NCERT Solution (Part - 4) - Trial Balance and Rectification of Errors | Accountancy Class 11 - Commerce PDF Download

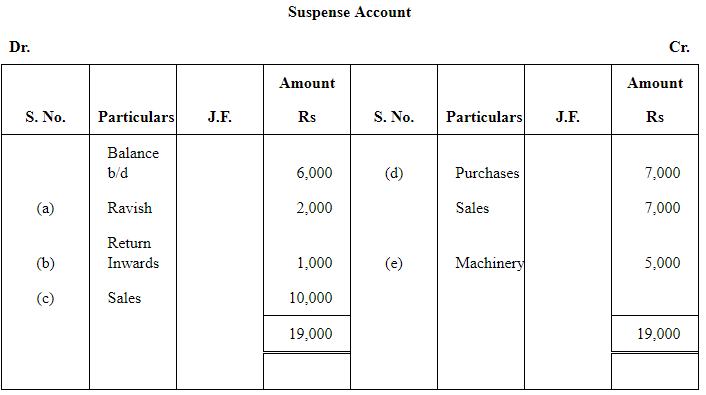

Q19 : Trial balance of Anuj did not agree. It showed an excess credit of Rs 6,000. He put the difference to suspense account. He discovered the following erro Rs

(a) Cash received from Ravish Rs 8,000 posted to his account as Rs 6,000.

(b) Returns inwards book overcast by Rs 1,000.

(c) Total of sales book Rs 10,000 was not posted to Sales account.

(d) Credit purchases from Nanak Rs 7,000 were recorded in sales Book. However, Nanak’s account was correctly credited.

(e) Machinery purchased for Rs 10,000 was posted to purchases account as Rs 5,000. Rectify the errors and prepar suspense account.

Answer :

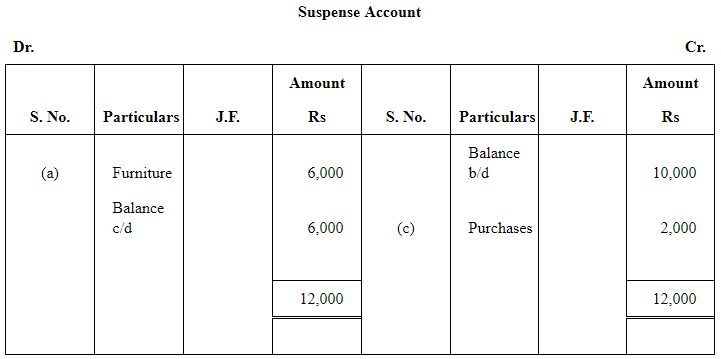

Q20 : Trial balance of Raju showed an excess debit of Rs 10,000. He put the difference to suspense account and discovered the following errors:

(a) Depreciation written-off the furniture Rs 6,000 was not posted to Furniture account.

(b) Credit sales to Rupam Rs 10,000 were recorded as Rs 7,000.

(c) Purchases book undercast by Rs 2,000.

(d) Cash sales to Rana Rs 5,000 were not posted.

(e) Old Machinery sold for Rs 7,000 was credited to sales account.

(f) Discount received Rs 800 from Kanan on playing cash to him was not posted. Rectify the errors and prepar suspense account.

Answer :

Note: As per the solution, suspense account shows the credit balance of Rs 6,000. However, in the book the answer is credit balance of Rs 1,000. So, in order to match the answer with the book item (d) is taken as, ‘Cash Sales to Rana Rs 5,000 were not posted to the sales account.’ Thus, the rectifying entry of this error will be:

Suspense A/c Dr. 5,000

To Sales A/c 5,000

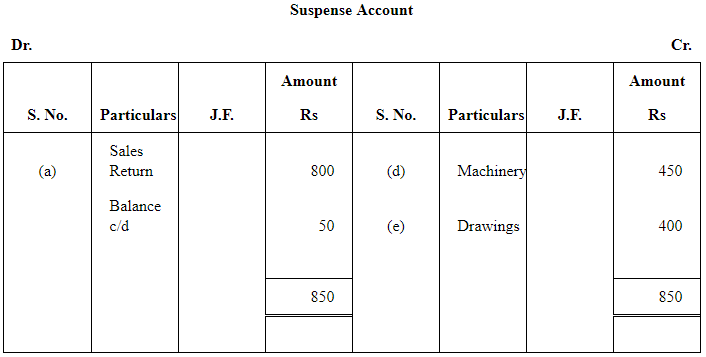

Q21 : Trial balance of Madan did not agree and he put the difference to suspense account. He discovered the following errors:

(a) Sales return book overcast by Rs 800.

