Unit 4: Retirement of a Partner Chapter Notes | Accounting for CA Foundation PDF Download

Unit Overview

Introduction

A partner may retire from a partnership firm due to reasons such as old age or illness. Typically, the business of the partnership firm does not cease when one partner retires, as the remaining partners can continue running the business.When a partner retires, a readjustment occurs similar to when a new partner is admitted. The continuing partners benefit by gaining the retiring partner’s share of the profits. To settle the retiring partner’s claims, the remaining partners arrange the necessary funds.

Several adjustments are made during this process:

- Assets and liabilities are revalued.

- The value of goodwill is updated.

- The surrender value of any joint life policy is considered.

Any revaluation profits and reserves are transferred to the capital or current accounts of the partners. Finally, the exact amount due to the retiring partner is calculated and paid.

Calculation of Gaining Ratio

When a partner retires, the remaining partners will benefit by gaining the retiring partner’s share of profits. For instance, if A, B, and C share profits and losses in the ratio of 5:3:2, and B retires, A and C need to decide how they will share profits and losses in the future.

If they agree to share profits and losses in the ratio of 3:2, then:

- A gains 1/10th of the share, and

- C gains 2/10th of the share.

This means the gaining ratio between A and C is 1:2. However, if A and C decide to continue sharing in the ratio of 5:2, it indicates that they are dividing the gained share according to the previous profit-sharing ratio.

Example: Amir, Jamir and Samir are in partnership sharing profits and losses at the ratio of 3:2:1. Now Amir wants to retire and Jamir and Samir want to continue at the ratio of 3:2. In this case, Jamir gains 8/30th of share of partnership (3/5 less 2/6) whereas Samir gains 7/30th (2/5 less 1/6) share of the partnership. So gaining ratio between Jamir and Samir is 8:7. On the other hand, if Jamir and Samir would decide to continue sharing profits and losses at the ratio of 2:1, then Jamir would gain 2/6th share of partnership i.e. [(2/3)–(2/6)], and Samir would gain 1/6th share of partnership i.e. [(1/3)–(1/6)]. So it appears that in such a case gaining ratio of Jamir and Samir would be 2:1. i.e., the existing profit sharing ratio between them.

Thus, on the retirement or death of a partner, his share in the profit would be taken by the remaining partners. In other words, they get additional share which is obviously a gain or benefit. The calculation of gaining ratio or benefit ratio is done as follows:

(i) When the new ratio is given, gaining ratio is calculated by deducting their old share of profits from the new share.

(ii) When the new profit sharing ratio is not given and the remaining partners share the future profits in the same ratio as before, the gaining ratio would be the old profit sharing ratio.

Observe the following table:

Calculation of New Profit Sharing Ratio

Case 1: When nothing is given about the new profit sharing ratio of the remaining partners: Under this situation the calculation of new ratio is done by striking out the share of the retiring partner.

Example : Alok, Bhaskar and Chetan are partners sharing in the ratio 3:2:1. Calculate new ratio if:

(a) If Alok retires.

(b) If Bhaskar retires.

(c) If Chetan retires.

Solution

Old Profit ratio = 3:2:1

(a) If Alok retires new profit ratio will be 2:1

(b) If Bhaskar retires new profit ratio will be 3:1

(c) If Chetan retires new profit ratio will be 3:2

Case 2: When gains of the continuing partners are specifically given in the question: In such a case, the new shares of the continuing partners are calculated by adding their respective gain to their old share.

New share = Old share + Gain

Example: Aarav, Banta and Chunmun are partners sharing in the ratio 3:2:1. Aarav retires and his share is taken over by the remaining partners as follow

Banta takes 2/6th from Aarav.

Chunmun takes 1/6th from Aarav.

Calculate new ratio.

Solution

Banta’s New Share = Banta’s old share + Banta’s gain = 2/6 + 2/6 = 4/6

Chunmun’s New Share = Chunmun’s old share + Chunmun’s gain = 1/6 + 1/6 = 2/6

So the new share = 4/6: 2/6 = 2:1

Case 3: When the ratio in which the remaining partners acquire the share of the outgoing partner is given:

Example: Deepu, Tasha and Honey are partners sharing profits in the ratio 3:2:1. Tasha retires and his share was acquired by deepu and honey in the ratio 2:1. Calculate new ratio.

