NCERT Solution (Part - 2) - Trial Balance and Rectification of Errors | Accountancy Class 11 - Commerce PDF Download

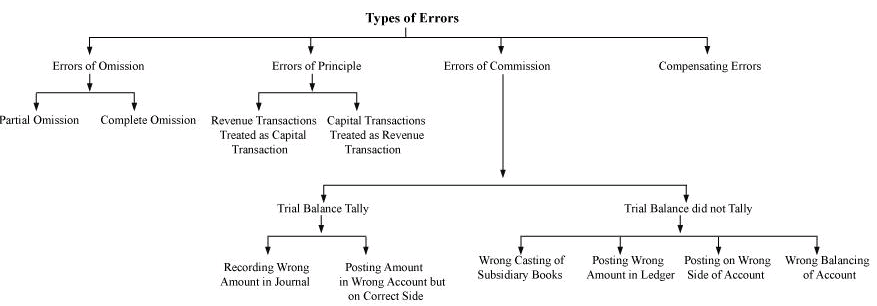

Q4 : What are the different types of errors that are usually committed in recording business transaction?

Answer :

1. Errors of omission- When an entry gets omitted during recording in the book of original entry or during posting the transaction, then error of omission is committed. There are two types of errors of omission, viz.:

- Partial omission - When a transaction is correctly recorded in one side of account but is not recorded in the other side of the account. For example, goods sold to Mahesh recorded in sales but omitted to be recorded in Mahesh's account. It affects the trial balance.

2. Complete omission- When a transaction gets completely omitted to be recorded in the books, then it is the case of complete omission . For example, transaction related to purchase of goods from Rakesh is not recorded in the purchases book. Such omissions does not affect the trial balance.

2. Errors of principle- These refer to those errors that are committed when recording of

transactions in the book of the original entry is done against the accounting principle. These errors affect the trial balance.

3. These errors are committed when proper distinction is not made between revenue income or expenditure and capital income or expenditure. These are of two types:

When revenue transactions are treated as capital transactionsWhen capital transactions are treated as revenue transactions.For example, repairs made to machinery, recorded in machinery account.

4. Errors of commission- These refer to those errors that are committed when transactions are recorded with wrong amounts, wrong balancing, wrong posting and/or wrong carrying forwarded is done.

5. . These are of two types:

- Trial balance does not agree

When trial balance does not agree, then there exist one-sided errors that affect only one

account and thereby are easily detectable. These one-sided errors exist due to the

following reasons:

i. Wrong casting of subsidiary bookPosting wrong amount in ledgerPosting on the wrong side

of accountWrong balancing of account - Trial balance agrees

i. When the trial balance agrees, then it should not be taken for granted that there are no

errors, as the tallied trial balance just ensures the absence of arithmetical errors.These

errors are not easily detectable; as these do notaffect the trial balance. These errors arise

due to:Recording wrong amount in the original book

ii. Posting amount in the wrong account but in the correct side

6. Compensating errors- When effects of one error are cancelled by the effects of another error of an equal amount, then compensating errors are committed. For example, Mr. A's account was credited by Rs 2,000 instead of 200 and Mr. B's account was credited by Rs 200 instead of 2,000. In this case, the error in Mr. A's account will be compensated by the error in Mr. B's account.

Q5 : As an accountant of a company, you are disappointed to learn that the totals in your new trial balance are not equal. After going through a careful analysis, you have discovered only one error. Specifically, the balance of the Office Equipment account has a debit balance of Rs. 15,600 on the trial balance. However, you have figured out that a correctly recorded credit purchase of pen-drive for Rs 3,500 was posted from the journal to the ledger with a Rs. 3,500 debit to Office Equipment and another Rs. 3,500 debit to creditors accounts. Answer each of the following questions and present the amount of any misstatement :

(a) Is the balance of the office equipment account overstated, understated, or

correctly stated in the trial balance?

(b) Is the balance of the creditors account overstated, understated, or correctly stated in the trial balance?

(c) Is the debit column total of the trial balance overstated, understated, or correctly stated?

(d) Is the credit column total of the trial balance overstated, understated, or correctly stated?

(e) If the debit column total of the trial balance is Rs. 2,40,000 before correcting the error, what is the total of credit column.

Answer : According to the given information, trial balance does not agree. Pen-drive is wrongly debited to office equipment account, instead of stationery account and supplier account is debited instead of crediting. Due to these mistakes, the following errors are

committed:

1. The balance of office equipment is overstated by Rs 3,500.

2. The balance of creditors account is understated by Rs 7,000.

3. The total of the debit column of the trial balance is correctly stated.

4. The total of the credit column of the trial balance is understated by Rs 7,000.

5. If the total of the debit column of the trial balance is Rs 2,40,000 before rectifying error, the total of the credit column of the trial balance is Rs 2,33,000 (i.e., Rs 2,40,000 - Rs 7,000).

