NCERT Solution (Part - 4) - Recording of Transactions-I | Accountancy Class 11 - Commerce PDF Download

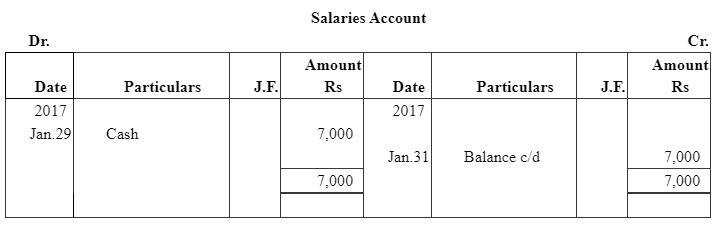

Page No 94:

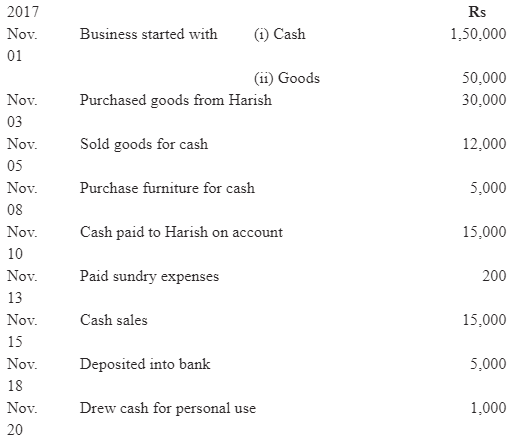

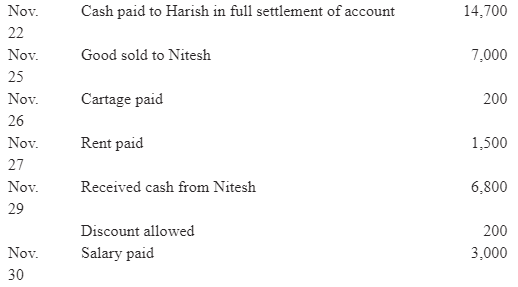

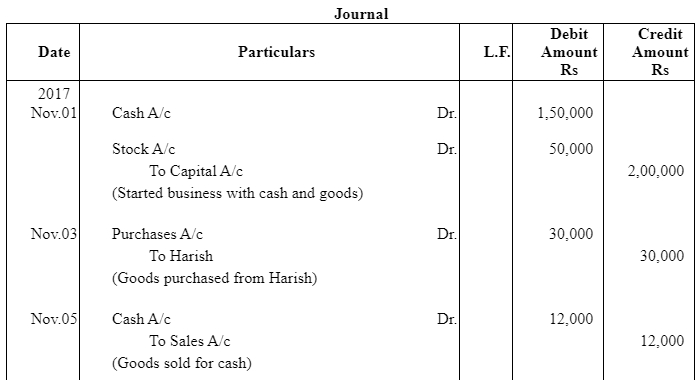

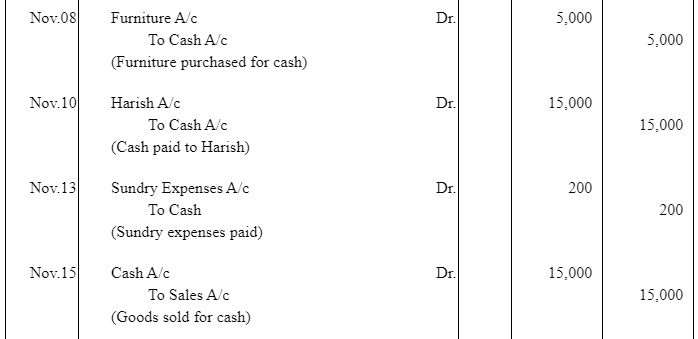

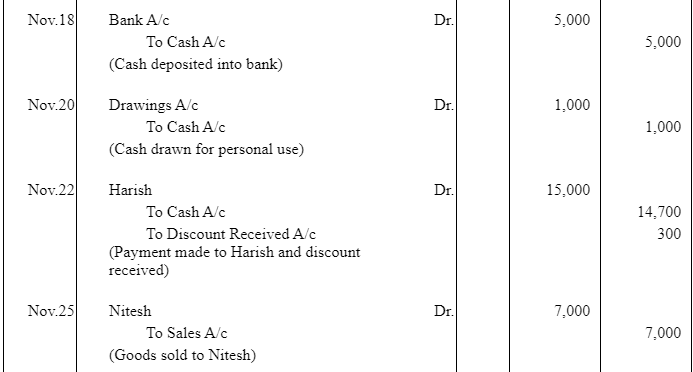

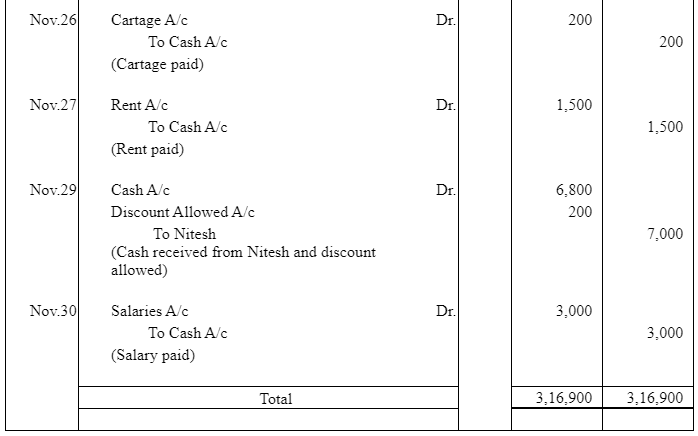

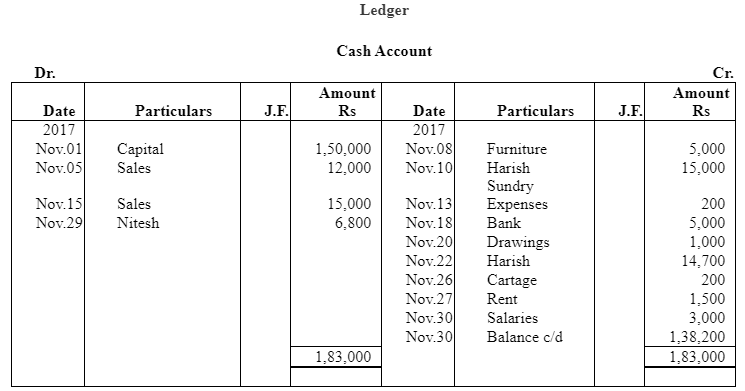

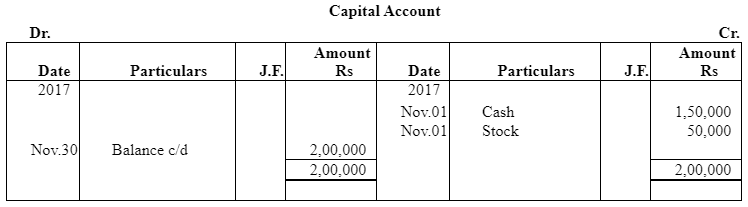

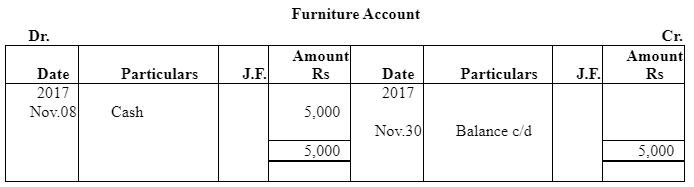

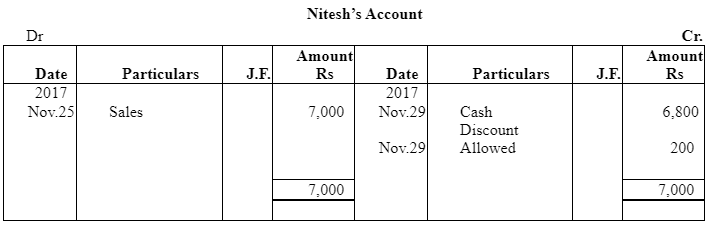

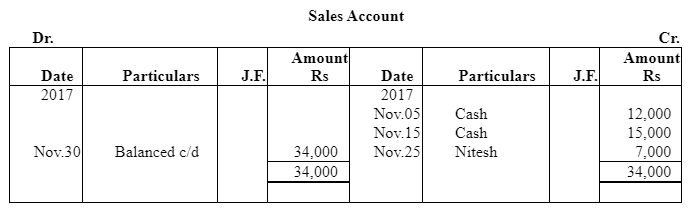

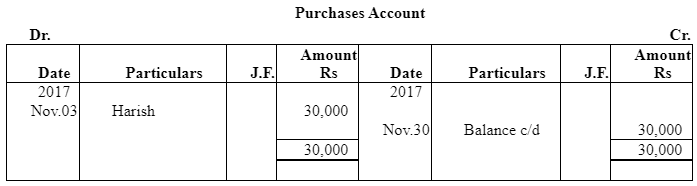

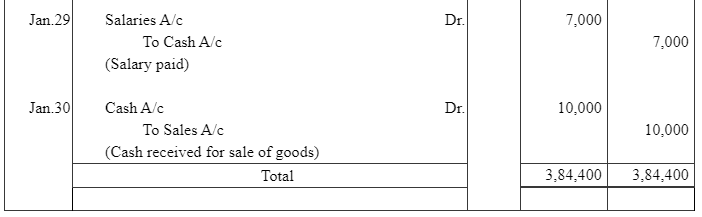

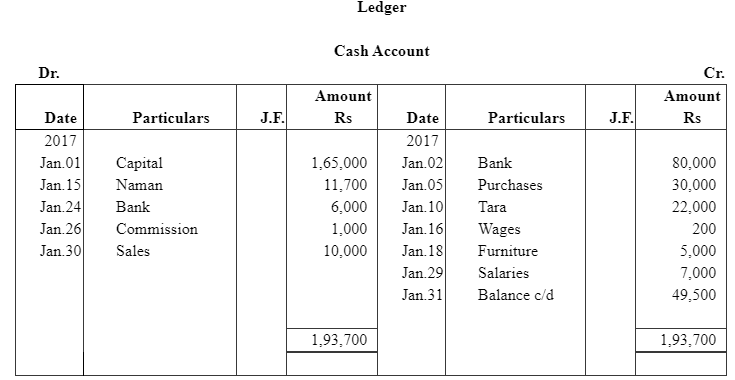

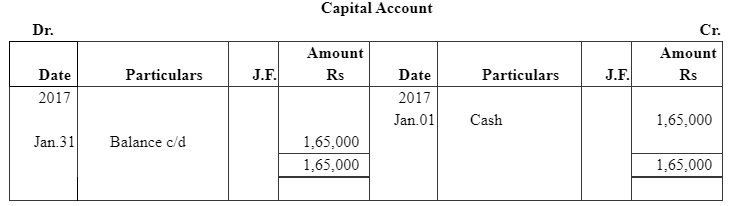

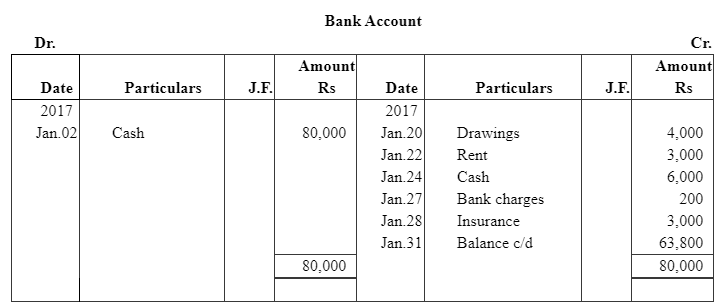

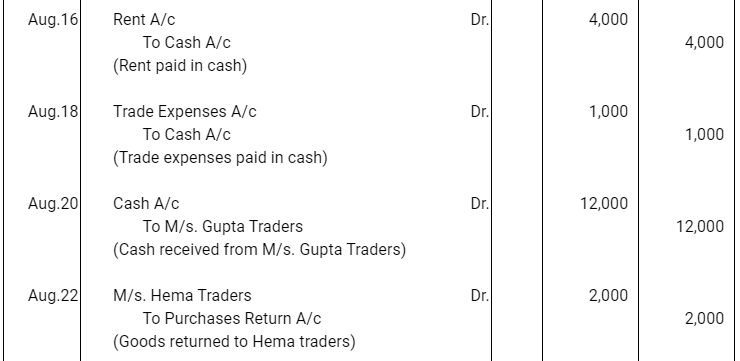

