NCERT Solution (Part - 3) - Issue and Redemption of Debentures | Additional Study Material for Commerce PDF Download

Question 8: Describe the steps for creating Sinking Fund for redemption of debentures.

Answer: The various steps involved in the creation of Sinking Fund for redemption of debentures can be better understood by the help of the example explained below.

A Company issued 10% Debentures of Rs 5,00,000 for 3 years. The investment is expected to earn 6% p.a. The Sinking Fund table shows that 0.31411 invested annually at 6% amount to Rs 1 in 3 years.

Step 1: Calculate the amount of instalment to be required every year for investment with the help of the Sinking Fund table. Like in the example Rs 1,57,055 (i.e. 0.31411 × 5,00,000) is required every year.

Step 2: The amount of instalment calculated in the above step is transferred to the Debenture Redemption Fund (Sinking Fund) by debiting from Profit and Loss Appropriation Account.

Step 3: In the first year, the above instalment is invested to yield amount required for redemption of debenture by debiting Debenture Redemption Fund Investment Account.

Step 4: The interest on investment is received on half yearly or annual basis. In the example, the interest of Rs 9,423 is received on annual basis.

Step 5: The total amount of investment, i.e. interest plus instalment is invested in the subsequent year. In the example, Rs 1,66,478 (i.e. Rs 1,57,055 + Rs 9,423) is invested in the next year.

Step 6: Repeat the Step 2, 3, 4 for each subsequent years up to the end of the life of the debenture. In the year of redemption, the instalment (i.e. the last instalment) will be debited to the Profit and Loss Appropriation Account but will not be invested.

Step 7: In the year of redemption, the investment is sold off.

Step 8: The profit (loss) on the sale of the investment is transferred by debiting (crediting) Debenture Redemption Fund Investment Account to the Debenture Redemption Fund Account.

Step 9: The payment to the debenture holder is made.

Step 10: The balance of Debenture Redemption Fund Account if any, is transferred to the General Reserve.

Question 9: Can a company purchase its own debentures in the open market? Explain.

ANSWER: Yes, a company can purchase its own debentures provided it is authorised by its Article of Association. As per the Company Act, if a company is authorised by its Article of Association, only then it may purchase its own debentures from the open market. The main purposes of such purchase are as follows:

1. For immediate cancellation of debenture liability, if the interest rate on its debenture is higher than the market rate of interest.

2. A company may also purchase its own debentures with the motive of investment and sell them at higher price in future and thereby earn profit.

A company may purchase its own debentures at discount or at premium for cancellation.

1. If Debentures are purchased at Discount for Cancellation

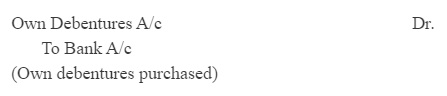

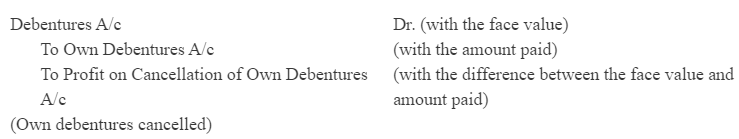

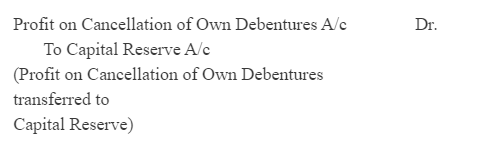

When the company purchases its own debentures at discount for cancellation, then the following Journal entries are recorded.

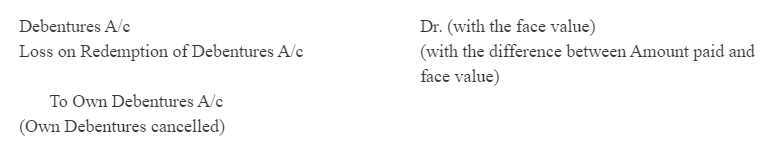

2. If Debentures are Purchased at Premium for Cancellation

Question 10: What is meant by conversion of debentures? Describe the method of such a conversion.

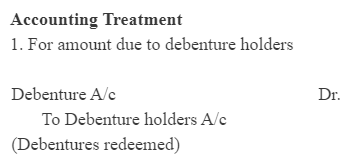

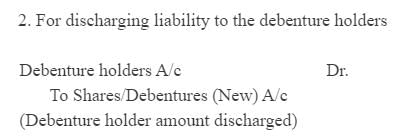

ANSWER: When a debenture holder can convert his/her debentures into shares or new debentures after the expiry of a specified period of time, then it is known as redemption of debentures by conversion. As the company does not need to pay any funds for the redemption, so there is no need to maintain Debenture Redemption Reserve (DRR). The new shares or debentures may be issued at par, premium or at discount.

If a debenture holder exercises the conversion option, then the issue price of shares must be equal to or less than the amount actually received from debentures.

Page No 143:

Numerical Questions:

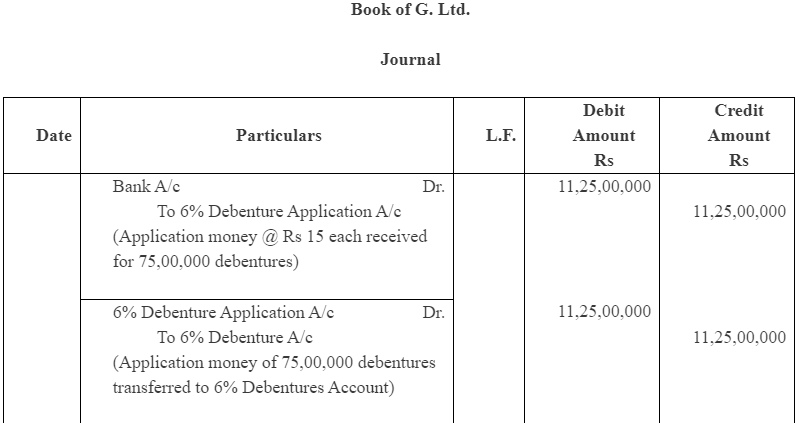

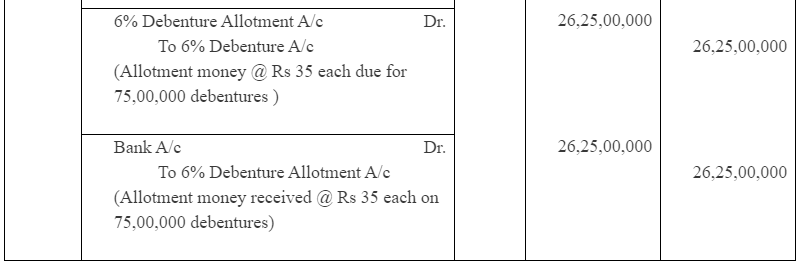

Question 1: G.Ltd. issued 75,00,000, 6% Debenture of Rs 50 each at par payable Rs 15 on application and Rs 35 on allotment, redeemable at par after 7 years from the date of issue of debenture. Record necessary entries in the books of Company.

