NCERT Solutions (Part - 1) - Depreciation, Provisions, and Reserves | Accountancy Class 11 - Commerce PDF Download

Short Answer Questions

Q1. What is ‘Depreciation’?

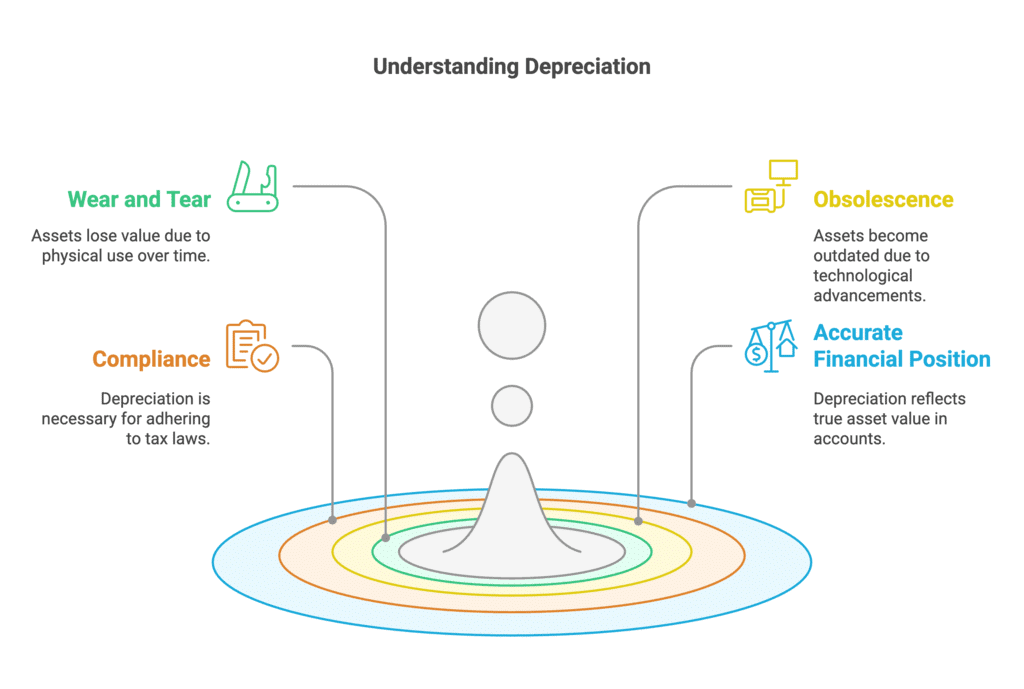

Ans: Depreciation refers to the reduction in the value of fixed assets due to wear and tear over time. These fixed assets can include items such as furniture, machinery, and buildings. It is important to note that land is not considered a depreciable asset, as its value typically increases over time.

Q2. State briefly the need for providing depreciation.

Ans: The following are the requirements for providing depreciation:

- The value of fixed assets decreases over time due to wear and tear, which reduces the asset's capacity.

- Depreciation must be recorded to accurately reflect this effect in the books of account.

- It portrays the true financial position of the business, preventing the overvaluation of assets.

- Depreciation complies with tax regulations and other legal requirements.

- It helps the business adhere to the revenue matching principle, ensuring that expenses are matched with the income they generate in the same period.

Q3. What are the causes of depreciation?

Ans: The following are the causes of depreciation:

- Some current assets have a finite life, after which they become perishable. Inventory is an example of such an asset.

- Fixed assets experience wear and tear over time, necessitating the recording of the reduction in their cost.

- As new technological innovations emerge, fixed assets such as equipment and machinery can become obsolete. This must be properly recorded in the books of account, and depreciation accomplishes this.

- The use of certain assets depletes over time, and this depletion is recorded through accounting depreciation. Examples of such assets include gas and oil reservoirs.