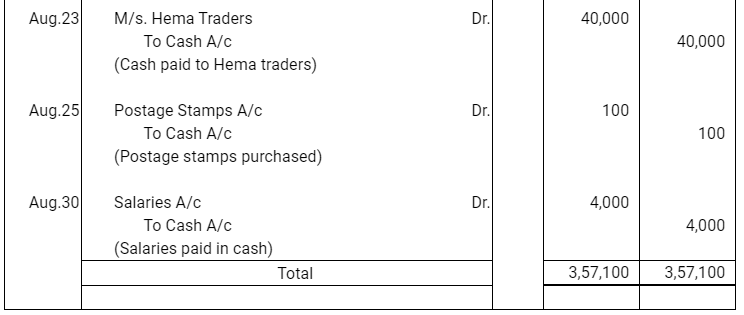

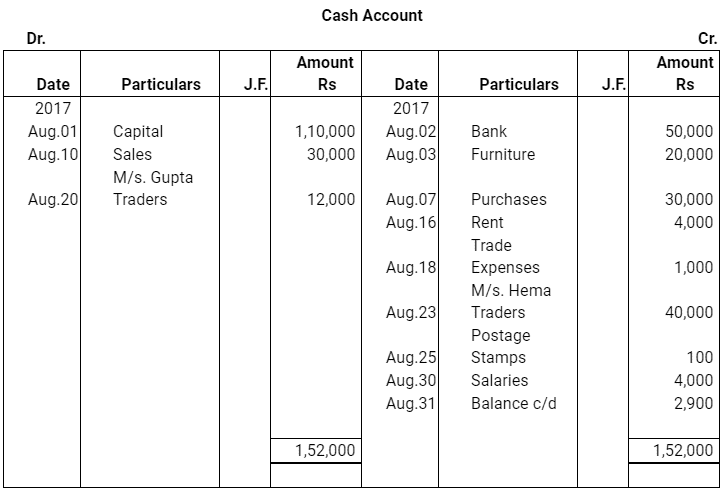

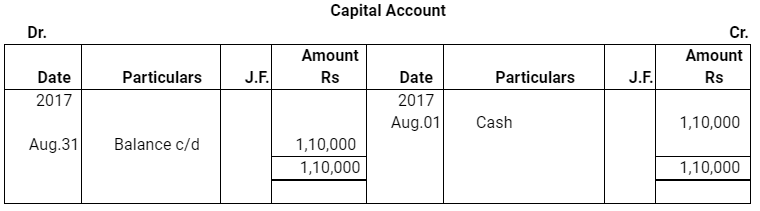

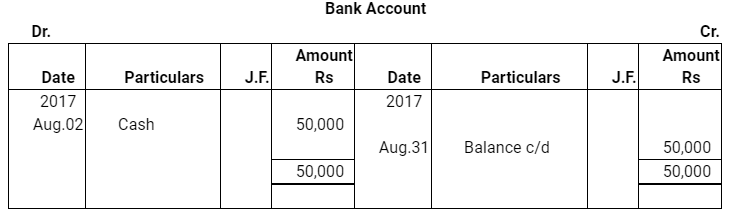

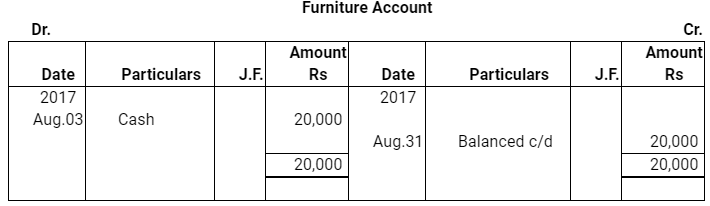

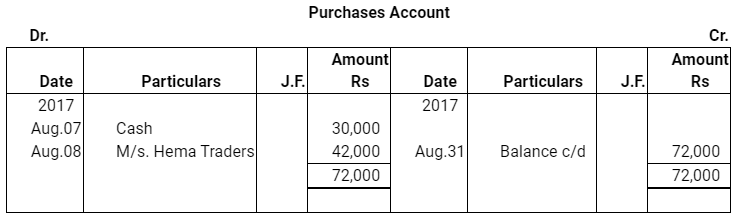

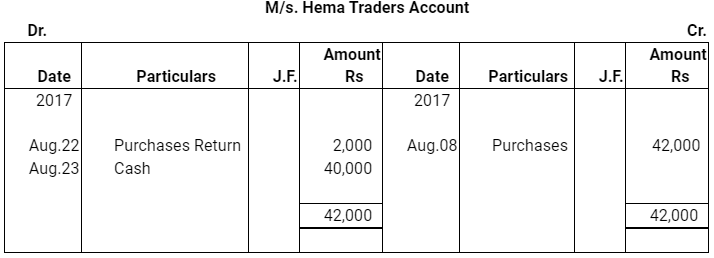

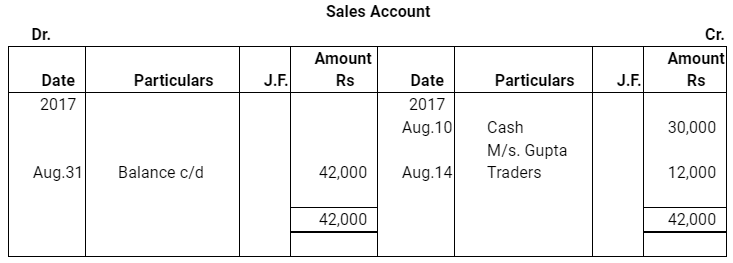

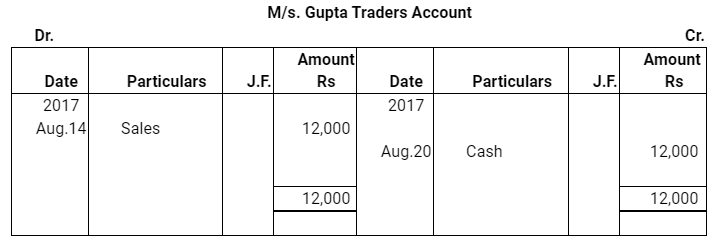

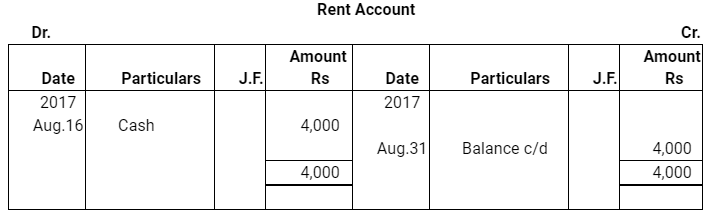

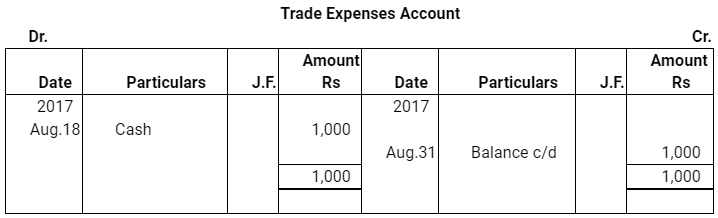

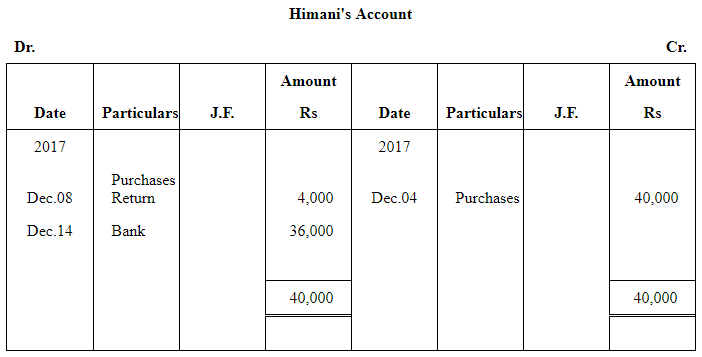

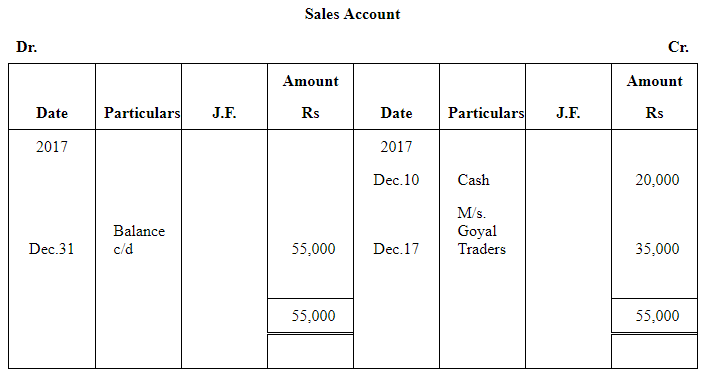

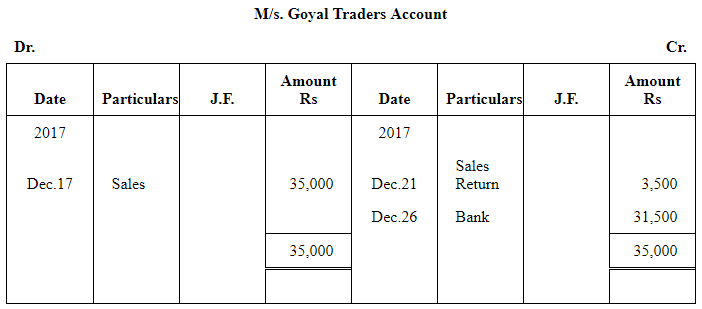

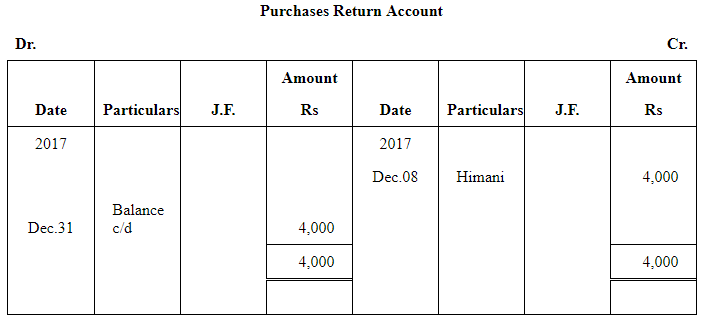

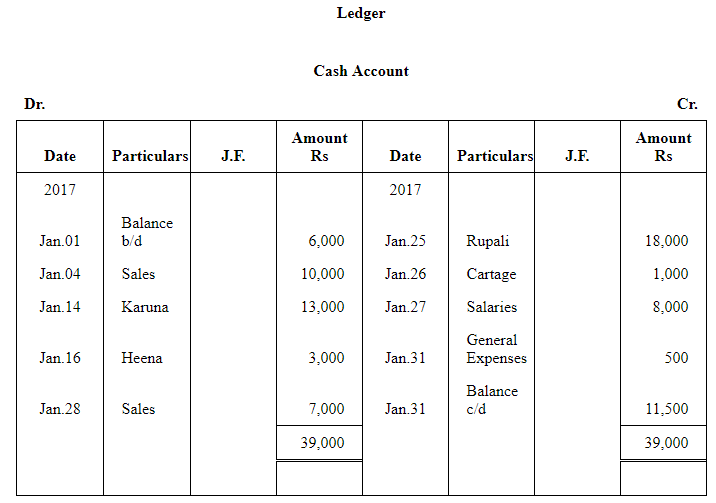

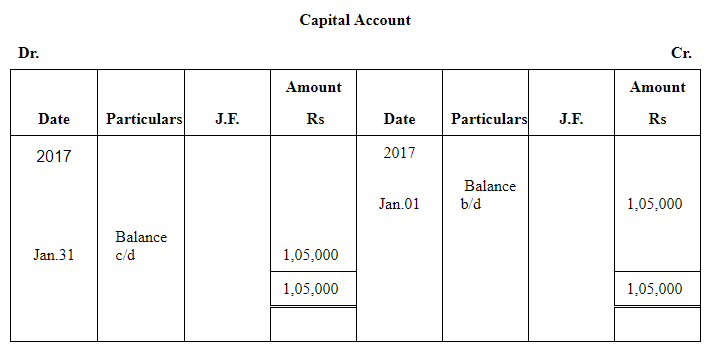

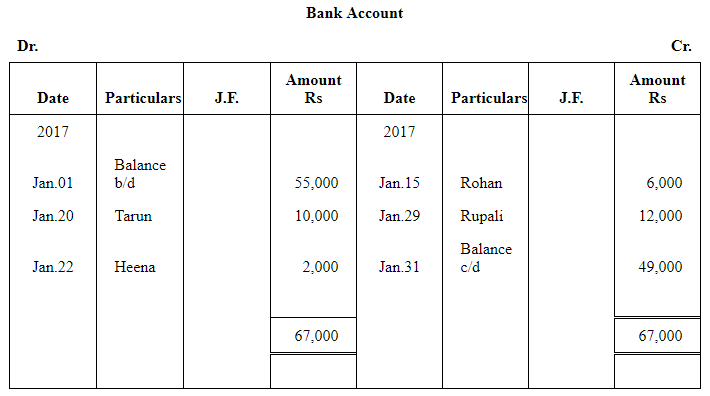

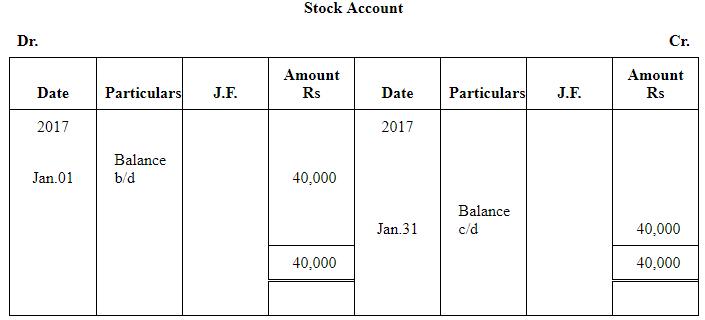

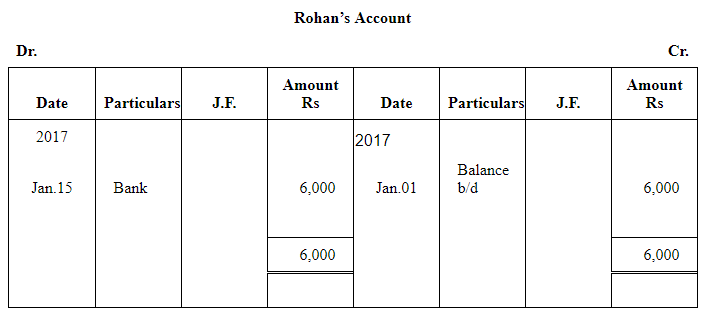

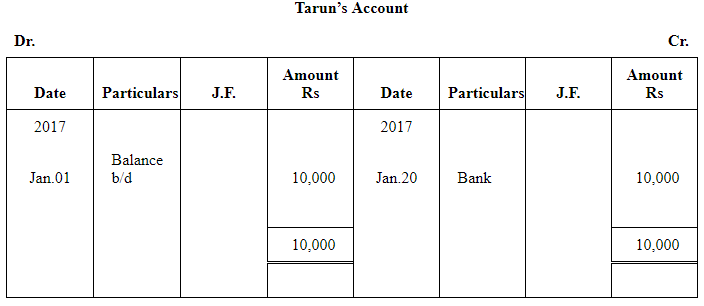

