Class 10 Exam > Class 10 Notes > Social Studies (SST) Class 10 > Key Concepts: Money & Credit

Key Concepts: Money & Credit | Social Studies (SST) Class 10 PDF Download

| Table of contents |

|

| Money as a Medium of Exchange |

|

| Banks and Loans |

|

| Credit |

|

| Formal Sector Credit in India |

|

| Self-Help Groups |

|

Money as a Medium of Exchange

Money is anything that is commonly accepted as a medium of exchange and in the discharge of debts.

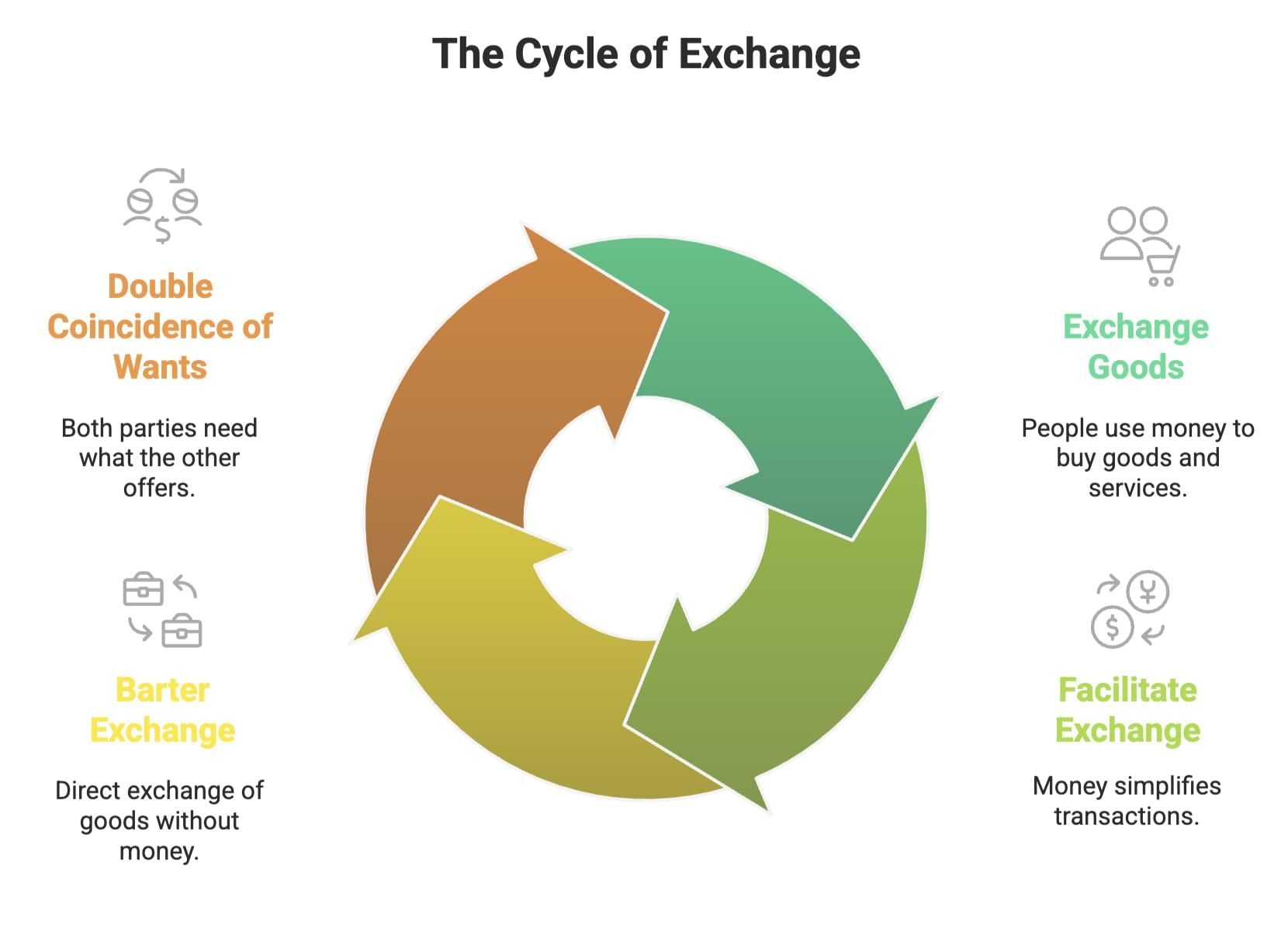

- People exchange goods and services through the medium of money. Money by itself has no utility. It is only an intermediary. The use of money facilitates exchange.

- Direct exchange of goods against goods without the use of money is called barter exchange (i.e. exchange of goods for goods). This is also known as the CC economy (i.e. commodity for commodity economy).

- Simultaneous fulfilment of mutual wants by buyers and sellers is known as the double coincidence of wants. Let us understand this concept with the help of an example :

A shoe manufacturer wants to sell his shoes in the market and buy wheat. Now he has to exchange shoes for wheat without the use of money directly. He would have to look for a wheat-growing farmer who not only wants to sell wheat but also wants to buy shoes in exchange.