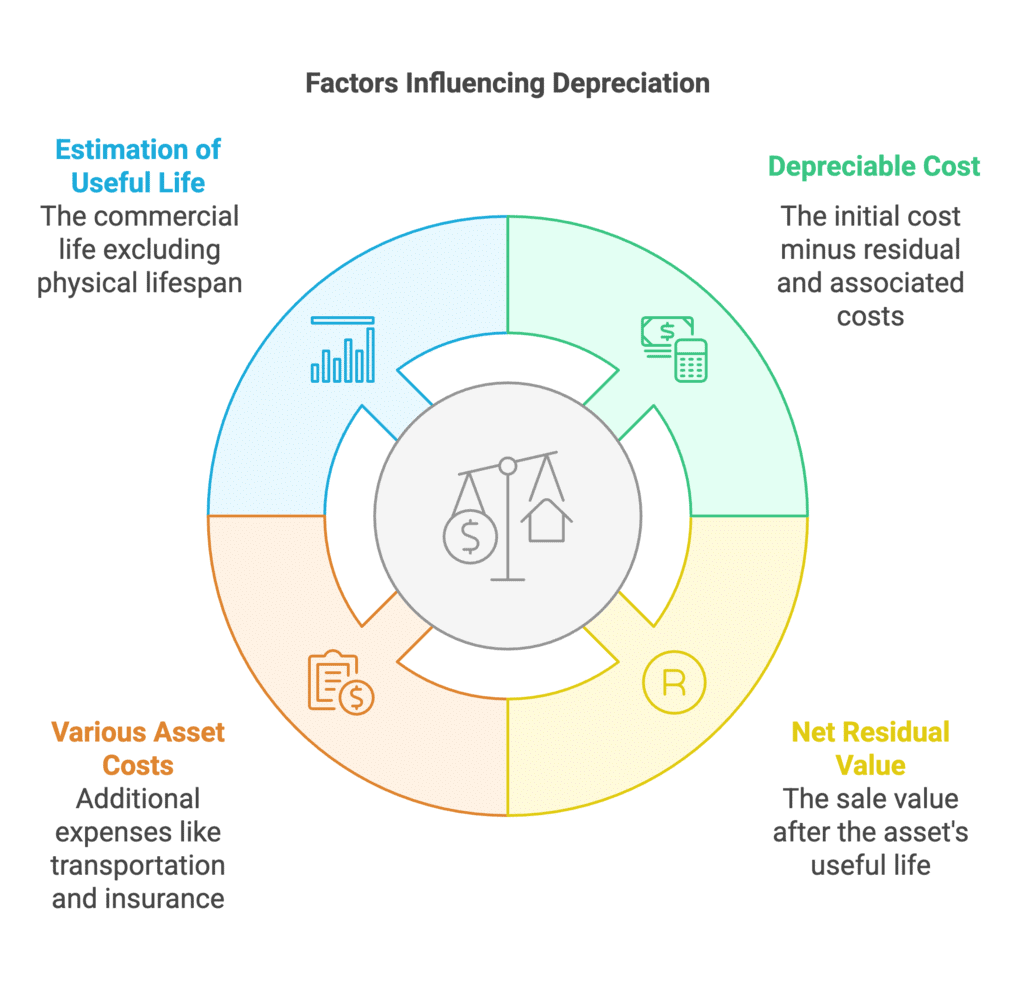

Q4. Explain basic factors affecting the amount of depreciation.

Ans: The following are the primary factors that influence the amount of depreciation:

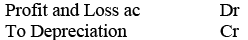

- Depreciable cost: This is the cost that remains after deducting both the residual cost and the various costs associated with the asset. The total depreciation charged over the useful life should equal the total depreciation.

- Net residual value: This refers to the asset's sales value after its useful life has ended. It is calculated by deducting all expenses incurred during the asset's disposal.

- Various costs of the asset: In addition to the basic purchase cost, an asset may incur other expenses such as transportation, commission fees, and insurance premiums. These costs are essential to restore the asset to working order.

- Estimation of useful life: The useful life of any asset is defined as its actual commercial life. This concept excludes the physical lifespan, as it considers that the asset may still have value even after its useful life has ended, although it may not be commercially productive for the business.

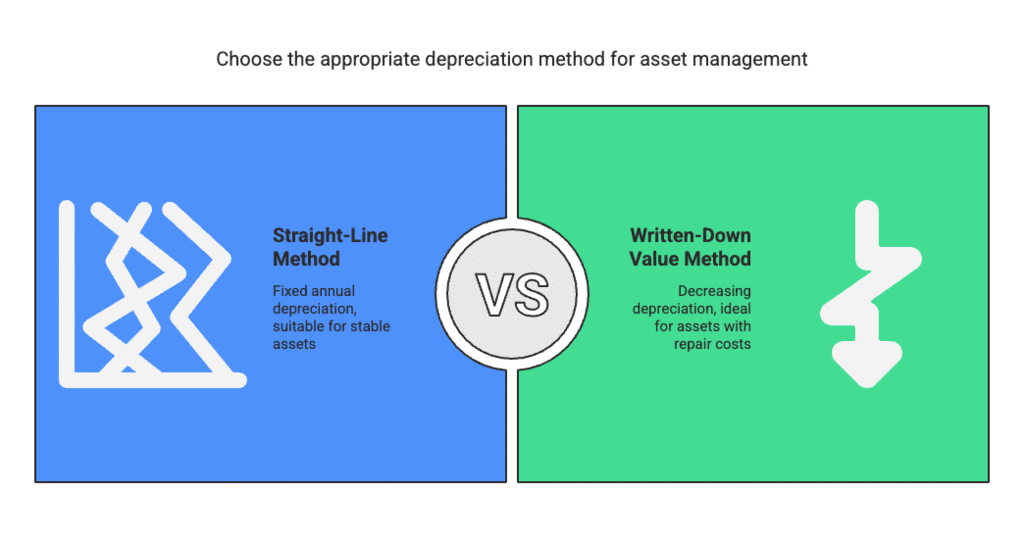

Q5. Distinguish between straight-line method and written-down value method of calculating depreciation.

Ans: The following are the differences between the straight line and the written down value methods of calculating depreciation:

- The straight-line method calculates depreciation based on the original cost, while the written-down value method calculates depreciation based on the net cost.

- In the straight-line method, the amount of annual depreciation is fixed; in contrast, the written-down value method results in depreciation reducing the asset's value each successive year.

- The straight-line method charges depreciation based on the total cost of the asset, which includes both the depreciation charge and any repair expenses.

- Conversely, in the written down value method, the depreciation charge decreases year after year, meaning the total charge remains constant.

- The income tax authority recognises the written-down value method of depreciation but not the straight-line method.

- Straight-line depreciation is suitable for assets requiring fewer repairs and thus becoming less obsolete over time; examples include land and buildings.

- The written-down value method is typically used when there are significant repair expenses or where technological changes affect market value.

Q6. “In case of a long term asset, repair and maintenance expenses are expected to rise in later years than in earlier year”. Which method is suitable for charging depreciation if the management does not want to increase burden on profits and loss account on account of depreciation and repair.

