NABARD Practice Test - 8 - Banking Exams MCQ

30 Questions MCQ Test - NABARD Practice Test - 8

Study the following information carefully and answer the questions given below:

‘A – B’ means “A is father of B”.

‘A % B’ means “A is sister of B”.

‘A x B’ means “A is mother of B”.

‘A + B’ means “A is brother of B”.

.Q. Which of the following expression represents “B is aunt of D?

Study the following information carefully and answer the questions given below:

‘A – B’ means “A is father of B”.

‘A % B’ means “A is sister of B”.

‘A x B’ means “A is mother of B”.

‘A + B’ means “A is brother of B”.

Q. How is S related to Q in the expression “P – Q % R X S?

| 1 Crore+ students have signed up on EduRev. Have you? Download the App |

Directions

Study the following information carefully and answer the questions given below:

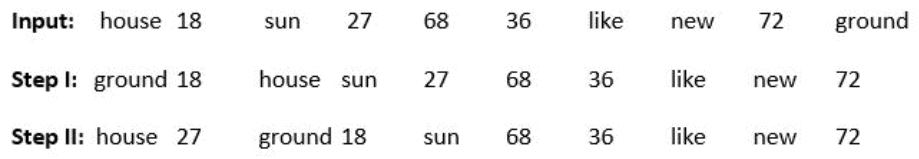

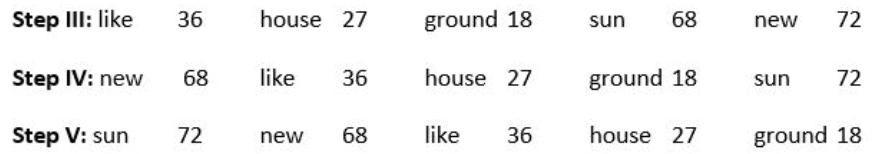

A word and number arrangement machine when given an input line of words and numbers rearranges them following a particular rule in each step. The following is an illustration of input and rearrangement. (All numbers are two-digit numbers).

And step V is the last step of the above input. As per the rules followed in the above steps, find out in each of the following questions, the appropriate step for the given input.

Input: 75 centre 22 32 tall person equal 42 50 hope wave 26

Q. What is the position of ‘ person’ in step IV?

Directions

Study the following information carefully and answer the questions given below:

A word and number arrangement machine when given an input line of words and numbers rearranges them following a particular rule in each step. The following is an illustration of input and rearrangement. (All numbers are two-digit numbers).

And step V is the last step of the above input. As per the rules followed in the above steps, find out in each of the following questions, the appropriate step for the given input.

Input: 75 centre 22 32 tall person equal 42 50 hope wave 26

Q. Which step would be the following output?

Tall 50 person 42 hope 32 equal 26 centre 22 75 wave

Directions

Study the following information carefully and answer the questions given below:

A word and number arrangement machine when given an input line of words and numbers rearranges them following a particular rule in each step. The following is an illustration of input and rearrangement. (All numbers are two-digit numbers).

And step V is the last step of the above input. As per the rules followed in the above steps, find out in each of the following questions, the appropriate step for the given input.

Input: 75 centre 22 32 tall person equal 42 50 hope wave 26

Q. How many steps will be required to complete the arrangement?

Directions

In each of the questions below are given three statements followed by three conclusions numbered I, II and III. You have to take the given statements to be true even if they seem to be at variance with commonly known facts. Read all the conclusions and then decide which of given conclusions logically follows from the given statements disregarding commonly known facts.

Statements: All bold are cowards.

No bold is a tall.

Some tall are short.

Conclusions: I. Some cowards are not tall.

II. All tall are not bold.

III. At least some short are not bold.

Directions

In each of the questions below are given three statements followed by three conclusions numbered I, II and III. You have to take the given statements to be true even if they seem to be at variance with commonly known facts. Read all the conclusions and then decide which of given conclusions logically follows from the given statements disregarding commonly known facts.

Statements: All rollers are coasters.

Some swings are rollers.

All bridges are swings.

. Conclusions: I. All coasters being swings is a possibility.