Answer:

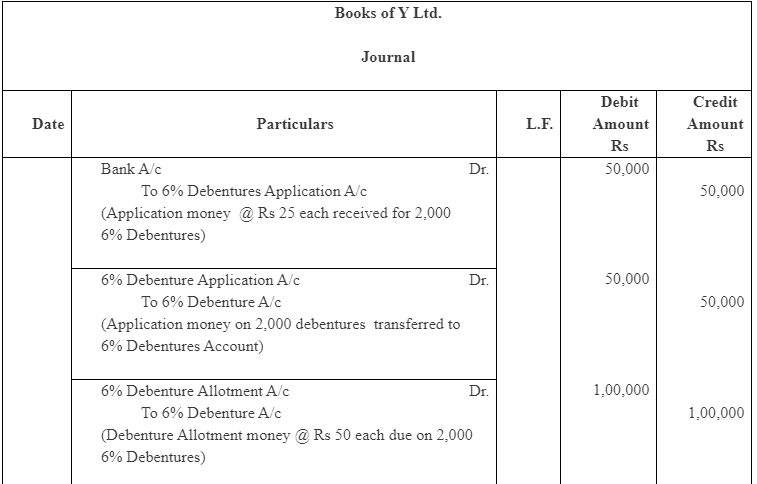

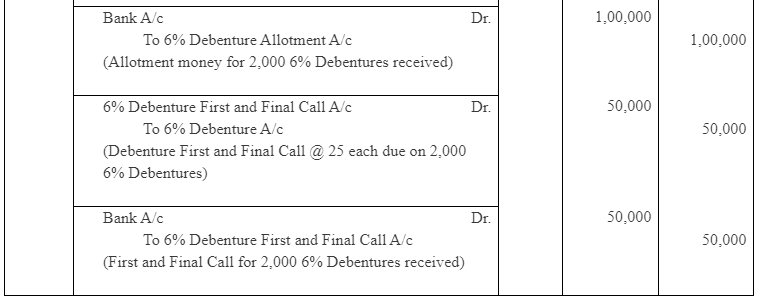

Question 2: Y.Ltd. issued 2,000, 6% Debentures of Rs 100 each payable as follows: Rs 25 on application; Rs 50 on allotment and Rs 25 on First and Final call.

ANSWER:

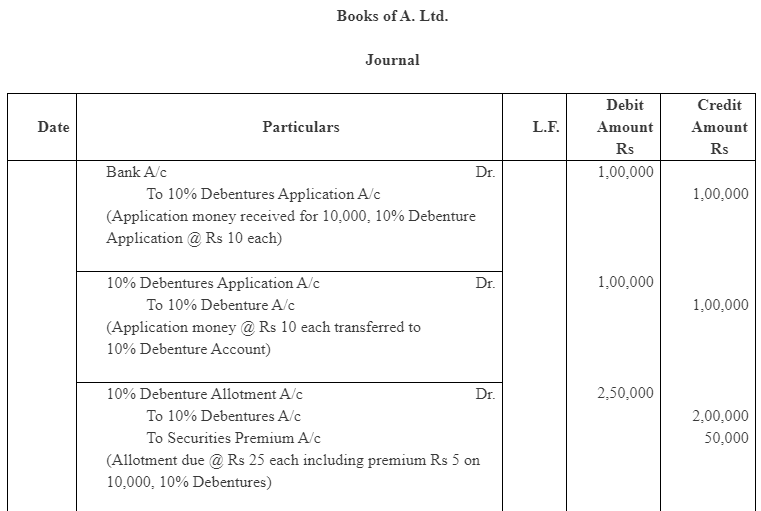

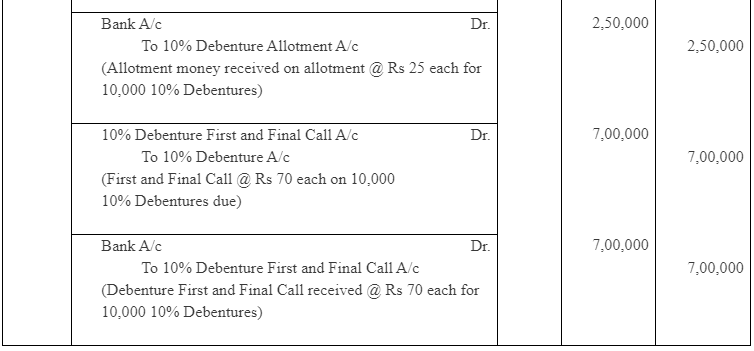

Question 3: A.Ltd. issued 10,000, 10% Debentures of Rs 100 each at a premium of 5% payable as follows:

Rs 10 on Application;

Rs 20 along with premium on allotment and balance on First and Final call. Record necessary Journal Entries.

ANSWER:

Page No 144:

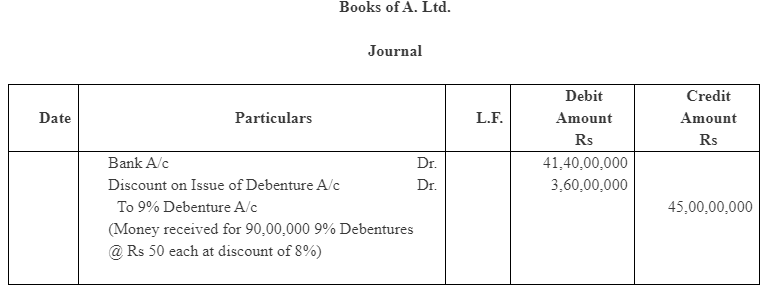

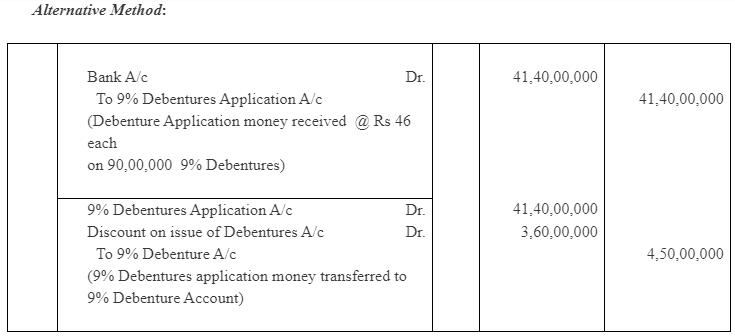

Question 4: A. Ltd. issued 90,00,000, 9% Debenture of Rs 50 each at a discount of 8%, redeemable at par any time after 9 years. Record necessary entries in the books of A. Ltd.