Ans: When dealing with long-term assets, if repair and maintenance costs are expected to rise in the later years of the asset's life, the written-down value method is more suitable than the straight-line method of depreciation. This method is advantageous as it does not significantly burden the profit and loss account with depreciation expenses. Using the written-down value method means that the rate of depreciation decreases each year, which aligns with the anticipated rise in maintenance costs. Consequently, this approach allows for a smoother financial impact over time.

Q7. What are the effects of depreciation on profit and loss account and balance sheet?

Ans: Depreciation has a direct impact on the profit and loss account because it is recorded as an expense. When the amount of depreciation is higher, the net income of the company is lower compared to situations where the rate of depreciation is lower. The effect of depreciation on the balance sheet reduces the net amount of assets, which further impacts the business's net income. This reduction in asset value can affect financial ratios and overall company performance.

Q8. Distinguish between ‘provision’ and ‘reserve’.

Ans: The distinction between provision and reserve is as follows:

- Provision refers to a charge against profit that helps determine net profit, while a reserve is an appropriation of profit aimed at strengthening the financial position of a business.

- Provisions account for likely expenses that the business may incur during a specific accounting period. In contrast, reserves are used to enhance the business's financial standing.

- On the balance sheet, provisions appear on the asset side, whereas reserves are listed as a current liability on the liabilities side.

- Provisions reduce taxable profit since they are deducted from pre-tax earnings, while reserves are calculated based on profits after taxes, thus not affecting taxable profits.

- The creation of provisions is mandated by regulations to ensure fair profit reporting, whereas the establishment of reserves, except for specific types, is at the company’s discretion.

- Provisions cannot be distributed as dividends, but a company can use its general reserve for this purpose.

Q9. Give four examples each of ‘provision’ and ‘reserves’.

Ans: Provisions are necessary for businesses to account for identifiable expenses expected during an accounting period. Reserves, on the other hand, are funds set aside to strengthen the company's financial position. Below are four examples of each:

Provisions:

- Provision for bad and doubtful debts

- Provision for repairs and maintenance

- Provision for depreciation

- Provision for taxes

Reserves:

- General reserve

- Capital reserve

- Workmen compensation reserve

- Dividend equalisation reserve

Q10. Distinguish between ‘revenue reserve’ and ‘capital reserve’.

Ans: The following are the distinctions between revenue reserves and capital reserves:

- Revenue reserves are created to strengthen the financial position of the business, while capital reserves are established to meet legal requirements.

- Revenue reserves are typically used to address contingencies and general needs, such as dividend distributions, whereas capital reserves are dedicated to fulfilling legal obligations.

- Revenue reserves arise from revenue profits generated during the routine operations of the business.

- In contrast, capital reserves are created from the business's capital and are intended for purposes that do not occur in regular business operations.

Q11. Give four examples each of ‘revenue reserve’ and ‘capital reserves’.

Ans: Here are four examples of revenue reserves:

- General reserve

- Dividend equalisation reserve

- Workers' compensation reserve

- Debenture redemption reserve

The four examples of capital reserves are as follows:

- Premium on share or debenture issuance

- Profit from the sale of fixed assets

- Profit from the revaluation of fixed assets and liabilities

- Profit from the redemption of debentures

Q12. Distinguish between ‘general reserve’ and ‘specific reserve’.

Ans: The general reserve is established to strengthen the company's financial position and can be utilised for any purpose deemed necessary by management. In contrast, a specific reserve is created to address a particular need within the organisation. When specific reserves are employed for their intended purpose, they eventually outlive their usefulness.

Q13. Explain the concept of ‘secret reserve’.

Ans: The secret reserve is a financial concept used to manage a business's tax liability. It helps to combine profits made in profitable years with losses incurred in others, ultimately aiming to increase net profits. Notably, the secret reserve is not presented on the company's Balance Sheet. It is typically created through:

- High depreciation rates on assets.

- Classifying contingent liabilities as actual liabilities.

- Making excessive provisions for doubtful debts.

Establishing a secret reserve is permissible, provided it remains within reasonable limits.

Long Answer Questions

Q1. Explain the concept of depreciation. What is the need for charging depreciation and what are the causes of depreciation?

Ans: Depreciation is defined as the reduction in the value of a business's asset over time. Fixed assets that must be depreciated include machinery, furniture, buildings, and offices. It is important to note that land is not a depreciable asset, as its value typically increases over time. The following are the reasons for charging depreciation:

- Every fixed asset loses value over time due to wear and tear, which reduces its working capacity. Hence, depreciation is recorded in the books of accounts to reflect this decrease.

- Depreciation accurately depicts the company's financial position, preventing the overestimation of asset values in the accounts.

- Companies must comply with tax regulations, which require the recording of depreciation in their accounts. According to revenue matching principles, expenses must be recognised in the same accounting period in which they occur to align with the revenue generated.

The following are the causes of depreciation:

- The value of fixed assets decreases over time as equipment and machinery become obsolete due to advancements in technology. This obsolescence must be recorded through accounting depreciation.

- Some fixed assets have a short lifespan and may become unusable after their expected life, similar to current assets like inventory. It is crucial for businesses to record such depreciation in their asset valuations.

- All fixed assets are subject to wear and tear, which reduces their value. Recording this depreciation is necessary to account for the asset's diminishing worth.

- As certain assets are used, they deplete in value; thus, depreciation serves as a means to account for this decline.

Q2. Discuss in detail the straight line method and written down value method of depreciation. Distinguish between the two and also give situations where they are useful.

