Sources of Business Finance Chapter Notes | Business Studies (BST) Class 11 - Commerce PDF Download

| Table of contents |

|

| Introduction |

|

| Classification of Sources of Funds |

|

| Sources of Finance |

|

| Factors Affecting the Choice of Source of Funds |

|

Introduction

- This chapter gives an overview of the various sources from which funds can be obtained for starting and running a business.

- It discusses the advantages and limitations of different sources and highlights the factors that determine the choice of a suitable source of business finance.

- Knowing about the different sources of raising money is crucial for anyone looking to start a business.

- Understanding the relative merits and demerits of various sources is equally important to make an appropriate choice.

Meaning, Nature and Significance of Business Finance

Meaning of Business Finance

- Business finance refers to the funds necessary for carrying out various activities in a business. It is essential for the smooth functioning of any business organization.

- Finance is often called the "lifeblood" of business because without adequate funds, a business cannot operate effectively.

- The initial capital provided by an entrepreneur is usually not enough to meet all the financial requirements of a business. Therefore, business owners need to identify and secure additional sources of finance to meet their needs.

Importance of Business Finance

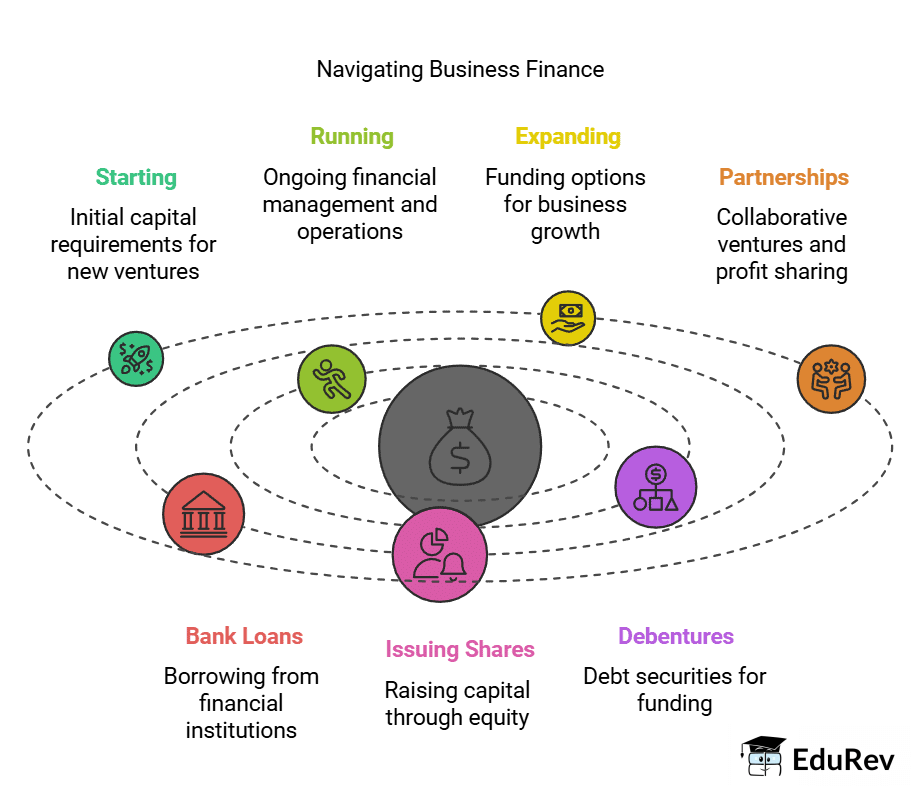

- Business finance is crucial for starting, running, and expanding. business. It involves assessing the financial needs of the business and identifying various sources of finance to meet those needs.

- Different methods of raising funds have their own advantages and limitations. The choice of financing method depends on factors such as the purpose and duration for which the funds are required.

- For example, in the case of Mr. Anil Singh, who wants to expand his successful restaurant business, he needs to consider various options such as partnerships, bank loans, issuing shares, or deb

- entures to raise the necessary funds. Each option has its own implications for profit sharing and control of the business.

Financial Needs of a Business

The financial needs of a business can be categorized into different types based on the purpose and timing of the funds required.

- Initial Funds: When an entrepreneur decides to start a business, certain funds are needed immediately for the purchase of fixed assets such as plant and machinery, furniture, and equipment.

- Operational Funds: Ongoing funds are necessary for day-to-day operations, including the purchase of raw materials, payment of salaries to employees, and other regular expenses.

- Expansion Funds: As a business grows, it requires additional funds for expansion and development, such as opening new branches, increasing production capacity, or diversifying into new products or services.

Example of Mr Anil Singh: In the case of Mr Anil Singh, who has been running a successful restaurant and wants to expand into a chain of restaurants, he needs to assess his financial requirements for both immediate and future needs. This includes funds for setting up new locations, hiring additional staff, and marketing the new outlets.

Fixed Capital Requirements

- Starting a business requires funds to purchase fixed assets such as land, buildings, machinery, and furniture. This is known as fixed capital requirement.

- Fixed assets remain invested in the business for a long time. Different businesses need varying amounts of fixed capital depending on factors like the nature of the business.

- For example, a trading business may require less fixed capital compared to a manufacturing business. Similarly, large enterprises need more fixed capital than small ones.

Working Capital Requirements

- Working capital refers to the funds necessary for day-to-day operations, including current assets like materials, bills receivable, and expenses such as salaries, wages, taxes, and rent.

- The amount of working capital needed varies from one business to another based on factors like sales turnover and credit policies. For instance, a business selling on credit or with slow sales turnover requires more working capital than one selling for cash or with a fast turnover.

- As a business grows and expands, the need for both fixed and working capital increases. There may be times when additional funds are necessary for upgrading technology, building higher inventories, meeting current debts, expanding, or relocating.

- Therefore, it is crucial to evaluate different sources from which funds can be raised.