(b) Purchases return to Sahu Rs 2,000 were not posted.

(c) Goods purchased on credit from Narula Rs 4,000 though taken into stock, but no entry was passed in the books.

(d) Installation charges on new machinery purchased Rs 500 were debited to sundry expenses account as Rs 50.

(e) Rent paid for residential accommodation of madam (the proprietor) Rs 1,400 was debited to Rent account Rectify the errors and prepare suspense account to ascertain the difference in trial balance.

Answer :

Note: As per the solution Suspense Account shows a credit balance of Rs 50. However, as per the answer given in the book, it is a credit balance of Rs 2050. In order to match answer with the book item (b) is taken as, ‘Purchases return to Sahu Rs 2,000 were not posted to Sahu’s Account.’ Thus, the rectifying entry for this error will be as:

Sahu’s A/c Dr. 2,000

To Suspense A/c 2,000

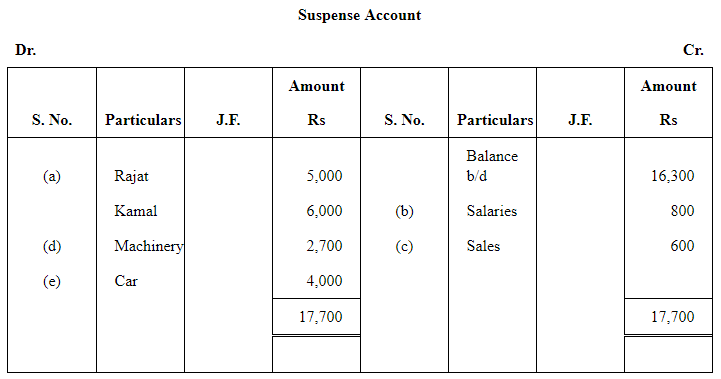

Q22 : Trial balance of Kohli did not agree and showed an excess debit of Rs 16,300. He put the difference to a suspense account and discovered the following errors:

(a) Cash received from Rajat Rs 5,000 was posted to the debit of Kamal as Rs 6,000.

(b) Salaries paid to an employee Rs 2,000 were debited to his personal account as Rs 1,200.

(c) Goods withdrawn by proprietor for personal use Rs 1,000 were credited to sales account as Rs 1,600.

(d) Depreciation provided on machinery Rs 3,000 was posted to Machinery account as Rs 300.

(e) Sale of old car for Rs 10,000 was credited to sales account as Rs 6,000. Rectify the errors and prepare suspense account.

Answer :

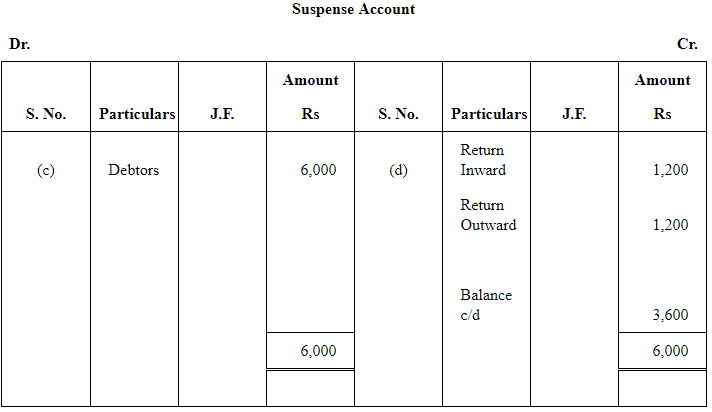

Q23 : Give journal entries to rectify the following errors assuming that suspense account had been opened.

(a) Goods distributed as free sample Rs 5,000 were not recorded in the books.(b) Goods withdrawn for personal use by the proprietor Rs 2,000 were not recorded in the books.