Ans: The Straight-Line Method is a technique used to calculate the depreciation of an asset based on its original cost. Under this method, the amount of depreciation is fixed, meaning that the same amount is deducted each year over the asset's useful life. In contrast, the Written Down Value Method calculates depreciation on a decreasing basis. Here, the depreciation is applied to the remaining book value of the asset, resulting in smaller depreciation amounts in later years as the asset's value decreases. The advantages of the Straight-Line Method include:

- It is simpler and easier to calculate than the Written Down Value Method.

- Assets can be depreciated until their value reaches zero.

- Since the same amount of depreciation is charged each year, it allows for easier comparisons in the Statement of Profit or Loss.

- This method is suitable for assets that incur low repair and maintenance costs due to their continuous use.

However, the Straight-Line Method has some limitations:

- The burden of depreciation may increase on the profit or loss account in later years as the asset ages, leading to higher repair and maintenance costs.

- Even if the asset remains usable, its recorded value can become zero.

On the other hand, the Written Down Value Method offers the following advantages:

- This method is based on the assumption that assets are used more intensively in their early years and less in later ones.

- It is particularly appropriate for assets that incur higher repair costs in later years, as the depreciation amount decreases.

- This method is recognised by income tax authorities.

- It helps reduce the loss from asset obsolescence by charging more depreciation in the early years.

Nevertheless, the Written Down Value Method also has its limitations:

- The calculation can be complex and difficult to manage.

- Assets cannot be completely written off while they are still in use, as their value does not reach zero.

Q3. Describe in detail two methods of recording depreciation. Also, give the necessary journal entries.

Ans: Depreciation is recorded using one of two methods:

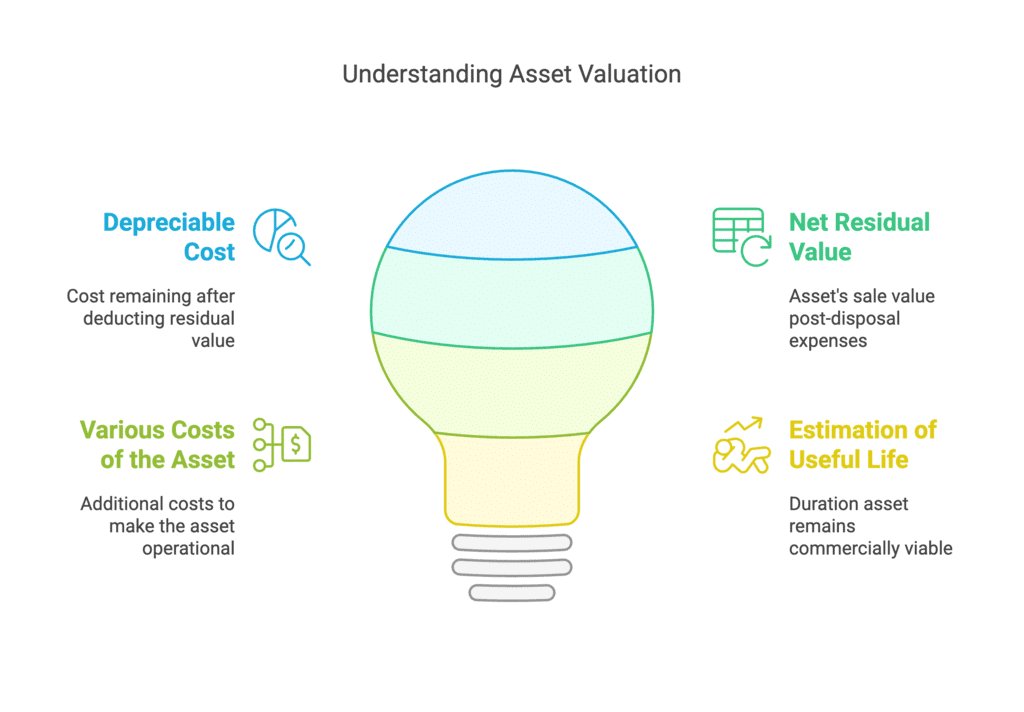

(I) Charging depreciation directly to the asset account – In this method, depreciation is first charged from the asset's cost, then to the profit and loss account. The balance sheet thus shows the net value of the asset after depreciation is deducted. The journal entries in this method are as follows:

- Subtracting depreciation from the asset's cost

- To charge the depreciation to profit and loss account

(II) Making a provision for accumulated depreciation – The amount of depreciation to be charged in the accumulated under the separate account under this method of charging depreciation. Thus, in the balance sheet, the asset's value is shown in its original value, and the accumulated amount of depreciation is shown in the liabilities side of the balance sheet.

The journal entries in this method are as follows:

- Including depreciation in the depreciation provision

- To charge the depreciation to profit and loss account

Q4. Explain the determinants of the amount of depreciation.

Ans:

- Depreciable cost: This is the cost that remains after deducting both the residual cost and the various costs of the asset. The total depreciation should be equal to the total depreciation charged over the useful life of the asset.

- Net residual value: This is the value of the asset's sale after its useful life has ended. It is calculated by deducting all expenses incurred during the disposal of the asset.

- Various Costs of the Asset: Aside from the basic purchase cost of the asset, an asset will incur various costs. These expenses can take the form of transportation, commission fees, insurance premiums, and so on. These are the expenses incurred in order to restore the asset to working order.

- Estimation of useful life: The useful life of any asset is defined as its actual commercial life. As a result, the concept of the asset's physical life is excluded because it considers the fact that the asset will continue to sustain even after its useful life has ended, which may not be of commercial productivity for the business.

Q5. Name and explain different types of reserves in detail.