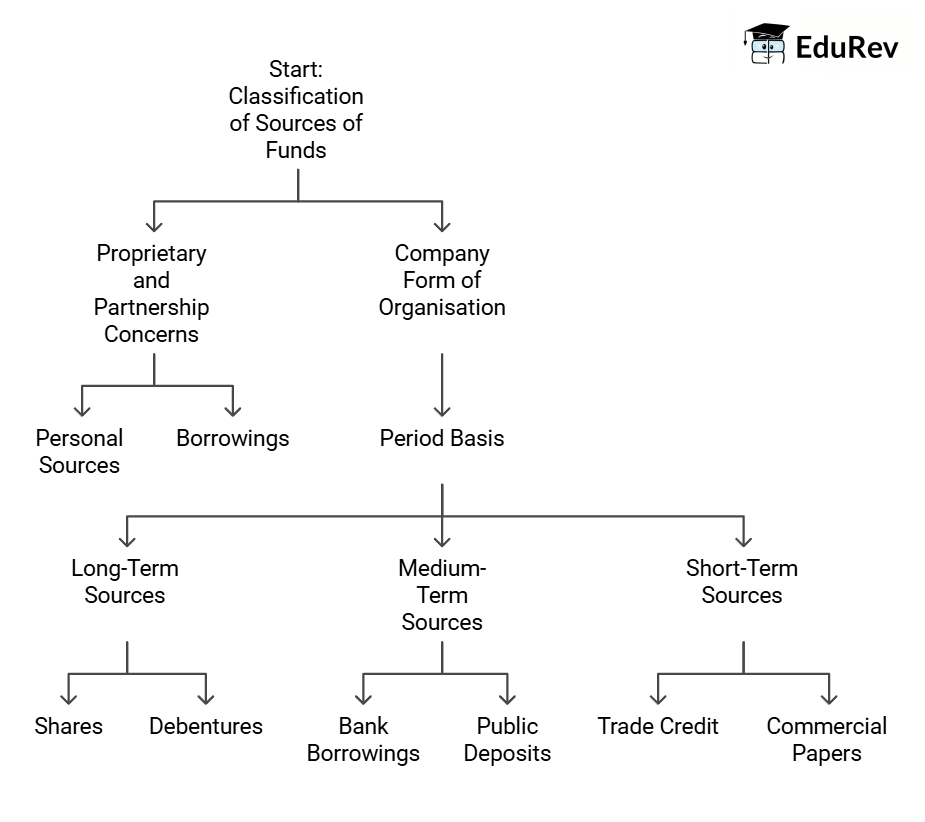

Classification of Sources of Funds

- Proprietary and Partnership Concerns: Funds can be raised from personal sources or through borrowings from banks, friends, etc.

- Company Form of Organisation: Different sources of business finance can be categorized based on period, source of generation, and ownership.

Period Basis

Long-Term Sources

- Duration: Exceeding 5 years

- Examples: Shares, debentures, long-term borrowings, loans from financial institutions

- Purpose: Acquisition of fixed assets such as equipment and plant

Medium-Term Sources

- Duration: More than 1 year but less than 5 years

- Examples: Borrowings from commercial banks, public deposits, lease financing, loans from financial institutions

- Purpose: Financing needs for a medium duration

Short-Term Sources

- Duration: Not exceeding 1 year

- Examples: Trade credit, loans from commercial banks, commercial papers

- Purpose: Financing current assets such as accounts re

- ceivable and inventories

Ownership Basis

Owner’s Funds

- Definition: Funds provided by the owners of an enterprise, including sole traders, partners, or shareholders of a company

- Components: Capital contributed by owners and profits reinvested in the business

- Characteristics: The owner’s capital remains invested for the long term and is not required to be refunded during the business’s life. Forms the basis for owners' control over management.

- Examples: Issue of equity shares and retained earnings

Borrowed Funds

- Definition: Funds raised through loans or borrowings

- Sources: Loans from commercial banks, loans from financial institutions, issue of debentures, public deposits, trade credit

- Characteristics: Funds are provided for a specified period, on certain terms and conditions, and must be repaid after the expiry of the period. A fixed rate of interest is paid by the borrowers.

Businesses often require short-term financing during the gap between seasons. Wholesalers and manufacturers with a significant portion of their assets tied up in inventories or receivables also need substantial funds for a short duration.

However, relying on borrowed funds can be burdensome, as interest payments are required even during periods of low earnings or losses. Typically, borrowed funds are secured against fixed assets.

Source of Generation Basis

- Funds can be categorized based on whether they are generated internally within the organization or sourced externally.

- Internal sources of funds are those generated from within the business, such as:

1. accelerating the collection of receivables

2. selling surplus inventories

3. reinvesting profitsHowever, internal sources can only meet the limited needs of the business. - External sources of funds include:

1. suppliers

2. lenders

3. investorsWhen large amounts of money are needed, external sources are typically used, although they may be more costly than internal sources. - In some cases, businesses may need to mortgage their assets as security when obtaining funds from external sources.

- Common examples of external sources of funds include: issuing debentures, borrowing from commercial banks and financial institutions as well as accepting public deposits.

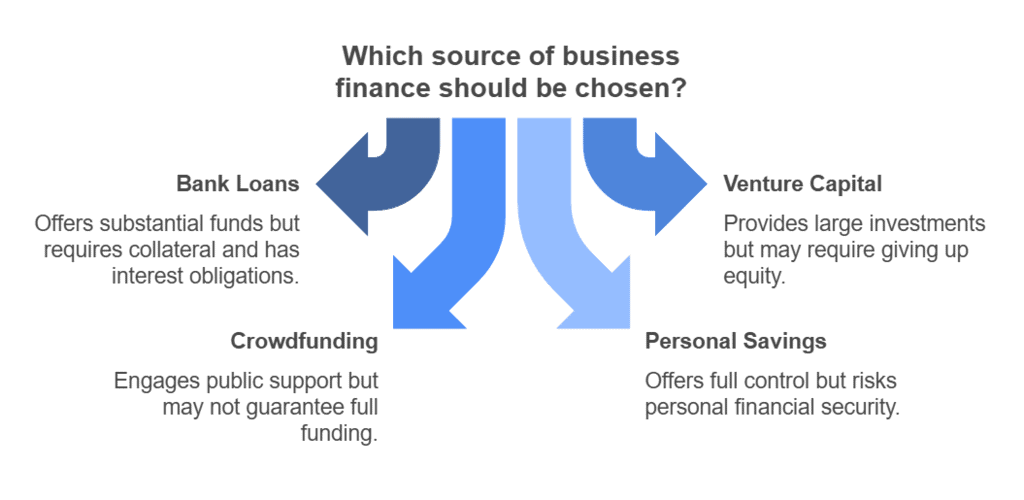

Sources of Finance

A business can obtain funds from various sources, each with its own unique characteristics. It's important to understand these differences to identify the best source for raising funds. There isn't a one-size-fits-all solution; the choice of funding source depends on factors like the situation, purpose, cost, and associated risk. For instance, if a business needs to finance fixed capital requirements, it may require long-term funds, which can be raised through owned or borrowed funds. On the other hand, for day-to-day operational needs, short-term sources may be more appropriate. Here’s a brief overview of various sources of finance along with their advantages and limitations.

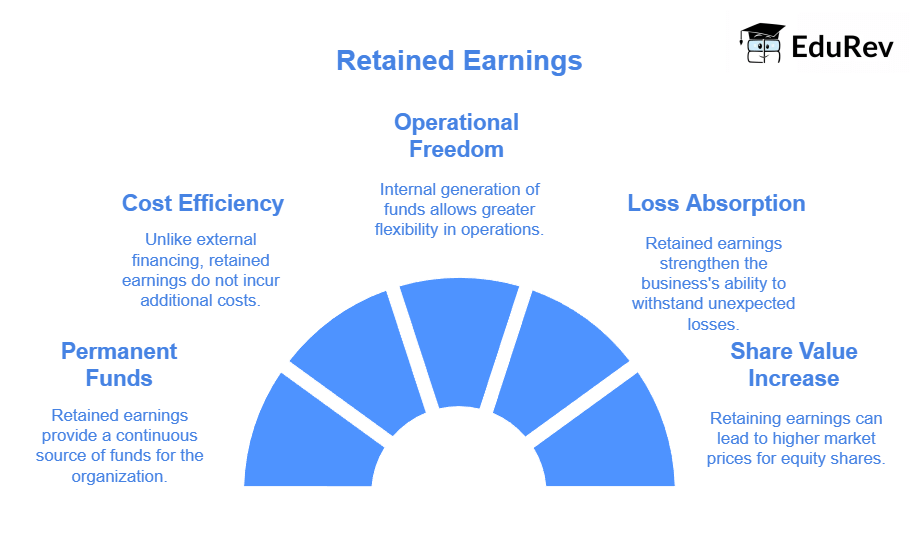

Retained Earnings

Meaning of Retained Earnings

- When a company earns profits, it doesn’t always distribute all of it to shareholders as dividends. Instead, a portion of these profits may be kept in the business for future use. This practice is known as retained earnings.