(c) Bill receivable received from a debtor Rs 6,000 was not posted to his account.

(d) Total of Returns inwards book Rs 1,200 was posted to Returns outwards account.

(e) Discount allowed to Reema Rs 700 on receiving cash from her was recorded in the books as Rs 70.

Answer :

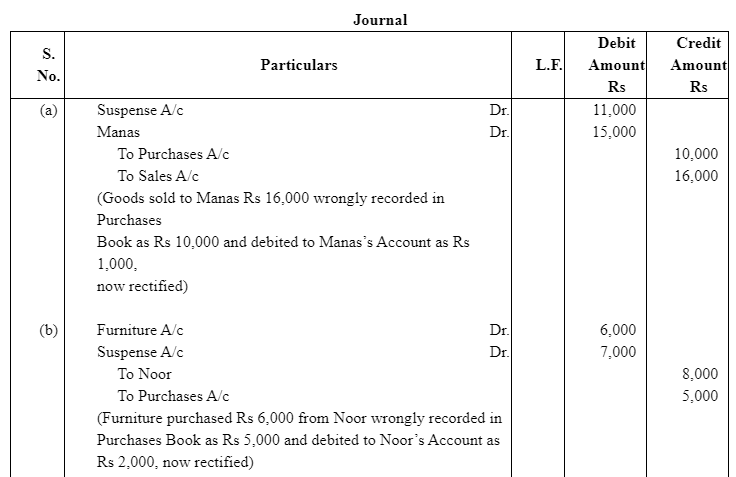

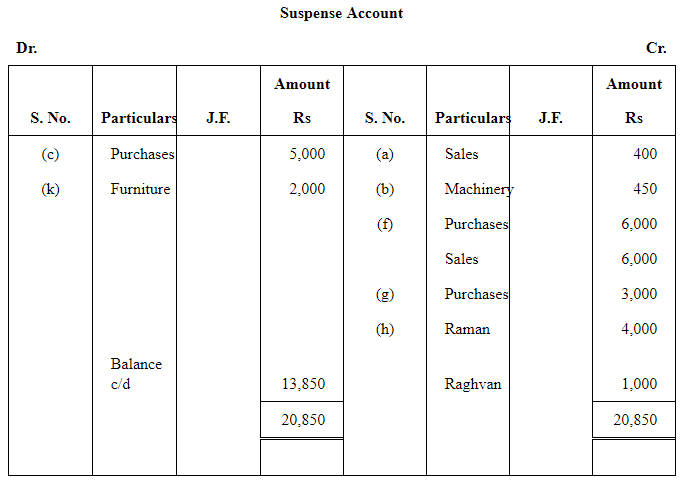

Q24 : Trial balance of Khatau did not agree. He put the difference to suspense account and discovered the following errors:

(a) Credit sales to Manas Rs 16,000 were recorded in the purchases book as Rs 10,000 and posted to the debit 1,000.

(b) Furniture purchased from Noor Rs 6,000 was recorded through purchases book as Rs 5,000 and posted to Rs 2,000.

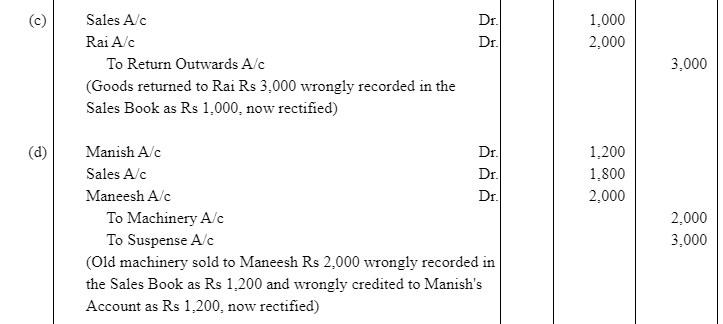

(c) Goods returned to Rai Rs 3,000 recorded through the Sales book as Rs 1,000.

(d) Old machinery sold for Rs 2,000 to Maneesh recorded through sales book as Rs 1,800 and posted to the credit Rs 1,200.