Ans: A business establishes a reserve to strengthen its financial position through retained earnings. There are several types of reserves:

1. Revenue Reserve: This reserve is created from profits generated by the business's normal operations. It can be used for either a general or a specific purpose. There are two kinds of revenue reserves:

- General Reserve: Created without a specific purpose, these reserves can be used for various objectives, including expansion and growth. Examples include retained earnings and contingency reserves.

- Specific Reserve: These reserves are created for a specific purpose. Examples include debenture redemption reserves and dividend equalisation reserves.

2. Capital Reserve: This reserve is created from capital profits, which are profits from activities outside normal business operations, such as the sale of fixed assets. It is intended to compensate for capital losses and cannot be paid out as dividends. Examples of capital reserves include:

- Premium on share issuance

- Premium on debenture issuance

- Profit from debenture redemption

- Profit from the sale of fixed assets

- Profit from the reissue of forfeited shares

- Profit before incorporation

3. Secret Reserves: These reserves are created by overstating liabilities or understating assets and are not reflected in the balance sheet. This practice reduces tax liabilities by overstating liabilities. Management often creates secret reserves to lower profits and avoid competition. The Companies Act of 1956 prohibits the establishment of secret reserves and mandates full disclosure of all material facts and accounting policies when preparing final statements.

Q6. What are ‘provisions’. How are they created? Give accounting treatment in case of provision for doubtful Debts.

Ans: Provisions are created by businesses to account for anticipated expenses and losses that they foresee in the future. These provisions are deducted from the business's revenue and are reflected either as a deduction from assets or as a current liability. Examples of provisions include:

- Provision for bad and doubtful debts

- Provision for depreciation

- Provision for repairs and maintenance

The accounting treatment for the provision for doubtful debts is crucial. Doubtful debts refer to those amounts that the company is uncertain about recovering. To manage this uncertainty, the company makes a provision to recognise potential losses. The standard journal entry for this provision is documented as follows:

Numerical Question Answers

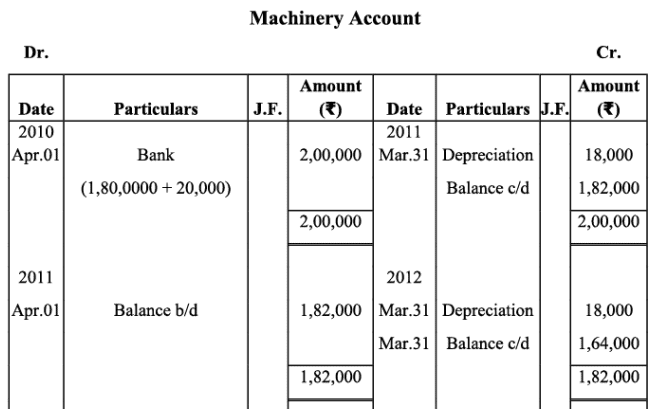

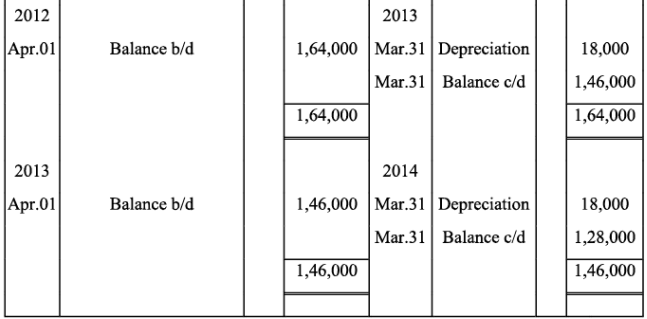

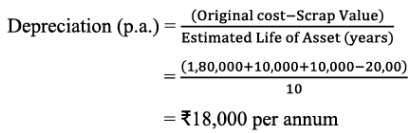

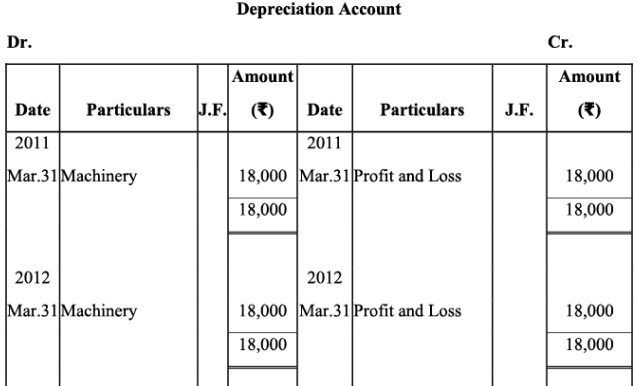

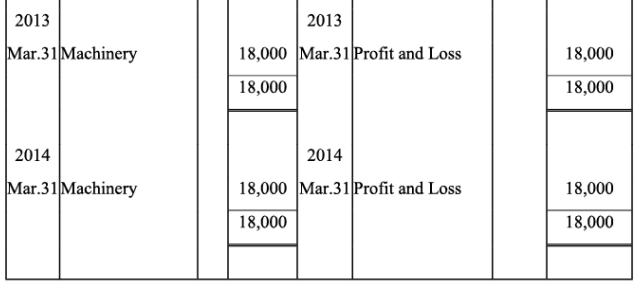

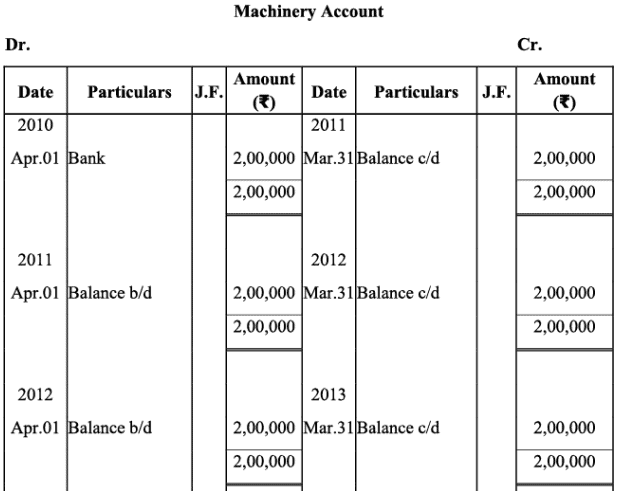

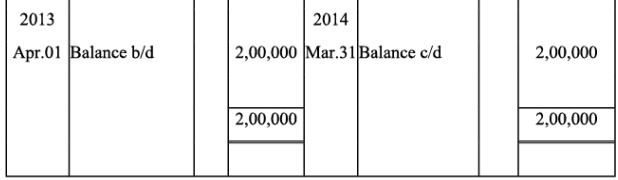

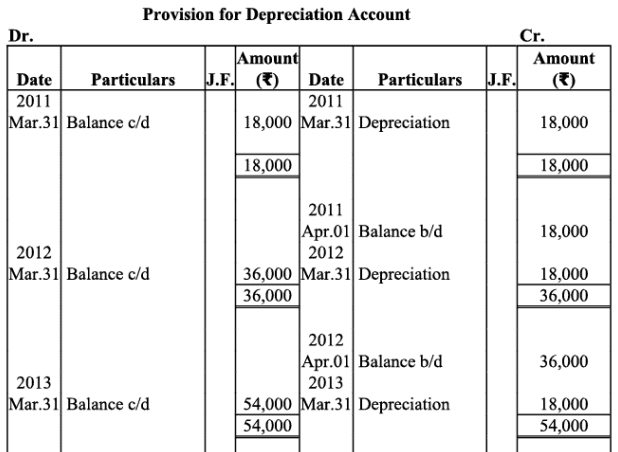

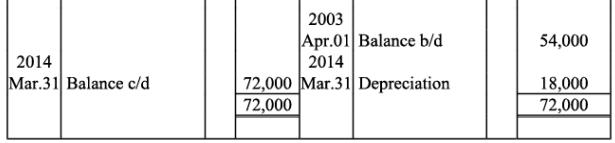

Q1: On April l, 2010, Bajrang Marbles purchased a Machine for Rs. 1,80,000 and spent Rs. 10,000 on its carnage and Rs. 10,000 on its installation. It is estimated that its working life is 10 years and after 10 years its scrap value will be Rs. 20,000.

(a)Prepare Machine account and Depreciation account for the first four years by providing depreciation on straight line method. Accounts are closed on March 31st every year.

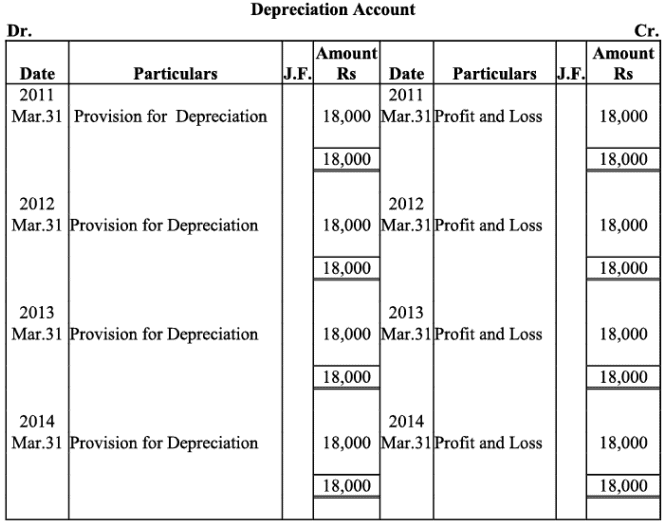

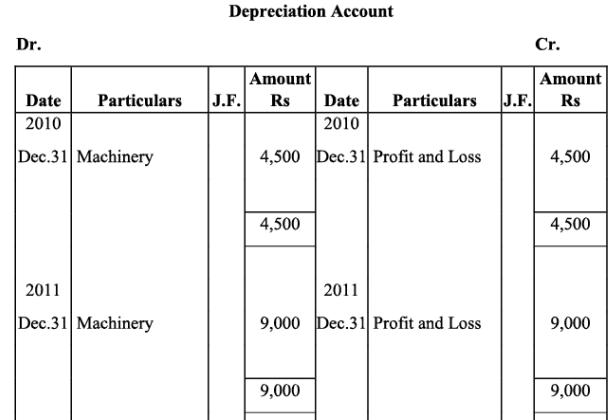

(b)Prepare Machine account, Depreciation account and Provision for depreciation account (or accumulated depreciation account) for the first four years by providing depreciation using straight line method accounts are closed on March 31 every year.