Page No. : 228

Numerical questions :

Q1 : Rectify the following errors:

(i) Credit sales to Mohan Rs 7,000 were not recorded.

(ii) Credit purchases from Rohan Rs 9,000 were not recorded.

(iii) Goods returned to Rakesh Rs 4,000 were not recorded.

(iv) Goods returned from Mahesh Rs 1,000 were not recorded.

Answer :

Q2 : Rectify the following errors:

(i) Credit sales to Mohan Rs 7,000 were recorded as Rs 700.

(ii) Credit purchases from Rohan Rs 9,000 were recorded. as Rs 900.

(iii) Goods returned to Rakesh Rs 4,000 were recorded as Rs 400.

(iv) Goods returned from Mahesh Rs 1,000 were recorded as Rs 100.

Answer :

Q3 : Rectify the following errors:

(i) Credit sales to Mohan Rs 7,000 were recorded as Rs 7,200.

(ii) Credit purchases from Rohan Rs 9,000 were recorded as Rs 9,900.

(iii) Goods returned to Rakesh Rs 4,000 were recorded as Rs 4,040.

(iv) Goods returned from Mahesh Rs 1,000 were recorded as Rs 1,600.

Answer :

Page No. : 228

Q4 : Rectify the following errors:

(a) Salary paid Rs 5,000 was debited to employee's personal account.

(b) Rent Paid Rs 4,000 was posted to landlord's personal account.

(c) Goods withdrawn by proprietor for personal use Rs 1,000 were debited to sundry expenses account.

(d) Cash received from Kohli Rs 2,000 was posted to Kapur's account.

(e) Cash paid to Babu Rs 1,500 was posted to Sabu's account.

Answer :

Q5 : Rectify the following errors:

(a) Credit Sales to Mohan Rs 7,000 were recorded in purchases book.

(b) Credit Purchases from Rohan Rs 900 were recorded in sales book.

(c) Goods returned to Rakesh Rs 4,000 were recorded in the sales return book.

(d) Goods returned from Mahesh Rs 1,000 were recorded in purchases return book.

(e) Goods returned from Nahesh Rs 2,000 were recorded in purchases book.

Answer :

Q6 : Rectify the following errors:

(a) Sales book overcast by Rs 700.

(b) Purchases book overcast by Rs 500.

(c) Sales return book overcast by Rs 300.

(d) Purchase return book overcast by Rs 200.

Answer :

Q7 : Rectify the following errors :

(a) Sales book undercast by Rs 300.

(b) Purchases book undercast by Rs 400.

(c) Return Inwards book undercast by Rs 200.

(d) Return outwards book undercast by Rs 100.

Answer :

