NCERT Solution: Issue and Redemption of Debentures- 1 | Accountancy Class 12 - Commerce PDF Download

Short Answer Questions

Q1: What is meant by a Debenture?

Ans: The word Debenture is derived from a Latin word 'debere' which means to borrow. A debenture is issued in the form of a certificate under the seal of a company and containing a contract for the repayment of the principal sum after a fixed period of time and payment of interest at regular intervals, generally half yearly. Debentures are issued by a company for acquiring long-term borrowings.

Q2: What does a Bearer Debenture mean?

Ans: When a company does not maintain any record of the debenture holders and the debenture is transferable mere by delivery, then the type of the debenture held by the holders is termed as Bearer Debenture. Interests on such debentures are paid to the persons who produce the interest coupons that are attached with these debentures in a specified bank.

Q3: State the meaning of ‘Debentures issued as a Collateral Security’.

Ans: The term collateral security means additional or secondary security in addition to the primary security. Sometimes, when a company takes loan from a financial institution, then besides the primary security, the company may issue debenture for additional security (as collateral security). The lender who receives debenture as collateral security is not entitled for interest on these debentures. If any default is made by the company in paying back the principal amount (i.e. the loan amount) or interest on the loan, then the lender has the full right to recover his/her dues from the sale of primary security. But, if the primary security is not sufficient to recover the amount of the debt, then the debentures issued as collateral may be used for recovery of the remaining amount.

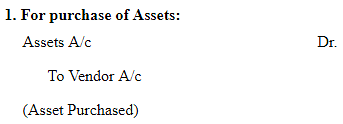

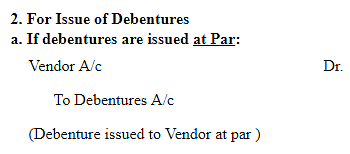

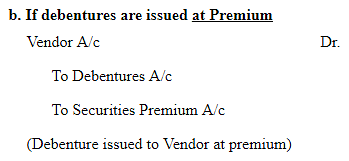

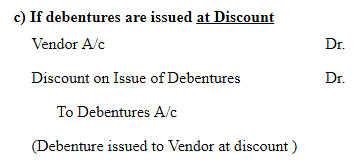

Q4: What is meant by ‘Issue of debentures for Consideration other than Cash'?

Ans: If a company purchases assets from its suppliers or vendors, then instead of paying them in cash the company issues debentures to them. This is known as issue of debenture for consideration other than cash. The issue of debenture for consideration other than cash serves the purpose of both the vendor as well as of the purchaser (company). From the purchaser’s point of view, purchasing an asset against the issue of debentures requires no additional cost for raising loans or arranging funds immediately. On the other hand, the vendor gets interest on the amount of debentures received. In this case, payment is deferred by issue of debentures and interest is paid for time lag payment. Debentures may be issued at par, premium or discount to the vendor.

Accounting treatment for Issue of Debentures for Consideration other than Cash

Q5: What is meant by Issue of debenture at discount and redeemable at premium?

Ans: When debentures are issued below its par value (or the face value) but are redeemed at price higher than its par value, then it is termed as issue of debenture at discount and redeemable at premium. The difference between the issue price and the redemption price is treated as loss on issue of debenture.

Example:

A 10% debenture of Rs 1,000 is issued at 5% discount and is redeemed at 10% premium.

Total loss = Payment made at redemption – Amount received on issue of debenture

1,100 – 950 = Rs 150

Q6: What is ‘Capital Reserve’?

Ans: Capital Reserve is a reserve that is created out of capital profits i.e. gains or profits arising from other than the normal activities of business operations i.e. activities other than sale or purchase of goods and services. This reserve is utilised to meet future capital losses, if any, and to issue bonus shares. It cannot be distributed as dividend among the share holders. The Capital Reserve is generated out of the following activities:

i. Premium on issue of shares.

ii. Premium on issue of debentures.

iii. Profit on redemption of debentures.

iv. Profit on sale of fixed assets.

v. Profit on reissue of forfeited shares.

vi. Profit prior to incorporation, etc.