II. Some swings are not bridges.

III. At least some rollers are definitely swings.

Directions

In each of the questions below are given three statements followed by three conclusions numbered I, II and III. You have to take the given statements to be true even if they seem to be at variance with commonly known facts. Read all the conclusions and then decide which of given conclusions logically follows from the given statements disregarding commonly known facts.

Statements: All books are pages.

Some notes are books.

All assignments are notes.

. Conclusions: I. At least some pages are not books.

II. All assignments are pages.

III. No assignment is a book.

Directions

Study the following information carefully and answer the questions given below:

In a certain language ‘people are in taking’ is written as ‘pa na sa lo’, ‘fitness in levels taking' is written as’pi re na pa’, ‘people fitness up notch’ is written as ‘pi co lo qa’, and ‘notch the taking with’ is written as ‘qa pa ki fe’.

Q. How is ‘taking’ written in that code language?

Directions

Study the following information carefully and answer the questions given below:

In a certain language ‘people are in taking’ is written as ‘pa na sa lo’, ‘fitness in levels taking' is written as’pi re na pa’, ‘people fitness up notch’ is written as ‘pi co lo qa’, and ‘notch the taking with’ is written as ‘qa pa ki fe’.

Q. What does ‘lo’ stand for in the given code language?

Directions

Study the following information carefully and answer the questions given below:

In a certain language ‘people are in taking’ is written as ‘pa na sa lo’, ‘fitness in levels taking' is written as’pi re na pa’, ‘people fitness up notch’ is written as ‘pi co lo qa’, and ‘notch the taking with’ is written as ‘qa pa ki fe’.

Q. What may be the possible code for ‘levels the with’ in the given code language?

Directions

Study the following information carefully and answer the given questions.

P, Q, R, S, T, U, V, and W are eight friends who live in eight storey building. The ground floor is numbered one and the topmost floor is numbered eight. Each of them likes different flowers, viz. Rose, Lily, Lotus, Hibiscus, Sunflower, Jasmine, Marigold and Daisy but not necessarily in the same order.

(i)There is only one floor between P and the one who likes Daisy.

(ii) The person who likes Daisy does not live on floor number 1.

(iii)S lives just below Q.

(iv)The one who likes Rose lives on an even-numbered floor and just above the floor who likes Sunflower.

(v)The person who likes Jasmine lives on an even numbered floor but not on the 8th floor.

(vi)Neither S nor W lives on first floor.

(vii)Only one person lives between the one who likes Marigold and S.

(viii)P lives on an odd numbered floor an T lives just above P.

(ix)Q lives on the fourth floor.

(x)Only two persons live between the person who likes Jasmine and P.

(xi)U lives just below the one who likes Sunflower.

(xii)S does not like neither Sunflower nor Daisy.

(xiii)The one who likes Lotus does not live on an odd numbered floor.

(xiv)V does not like Lily.

(xv)There are two floors between the floor on which W lives and the floor on which T lives.

(xvi)Only two persons live between the one who likes Hibiscus and the one who likes Lotus.

Q. Who among the following likes Lily?

Directions

Study the following information carefully and answer the given questions.

P, Q, R, S, T, U, V, and W are eight friends who live in eight storey building. The ground floor is numbered one and the topmost floor is numbered eight. Each of them likes different flowers, viz. Rose, Lily, Lotus, Hibiscus, Sunflower, Jasmine, Marigold and Daisy but not necessarily in the same order.

(i)There is only one floor between P and the one who likes Daisy.

(ii) The person who likes Daisy does not live on floor number 1.

(iii)S lives just below Q.

(iv)The one who likes Rose lives on an even-numbered floor and just above the floor who likes Sunflower.

(v)The person who likes Jasmine lives on an even numbered floor but not on the 8th floor.

(vi)Neither S nor W lives on first floor.

(vii)Only one person lives between the one who likes Marigold and S.

(viii)P lives on an odd numbered floor an T lives just above P.

(ix)Q lives on the fourth floor.

(x)Only two persons live between the person who likes Jasmine and P.

(xi)U lives just below the one who likes Sunflower.

(xii)S does not like neither Sunflower nor Daisy.

(xiii)The one who likes Lotus does not live on an odd numbered floor.

(xiv)V does not like Lily.

(xv)There are two floors between the floor on which W lives and the floor on which T lives.