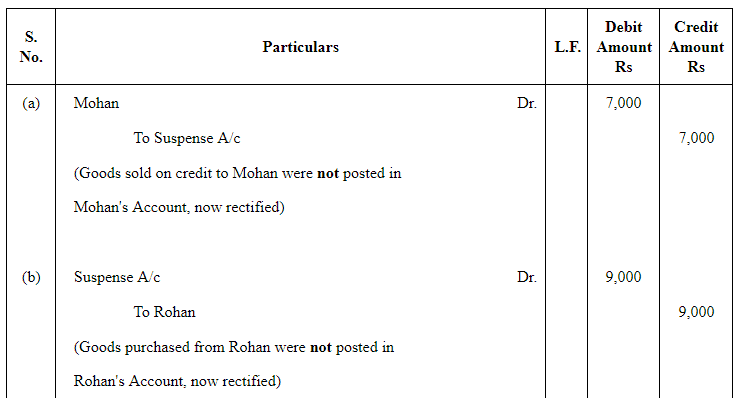

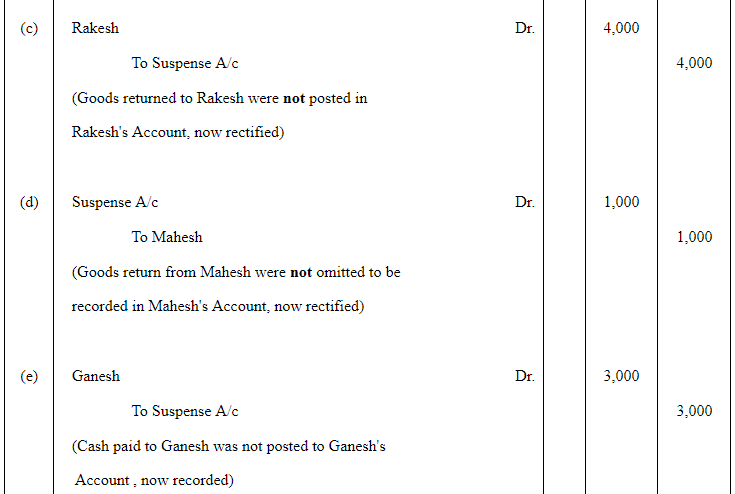

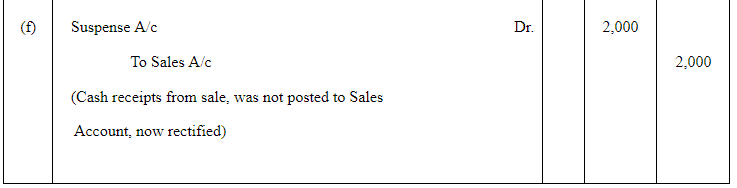

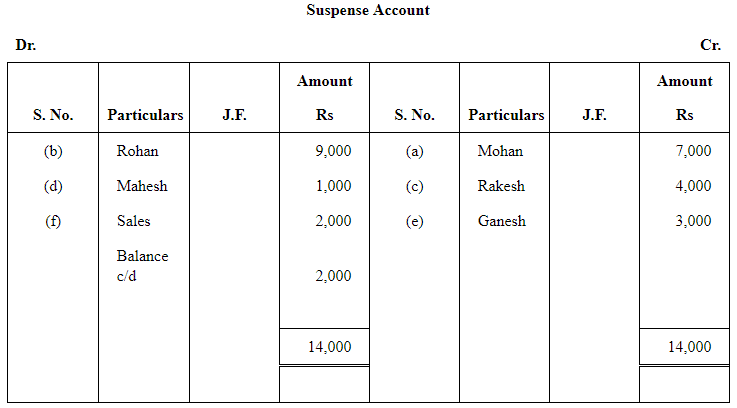

Q8 : Rectify the following errors and ascertain the amount of difference in trial balance by preparing suspense account:

(a) Credit sales to Mohan Rs 7,000 were not posted.

(b) Credit purchases from Rohan Rs 9,000 were not posted.

(c) Goods returned to Rakesh Rs 4,000 were not posted.

(d) Goods returned from Mahesh Rs 1,000 were not posted.

(e) Cash paid to Ganesh Rs 3,000 was not posted.

(f) Cash sales Rs 2,000 were not posted.

Answer :

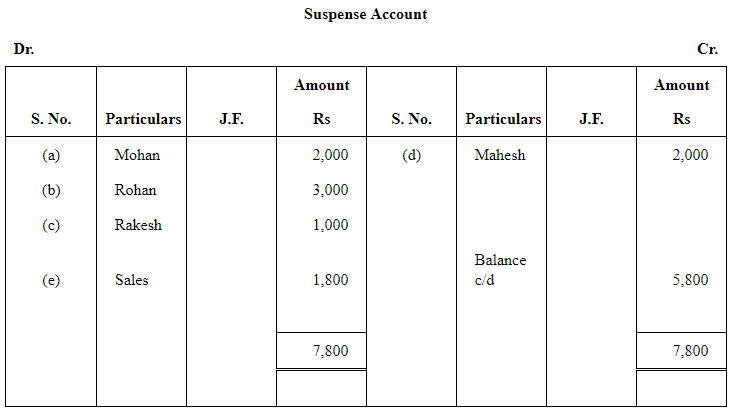

Q9 : Rectify the following errors and ascertain the amount of difference in trial balance by preparing suspense account:

(a) Credit sales to Mohan Rs 7,000 were posted as Rs 9,000.

(b) Credit purchases from Rohan Rs 9,000 were posted as Rs 6,000.

(c) Goods returned to Rakesh Rs 4,000 were posted as Rs 5,000.

(d) Goods returned from Mahesh Rs 1,000 were posted as Rs 3,000.

(e) Cash sales Rs 2,000 were posted as Rs 200.

Answer :

Note: In order to match answer with that of the answer given in the book it has been assumed that all the errors mentioned in this question are errors of partial omission.

|

61 videos|154 docs|35 tests

|

FAQs on NCERT Solution (Part - 2) - Trial Balance and Rectification of Errors - Accountancy Class 11 - Commerce

| 1. What is a trial balance? |  |

| 2. What is the purpose of rectifying errors in accounting? |  |

| 3. What are the different types of errors that can occur in accounting? |  |

| 4. What is the difference between a suspense account and an error account? |  |

| 5. How can errors in accounting be prevented? |  |