Q7: What is meant by an ‘Irredeemable Debenture’?

Ans: Irredeemable Debentures are those debentures that are not repayable or redeemable by a company during its life time. These are repayable only at the time of winding up of the company. These are also known as Perpetual Debentures that means debentures having indefinite life. In India, now days, no company can issue irredeemable debentures.

Q8: What is a ‘Convertible Debenture’?

Ans: Convertible Debentures are those debentures that can be converted into equity shares after a specified period of time. These are of following two types:

i. Fully Convertible Debentures: When the whole amount of a debenture is convertible into equity shares worth of equivalent amount, then these debentures are called Fully Convertible Debentures. There is no need to maintain Debenture Redemption Reserves for such debentures.

ii. Partly Convertible Debentures: When only a part of the amount of a debenture is convertible into equity share, then these debentures are called Partly Convertible Debentures. In this regards, the Debenture Redemption Reserve is maintained only for the non-convertible part of the debenture.

Q9: What is meant by ‘Mortgaged Debentures’?

Ans: Mortgaged Debentures are those debentures that are secured against asset/s of a company. These are also known as secured debentures. If the debentures are secured against a particular asset, then it is called fixed charge whereas, if the debentures are secured against all the assets of a company, then it is called floating charge. In case the company fails to pay back the principal amount of debenture or fails to meet its interest obligations on the due date, then the debenture holders have the right to sell the mortgage asset in order to realise their amount due to the company.

Q10: What is discount on issue of debentures?

Ans: When the debentures are issued at a price below its par value or face value, then it is said that the debentures are issued at discount. The difference between the issue price and the face value of the debenture is regarded as a capital loss.

As per the Revised Schedule VI of the Companies Act, Discount on Issue of Debentures is shown in the Notes to Accounts:

1. With the amount that is to be written off within 12 months from the date of Balance Sheet - Shown under Other Current Assets

2. With the amount that is to be written off after 12 months from the date of Balance Sheet - Shown under Other Non-Current Assets

Q11: What is meant by ‘Premium on Redemption of Debentures’?

Ans: When the debentures are redeemed at a price more than its face value or the par value, then it is said that the debentures are redeemed at premium. The difference between the redeemed price and the par value is regarded as a capital loss and this loss is written off till the redemption of the debentures. The Premium on Redemption of Debenture is shown in the Notes to Accounts under the sub-head of 'Other Long-term Liabilities'. The final balance is shown under the main head of 'Non-Current Liabilities' on the Equity and Liabilities side of the Company's Balance Sheet.

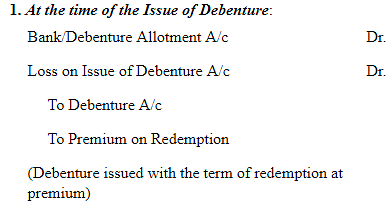

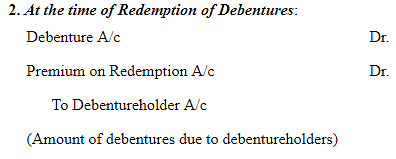

Accounting Treatment for Premium on Redemption on Debentures:

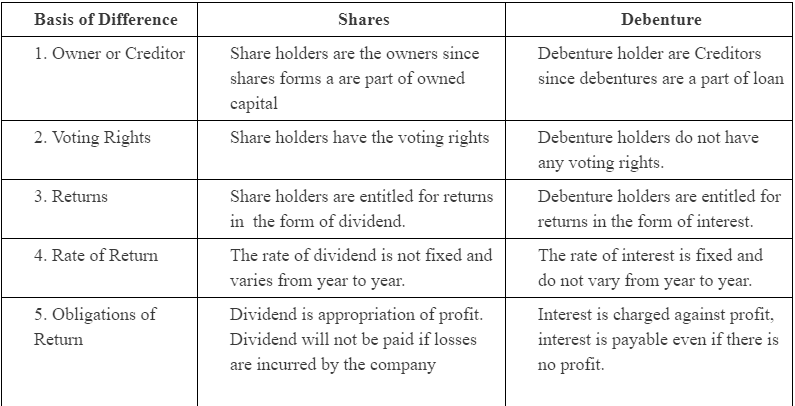

Q12: How are debentures different from shares? Give two points.