(xvi)Only two persons live between the one who likes Hibiscus and the one who likes Lotus.

Q. How many people are there between T and Q?

Directions

Study the following information carefully and answer the given questions.

P, Q, R, S, T, U, V, and W are eight friends who live in eight storey building. The ground floor is numbered one and the topmost floor is numbered eight. Each of them likes different flowers, viz. Rose, Lily, Lotus, Hibiscus, Sunflower, Jasmine, Marigold and Daisy but not necessarily in the same order.

(i)There is only one floor between P and the one who likes Daisy.

(ii) The person who likes Daisy does not live on floor number 1.

(iii)S lives just below Q.

(iv)The one who likes Rose lives on an even-numbered floor and just above the floor who likes Sunflower.

(v)The person who likes Jasmine lives on an even numbered floor but not on the 8th floor.

(vi)Neither S nor W lives on first floor.

(vii)Only one person lives between the one who likes Marigold and S.

(viii)P lives on an odd numbered floor an T lives just above P.

(ix)Q lives on the fourth floor.

(x)Only two persons live between the person who likes Jasmine and P.

(xi)U lives just below the one who likes Sunflower.

(xii)S does not like neither Sunflower nor Daisy.

(xiii)The one who likes Lotus does not live on an odd numbered floor.

(xiv)V does not like Lily.

(xv)There are two floors between the floor on which W lives and the floor on which T lives.

(xvi)Only two persons live between the one who likes Hibiscus and the one who likes Lotus.

Q. Who among the following lives on the top most floor

Directions

Study the following information carefully and answer the given questions.

P, Q, R, S, T, U, V, and W are eight friends who live in eight storey building. The ground floor is numbered one and the topmost floor is numbered eight. Each of them likes different flowers, viz. Rose, Lily, Lotus, Hibiscus, Sunflower, Jasmine, Marigold and Daisy but not necessarily in the same order.

(i)There is only one floor between P and the one who likes Daisy.

(ii) The person who likes Daisy does not live on floor number 1.

(iii)S lives just below Q.

(iv)The one who likes Rose lives on an even-numbered floor and just above the floor who likes Sunflower.

(v)The person who likes Jasmine lives on an even numbered floor but not on the 8th floor.

(vi)Neither S nor W lives on first floor.

(vii)Only one person lives between the one who likes Marigold and S.

(viii)P lives on an odd numbered floor an T lives just above P.

(ix)Q lives on the fourth floor.

(x)Only two persons live between the person who likes Jasmine and P.

(xi)U lives just below the one who likes Sunflower.

(xii)S does not like neither Sunflower nor Daisy.

(xiii)The one who likes Lotus does not live on an odd numbered floor.

(xiv)V does not like Lily.

(xv)There are two floors between the floor on which W lives and the floor on which T lives.

(xvi)Only two persons live between the one who likes Hibiscus and the one who likes Lotus.

Q. Which of the following combination is/are true?

Directions

Study the following information carefully and answer the questions given below:

A, B, C, D, E, F, G and H are eight friends sitting around a circular table. Six of them are facing the centre. All of them speak different language, viz. English, Hindi, Marathi, Telugu, Tamil, Malayalam, Bengali and Sanskrit.

G is third to the right of A and speaks English. D is third to the left of A. D and G are neighbours of B, who speaks Tamil. The one who speaks Telugu sits on the immediate right of B. H is third to the right of E and speaks Bengali. A and H are not neighbors of the person who speaks Malayalam. F does not speak Marathi or Telugu. The person who speaks Sanskrit is sitting opposite to E. C is an immediate neighbour of D. The person who is opposite B is facing outward and B is the immediate neighbor of the person who speaks Telugu.

Q. Who among the following speaks Malyalam?

Directions

Study the following information carefully and answer the questions given below:

A, B, C, D, E, F, G and H are eight friends sitting around a circular table. Six of them are facing the centre. All of them speak different language, viz. English, Hindi, Marathi, Telugu, Tamil, Malayalam, Bengali and Sanskrit.

