NCERT Solution - Reconstitution - Retirement/Death of a Partner | Accountancy Class 12 - Commerce PDF Download

Short Answer Questions

Q1: What are the different ways in which a partner can retire from the firm?Ans: The following are the different ways in which a partner can retire from a firm.

(i) With the consent of all other partners: A partner must take the consent of all the co-partners of the firm before his/her retirement. Thereafter, the partner can retire from the firm if and only if all the partners agree on the decision of his/her retirement.

(ii) With an express agreement by all the partners: In case of written agreement among the partners a partner may retire from the firm by expressing his/her intention of leaving the firm though a notice to the other partners of the firm.

(iii) By giving a written notice: If partnership among the partners is at will then a partner may retire by giving notice in writing to all the other partners informing them about his/her intention to retire.

Q2: Write the various matters that need adjustments at the time of retirement of partner/partners.

Ans: The following are the various matters that need to be adjusted at the time of retirement of partners/partner.

1. Calculation of new gaining ratio of all the remaining partners of the firm.

2. Calculation of new ratio of the remaining partners of the firm.

3. Calculation of goodwill of the new firm and its accounting treatment.

4. Revaluation of assets and liabilities of the new firm.

5. Distribution of accumulated profits and losses and reserves among all the partners (including the retiring partner).

6. Treatment of Joint Life Policy

7. Settlement of the amount due to the retiring partner

8. Adjustment of capital accounts of the remaining partners in their new profit sharing ratio.

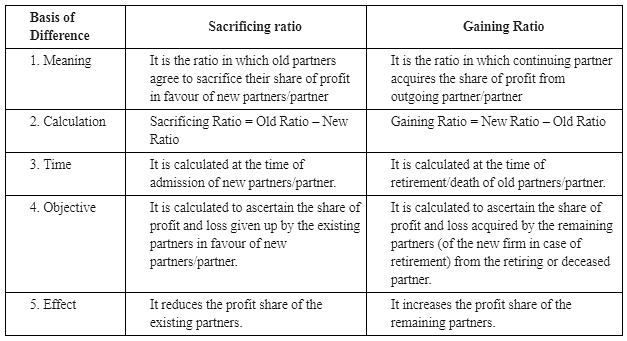

Q3: Distinguish between sacrificing ratio and gaining ratio.

Ans:

Q4: Why do firm revaluate assets and reassess their liabilities on retirement or on the event of death of a partner?

Ans: At the time of retirement or death of a partner, it becomes inevitable to revalue the assets and liabilities of the firm for ascertaining their true and fair values. The revaluation is necessary as the value of assets and liabilities may increase or decrease with the passage of time. Further, it may be possible that there are certain assets and liabilities that remained unrecorded in the books of accounts. The retiring or the deceased partner may be benefited or may bear loss due to change in the values of assets and liabilities. Therefore, the revaluation of the assets and liabilities is necessary in order to ascertain the true profit or loss that is to be divided among all the partners in their old profit sharing ratio.

Q5: Why a retiring/deceased partner is entitled to a share of goodwill of the firm?

Ans: Goodwill is an intangible asset of a firm that is earned by the efforts of all the partners of the firm. After the retirement or death of a partner, the fruits of the past performance and reputation will be shared only by the remaining partners. Thus the remaining partners should compensate the retiring or the deceased partner by entitling him/her a share of firm's goodwill.

Long Answer Questions

Q1: Explain the modes of payment to a retiring partner.Ans: The following are the modes of payment to a retiring partner.

(1) If the amount due to the retiring partner is to be paid in lump sum on the day of his/her retirement then the following Journal entry need to be passed.

Retiring Partner's Capital A/c Dr.

To Cash/Bank A/c

(Retiring partner paid in cash)

Retiring Partner's Capital A/c Dr.

To Retiring Partner's Loan A/c

(Retiring partner capital account transferred to the retiring partner's loan account @ -------- % p.a.).

(2) If the amount due to the retiring partner is to be paid in installments then the balancing figure of his/her capital account is transferred to his/her loan account. In this case, the retiring partner receives equal installments along with the interest on the amount outstanding. The following necessary Journal entry is to be passed.

Retiring Partner's Capital A/c Dr.

To Retiring Partner's Loan A/c

(Retiring partner capital account transferred to the retiring partner's loan account @ -------- % p.a.)

(3) If the amount due to the retiring partner is to be paid partly in cash and partly in equal installments then a certain amount is paid in cash to the retiring partner on the date of the retirement and the rest amount due to him/her is transferred to his/her loan account. The following necessary Journal entry is to be passed.

Retiring Partner's Capital A/c (with the total amount due to the retiring partner) Dr.

To Retiring Partner's Loan A/c (with the amount transferred to the partner's loan account)

To Cash A/c (with the amount paid in cash immediately on the date of the retirement

(Retiring partner partly paid in cash and balance transferred to the partner's loan account)

Q2: How will you compute the amount payable to a deceased partner?

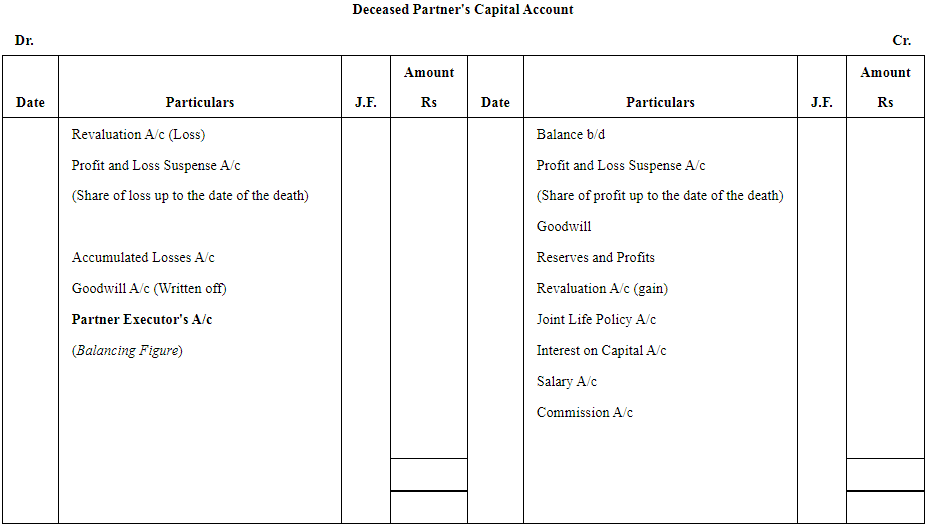

Ans: The legal executer of the deceased partner is entitled for the balancing figure of the deceased partner's capital account. The balancing figure of the deceased partner's capital account is derived after posting the below mentioned items in Step 1 and Step 2.

Step 1: The following items are posted in the debit side of the deceased partner's capital account.

(a) Credit balance of the deceased partner's capital account and/or current account.

(b) Deceased partner’s share of profit up to the date of his/her death.

(c) Deceased partner’s share of goodwill.

(d) Deceased partner’s share in accumulated reserves and profit account.

(e) Deceased partner’s share in gain on revaluation of assets and liabilities.

(f) Deceased partner’s share of Joint Life Policy.

(g) Interest on capital, if any, up to the date of the death.

(h) Salary or commission, if any, up to the date of the death.

Step 2: The following items are posted in the credit side of the deceased partner's capital account.

(a) Debit balance of the deceased partner's capital account and/or current account.

(b) Amount withdrawn in the form of drawings up to the date of death of the partner.