- Retained earnings represent a source of internal financing, also referred to as self-financing or “ploughing back of profits.”

- The amount of profit available for reinvestment in an organization depends on factors like net profits, dividend policy, and the age of the organization.

Merits of Retained Earnings

- Permanent Source of Funds: Retained earnings provide a lasting source of funds for an organization.

- No Explicit Costs: Unlike external financing, retained earnings do not incur costs such as interest, dividends, or flotation costs.

- Operational Freedom: Since the funds are generated internally, there is greater operational flexibility and freedom.

- Loss Absorption: Retained earnings enhance the capacity of the business to absorb unexpected losses.

- Increased Share Value: Retaining earnings may lead to an increase in the market price of the company’s equity shares.

Limitations of Retained Earnings

- Shareholder Dissatisfaction: Excessive ploughing back of profits may lead to dissatisfaction among shareholders who receive lower dividends.

- Uncertainty: Retained earnings are uncertain as business profits can fluctuate.

- Opportunity Cost: The opportunity cost associated with retained earnings is often not recognized, leading to potential suboptimal use of funds.

Trade Credit

Meaning of Trade Credit

- Trade credit refers to the credit extended by one trader to another for the purchase of goods and services.

- It allows businesses to acquire supplies without making immediate payments, facilitating short-term financing.

- Trade credit is recorded by the buyer as “sundry creditors” or “accounts payable.”

Characteristics of Trade Credit

- Granting Criteria: Trade credit is typically granted to customers with a reasonable financial standing and goodwill.

- Determining Factors: The volume and period of credit extended depend on factors such as the purchasing firm’s reputation, the seller’s financial position, volume of purchases, past payment record, and market competition.

- Variability: Terms of trade credit may vary between industries and individuals. A firm may also offer different credit terms to different customers.

Merits of Trade Credit

Trade credit offers several advantages, including:

- Convenience and Continuity: Trade credit is a convenient and continuous source of funds.

- Readily Available: Trade credit can be readily available if the seller knows the creditworthiness of the customers.

- Sales Promotion: Trade credit helps promote the sales of an organization.

- Inventory Financing: Organizations can use trade credit to finance an increase in inventory levels in anticipation of rising sales.

- No Asset Charge: Trade credit does not create any charge on the assets of the firm while providing funds.

Limitations of Trade Credit

Despite its benefits, trade credit has certain limitations:

- Overtrading Risk: Easy and flexible trade credit facilities may lead a firm to overtrade, increasing risks.

- Limited Funds: Only a limited amount of funds can be generated through trade credit.

- Costly Source: Trade credit is generally a more expensive source of funds compared to other options.

Factoring

Definition: Factoring is a financial service where a 'factor' provides various services, including:

- Discounting bills (with or without recourse) and collecting the client's debts.

- Selling receivables from the sale of goods or services to the factor at a discount.

Types of Factoring: There are two methods of factoring:

- Recourse Factoring: The client is not protected against bad debts.

- Non-Recourse Factoring: The factor assumes the credit risk, and the client is paid the full invoice amount in case of bad debts.

Additional Services: Factors also provide information about the creditworthiness of prospective clients and consultancy services in finance and marketing.

Fees: The factor charges fees for the services rendered.

History in India: Factoring services emerged in India in the early nineties due to RBI initiatives.

Providers: Organizations offering factoring services include:

- SBI Factors and Commercial Services Ltd.

- Canbank Factors Ltd.

- Foremost Factors Ltd.

- State Bank of India

- Canara Bank

- Punjab National Bank

- Allahabad Bank

- Non-banking finance companies and other agencies.

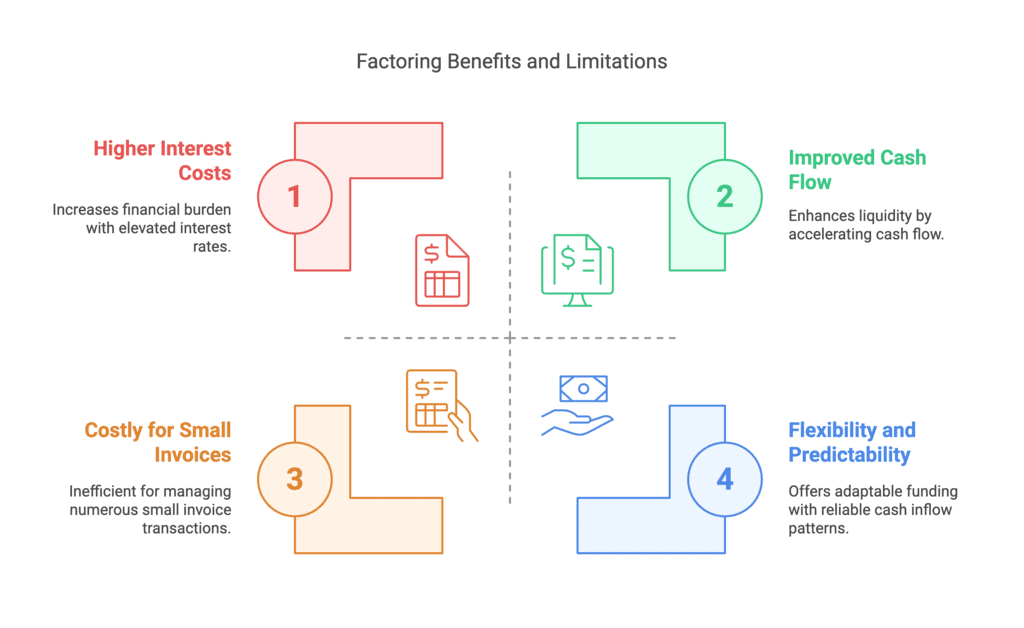

Merits of Factoring

- Cost-Effectiveness. Factoring is often cheaper than other financing methods like bank credit.

- Improved Cash Flow. Factoring accelerates cash flow, enabling clients to meet their liabilities promptly.

- Flexibility and Predictability. Factoring provides flexible funding and ensures a consistent pattern of cash inflows from credit sales.

- Security for Debt. It offers security for debts that a firm might struggle to obtain otherwise.

- No Asset Charges. Factoring does not create any charges on the firm’s assets.

- Focus on Core Business. Clients can concentrate on other business areas as the factor takes on credit control responsibilities.

Limitations of Factoring

- Costly for Small Invoices. Factoring can be expensive when dealing with numerous small invoices.

- Higher Interest Costs. Advancements in finance from the factor are usually available at a higher interest rate than normal.