Ans:

(a) Books of Bajrang Marbles

Working notes: Calculation of annual depreciation

(b)

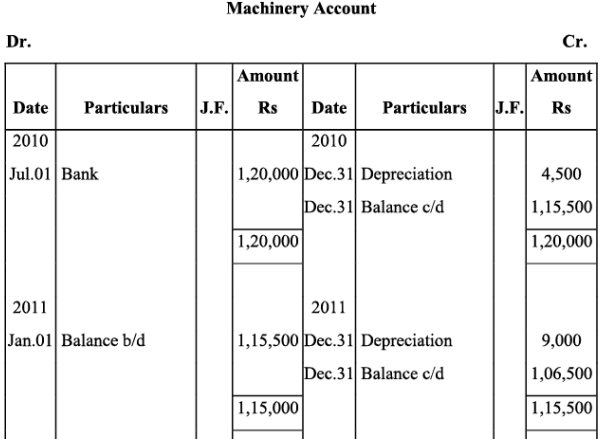

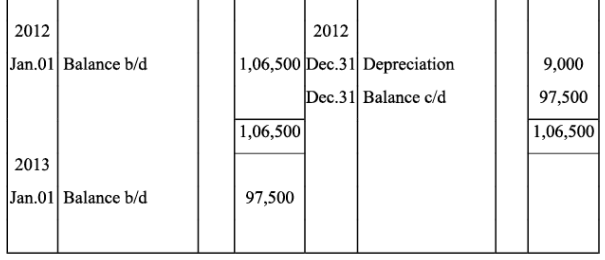

Q2: On July 01, 2010, Ashok Ltd. Purchased a Machine for Rs. 1,08,000 and spent Rs. 12,000 on its installation. At the time of purchase it was estimated that the effective commercial life of the machine will be 12 years and after 12 years its salvage value will be Rs. 12,000.

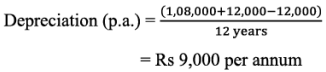

Prepare machine account and depreciation Account in the books of Ashok Ltd. For first three years, if depreciation is written off according to straight line method. The account are closed on December 31st, every year.

Ans: Books of Ashok Ltd.

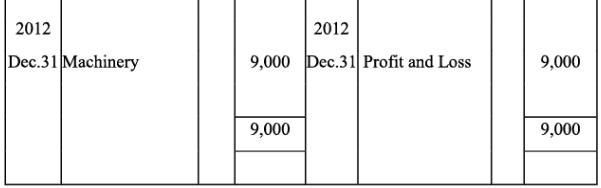

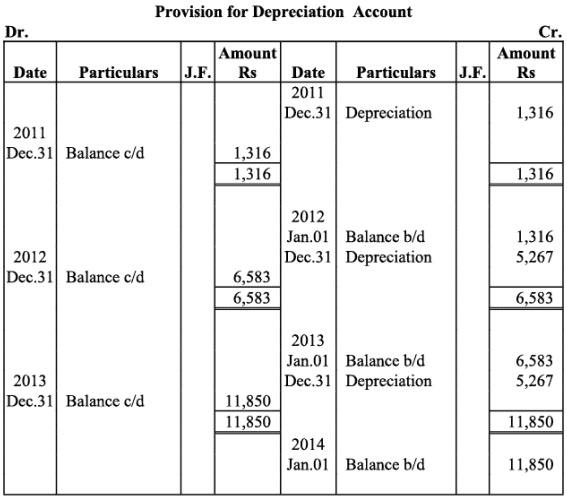

Working Note: Calculation of annual depreciation

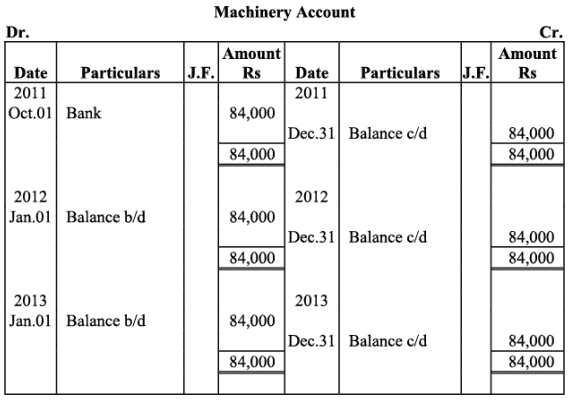

Q3: Reliance Ltd. Purchased a second hand machine for Rs. 56,000 on October 01, 2011 and spent Rs. 28,000 on its overhaul and installation before putting it to operation. It is expected that the machine can be sold for Rs. 6,000 at the end of its useful life of 15 years. Moreover, an estimated cost of Rs. 1,000 is expected to be incurred to recover the salvage value of Rs. 6,000. Prepare machine account and Provision for depreciation account for the first three years charging depreciation by fixed Instalment Method. Accounts are closed on March 31, every year.

Ans: Books of Reliance Ltd.

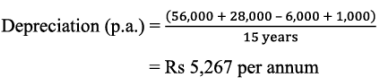

Working Note: Calculation of annual depreciation

Note: As per the solution, the balance of provision for depreciation account, as on March.31, 2015 is Rs 11,850; whereas, as per the book, it is Rs 18,200. However, if we ignore the scrap value and prepare provision for depreciation for 4 years, the answer would match to that of the book.