(c) Interest on drawings, if any, up to the date of the death.

(d) Deceased partner’s share in loss on revaluation of assets and liabilities.

(e) Deceased partner’s share of loss up to the date of the death.

(f) Deceased partner’s share in the accumulated losses of the firm.

The legal executor is entitled for the balancing figure that is the excess of the credit side over the debit side of the deceased partner's capital account.

Q3: Explain the treatment of goodwill at the time of retirement or on the event of death of a partner?

Ans: At the time of retirement or at the event of death of a partner, the goodwill is adjusted among the partners in gaining ratio with the share of goodwill of the retiring or the deceased partner. As per Para 16 of Accounting Standard 10, it is mandatory to record goodwill in the books only when consideration in money or money’s worth has been paid for it.

In case of retirement and death of a partner, goodwill account cannot be raised. There are namely two probable situations on which the treatment of goodwill rests.

1. If goodwill already appears in the books of the firm.

2. If no goodwill appears in the books of the firm.

Situation 1: If goodwill already appears in the books of the firm.

Step 1: Write off the existing goodwill

If goodwill already appears in the old balance sheet of the firm (if mentioned in the question), then first of all, this goodwill should be written off and should be distributed among all the partners of the firm including the retiring or the deceased partner in their old profit sharing ratio. The following Journal entry is passed to write off the old/existing goodwill.

All Partners' Capital A/c Dr.

To Goodwill A/c

(Goodwill written of among all the partners in their old ratio)

Step 2: Adjusting goodwill through partner's capital account.

After writing off the old goodwill, the goodwill need to be adjusted through the partner's capital account with the share of the goodwill of the retiring or the deceased partner. The following Journal entry is passed.

Remaining Partner's Capital A/c Dr.

To Retiring/Deceased Partner's Capital A/c

(Gaining Partner's Capital A/c is debited in their gaining share and retiring/deceased partner's capital account in credited for their share of goodwill)

Situation 2: If no goodwill appears in the books of the firm.

As no goodwill appears in the books of the firm, so the goodwill is adjusted through the partner's capital account with the share of the goodwill of the retiring or the deceased partner. The following Journal entry is passed.

Remaining Partner's Capital A/c Dr.

To Retiring/Deceased Partner's Capital A/c

(Gaining partner's capital account is debited in their gaining share and retiring/deceased partner's capital account in credited for their share of goodwill)

Q4: Discuss the various methods of computing the share in profits in the event of death of a partner.

Ans: In case of death of a partner during the year, his/her executer is entitled for share of profit up to the date of death of the partner.

The share of profit can be calculated by one of the two methods.

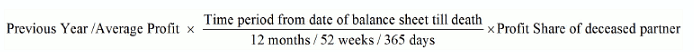

1) On time basis: Under this method, profit up to the date of the death of the partner is calculated on the basis of the last year's/years' profit or average profit of last few years. In this approach, it is assumed that the profit will be uniform throughout the current year. The deceased partner will be entitled for the share of the profit proportionately up to the date of his/her death.

Share of Deceased Partner in Profit =

Example- A, B and C are equal partners. The profit of the firm for the years 2008, 2009 and 2010 are Rs 10,00,000, Rs 7,00,000 and Rs 13,00,000 respectively. C dies on April 30, 2011. The share of C in the firm's profit will be calculated on the basis of average profit of last three years. Firm closes its books every year on December 31.

In this case, C's share in the profits will be calculated for four months, i.e. from January 01, 2011 to April 30, 2011.

2) On the sale basis: Under this method, profit is calculated on the basis of last year's sale. In this situation, it is assumed that the net profit margin of the current year's sale is similar to that of the last year's.

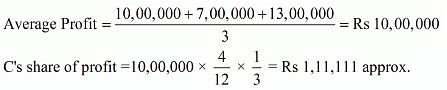

Share of Deceased Partner's Profit =  × Sales from the beginning of the current year up to the date of death × Share of deceased partner

× Sales from the beginning of the current year up to the date of death × Share of deceased partner

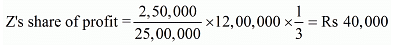

Example- X Y and Z are equal partners. The last year's sales and profit were Rs 25,00,000 and Rs 2,50,000. Z died on the April 30, 2011. Sales of the current year till the date of Z's death amounts to Rs 12,00,000. Firm closes its books on December 31 every year.

Numerical Questions

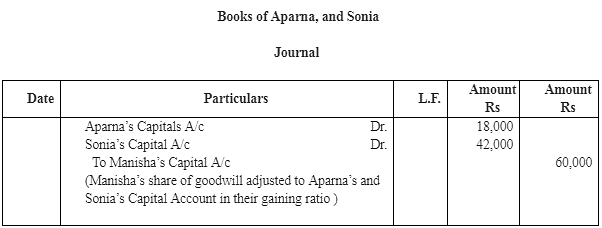

Q1: Aparna, Manisha and Sonia are partners sharing profits in the ratio of 3 : 2 : 1. Manisha retires and goodwill of the firm is valued at Rs. 1,80,000. Aparna and Sonia decided to share future in the ratio of 3 : 2. Record necessary journal entries.Ans: Working Notes:

Working Notes:

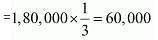

1. Manisha’s share in goodwill:

Total goodwill of the firm × Retiring Partner’s Share

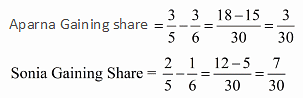

2. Gaining Ratio = New Ratio − Old Ratio

Gaining Ratio between Aparna and Sonia = 3 : 7

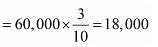

3. Aparna’s share in goodwill

Sonia’s share in goodwill

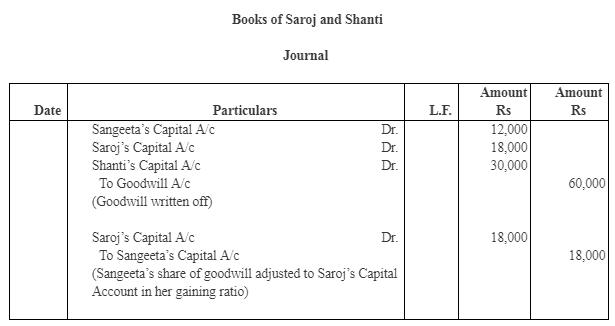

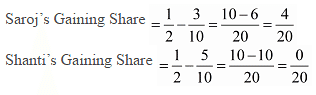

Q2: Sangeeta, Saroj and Shanti are partners sharing profits in the ratio of 2 : 3 : 5. Goodwill is appearing in the books at a value of Rs. 60,000. Sangeeta retires and goodwill is valued at Rs. 90,000. Saroj and Shanti decided to share future profits equally. Record necessary journal entries.

