NCERT Solution (Part - 4) - Bills of Exchange | Accountancy Class 11 - Commerce PDF Download

Page No 337:

Question 19:

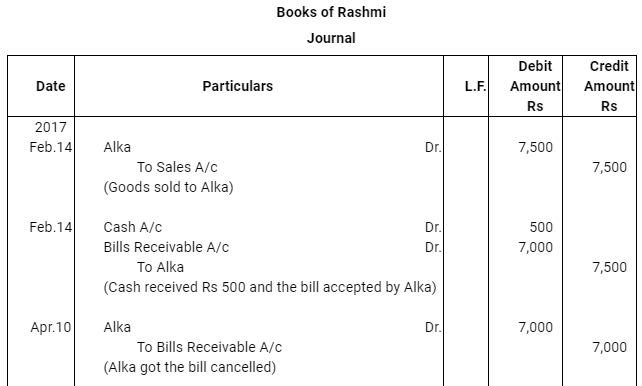

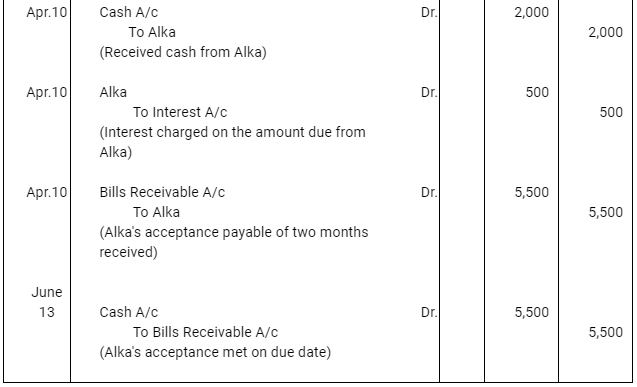

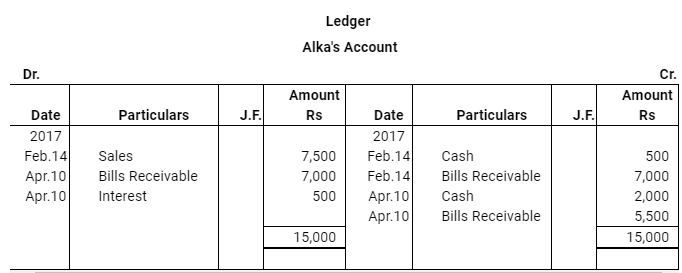

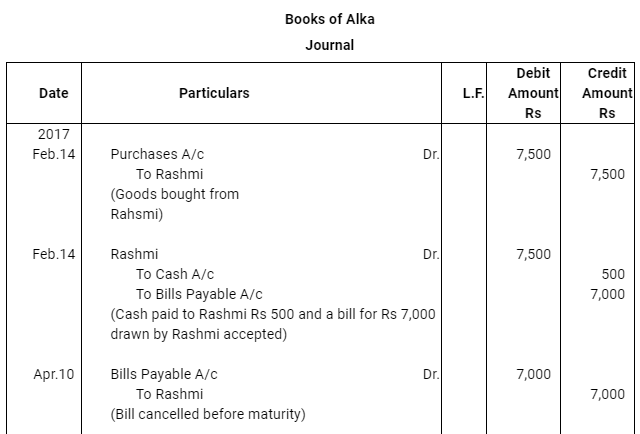

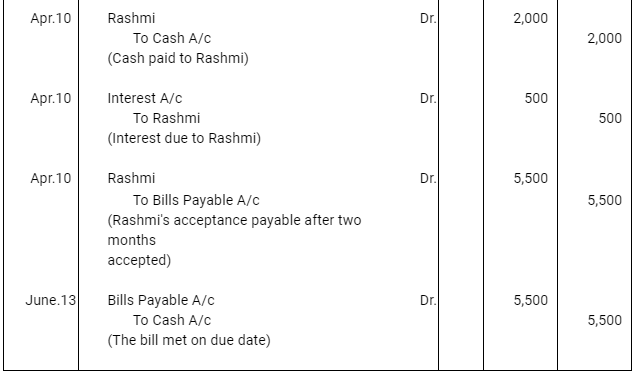

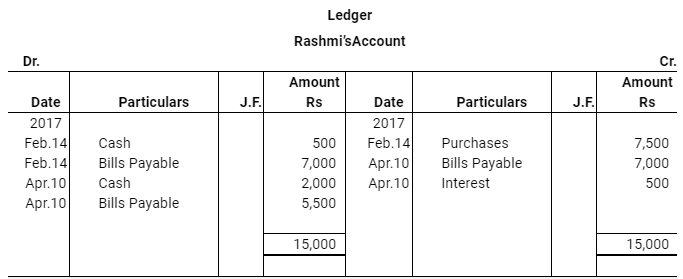

On Feb. 14, 2017 Rashmi sold good Rs 7,500 to Alka. Alka paid Rs 500 in cash and for the bank balance accepted a bill of exchange drawn upon her by Rashmi payable after two months. On Apr.10, 2017 Alka approached Rashmi to cancel the bill since she was short of funds. She further requested Rashmi to accept Rs 2,000 in cash and draw a new bill for the balance including interest Rs 500. Rashmi accepted Alka’s request and drew a new bill for the amount due payable after 2 months. The bill was accepted by Alka. The new bill was duly met by Alka on maturity.

Record the necessary journal entries in the books of Rashmi and Alka and prepared Alka’s account in the books of Rashmi’s and Rashmi’s account in the books of Alka’s.

ANSWER:

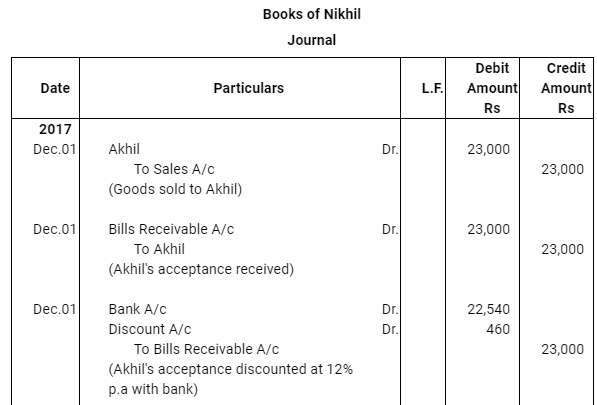

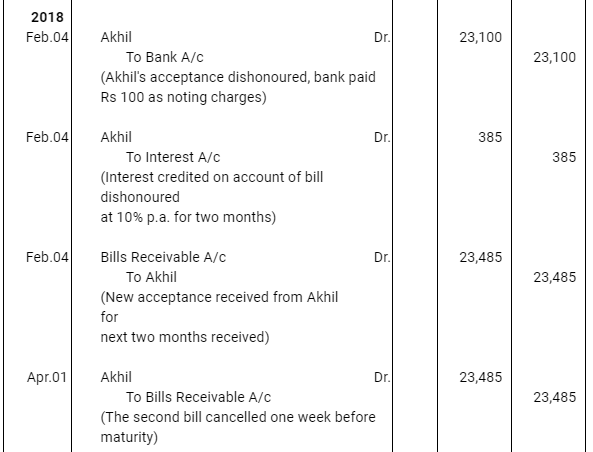

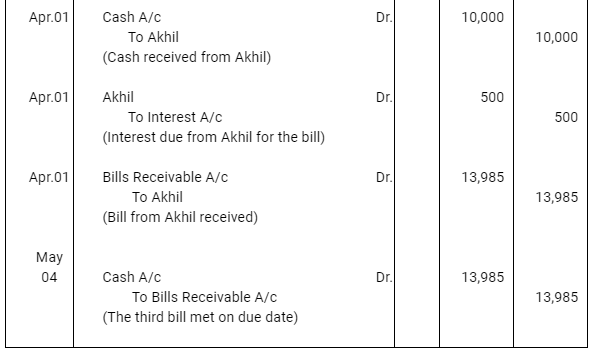

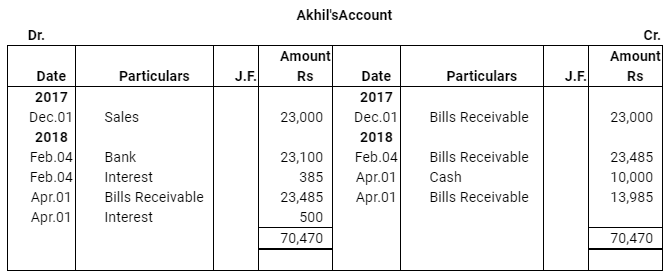

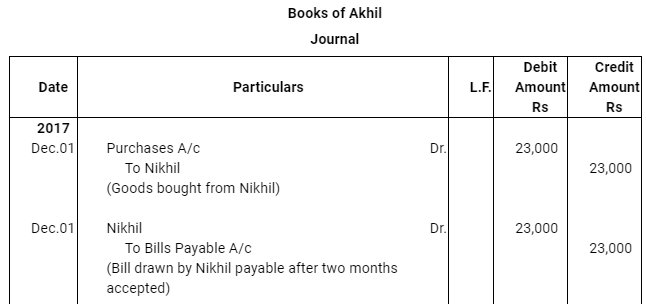

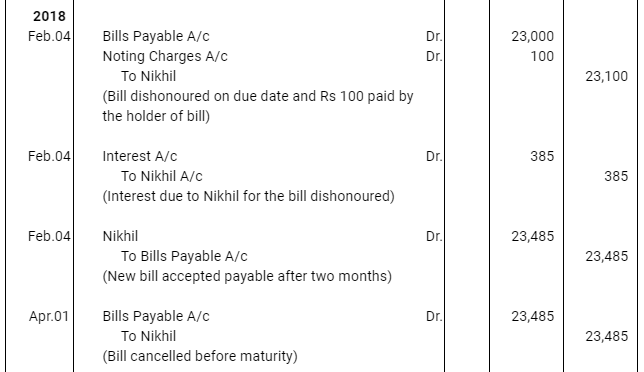

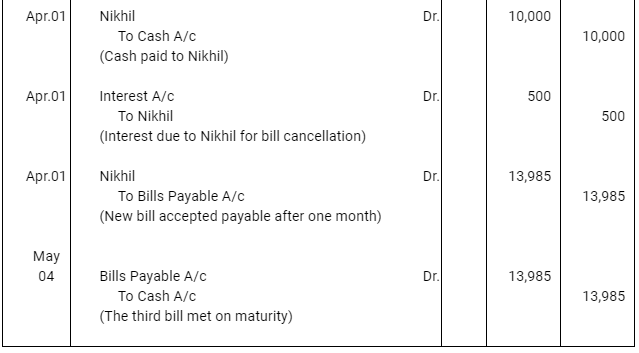

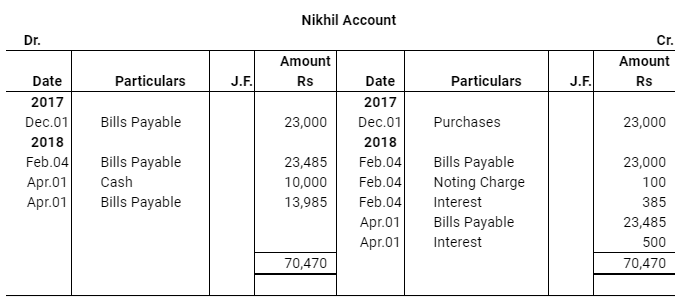

Question 20: Nikhil sold goods for Rs 23,000 to Akhil on Dec. 01, 2017. He drew upon Akhil a bill of exchange for the same amount payable after 2 months. Akhil accepted the bill and sent it back to Nikhil. Nikhil discounted the bill immediately with his bank @12 p.a. On the due date Akhil dishonoured the bill of exchange and the bank paid Rs 100 as noting charges. Akhil requested Nikhil to draw a new bill upon him with interest @10% p.a. which he agreed. The new bill was payable after two months. A week before the maturity of the second bill Akhil requested Nikhil to cancel the second bill. He further requested to accept Rs 10,000 in cash immediately and drew a third bill upon him including interest of Rs 500. Nikhil agreed to Akhil’s request. The third bill was payable after one month. Akhil met the third bill on its maturity. Record the necessary journal entries in the books of Nikhil and Akhil and also prepare Akhil’s account in the books of Nikhil and Nikhil’s account in the books of Akhil.

ANSWER:

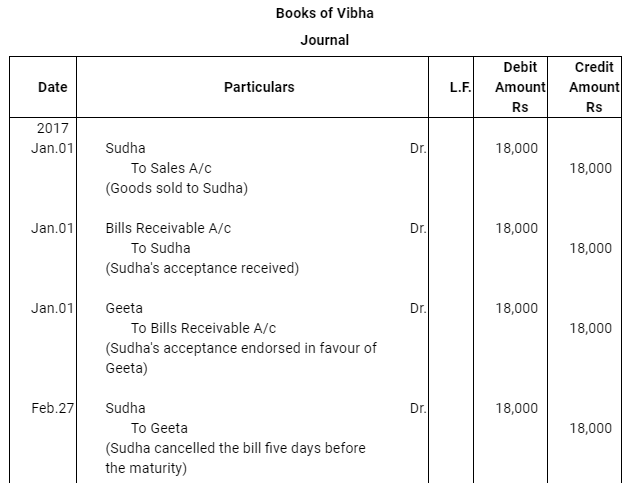

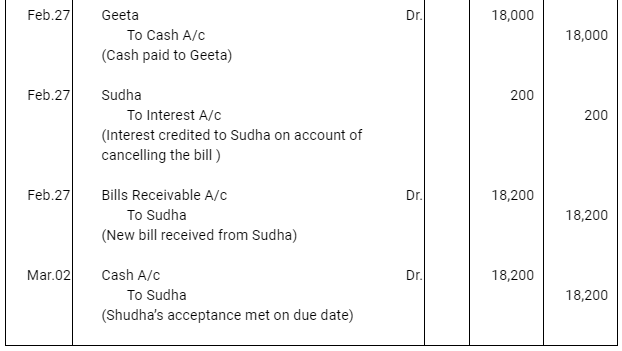

Question 21: On Jan 01, 2017 Vibha sold goods worth Rs 18,000 to Sudha and drew upon the latter a bill of exchange for the same amount payable after two months. Sudha accepted Vibha’s draft and returned the same to Vibha after acceptance. Vibha endorsed the bill immediately in favour of her creditor Geeta. Five days before the maturity of the bill Sudha requested Vibha to cancel the bill since she was short of funds. She further requested to draw a new bill upon her including interest of Rs 200. Vibha accepted Sudha’s request. Vibha took the bill from Geeta by making the payment to her in cash and cancelled the same. Then she drew a new bill upon Sudha as agreed. The new bill was payable after one month. The new bill was duly met by Sudha on maturity. Record the necessary journal entries in the books of Vibha.

ANSWER:

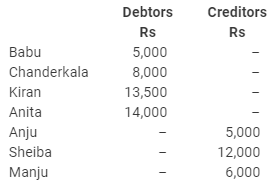

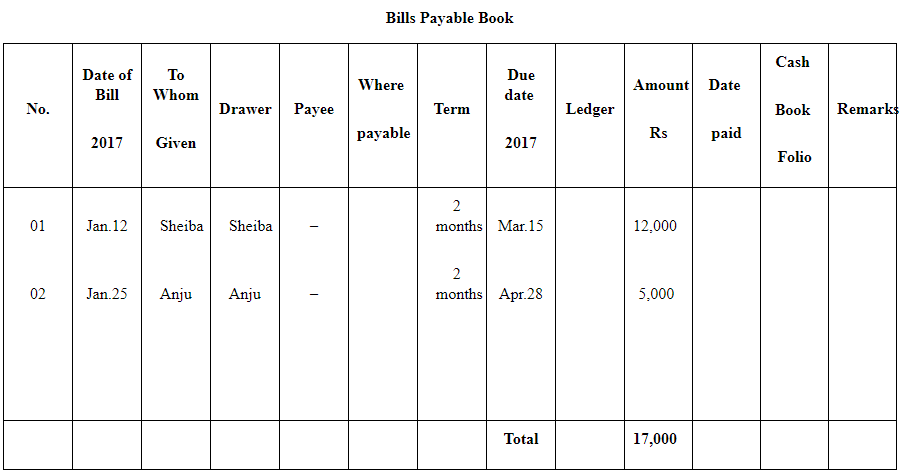

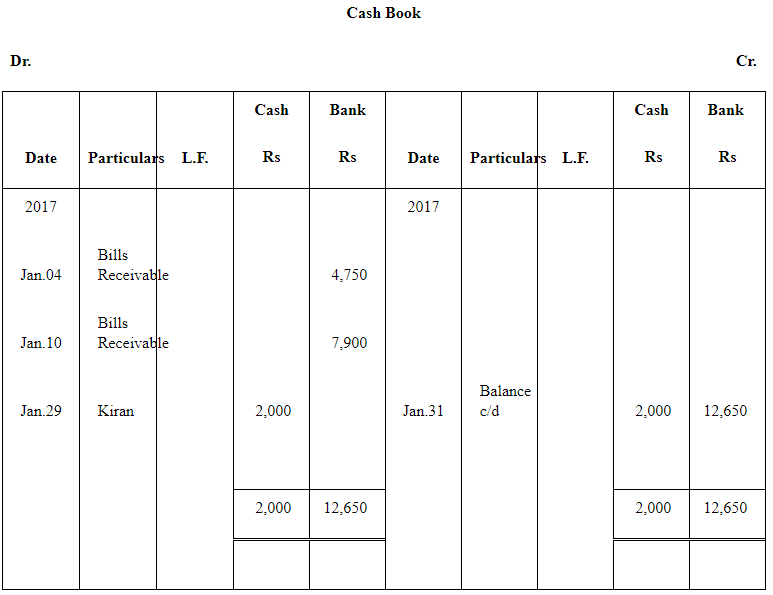

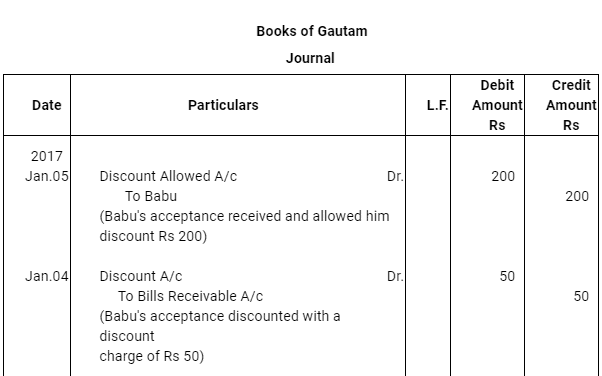

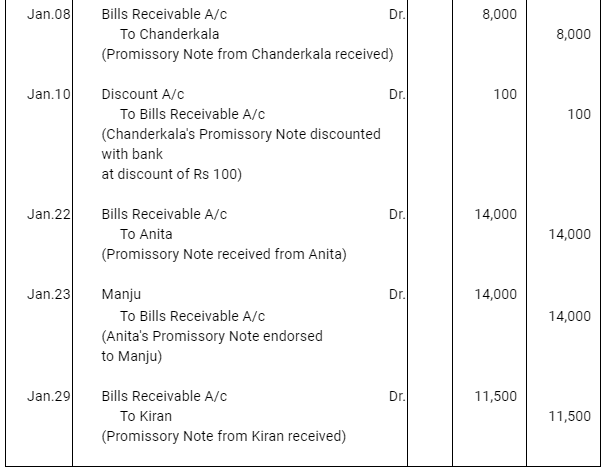

Question 22: Following was the position of debtor and creditor of Gautam as on 1.1.2017.

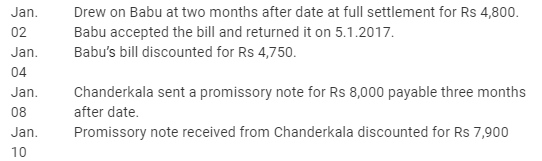

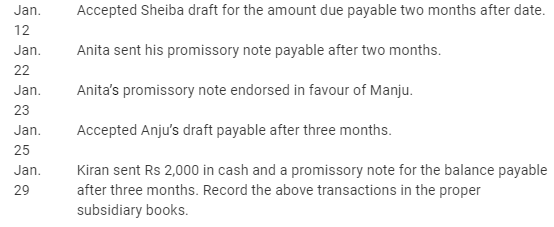