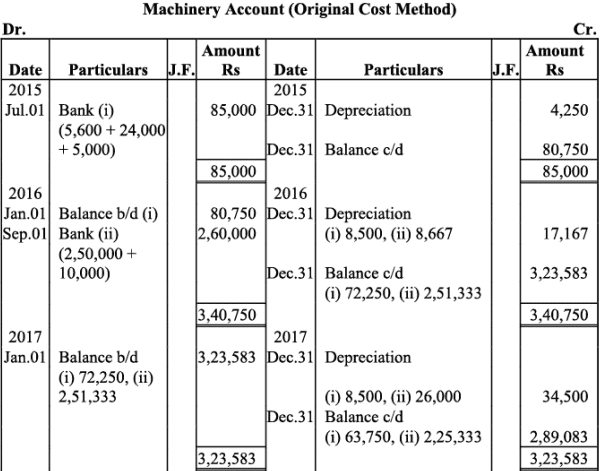

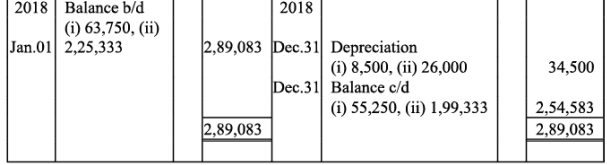

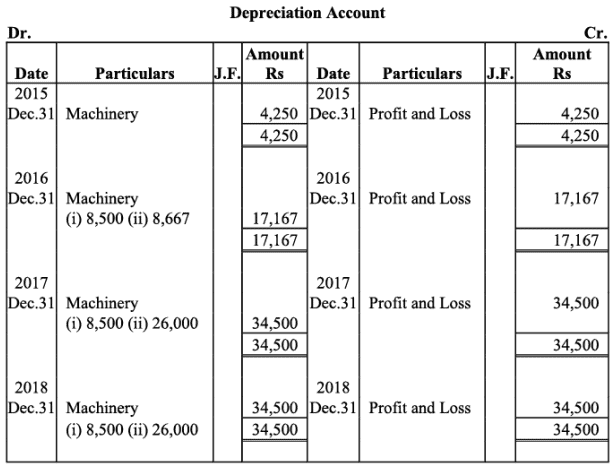

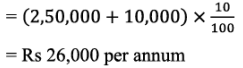

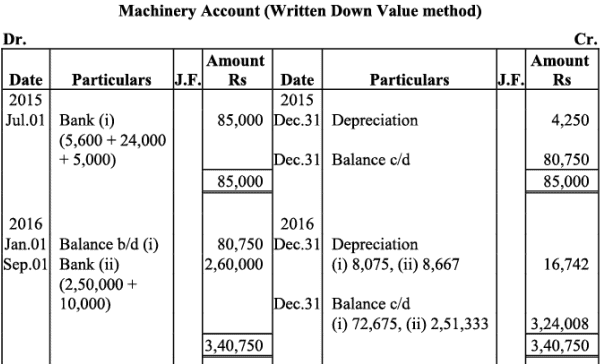

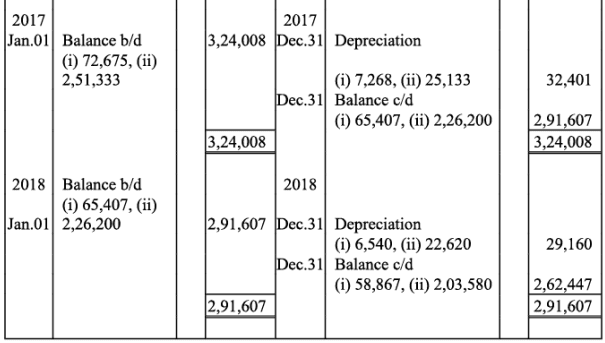

Q4: Berlia Ltd. Purchased a second hand machine for Rs 56,000 on July 01,2015 and spent Rs 24,000 on its repair and installation and Rs 5,000 for its carriage. On September 01, 2016, it purchased another machine for Rs 2,50,000 and spent Rs 10,000 on its installation.

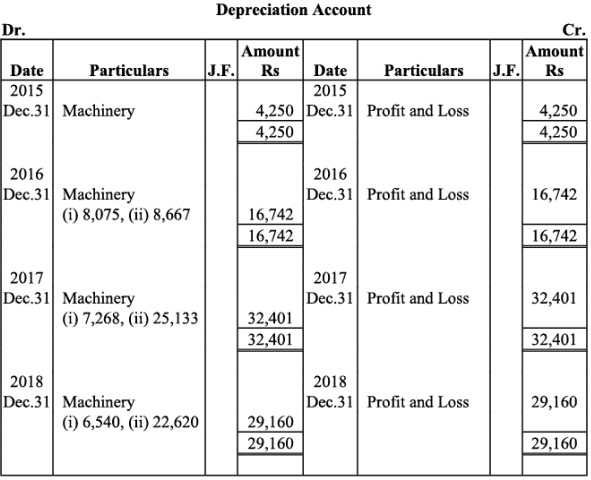

(a) Depreciation is provided on machinery @10% p.a on original cost method annually on December 31. Prepare machinery account and depreciation account from the year 2015 to 2018.

(b) Prepare machinery account and depreciation account from the year 2015 to 20018, if depreciation is provided on machinery @10% p.a. on written down value method annually on December 31.

Ans:

(a)Books of Berlia Ltd.

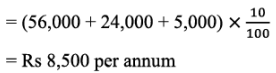

Working notes: Calculation of annual depreciation

(i) Depreciation (p.a.) on Machinery Purchased on July 01, 2015

(ii) Depreciation (p.a.) on Machinery purchased on September 01, 2016.

(b)

|

61 videos|154 docs|35 tests

|

FAQs on NCERT Solutions (Part - 1) - Depreciation, Provisions, and Reserves - Accountancy Class 11 - Commerce

| 1. What is depreciation and how is it calculated ? |  |

| 2. What are provisions and how do they differ from reserves ? |  |

| 3. Why is it important for a business to maintain reserves ? |  |

| 4. What are the different methods of calculating depreciation ? |  |

| 5. How does depreciation affect a company's financial statements ? |  |