Ans: Working Notes:

Working Notes:

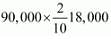

1. Sangeeta’s share of goodwill.

Total goodwill of the firm x Retiring Partner’s share =

2. Gaining Ratio = New Ratio – Old Ratio

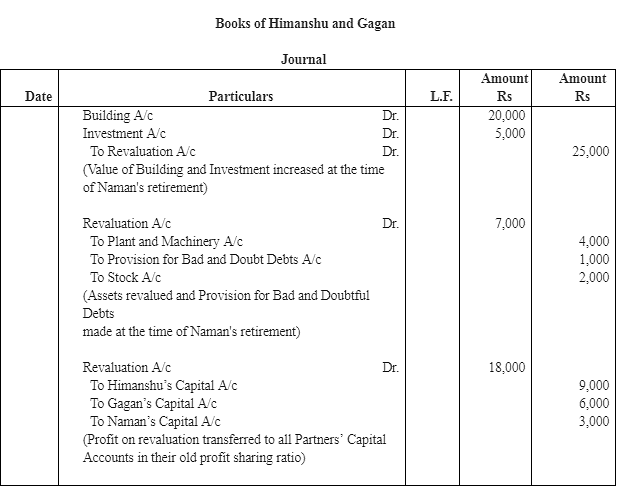

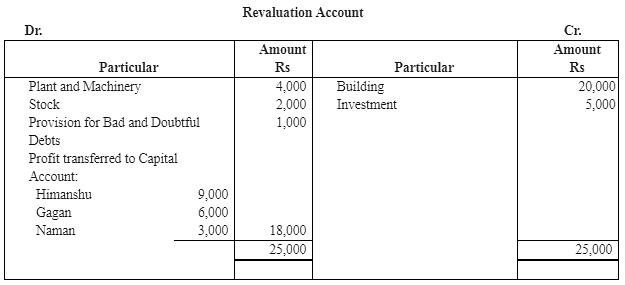

Q3: Himanshu, Gagan and Naman are partners sharing profits and losses in the ratio of 3 : 2 : 1. On March 31, 2019, Naman retires. The various assets and liabilities of the firm on the date were as follows: Cash Rs. 10,000, Building Rs. 1,00,000, Plant and Machinery Rs. 40,000, Stock Rs. 20,000, Debtors Rs. 20,000 and Investments Rs. 30,000.

The following was agreed upon between the partners on Naman’s retirement:

(i) Building to be appreciated by 20%.

(ii) Plant and Machinery to be depreciated by 10%.

(iii) A provision of 5% on debtors to be created for bad and doubtful debts.

(iv) Stock was to be valued at Rs. 18,000 and Investment at Rs. 35,000.

Record the necessary journal entries to the above effect and prepare the revaluation account.

Ans:

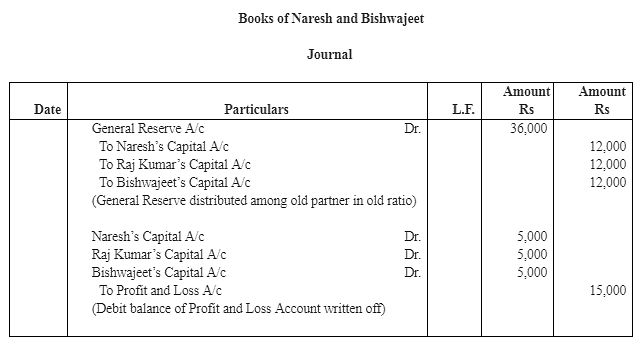

Q4: Naresh, Raj Kumar and Bishwajeet are equal partners. Raj Kumar decides to retire. On the date of his retirement, the Balance Sheet of the firm showed the following: General Reserves Rs 36,000 and Profit and Loss Account (Dr.) Rs 15,000.

Pass the necessary journal entries to the above effect.

Ans:

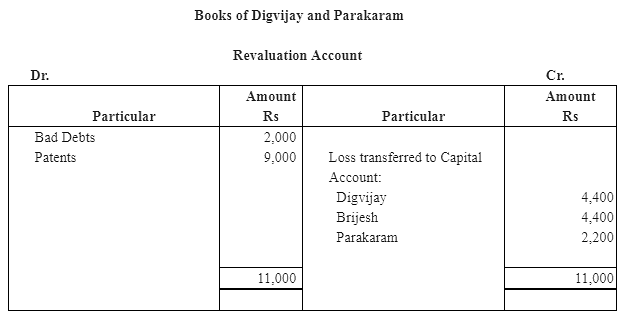

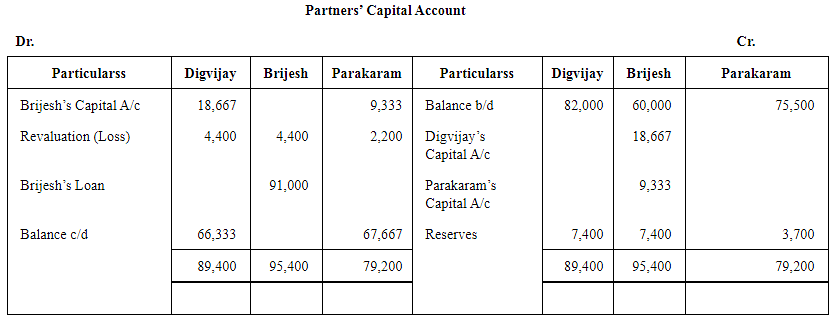

Q5 : Digvijay, Brijesh and Parakaram were partners in a firm sharing profits in the ratio of 2 : 2 : 1. Their Balance Sheet as on March 31, 2020 was as follows:

Brijesh retired on March 31, 2020 on the following terms:

(i) Goodwill of the firm was valued at Rs 70,000 and was not to appear in the books.

(ii) Bad debts amounting to Rs 2,000 were to be written off.

(iii) Patents were considered as valueless.

Prepare Revaluation Account, Partners’ Capital Accounts and the Balance Sheet of Digvijay and Parakaram after Brijesh’s retirement.

Ans:

Note: As sufficient balance is not available to pay the amount due to Brijesh, the balance of his Capital Account transferred to his Loan Account.

Working Note:

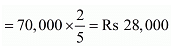

1. Brijesh’s Share of Goodwill

Total goodwill of the firm ´ Retiring Partner’s Share

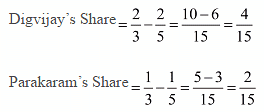

2. Gaining Ratio = New Ratio – Old Ratio

Gaining ratio between Digvijay and Parakaram = 4 : 2 or 2 : 1

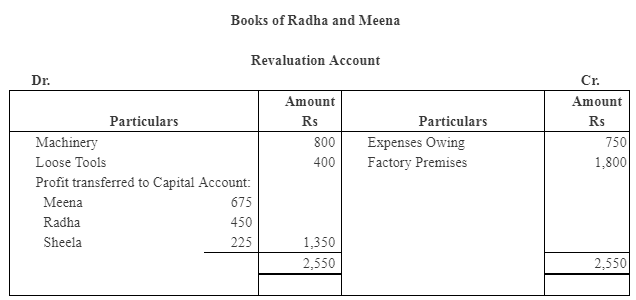

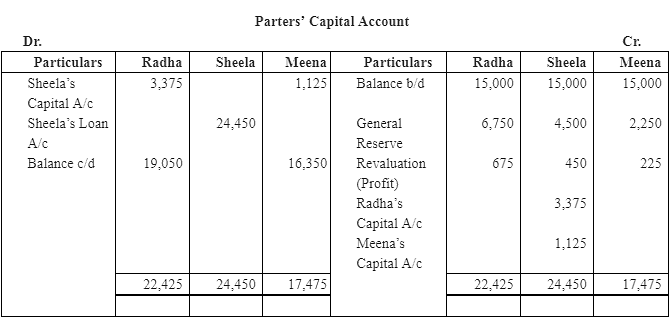

Q6: Radha, Sheela and Meena were in partnership sharing profits and losses in the proportion of 3:2:1. On April 1, 2019, Sheela retires from the firm. On that date, their Balance Sheet was as follows:

The terms were:

The terms were:

(a) Goodwill of the firm was valued at Rs 13,000.

