NCERT Solution: Issue and Redemption of Debentures- 2 | Accountancy Class 12 - Commerce PDF Download

Numerical Questions

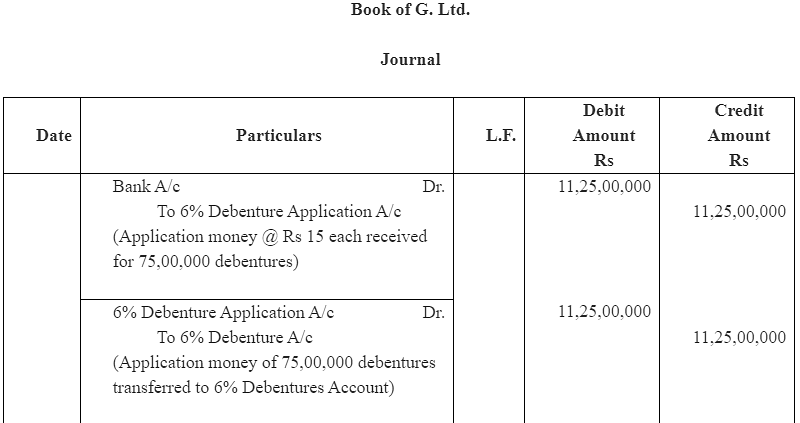

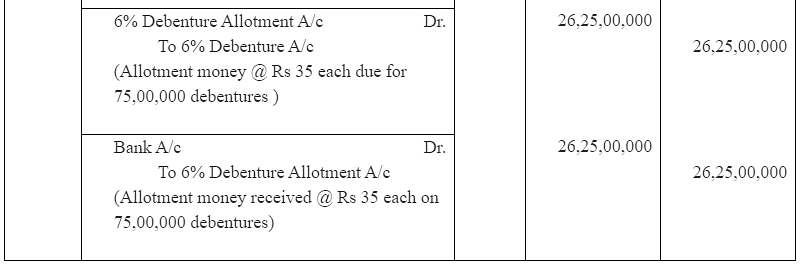

Q1: G. Ltd. a listed company issued 75,00,000, 6% debentures of Rs. 50 each at par payable Rs. 15 on application and Rs. 35 on allotment, redeemable at par after 7 years from the date of issue of debentures. Record necessary entries in the books of Company.

Ans:

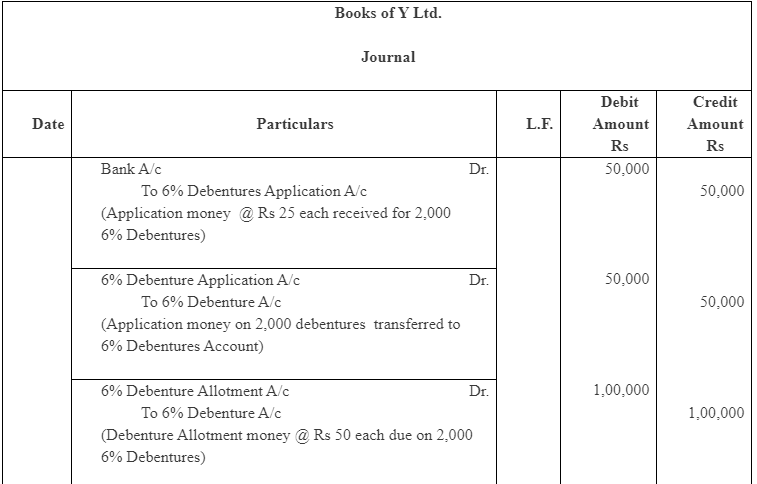

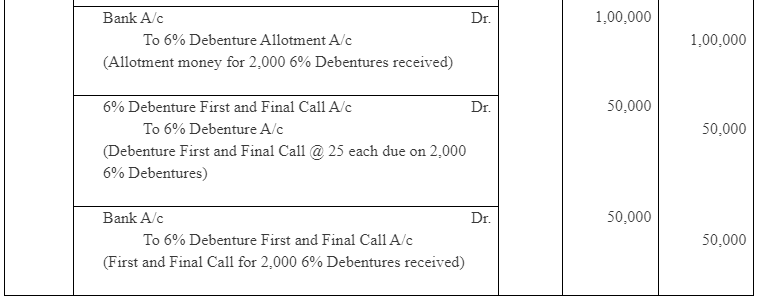

Q2: Y. Ltd. issued 2,000, 6% debentures of Rs. 100 each payable as follows: Rs. 25 on application; Rs. 50 on allotment and Rs. 25 on first and final call. Record necessary entries in the books of the company.

Ans:

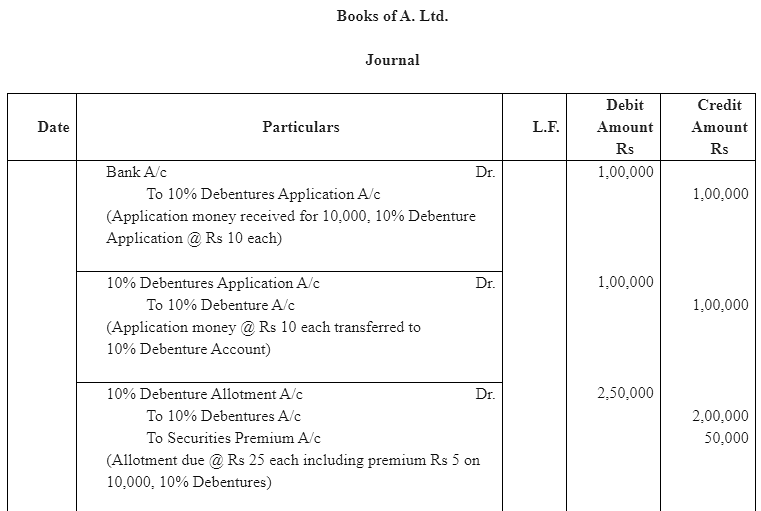

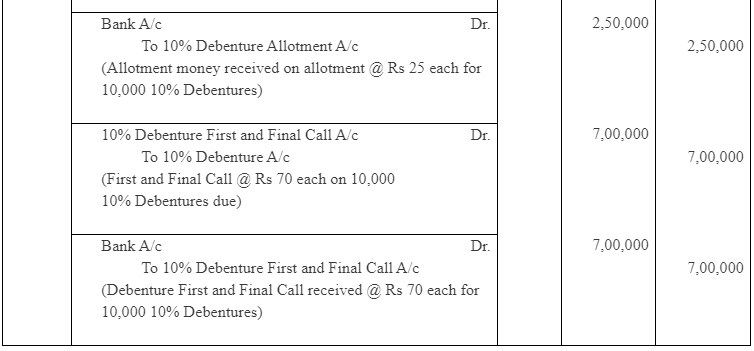

Q3: A. Ltd. issued 10,000, 10% debentures of Rs. 100 each at a premium of 5% payable as follows:

Rs 10 on Application;

Rs. 20 along with premium on allotment and balance on first and final call.