Forms of Money

- Before the introduction of coins, a variety of objects were used as money. For example, since the very early ages, Indians used grains and cattle as money.

- Thereafter came the use of metallic coins–gold, silver, copper coins.

- This process was finally taken over by paper money (which means currency notes).

- As the volume of transactions increased, even paper money started becoming inconvenient because of the time involved in its counting and the space required for its safekeeping. This led to the introduction of bank money (credit money) in the form of cheques, demand drafts, credit cards, etc.

Question for Key Concepts: Money & CreditTry yourself: What is the purpose of money in an economy?View Solution

Banks and Loans

- The major function of a bank is to give loans, particularly to businessmen and entrepreneurs, and thereby earn interest.

- Banks get money for providing loans by accepting deposits from people. Deposits are the lifeline of a bank. These are of two types: time deposits and demand deposits. Time deposits can be withdrawn only after a specified period of time. Demand deposits in the bank can be withdrawn on demand by issuing cheques.

- The facility of cheques against demand deposits makes it possible to directly settle payments without the use of cash.

Credit

- Credit (i.e. giving loans) refers to an agreement in which the lender supplies the borrower with money, goods or services in return for the promise of future payments with interest.

- Credit plays a vital and positive role in society. This can be explained further with the help of a suitable example. Saleem obtains loans to meet the needs of production. The credit helps him to meet the need of ongoing expenses of production, complete production in time, and thereby increase his earnings.

- Sometimes, credit, instead of helping people, pushes them into a debt trap. In Swapana’s case, who is a farmer, the failure of the crop made loan repayment impossible. Credit in this case pushes the borrower into a situation from which recovery is painful.

- Terms of credit include interest rate, collateral and documentation requirements and the mode of repayment. The terms of credit may vary depending on the nature of the lender and the borrower.

- Collateral is an asset that the borrower owns (such as land, building, vehicles, livestock, etc.) and uses as a guarantee to the lender until the loan is repaid.

Formal Sector Credit in India

- Formal credit is generally available from banks and cooperatives. They charge lower rates of interest than informal institutions. The Reserve Bank of India (RBI) supervises the functioning of formal sources of loans.

- Informal lenders include moneylenders, traders, employers, relatives and friends, etc. They charge much higher interest on loans. There is no one to stop them from using unfair means to get their money back.

Self-Help Groups

- The idea behind Self-Help Groups is to organise the rural poor into self-help groups and collect their savings. Saving per member varies from Rs 25 to Rs 100 or more, depending on the ability of the people to save.

- Members can take small loans from the group itself to meet their own needs. The group charges a lower rate of interest on these loans.

- If the group is regular in savings, it becomes eligible to avail of a loan from the bank.

The document Key Concepts: Money & Credit | Social Studies (SST) Class 10 is a part of the Class 10 Course Social Studies (SST) Class 10.

All you need of Class 10 at this link: Class 10

|

94 videos|630 docs|79 tests

|

FAQs on Key Concepts: Money & Credit - Social Studies (SST) Class 10

| 1. What is the difference between money and credit? |  |

Ans. Money is a medium of exchange that is accepted as payment for goods and services. It is used to make purchases, pay bills, and settle debts. Credit, on the other hand, is a form of borrowing in which the borrower receives funds that must be repaid with interest. While money is a tangible asset, credit is a promise to pay in the future.

| 2. How does credit affect the economy? |  |

Ans. Credit plays a significant role in the economy by enabling individuals and businesses to finance purchases and investments that they would not otherwise be able to afford. It provides liquidity to the financial system and stimulates economic growth. However, excessive credit can lead to inflation, asset bubbles, and financial crises, as we have seen in the past.

| 3. What are the advantages of using credit? |  |

Ans. The advantages of using credit include the ability to finance large purchases such as a home or car, the convenience of paying for goods and services without cash, and the ability to build a credit history that can improve your ability to obtain loans and credit in the future. Credit can also offer rewards and benefits such as cashback, travel points, and discounts.

| 4. What are the risks associated with borrowing on credit? |  |

Ans. The risks associated with borrowing on credit include the possibility of falling into debt, paying high interest rates, late fees, and penalties. Borrowers must also be aware of the terms and conditions of their credit agreements, including payment schedules, repayment terms, and penalties for default. Failure to repay debts can result in damage to credit scores, legal action, and repossession of assets.

| 5. How can individuals manage their credit effectively? |  |

Ans. Individuals can manage their credit effectively by setting a budget, paying bills on time, monitoring credit reports and scores, avoiding unnecessary debt, and using credit responsibly. They should also be aware of their credit utilization rate, which is the percentage of available credit they are using, and try to keep it below 30%. Finally, they should always read and understand the terms and conditions of any credit agreement before signing.

Related Searches