- Third-Party Involvement. The factor acts as a third party, which may make customers uncomfortable.

Lease Financing

A lease is a legal agreement in which the owner of an asset (the lessor) allows another party (the lessee) to use the asset in exchange for regular payments. Essentially, it involves renting an asset for a specified period. The lessee pays a fixed amount, known as lease rental, to the lessor for the asset's use. The lease contract outlines the terms and conditions governing the arrangement. At the end of the lease period, the asset is returned to the lessor. Lease financing plays a crucial role in helping firms modernize and diversify. It is particularly common to acquire assets like computers and electronic equipment, which tend to become outdated quickly due to rapid technological advancements. When considering a leasing decision, it's important to compare the cost of leasing an asset with the cost of owning the same asset.

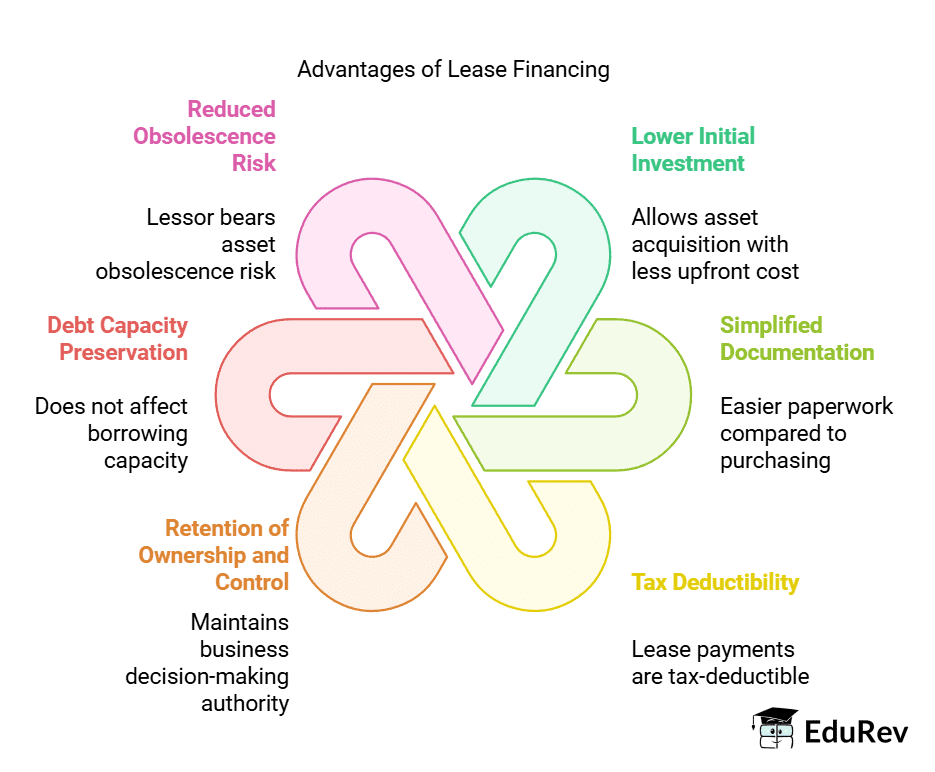

Merits of Lease Financing

The key advantages of lease financing include:

- Lower Initial Investment. Lease financing allows the lessee to acquire an asset with a lower upfront investment compared to purchasing it outright.

- Simplified Documentation. The documentation process for lease financing is typically straightforward, making it easier for businesses to finance assets.

- Tax Deductibility. Lease rentals paid by the lessee are tax-deductible, reducing the taxable profits of the lessee and providing potential tax benefits.

- Retention of Ownership and Control. Lease financing enables businesses to obtain financing without diluting ownership or control of the business. This is particularly beneficial for maintaining decision-making authority and strategic control.

- Debt Capacity Preservation. The lease agreement does not impact the enterprise's debt-raising capacity. This means that businesses can still raise funds through other means without being hindered by the lease obligation.

- Reduced Obsolescence Risk. The risk of asset obsolescence is borne by the lessor. This arrangement provides greater flexibility to the lessee, allowing them to replace the asset

- more easily when it becomes outdated or no longer meets their needs.

Limitations of Lease Financing

Lease financing, while beneficial in many ways, comes with several limitations that potential lessees should be aware of:

- Restrictions on Asset Use:. lease agreement may impose certain restrictions on how the lessee can use the asset. For instance, the lessee might not be allowed to make any alterations or modifications to the asset during the lease term.

- Premature Termination Costs: If the leased equipment becomes unsuitable for the lessee's needs and they choose to terminate the lease agreement early, it can result in higher payout obligations. This can be a significant financial burden for the lessee.

- Impact on Business Operations: The lessee's normal business operations may be adversely affected if the lease is not renewed at the end of the term. This can lead to disruptions and potential losses for the business.

- Ownership and Residual Value: One of the key drawbacks of lease financing is that the lessee never becomes the owner of the asset. This means that the lessee is deprived of the residual value of the asset at the end of the lease term, which can be a missed financial opportunity.

The Lessors

1. Specialized leasing companies: There are around 400 large companies in India that focus specifically on leasing and are known as leasing companies. These companies specialize in providing lease financing for various assets.

2. Banks and bank subsidiaries: In February 1994, the Reserve Bank of India (RBI) permitted banks to engage directly in leasing activities. Before this, only bank subsidiaries were allowed to participate in leasing, as the RBI considered it a non-banking activity. This move opened up the banking sector to leasing operations.

3. Specialized financial institutions: Various financial institutions, both at the Central and State levels in India, utilize leasing as a financial instrument alongside traditional financing methods. ICICI, for example, is recognized as a pioneer in the Indian leasing industry.

4. Manufacturer-lessors: As competition drives manufacturers to add value to their products, leasing has become an attractive sales option for them. Vendor leasing is gaining popularity, with manufacturers of automobiles, consumer durables, and other products forming alliances or joint ventures with leasing companies to offer lease financing for their products.

The Lessees

1. Public sector undertakings: There has been significant growth in lease financing among public sector undertakings in India. Both centrally and state-owned entities are increasingly resorting to lease financing as a viable option.

2. Mid-market companies: Mid-market companies, which have good creditworthiness but lower public profiles, are turning to lease financing as an alternative to traditional bank or institutional financing. Lease financing offers them flexibility and access to funds.

3. Consumers: Following negative experiences with corporate financing, there has been a shift towards retail funding of consumer durables. Car leasing, for example, has become a significant market in India, with consumers opting for lease agreements to finance their vehicle purchases.

4. Government departments and authorities: Government entities have recently entered the leasing market, with departments such as the Department of Telecommunications leading the way. The central government, for instance, has issued tenders for lease financing worth approximately ₹1000 crores, demonstrating its involvement in lease financing initiatives.