Solution

Share acquired by Deepu = 2/6 × 2/3 = 4/18

Share acquired by Honey = 2/6 × 1/3 = 2/18

Deepu’s new Share = Deepu ‘s old share + Deepu’s gain = 3/6 + 4/18 = 13/18

Honey’s new Share = Honey’s old share + Honey’s gain = 1/6+ 2/18 = 5/18

New Ratio = 13:5

Calculation of Gaining Ratio

Case – 1

A, B and C are partners sharing profits and losses in the ratio of 1/2, 3/10 and 1/5 respectively. B retires from the firm and A&C decide to share future profits and losses in the ratio of 3:2.

Case – 2

W, A, B and C are partners sharing profits and losses in the ratio of 1/3, 1/6, 1/3 and 1/6 respectively. B retires and W, A and C decide to share future profits and losses equally.

Case – 3

A, B and C are partners sharing profits and losses in the ratio of 25:15:9. B retires and it is decided that profit sharing ratio between A&C will be the same as existing between B and C.

Ratio of B and C = 15 : 9 = 5 : 3

Therefore new ratio of A and C should be 5 : 3

Case – 4

A, B and C are partners sharing profits and losses in the ratio of 4/9, 1/3 and 2/9. B retires and surrenders 1/9th of his share in favour of A and remaining in favour of C.

Case – 5

A, B & C are partners sharing profits and losses in the ratio of 1/2 , 3/10 and 1/5 respectively. B retires and his share is taken by A and C in the ratio of 2:1. Then immediately W is admitted for 1/4th share of profit, half of which was gifted by A and remaining share was taken by W equally from A and C.

Revaluation of Assets and Liabilities on Retirement of a Partner

Upon the retirement of a partner, it is necessary to revalue the assets and liabilities similar to the process followed during the admission of a partner. If there is a revaluation profit, it should be shared among all partners, including the retiring partner, according to the existing profit-sharing ratio. Conversely, a loss on revaluation must also be distributed among all partners, including the retiring partner, based on the same ratio. To determine the profit or loss from the revaluation of assets and liabilities, a Revaluation Account or Profit and Loss Adjustment Account is created, which is subsequently closed by transferring the resulting profit or loss to the Partners’ Capital Accounts.If it is decided that revalued figures of assets and liabilities will not appear in the balance sheet of the continuing partners, then a journal entry should be passed with the amount payable or chargeable to the retiring partner which the continuing partners will share at the ratio of gain. In the first instance, the journal entry for distribution of profit or loss on revaluation which will appear in the balance sheet also is as follows:

Now see how to deal with a situation where revalued figures will not appear in the Balance Sheet.

If A, B & C share profits and losses equally and there is a revaluation profit of ` 30,000 calculated on A’s retirement, then ` 10,000 becomes due to A which is to be borne by B and C equally. So the journal entry will be as follows:

To reflect a ₹10,000 increase in fixed assets and a ₹2,000 decrease in trade payables, debit the respective asset and liability accounts. Then, credit the partners’ capital account based on the existing profit-sharing ratio. After that, debit the partners’ capital accounts for the gain according to the new profit-sharing ratio and credit the asset and liability accounts accordingly.

In this case it is not necessary to open a separate Revaluation Account. However, the above effect can also be given through Memorandum Revaluation Account as discussed in the case of admission of a partner in unit 3.

Reserve

Upon the retirement of a partner, any undistributed profits or reserves reflected in the Balance Sheet should be allocated to the Partners' Capital Accounts according to the previous profit-sharing ratio. Alternatively, if the remaining partners maintain the same profit-sharing ratio, only the retiring partner's share may be transferred to their Capital Account.For example, A, B and C were in partnership sharing profits and losses at the ratio 5:3: 2. A retired and B and C agreed to share profits and losses at the ratio of 3:2. Reserve balance was ₹ 10,000. In this case either of the following journal entries can be passed:

Note that alternative (2) has the same implications because B and C continued at the same ratio 3: 2 as they did before A’s retirement.