ANSWER:

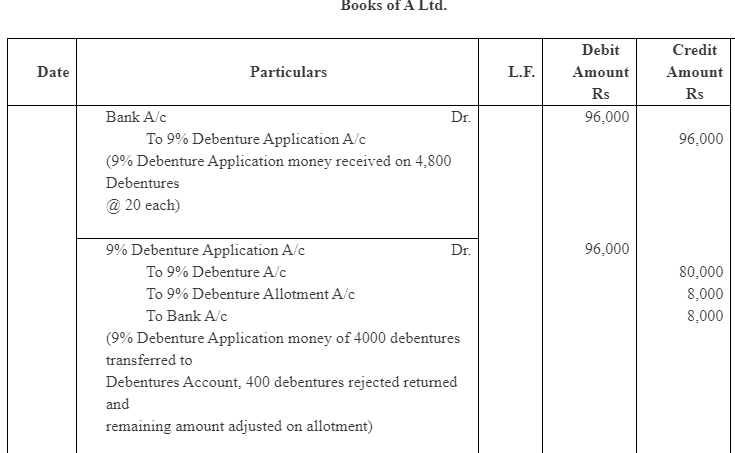

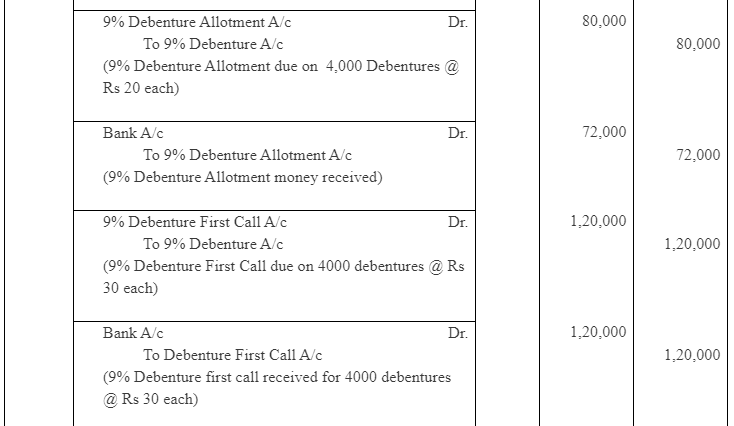

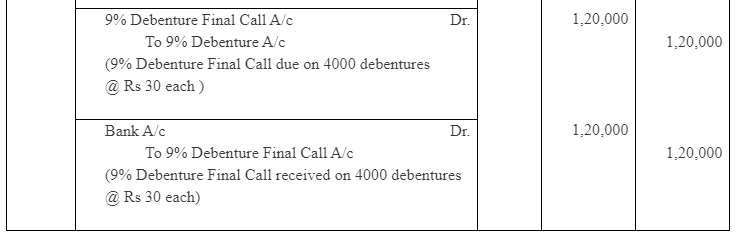

Question 5: A. Ltd. issued 4,000, 9% Debentures of Rs 100 each on the following terms:

Rs 20 on Application;

Rs 20 on Allotment;

Rs 30 on First call; and

Rs 30 on Final call.

The public applied for 4,800 Debentures. Applications for 3,600 Debentures were accepted in full. Applications for 800 Debentures were allotted 400 Debentures and applications for 400 Debentures were rejected.

ANSWER:

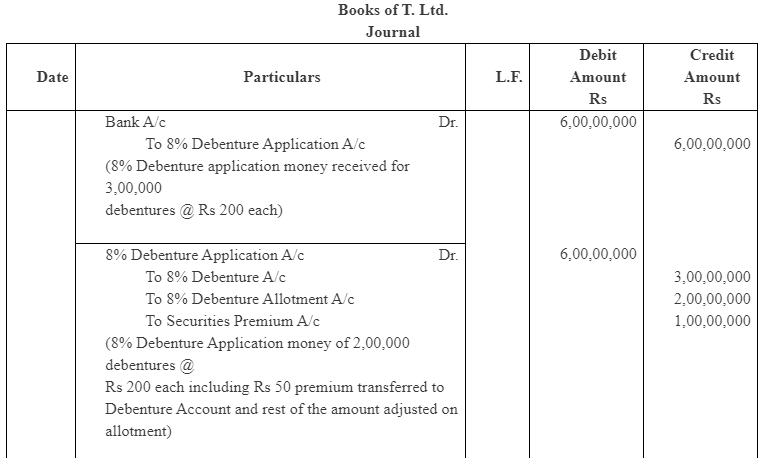

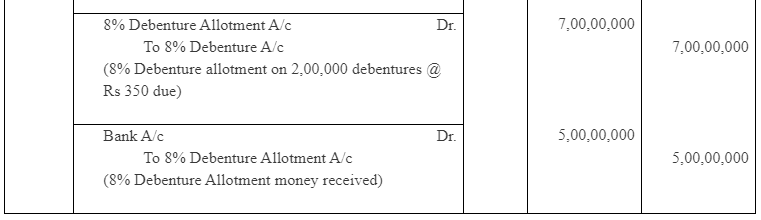

Question 6: T. Ltd. offered 2,00,000, 8% Debenture of Rs 500 each on June 30, 2002 at a premium of 10% payable as Rs 200 on application (including premium) and balance on allotment, redeemable at par after 8 years. But application are received for 3,00,000 debenture and the allotment is made on pro-rata basis. All the money due on application and allotment is received. Record necessary entries regarding issue of debenture.

