NCERT Solutions (Part - 3) - Admission of a Partner | Additional Study Material for Commerce PDF Download

Page No. 172

Question 32: Pinky, Qumar and Roopa partners in a firm sharing profits and losses in the ratio of 3:2:1. S is admitted as a new partner for 1/4 share in the profits of the firm, whichs he gets 1/8 from Pinky, and 1/16 each from Qmar and Roopa. The total capital of the new firm after Seema’s admission will be Rs 2,40,000. Seema is required to bring in cash equal to 1/4 of the total capital of the new firm. The capitals of the old partners also have to be adjusted in proportion of their profit sharing ratio. The capitals of Pinky, Qumar and Roopa after all adjustments in respect of goodwill and revaluation of assets and liabilities have been made are Pinky Rs 80,000, Qumar Rs 30,000 and Roopa Rs 20,000. Calculate the capitals of all the partners and record the necessary journal entries for doing adjustments in respect of capitals according to the agreement between the partners?

Answer:

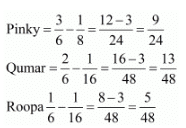

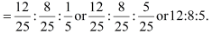

1) Calculation of new profit sharing Ratio = Old Ratio − Sacrificing Ratio

New profit sharing ratio between Pinky, Qumar, Roopa and Seema

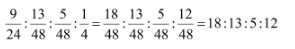

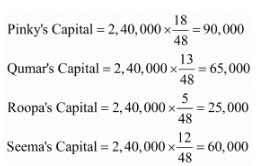

2) Required capital of all partners in the new firm

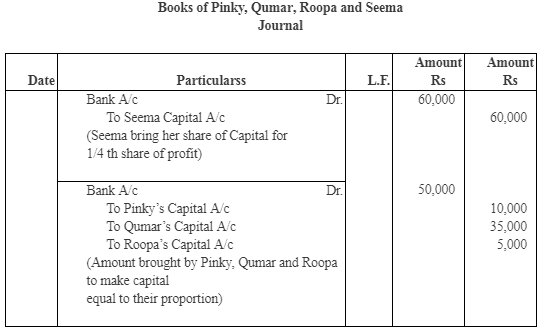

3) Amount to be brought by each partner

Pinky = 90,000 − 80,000 = 10,000

Qumar = 65,000 − 30,000 = 35,000

Roopa = 25,000 − 20,000 = 5,000

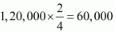

Seema = 2,40,000  =60,000

=60,000

Page No. 173

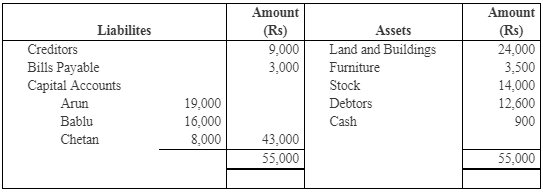

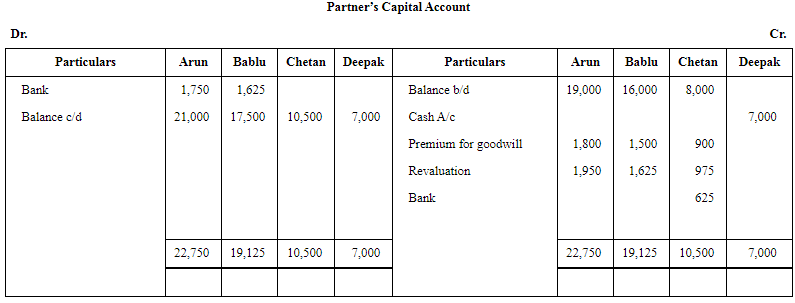

Question 33: The following was the Balance Sheet of Arun, Bablu and Chetan sharing profits and losses in the ratio of  respectively.

respectively.