Take another example: X, Y and Z were equal partners. Z decided to retire. X and Y decided to continue at the ratio of 3: 2. Reserve standing at the date of retirement of Z was ₹ 9,000. In this case adjustment of Z’s share was not sufficient since the relationship between X and Y was also changed.

Gaining Ratio: X: Y 4: 1

This is different from 1: 1. So alternative (1) is to be followed in this case.

If the continuing partners want to show reserve in the Balance Sheet, the journal entry will be:

Final Payment to a Retiring Partner

The final payment to a retiring partner involves several adjustments in the Capital Account, including the transfer of reserves, goodwill, and profit or loss on revaluation. Once these adjustments are made, the balance in the Capital Account represents the amount to be paid to the retiring partner.Immediate Payment by Continuing Partners

If the continuing partners decide to pay the entire amount owed to the retiring partner at the time of retirement, the journal entry will be as follows:

- Retiring Partner’s Capital Account Debit

- To Bank Account Credit

Retaining Portion as Loan

If the retiring partner agrees to retain a portion of their claim as a loan to the partnership, the journal entry will be:

- Retiring Partner’s Capital Account Debit

- To Retiring Partner’s Loan Account Credit

- To Bank Account Credit

Payment Alternatives

The payment to the retiring partner is typically made according to the terms of the partnership agreement, which may provide for one of the following alternatives:

- Installment Payments: Repayment may be made in installments over a period of time, with interest paid on the outstanding balance, treating it as a loan to the outgoing partner.

- Loan to the Firm: The amount due may be treated as a loan to the firm, with the firm paying either a fixed interest rate or a share of the profits.

- Annuity Payments: An annuity may be paid to the retired partner for life, for a specified number of years, or for the life of a dependent.

ILLUSTRATION 1

A and B are partners in a business sharing profit and losses as A-3/5th and B-2/5th. Their balance sheet as on 1st January, 2022 is given below:

B retires from the business owing to illness and A takes it over. The following revaluation was made:

(1) The goodwill of the firm is valued at ₹ 25,000.

(2) Depreciate Plant & Machinery by 7.5% and Inventories by 15%.

(3) Doubtful debts provision is raised against trade receivables at 5% and a discount reserve against trade payables at 2%.

Required:

Journalize the above transactions in the books of the firm and close the Partners’ Accounts as on 1st January 2022. Give also the opening Balance Sheet of A.

SOLUTION

Note: Here it is assumed that amount payable to B is transferred to his loan a/c.

ILLUSTRATION 2

F, G and K were partners in LLP sharing profits and losses at the 2:2: 1. K wants to retire on 31.12.2022. Given below is the Balance Sheet of the partnership as well as other information:

F and G agree to share profits and losses at the ratio of 3: 2 in future. Value of Goodwill is taken to be ₹ 50,000. Sundry Fixed Assets are revalued upward by ₹ 30,000 and Inventories by ₹10,000. Bills Receivable dishonoured ₹ 5,000 on 31.12.2022 but not recorded in the books. Dishonour of bill was due to insolvency of the customer. F and G agree to bring sufficient cash to discharge claim of K and to make their capital proportionate. Also they wanted to maintain ₹ 75,000 bank balance for working capital.

Required:

Pass necessary journal entries, capital accounts of partners and draft the Balance Sheet of Ms/ F & G after K’s retirement.

SOLUTION

Working Note:

Adjusting entry for goodwill

Adjusting entry:

Working Notes:

ILLUSTRATION 3

A, B & C were in partnership sharing profits in the proportions of 5:4:3. The balance sheet of the firm as on 31st March, 2022 was as under:

A had been suffering from ill-health and gave notice that he wished to retire. An agreement was, therefore, entered into as on 31st March, 2022, the terms of which were as follows:

(i) The profit and loss account for the year ended 31st March, 2022 which showed a net profit of ₹ 48,000 was to be re-opened. B was to be credited with ₹ 4,000 as bonus, in consideration of the extra work which had devolved upon him during the year. The profit sharing was to be revised from 1st April, 2021, as 3:4:4.