Ans:

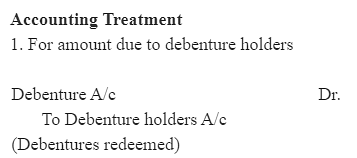

Q13: What is meant by redemption of debentures?

Ans: Redemption of debenture means repayment of debentures by the company to the debenture holders. In other words, it implies the discharge of liabilities by repaying the amount due to the debenture holders as per the terms and conditions determined at the time of issue of debentures. Debentures may be redeemable at par, premium or discount, but, nowa days, these are mostly redeemable at par or premium. The redemption can be done out of profits or from the fresh issue of debentures or shares. Redemption of debentures may be done by the following methods:

- In lump sum at the time of maturity,

- In instalments by draw of lots at the end of each year,

- By purchase in open market whenever price is below its face value,

- By converting debentures into shares or new debentures.

Q14: Can the company purchase its own debentures?

Ans: Yes, a company can purchase its own debentures provided it is authorised by its Article of Association. As per the Company Act, if a company is authorised by its Article of Association, only then it may purchase its own debentures from the open market. The main purposes of such purchase are as follows:

1. For immediate cancellation of debenture liability, if the interest rate on its debenture is higher than the market rate of interest.

2. A company may also purchase its own debentures with the motive of investment and sell them at higher price in future and thereby earn profit.

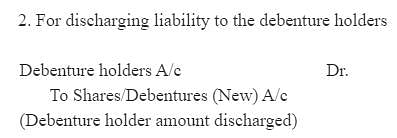

Q15: What is meant by redemption of debentures by conversion?

Ans: When a debenture holder can convert his/her debentures into shares or new debentures after the expiry of a specified period of time, then it is known as redemption of debentures by conversion. As the company do not need to pay any funds for the redemption, so there is no need to maintain the Debenture Redemption Reserve (DRR). The new shares or debentures may be issued at par, premium or at discount.

Q16: How would you deal with ‘Premium on Redemption of Debentures’?

Ans: When the debentures are redeemed at a price more than its face value or the par value, then it is said that the debentures are redeemed at premium. The difference between the redeemed price and the par value is regarded as a capital loss and this loss is written off till the redemption of the debentures. The Premium on Redemption of Debenture is shown in the Notes to Accounts under the sub-head of 'Other Long-term Liabilities'. The final balance is shown under the main head of 'Non-Current Liabilities' on the Equity and Liabilities side of the Company's Balance Sheet.

Accounting Treatment for Premium on Redemption on Debentures:

Q17: What is meant by redemption of debentures by ‘Purchase in the Open Market?

Ans: According to the Company Act, if a company is authorised by its Article of Association, only then it may purchase its own debentures from the open market. The main purpose of such purchase is as follows:

1. For immediate cancellation of debenture liability, if the interest rate on its debenture is higher than the market rate of interest.

2. A company may also purchase its own debentures with the motive of investment and sell them at higher price in future and thereby earn profit.

Long Answer Questions

Q1: Explain the different types of debentures?

Ans: Debentures are issued by a company for acquiring long-term borrowings.

They can be classified on the following basis.

1. On the basis of Security

a. Secured Debentures- Mortgaged Debentures are those debentures that are secured against asset/s of a company. These are also known as secured debentures. In case the company fails to pay back the principal amount of debenture or fails to meet its interest obligations on the due date, then the debenture holders have the right to sell the mortgaged asset in order to realise their amount due to the company.

b. Unsecured Debentures- These debentures are treated as unsecured creditors. They do not have any security. These are uncommon now days.