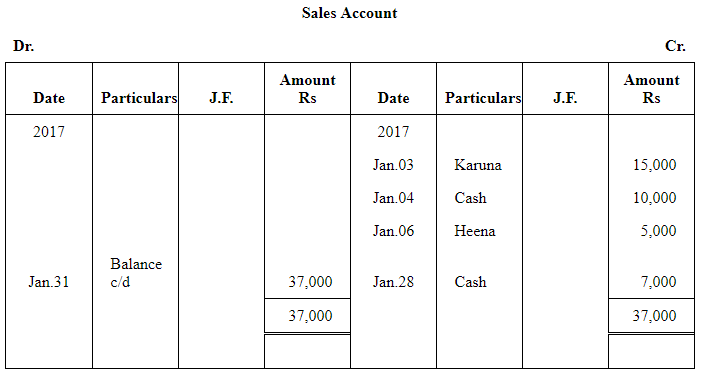

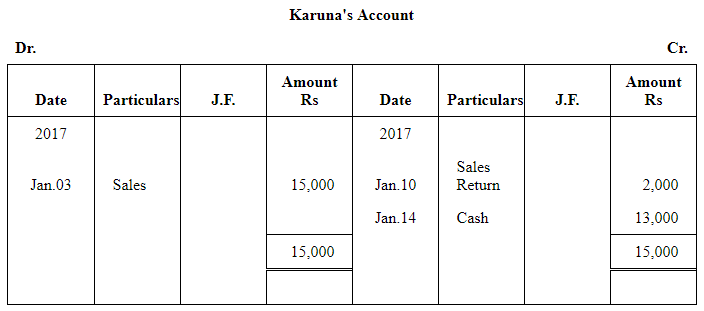

Q16 : Journalise the following transactions, post to the ledger:

Answer :

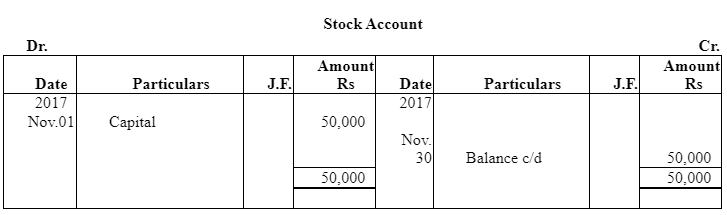

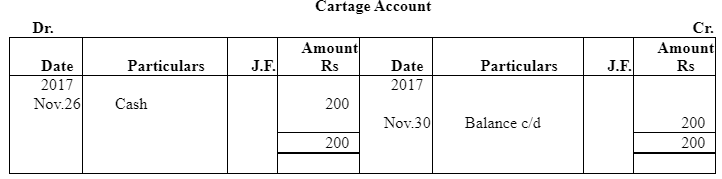

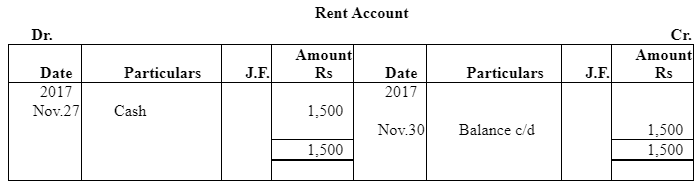

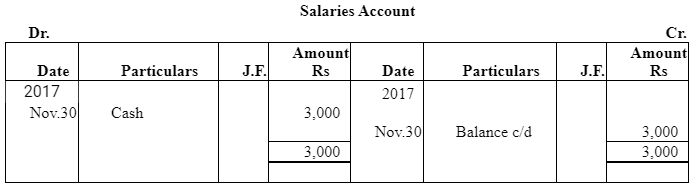

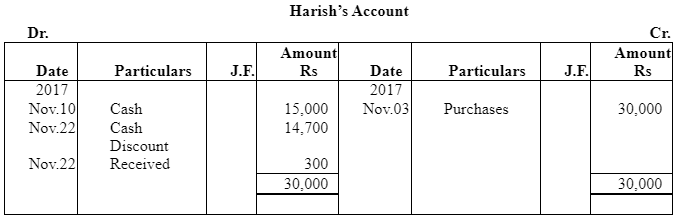

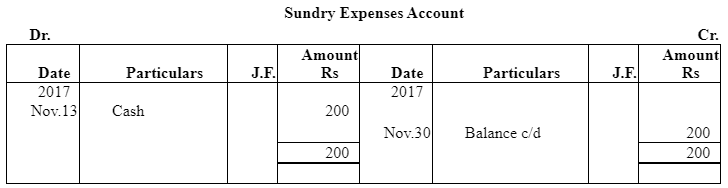

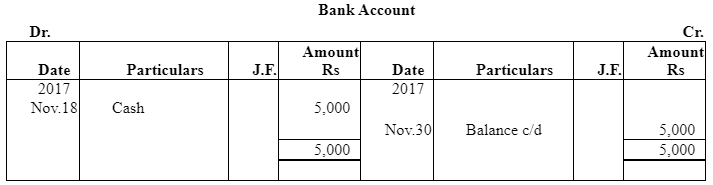

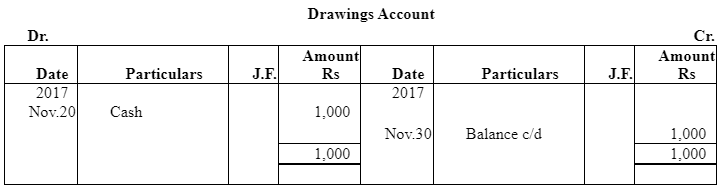

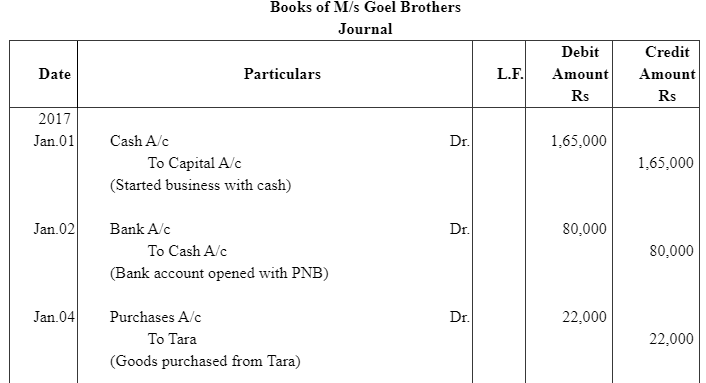

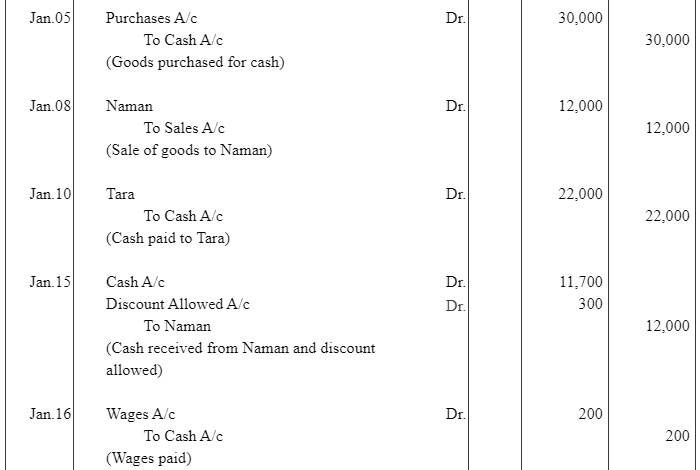

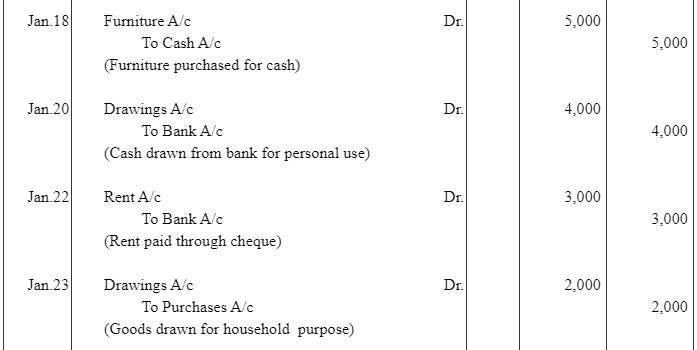

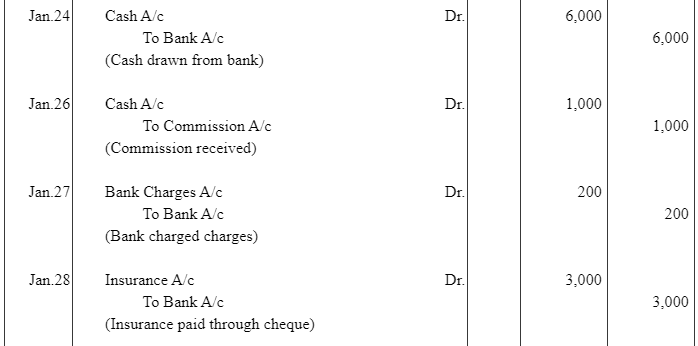

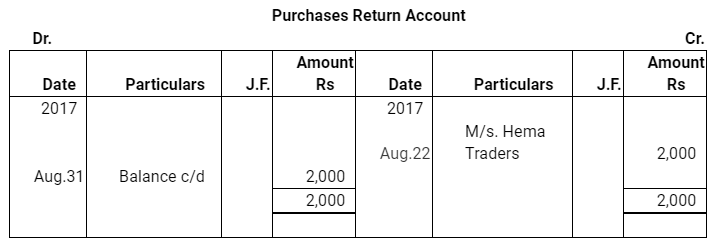

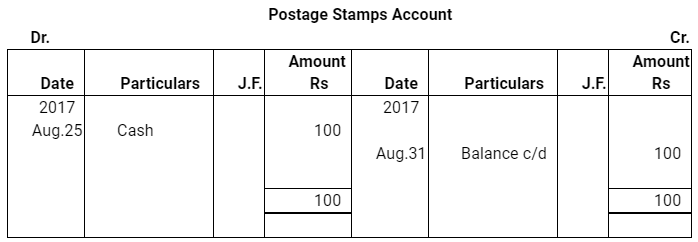

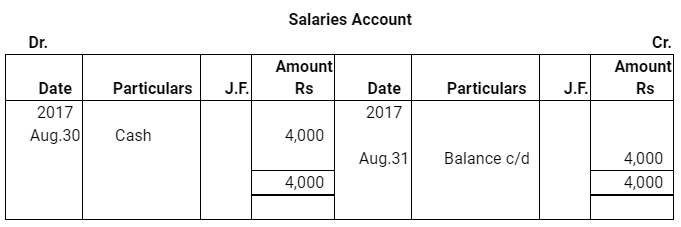

Q 17 : Journalise the following transactions is the journal of M/s. Goel Brothers and post them to the ledger.

