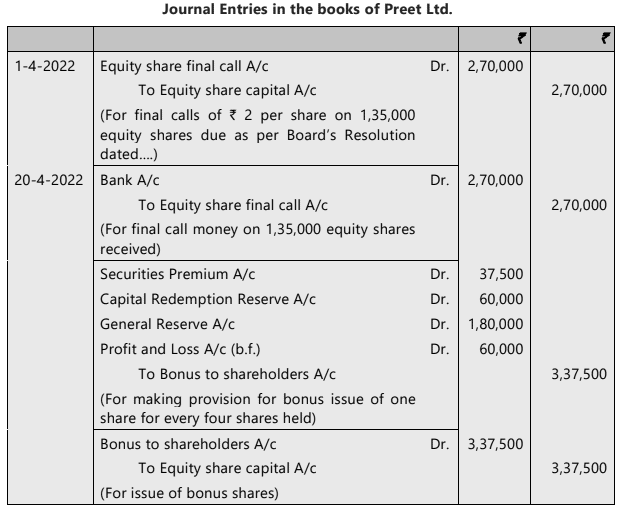

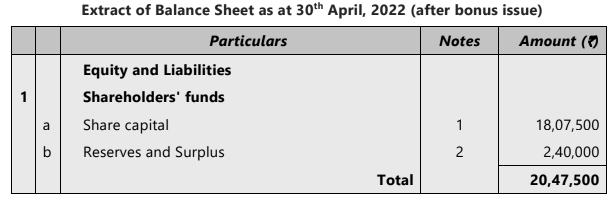

ILLUSTRATION 4

Following notes pertain to the Balance Sheet of Preet Ltd. as at 31st March, 2022

On 1st April, 2022, the Company has made final call @ ₹2 each on 1,35,000 equity shares. The call money was received by 20th April, 2022. Thereafter, the company decided to capitalise its reserves by way of bonus at the rate of one share for every four shares held.

Show necessary journal entries in the books of the company and prepare the extract of the balance sheet as on 30th April, 2022 after bonus issue.

SOLUTION

Notes to Accounts

Working Notes:

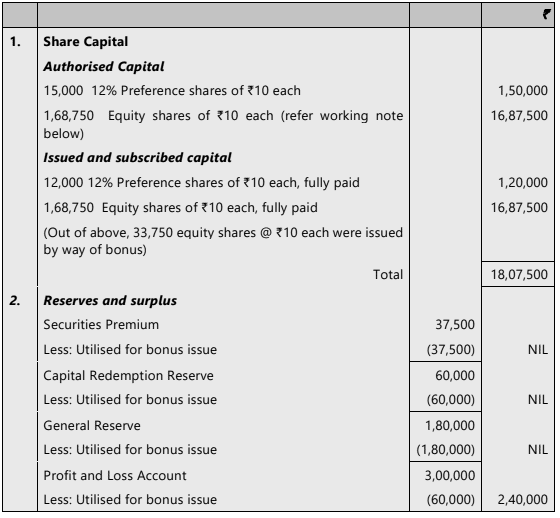

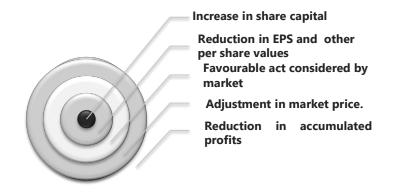

Effects of Bonus Issue

Bonus issue has following major effects:

Right Issue

- Right Issue is governed by Section 62(1)(a) of the Companies Act, 2013.

- It allows companies to raise subscribed share capital by issuing further shares.

- Existing shareholders have the right to subscribe to new shares to maintain their voting and governance rights.

- If they do not wish to subscribe, they can renounce their rights in favor of someone else.

- Value of Right: Cum-right value of share vs. Ex-right value of share.

- Example: Shareholder X can subscribe to 100 new shares, maintaining a 1% stake or renounce the right to Shareholder Y.