2. On the basis of Tenure

a. Redeemable Debenture- These debentures are payable after the expiry of a specific period. These debentures can be redeemed at par or premium either in lump sum or in installment. Generally all debentures are redeemable.

b. Irredeemable Debenture- Irredeemable Debentures are those debentures that cannot be repayable or redeemable by a company during its life time. These are repayable only at the time of winding up of the company. These are also known as Perpetual Debentures that means debentures having indefinite life. In India, now days, no company can issue irredeemable debentures.

3. On the basis of Mode of Redemption

a. Convertible Debentures- Convertible Debentures are those debentures that can be converted into equity shares after a specified period of time. These are of following two types:

i. Fully Convertible Debentures: When the whole amount of a debenture is convertible into equity shares of equivalent amount, then these debentures are called Fully Convertible Debentures. There is no need to maintain Debenture Redemption Reserves for such debentures.

ii. Partly Convertible Debentures: When only a part of the amount of a debenture is convertible into equity shares, then these debentures are called Partly Convertible Debentures. In this regards, the Debenture Redemption Reserve is maintained only for the non-convertible part of the debenture.

b. Non-Convertible Debenture- These debentures cannot be converted into shares. Generally debentures are non convertible.

4. On the basis of Coupon Rate

a. Zero Coupon Rate- These debentures do not contain a specific rate of interest and can be issued at discount. The excess of the face value of the debenture over its issue price is considered as interest amount.

b. Specific Rate- These debentures carry a specific rate of interest which may be fixed or floating.

5. On the basis of Registration

a. Registered Debenture- While issuing such debentures, the company maintains a record regarding name, address and number of holding of debentures in the Register of Debenture Holders of the company.

b. Bearer Debentures- When a company does not maintain any record of the debenture holders and the debenture is transferable mere by delivery, then the type of the debenture held by the holders is termed as Bearer Debenture. Interests on such debentures are paid to the persons who produce the interest coupons that are attached with these debentures in a specified bank.

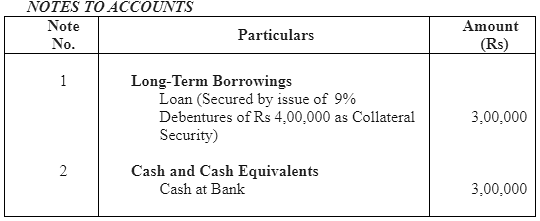

Q2: Distinguish between a debenture and a share. Why is debenture known as loan capital? Explain.

Ans:

Issue of debentures implies incurring long-term indebtedness. Generally, a company issues debentures for acquiring long-term borrowings to achieve its long-run targets and growth. Like the owner’s capital, interest is also payable on the principal amount of the debenture. The interest paid is regarded as an expense for the company and is deductible under Income Tax Act. Therefore, debentures are also known as loan capital because they are redeemable after a long period of time.

Q3: Describe the meaning of ‘Debenture Issued as Collateral Securities’. What accounting treatment is given to the issue of debentures in the books of accounts?

Ans: The term collateral security means additional or secondary security in addition to the primary security. Sometimes, when a company takes loan from a financial institution, then besides the primary security, the company may issue debenture for additional security (as collateral security). The lender who receives debenture as collateral security is not entitled for interest on these debentures. If any default is made by the company in paying back the principal amount (i.e. the loan amount) or interest on the loan, then the lender has the full right to recover his/her dues from the sale of primary security. But, if the primary security is not sufficient to recover the amount of debt, then the debentures issued as collateral may be used for recovery of the remaining amount.

