Short Answer Questions - National Income and Related Aggregates | Economics Class 12 - Commerce PDF Download

One Mark Questions

1. When will the domestic income be greater than the national income?

Ans: When the net factor income from abroad is negative.

2. What is national disposable income?

Ans. It is the income, which is available to the whole economy for spending or disposal NNP Mp + net current transfers from abroad = NDI

3. What must be added to domestic factor income to obtain national income?

Ans. Net factor income from abroad.

4. Explain the meaning of non-market activities

Ans. Non-marketing activities refer to the acquiring of many final goods and services, not through regular market transactions. E.g. vegetables are grown in the backyard of the house.

5. Define nominal GNP

Ans. GNP measured in terms of current market prices is called nominal GNP.

6. Define Real GNP.

Ans. GNP computed at constant prices (base year price) is called real GNP.

7. Meaning of real flow.

Ans. It refers to the flow of goods and services between different sectors of the economy. E.g.. Flow of factor services from household to firm and flow of goods and services from firm to household.

8. Define money flow.

Ans. It refers to the flow of money between different sectors of the economy such as firms, households etc. E.g. Flow of factor income from firm to household and consumption expenditure from household to firm.

9. What is depreciation?

Ans. Depreciation is the loss in the value of fixed capital due to normal wear and tear, foreseen obsolescence and normal rate of accidental damage. It is also known as consumption of fixed capital.

10. Distinguish between goods and services.

Ans. Goods are physical products, capable of being delivered to a purchaser. It involves the transfer of ownership from seller to buyer. For example: television, computers, cars, etc.

Services are all those economic activities essentially intangible that provide the satisfaction of wants and are not necessarily linked to the sale of a product. For example: transportation, banking, insurance, etc.

3- 4 Mark Questions

1. Distinguish between GDPMp and GNP FC.

Ans. The difference between both arises due to

1) Net factor income from abroad. and

2) Net indirect taxes. In GDPMp Net factor income from abroad is not included but it includes net indirect taxes.

GNP FC = GDPMp + net factor income from abroad – net indirect taxes

2. Distinguish between personal income and private income.

Ans. Personal income is the sum total of earned income and transfer incomes received by persons from all sources within and outside the country.

Personal income = private income – corporate tax –corporate savings (undistributed profit)

Private income consists of factor income and transfer income received from all sources by private sectors within and outside the country.

3. Distinguish between nominal GNP and real GNP.

Ans. Nominal GNP is measured at current prices. Since this aggregate measures the value of goods and services at current year prices, GNP will change when the volume of product changes or price changes or when both change.

Real GNP is computed at constant prices. Under real GNP, value is expressed in terms of prices prevailing in the base year. This measure takes only quantity changes. Real GNP is the indicator of real income level in the economy.

4. Explain the main steps involved in measuring national income through product methods.

Ans.

- Classify the producing units into industrial sectors like primary, secondary and tertiary sectors.

- Estimate the net value added at the factor cost.

- Estimate value of output by sales + change in stock

- Estimate gross value added by value of output – intermediate consumption

- Deduct depreciation and net indirect tax from gross value added at market price to arrive at net value added at factor cost = NDP Fc

- Add net factor income received from abroad to NDP Fc to obtain NNP FC which is the national income

5. Explain the steps involved in the calculation of national income through the income method.

Ans.

- Classify the producing enterprises into industrial sectors like primary, secondary and tertiary.

- Estimate the following factor income paid out by the producing units in each sector i.e.

*Compensation of employees

*Operating surplus

*Mixed income of self-employed - Take the sum of the factor income by all the industrial sectors to arrive at the NDP Fc(Which is called domestic income)

- Add net factor income from abroad to the net domestic product at factor cost to arrive at the net national product at factor cost.

6. Explain the main steps involved in measuring national income through the expenditure method.

Ans.

- Classify the economic units incurring final expenditure into distant groups like households, government, firms etc.

- .Estimate the following expenditure on final products by all economic units

a. Private final consumption expenditure

b. Government final consumption expenditure

c. Gross domestic capital formation

d. Net export

(Sum total of above gives GDPMp) - Deduct depreciation, and net indirect taxes to get NDP Fc

- Add net factor income from abroad to NDP Fc to arrive at NNP FC.

7. What are the precautions to be taken while calculating national income through the product method (value-added method).

Ans.

- Avoid double counting of production, take only the value added by each production unit.

- The output produced for self-consumption to be included

- The sale & purchase of second-hand goods should not be included.

- The value of intermediate consumption should not be included

- The value of services rendered in sales must be included.