(ii) Goodwill was to be valued at two years’ purchase of the average profits of the preceding five years. The fixtures were to be valued by an independent valuer. The valuations arising out of the above agreement were goodwill ₹ 56,800 and fixtures ₹ 10,980. A provision of 2% was to be made for doubtful debts and the remaining assets were to be taken at their book values.

B and C agreed, as between themselves, to continue the business, sharing profits in the ratio of 3:2 and decided to retain the fixtures on the books at the revised value, and to increase the provision for doubtful debts to 6%.

Required:

Submit the journal entries necessary to give effect to the above arrangements and to draw up the capital account of the partners after carrying out all adjusting entries as stated above.

SOLUTION

Note: The balance of A’s Capital Account has been transferred to A’s Loan Account.

Working Note:

Calculation for adjustment of Amount of Goodwill

ILLUSTRATION 4

K, L & M are partners sharing profits and losses in the ratio 5:3:2. Due to illness, L wanted to retire from the firm on 31.3.2022 and admit his son N in his place.

On retirement of L assets were revalued: Furniture ₹ 10,000 and Inventory in trade ₹ 30,000. 50% of the amount due to L was paid off in cash and the balance was retained in the firm as capital of N. On admission of the new partner, goodwill was valued at ₹ 50,000. Partners are being paid off their extra balances to make capital proportionate by keeping N’s capital as base.

You are required to give:

(i) Necessary journal entries; (ii) balance sheet of M/s K, M and N as on 1.4.2022; (iii) capital accounts of partners.

SOLUTION

Working Note:

1. Calculation for adjustment of Amount of Goodwill

2. Calculation of excess capital paid off to M to make capital proportionate.

ILLUSTRATION 5

Dowell llp. with partners Mr. A, Mr. B and Mr., C, are sharing profits and losses in the ratio of 10:6:4. The balance sheet of the firm as at 31st March, 2022 is as under:

It was mutually agreed that Mr. B will retire from partnership and in his place Mr. D will be admitted as a partner with effect from 1st April, 2022. For this purpose, the following adjustments are to be made:

(a) Goodwill is to be valued at ₹ 1 lakh but the same will not appear as an asset in the books of the reconstituted firm.

(b) Buildings and plant and machinery are to be depreciated by 5% and 20% respectively. Investments are to be taken over by the retiring partner at ₹ 15,000. Provision of 20% is to be made on Trade receivables to cover doubtful debts.

(c) In the reconstituted firm, the total capital will be ₹ 2 lakhs which will be contributed by Mr. A, Mr. C and Mr. D in their new profit sharing ratio, which is 2:2:1.

(i) The surplus funds, if any, will be used for repaying bank overdraft.

(ii) The amount due to retiring partner shall be transferred to his loan account.

Required:

Prepare

(a) Revaluation account;

(b) Partners’ capital accounts;

(c) Bank account; and

(d) Balance sheet of the reconstituted firm as on 1st April, 2022.

SOLUTION

Note: Even though the problem says goodwill ₹ 1,00,000 to appear in new Balance Sheet, it is written off so as to company with Accounting Standard. Net entry for goodwill is:

C's capital Dr. 20,000

D's capital Dr. 20,000

To A's capital 10,000

To B's capital 30,000

Paying a Partner’s Loan in Instalment

Paying off a partner's loan typically involves arranging financing, but if the loan requires repayment in equal installments with interest, it should be divided into equal parts. For example, if a partner's loan of ₹30,000 is to be paid in four annual installments at an interest rate of 6% per annum, each annual installment for the loan is ₹7,500. In the first year, the interest is ₹1,800 (6% of ₹30,000), making the total payment ₹9,300. After this payment, the remaining balance is ₹22,500. In the second year, the interest on the new balance is ₹1,350, so the payment will be ₹7,500 plus interest, totaling ₹8,850. The loan account will be recorded in the books accordingly.