(b) Expenses owing to be brought down to Rs 3,750.

(c) Machinery and Loose Tools are to be valued at 10% less than their book

value.

(d) Factory premises are to be revalued at Rs 24,300.

Prepare:

1. Revaluation account

2. Partner’s capital accounts and

3. Balance sheet of the firm after retirement of Sheela.

Ans:

Working Notes:

Working Notes:

(1) Sheela’s share of goodwill

Total goodwill of the firm × Retiring Partner’s share

(2) Gaining Ratio = New Ratio − Old Ratio

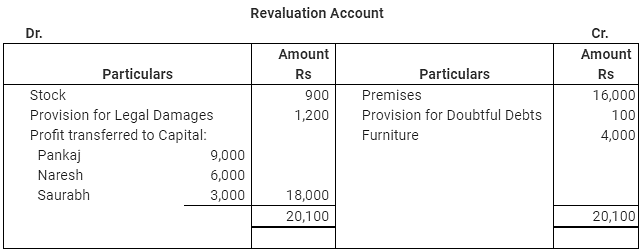

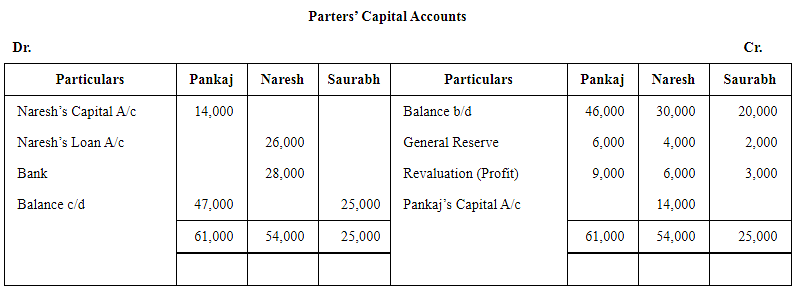

Q7: Pankaj, Naresh and Saurabh are partners sharing profits in the ratio of 3 : 2 : 1. Naresh retired from the firm due to his illness on Septmber 30, 2017. On that date the Balance Sheet of the firm was as follows: Additional Information

Additional Information

(i) Premises have appreciated by 20%, stock depreciated by 10% and provision for doubtful debts was to be made 5% on debtors. Further, provision for legal damages is to be made for Rs 1,200 and furniture to be brought up to Rs 45,000.

(The amount of Rs 450 that is being given in the book for furniture is a mistake, as it should be Rs 45,000)

(ii) Goodwill of the firm be valued at Rs 42,000.

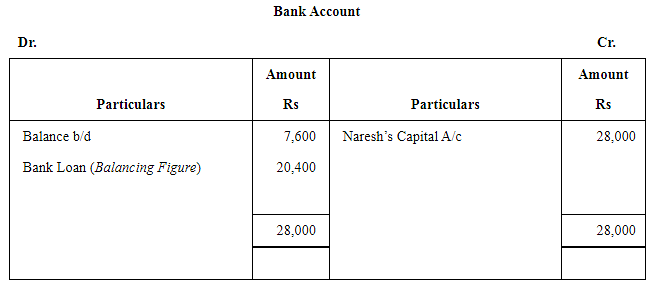

(iii) Rs 26,000 from Naresh’s Capital account be transferred to his loan account and balance be paid through bank; if required, necessary loan may be obtained from Bank.

(iv) New profit sharing ratio of Pankaj and Saurabh is decided to be 5:1.

Give the necessary ledger accounts and balance sheet of the firm after Naresh’s retirement.

Ans:

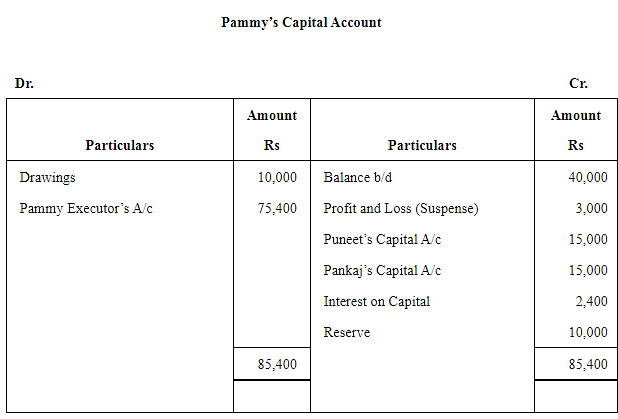

Q8: Puneet, Pankaj and Pammy are partners in a business sharing profits and losses in the ratio of 2 : 2 : 1 respectively. Their balance sheet as on March 31, 2019 was as follows: Mr. Pammy died on September 30, 2017. The partnership deed provided the following:

Mr. Pammy died on September 30, 2017. The partnership deed provided the following:

(i) The deceased partner will be entitled to his share of profit up to the date of death calculated on the basis of previous year’s profit.

(ii) He will be entitled to his share of goodwill of the firm calculated on the basis of 3 years’ purchase of average of last 4 years’ profit. The profits for the last four financial years are given below: for 2015–16; Rs. 80,000; for 2016–17, Rs. 50,000; for 2017–18, Rs. 40,000; for 2018–19, Rs. 30,000.

The drawings of the deceased partner up to the date of death amounted to Rs 10,000. Interest on capital is to be allowed at 12% per annum.

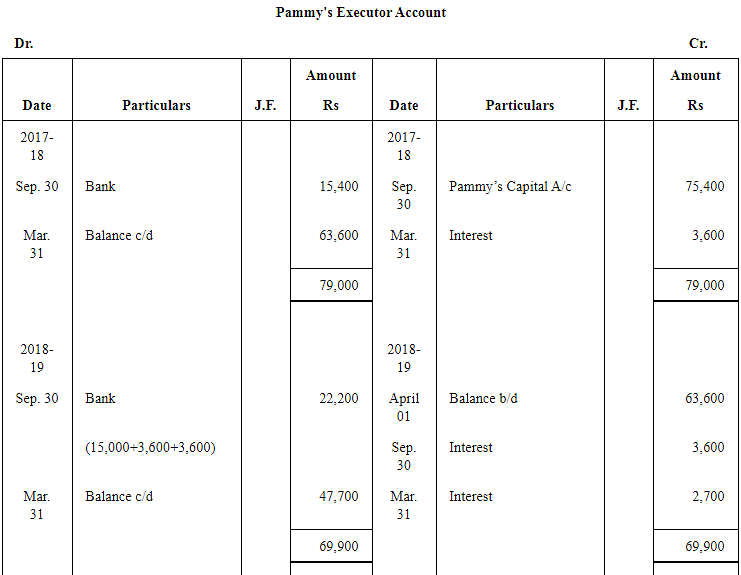

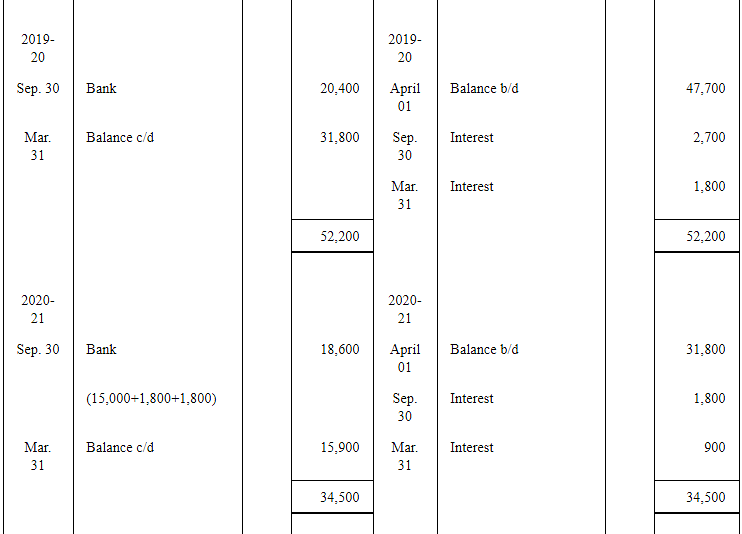

Surviving partners agreed that Rs 15,400 should be paid to the executors immediately and the balance in four equal yearly instalments with interest at 12% p.a. on outstanding balance.