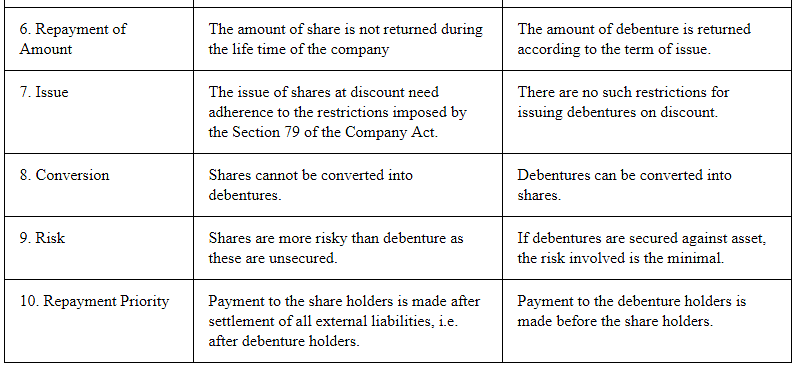

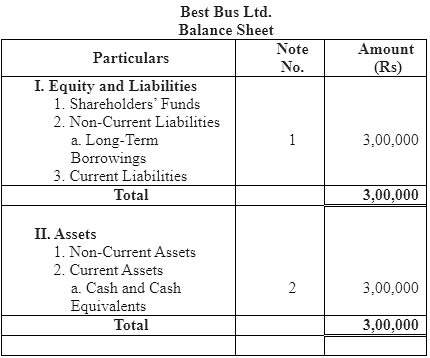

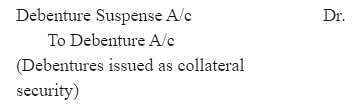

Accounting Treatment:

There are two ways to record issue of debentures as collateral security:

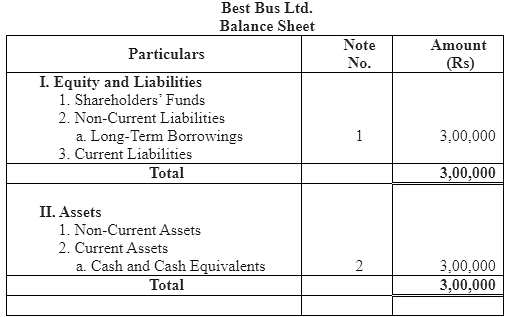

1. No Entry

As no liability has been created so no Journal entry is recorded in the books of account. As per the Revised Schedule-VI of the Companies Act, the issue of debenture as collateral security is shown as a Long-Term Borrowings under the heading of Non-Current Liabilities on the Equity and Liabilities side of the Balance Sheet. In the Notes to Accounts of Long-Term Borrowings, the Loan so taken is shown. And in the Notes to Accounts of Cash and Cash Equivalents, the amount of loan so received (in cash) is shown. This can be better understood with the help of the below explained example.

Example- Suppose Best Bus Ltd. issued 4,000 9% Debentures of Rs 100 each as collateral security to NBP bank for a loan of Rs 3,00,000.

2. By Making Entry

In order to record the issue of debentures as collateral security, the following necessary Journal entries are made in the books of account.

At the time of Issue of Debentures as Collateral Security

In this case, as per the Revised Schedule VI of the Companies Act, Debentures so issued as collateral security will be shown as Long-Term Borrowings under the head of Non-Current Liabilities of the Equity and Liabilities side of the Company's Balance Sheet. Unlike Method-1, in this method, Debentures Suspense Account is deducted from the Debentures Account in the Notes to Accounts of Long-Term Borrowings.

Q4: Explain the different terms for the issue of debentures with reference to their redemption.

Ans: The different terms for the issue of debentures with reference to their redemption can be the combinations of at par, at premium and at discount. Normally, the debentures are not redeemable at discount. The permutation and the combination of the various terms of issue and redemption of debentures give rise to following six situations:

1. Issue at Par, Redeemable at Par.

2. Issue at Premium, Redeemable at Par.

3. Issue at Discount, Redeemable at Par.

4. Issue at Par, Redeemable at Premium.

5. Issue at Premium, Redeemable at Premium.

6. Issue at Discount Redeemable at Premium.

1. Issue at Par and Redeemable at Par- When the debentures are issued and are redeemed at their face value, then the following Journal entry is passed.