ILLUSTRATION 6

M/s X is a partnership firm with the partners A, B and C sharing profits and losses in the ratio of 3:2:5. The balance sheet of the firm as on 30th June 2022, was as under:

It was mutually agreed that B will retire from partnership and in his place D will be admitted as a partner with effect from 1st July, 2022. For this purpose, the following adjustments are to be made:

(a) Goodwill of the firm is to be valued at ` 2 lakhs due to the firm’s locational advantage but the same will not appear as an asset in the books of the reconstituted firm.

(b) Buildings and plant and machinery are to be valued at 90% and 85% of the respective balance sheet values. Investments are to be taken over by the retiring partner at ` 25,000.

Trade receivables are considered good only upto 90% of balance sheet figure. Balance be considered bad.

(c) In the reconstituted firm, the total capital will be ` 3 lakhs, which will be contributed by A, C and D in their new profit sharing ratio, which is 3:4:3.

(d) The amount due to retiring partner shall be transferred to his loan account.

Required:

Prepare Revaluation Account and Partners’ Capital Accounts.

SOLUTION

Working Notes:

1. Adjustment of goodwill

Goodwill of the firm is valued at ₹ 2 lakhs

Sacrificing ratio:

A 3/10-3/10 = 0

B 2/10-0 = 2/10

C 5/10-4/10 = 1/10

Hence, sacrificing ratio of B and C is 2:1. A has not sacrificed any share in profits after retirement of B and admission of D in his place.

Adjustment of D’s share of goodwill through existing partners’ capital accounts in the profit sacrificing ratio:

2. Capital of partners in the reconstituted firm :

Joint Life Policy

- A partnership firm can opt for a Joint Life Insurance Policy covering all partners.

- The firm pays the premium, and the policy amount is payable to the firm upon the death of any partner or at policy maturity, whichever occurs first.

- This policy aims to alleviate financial burdens when a large sum is due to the legal representatives of a deceased partner or a retiring partner.

Accounting Treatments for Joint Life Policy

The accounting for the premium paid and the Joint Life Policy can be handled in several ways:

1. Premium Treated as an Expense

- When the premium is considered an expense, it is closed every year by transferring it to the profit and loss account.

- In this case, the entire amount received from the insurance company, either on policy surrender or upon the death of a partner, is recognized as a gain.

Accounting Entries:

- On Payment of Premium: Debit Joint Life Policy Insurance Premium A/c and Credit Bank A/c.

- On Charging to Profit and Loss Account: Debit Profit and Loss Account and Credit Joint Life Policy Insurance Premium A/c.

- On Maturity of the Policy: Debit Insurance Company/Bank Account and Credit Partners’ Capital A/cs (individually), including the account of the representative of a deceased partner.

2. Premium Treated as an Asset

- In this approach, the insurance premium paid is first debited to the life policy account and credited to the bank account.

- At the end of the year, the amount exceeding the surrender value is treated as a loss and transferred to the Profit and Loss Account.

- When the amount received from the insurance company exceeds the surrender value, it results in a gain, which is transferred to the capital accounts of the partners in the profit-sharing ratio.

3. Creation of Joint Policy Reserve Account

- Under this method, the premium paid is debited to the policy account and credited to the bank account.

- At the end of the year, an amount equal to the premium is transferred from the Profit and Loss Appropriation Account to the Policy Reserve Account.

- Subsequently, the policy account is adjusted to its surrender value by debiting the life policy reserve account with the amount exceeding the surrender value.

- This method ensures that the policy account appears on the asset side and the policy reserve account on the liabilities side of the Balance Sheet until realization.

- Both accounts are presented in the Balance Sheet at the surrender value of the policy.

- Upon the death of a partner, the Joint Life Policy Reserve Account is transferred to the Joint Life Policy Account, and the balance is distributed to the Partners’ Capital Accounts.