G is third to the right of A and speaks English. D is third to the left of A. D and G are neighbours of B, who speaks Tamil. The one who speaks Telugu sits on the immediate right of B. H is third to the right of E and speaks Bengali. A and H are not neighbors of the person who speaks Malayalam. F does not speak Marathi or Telugu. The person who speaks Sanskrit is sitting opposite to E. C is an immediate neighbour of D. The person who is opposite B is facing outward and B is the immediate neighbor of the person who speaks Telugu.

Q. How many persons are there between C and the person who speaks Hindi(Counting clockwise direction starting from C)?

Directions

Study the following information carefully and answer the questions given below:

A, B, C, D, E, F, G and H are eight friends sitting around a circular table. Six of them are facing the centre. All of them speak different language, viz. English, Hindi, Marathi, Telugu, Tamil, Malayalam, Bengali and Sanskrit.

G is third to the right of A and speaks English. D is third to the left of A. D and G are neighbours of B, who speaks Tamil. The one who speaks Telugu sits on the immediate right of B. H is third to the right of E and speaks Bengali. A and H are not neighbors of the person who speaks Malayalam. F does not speak Marathi or Telugu. The person who speaks Sanskrit is sitting opposite to E. C is an immediate neighbour of D. The person who is opposite B is facing outward and B is the immediate neighbor of the person who speaks Telugu.

Q. The person who is sitting to the right of B speaks which of the following language?

Directions

Study the following information carefully and answer the questions given below:

A, B, C, D, E, F, G and H are eight friends sitting around a circular table. Six of them are facing the centre. All of them speak different language, viz. English, Hindi, Marathi, Telugu, Tamil, Malayalam, Bengali and Sanskrit.

G is third to the right of A and speaks English. D is third to the left of A. D and G are neighbours of B, who speaks Tamil. The one who speaks Telugu sits on the immediate right of B. H is third to the right of E and speaks Bengali. A and H are not neighbors of the person who speaks Malayalam. F does not speak Marathi or Telugu. The person who speaks Sanskrit is sitting opposite to E. C is an immediate neighbour of D. The person who is opposite B is facing outward and B is the immediate neighbor of the person who speaks Telugu.

Q. What is the position of E with respect to D?

Directions

Study the following information carefully and answer the questions given below:

A, B, C, D, E, F, G and H are eight friends sitting around a circular table. Six of them are facing the centre. All of them speak different language, viz. English, Hindi, Marathi, Telugu, Tamil, Malayalam, Bengali and Sanskrit.

G is third to the right of A and speaks English. D is third to the left of A. D and G are neighbours of B, who speaks Tamil. The one who speaks Telugu sits on the immediate right of B. H is third to the right of E and speaks Bengali. A and H are not neighbors of the person who speaks Malayalam. F does not speak Marathi or Telugu. The person who speaks Sanskrit is sitting opposite to E. C is an immediate neighbour of D. The person who is opposite B is facing outward and B is the immediate neighbor of the person who speaks Telugu.

Q. Which of the following statement is true?

Directions

Read the passage given below and answer the questions that follow based on it.

Can the selling price rise when a market is over-supplied and demand is dull? Economics tells us that it can’t, but the Indian housing market seems to be defying this rule. Earlier this month, the Ministry of Housing flagged off a new index — the NHB Residex — designed to track housing price trends in 50 cities across India. Releasing the data, the Ministry claimed that the new index offered proof that demonetisation hadn’t dealt a big blow to the housing market.

Trends in the Residex certainly support this claim. According to lenders’ data compiled by the NHB Residex, as many as 32 of the 50 cities tracked registered rising housing prices and 13 recorded stable trends, in the twelve months to March 2017. Only 5 cities saw declines. Large markets also exhibited very positive long-term trends. The Residex noted a 44% rise in home prices in Pune, 41% in Mumbai, 37% in Bengaluru and 33% in Chennai, from FY13 to the first quarter of FY17.

But this trend of resilient prices sits rather oddly with the tales of woe about the residential market doing the rounds in the last couple of years, which talk of slower sales and a stockpile of unsold homes.