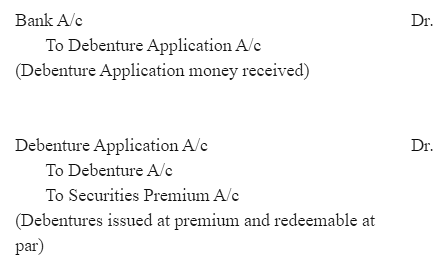

2. Issue at Premium and Redeemable at Par- When the debentures are issued at premium and are redeemable at par, then the following Journal entry is passed. As premium is a gain for a company so it is credited in the Journal entry.

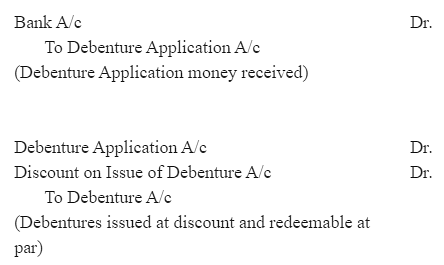

3. Issue at Discount and Redeemable at Par- When the debentures are issued at discount and are redeemable at par, then the following Journal entry is passed. As discount is a loss for a company so it is debited in the Journal entry.

4. Issue at Par and Redeemable at Premium- When debentures are issued at par and redeemable at premium, then the following Journal entry is passed. In such case, the company did not suffer any loss at the time of issue but there will be loss at the time of redemption.

5. Issued at Premium and Redemption at Premium- When the debentures are issued and redeemable at premium, then the following Journal entry is passed.

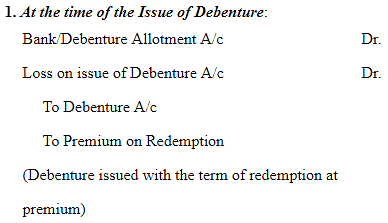

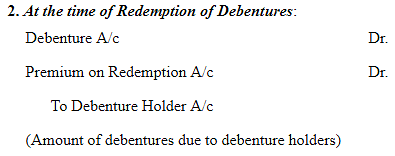

6. Issue of Discount and Redemption at Premium- When the debentures are issued at discount and redeemable at premium, then the following Journal entry is passed.

Q6: Differentiate between redemption of debentures out of capital and out of profits.

Ans: Redemption of Debentures Out of Capital

When debentures are redeemed out of capital and no profits are utilised for redemption, then such redemption is termed as redemption out of capital. In such a situation, no profits are transferred to the Debenture Redemption Reserve (DRR).

As per the guideline laid down by Securities and Exchange Board of India (SEBI) and the Section 117C of Company Act of 1956, the creation of DRR is mandatory (DRR). Therefore, it is not possible to redeem debentures purely out of capital, as it reduces the value of assets. The following companies are exempted from the creation of DRR.

1. Infrastructure companies (i.e. those companies that are engaged in the business of developing, maintaining and operating infrastructure facilities)

2. A Company that issues debentures with a maturity up to 18 months

Redemption of Debenture Out of Profits

When debentures are redeemed out of profit then no capital is utilised for redemption. Before redeeming the debentures profits are transferred to DRR from Profit and Loss Appropriation Account. The creation of DRR is mandatory as per the guidelines laid down by Securities and Exchange Board of India (SEBI). SEBI mandates transferring amount equal to 50% of debentures issued to DRR before redeeming debentures. In this method, as profits are transferred to the DRR Account, thereby reducing the total amount of profits, therefore this method is termed as Redemption of Debentures Out of Profits. In this method, first of all, the required profits are transferred from Statement of Profit and Loss to the DRR Account. The working of which is shown in the Notes to Accounts of Reserves and Surplus (as prescribed in Revised Schedule VI). The final balance (after considering DRR) is shown as the sub-head 'Reserves and Surplus' under the main head of Shareholders' Funds on the Equity and Liabilities side of the Company's Balance Sheet. Lastly, when all the debentures are redeemed, then DRR account is closed by transferring its amount to the General Reserve.

Q7: Explain the guidelines of SEBI for creating Debenture Redemption Reserve.