The following transactions took place in the month of Jan 2017:

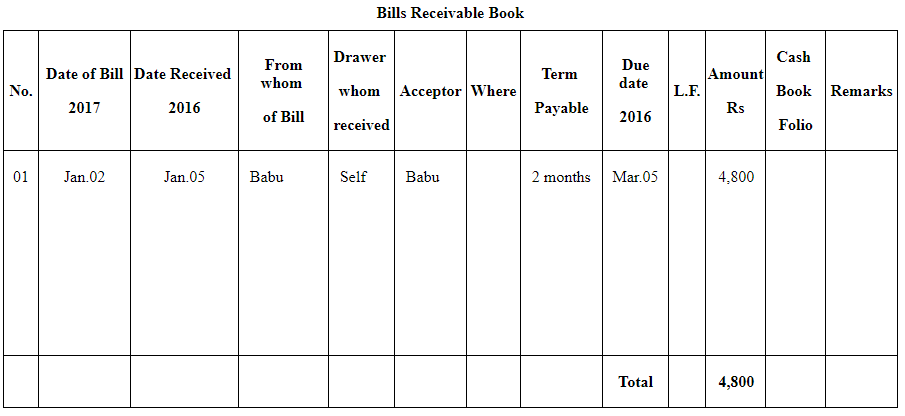

ANSWER:

There is difference between Bills of Exchange and Promissory Note. In case of Promissory Note, parties are makers and payees. However, in Bills of Exchange parties are Drawer, drawee (acceptor) and payee on account difference Promissory Note has not been recorded in Bills Receivable and Bills Payable book.