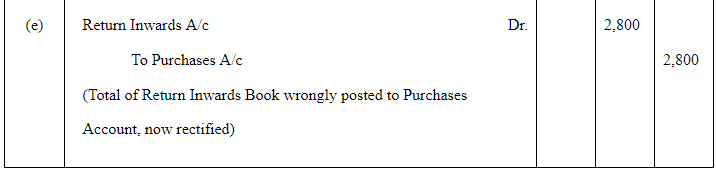

(e) Total of Returns inwards book Rs 2,800 posted to Purchase account.

Rectify the above errors and prepare suspense account to ascertain the difference in trial balance.

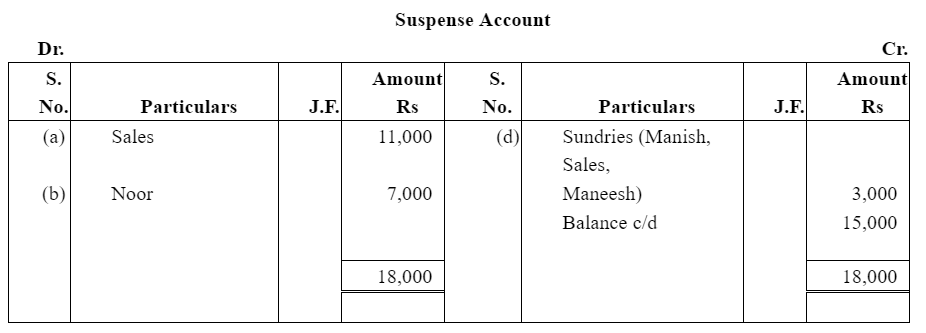

Answer :

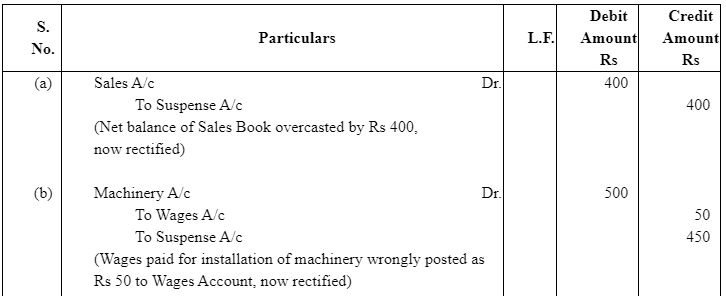

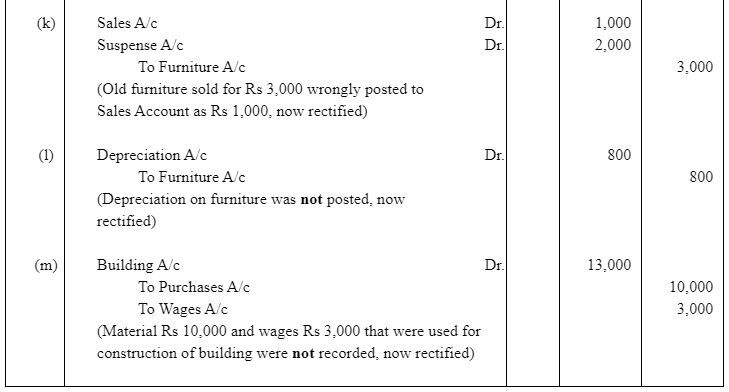

Q25 : Trial balance of John did not agree. He put the difference to suspense account and discovered the following errors :

(a) In the sales book for the month of January total of page 2 was carried forward to page 3 as Rs 1,000 instea total of page 6 was carried forward to page 7 as Rs 5,600 instead of Rs 5,000.

(b) Wages paid for installation of machinery Rs 500 was posted to wages account as Rs 50.

