NCERT Solution (Part - 2) - Accounting for Share Capital | Additional Study Material for Commerce PDF Download

Question 7 : Explain the terms 'Over-subscription' and 'Under-subscription'. How are they dealt with in accounting records?

Answer: When the total number of applications received for shares exceeds the number of shares offered by the company to the public, the situation of Over-subscription arises. A company can opt for any of the three alternatives to allot shares in case of Over-subscription of shares.

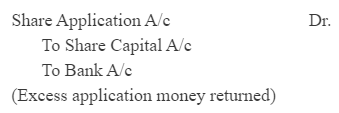

i) Excess applications are refused and money received on excess applications is returned to the applicants.

The company can refuse excess applications and the money received on these excess applications is returned to the applicants.

Example: Shares issued 10,000 @ Rs 10 per share and money received for 12,000 shares. Amount is payable Rs 2 on application, Rs 5 on allotment, Rs 3 on first and final call.

Bank A/c | Dr. | 24,000 |

| |

| To Share Application A/c |

| 24,000 | |

(Application money received for 12,000 shares) |

|

| ||

|

|

|

|

|

Share Application A/c | Dr. | 24,000 |

| |

| To Share Capital A/c |

| 20,000 | |

| To Bank A/c |

| 4,000 | |

(Application money transferred to Share Capital Account and the excess money returned) | ||||

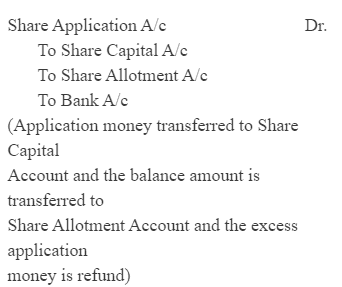

ii) Pro rata Basis

The company can allot shares on pro rata basis to all the share applicants. The excess amount received in the application is adjusted on the allotment.

Share Application A/c | Dr. | |

| To Share Capital A/c | |

| To Share Allotment A/c | |

(Adjustment of application money on allotment) | ||

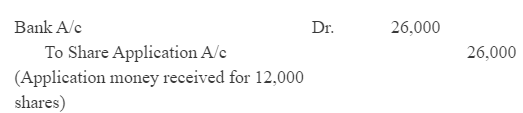

Example: Shares issued 10,000 @ Rs 10 per share and money received for 12,000 shares. Amount is payable Rs 2 on application, Rs 5 on allotment, Rs 3 on first and final call.

Bank A/c | Dr. | 24,000 |

| |

| To Share Application A/c |

| 24,000 | |

(Application money received for 12,000 shares) |

|

| ||

|

|

|

|

|

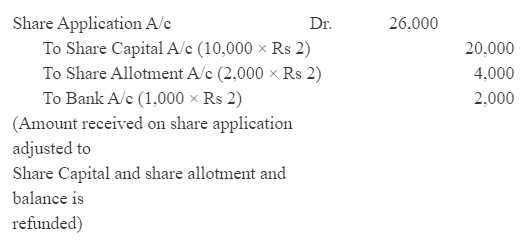

Share Application A/c | Dr. | 24,000 |

| |

| To Share Capital A/c |

| 20,000 | |

| To Share Allotment A/c |

| 4,000 | |

(Application money transferred to Share Capital Account and the balance amount is transferred to Share Allotment Account) |

|

| ||

|

|

|

|

|

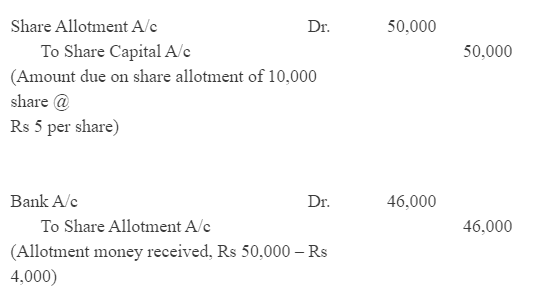

Share Allotment A/c | Dr. | 50,000 |

| |

| To Share Capital A/c |

| 50,000 | |

(Amount due on allotment of 10,000 shares @ Rs 5 per share) |

|

| ||

|

|

|

|

|

Bank A/c | Dr. | 46,000 |

| |

| To Share Allotment |

| 46,000 | |

(Allotment money received, Rs 50,000 – Rs 4,000) | ||||

iii) Pro rata and refund of money

In this case, the company follows a combination of both the method. It may reject some share applications and may allot some applications on the pro rata basis.