The year 2016-17 saw a perfect storm of events come together to dampen demand for housing in India. First came demonetisation and the resulting purge of the cash component in real estate transactions. Then the Budget delivered a rude shock by capping the tax break from ‘loss on house property’ at ₹2 lakh a year, for second and subsequent homes. This effectively put paid to the ‘investment’ buying of homes, a key source of housing demand in Tier 1 cities. Cloudy job prospects, stingy increments and layoffs for the IT sector dampened purchases by this crucial segment too. The last nail in the coffin was the enactment of RERA (Real Estate Regulation Act) on May 1. The new law, which forces developers to segregate buyer advances and deploy it only in specific projects, was expected to result in a working capital crunch for developers. The industry was in go-slow mode in the run up to this event. Reports show that these events did, in fact, shake up the housing market. Consulting firm Knight Frank India noted in a recent review that the sales of residential homes in the top eight cities fell by a precipitous 48% in the second half of 2016, compared with the previous year. In January-June 2017, they climbed from that abyss, but home sales in these cities were still 11% below 2016 levels.

Q. What is meaning of the phrase ‘flagged off’ as used in the above passage?

Directions

Read the passage given below and answer the questions that follow based on it.

Can the selling price rise when a market is over-supplied and demand is dull? Economics tells us that it can’t, but the Indian housing market seems to be defying this rule. Earlier this month, the Ministry of Housing flagged off a new index — the NHB Residex — designed to track housing price trends in 50 cities across India. Releasing the data, the Ministry claimed that the new index offered proof that demonetisation hadn’t dealt a big blow to the housing market.

Trends in the Residex certainly support this claim. According to lenders’ data compiled by the NHB Residex, as many as 32 of the 50 cities tracked registered rising housing prices and 13 recorded stable trends, in the twelve months to March 2017. Only 5 cities saw declines. Large markets also exhibited very positive long-term trends. The Residex noted a 44% rise in home prices in Pune, 41% in Mumbai, 37% in Bengaluru and 33% in Chennai, from FY13 to the first quarter of FY17.

But this trend of resilient prices sits rather oddly with the tales of woe about the residential market doing the rounds in the last couple of years, which talk of slower sales and a stockpile of unsold homes.

The year 2016-17 saw a perfect storm of events come together to dampen demand for housing in India. First came demonetisation and the resulting purge of the cash component in real estate transactions. Then the Budget delivered a rude shock by capping the tax break from ‘loss on house property’ at ₹2 lakh a year, for second and subsequent homes. This effectively put paid to the ‘investment’ buying of homes, a key source of housing demand in Tier 1 cities. Cloudy job prospects, stingy increments and layoffs for the IT sector dampened purchases by this crucial segment too. The last nail in the coffin was the enactment of RERA (Real Estate Regulation Act) on May 1. The new law, which forces developers to segregate buyer advances and deploy it only in specific projects, was expected to result in a working capital crunch for developers. The industry was in go-slow mode in the run up to this event. Reports show that these events did, in fact, shake up the housing market. Consulting firm Knight Frank India noted in a recent review that the sales of residential homes in the top eight cities fell by a precipitous 48% in the second half of 2016, compared with the previous year. In January-June 2017, they climbed from that abyss, but home sales in these cities were still 11% below 2016 levels.

Q. What is the use of NHB Residex?

Directions

Read the passage given below and answer the questions that follow based on it.

Can the selling price rise when a market is over-supplied and demand is dull? Economics tells us that it can’t, but the Indian housing market seems to be defying this rule. Earlier this month, the Ministry of Housing flagged off a new index — the NHB Residex — designed to track housing price trends in 50 cities across India. Releasing the data, the Ministry claimed that the new index offered proof that demonetisation hadn’t dealt a big blow to the housing market.

Trends in the Residex certainly support this claim. According to lenders’ data compiled by the NHB Residex, as many as 32 of the 50 cities tracked registered rising housing prices and 13 recorded stable trends, in the twelve months to March 2017. Only 5 cities saw declines. Large markets also exhibited very positive long-term trends. The Residex noted a 44% rise in home prices in Pune, 41% in Mumbai, 37% in Bengaluru and 33% in Chennai, from FY13 to the first quarter of FY17.

But this trend of resilient prices sits rather oddly with the tales of woe about the residential market doing the rounds in the last couple of years, which talk of slower sales and a stockpile of unsold homes.