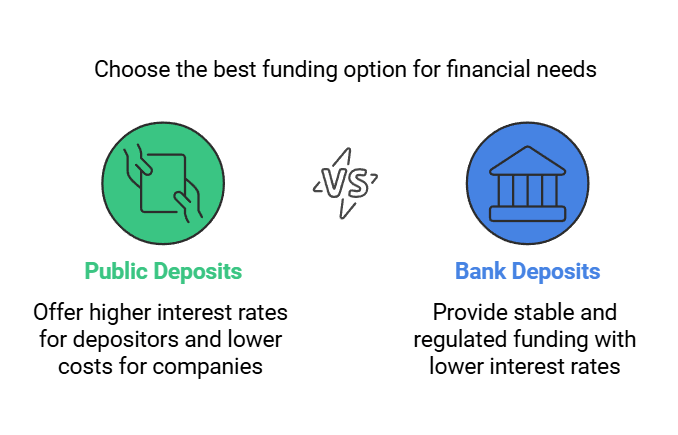

Public Deposits

Public deposits refer to the funds raised by organizations directly from the public. These deposits usually offer higher interest rates compared to bank deposits. Individuals interested in depositing money in an organization can do so by filling out a prescribed form, and in return, the organization issues a deposit receipt as an acknowledgement of the debt.

Public deposits can address both the medium and short-term financial needs of a business. They are advantageous for both the depositors and the organization. Deposit holders receive a higher interest rate than what banks offer, while the cost of deposits for the company is lower than borrowing costs from banks. Typically, companies invite public deposits for a period of up to three years, and the acceptance of these deposits is regulated by the Reserve Bank of India.

Merits of Public Deposits:

- The process of obtaining public deposits is straightforward and lacks the restrictive conditions often found in loan agreements.

- Public deposits are usually less expensive than borrowing from banks and financial institutions.

Limitations of Public Deposits:

- New companies may face challenges in raising funds through public deposits.

- Public deposits can be an unreliable source of finance, as the public may not respond when the company needs money.

- Collecting public deposits can be difficult, especially when the required deposit size is large.

Commercial Paper

Commercial Paper (CP) is a short-term, unsecured financial instrument used by companies to raise funds. It is typically issued at a discount and sold to investors, such as banks, mutual funds, and other financial institutions. The maturity period of a CP usually ranges from a few days to a maximum of one year.

Key Features:

- Denomination: CPs are issued in denominations of Rs. 5 lakh or multiples thereof.

- Maturity: The maturity date of the CP should not exceed the validity period of the issuer's credit rating.

- Unsecured: CPs are sold on an unsecured basis, meaning they are not backed by collateral.

- Transferability: CPs are freely transferable, making them highly liquid instruments.

- Cost: The cost of issuing CPs is generally lower than that of commercial bank loans, providing a cost-effective source of funds for companies.

- Continuous Funding: CPs offer a continuous source of funds as their maturity can be tailored to the issuer's requirements. Maturing CPs can be repaid by issuing new ones.

Merits of Commercial Paper:

- Unsecured and Flexible: CPs are sold on an unsecured basis without restrictive conditions, offering flexibility to issuers.

- High Liquidity: Being freely transferable, CPs have high liquidity, making them attractive to investors.

- Cost-Effective: The cost of CPs is generally lower than that of commercial bank loans, providing issuers with a cost-effective source of funds.

- Continuous Source of Funds: CPs offer a continuous source of funds as their maturity can be tailored to the issuing firm’s requirements. Maturing CPs can be repaid by issuing new ones.

- Investment Opportunity: Companies can park their excess funds in CPs, earning a good return on their surplus liquidity.

Limitations of Commercial Paper:

- Creditworthiness: Only financially sound and highly rated firms can raise money through CPs. New and moderately rated firms may not be able to access this funding method.

- Liquidity Constraints: The amount that can be raised through CPs is limited to the excess liquidity available with fund suppliers at a given time.

Issue of Shares

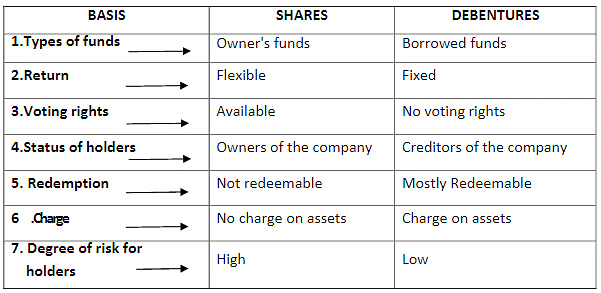

(a) Equity Shares

- Definition: Equity shares are the primary means by which a company raises long-term capital. They represent ownership in the company and are often referred to as ownership capital or owner’s funds.

- Ownership Rights: Shareholders who hold equity shares are considered residual owners of the company. This means they have a claim on the company’s profits after all other expenses and obligations have been met.

- Dividends: Unlike preference shareholders, equity shareholders do not receive a fixed dividend. Instead, they are paid dividends based on the company’s earnings and the board of directors’ decisions.

- Prerequisite for Company Formation: Equity share capital is essential for the creation of a company. It provides the necessary funds to start and operate the business.

- Residual Claim: Equity shareholders are called residual owners because they receive what is left after all other claims on the company’s assets and profits have been settled. This gives them a higher risk but also the potential for higher rewards.

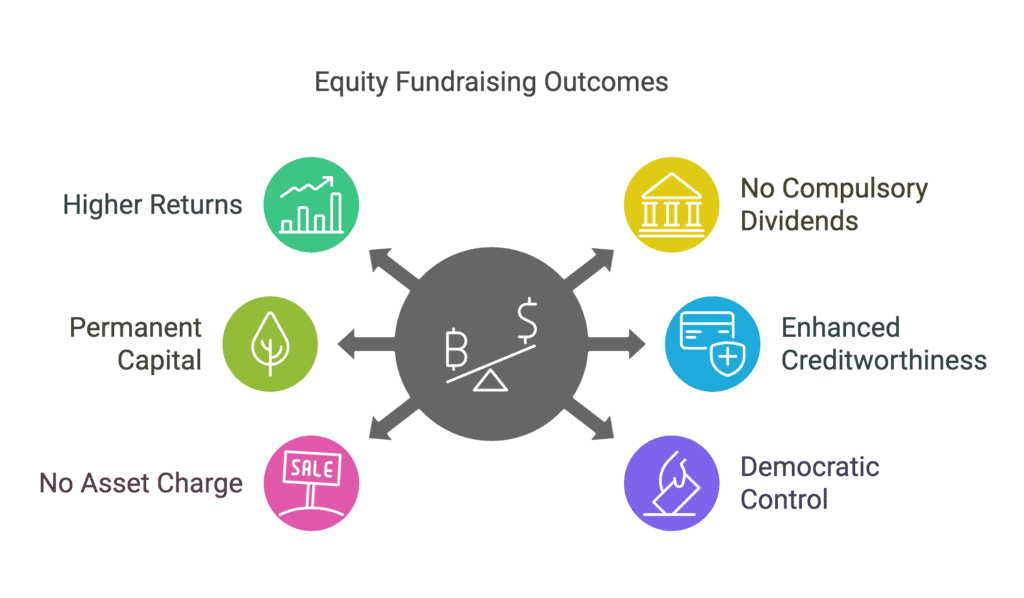

Merits of Raising Funds through Equity Shares:

- Higher Returns: Equity shares are suitable for investors who are willing to take on risk in exchange for the potential of higher returns.