Example: Shares issued 10,000 @ Rs 10 per share and money received for 13,000 shares. Amount is payable Rs 2 on application, Rs 5 on allotment, Rs 3 on first and final call. If the company rejects the applications for 1,000 shares and allots the remaining on the pro rata basis.

Under-subscription- When the number of shares applied by the public is lesser than the number of shares issued by the company, then the situation of Under-subscription arises. As per the Company Act, the Minimum Subscription is 90% of the shares issued by the company. This implies that the company can allot shares to the applicants provided if applications for 90% of the issued shares are received. Otherwise, the company should refund the entire application amount received. In this regard, necessary Journal entry is passed only after receiving and refunding of the application money.

Question 8 : Describe the purposes for which a company can use 'Securities Premium Account'.

Answer : As per the Section 78 of the Companies Act of 1956, the amount of securities premium can be used by the company for the following activities:

1. For paying up unissued shares of the company to be issued to members (shareholders) of the company as fully paid bonus share,

2. For writing off the preliminary expenses of the company,

3. For writing off the expenses of, or the commission paid or discount allowed on, any issue of shares or debentures of the company,

4. For paying up the premium that is to be payable on redemption of preference shares or debentures of the company.

5. Further, as per the Section 77A, the securities premium amount can also be utilised by the company to Buy-back its own shares.

Question 9 : State clearly the conditions under which a company can issue shares at a discount.

Answer : As per the Section 79 of the Company Act of 1956, following are the conditions under which a company can issue shares at a discount.

1. A company can issue shares at discount provided it has previously issued such type of shares.

2. The issue of shares at a discount is authorised by a resolution passed by the company in the General Meeting and sanction obtained from the Company Law Tribunal.

3. The resolution specifies that the maximum rate of discount is 10% of the face value of the shares, unless higher percentage of discount allowed by the Company Law Tribunal.

4. A company can issue shares at discount atleast after one year from the date of commencing business.

5. If a company wants to issue shares at discount, then it must issue them within two months of obtaining sanction from the Company Law Tribunal.

6. Every prospectus related to the issue of the shares should explicitly and clearly contain particulars of the discount allowed on the issue of shares.

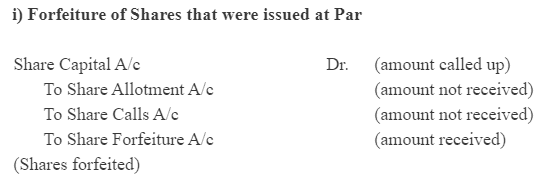

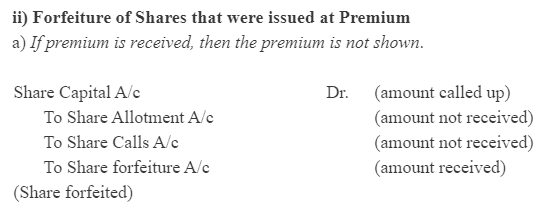

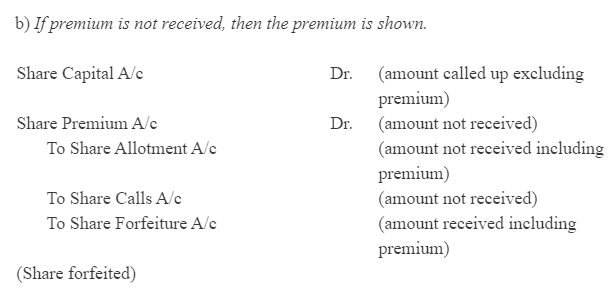

Question 10: Explain the term 'Forfeiture of Shares' and give the accounting treatment on forfeiture.

Answer : If a shareholder fails to pay the allotment money and/or any subsequent calls, then the company has the right to forfeit shares by giving a proper notice to the shareholder.

As per the Table A of the Company Act, the procedure of forfeiting shares is mentioned below.