The year 2016-17 saw a perfect storm of events come together to dampen demand for housing in India. First came demonetisation and the resulting purge of the cash component in real estate transactions. Then the Budget delivered a rude shock by capping the tax break from ‘loss on house property’ at ₹2 lakh a year, for second and subsequent homes. This effectively put paid to the ‘investment’ buying of homes, a key source of housing demand in Tier 1 cities. Cloudy job prospects, stingy increments and layoffs for the IT sector dampened purchases by this crucial segment too. The last nail in the coffin was the enactment of RERA (Real Estate Regulation Act) on May 1. The new law, which forces developers to segregate buyer advances and deploy it only in specific projects, was expected to result in a working capital crunch for developers. The industry was in go-slow mode in the run up to this event. Reports show that these events did, in fact, shake up the housing market. Consulting firm Knight Frank India noted in a recent review that the sales of residential homes in the top eight cities fell by a precipitous 48% in the second half of 2016, compared with the previous year. In January-June 2017, they climbed from that abyss, but home sales in these cities were still 11% below 2016 levels.

Q. What is the meaning of the phrase “The last nail in the coffin”?

Directions

Read the passage given below and answer the questions that follow based on it.

Can the selling price rise when a market is over-supplied and demand is dull? Economics tells us that it can’t, but the Indian housing market seems to be defying this rule. Earlier this month, the Ministry of Housing flagged off a new index — the NHB Residex — designed to track housing price trends in 50 cities across India. Releasing the data, the Ministry claimed that the new index offered proof that demonetisation hadn’t dealt a big blow to the housing market.

Trends in the Residex certainly support this claim. According to lenders’ data compiled by the NHB Residex, as many as 32 of the 50 cities tracked registered rising housing prices and 13 recorded stable trends, in the twelve months to March 2017. Only 5 cities saw declines. Large markets also exhibited very positive long-term trends. The Residex noted a 44% rise in home prices in Pune, 41% in Mumbai, 37% in Bengaluru and 33% in Chennai, from FY13 to the first quarter of FY17.

But this trend of resilient prices sits rather oddly with the tales of woe about the residential market doing the rounds in the last couple of years, which talk of slower sales and a stockpile of unsold homes.

The year 2016-17 saw a perfect storm of events come together to dampen demand for housing in India. First came demonetisation and the resulting purge of the cash component in real estate transactions. Then the Budget delivered a rude shock by capping the tax break from ‘loss on house property’ at ₹2 lakh a year, for second and subsequent homes. This effectively put paid to the ‘investment’ buying of homes, a key source of housing demand in Tier 1 cities. Cloudy job prospects, stingy increments and layoffs for the IT sector dampened purchases by this crucial segment too. The last nail in the coffin was the enactment of RERA (Real Estate Regulation Act) on May 1. The new law, which forces developers to segregate buyer advances and deploy it only in specific projects, was expected to result in a working capital crunch for developers. The industry was in go-slow mode in the run up to this event. Reports show that these events did, in fact, shake up the housing market. Consulting firm Knight Frank India noted in a recent review that the sales of residential homes in the top eight cities fell by a precipitous 48% in the second half of 2016, compared with the previous year. In January-June 2017, they climbed from that abyss, but home sales in these cities were still 11% below 2016 levels.

Q. Which of the following events, according to the passage, are responsible for the dampened demand of housing in India?

Directions

Read the passage given below and answer the questions that follow based on it.

Can the selling price rise when a market is over-supplied and demand is dull? Economics tells us that it can’t, but the Indian housing market seems to be defying this rule. Earlier this month, the Ministry of Housing flagged off a new index — the NHB Residex — designed to track housing price trends in 50 cities across India. Releasing the data, the Ministry claimed that the new index offered proof that demonetisation hadn’t dealt a big blow to the housing market.

Trends in the Residex certainly support this claim. According to lenders’ data compiled by the NHB Residex, as many as 32 of the 50 cities tracked registered rising housing prices and 13 recorded stable trends, in the twelve months to March 2017. Only 5 cities saw declines. Large markets also exhibited very positive long-term trends. The Residex noted a 44% rise in home prices in Pune, 41% in Mumbai, 37% in Bengaluru and 33% in Chennai, from FY13 to the first quarter of FY17.

But this trend of resilient prices sits rather oddly with the tales of woe about the residential market doing the rounds in the last couple of years, which talk of slower sales and a stockpile of unsold homes.