Page No 339:

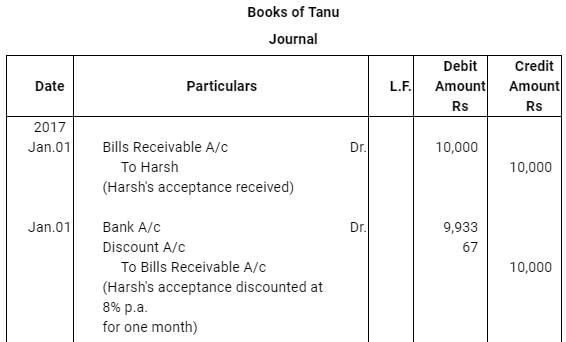

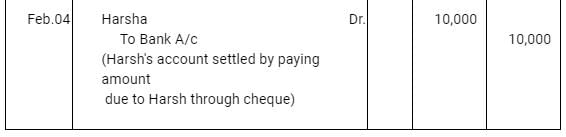

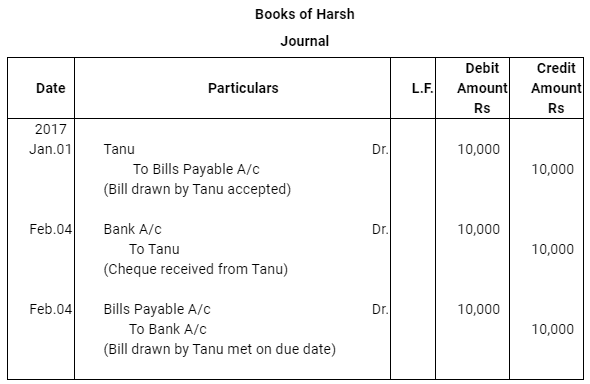

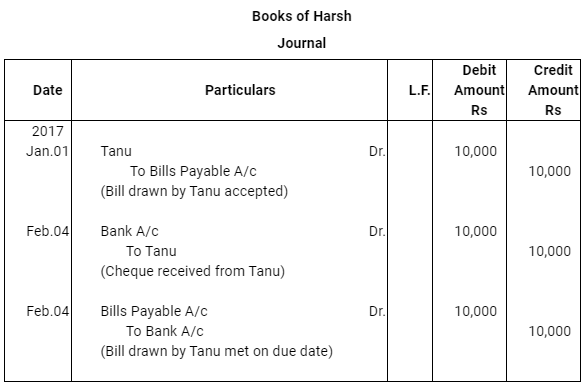

Question 23: On Jan. 01, 2017 Harsh accepted a month bill for Rs 10,000 drawn on him by tanu for latter’s benefit. Tanu discounted the bill on same day @ 8% p.a. On the due date tanu sent a cheque to Harsh for honour the bill. Harsh duly honoured his acceptance. Record the journal entries in the Books of Tanu and Harsh.

ANSWER:

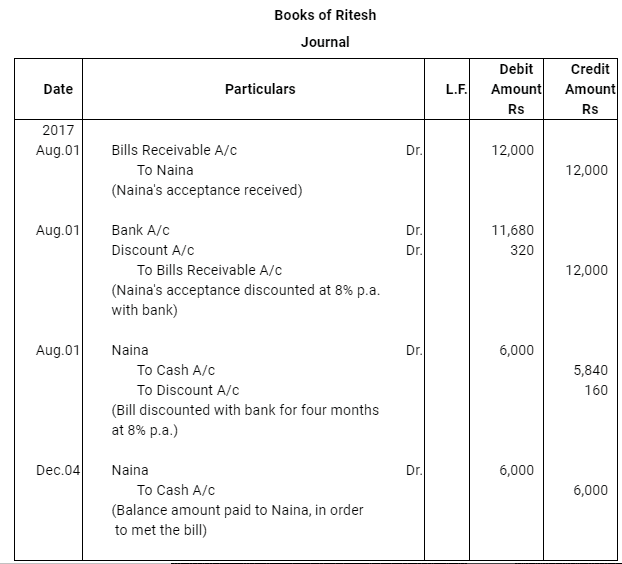

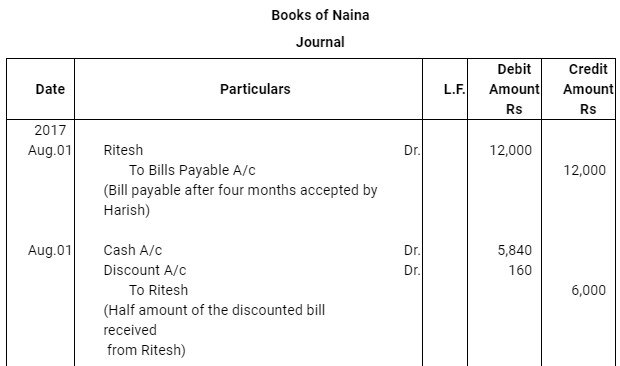

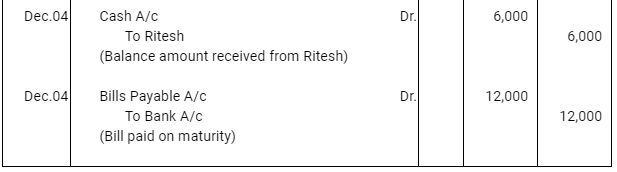

Question 24: Ritesh and Naina were in need of funds temporarily. On August 01 2017 Ritesh drew upon Naina a bill for Rs 12,000 for 4 months. Naina accepted the bill and returned to Ritesh. Ritesh discounted the Bill @ 8% p.a. Half amount of the discounted bill remitted to Naina. On due date, Ritesh sent the required sum to Naina, who met the bill. Journalise the transaction in the books of both the parties.

ANSWER:

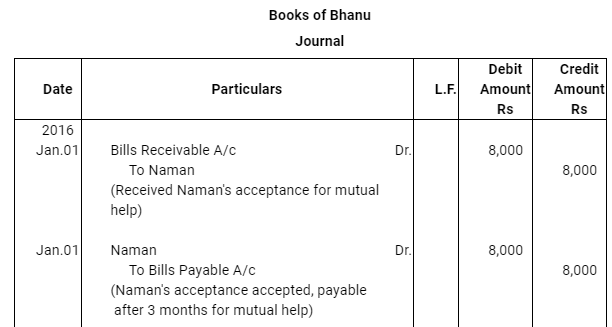

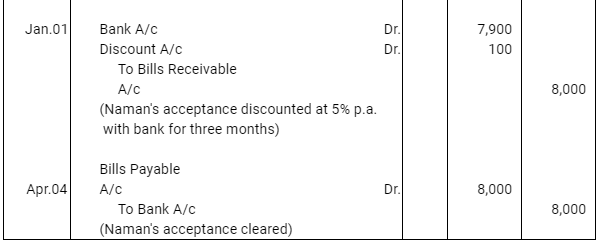

Question 25: On Jan. 01, 2016, Bhanu and Naman drew on each other a bill for Rs 8,000 payable 3 months after the due date for their Mutual benefit. On January 02 they discounted with their bank each other’s bill at 5% p.a. on the due date each met his own acceptance. Give journal entry in the books of Bhanu and Naman.

ANSWER:

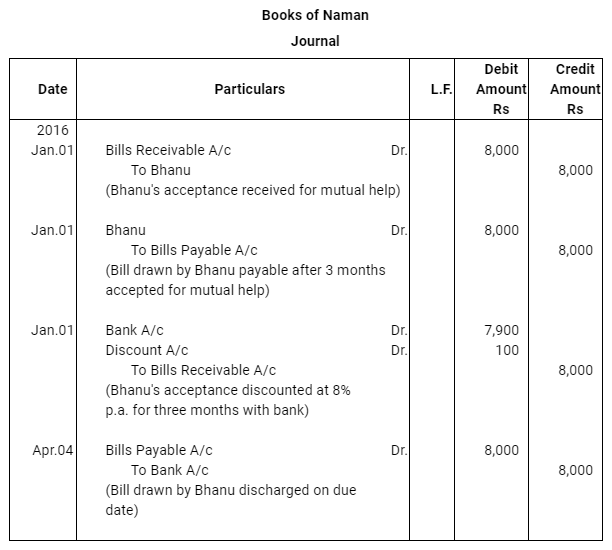

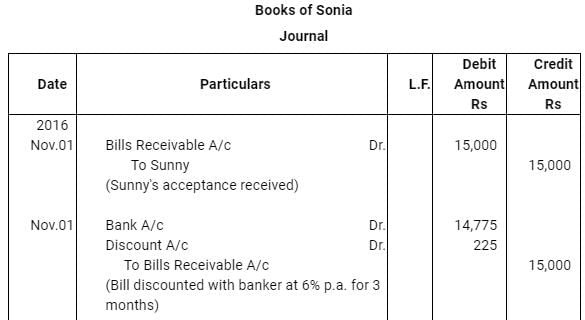

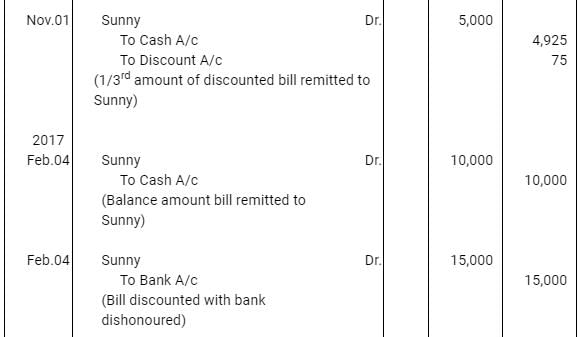

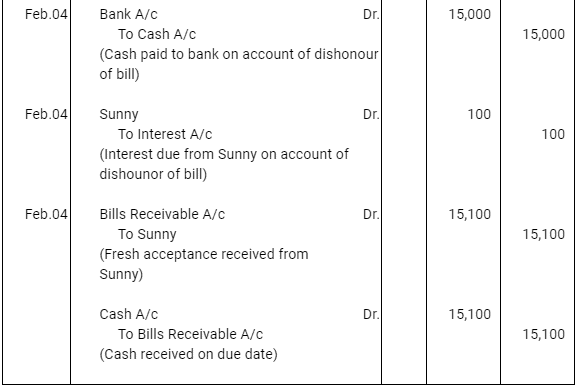

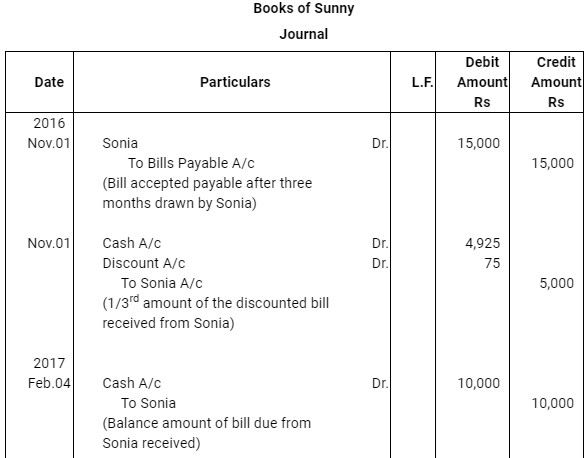

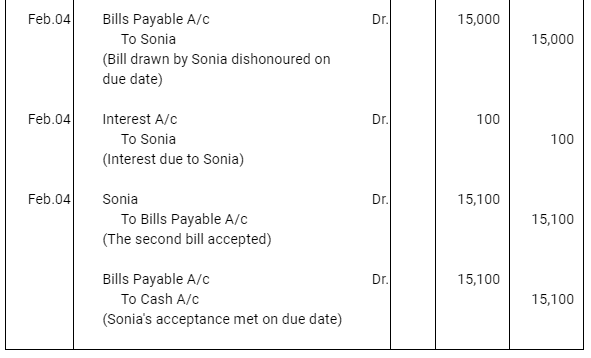

Question 26: On Nov. 01, 2016 Sonia drawn a bill on sunny for Rs 15,000 for 3 months for mutual accommodation. Sunny accepts the bill and return it to sonia. Sonia discounted the same with his bankers @ 6% p.a. The proceeds are shared between sonia and sunny in proportion of 2/3rd, 1/3rd respectively. On the due date sonia remits his proportion to sunny who fails to met the bill and as a result sonia has to meet it. Sunny Give a fresh acceptance for the amount due to sonia plus interest of Rs 100 sunny meet his second acceptance on due date. Record the necessary journal entries in the books of sonia and sunny.

ANSWER:

Note: In the question, the maturity date of the second bill is not mentioned; so, the date of honouring the bill has not been shown.

|

61 videos|154 docs|35 tests

|

FAQs on NCERT Solution (Part - 4) - Bills of Exchange - Accountancy Class 11 - Commerce

| 1. What is a bill of exchange? |  |

| 2. How does a bill of exchange work? |  |

| 3. What are the parties involved in a bill of exchange? |  |

| 4. Are bills of exchange legally enforceable? |  |

| 5. What are the advantages of using bills of exchange? |  |