1. A notice is sent to default shareholder stating him/her to pay Calls in Arrears along with the interest accrued on the outstanding calls money within a period of 14 days of the receipt of notice, otherwise, the shares will be forfeited.

2. If the shareholder does not pay the amount, then the company has the right to forfeit his/her share by passing a resolution.

3. A notice of that resolution is send to the default shareholder and a public notice of the same is published in a daily newspaper.

4. The name of the shareholder is removed from the register of members (i.e. shareholders).

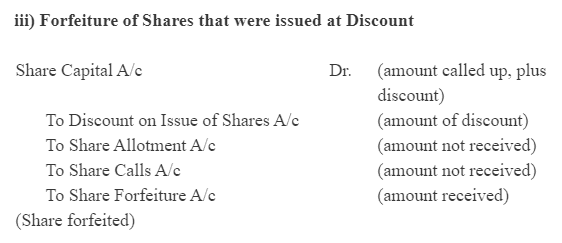

Accounting Treatment for Forfeiture of Shares:

Page No 66

Numerical questions

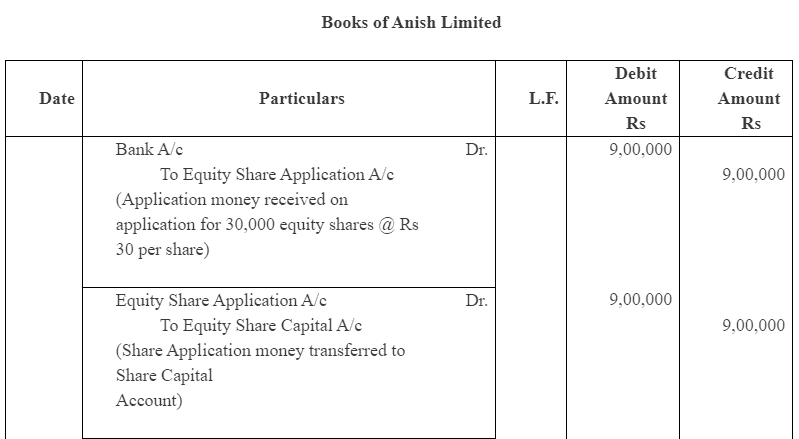

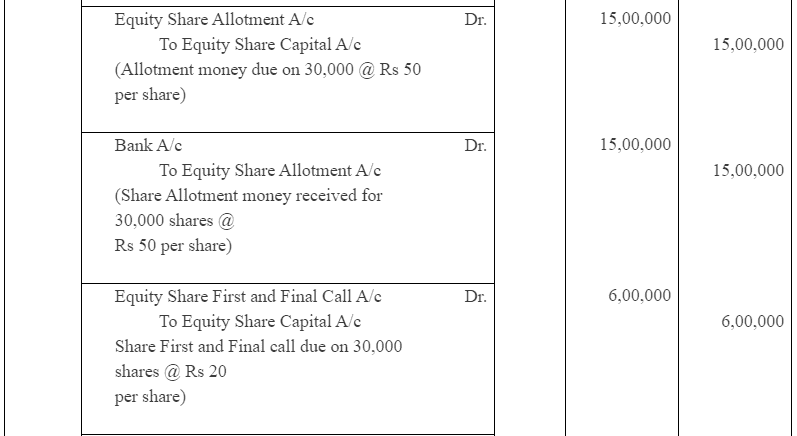

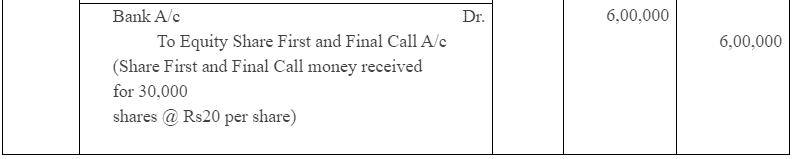

Question 1: Anish Limited issued 30,000 equity shares of Rs 100 each payable at Rs 30 on application, Rs 50 on allotment and Rs 20 on Ist and final call. All money was duly received. Record these transactions in the journal of the company.