Show Mr. Pammy’s Capital account, his Executor’s account till the settlement of the amount due.

Ans:

Working Notes:

Working Notes:

(1) Pammy’s Share of Profit

Previous Year’s Profit x Proportionate Period x Share of Deceased Partner

(2) Pammy’s Share of Goodwill

Goodwill of the firm = Average Profit x Numbers of Year’s Purchase

Average Profit

Goodwill of the firm = 50,000 x 3 = Rs 1,50,000

(3) Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio between Puneet and Pankaj = 2 : 2 or 1 : 1

(4) Interest on Capital for 6 months, i.e. from April 1, 2007 to September 30, 2007

Amount of Capital x Rate of Interest x Period

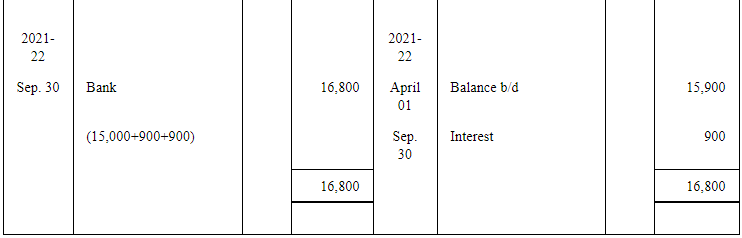

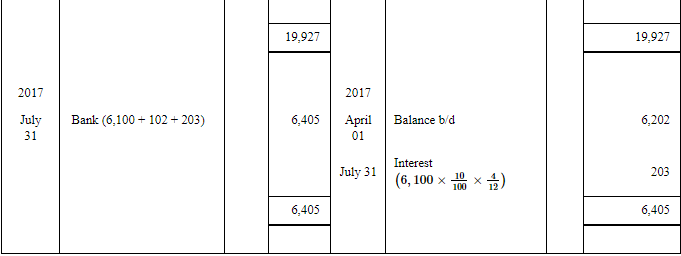

(5) Interest AmountThe firm closes its books every year on March 31, while installments to Pammy's Executor are paid on September 30 every year.

Amount outstanding on 30 September = 75,400 – 15,400 = Rs 60,000

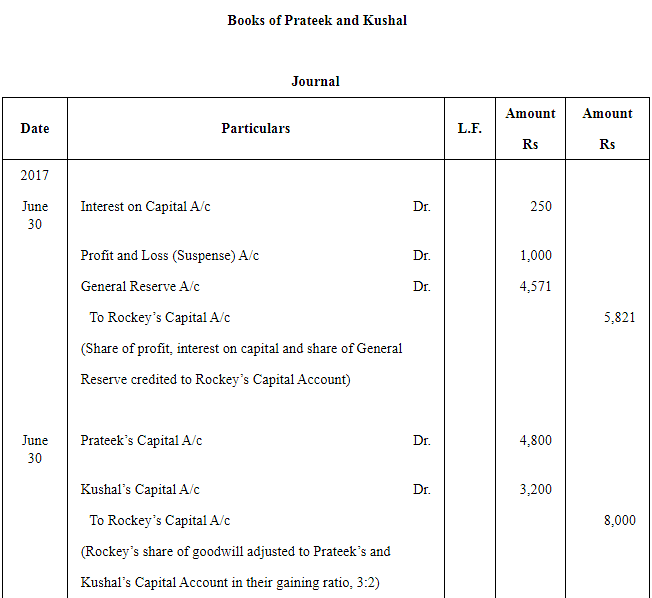

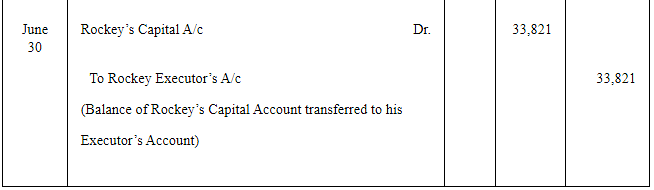

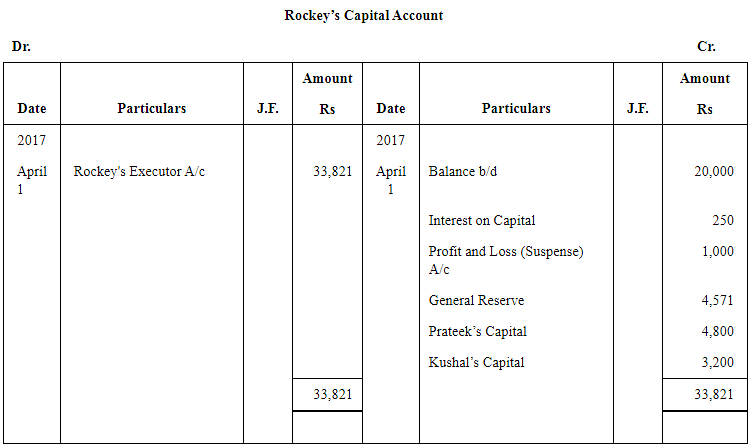

Q9 : Following is the Balance Sheet of Prateek, Rockey and Kushal as on March 31, 2020.

Rockey died on June 30, 2020. Under the terms of the partnership deed, the executors of a deceased partner were entitled to:

(a) Amount standing to the credit of the Partner’s Capital account.

(b) Interest on capital at 5% per annum.

(c) Share of goodwill on the basis of twice the average of the past three years’ profit and d) Share of profit from the closing date of the last financial year to the date of death on the basis of last year’s profit.

Profits for the year ending on March 31, 2018, March 31, 2019 and March 31, 2020 were Rs. 12,000, Rs. 16,000 and Rs. 14,000 respectively.

Profits were shared in the ratio of capitals.

Pass the necessary journal entries and draw up Rockey’s capital account to be rendered to his executor.