They agreed to take Deepak into partnership and give him a share of 1/8 on the following terms:

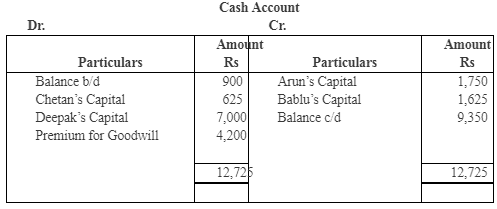

(a) that Deepak should bring in Rs 4,200 as goodwill and Rs 7,000 as his Capital;

(b) that furniture be depreciated by 12%;

(c) that stock be depreciated by 10% ;

(d) that a Reserve of 5% be created for doubtful debts;

(e) that the value of land and buildings having appreciated be brought upto Rs 31,000;

(f) that after making the adjustments the capital accounts of the old partners (who continue to share in the same proportion as before) be adjusted on the basis of the proportion of Deepak’s Capital to his share in the business, i.e., actual cash to be paid off to, or brought in by the old partners as the case may be.

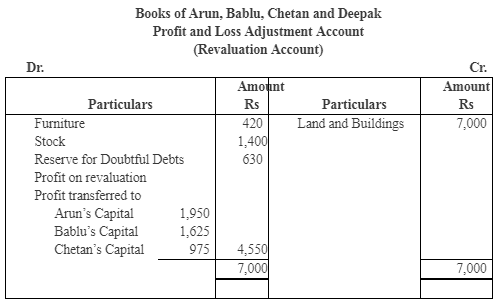

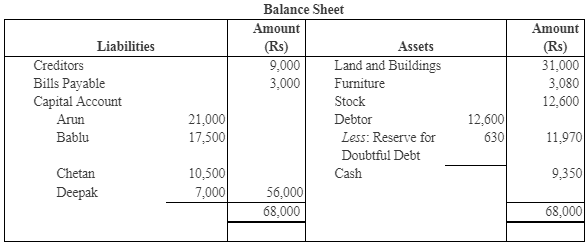

Prepare Cash Account, Profit and Loss Adjustment Account (Revaluation Account) and the Opening Balance Sheet of the new firm.

Answer:

Working Note:

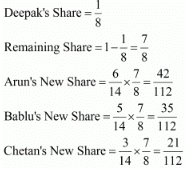

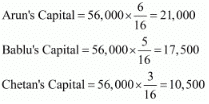

1) 2) Calculation of New Profit Sharing Ratio

2) Calculation of New Profit Sharing Ratio

New Profit sharing ratio of Arun, Bablu, Chetan and Deepak

= 42:35:21:14 or 6:5:3:2

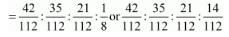

3) Calculation of capital of Arun, Bablu, and Chetan in the new firm

Deepak bring Rs 7,000 for  th share of profit.

th share of profit.