- No Compulsory Dividends: Companies are not obliged to pay dividends to equity shareholders. This flexibility reduces the financial burden on the company.

- Permanent Capital: Equity capital is considered permanent since it is repaid only during the liquidation of the company. This provides a safety net for creditors.

- Creditworthiness: Equity capital enhances the creditworthiness of the company, instilling confidence in potential lenders and investors.

- No Asset Charge: Funds raised through equity issuance do not create a charge on the company’s assets. This allows the company to mortgage its assets for additional borrowing if needed.

- Democratic Control: The voting rights of equity shareholders ensure democratic control over the management of the company.

Limitations of Raising Funds through Equity Shares:

- Fluctuating Returns: Equity shares may not appeal to investors seeking steady income, as their returns can fluctuate significantly.

- Higher Cost: The cost of raising funds through equity shares is often higher compared to other sources of finance.

- Dilution of Voting Power: Issuing additional equity shares dilutes the voting power and earnings of existing equity shareholders.

- Procedural Delays: Raising funds through equity shares involves more formalities and procedural delays compared to other methods.

(b) Preference Shares

The capital raised by issue of preference shares is called preference share capital.

Types of Preference Shares

- Cumulative Preference Shares: These shares allow the accumulation of unpaid dividends to be carried forward to future years if they are not paid in a particular year.

- Non-Cumulative Preference Shares: In contrast, non-cumulative shares do not accumulate unpaid dividends. If a dividend is not paid in a specific year, it is not carried forward.

- Participating Preference Shares: These shares have the right to participate in the company's surplus profits after a certain rate of dividend has been paid on equity shares.

- Non-Participating Preference Shares: Non-participating preference shares do not have the right to participate in the company's additional profits.

Merits of Preference Shares:

- Steady Income: Preference shares provide a relatively steady income stream in the form of a fixed rate of return. This makes them appealing to investors seeking safety and stability.

- Low-Risk Investment: For investors who prefer a fixed rate of return with lower risk, preference shares offer an attractive option.

- No Control Dilution: Since preference shareholders do not have voting rights, the control of equity shareholders over the company’s management remains intact.

- Potential for Higher Equity Dividends: Paying a fixed rate of dividend to preference shareholders can enable a company to declare higher dividends for equity shareholders during profitable periods.

- Preferential Repayment: In the event of liquidation, preference shareholders have a preferential right to repayment over equity shareholders, providing an added layer of security.

- No Asset Charge: Preference capital does not create any charge against the company’s assets, allowing for greater flexibility in asset management.

Limitations of Preference Shares:

- Not Suitable for High-Risk Investors: Preference shares may not be suitable for investors willing to take on higher risks in exchange for potentially higher returns.

- Dilution of Equity Claims: Preference capital dilutes the claims of equity shareholders over the company’s assets, which may be a concern for equity investors.

- Higher Dividend Rates: The rate of dividend on preference shares is often higher than the interest rate on debentures, which can impact the company’s cost of capital.

- No Assured Return: Since dividends on preference shares are only paid when the company earns profits, there is no guaranteed return for investors. This may make preference shares less attractive to certain investors.

- Lack of Tax Deduction: Unlike interest payments on loans, dividend payments on preference shares are not deductible from profits as expenses. This means there is no tax saving associated with preference dividends.

What are Debentures?

Debentures are a crucial tool for companies looking to raise long-term debt capital. When a company issues debentures, it is essentially borrowing money from investors, promising to pay back the principal amount at a future date, along with a fixed rate of interest. Debenture holders become creditors of the company and are entitled to receive interest payments at specified intervals, usually every six months or annually.

Importance of Credit Rating

- Public issues of debentures need to be rated by credit rating agencies like CRISIL.

- The rating assesses the company’s track record, profitability, debt servicing ability, creditworthiness, and the risk involved in lending to the company.

- Companies can issue various types of debentures, including Zero Interest Debentures (ZIDs).

- ZIDs do not have a stated interest rate; instead, the return to investors is the difference between the debenture's face value and its purchase price.

Advantages of Debentures

- Fixed Income with Lower Risk: Investors prefer debentures for stable, fixed income with lower risk.

- Fixed Charge Funds: Debentures are fixed charge funds and do not share in the company's profits.

- Stability: Suitable for companies with stable sales and earnings.

- Control: Debentures do not carry voting rights, so they do not dilute equity shareholders' control.

- Cost-Effectiveness: Financing through debentures is cheaper than preference or equity capital because interest payments are tax-deductible.

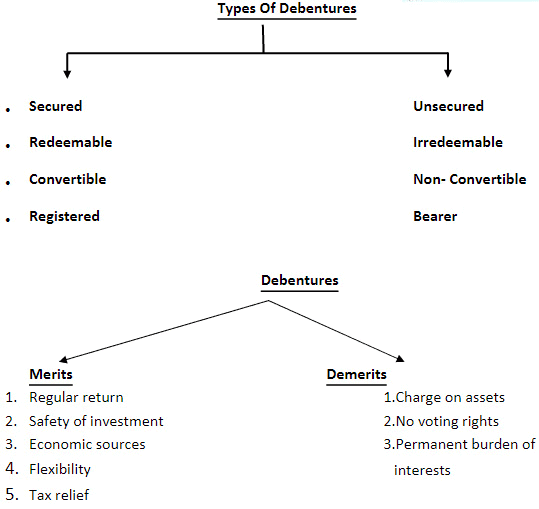

Types of Debentures

Debentures are a type of debt instrument used by companies to raise funds. They can be categorized based on various criteria:

- Secured and Unsecured: Secured debentures are backed by a charge on the company’s assets, which means the assets are mortgaged to secure the debenture holders. Unsecured debentures, on the other hand, do not have any such security on the company’s assets.

- Registered and Bearer: Registered debentures are recorded in the company’s register of debenture holders and can only be transferred through a formal instrument of transfer. Bearer debentures, however, are transferable by mere delivery, meaning they can be passed on without any formalities.

- Convertible and Non-Convertible: Convertible debentures can be converted into equity shares of the company after a specified period, while non-convertible debentures cannot be converted into equity shares.

First and Second Debentures

- First Debentures: These are debentures that are repaid before other debentures. They prioritise repayment over other debentures.

- Second Debentures: These debentures are repaid after the first debentures have been paid back. They have a lower priority in repayment compared to first debentures.

Commercial banks are a common source of finance for firms, particularly for medium to short-term periods. However, before a loan is sanctioned, the borrower is required to provide some security or create a charge on the assets of the firm.

Difference between Shares and Debentures

Commercial Banks

- Commercial banks occupy a vital position as they provide funds for different purposes as well as for different time periods.

- Banks extend loans to firms of all sizes and in many ways, like, cash credits, overdrafts, term loans, purchase/discounting of bills, and issue of letters of credit.

- The rate of interest charged by banks depends on various factors such as the characteristics of the firm and the level of interest rates in the economy.

- The loan is repaid either in lump sum or in instalments.

Merits

- Timely Assistance: Banks offer timely support to businesses by providing funds exactly when needed.

- Confidentiality: The information shared by borrowers with banks is kept confidential, allowing businesses to maintain secrecy.

