NCERT Solution (Part - 2) - Accounting Ratios | Additional Study Material for Commerce PDF Download

Page No.: 239

Numericals Questions:

Question 1: Current Ratio is 3.5:1 Working Capital is Rs 9,00,000. Calculate the amount of Current Assets and Current Liabilities.

Answer:

or, Current Assets = 3.5 Current Liabilities (1)

Working Capital = Current Assets - Current Liabilities

Working Capital = 90,000

or, Current Assets - Current Liabilities = 90,000

or, 3.5 Current Liabilities - Current Liabilities = 90,000 (from 1)

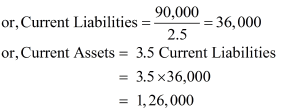

or, 2.5 Current Liabilities = 90,000

Question 2: Shine Limited has a current ratio 4.5:1 and quick ratio 3:1; if the stock is 36,000, calculate current liabilities and current assets.

Answer:

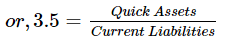

or, 4.5 Current Liabilities = Current Assets

or, 3 Current Liabilities = Quick Assets

Quick Assets = Current Assets- Inventory = Current Assets - 36,000

Current Assets − Quick Assets = 36,000

or, 4.5 Current Liabilities − 3 Current Liabilities = 36,000

or, 1.5 Current Liabilities = 36,000

or, Current Liabilities = 24,000

Current Assets = 4.5 Current Liabilities

or, Current Assets = 4.5 x 24,000

= 1,08,000

Note: The solution given in the book is incorrect as it from the given figures Current Assets is ascertained to be Rs 1,08,000 and Current Liabilities Rs 24,000.

Question 3: Current liabilities of a company are Rs 75,000. If current ratio is 4:1 and liquid ratio is 1:1, calculate value of current assets, liquid assets and inventory

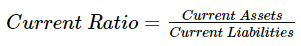

Answer: Current Ratio = Current Assets /Current Liabilities

or, 4 = Current Assets / 75,000

or, 4 × 75,000 = Current Assets

or, Current Assets = 3,00,000

Liquid Ratio = Liquid Assets / Current Liabilities

or, 1 = Liquid Assets / 75,000

Liquid Assets = 75,000

Inventory = Current Assets − Liquid Assets

= 3,00,000 − 75,000

= 2,25,000

Page No.: 240

Numericals Questions:

Question 1: Handa Ltd.has stock of Rs 20,000. Total liquid assets are Rs 1,00,000 and quick ratio is 2:1. Calculate current ratio.

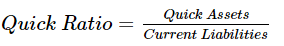

Answer: Quick Ratio = Quick Assets / Current Liabilities

or, 2 = 1,00,000 / Current Liabilities

or, Current Liabilities = 1,00,000 / 2

= 50,000

Current Assets = Liquid Assets + Inventory

= 1,00,000 + 20,000

= 1,20,000

Current Ratio = Current Assets / Current Liabilities

=1,20,000/ 50,000

=2.4/1= 2.4:1

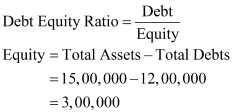

Question 2: Calculate debt equity ratio from the following information:

| Rs |

Total Assets | 15,00,000 |

Current Liabilities | 6,00,000 |

Total Debts | 12,00,000 |

Answer:

Long Term Depts = Total Depts - Current Liabilities

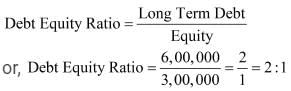

Question 3: Calculate Current Ratio if:

Inventory is Rs 6,00,000; Liquid Assets Rs 24,00,000; Quick Ratio 2:1.

Answer:

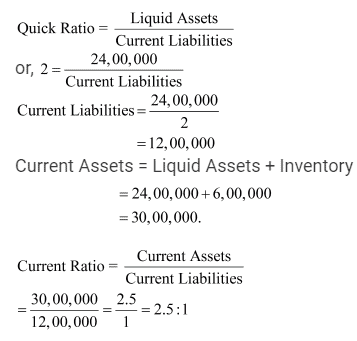

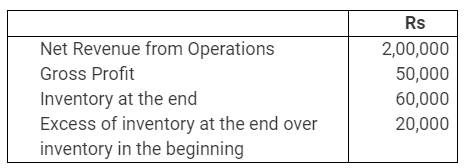

Question 4: Compute Stock Turnover Ratio from the following information:

Answer:

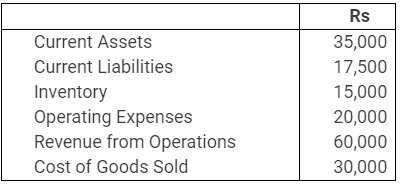

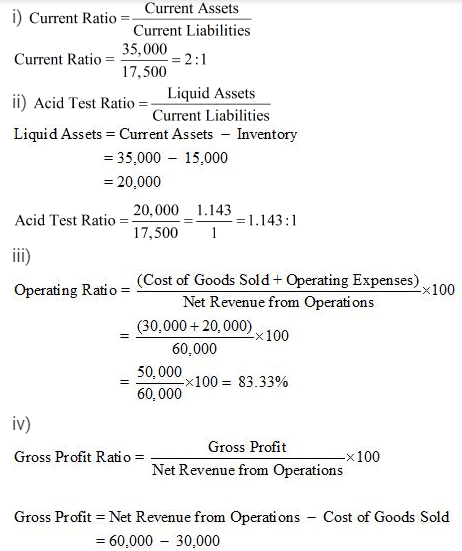

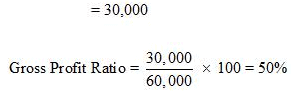

Question 5: Calculate following ratios from the following information:

(i) Current ratio (ii) Acid test ratio (iii) Operating Ratio (iv) Gross Profit Ratio

Answer:

Question 6: From the following information calculate:

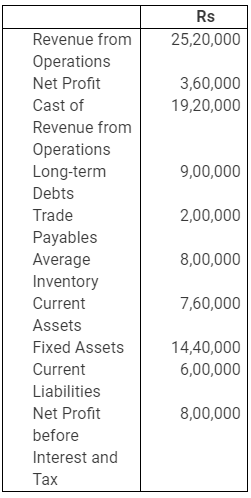

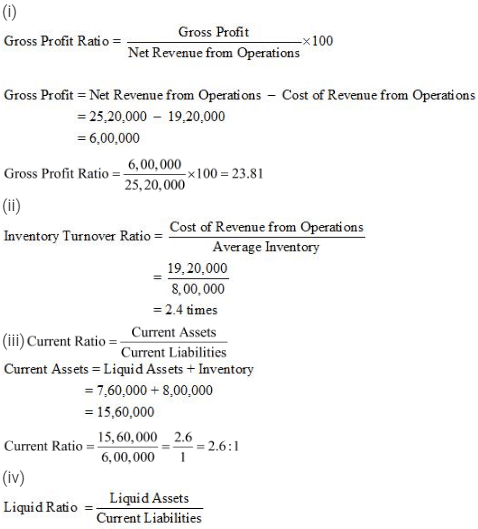

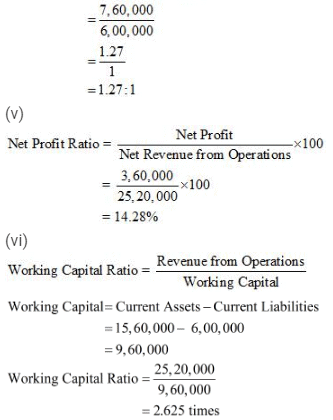

(i) Gross Profit Ratio (ii) Inventory Turnover Ratio (iii) Current Ratio (iv) Liquid Ratio (v) Net Profit Ratio (vi) Working capital Ratio:

Answer:

Note: There is a misprint in the question given in the textbook. The figure of Rs '760,000' represents the value of 'Liquid Assets' and not 'Current Assets'. The above solution has been worked out accordingly and the answer given as per the textbook is same as per the above solution.

Page No.: 241

Numericals Questions:

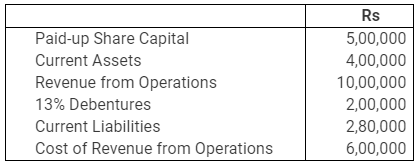

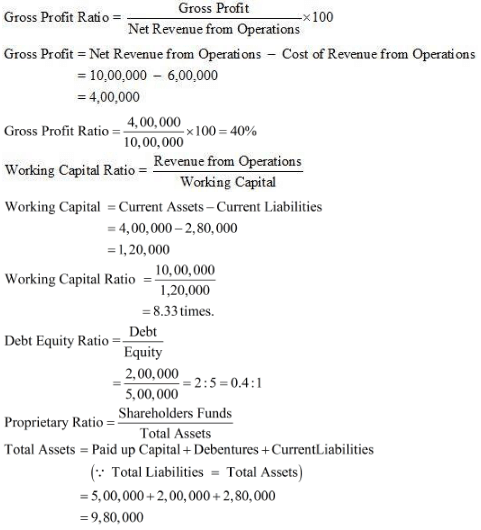

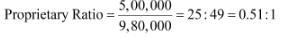

Question 1: Compute Gross Profit Ratio, Working Capital Turnover Ratio, Debt Equity Ratio and Proprietary Ratio from the following information:

Answer:

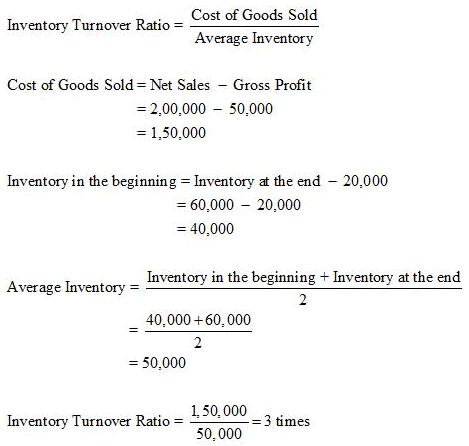

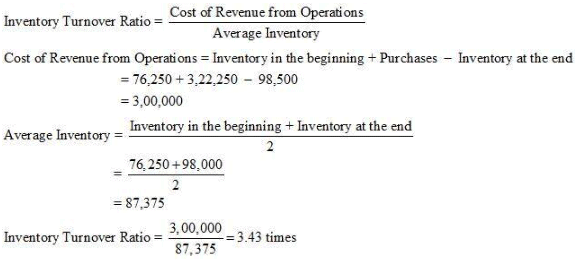

Question 2: Calculate Inventory Turnover Ratio if:

Inventory in the beginning is Rs 76,250, Inventory at the end is 98,500, Gross Revenue from Operations is Rs 5,20,000, Return Inwards is Rs 20,000, Purchases is Rs 3,22,250.

Answer:

|

4 videos|168 docs

|

FAQs on NCERT Solution (Part - 2) - Accounting Ratios - Additional Study Material for Commerce

| 1. What are accounting ratios and why are they important in commerce? |  |

| 2. How are accounting ratios calculated? |  |

| 3. What are the different types of accounting ratios? |  |

| 4. How can accounting ratios be used for financial analysis? |  |

| 5. What are the limitations of accounting ratios? |  |

|

Explore Courses for Commerce exam

|

|