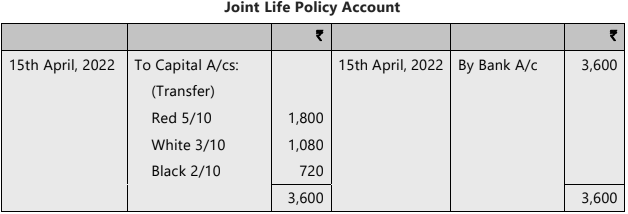

ILLUSTRATION 7

Red, White and Black shared profits and losses in the ratio of 5:3:2. They took out a joint life Policy in 2018 for ₹ 50,000, a premium of ₹ 3,000 being paid annually on 10th June. The surrender value of the policy on 31st December of various years was as follows: 2018 nil; 2019 ₹ 900; 2020 ₹ 2,000; 2021 ₹ 3,600. Black retires on 15th April, 2022.

Required:

Prepare ledger accounts assuming no Joint Life Policy Account is maintained.

SOLUTION

ILLUSTRATION 8

Red, White and Black shared profits and losses in the ratio of 5: 3: 2. They took out a Joint Life Policy in 2018 for ₹ 50,000, a premium of ₹ 3,000 being paid annually on 10th June. The surrender value of the policy on 31st December of various years was as follows: 2018 nil; 2019 ₹ 900: 2020 ₹ 2,000; 2021 ₹ 3,600.

Black retires on 15th April, 2022.

Required:

Prepare ledger accounts assuming Joint Life Policy Account is maintained on surrender value basis.

SOLUTION

ILLUSTRATION 9

A, B and C are in partnership sharing profits and losses at the ratio of 5:3: 2. The balance sheet of the firm on 31.12.2021 was as follows:

On 1.1.2022, A wants to retire, B and C agreed to continue at 2:1. Joint Life Policy was taken on 1.1.2017 for ₹ 1,00,000 and its surrender value as on 31.12.2021 was ₹ 25,000. For the purpose of A’s retirement goodwill was raised for ₹ 1,00,000. Sundry Fixed Assets was revalued for ₹ 1,10,000. But B and C did not prefer to show such an increase in assets in the balance sheet. Also they agreed to bring necessary cash to discharge 50% of the A’s claim, to make the bank balance ₹ 25,000 and to make their capital proportionate.

Required:

Prepare necessary journal entries to give the effect in capital accounts of partners.

SOLUTION

Working Notes:

Separate Life Policy

- Instead of having a joint life policy for all partners, each partner can take out individual life policies with the premium paid by the firm.

- Upon retirement, a retired partner is entitled to a proportionate amount from the life policies of all partners.

Example: Sona, Gabbu, and Amit are partners with a profit-sharing ratio of 3:1:1.

If Amit retire, then, Amit will get ₹60,000 x 1/5 = 12,500

ILLUSTRATION 10

Aarav, Nirav and Purav are partners in LLP sharing profits and losses in the ratio of 3:2:1. Their Balance Sheet as on 31st March, 2022 was as follows:

Purav retired from the business on 1st April 2022 on the following terms:

1. Goodwill was to be valued at 2 years purchase of average profit of past 3 years.

31st March, 2020 ₹ 41,000

31st March, 2021 ₹ 50,000

31st March, 2022 ₹ 55,000

2. Goodwill was not to be raised in the books of accounts.

3. Provision for Doubtful Debts was to be created on debtors at 5%.

4. Machinery is to be depreciated by 10% and stock is revalued at ₹ 71,000.

5. Building to be appreciated by 20%.

6. Aarav and Nirav to bring in additional capital of ` 35,000 and ` 25,000 respectively.

7. Balance payable to Purav must be paid immediately.

You are required to prepare:

1. Revaluation account

2. Partners capital accounts.

3. Bank account.

4. Balance Sheet after retirement.

SOLUTION

Working note :

Valuation of Goodwill (as per weight average method)

Weighted average profit (3,06,000/6) = 51,000Goodwill (2 years purchase) = 2 x 51,000 = ₹ 1,02,000

Purav’s share = 1/6th = 1,02,000/6 = 17,000Journal entry for adjustment of goodwill