8. Precautions to be taken while calculating national income through income method.

Ans.

- Income from owner-occupied house to be included.

- Wages & salaries in cash and kind are both to be included.

- Transfer income should not be included

- Interest on loans taken for production is only to be included. Interest on loan taken for consumption expenditure is non-factor income and so not included.

9. Precautions to be taken while calculations N.I under expenditure method.

Ans.

- Avoid double counting of expenditure by not including expenditure on intermediate product

- Transfer expenditure is not to be included

- Expenditure on the purchase of second-hand goods is not to be included.

10. Write down the limitations of using GDP as an index of the welfare of a country.

Ans. 1) The national income figures give no indications of the population, skill and resources of the country. A country may have high national income but it may be consumed by the increasing population so that the level of people’s well-being or welfare standard of living remains low.

2) High national income may be due to the greater area of the country or due to the concentration of some resources in our particular country.

3) National income does not consider the level of prices of the country. People may have income but may not be able to enjoy a high standard of living due to high prices.

4) High national income may be due to the large contribution made by a few industrialists

5) The level of unemployment is not taken into account.

6) National income does not care to reduce ecological degradation. Excess of economic activity which leads to ecological degradation reduces the welfare of the people.

Hence GNP and economic welfare are not positively related. Income in GNP does not bring about an increase in economic welfare.

11. ‘Machine purchased is always a final good’. Do you agree? Give a reason for your answer.

Ans. Whether the machine is a final good or it depends on how it is being used (end use). If the machine is bought by a household, then it is a final good. If the machine is bought by a firm for its own use, then also it is a final good. If the machine is bought by a firm for resale then it is an intermediate good.

12. What is double counting? How can it be avoided?

Ans. Counting the value of commodities at every stage of production more than one time is called double counting.

It can be avoided by

a) taking value-added method in the calculation of the national income.

b) By taking the value of the final commodity only while calculating national income.

13. Explain the circular flow with a two-sector economy.

Or

Explain the circular flow of income.

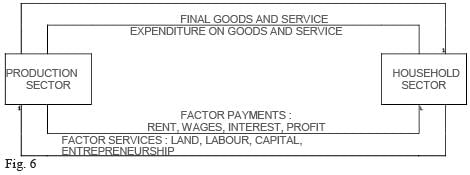

Ans. The circular flow with a two-sector economy can be explained with the help of the following diagram:

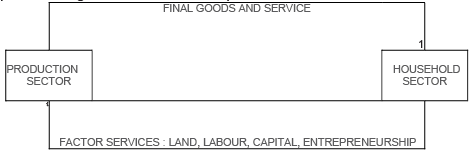

The above diagram shows the two sectors in the economy-the household sector and the production sector. The household sector has the endowment of factors of production (land, labour, capital and entrepreneurship) and it sells them to the production sector which produces goods and services by using these factor inputs. The production sector sells the goods and services it produces to the household sector. Thus, the output produced by the production sector is consumed by the household sector. It is called real flow, which involves the flow of goods and services.

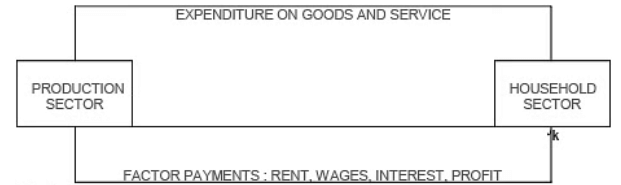

The production sector makes factor payments to the household sector in terms of wages for labour services, rent for land, interest for capital and profits to entrepreneurship. The household sector uses this income to incur expenditure on the purchase of consumer goods and services produced by the production sector. This flow of money payments and expenditures is known as money flow.

14. What is real flow and money flow?

Ans. Real flow refers to the flow of goods and services across different sectors in an economy. Households provide factors of production such as land, labour, capital and entrepreneurs to the firms. The firms, in turn, provide the goods and services so produced to the households.

Money flow refers to the flow of money value across different sectors in an economy. Factor incomes such as rent, wages, interest and profit flow from the production sector to the household sector and the payment for consumption of final goods and services or consumption expenditure flows from the household sector to the production sector.

|

64 videos|308 docs|51 tests

|

FAQs on Short Answer Questions - National Income and Related Aggregates - Economics Class 12 - Commerce

| 1. What is national income and why is it important? |  |

| 2. What are the different methods to calculate national income? |  |

| 3. What is the difference between Gross National Product (GNP) and Gross Domestic Product (GDP)? |  |

| 4. How do inflation and deflation affect national income? |  |

| 5. What role does government policy play in influencing national income? |  |