The debentuers were fully subscribed and all money was duly received.

Record necessary Journal entries. Also show how the amount will appear in the balance sheet.

Ans:

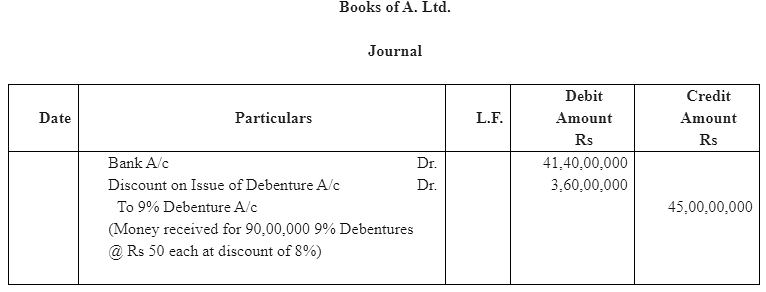

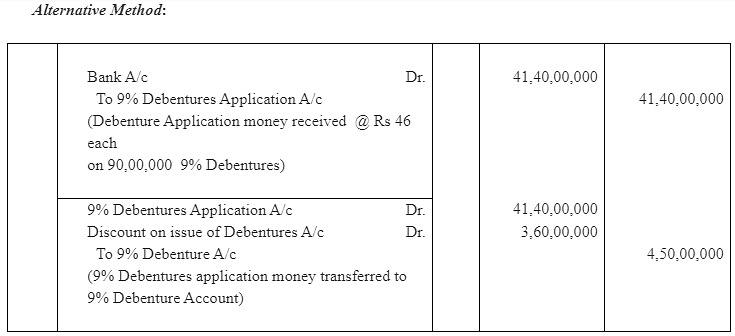

Q4: A. Ltd. issued 90,00,000, 9% debenture of Rs. 50 each at a of 8%, redeemable at par any time after 9 years Record necessary entries in the books of A. Ltd., for issue of debentures.

Ans:

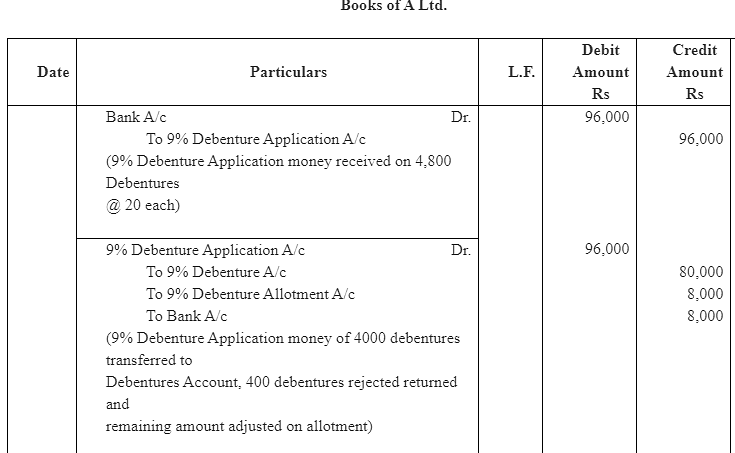

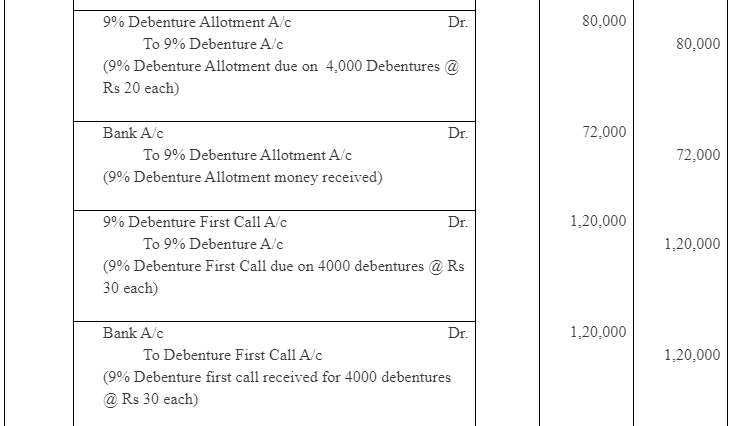

Q5: A. Ltd. issued 4,000, 9% Debentures of Rs 100 each on the following terms:

Rs 20 on Application;

Rs 20 on Allotment;

Rs 30 on First call; and

Rs 30 on Final call.

The public applied for 4,800 Debentures. Applications for 3,600 Debentures were accepted in full. Applications for 800 Debentures were allotted 400 Debentures and applications for 400 Debentures were rejected. All money called and duly received. Record necessary journal entries.

Ans:

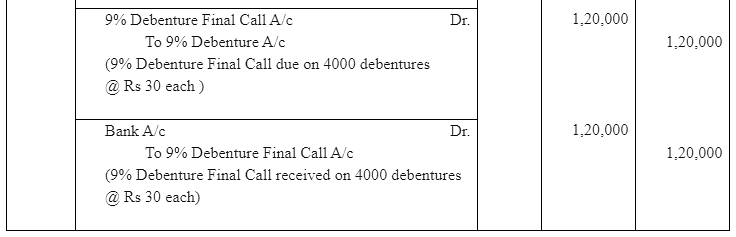

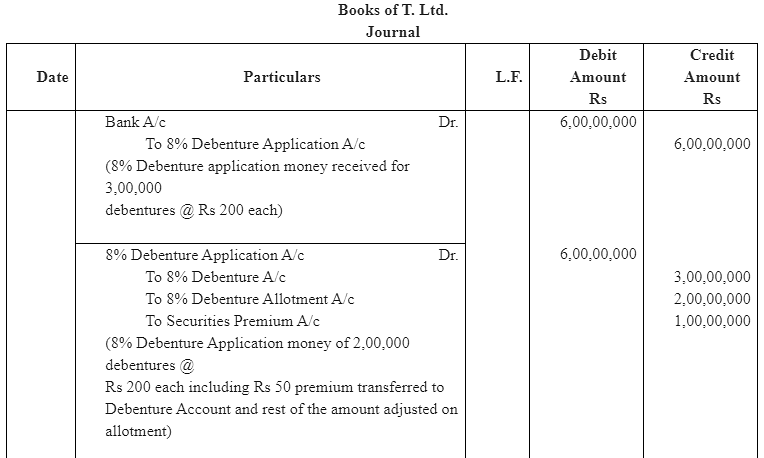

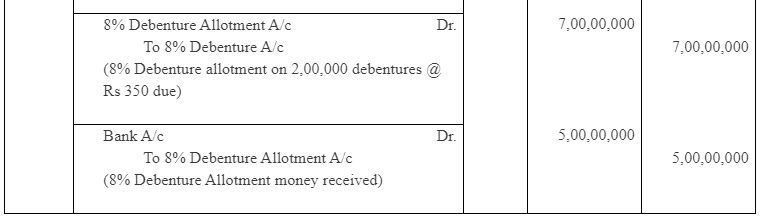

Q6: T. Ltd. offered 2,00,000, 8% debenture of Rs. 500 each on June 30, 2014 at a premium of 10% payable as Rs. 200 on application (including premium) and balance on allotment, redeemable at par after 8 years But application are received for 3,00,000 debentures and the allotment is made on pro-rata basis. All the money due on application and allotment was received. Record necessary entries regarding issue of debentures.

Ans:

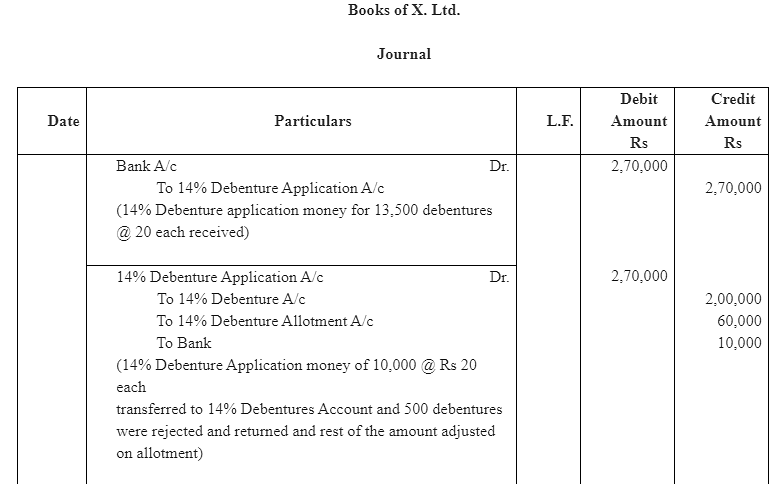

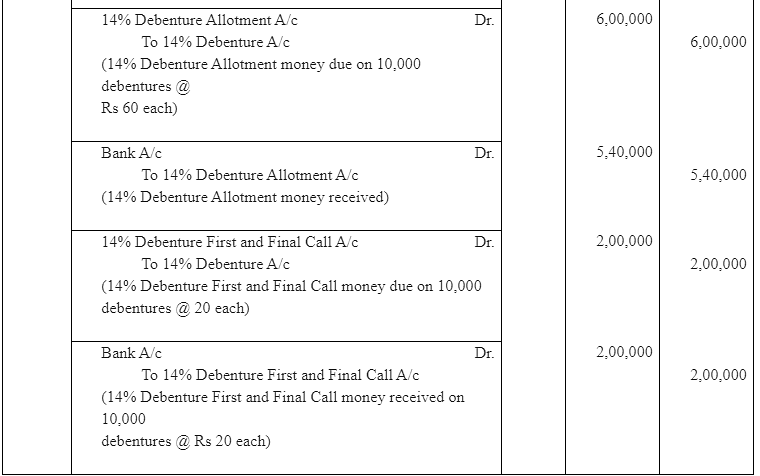

Question 7: X. Ltd. invites application for the issue of 10,000, 14% debentures of Rs 100 each payable as to Rs 20 on application, Rs 60 on allotment and the balance on call. The company receives applications for 13,500 debentures, out of which applications for 8,000 debentures are allotted in full, 5,000 only 40% and the remaining rejected. The surplus money on partially allotted applications is utilised towards allotment. All the sums due are duly received.

Ans:

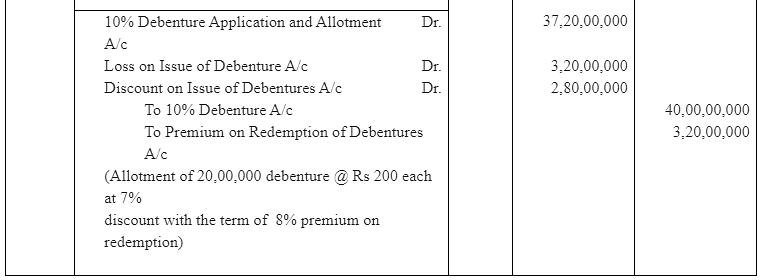

Q8: R. Ltd. offered 20,00,000, 10% debentures of Rs. 200 each at a discount of 7% redeemable at premium of 8% after 9 years Record necessary entries in the books of R. Ltd.

Ans:

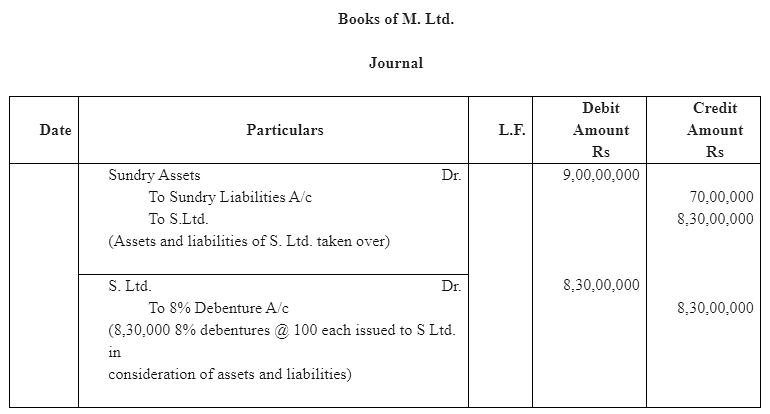

Q9: M. Ltd. took over assets of Rs 9,00,00,000 and liabilities of Rs 70,00,000 of S.Ltd. and issued 8% benture of Rs 100 each. Record necessary entries in the books of M. Ltd.