- Simplified Process: Unlike other sources, raising loans from banks does not require formalities like issuing a prospectus or underwriting, making it an easier option.

- Flexibility: Bank loans are flexible; the loan amount can be adjusted according to business needs, and repayments can be made in advance when funds are surplus.

Limitations

- Short-Term Availability: Funds are typically available for short periods, and extending or renewing them can be uncertain and challenging.

- Detailed Scrutiny: Banks conduct a thorough investigation of the company’s affairs and financial structure, often requiring security of assets and personal guarantees, making the process of obtaining funds more difficult.

- Stringent Terms: Banks may impose strict terms and conditions for granting loans, such as restrictions on the sale of mortgaged goods, which can hinder normal business operations.

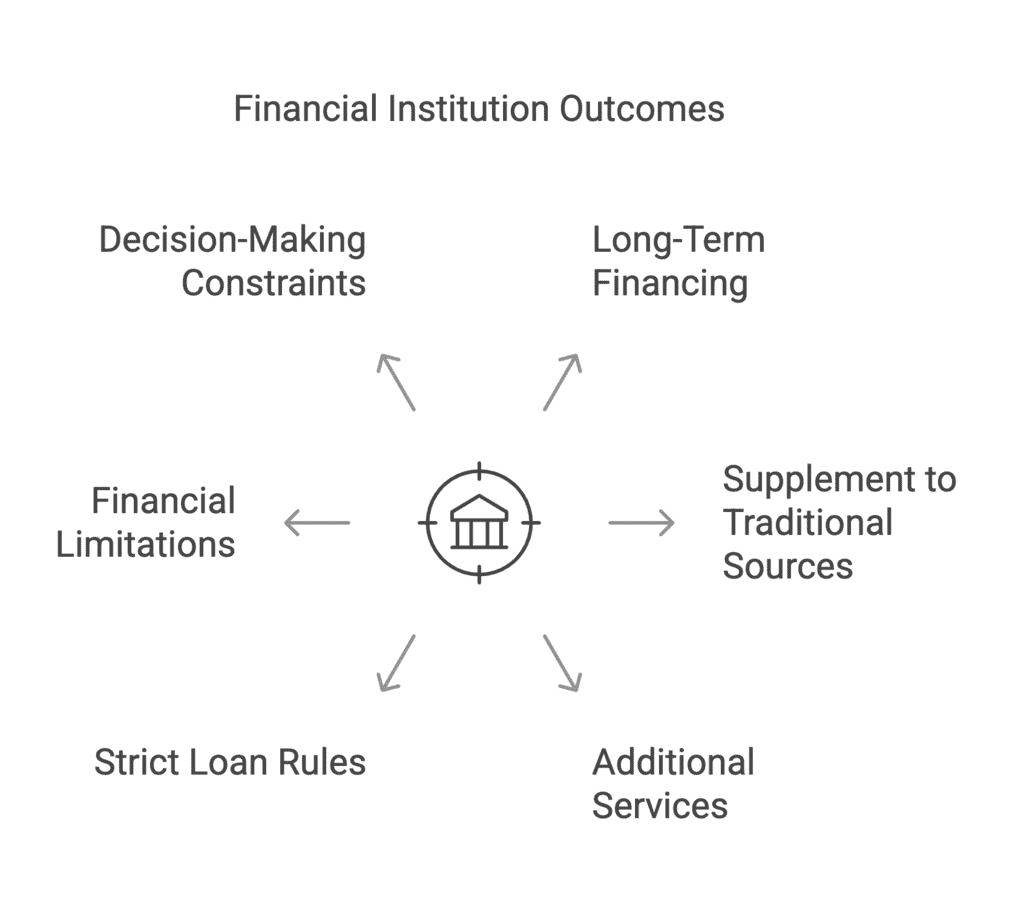

Financial Institutions

The government has set up various financial institutions across the country to provide finance to business organizations. These institutions, established by both central and state governments, offer owned capital and loan capital for long and medium-term requirements. They complement traditional financial agencies like commercial banks.

Often referred to as 'development banks' due to their focus on promoting industrial development, these institutions not only provide financial assistance but also conduct market surveys and offer technical and managerial support to enterprise operators. This source of financing is deemed suitable when large funds are needed for extended periods, particularly for expansion, reorganization, and modernization of an enterprise.

Merits

- Long-Term Financing: Financial institutions provide funds for long-term and medium-term needs, making them suitable for substantial projects.

- Supplement to Traditional Sources: They supplement traditional financial sources, ensuring a wider availability of funds.

- Additional Services: Besides financial support, these institutions offer market surveys, technical assistance, and managerial services, adding value to the financial assistance provided.

Limitations

- Financial institutions have strict rules when it comes to granting loans. The process involves many formalities, making it both time-consuming and costly.

- Certain limitations, like bans on dividend payments, are placed on the borrowing company by financial institutions, limiting their financial flexibility.

- Financial institutions may appoint their own representatives to the Board of Directors of the borrowing company, which can further limit the company's decision-making power.

Inter Corporate Deposits (ICD)

Inter Corporate Deposits (ICDs) are unsecured short-term deposits made by one company with another. The ICD market is utilized by large corporations for short-term cash management. According to Reserve Bank of India (RBI) guidelines, the minimum period for ICDs is 7 days, which can be extended up to one year.

Types of Inter-Corporate Deposits

- Three months deposits

- Six months deposits

- Call deposits

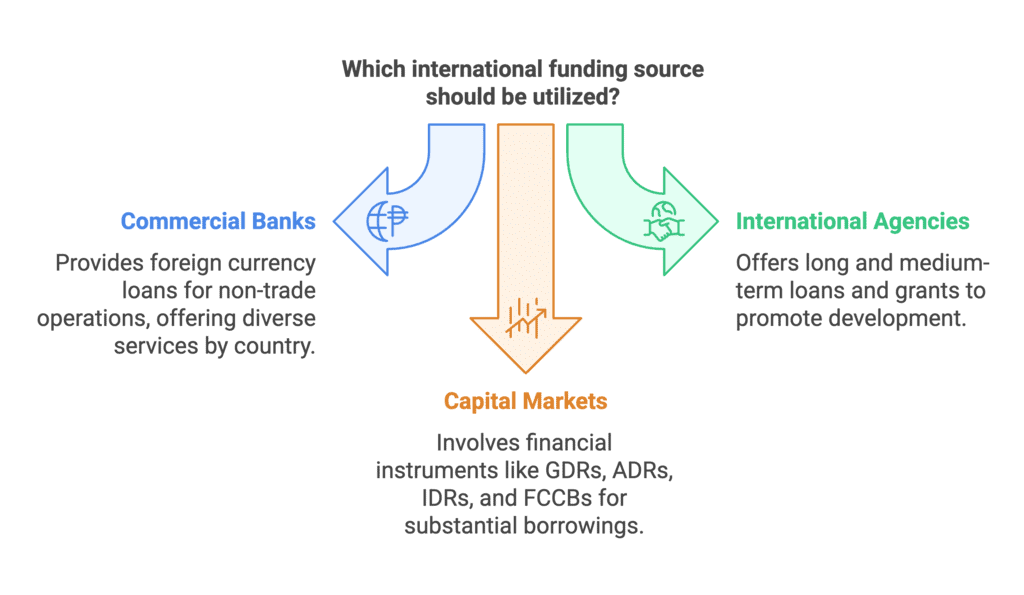

International Financing

With the globalization of economies and businesses, Indian companies now have access to funds from the global capital market. There are various international sources from where funds may be generated, including:

- Commercial Banks: Banks around the world offer foreign currency loans for business purposes, making them a crucial source of financing for non-trade international operations. The types of loans and services provided by banks vary by country. For instance, Standard Chartered has become a significant provider of foreign currency loans to Indian industries.