Answer :

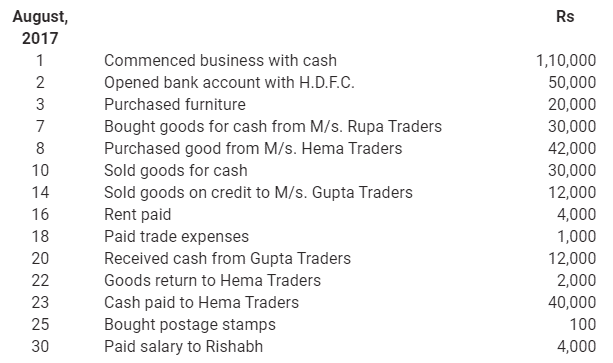

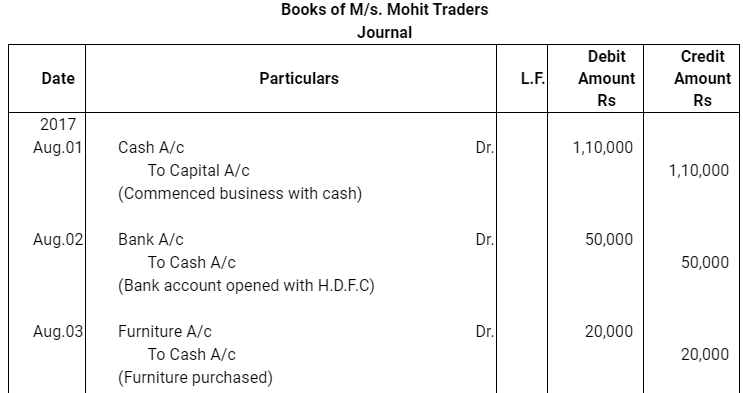

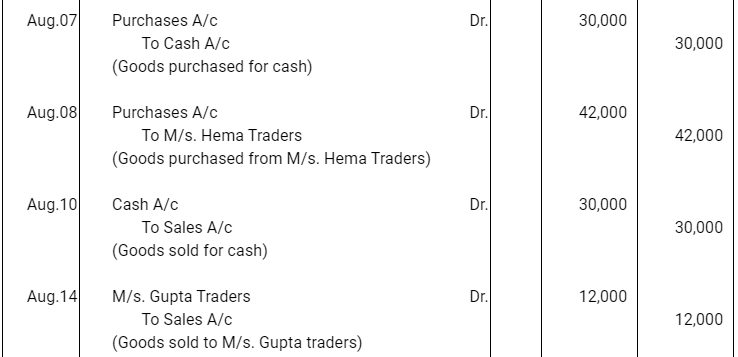

Q18 :

Give journal entries of M/s. Mohit traders; post them to the Ledger from the following transactions:

Answer:

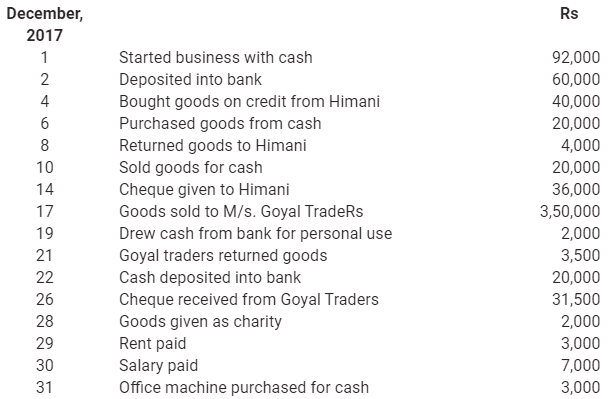

Q19 :