Ans:

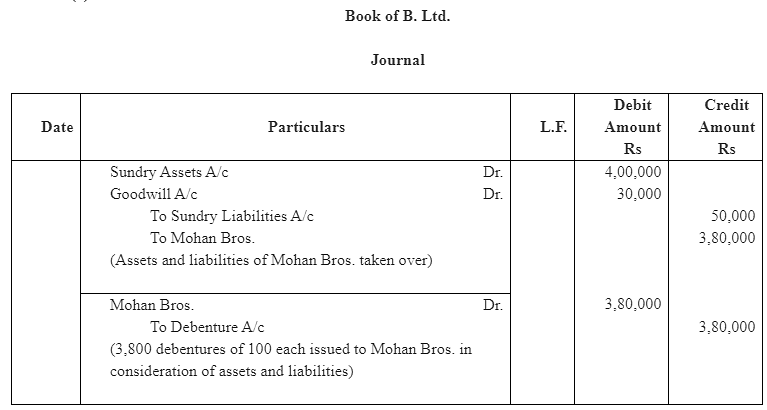

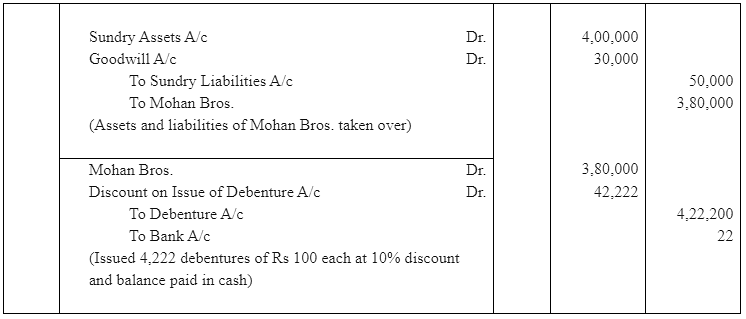

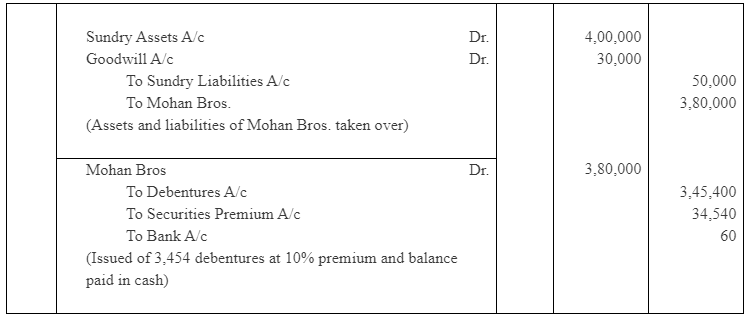

Q10: B. Ltd. purchased assets of the book value of Rs 4,00,000 and took over the liability of Rs 50,000 from Mohan Bros. It was agreed that the purchase consideration, settled at Rs,3,80,000, be paid by issuing debentures of Rs 100 each.

What Journal entries will be made in the following three cases, if debentures are issued:

(a) at par;

(b) at discount;

(c) at premium of 10%?

It was agreed that any fraction of debentures be paid in cash.

Ans:

Case (a) Case (b)

Case (b)

Case (c)

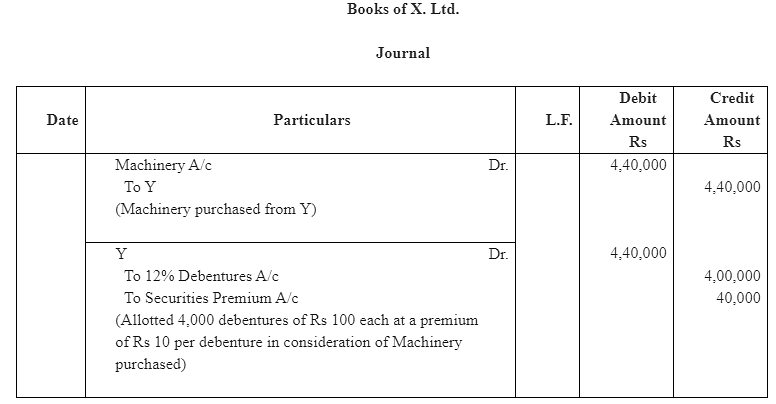

Q11: X. Ltd. purchased a Machinery from Y. Ltd. at an agreed purchase consideration of Rs. 4,40,000 to be satisfied by the issue of 12% debentures of Rs. 100 each at a premium of Rs. 10 per debenture. Journalise the transactions.

Ans:

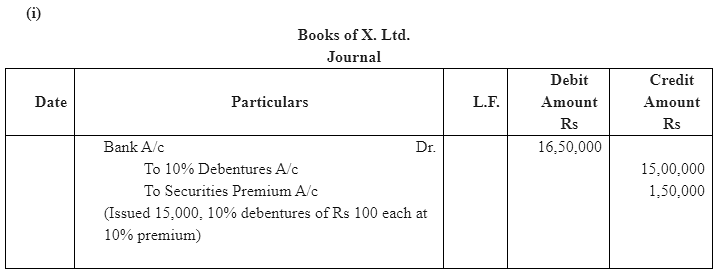

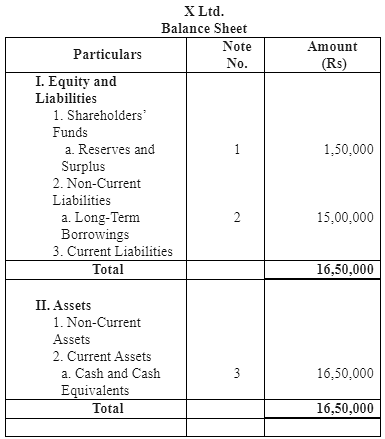

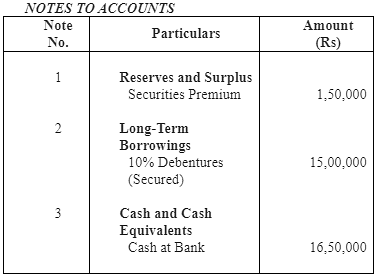

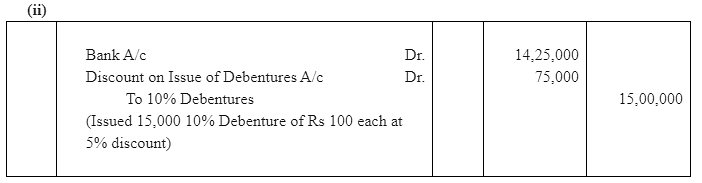

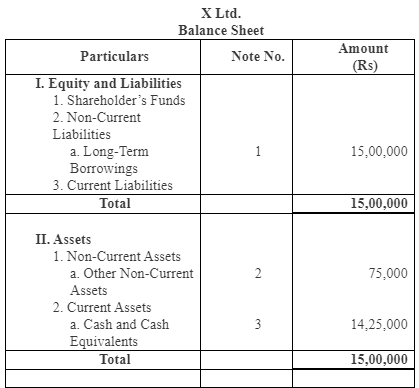

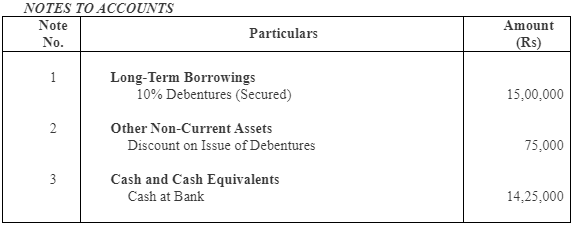

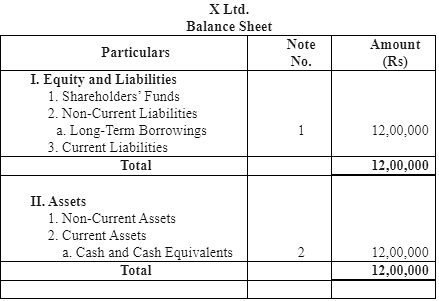

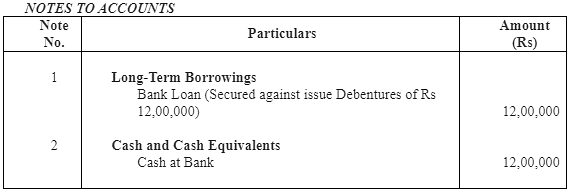

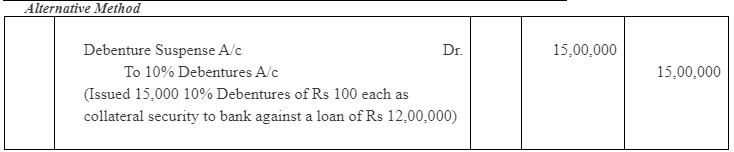

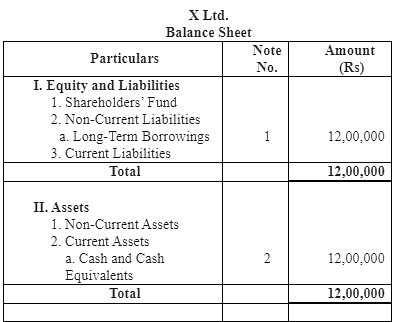

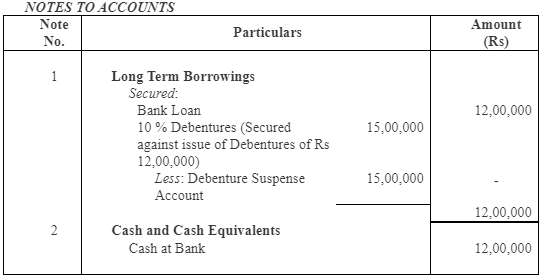

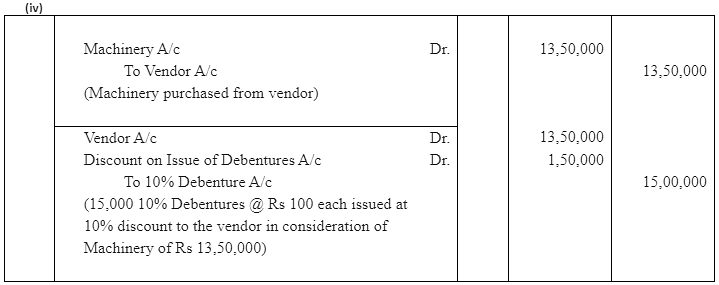

Q12: X. Ltd. issued 15,000, 10% debentures of Rs 100 each. Give journal entries and the Balance Sheet in each of the following cases:

(i) The debentures are issued at a premium of 10%;

(ii) The debentures are issued at a discount of 5%;

(iii) The debentures are issued as a collateral security to bank against a loan of Rs 12,00,000; and

(iv) The debentures are issued to a supplier of machinery costing Rs 13,50,000.

Ans:

(iii) No entry will be passed for issuing debentures as a collateral security

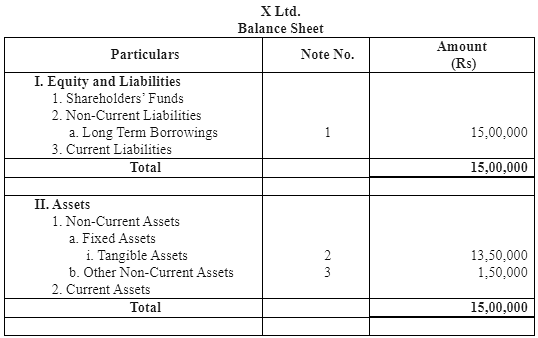

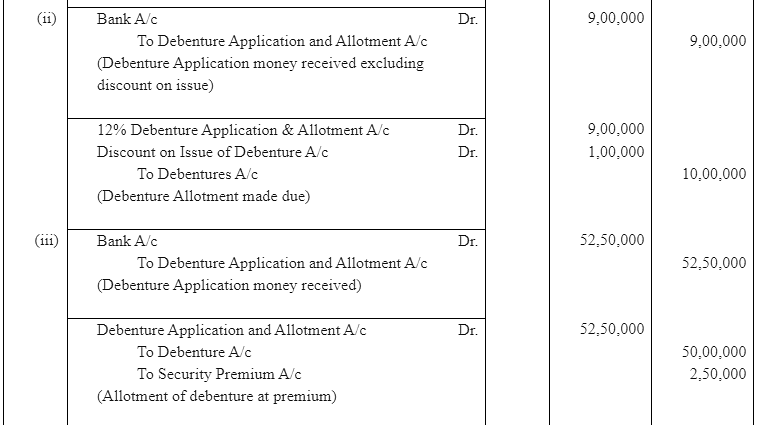

Q13: Journalise the following:

Q13: Journalise the following:

(i) A debenture issued at Rs 95, repayable at Rs 100;

(ii) A debenture issued at Rs 95, repayable at Rs 105; and

(iii) A debenture issued at Rs 100, repayable at Rs 105;

The face value of debenture in each of the above cases is Rs 100.