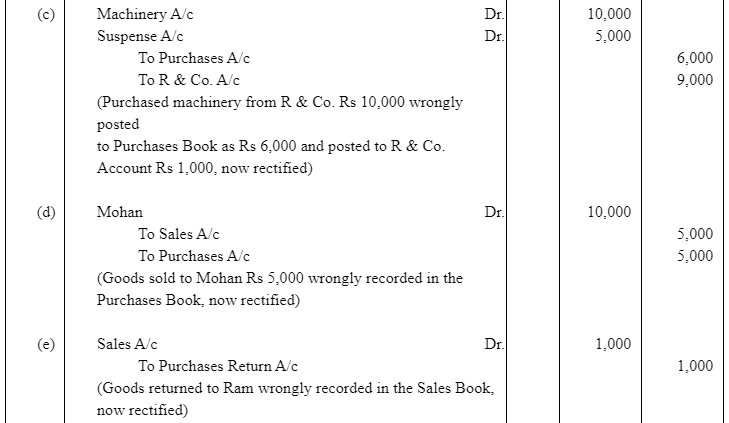

(c) Machinery purchased from R & Co. for Rs 10,000 on credit was entered in Purchase Book as Rs 6,000 and to R & Co. as Rs 1,000.

(d) Credit sales to Mohan Rs 5,000 were recorded in Purchases Book.

(e) Goods returned to Ram Rs 1,000 were recorded in Sales Book.

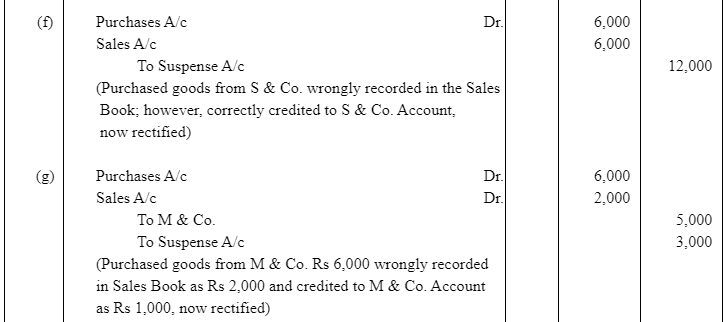

(f) Credit purchases from S & Co. for Rs 6,000 were recorded in sales book. However, S & Co. was correctly credited.

(g) Credit purchases from M & Co. Rs 6,000 were recorded in Sales Book as Rs 2,000 and posted there from & Co. as Rs 1,000.

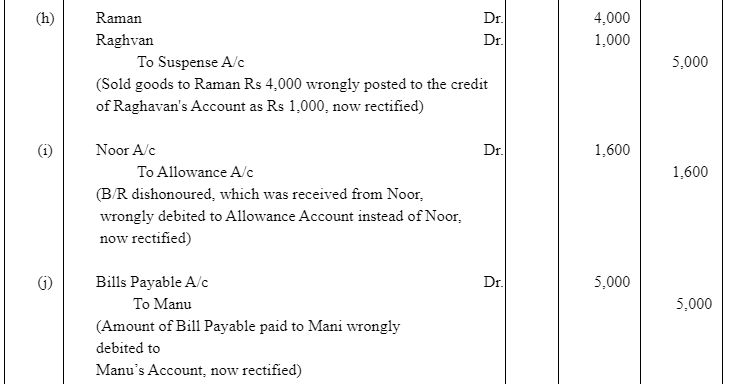

(h) Credit sales to Raman Rs 4,000 posted to the credit of Raghvan as Rs 1,000.

(i) Bill receivable for Rs 1,600 from Noor was dishonoured and posted to debit of Allowances account.

(j) Cash paid to Mani Rs 5,000 against our acceptance was debited to Manu.

(k) Old furniture sold for Rs 3,000 was posted to Sales account as Rs 1,000.

(l) Depreciation provided on furniture Rs 800 was not posted.

(m) Material Rs 10,000 and wages Rs 3,000 were used for construction of building. No adjustment was made Rectify the errors and prepare suspense to ascertain the difference in trial balance.

Answer

Note: In item (m), it has been assumed that the materials used in the construction of building are part of stock in trade.

|

64 videos|152 docs|35 tests

|

FAQs on NCERT Solution (Part - 4) - Trial Balance and Rectification of Errors - Accountancy Class 11 - Commerce

| 1. What is a trial balance and why is it important in accounting? |  |

| 2. How is a trial balance prepared? |  |

| 3. What are the types of errors that can be identified through a trial balance? |  |

| 4. How can errors identified through a trial balance be rectified? |  |

| 5. Can a trial balance guarantee the absence of errors in the accounting system? |  |

|

Explore Courses for Commerce exam

|

|