Ans:

Working Notes:

1. Rockey’s Share of Profit = Previous year’s profit × Proportionate Period × Share of Deceased Partner

2. Rockey’s Share of Goodwill

Goodwill of a firm = Average profit × Numbers of year’s Purchase

Goodwill of a firm = 14,000 × 2 = Rs 28,000

3. Gaining Ratio = New Ratio − Old Ratio

Gaining Ratio between Prateek and Kushal = 9:4 or 3:2

4. Interest on Capital for 3 months i.e. from April 1, 2007 to June 30, 2007

Amount of × Rate of Interest × Period

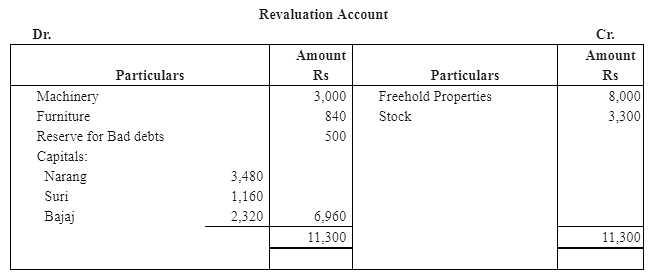

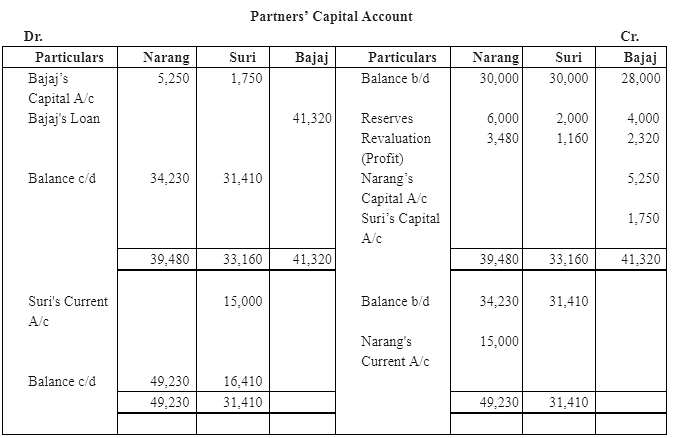

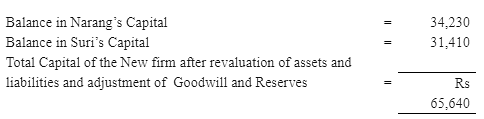

Q10: Narang, Suri and Bajaj are partners in a firm sharing profits and losses in proportion of 1/ 2 , 1 /6 and 1/ 3 respectively. The Balance Sheet on April 1, 2020 was as follows:

Bajaj retires from the business and the partners agree to the following:

(a) Freehold premises and stock are to be appreciated by 20% and 15% respectively.

(b) Machinery and furniture are to be reduced by 10% and 7% respectively.

(c) Bad Debts reserve is to be increased to Rs. 1,500.

(d) Goodwill is valued at Rs. 21,000 on Bajaj’s retirement.

(e) The continuing partners have decided to adjust their capitals in their new profit sharing ratio after retirement of Bajaj. Surplus/deficit, if any, in their capital accounts will be adjusted through current accounts.

Prepare necessary ledger accounts and draw the Balance Sheet of the reconstituted firm.

Ans:

Working Notes:

Working Notes:

1. Bajaj Share in Goodwill = Total Goodwill of the firm ´ Retiring Partner’s Share =

2. Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio between Narang and Suri = 3:1

3. Calculation of New Capitals of the existing partners.

Based on new profit sharing ratio of 3:1

Note:

i. In the given QSuri’s Capital is Rs 30,000 instead of Rs 20,000.

ii. Due to insufficient balance in Bajaj’s Capital Account, the amount due to Bajaj is transferred to his Loan Account.

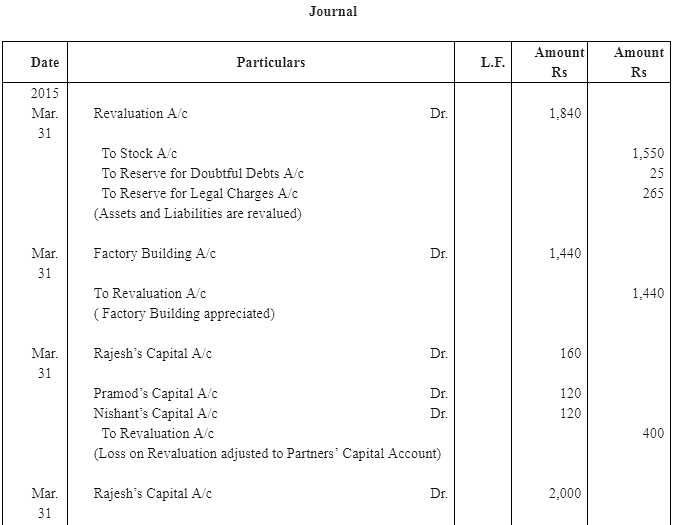

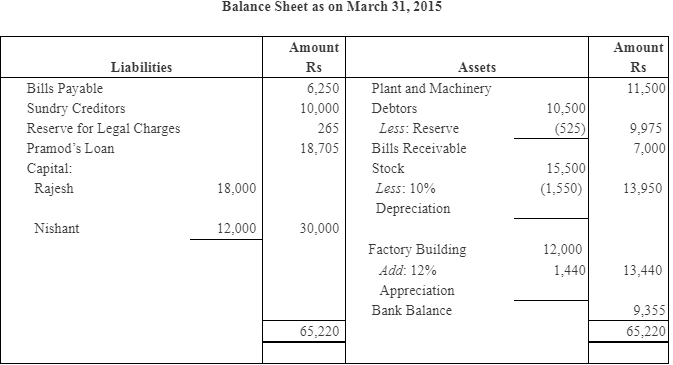

Q11: The Balance Sheet of Rajesh, Pramod and Nishant who were sharing profits in proportion to their capitals stood as on March 31, 2015:

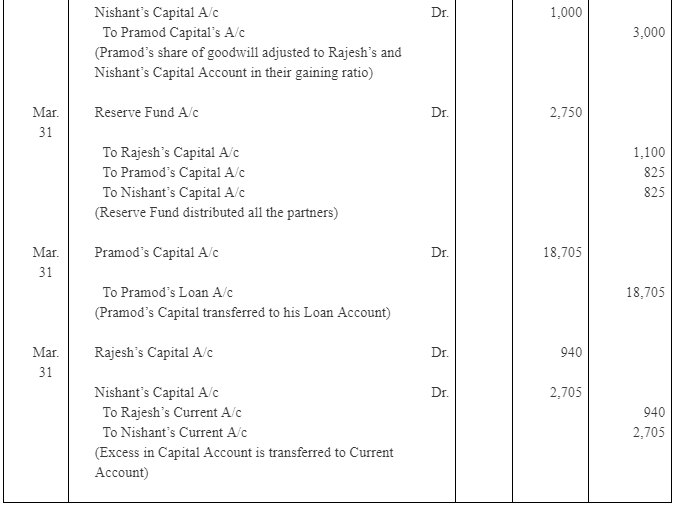

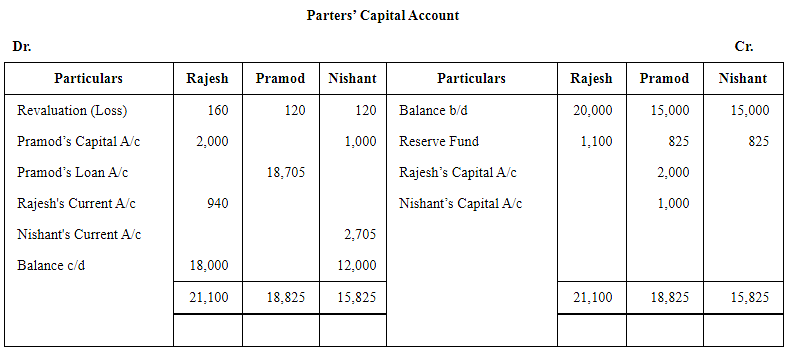

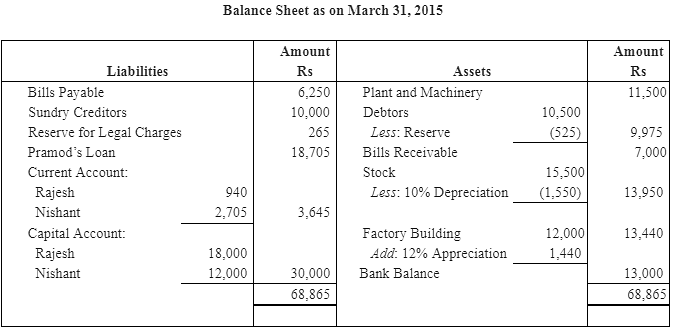

Pramod retired on the date of Balance Sheet and the following adjustments were made:

(a) Stock is to be reduced by 10%.