Ans:

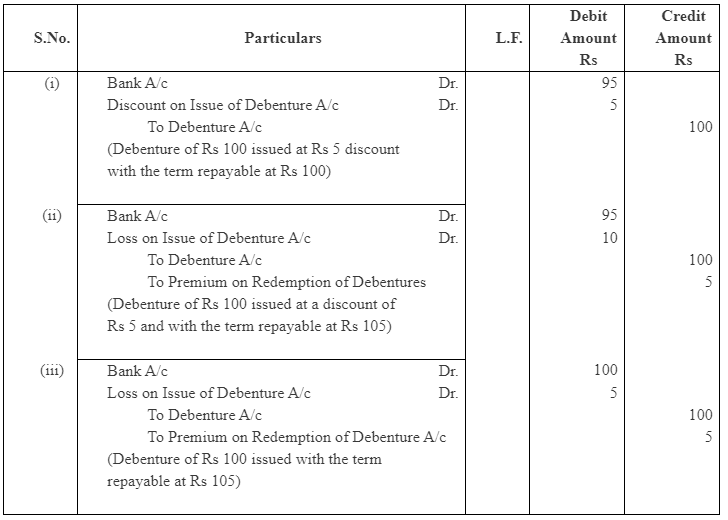

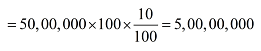

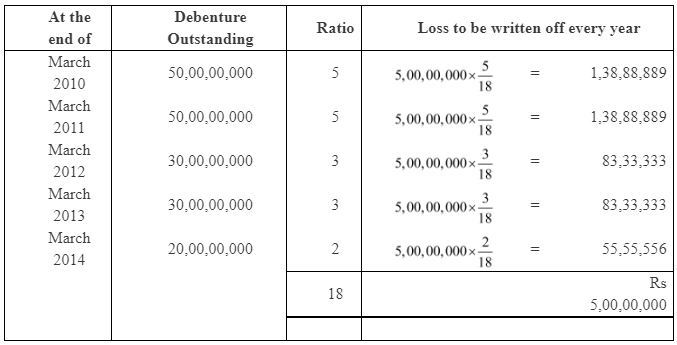

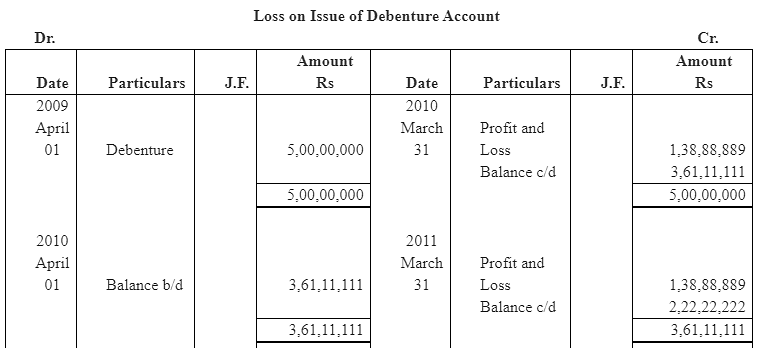

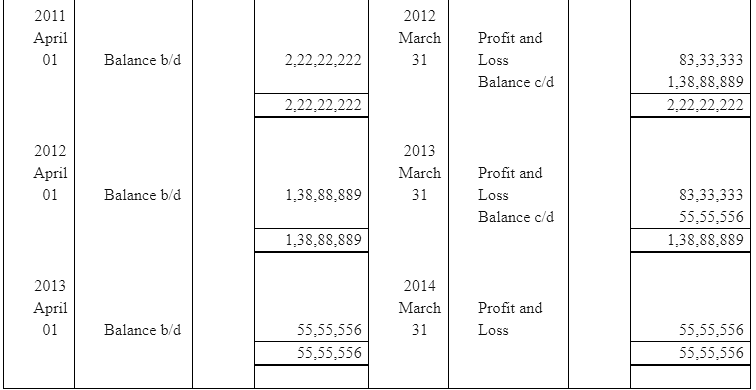

Q14: A. Ltd. issued 50,00,000, 8% Debenture of Rs 100 at a discount of 6% on April 01, 2009 redeemable at premium of 4% by draw of lots as under:

20,00,000 Debentures on March, 2011

10,00,000 Debentures on March, 2013

20,00,000 Debentures on March, 2014

Compute the amount of discount to be written-off in each year till debentures are paid. Also prepare discount/loss on issue of debenture account.

Ans:

Loss on issue of debenture = 6% (discount on issue) + 4% (premium on redemption) = 10%