Procedures for Right Issue

- Companies issuing new shares must follow specific procedures outlined in Section 62(1)(a) of the Companies Act 2013.

- Offer to Existing Shareholders: Shares must be offered to existing equity shareholders through a letter of offer.

- Notice Requirements: The offer notice should specify the number of shares offered and set a response time of 15 to 30 days.

- Right to Renounce: Unless prohibited by the company’s articles, the offer includes the right to renounce shares in favor of another person.

- Disposal of Unaccepted Shares: If the offer is not accepted within the specified time, the Board of Directors can dispose of the shares in a manner not disadvantageous to shareholders.

Exceptions to Existing Shareholders' Rights:

- Section 62 of the Companies Act recognizes situations where shares can be issued without offering them to existing shareholders.

- Special Resolution: Shares can be offered without existing shareholders’ rights if a special resolution is passed.

- Employee Stock Options: Shares can be issued to employees under a stock option scheme subject to specified conditions.

- Valuation Report: Shares can be offered to any persons for cash or consideration other than cash, based on a valuation report by a registered valuer.

- Conversion of Debentures/Loans: Section 62(3) allows for the increase of subscribed capital through the exercise of an option attached to debentures or loans, subject to special resolution approval.

- Government Directives: Section 62(4) allows for the conversion of government-issued debentures or loans into equity shares in the public interest, even without an option for conversion in the terms of issue.

Financial Effects of Further Issue

- Further issue of shares increases both the amount of equity (net worth) and liquid resources (bank balance) of a business.

- Book Value of a Share: Calculated as Net worth divided by the Number of shares. For example, with 10,000 shares and a net worth of 1,25,000, the book value is ` 12.50 per share.

- Market Value vs. Book Value: Market value reflects the present value of future cash flows expected from the share, while book value is based on current net worth.

- Cum-right Market Price: The market price before the rights issue.

- Ex-right Market Price: The market price after the rights issue.

- Theoretical Ex-Rights Price: The deemed value of a share immediately after a rights issue.

- Value of Right: Calculated as Cum-right value of share minus Ex-right value of share.

- Example: If a company has a net worth of ₹ 250,000 and issues 1,000 shares at ₹ 14 per share, the Ex-right value of share is ₹ 24 and the Value of Right is ₹ 1 per share.

Right of Renunciation

- Right of renunciation allows shareholders to surrender their right to buy securities and transfer it to another person.

- Shareholders have three choices with right shares: buy more shares, sell them in the market, or pass on the rights.

- The renunciation right is valuable and can be monetised by existing shareholders in a well-functioning capital market.

- Value of right is determined as Cum-right value of share minus Ex-right value of share.

- For example, if Ex-right value of share is ₹ 24, and Cum-right value is ₹ 25, the value of right is ₹ 1 per share.

Example:

- Mr. Narain’s Scenario:

- If Narain Exercises His Right: He pays ₹ 140 for 10 shares. His total investment becomes ₹ 2,640, averaging ₹ 24 per share.

- If Narain Does Not Exercise His Right: His holding’s worth declines to ₹ 2,400. He can renounce his right to Mr. Murthy, charging him ₹ 10 per share for the privilege.

- Murthy’s Position: Murthy’s total investment becomes ₹ 240, holding 10 shares at an average cost of ₹ 24 per share.

- Narain’s Final Holding: He ends up with a final holding worth ₹ 2,400 plus ₹ 100 from Murthy, matching his cum-right holding valuation.

ILLUSTRATION 5

A company offers new shares of ₹ 100 each at 25% premium to existing shareholders on one for four bases. The cum-right market price of a share is ₹ 150. Calculate the value of a right. What should be the ex-right market price of a share?