(b) Factory buildings were appreciated by 12%.

(c) Provision for doubtful debts be created up to 5%.

(d) Provision for legal charges to be made at Rs. 265.

(e) The goodwill of the firm be fixed at Rs. 10,000.

(f) The capital of the new firm be fixed at Rs. 30,000.

The continuing partners decide to keep their capitals in the new profit sharing ratio of 3 : 2.

Record journal entries and prepare the balance sheet of the reconstituted firm after transferring the balance in Pramod’s Capital account to his loan account.

Ans:

Working Notes:

(1) Pramod’s share of goodwill = Total goodwill of the firm × Retiring Partner’s Share =

(2) Gaining Ratio = New Ratio − Old Ratio

Gaining Ratio between Rajesh and Nishant = 2:1

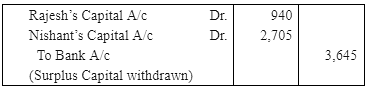

Note: In the above solution, in order to adjust the capital of remaining partners in the new firm according to their new profit sharing ratio, the surplus or the deficit of Capital Account is transferred to their Current Account. But, in order to match the answer with that of given in the book, the surplus or the deficit amount of the Partners' Capital Account, will either be withdrawn or brought in by the old partners. This treatment will be shown in the Partners’ Capital itself and no need to transfer the surplus or deficit capital balance to their Current Accounts. The following Journal entry is passed to record the withdrawal of surplus capital by the partners.

If existing partners withdraw their excess capital

Journal entry

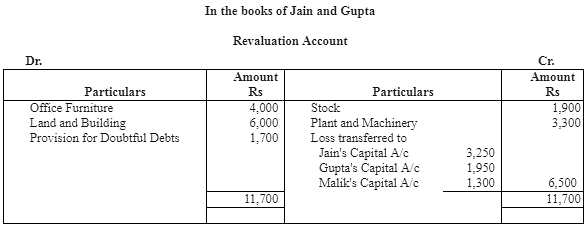

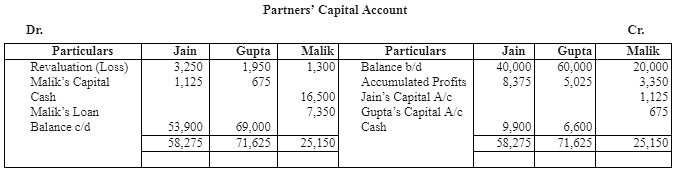

Q12: Following is the Balance Sheet of Jain, Gupta and Malik as on March 31, 2020.

The partners have been sharing profits in the ratio of 5:3:2. Malik decides to retire from business on April 1, 2020 and his share in the business is to be calculated as per the following terms of revaluation of assets and liabilities : Stock, Rs.20,000; Office furniture, Rs.14,250; Plant and Machinery Rs.23,530; Land and Building Rs.20,000.

A provision of Rs.1,700 to be created for doubtful debts. The goodwill of the firm is valued at Rs.9,000.

The continuing partners agreed to pay Rs.16,500 as cash on retirement of Malik, to be contributed by continuing partners in the ratio of 3:2. The balance in the capital account of Malik will be treated as loan.

Prepare Revaluation account, capital accounts, and Balance Sheet of the reconstituted firm.

Ans:

Working Note:

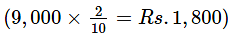

(1) Malik’s share of goodwill = Total Goodwill × Retiring Partner Share =

(2) Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio between Jain and Gupta = 10:6 or 5:3

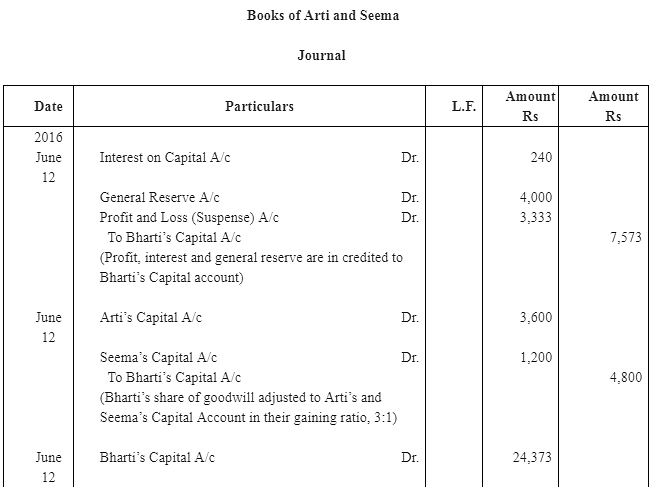

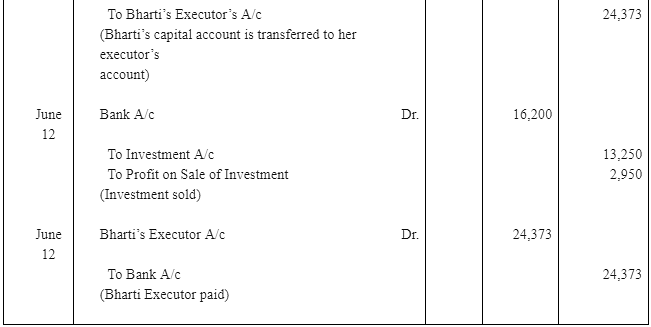

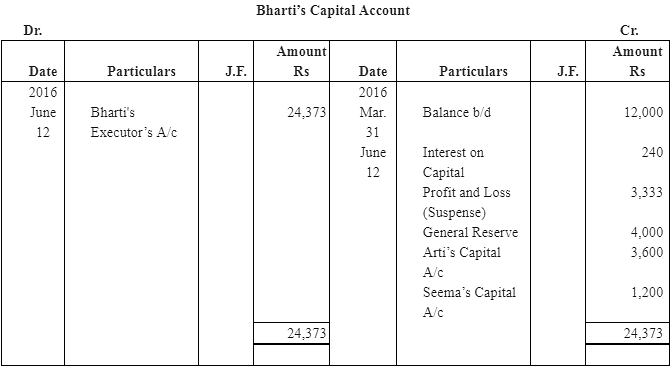

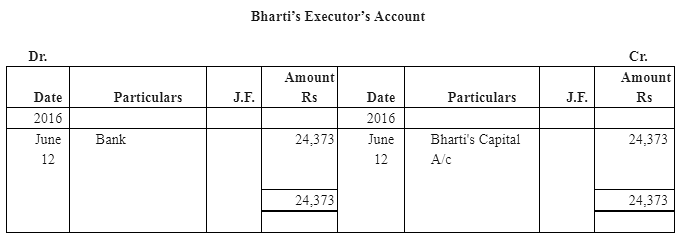

Q13 : Arti, Bharti and Seema are partners sharing profits in the proportion of 3:2:1 and their Balance Sheet as on March 31, 2020 stood as follows :

Bharti died on June 12, 2020 and according to the deed of the said partnership, her executors are entitled to be paid as under :

(a) The capital to her credit at the time of her death and interest thereon @ 10% per annum.