ILLUSTRATION 11

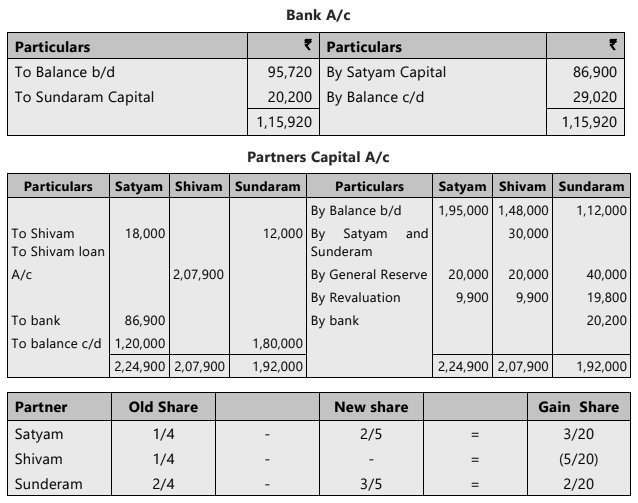

Satyam, Shivam & Sundaram are partners of M/s. Great Stationers sharing profits and losses in the ratio of 1:1:2.

On 31st March, 2022 their Balance Sheet was as under :

On 1st April 2022 Shivam retired on the following terms:

1. Goodwill is to be valued at ₹ 1,20,000 but the same will not appear as an asset in the books of the reconstituted firm.

2. Buildings is to be appreciated by 20% and Plant is to be depreciated by 10 %.

3. Investments are to be taken over by the Satyam in full settlement of his loan.

4. Provision of 5% is to be made on trade receivables to cover doubtful debts.

5. In the reconstituted firm, the total capital will be ₹ 3,00,000/- which will be contributed by Satyam and Sunderam in their new profit sharing ratio, which is 2:3.

6. The amount due to retiring partner shall be transferred to his loan account.

You are required to give journal entries to record above adjustments and also prepare Balance Sheet thereafter.

SOLUTION

Working Note:

ILLUSTRATION 12

On 31st March, 2022, the Balance Sheet of P, Q and R sharing profits and losses in proportion to their Capital stood as below:

On 1st April, 2022, P desired to retire from the firm and remaining partners decided to carry on the business. It was agreed to revalue the assets and liabilities on that date on the following basis:

(i) Land and Building be appreciated by 20%.

(ii) Plant and Machinery be depreciated by 30%.

(iii) Stock of goods to be valued at ₹ 10,000.

(iv) Old credit balances of Sundry creditors, ₹ 2,000 to be written back.

(v) Provisions for bad debts should be provided at 5%.

(vi) Unrecorded investment realised and cash obtained ₹ 7,550.

(vii) Goodwill of the entire firm is valued at ₹ 14,000 and P’s share of the goodwill is adjusted in the A/c’s of Q and R, who would share the future profits equally.

(viii) The total capital of the firm is to be the same as before retirement. Individual capital is in their profit sharing ratio.

(ix) Amount due to Mr. P is to be settled on the following basis:

50% on retirement and the balance 50% within one year.

Prepare (a) Revaluation account, (b) The Capital accounts of the partners, (c) Cash account and (d) Balance Sheet of the new firm M/s Q & R as on 1.04.2022.

SOLUTION

Working Notes:

Therefore, Q will bear – ¼ ⋅ 4000 or ₹ 1,000

R will bear = ¾ ⋅ 4000 or ₹ 3,000

|

68 videos|160 docs|83 tests

|

FAQs on Unit 4: Retirement of a Partner Chapter Notes - Accounting for CA Foundation

| 1. What is the gaining ratio in partnership accounting? |  |

| 2. How is the new profit-sharing ratio calculated after a partner retires? |  |

| 3. What factors should be considered while calculating the gaining ratio? |  |

| 4. Can the gaining ratio be negative? |  |

| 5. What is the significance of determining the gaining ratio in a partnership? |  |

|

Explore Courses for CA Foundation exam

|

|

Weighted average profit (3,06,000/6) = 51,000Goodwill (2 years purchase) = 2 x 51,000 = ₹ 1,02,000

Weighted average profit (3,06,000/6) = 51,000Goodwill (2 years purchase) = 2 x 51,000 = ₹ 1,02,000