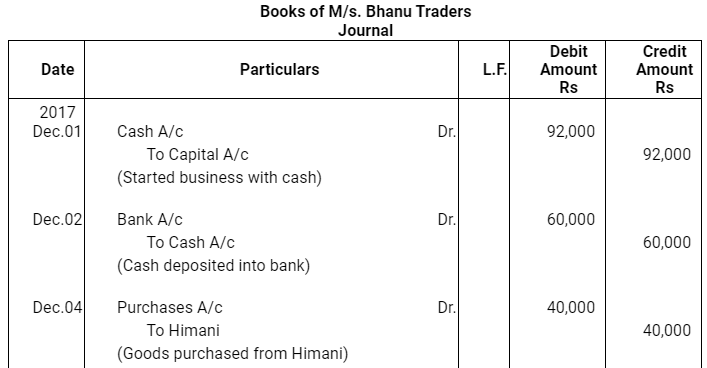

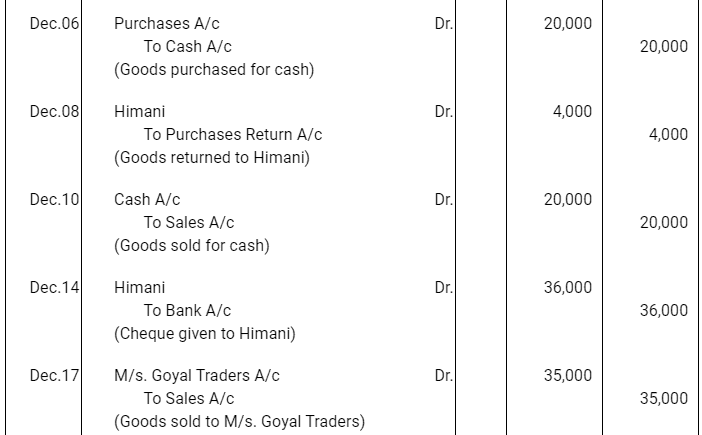

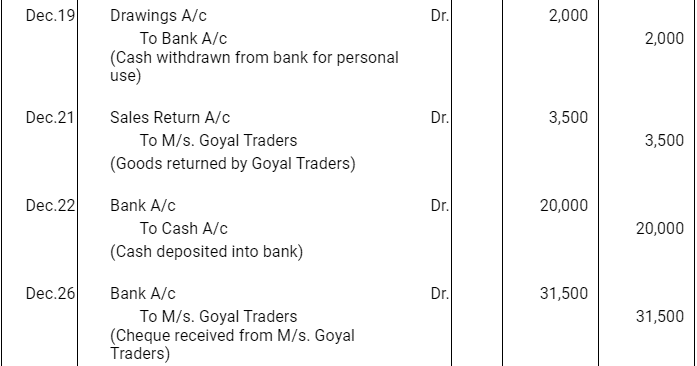

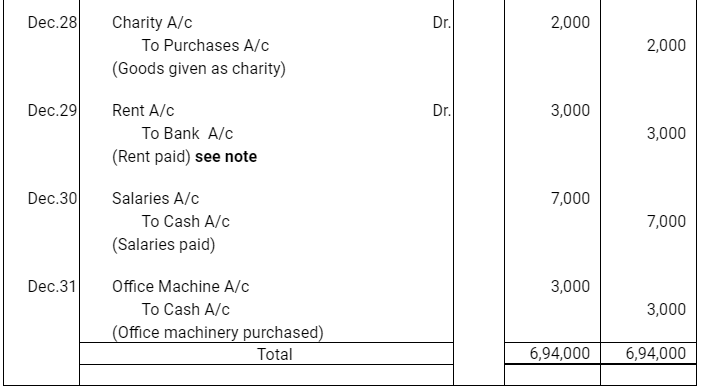

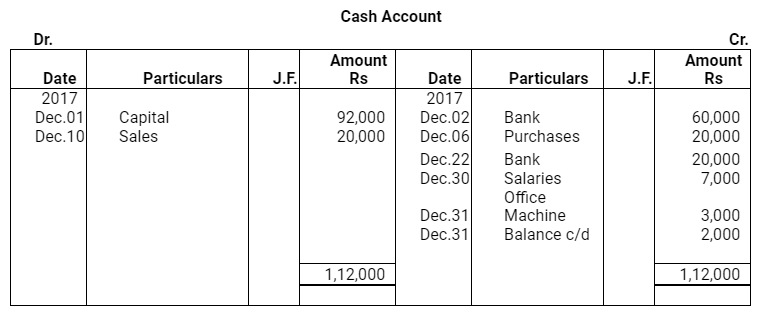

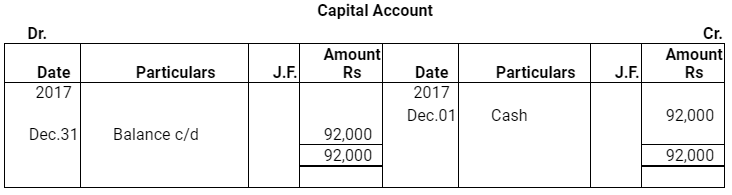

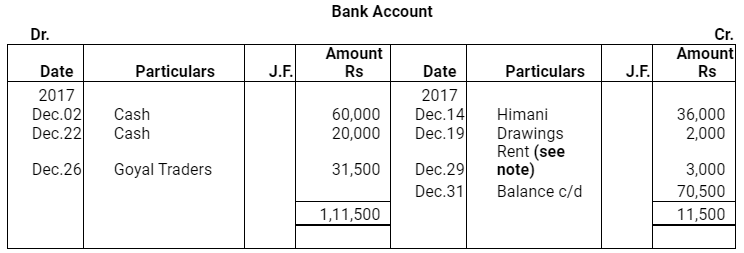

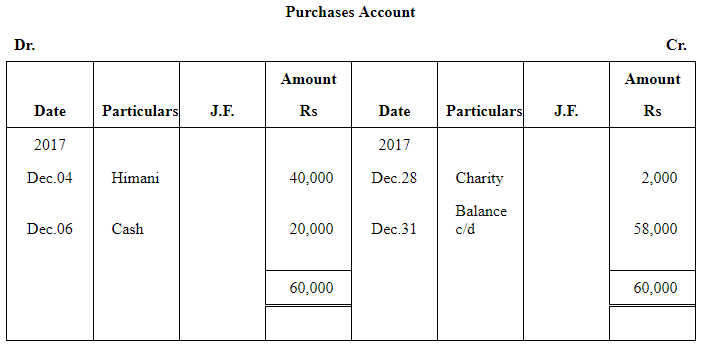

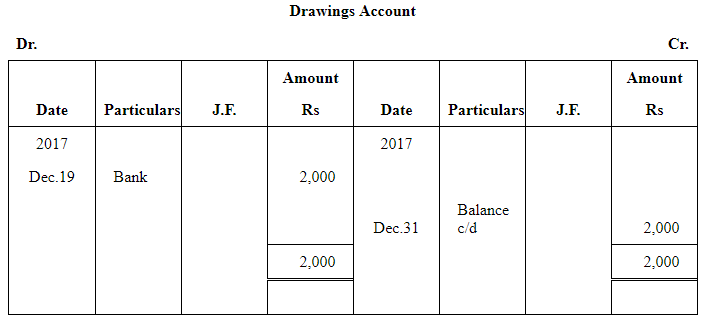

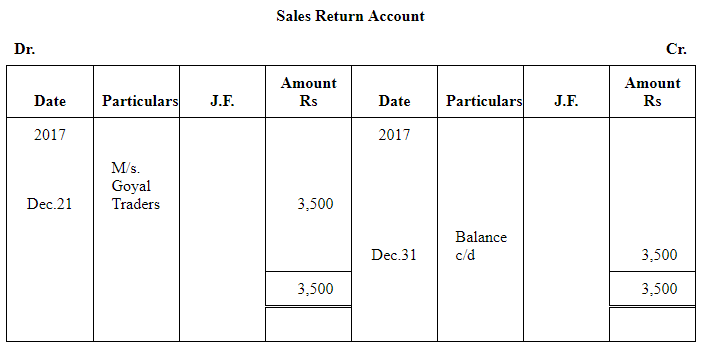

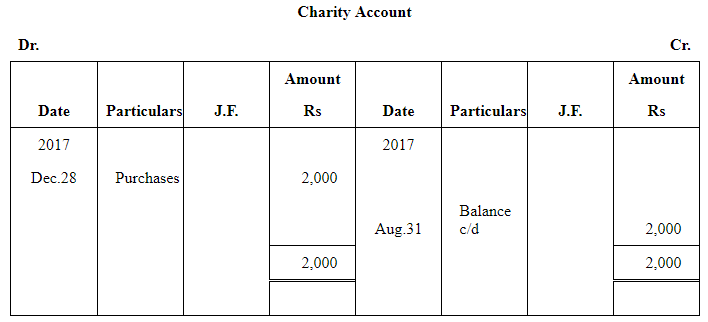

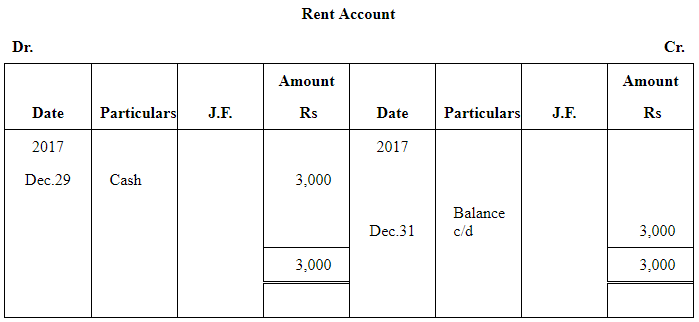

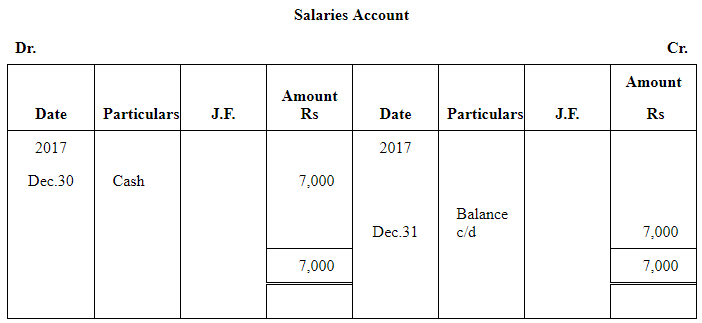

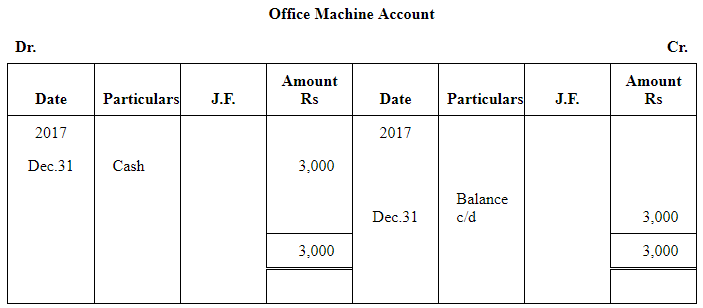

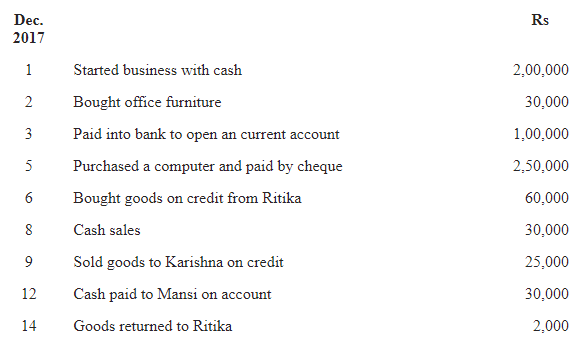

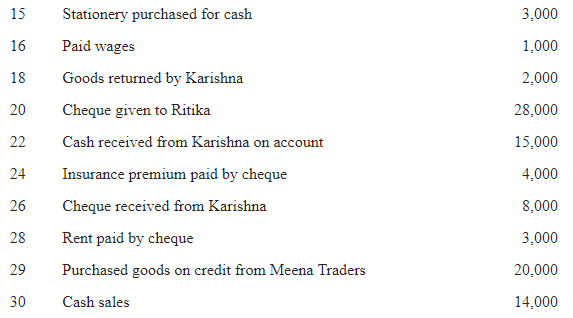

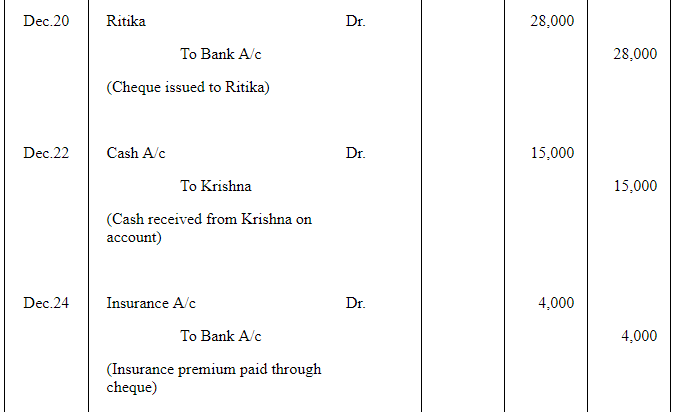

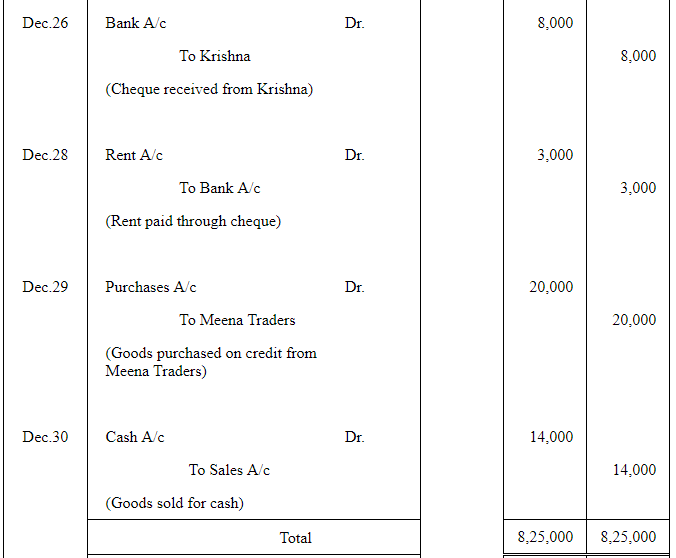

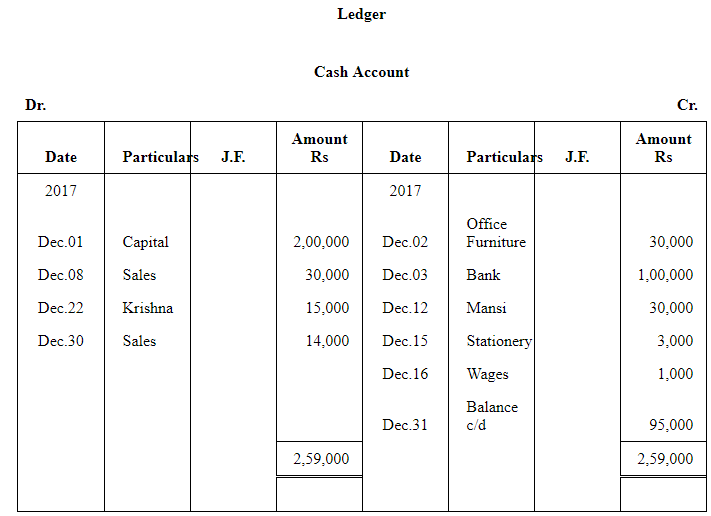

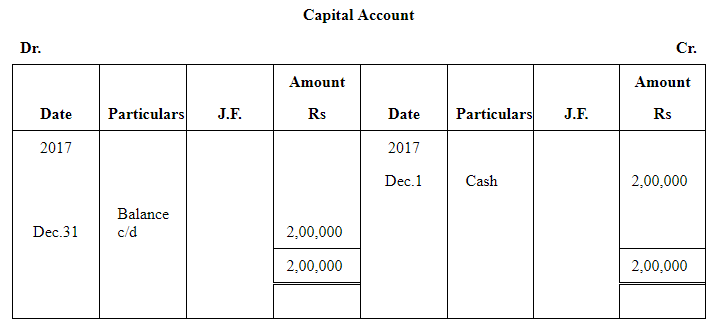

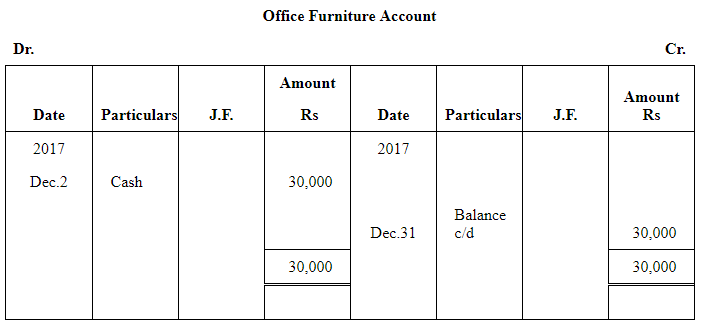

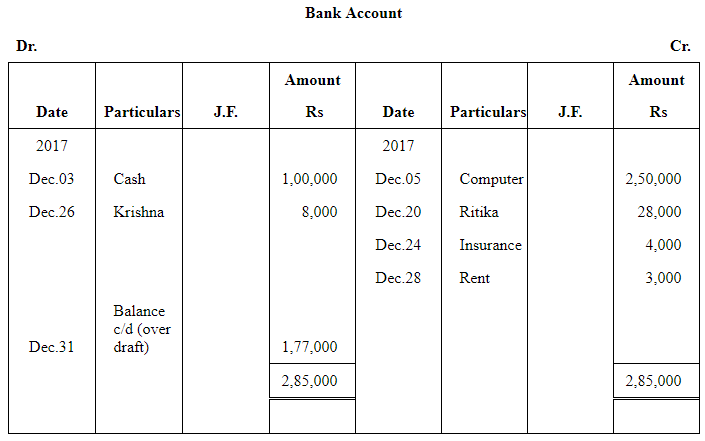

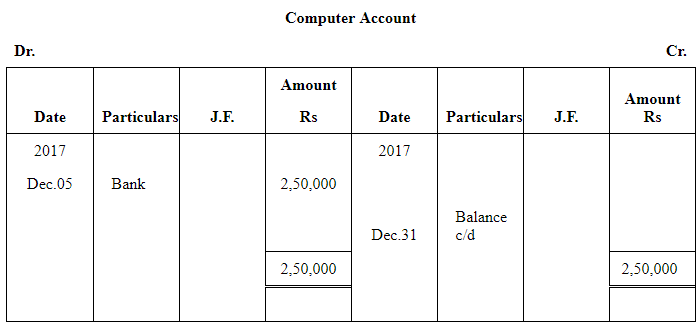

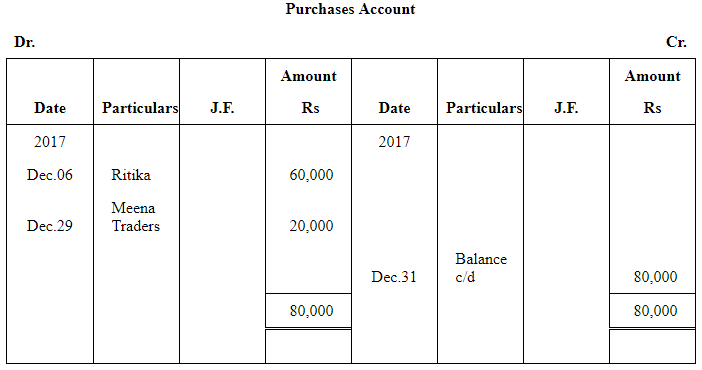

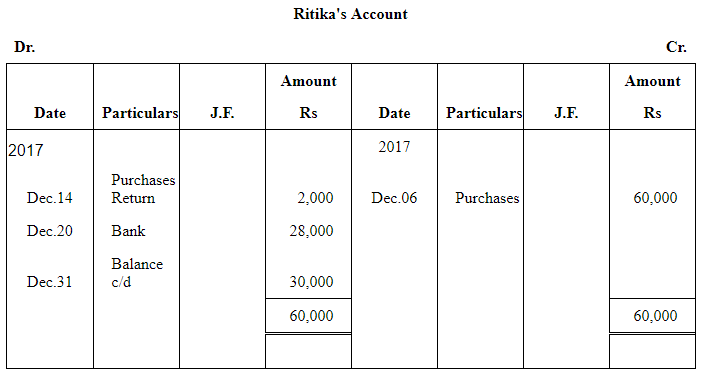

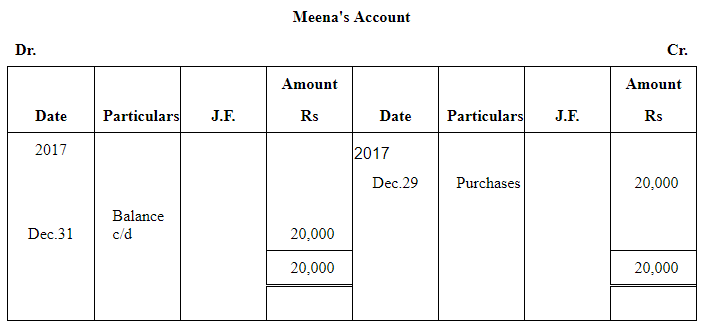