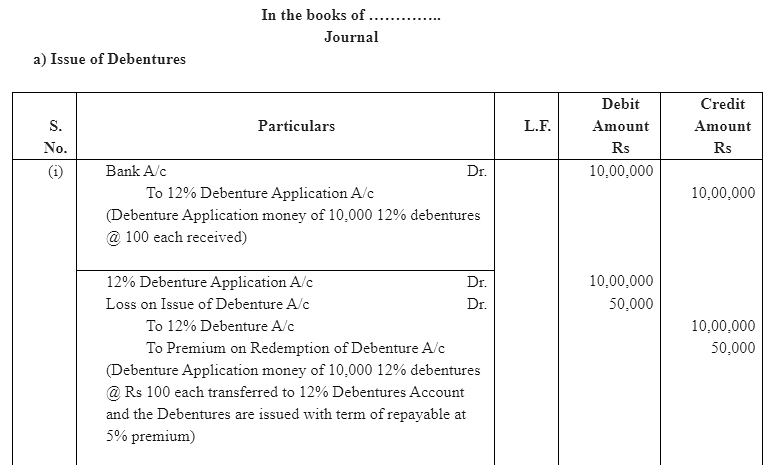

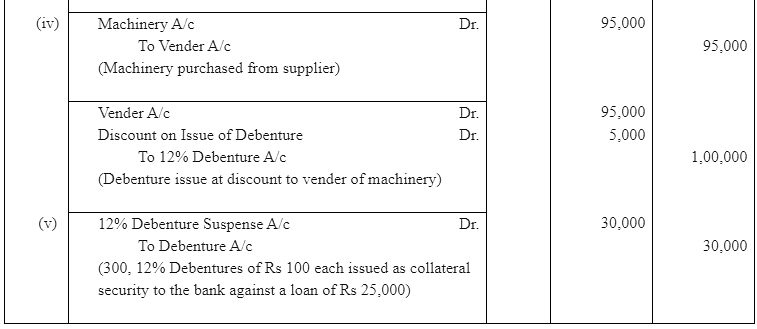

Question 15: A listed company issues the following debentures:

(i) 10,000, 12% debentures of Rs 100 each at par but redeemable at premium of 5% after 5 years;

(ii) 10,000, 12% debentures of Rs 100 each at a discount of 10% but redeemable at par after 5 years;

(iii) 5,000, 12% debentures of Rs 1,000 each at a premium of 5% but redeemable at par after 5 years;

(iv) 1,000, 12% debentures of Rs 100 each issued to a supplier of machinery costing Rs 95,000. The debentures are repayable after 5 years; and

(v) 300, 12% debentures of Rs 100 each as a collateral security to a bank which has advanced a loan of Rs 25,000 to the company for a period of 5 years.

Pass the journal entries to record the: (a) issue of debentures; and (b) repayment of debentures after the given period.

Ans:

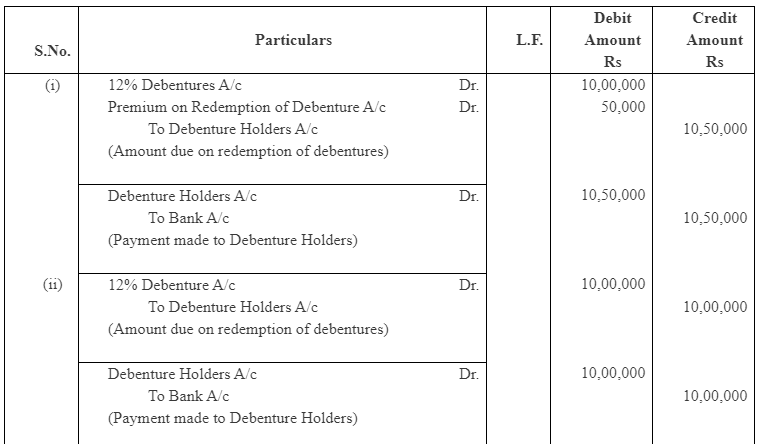

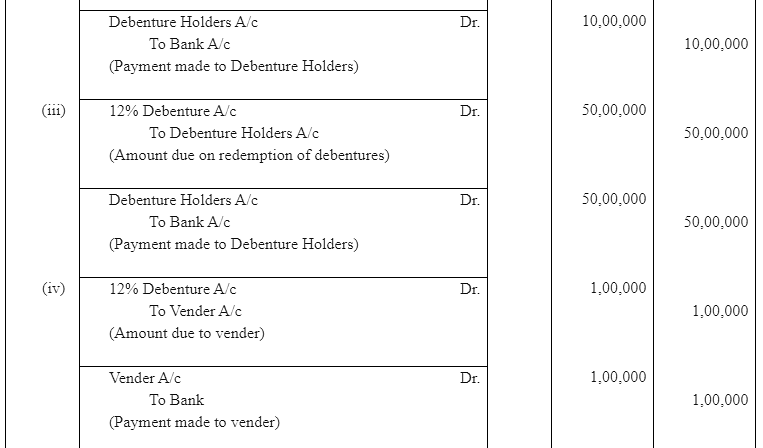

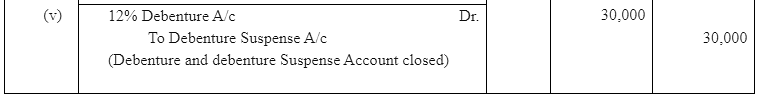

b) Repayment of Debentures

Q16: A listed company issued debentures of the face value of Rs 5,00,000 at a discount of 6% on April 01, 2014. These debentures are redeemable by annual drawings of Rs. 1,00,000 made on March 31 each year starting from March 31, 2016. Give journal entries for issue of debuntures, writing-off discount and regarding redemption of debentures.

Ans:

Issue of Debentures: The company issued debentures worth ₹5,00,000 at a 6% discount.

Discount = ₹5,00,000 × 6% = ₹30,000.

Net proceeds from the issue = ₹5,00,000 - ₹30,000 = ₹4,70,000.

Writing-Off Discount:

The discount of ₹30,000 is written off equally over 5 years: ₹30,000 ÷ 5 = ₹6,000 per year.

Redemption of Debentures:

Debentures are redeemed annually starting from March 31, 2016, for ₹1,00,000 each year.

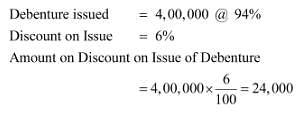

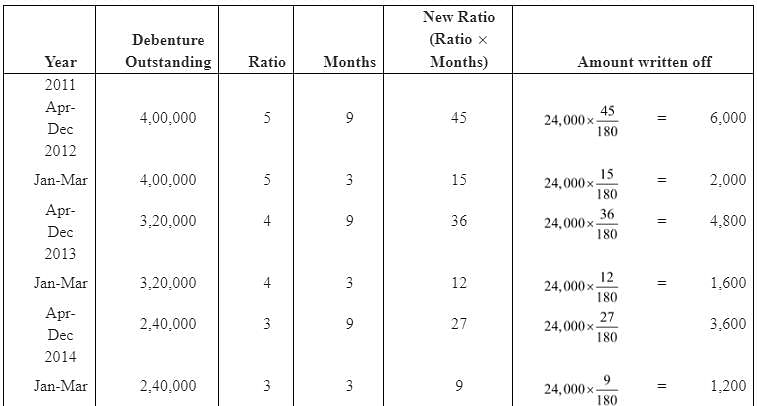

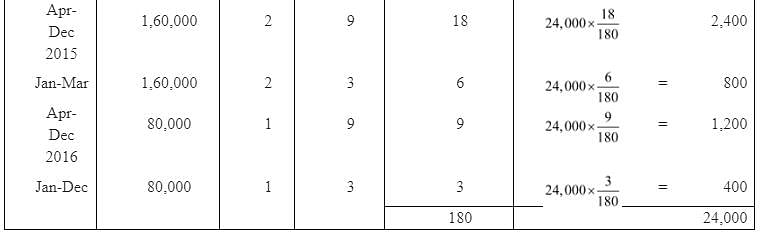

Q17: B. Ltd. a listed company issued debentures at 94% for Rs. 4,00,000 on April 01, 2011 repayable by five equal drawings of Rs. 80,000 each. The company prepares its final accounts on March 31 every year. Give Journal entries for issues and redemption of debentures.