(b) Her proportionate share of reserve fund.

(c) Her share of profits for the intervening period will be based on the sales during that period, which were calculated as Rs.1,00,000. The rate of profit during past three years had been 10% on sales.

(d) Goodwill according to her share of profit to be calculated by taking twice the amount of the average profit of the last three years less 20%. The profits of the previous years were :

2017 – Rs.8,200

2018 – Rs.9,000

2019 – Rs.9,800

The investments were sold for Rs.16,200 and her executors were paid out. Pass the necessary journal entries and write the account of the executors of Bharti.

Ans:

Working Notes:

Working Notes:

1. Bharti’s share of profit = Profit is 10% of sales

Sales during the last year for that period were Rs 1,00,000

If sales are Rs 1,00,000, then the profit is Rs 10,000

2. Bharti’s Share of Goodwill

Goodwill of the firm = Average Profit × Number of Years Purchase

Or, 9,000 − 20% of 9,000 = 9,000 − 1,800 = Rs 7,200

Goodwill of the firm = 7,200 × 2 = Rs 14,400

3. Gaining Ratio = New Ratio − Old Ratio

Gaining ratio between Arti and Seema = 3:1

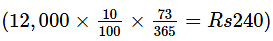

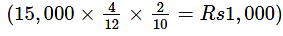

4. Interest on Capital for 73 days, i.e. from April 1, 2003 to June 12, 2003

Interest on capital = Amount of Capital × Ratio of Interest × Period =

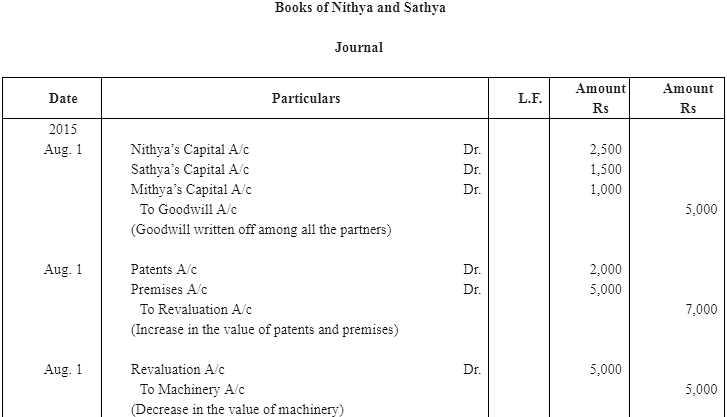

Q14: Nithya, Sathya and Mithya were partners sharing profits and losses in the ratio of 5:3:2. Their Balance Sheet as on March 31, 2020 was as follows :

Mithya dies on August 1, 2020. The agreement between the executors of Mithya and the partners stated that :

(a) Goodwill of the firm be valued at  times the average profits of last four years. The profits of four years were : in 2016-17, Rs.13,000; in 2017-18, Rs.12,000; in 2018-19, Rs.16,000; and in 2014-15, Rs.15,000.

times the average profits of last four years. The profits of four years were : in 2016-17, Rs.13,000; in 2017-18, Rs.12,000; in 2018-19, Rs.16,000; and in 2014-15, Rs.15,000.

(b) The patents are to be valued at Rs.8,000, Machinery at Rs.25,000 and Premises at Rs.25,000.

(c) The share of profit of Mithya should be calculated on the basis of the profit of 2019-20.

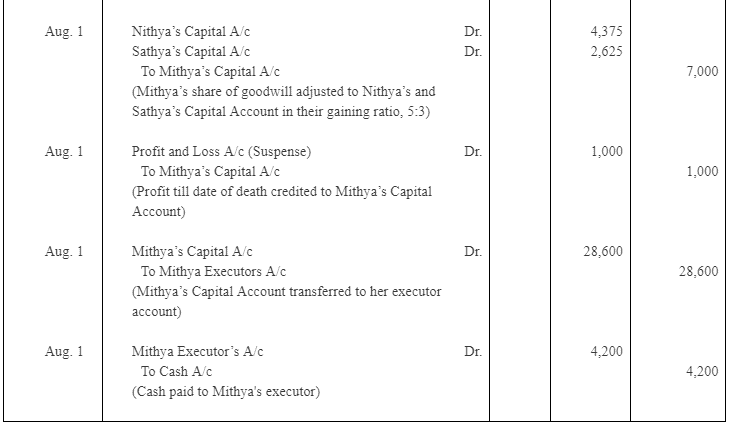

(d) Rs.4,200 should be paid immediately and the balance should be paid in 4 equal half-yearly instalments carrying interest @ 10%.

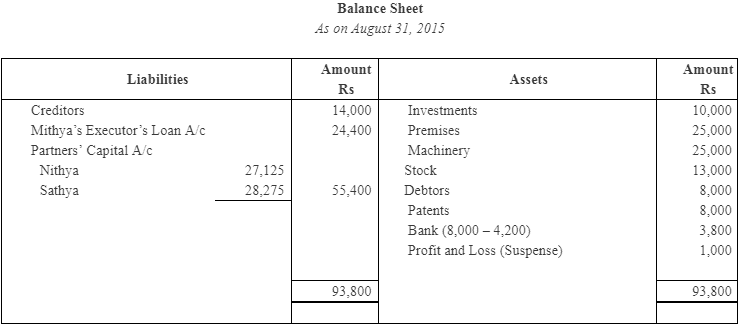

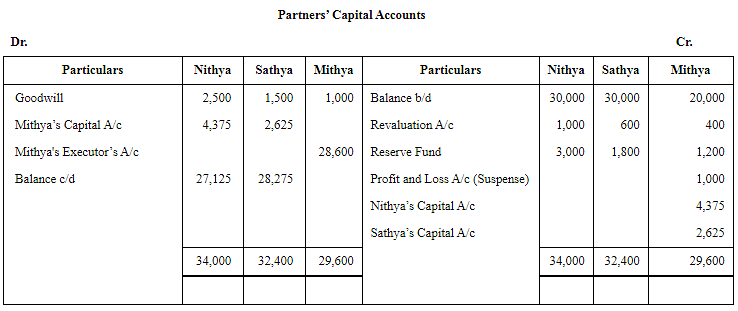

Record the necessary journal entries to give effect to the above and write the executor’s account till the amount is fully paid. Also prepare the Balance Sheet of Nithya and Sathya as it would appear on August 1, 2020 after giving effect to the adjustments.

Ans:

Working Notes:

1.

2. Mithya’s Share of Profit:

Previous year’s profit × Proportionate Period × Share of Profit =

3. Mithya’s share of Goodwill

Goodwill of a firm = Average Profit × Number of Year’s Purchase

4. Gaining Ratio = New Ratio – Old Ratio

Gaining Ratio between Nithya and Sathya = 5:3

|

42 videos|168 docs|43 tests

|

FAQs on NCERT Solution - Reconstitution - Retirement/Death of a Partner - Accountancy Class 12 - Commerce

| 1. What is the process of reconstitution of a partnership after the retirement of a partner? |  |

| 2. How is the goodwill of a partnership calculated at the time of a partner's retirement? |  |

| 3. What are the accounting entries required for the retirement of a partner? |  |

| 4. What happens to the partnership's liabilities when a partner retires? |  |

| 5. How does the death of a partner affect the partnership? |  |

|

Explore Courses for Commerce exam

|

|