Hence total capital of the new firm =

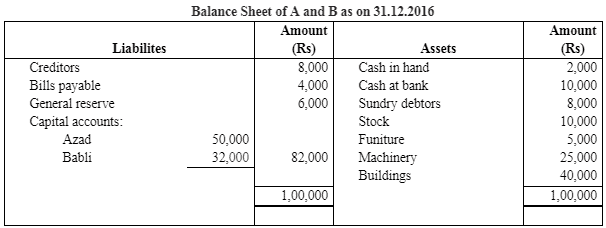

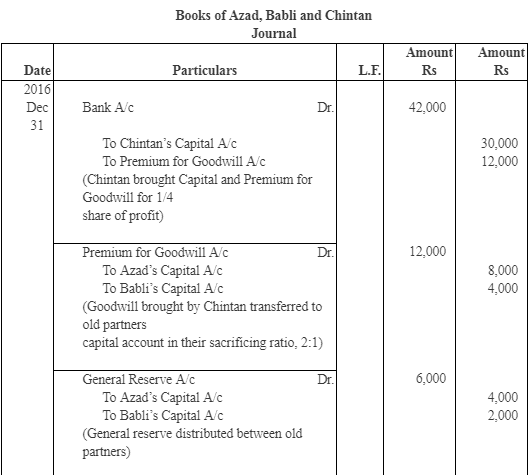

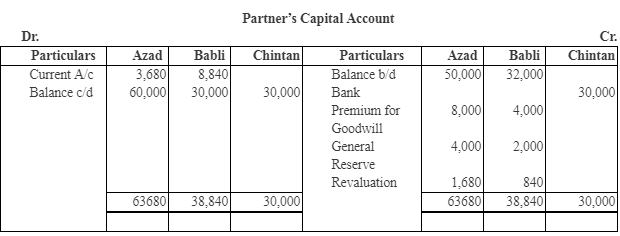

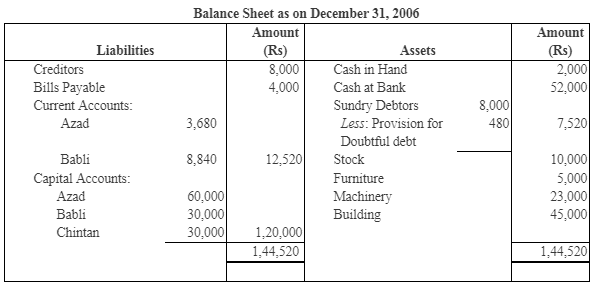

Question 34: Azad and Babli are partners in a firm sharing profits and losses in the ratio of 2:1. Chintan is admitted into the firm with 1/4 share in profits. Chintan will bring in Rs 30,000 as his capital and the capitals of Azad and Babli are to be adjusted in the profit sharing ratio. The Balance Sheet of Azad and Babli as on December 31, 2016 (before Chintan’s admission) was as follows:

It was agreed that:

i) Chintan will bring in Rs 12,000 as his share of goodwill premium.

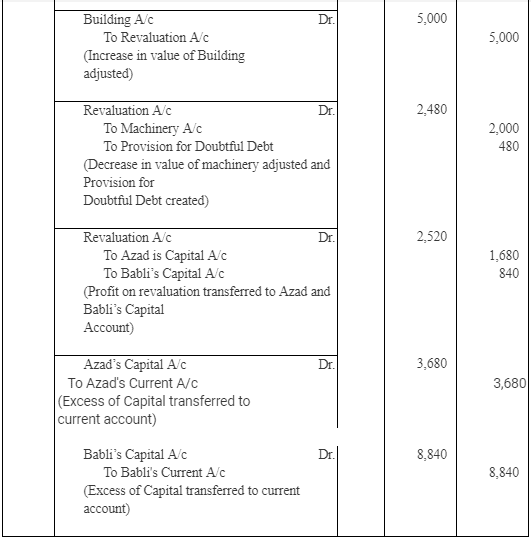

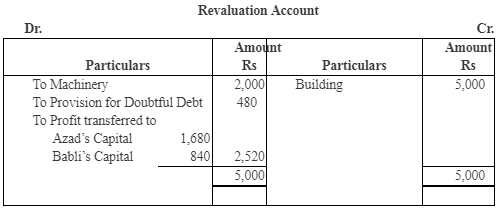

ii) Buildings were valued at Rs 45,000 and Machinery at Rs 23,000.

iii) A provision for doubtful debts is to be created @ 6% on debtors.

iv) The capital accounts of Azad and Babli are to be adjusted by opening current accounts.

Record necessary journal entries, show necessary ledger accounts and prepare the Balance Sheet after admission.

Answer:

Working Note:

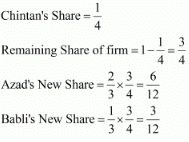

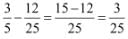

1) Calculation of New Profit Sharing Ratio

New Profit sharing ratio of Azad, Babli and Chintan

2) New Capital of Azad, and Babli

Chintan bring Rs 30,000 for share of profit. Hence total capital of a firm = 30,000

share of profit. Hence total capital of a firm = 30,000 =1,20,000

=1,20,000

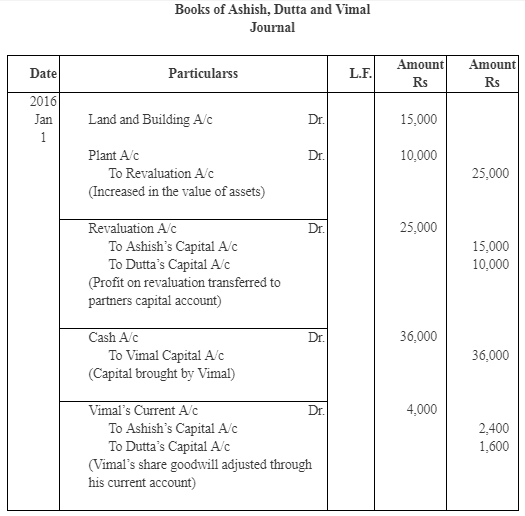

Azad’s Capital =

Babli’s Capital =

Page No 174:

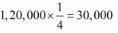

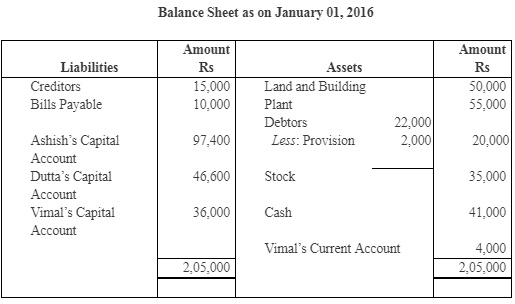

Question 35: Ashish and Dutta were partners in a firm sharing profits in 3:2 ratio. On Jan. 01, 2015 they admitted Vimal for 1/5 share in the profits. The Balance Sheet of Ashish and Dutta as on Jan. 01, 2016 was as follows:

It was agreed that:

i) The value of Land and Building be increased by Rs 15,000.

ii) The value of plant be increased by 10,000.

iii) Goodwill of the firm be valued at Rs 20,000.

iv) Vimal to bring in capital to the extent of 1/5th of the total capital of the new firm.

Record the necessary journal entries and prepare the Balance Sheet of the firm after Vimal’s admission.

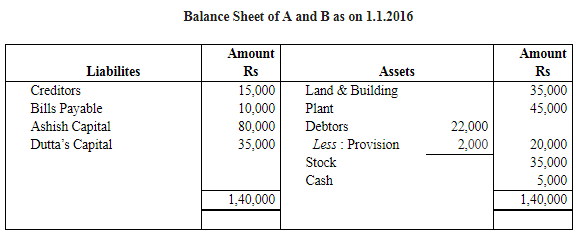

Answer:

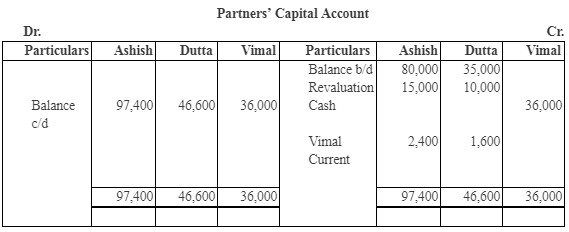

Working Note:

1)

2)

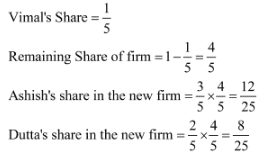

3) Calculation of New Profit Sharing Ratio

New Profit sharing ratio of Ashish, Dutta and Vimal

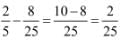

4) Sacrificing Ratio = Old Ratio – New Ratio

Ashish’s Sacrificing Share =

Dutta’s Sacrificing Share =

Sacrificing Ratio between Ashish and Dutta is 3:2

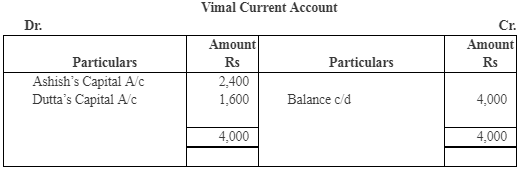

Note: Here, Goodwill has been adjusted through current account because Vimal has not brought his share of goodwill and he is to bring capital in proportion to total capital of the new firm after adjustment.

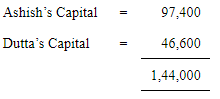

5) Capital of new firm on the basis of old partners adjusted capital:

Total adjusted capital of old partners

Remaining Share of Ashish and Dutta (old partners) in the new firm =

Capital of the new firm = 1,44,000 =1,80,000

=1,80,000

Vimal’s share in the capital of the new firm = 1,80,000 =36,000.

=36,000.

|

4 videos|168 docs

|

FAQs on NCERT Solutions (Part - 3) - Admission of a Partner - Additional Study Material for Commerce

| 1. What is the meaning of admission of a partner in commerce? |  |

| 2. What are the reasons for admitting a new partner in a partnership firm? |  |

| 3. How is the new partner's share of profit calculated upon admission? |  |

| 4. What are the legal formalities involved in the admission of a partner? |  |

| 5. What are the consequences of the admission of a new partner on the existing partnership firm? |  |

|

Explore Courses for Commerce exam

|

|