ANSWER:

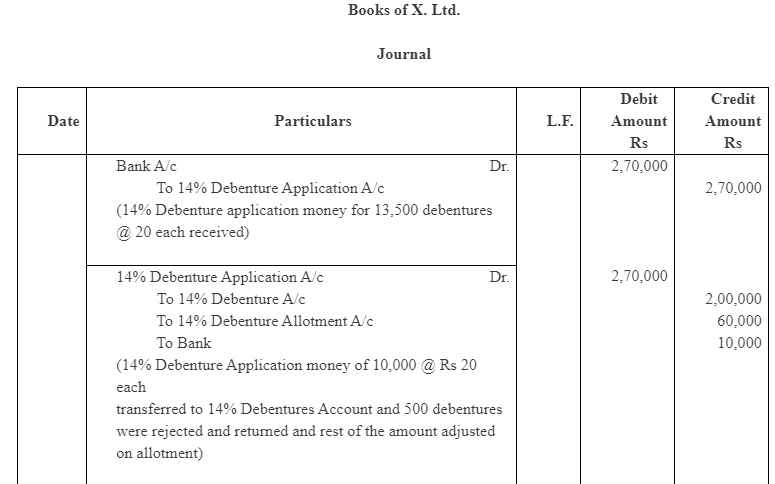

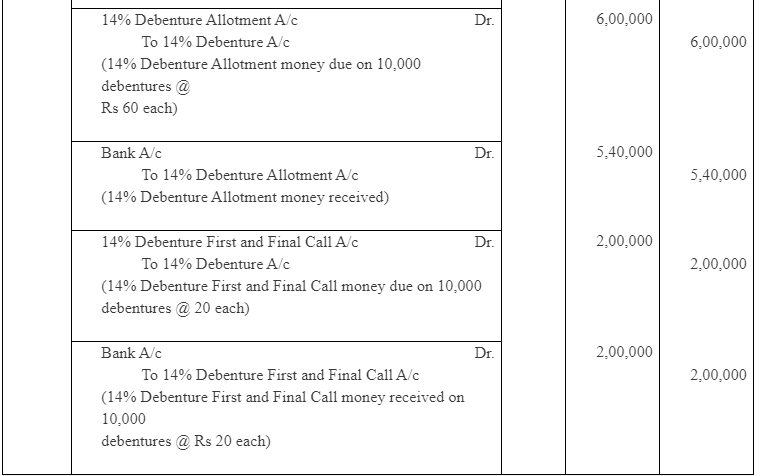

Question 7: X.Ltd. invites application for the issue of 10,000, 14% debentures of Rs 100 each payable as to Rs 20 on application, Rs 60 on allotment and the balance on call. The company receives applications for 13,500 debentures, out of which applications for 8,000 debentures are allotted in full, 5,000 only 40% and the remaining rejected. The surplus money on partially allotted applications is utilised towards allotment. All the sums due are duly received.

ANSWER:

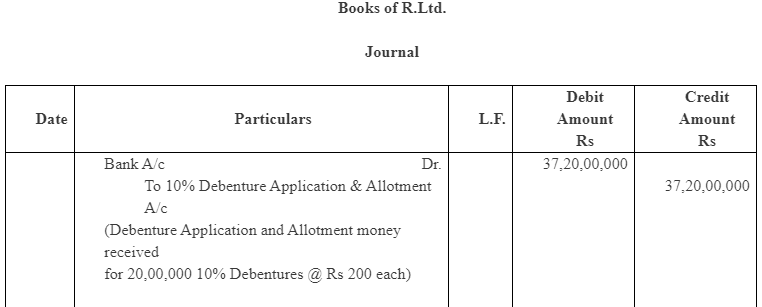

Question 8: R.Ltd. offered 20,00,000, 10% Debenture of Rs 200 each at a discount of 7% redeemable at premium of 8% after 9 years. Record necessary entries in the books of R. Ltd.

ANSWER:

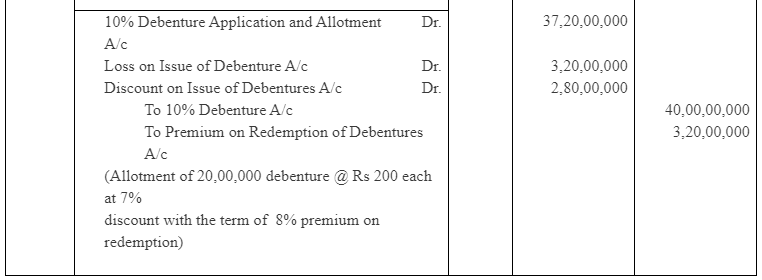

Question 9: M.Ltd. took over assets of Rs 9,00,00,000 and liabilities of Rs 70,00,000 of S.Ltd. and issued 8% benture of Rs 100 each. Record necessary entries in the books of M. Ltd.

ANSWER:

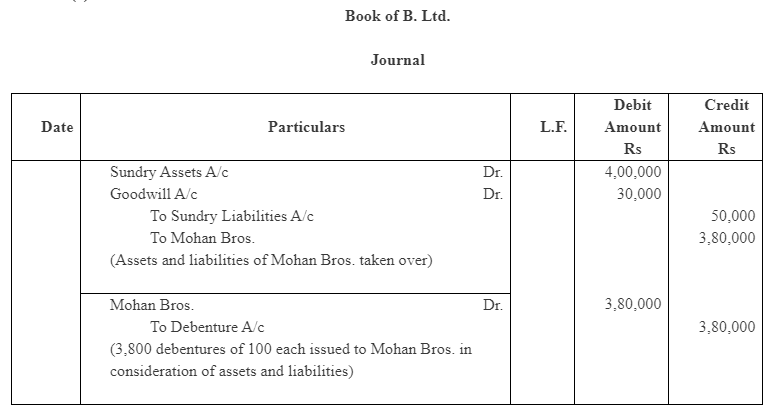

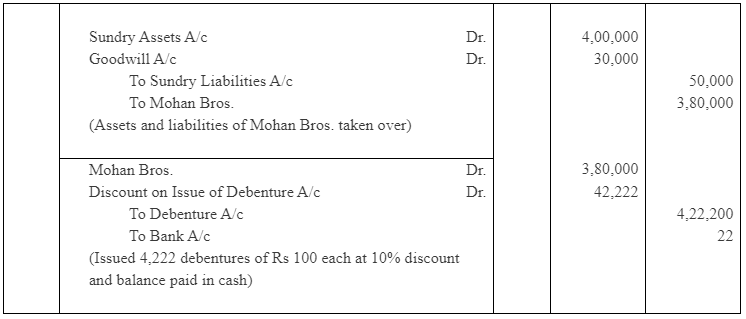

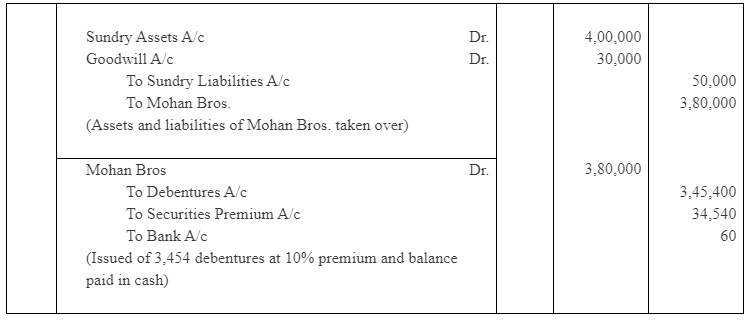

Question 10: B.Ltd. purchased assets of the book value of Rs 4,00,000 and took over the liability of Rs 50,000 from Mohan Bros. It was agreed that the purchase consideration, settled at Rs,3,80,000, be paid by issuing debentures of Rs 100 each.

What Journal entries will be made in the following three cases, if debentures are issued: (a) at par; (b) at discount; (c) at premium of 10%? It was agreed that any fraction of debentures be paid in cash.

ANSWER:

Case (a)

Case (b)

Case (c)

Page No 145:

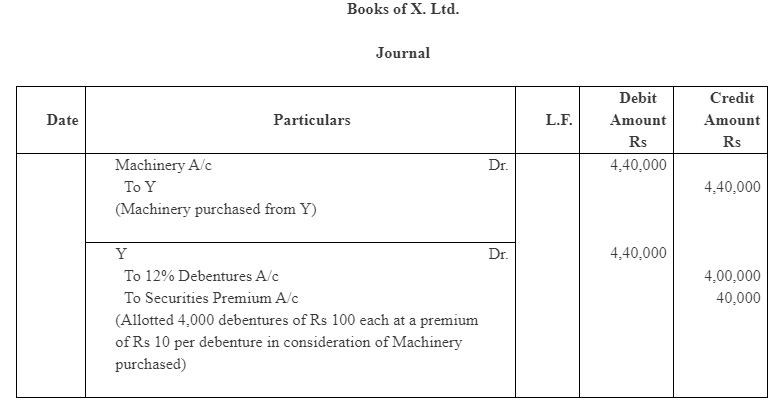

Question 11: X.Ltd. purchased a Machinery from Y for an agreed purchase consideration of Rs 4,40,000 to be satisfied by the issue of 12% debentures of Rs 100 each at a premium of Rs 10 per debenture. Journalise the transactions.

ANSWER:

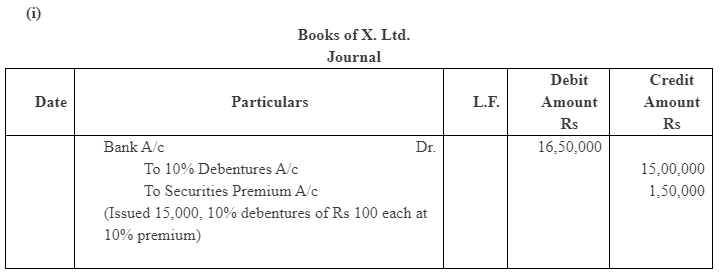

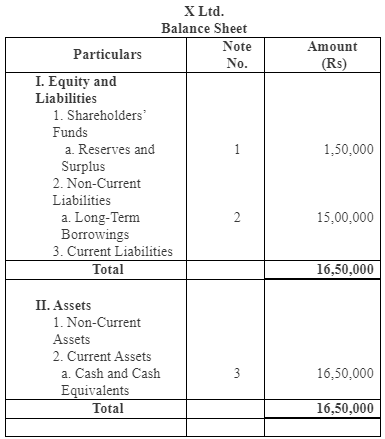

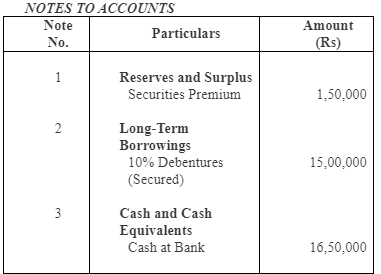

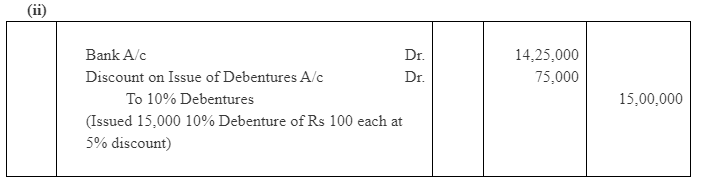

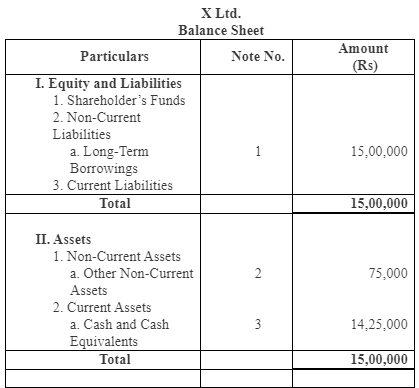

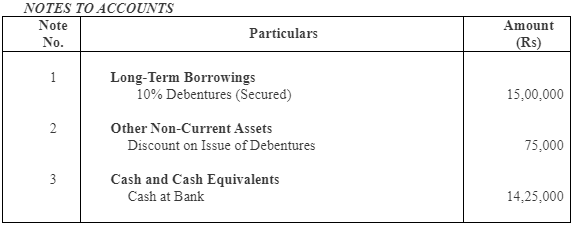

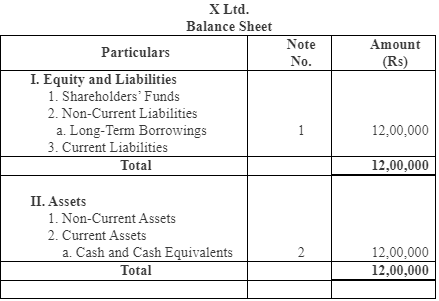

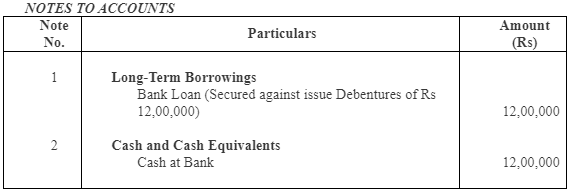

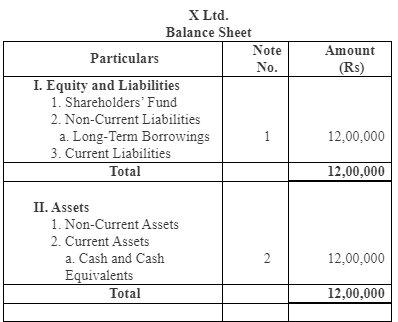

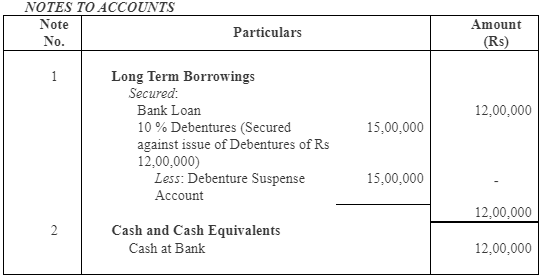

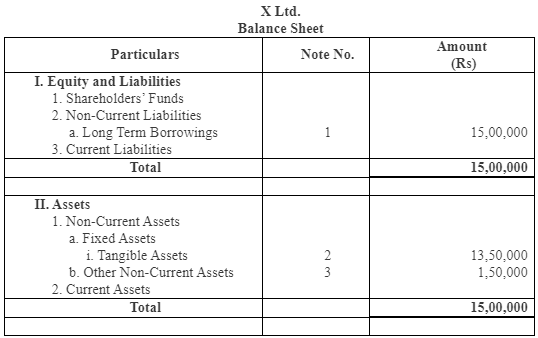

Question 12: X.Ltd. issued 15,000, 10% debentures of Rs 100 each. Give journal entries and the Balance Sheet in each of the following cases:

(i) The debentures are issued at a premium of 10%;

(ii) The debentures are issued at a discount of 5%;

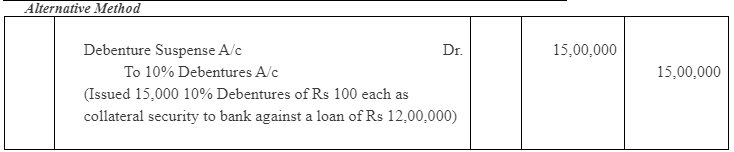

(iii) The debentures are issued as a collateral security to bank against a loan of Rs 12,00,000; and

(iv) The debentures are issued to a supplier of machinery costing Rs 13,50,000.

ANSWER:

(iii) No entry will be passed for issuing debentures as a collateral security

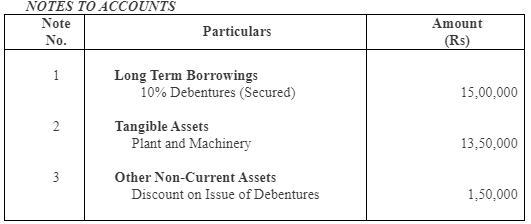

Question 13: Journalise the following:

(i) A debenture issued at Rs 95, repayable at Rs 100;

(ii) A debenture issued at Rs 95, repayable at Rs 105; and

(iii) A debenture issued at Rs 100, repayable at Rs 105;

The face value of debenture in each of the above cases is Rs 100.

ANSWER:

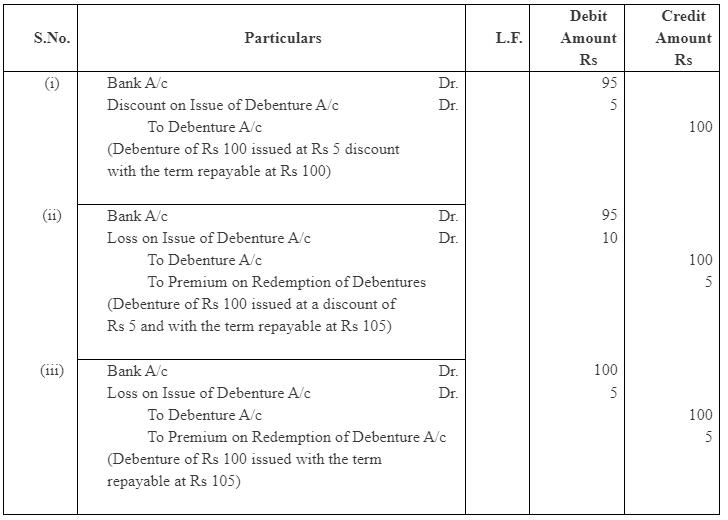

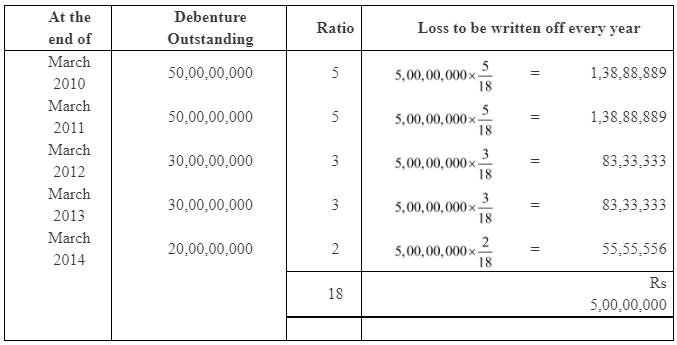

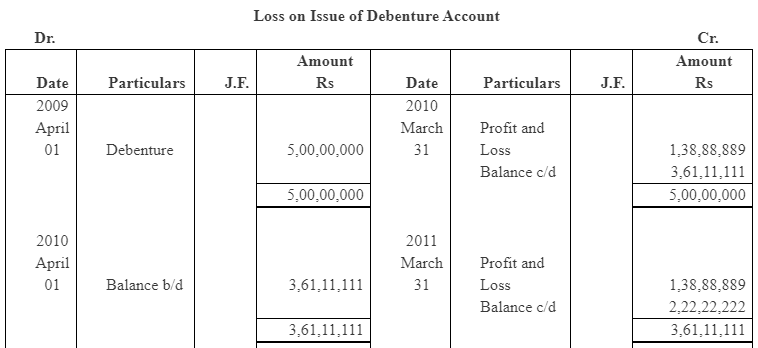

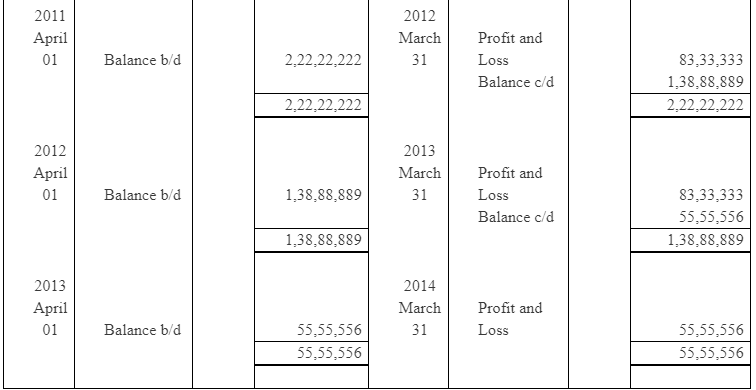

Question 14: A.Ltd. issued 50,00,000, 8% Debenture of Rs 100 at a discount of 6% on April 01, 2009 redeemable at premium of 4% by draw of lots as under:

20,00,000 Debentures on March, 2011

10,00,000 Debentures on March, 2013

20,00,000 Debentures on March, 2014

Compute the amount of discount to be written-off in each year till debentures are paid. Also prepare discount/loss on issue of debenture account.

ANSWER:

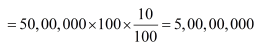

Loss on issue of debenture = 6% (discount on issue) + 4% (premium on redemption) = 10%

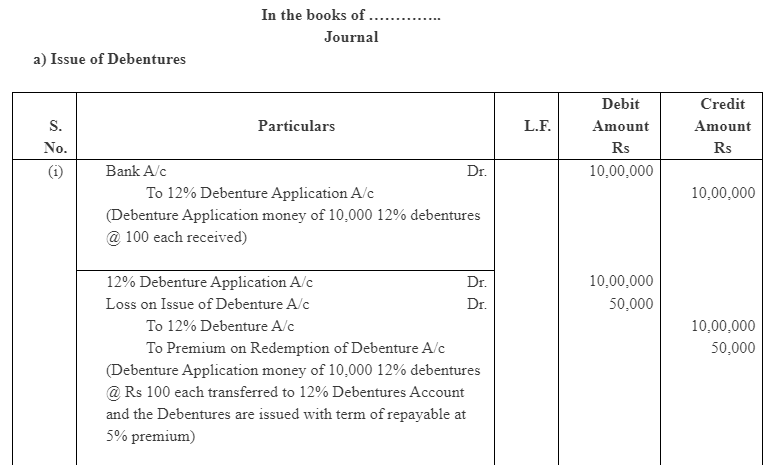

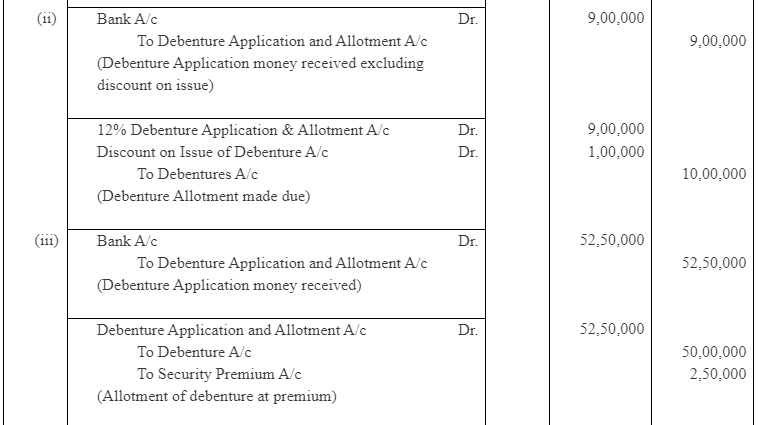

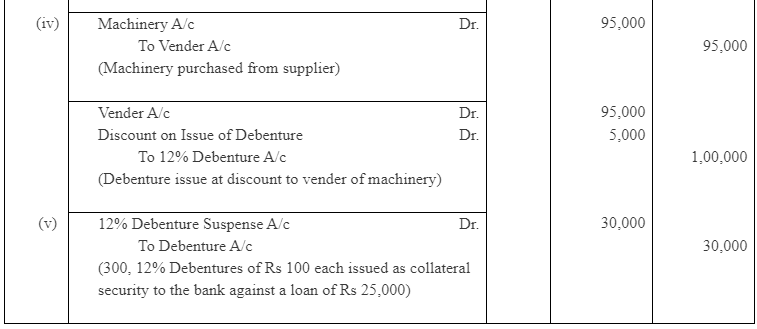

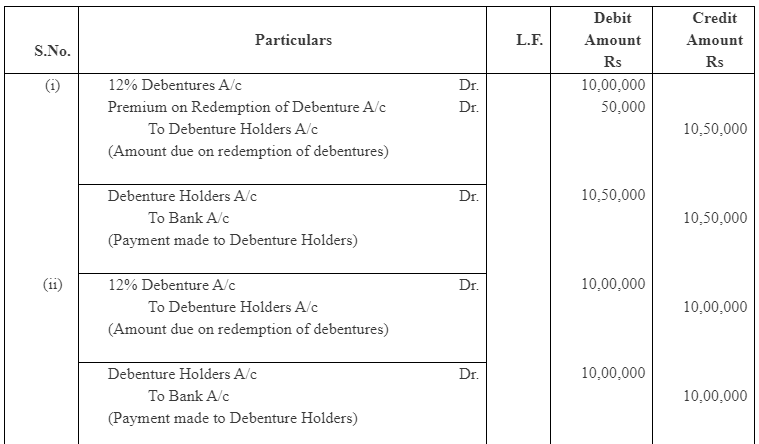

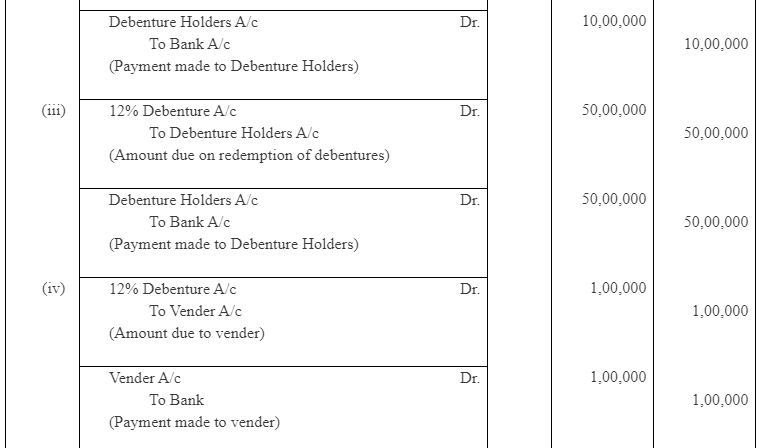

Question 15: A company issues the following debentures:

(i) 10,000, 12% debentures of Rs 100 each at par but redeemable at premium of 5% after 5 years;

(ii) 10,000, 12% debentures of Rs 100 each at a discount of 10% but redeemable at par after 5 years;

(iii) 5,000, 12% debentures of Rs 1,000 each at a premium of 5% but redeemable at par after 5 years;

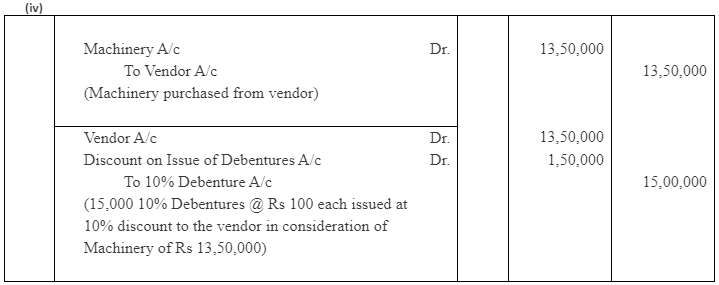

(iv) 1,000, 12% debentures of Rs 100 each issued to a supplier of machinery costing Rs 95,000. The debentures are repayable after 5 years; and

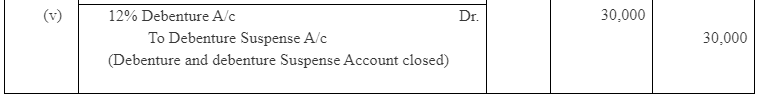

(v) 300, 12% debentures of Rs 100 each as a collateral security to a bank which has advanced a loan of Rs 25,000 to the company for a period of 5 years.

Pass the journal entries to record the: (a) issue of debentures; and (b) repayment of debentures after the given period.

ANSWER:

b) Repayment of Debentures

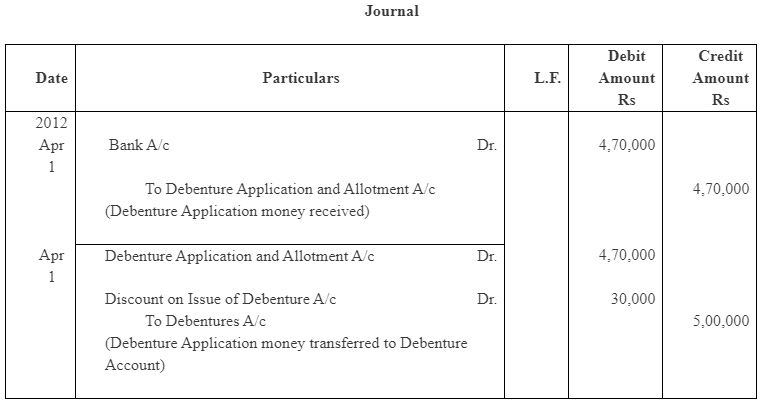

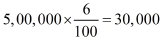

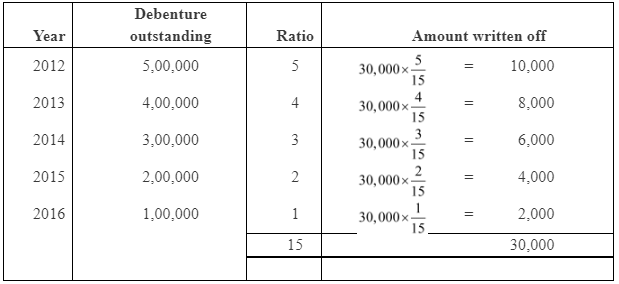

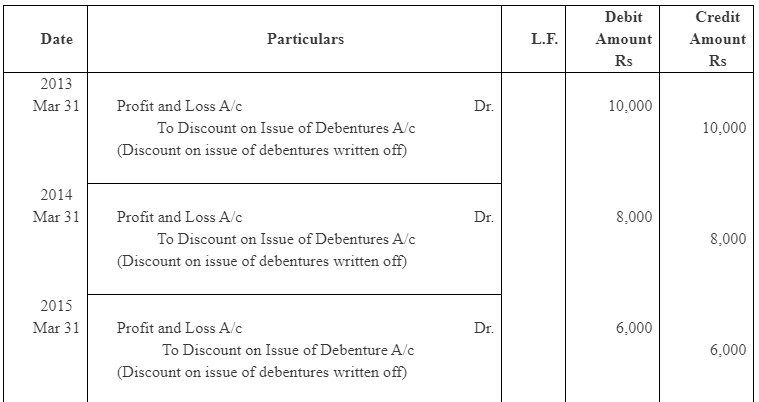

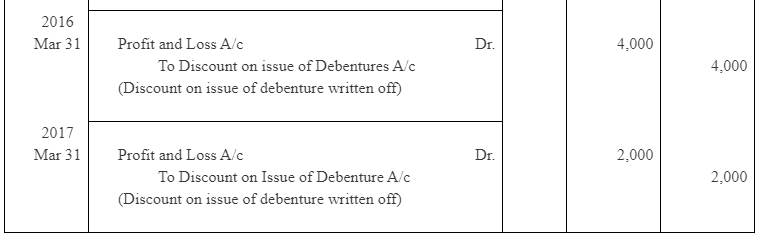

Question 16: A company issued debentures of the face value of Rs 5,00,000 at a discount of 6% on April 01, 2012. These debentures are redeemable by annual drawings of Rs. 1,00,000 made on March 31 each year. The directors decided to write off discount based on the debentures outstanding each year.

Calculate the amount of discount to be written-off each year. Give journal entries also.

ANSWER:

Amount of Discount on issue of Debenture =

Assuming that the amount of discount on issue of debentures is to be written off in 5 years.

|

4 videos|168 docs

|

FAQs on NCERT Solution (Part - 3) - Issue and Redemption of Debentures - Additional Study Material for Commerce

| 1. What is the meaning of debentures? |  |

| 2. How are debentures issued? |  |

| 3. What is the process of debenture redemption? |  |

| 4. What are the types of debenture redemption reserves? |  |

| 5. What are the advantages of issuing debentures for a company? |  |