- International Agencies and Development Banks: Various international agencies and development banks have been established to finance international trade and business, offering long and medium-term loans and grants to promote development in economically disadvantaged areas. Notable organizations include the International Finance Corporation (IFC), EXIM Bank, and the Asian Development Bank.

- International Capital Markets:Modern organizations, including multinational companies, rely on substantial borrowings in both rupees and foreign currencies. Prominent financial instruments used for this purpose include:

(a) Global Depository Receipts (GDRs): These are issued by depository banks against local currency shares of a company. The depository bank issues receipts denominated in US dollars, which can be traded freely like any other security. In the Indian context, GDRs are instruments issued abroad by Indian companies to raise funds in foreign currency, listed and traded on foreign stock exchanges. Holders of GDRs do not have voting rights but are entitled to dividends and capital appreciation. Indian companies such as Infosys, Reliance, Wipro, and ICICI have raised funds through GDRs.

(b) American Depository Receipts (ADRs): Similar to GDRs, ADRs are issued by companies in the USA and can be bought and sold in American markets like regular stocks. They can only be issued to American citizens and listed and traded on US stock exchanges.

(c) Indian Depository Receipts (IDRs):An IDR is a financial instrument issued in Indian Rupees, similar to a global depository receipt. It is created by an Indian Depository to allow foreign companies to raise funds from the Indian securities market. The foreign company deposits shares with an Indian Depository, which then issues receipts to Indian investors. IDR holders benefit from the underlying shares and receive perks like bonuses and dividends. According to SEBI guidelines, IDRs are issued to Indian residents in the same manner as domestic shares. The first IDR in the Indian securities market was issued by Standard Chartered PLC in June 2010.

(d) Foreign Currency Convertible Bonds (FCCBs):FCCBs are debt securities linked to equity, giving holders the option to convert them into equity shares or depository receipts after a specified period. Holders can choose to convert their bonds into equity at a predetermined price or exchange rate or retain the bonds until maturity.

Companies Increasingly Opt for GDR Issues

- There is a notable increase in companies, particularly small and medium-sized enterprises, turning to the overseas market to raise funds through Global Depository Receipts (GDRs).

- GDR offerings have seen a significant rise, with five firms already raising $464 million in the current year, which is almost double the amounts raised in previous years.

GDR Trends and Comparisons

- The amount raised through GDRs this year is compared to past years, showing a substantial increase:

1. $228.6 million raised by nine companies in 2004

2. $63.09 million was mobilised by four companies in 2003 - Nearly 20 companies are preparing to launch GDR issues worth over $1 billion in the coming months.

FCCB Market

- Although the number of companies opting for FCCB issues has decreased, some companies continue to pursue this route due to relaxed rules and disclosure norms.

- For instance, Aarti Drugs Ltd. plans to raise $12 million by issuing FCCBs.

Shift in Preference: GDR vs. FCCB

- There is a noticeable shift in preference from FCCB to GDR issues, driven by rising interest rates abroad.

- Companies like Opto Circuits are choosing GDR issues for relatively small amounts, such as $20 million with a green-shoe option of $5 million.

Upcoming GDR Issues

- Several companies are planning GDR issues, including Videocon Industries, Lyka Labs, Indian Overseas Bank, Jubilant Organosys, Maharashtra Seamless, Moschip Semiconductors, and Crew BOS.

- Banks like UTI Bank and Centurion Bank have also raised funds from the GDR market recently.

Factors Affecting the Choice of Source of Funds

Businesses have different types of financial needs, including long-term, short-term, fixed, and fluctuating needs. As a result, they use various sources to raise funds. While short-term borrowings can reduce costs by minimizing idle capital, long-term borrowings are often necessary for various reasons. Similarly, equity capital plays a crucial role in fundraising within the corporate sector.

Since no single source of funds is without limitations, it is advisable to use a combination of sources rather than relying on just one. Several factors influence the choice of this combination, making it a complex decision for businesses. The following are the key factors affecting the choice of source of finance:

- Cost: Consider both the cost of procuring funds and the cost of utilizing them when deciding on the source of funds.

- Financial Strength and Stability:. business's financial strength is crucial in determining its ability to repay borrowed funds. If earnings are unstable, fixed-charge funds like preference shares and debentures should be chosen carefully, as they increase financial burden.

- Form of Organisation and Legal Status: The type of business organization and its legal status influence the choice of funding source. For instance, a partnership firm cannot issue equity shares, which are only available to joint-stock companies.

- Purpose and Time Period: Plan according to the duration for which funds are needed. Short-term needs can be met through low-interest borrowing options like trade credit or commercial paper, while long-term financing may involve issuing shares or debentures. Additionally, match the source of funds with their intended use; for example, avoid financing long-term expansion plans with short-term loans.

- Risk Profile: Each source of finance carries a different level of risk. Equity finance is considered less risky because shareholders are paid only when the company winds up, and dividends are not mandatory if there are no profits. On the other hand, loans come with a strict repayment schedule for both principal and interest, regardless of the company’s profitability.

- Control: The source of funds can impact the control and power of the owners over the management of the firm. Issuing equity shares can dilute control since shareholders have voting rights. Financial institutions may also impose conditions or take control of assets as part of a loan agreement. Therefore, businesses should consider how much control they are willing to share when choosing a source of finance.

- Effect on Creditworthiness: The reliance on certain sources of finance can influence a business’s creditworthiness. For instance, issuing secured debentures may deter unsecured creditors from extending further loans, thus affecting the company’s credit standing.

- Flexibility and Ease: The flexibility and ease of obtaining funds can also affect the choice of source. For example, borrowing from banks and financial institutions may involve restrictive provisions, detailed investigations, and extensive documentation, making it less preferable compared to other readily available options.

- Tax Benefits: Different sources of finance offer varying tax benefits. Interest paid on debentures and loans is tax-deductible, while dividends on preference shares are not. Therefore, organizations seeking tax advantages may prefer sources that offer tax-deductible expenses.

|

38 videos|180 docs|28 tests

|

FAQs on Sources of Business Finance Chapter Notes - Business Studies (BST) Class 11 - Commerce

| 1. What are the primary classifications of sources of funds for a business? |  |

| 2. What are the common sources of finance available for businesses? |  |

| 3. What factors should a business consider when choosing a source of funds? |  |

| 4. How do market conditions affect the choice of source of finance for a business? |  |

| 5. What are the advantages and disadvantages of using equity financing as a source of funds? |  |