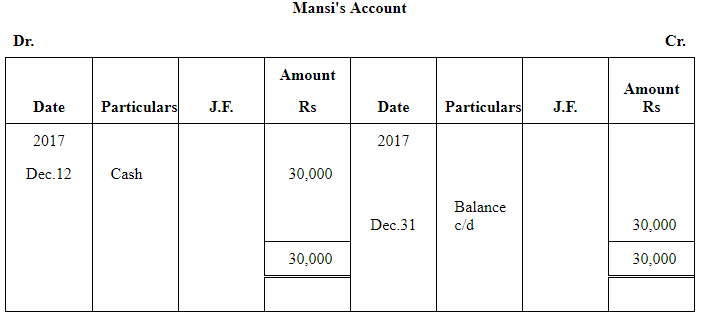

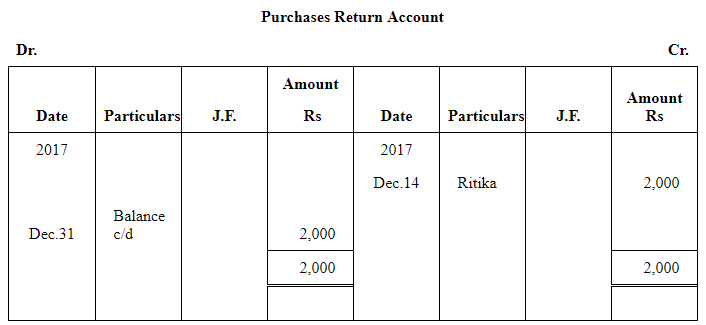

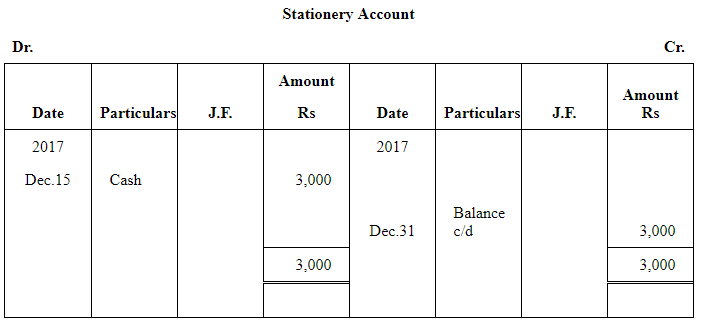

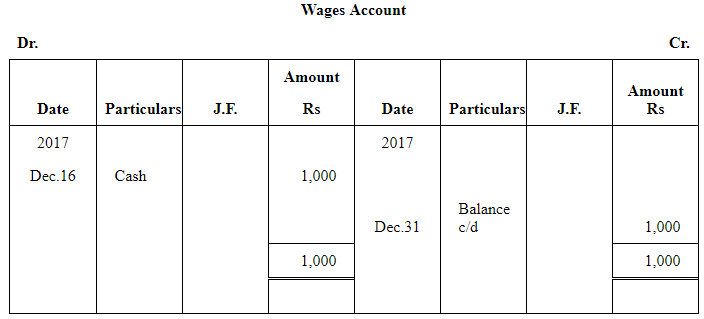

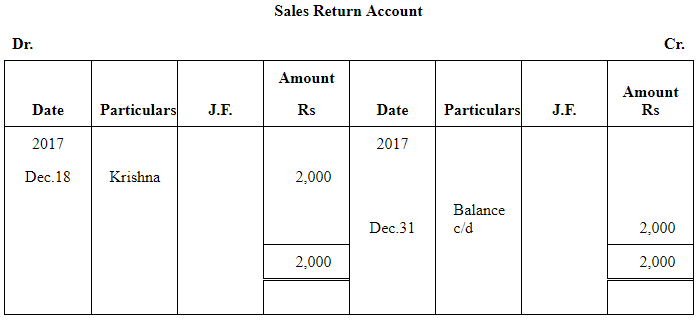

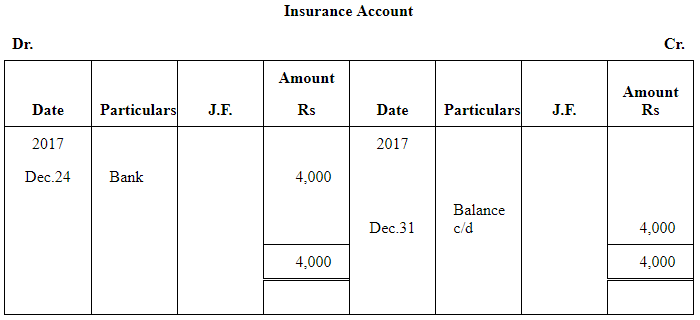

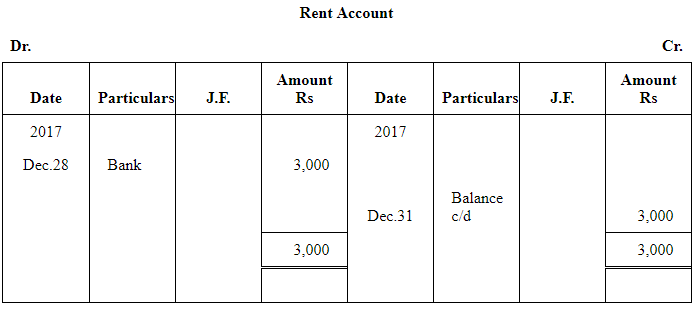

Journalise the following transaction in the Books of the M/s. Bhanu Traders and Post them into the Ledger.

Answer :

Note: For transaction on December 29, 2017, it has been assumed that the rent of Rs 3,000 is paid through cheque. If instead the rent would have been paid in cash, the cash account would have shown a credit (negative) balance and that is logically not correct.

Page No 96:

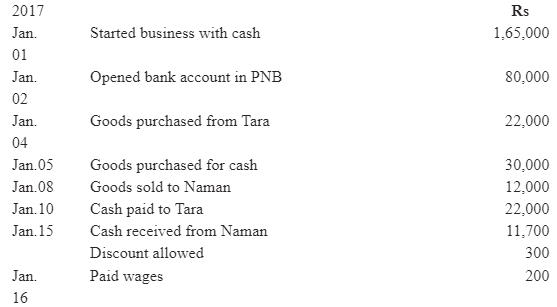

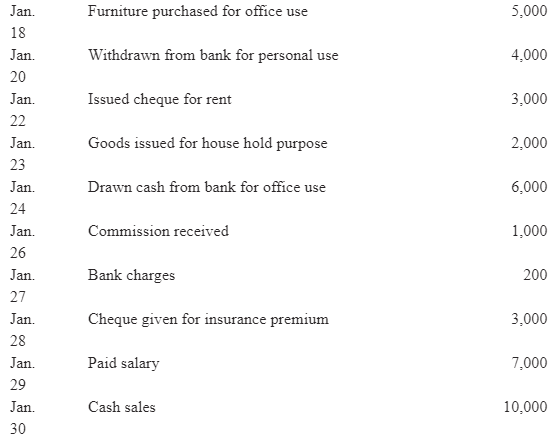

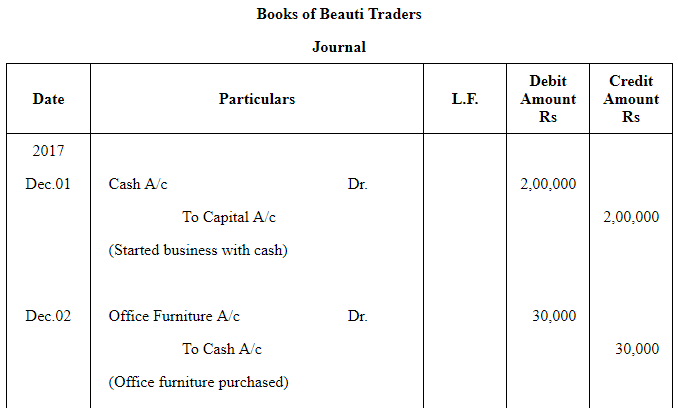

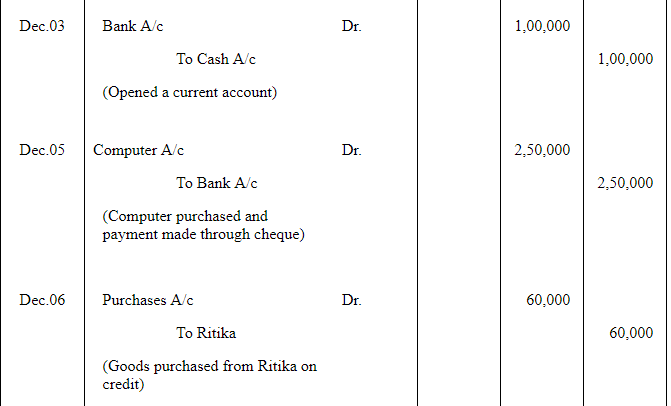

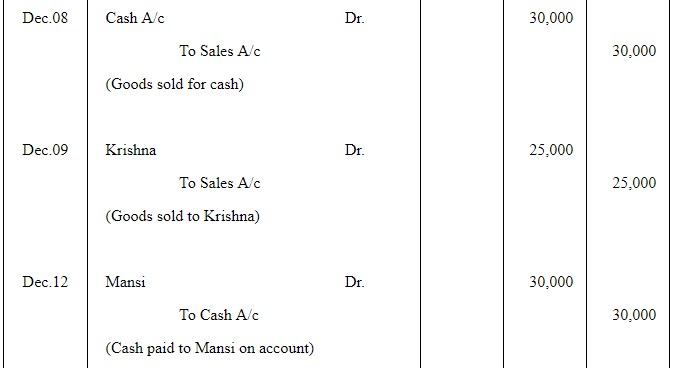

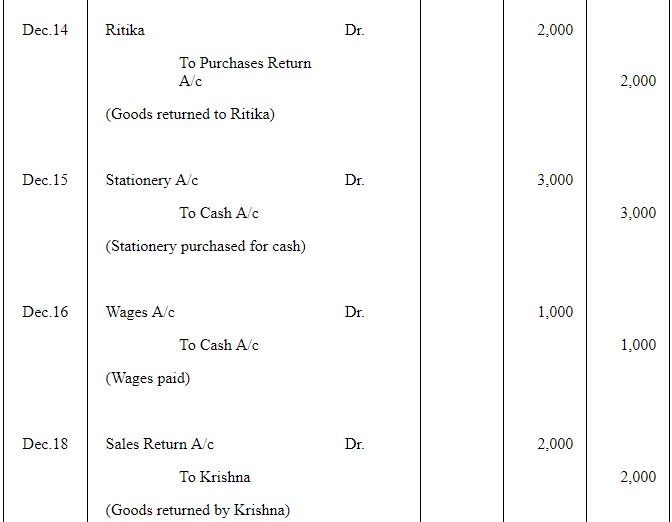

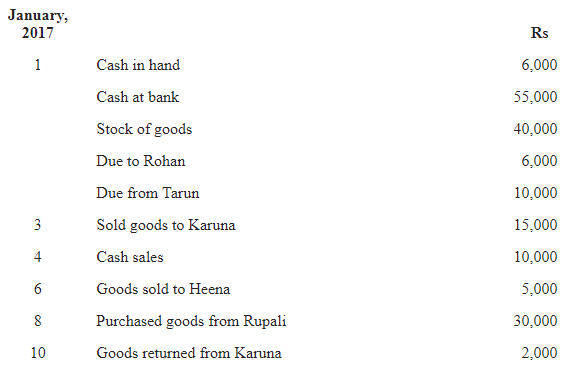

Q20 : Journalise the following transaction in the Book of M/s. Beauti tradeRs Also post them in the ledger.

Answer :