Ans: The following are the main points of SEBI’s guidelines for creation of Debenture Redemption Reserve (DRR).

1. Every company that issues debentures with a maturity of more than 18 months shall create DRR.

2. An amount equal to 50% of debenture issued shall be transferred to DRR before starting redemption of debentures.

3. Creation of DRR is applicable only for Non-Convertible Debentures and for non-convertible part of Partly Convertible Debentures.

4. Any withdrawal from DRR is allowed only after 10% of debentures are redeemed.

Thus, as per the SEBI’s guidelines, 50% of the debentures issued should be redeemed out of the profits that are transferred to DRR and the remaining 50% of the debentures issued can be redeemed either out of profits or out of capital. Hence, no company can redeem all the debentures issued purely out of the capital.

As per the SEBI’s guidelines the following companies are exempted from the creation of DRR.

1. Infrastructure companies (i.e. those companies that are engaged in the business of developing, maintaining and operating infrastructure facilities)

2. A Company that issues debentures with a maturity up to 18 months

Q8: Can a company purchase its own debentures in the open market? Explain.

Ans: Yes, a company can purchase its own debentures provided it is authorised by its Article of Association. As per the Company Act, if a company is authorised by its Article of Association, only then it may purchase its own debentures from the open market. The main purposes of such purchase are as follows:

1. For immediate cancellation of debenture liability, if the interest rate on its debenture is higher than the market rate of interest.

2. A company may also purchase its own debentures with the motive of investment and sell them at higher price in future and thereby earn profit.

A company may purchase its own debentures at discount or at premium for cancellation.

1. If Debentures are purchased at Discount for Cancellation

When the company purchases its own debentures at discount for cancellation, then the following Journal entries are recorded. 2. If Debentures are Purchased at Premium for Cancellation

2. If Debentures are Purchased at Premium for Cancellation

Q9: What is meant by conversion of debentures? Describe the method of such a conversion.

Ans: When a debenture holder can convert his/her debentures into shares or new debentures after the expiry of a specified period of time, then it is known as redemption of debentures by conversion. As the company does not need to pay any funds for the redemption, so there is no need to maintain Debenture Redemption Reserve (DRR). The new shares or debentures may be issued at par, premium or at discount.

If a debenture holder exercises the conversion option, then the issue price of shares must be equal to or less than the amount actually received from debentures.

|

42 videos|168 docs|43 tests

|

FAQs on NCERT Solution: Issue and Redemption of Debentures- 1 - Accountancy Class 12 - Commerce

| 1. What are debentures and how do they work in a company’s financing? |  |

| 2. What are the different types of debentures? |  |

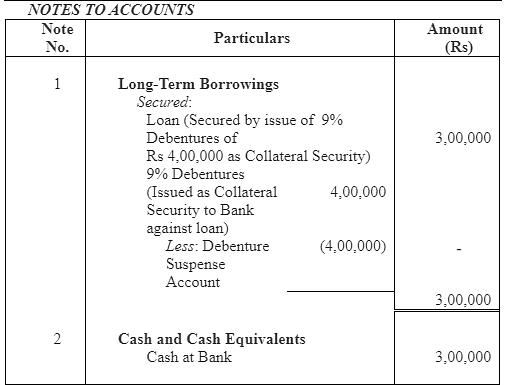

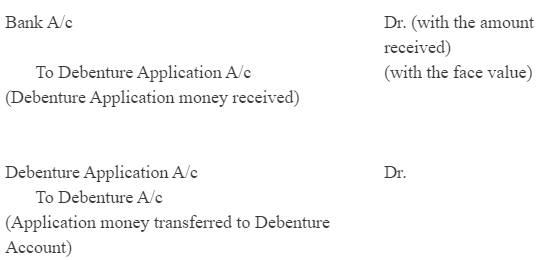

| 3. What is the process of issuing debentures? |  |

| 4. How are debentures redeemed? |  |

| 5. What are the advantages and disadvantages of investing in debentures? |  |

|

Explore Courses for Commerce exam

|

|