SOLUTION

Ex-right value of the shares = (Cum-right value of the existing shares + Rights shares Issue Price) / (Existing Number of shares + No. of right shares)

= (₹ 150 X 4 Shares + ₹ 125 X 1 Share) / (4 + 1) Shares

= ₹ 725 / 5 shares =₹ 145 per share.

Value of right = Cum-right value of the share – Ex-right value of the share = ₹ 150 – ₹ 145 = ₹ 5 per share.

Hence, any one desirous of having a confirmed allotment of one share from the company at ₹ 125 will have to pay ₹ 20 (4 shares X ₹ 5) to an existing shareholder holding 4 shares and willing to renounce his right of buying one share in favour of that person.

Accounting for Rights Issue

The accounting treatment for rights shares is identical to that of ordinary shares. The following journal entry is made:- Bank A/cTo Equity Shares Capital A/c

In case rights shares are offered at a premium, the premium amount is credited to the Securities Premium Account. The accounting entry in such a case is:

- Bank A/c Dr.

- To Equity Share Capital A/c

- To Securities Premium A/c

Example 4: A company with 70,000 shares of ₹10 each as its issued share capital, and a market value of ₹21, issues rights shares in the ratio of 1:10 at an issue price of ₹10. Pass the journal entry for the issue of right shares.

Journal Entry for Right Shares Subscription

- Bank A/cDr. ₹70,000

- To Equity Share Capital A/c ₹70,000

(Being the issue of 7,000 right shares at a price of ₹10)

Working Note: Number of rights shares to be issued = 70,000 / 10 x 1 = 7,000 shares

Example 5: A company with 1,00,000 shares of ₹10 each as its issued share capital, and a market value of ₹46, issues rights shares in the ratio of 1:10 at an issue price of ₹31. Pass the journal entry for the issue of right shares.

Journal Entry for Right Shares Subscription

- Bank A/cDr. ₹3,10,000

- To Equity Share Capital A/c ₹1,00,000

- To Securities Premium A/c ₹2,10,000

(Being the issue of 10,000 right shares at ₹31)

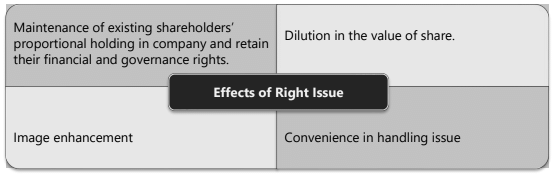

Advantages and Disadvantages of Right Issue

Advantages of Right Issue

- Proportional Holding: Right issues allow existing shareholders to maintain their proportional ownership in the company, preserving their financial and governance rights. This prevents management from issuing shares to select individuals for better control over the company's affairs.

- Value Compensation: In efficient capital markets, right issues typically lead to share value dilution. However, existing shareholders benefit from acquiring new shares at a discounted price, offsetting the decline in share value. The cum-right value remains intact if shareholders renounce their rights in favor of a third party.

- Cost Hedge: Right issues serve as a natural hedge against the expenses associated with public issues, making them more cost-effective for companies.

- Positive Perception: Right issues enhance a company's image, as they are viewed positively by the public and shareholders.

- Higher Success Rate: The likelihood of success for a right issue is generally higher than that of a public issue, and it is logistically easier to manage.

Disadvantages of Right Issue

- Market Value Dilution: Right issues inevitably lead to a dilution in the market value of the company's shares.

- Price Assessment: The attractive price of a right issue should be carefully evaluated against its true worth to ensure a favorable deal.

Effects of Right Issue

|

68 videos|265 docs|83 tests

|

FAQs on Unit 4: Accounting for Bonus Issue and Right Issue Chapter Notes - Accounting for CA Foundation

| 1. What is a rights issue in the context of corporate finance? |  |

| 2. How is a rights issue accounted for in the financial statements? |  |

| 3. What are the advantages of a rights issue for a company? |  |

| 4. What are the disadvantages of a rights issue? |  |

| 5. How does accounting for a bonus issue differ from a rights issue? |  |