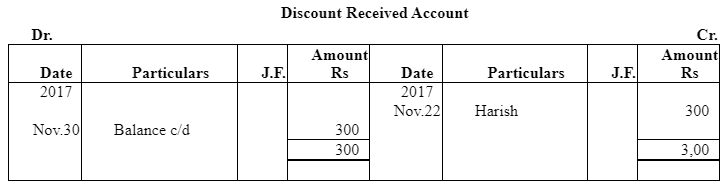

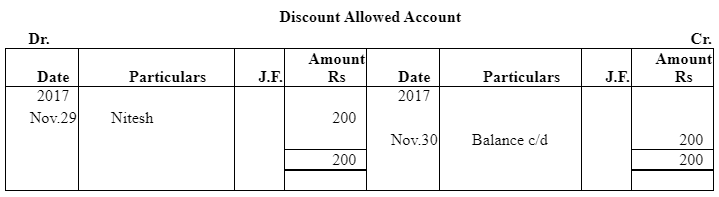

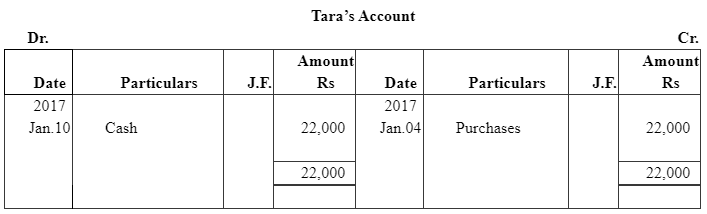

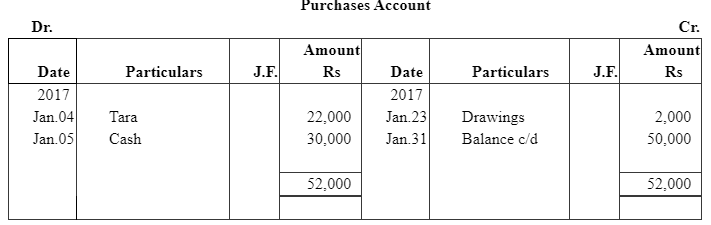

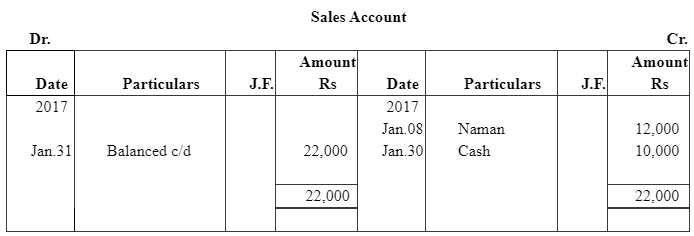

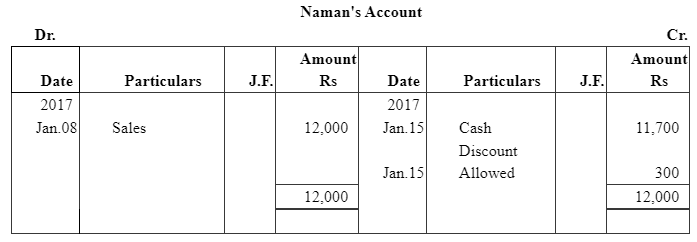

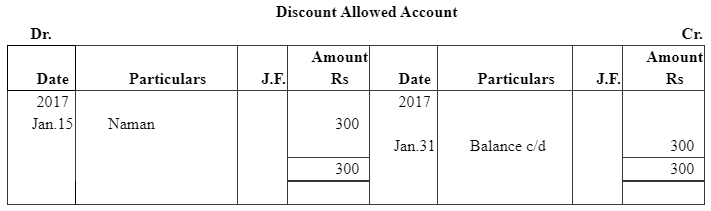

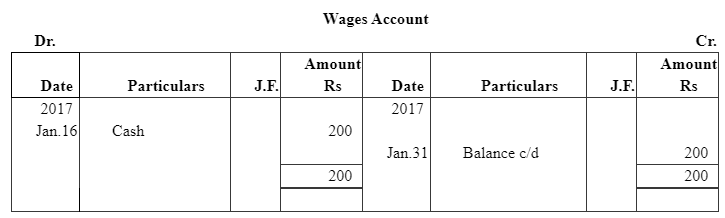

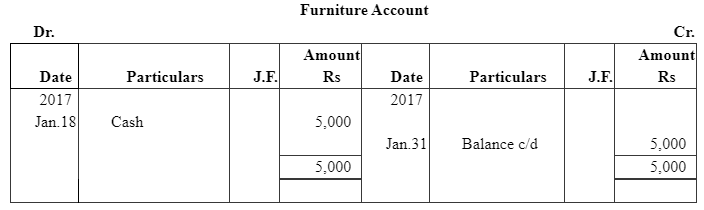

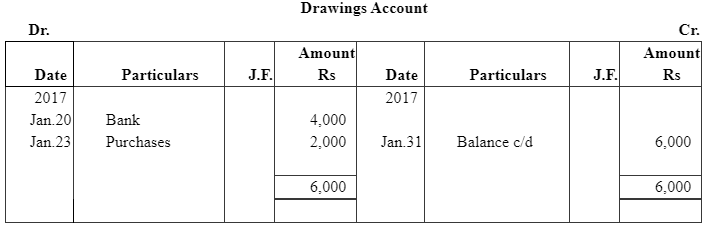

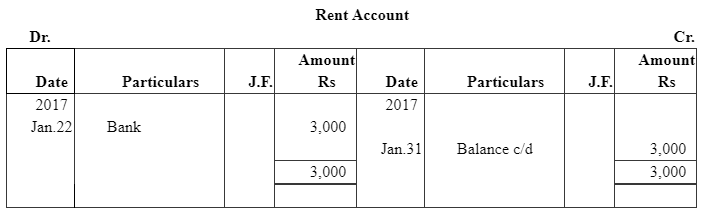

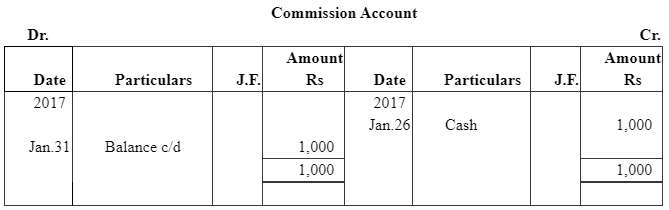

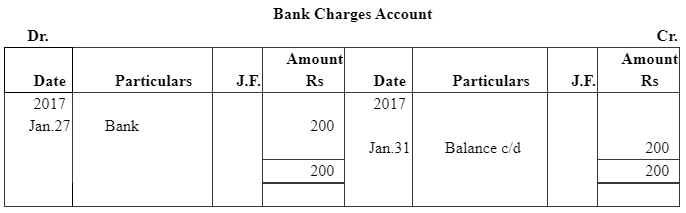

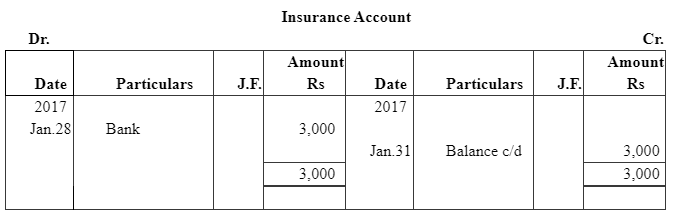

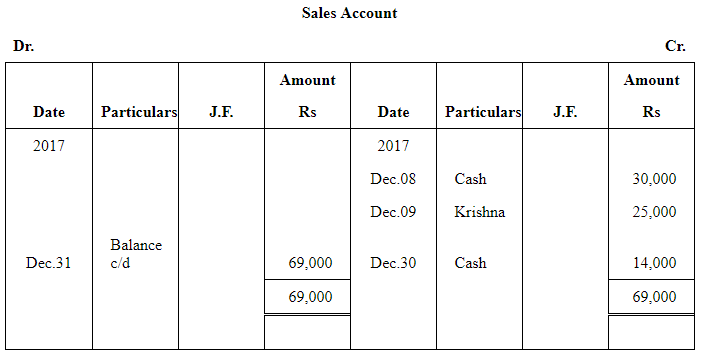

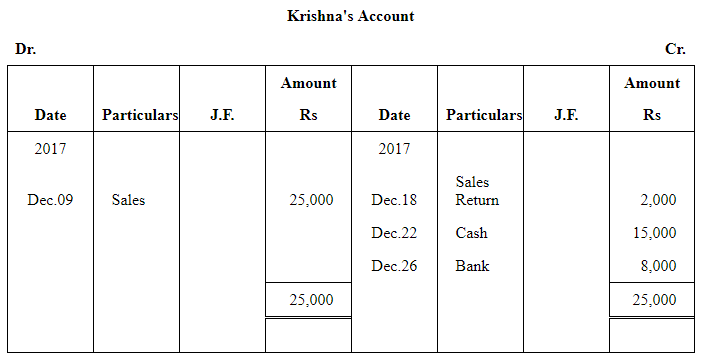

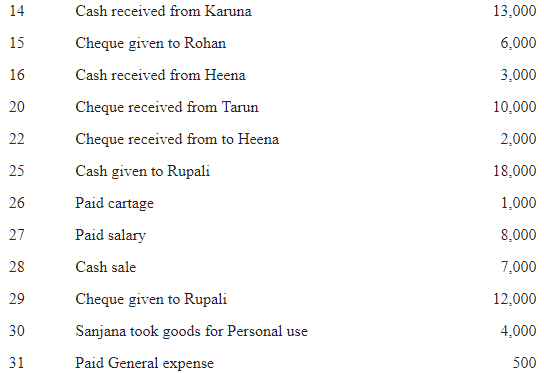

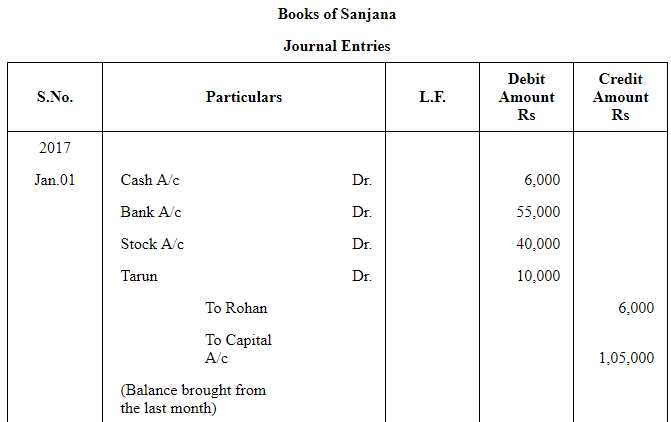

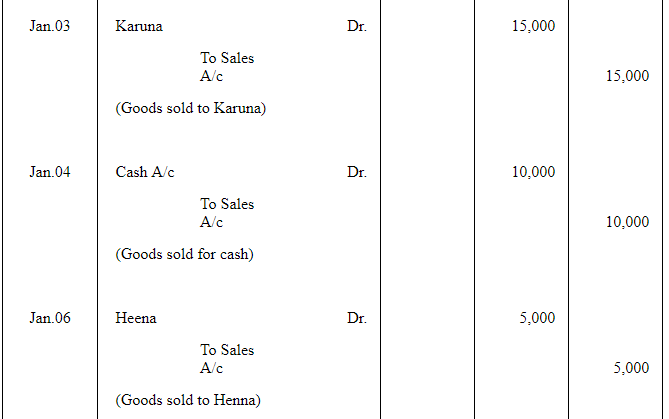

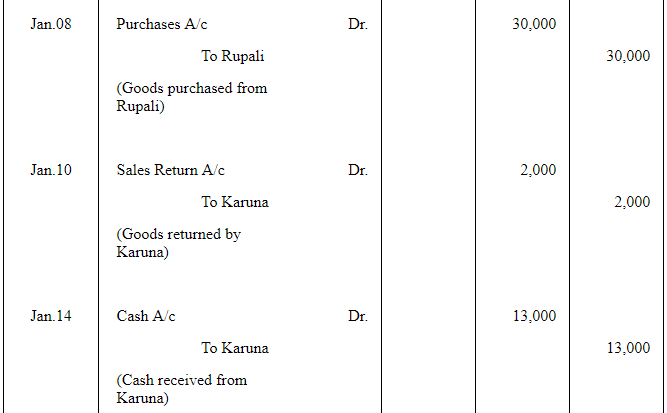

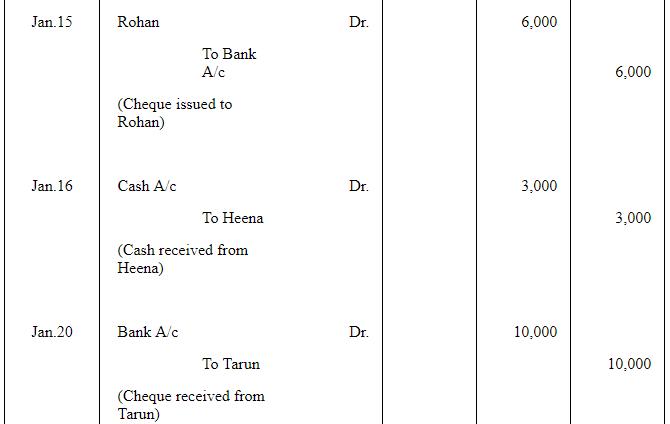

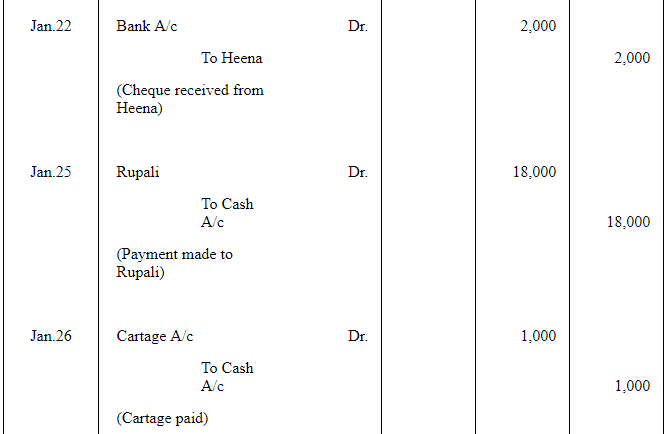

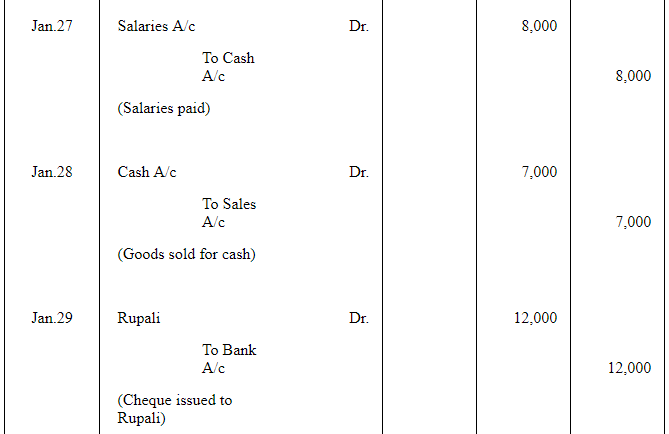

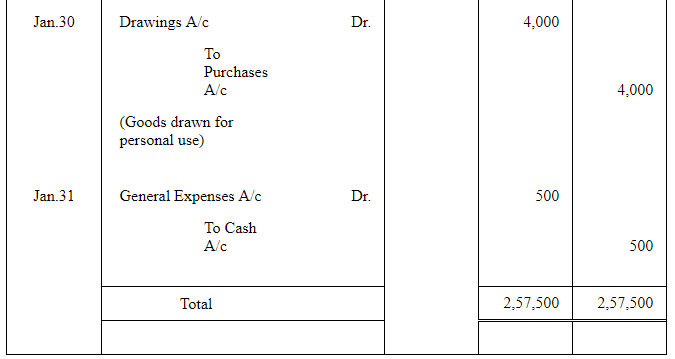

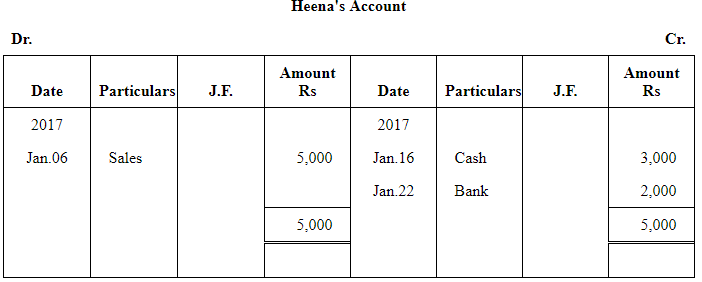

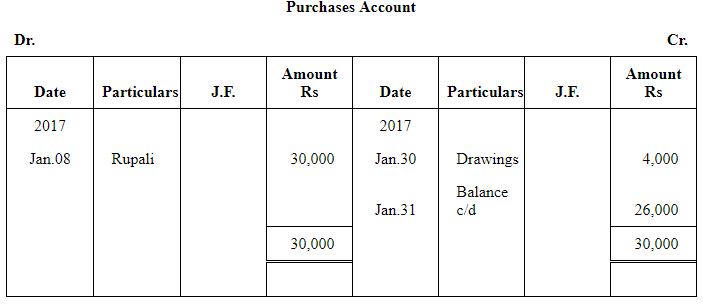

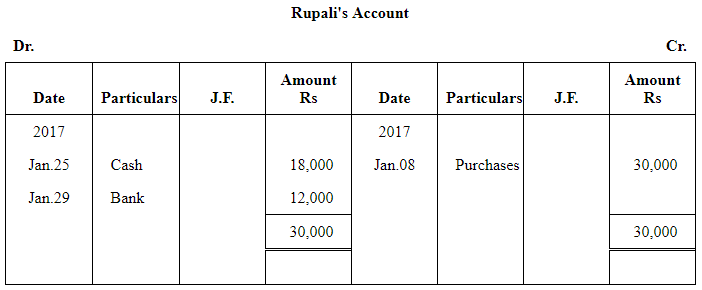

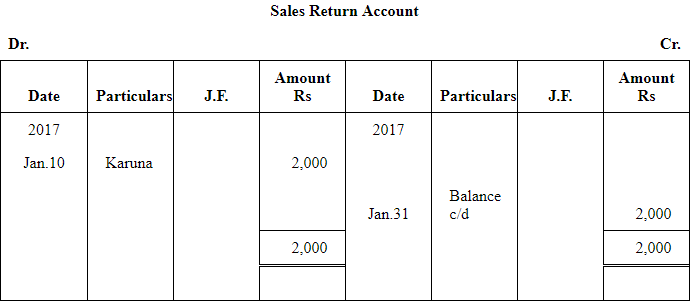

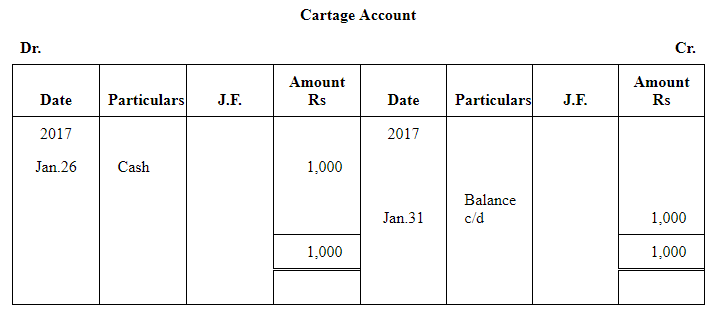

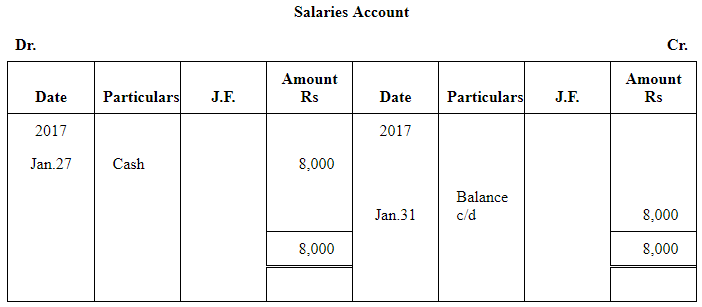

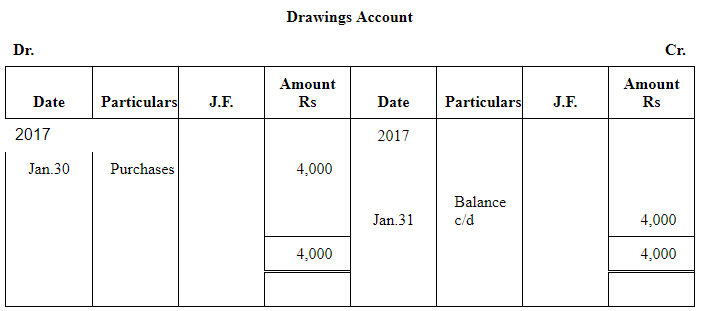

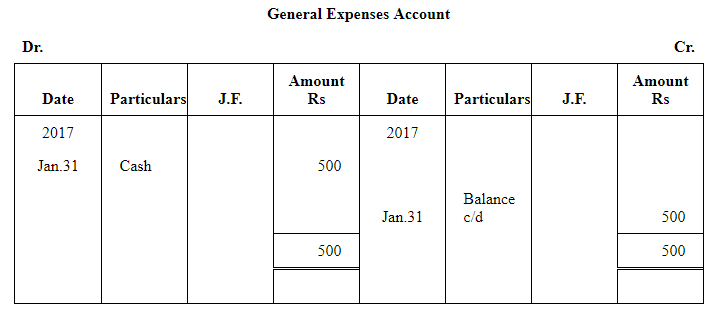

Q21 : Journalise the following transaction in the books of Sanjana and post them into the ledger:

Answer :

Page No 97:

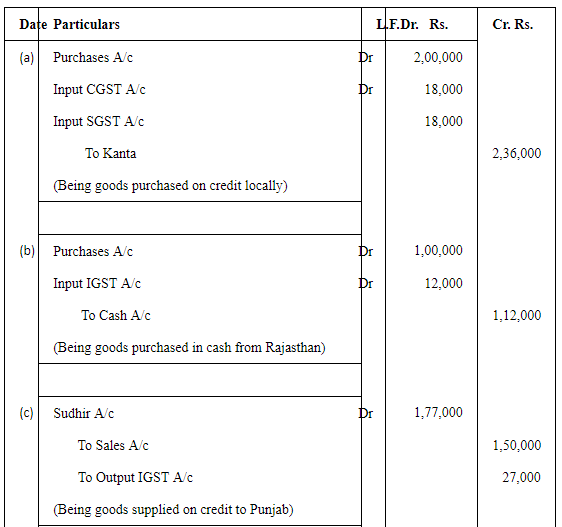