Answer :

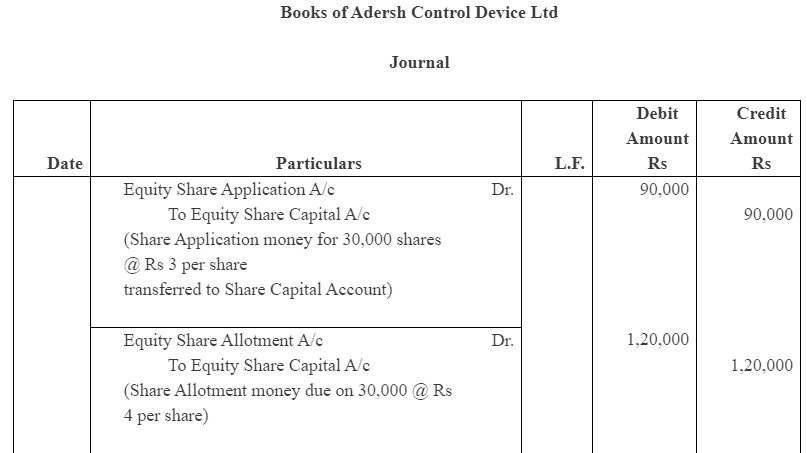

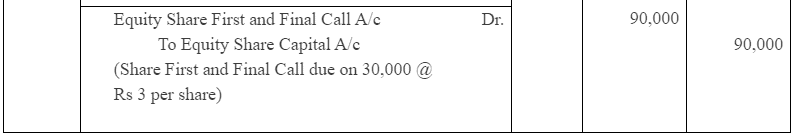

Question 2 : The Adersh Control Device Ltd was registered with the authorised capital of Rs 3,00,000 divided into 30,000 shares of Rs 10 each, which were offered to the public. Amount payable as Rs 3 per share on application, Rs 4 per share on allotment and Rs 3 per share on first and final call. These share were fully subscribed and all money was dully received. Prepare journal and Cash Book.

Answer :