Ans:

Amount of discount to written off every year

In 2011 = Rs 6,000

In 2012 = 2,000 + 4,800 = Rs 6,800

In 2013 = 1,600 + 3,600 = Rs 5,200

In 2014 = 1,200 + 2,400 = Rs 3,600

In 2015 = 800 + 1,200 = Rs 2,000

In 2016 = Rs 400

Working Notes

i) Amount of discount to be written off every year

Note: In the question, the closing date of the accounting year is March 31, however, it should be December 31.

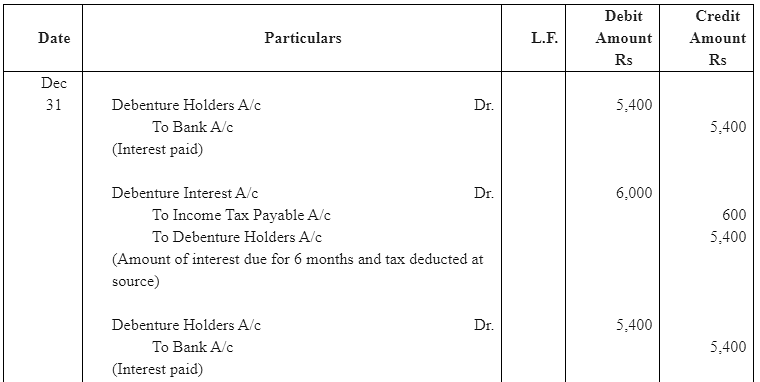

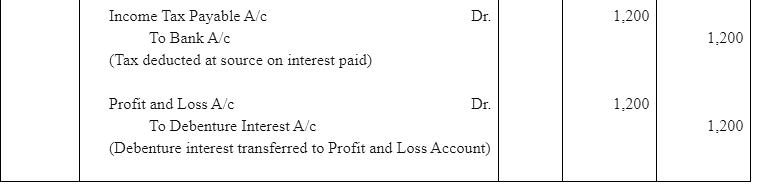

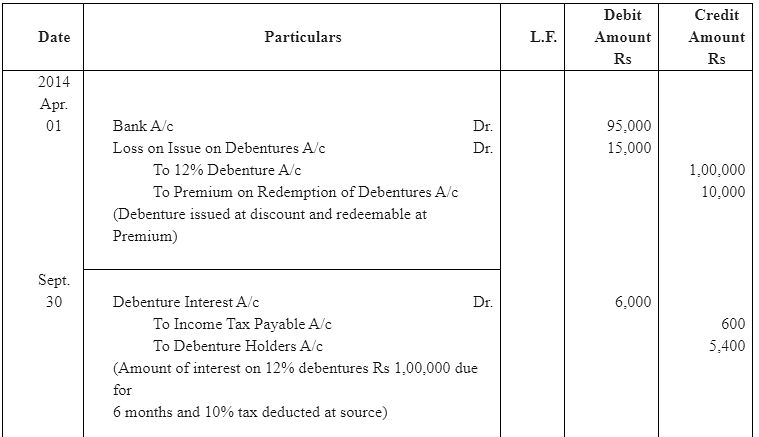

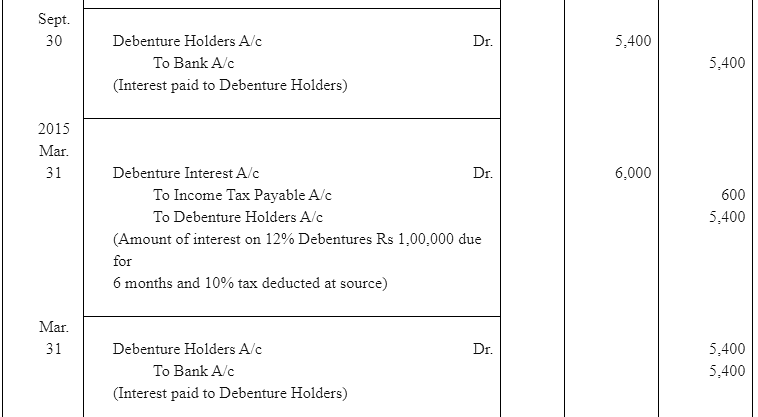

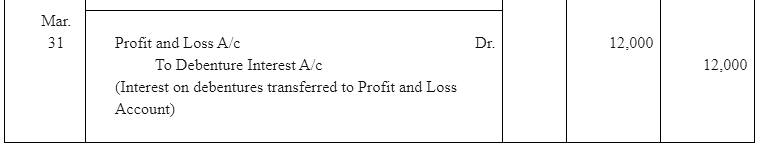

Q18: B. Ltd. issued 1,000, 12% debentures of Rs 100 each on April 01, 2014 at a discount of 5% redeemable at a premium of 10%.

Give journal entries relating to the issue of debentures and debentures interest for the period ending March 31, 2015 assuming that interest is paid half yearly on September 30 and March 31 and tax deducted at source is 10%.

Ans:

|

42 videos|168 docs|43 tests

|

FAQs on NCERT Solution: Issue and Redemption of Debentures- 2 - Accountancy Class 12 - Commerce

| 1. What are debentures and how are they different from shares? |  |

| 2. What is the process of issuing debentures? |  |

| 3. What are the different types of debentures? |  |

| 4. How is the redemption of debentures carried out? |  |

| 5. What are the advantages of investing in debentures for investors? |  |

|

Explore Courses for Commerce exam

|

|