Question 22:Record journal entries for the following transactions in the books of Anudeep of Delhi:

(a) Bought goods Rs. 2,00,000 from Kanta of Delhi (CGST @ 9%, SGST @ 9%)

(b) Bought goods Rs. 1,00,000 for cash from Rajasthan (IGST @ 12%)

(c) Sold goods Rs. 1,50,000 to Sudhir of Punjab (IGST @ 18%)

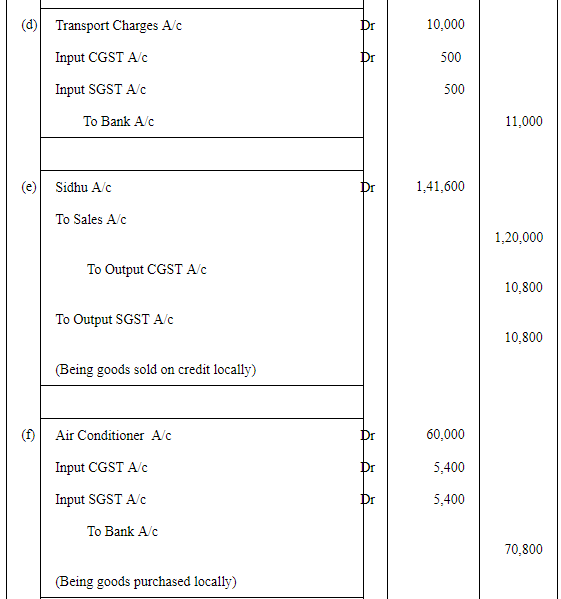

(d) Paid for Railway Transport Rs. 10,000 (CGST @ 5%, SGST @ 5%)

(e) Sold goods Rs. 1,20,000 to Sidhu of Delhi (CGST @ 9%, SGST @ 9%)

(f) Bought Air-Condition for office use Rs. 60,000 (CGST @ 9%, SGST @ 9%)

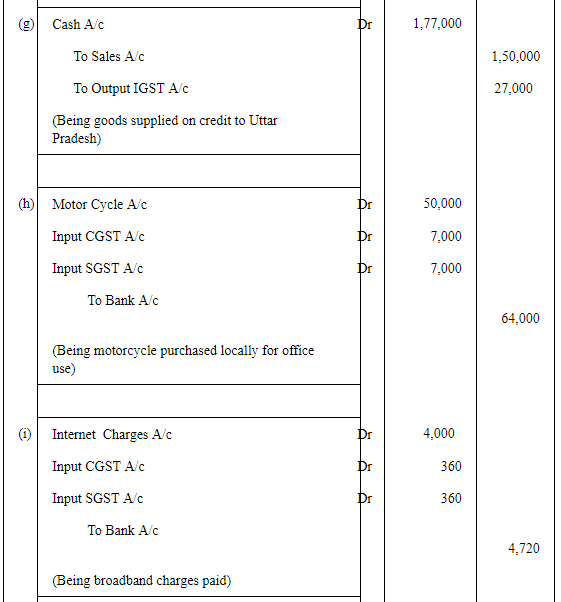

(g) Sold goods Rs. 1,50,000 for cash to Sunil to Uttar Pradesh (IGST 18%)

(h) Bought Motor Cycle for business use Rs. 50,000 (CGST 14%, SGST @ 14%)

(i) Paid for Broadband services Rs. 4,000 (CGST @ 9%, SGST @ 0%)

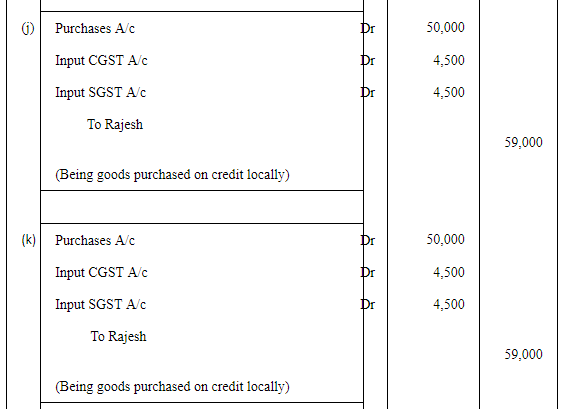

(j) Bought goods Rs. 50,000 from Rajesh, Delhi (CGST @ 9%, SGST @ 9%)

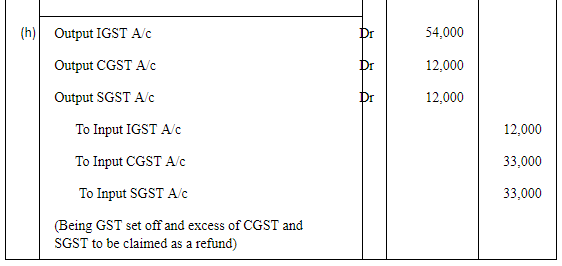

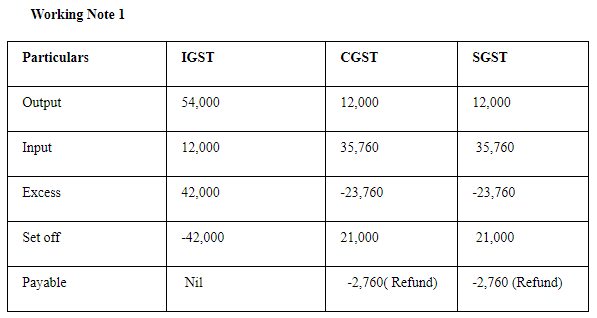

ANSWER:

|

61 videos|154 docs|35 tests

|

FAQs on NCERT Solution (Part - 4) - Recording of Transactions-I - Accountancy Class 11 - Commerce

| 1. What is the purpose of recording transactions in accounting? |  |

| 2. What are the different methods of recording transactions? |  |

| 3. How are transactions recorded in the single-entry system? |  |

| 4. How are transactions recorded in the double-entry system? |  |

| 5. What are the advantages of recording transactions accurately and promptly? |  |