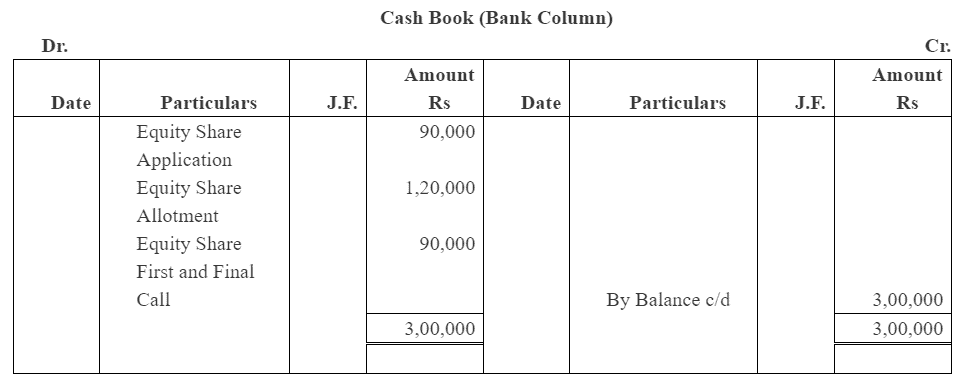

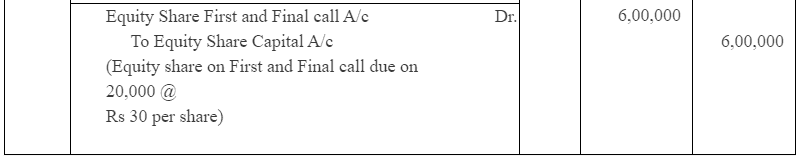

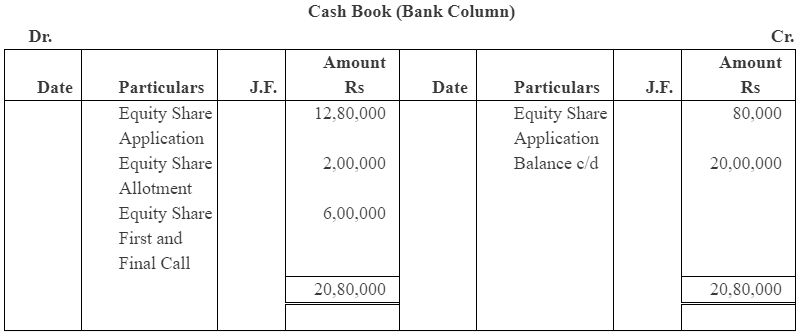

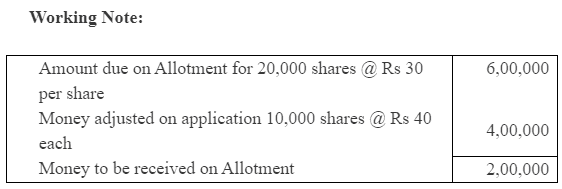

Question 3: Software solution India Ltd inviting application for 20,000 equity share of Rs 100 each, payable Rs 40 on application, Rs 30 on allotment and Rs 30 on call. The company received applications for 32,000 shares. Application for 2,000 shares were rejected and money returned to Applicants. Applications for 10,000 shares were accepted in full and applicants for 20,000 share allotted half of the number of share applied and excess application money adjusted into allotment. All money received due on allotment and call. Prepare journal and cash book.

Answer :

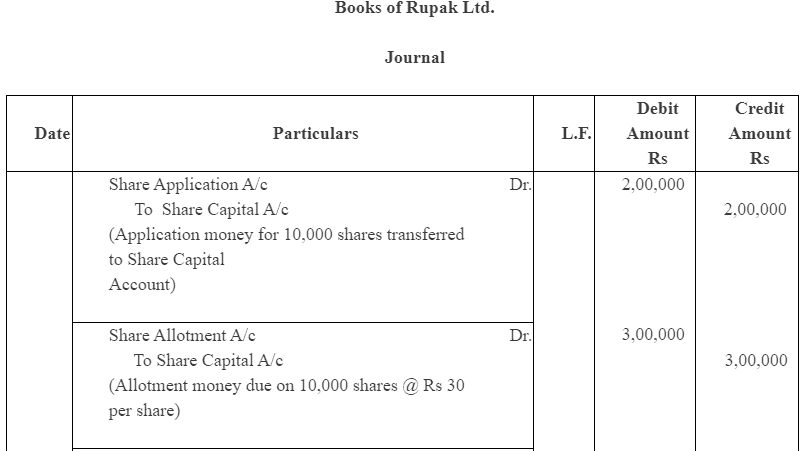

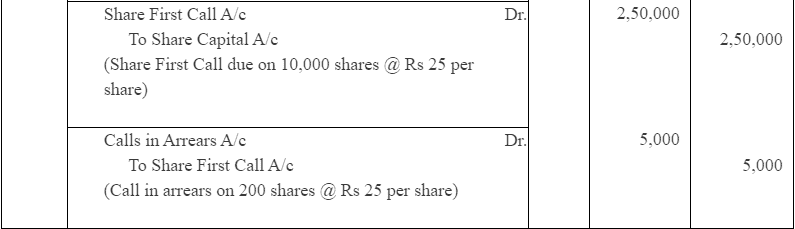

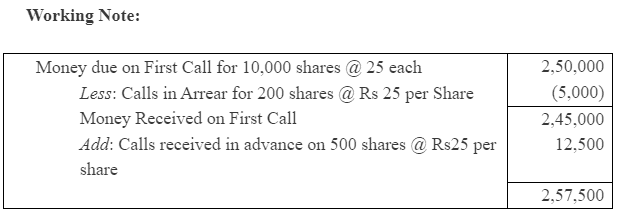

Question 4 : Rupak Ltd. issued 10,000 shares of Rs 100 each payable Rs 20 per share on application, Rs 30 per share on allotment and balance in two calls of Rs 25 per share. The application and allotment money were duly received. On first call all member pays their dues except one member holding 200 shares, while another member holding 500 shares paid for the balance due in full. Final call was not made. Give journal entries and prepare cash book.

Answer :

|

4 videos|168 docs

|

FAQs on NCERT Solution (Part - 2) - Accounting for Share Capital - Additional Study Material for Commerce

| 1. What is share capital in accounting? |  |

| 2. What is the difference between authorized, issued and subscribed share capital? |  |

| 3. What is the impact of issuing bonus shares on the share capital of a company? |  |

| 4. How is the share capital of a company reported in the balance sheet? |  |

| 5. What is the significance of share premium in accounting for share capital? |  |