The year 2016-17 saw a perfect storm of events come together to dampen demand for housing in India. First came demonetisation and the resulting purge of the cash component in real estate transactions. Then the Budget delivered a rude shock by capping the tax break from ‘loss on house property’ at ₹2 lakh a year, for second and subsequent homes. This effectively put paid to the ‘investment’ buying of homes, a key source of housing demand in Tier 1 cities. Cloudy job prospects, stingy increments and layoffs for the IT sector dampened purchases by this crucial segment too. The last nail in the coffin was the enactment of RERA (Real Estate Regulation Act) on May 1. The new law, which forces developers to segregate buyer advances and deploy it only in specific projects, was expected to result in a working capital crunch for developers. The industry was in go-slow mode in the run up to this event. Reports show that these events did, in fact, shake up the housing market. Consulting firm Knight Frank India noted in a recent review that the sales of residential homes in the top eight cities fell by a precipitous 48% in the second half of 2016, compared with the previous year. In January-June 2017, they climbed from that abyss, but home sales in these cities were still 11% below 2016 levels.

Q. Choose the word which is most similar in meaning to the word abyss as used in passage.

Directions

Read the passage given below and answer the questions that follow based on it.

Can the selling price rise when a market is over-supplied and demand is dull? Economics tells us that it can’t, but the Indian housing market seems to be defying this rule. Earlier this month, the Ministry of Housing flagged off a new index — the NHB Residex — designed to track housing price trends in 50 cities across India. Releasing the data, the Ministry claimed that the new index offered proof that demonetisation hadn’t dealt a big blow to the housing market.

Trends in the Residex certainly support this claim. According to lenders’ data compiled by the NHB Residex, as many as 32 of the 50 cities tracked registered rising housing prices and 13 recorded stable trends, in the twelve months to March 2017. Only 5 cities saw declines. Large markets also exhibited very positive long-term trends. The Residex noted a 44% rise in home prices in Pune, 41% in Mumbai, 37% in Bengaluru and 33% in Chennai, from FY13 to the first quarter of FY17.

But this trend of resilient prices sits rather oddly with the tales of woe about the residential market doing the rounds in the last couple of years, which talk of slower sales and a stockpile of unsold homes.

The year 2016-17 saw a perfect storm of events come together to dampen demand for housing in India. First came demonetisation and the resulting purge of the cash component in real estate transactions. Then the Budget delivered a rude shock by capping the tax break from ‘loss on house property’ at ₹2 lakh a year, for second and subsequent homes. This effectively put paid to the ‘investment’ buying of homes, a key source of housing demand in Tier 1 cities. Cloudy job prospects, stingy increments and layoffs for the IT sector dampened purchases by this crucial segment too. The last nail in the coffin was the enactment of RERA (Real Estate Regulation Act) on May 1. The new law, which forces developers to segregate buyer advances and deploy it only in specific projects, was expected to result in a working capital crunch for developers. The industry was in go-slow mode in the run up to this event. Reports show that these events did, in fact, shake up the housing market. Consulting firm Knight Frank India noted in a recent review that the sales of residential homes in the top eight cities fell by a precipitous 48% in the second half of 2016, compared with the previous year. In January-June 2017, they climbed from that abyss, but home sales in these cities were still 11% below 2016 levels.

Q. Choose the word which is most similar in meaning to the word compiled as used in passage.

Directions

Read the passage given below and answer the questions that follow based on it.

Can the selling price rise when a market is over-supplied and demand is dull? Economics tells us that it can’t, but the Indian housing market seems to be defying this rule. Earlier this month, the Ministry of Housing flagged off a new index — the NHB Residex — designed to track housing price trends in 50 cities across India. Releasing the data, the Ministry claimed that the new index offered proof that demonetisation hadn’t dealt a big blow to the housing market.

Trends in the Residex certainly support this claim. According to lenders’ data compiled by the NHB Residex, as many as 32 of the 50 cities tracked registered rising housing prices and 13 recorded stable trends, in the twelve months to March 2017. Only 5 cities saw declines. Large markets also exhibited very positive long-term trends. The Residex noted a 44% rise in home prices in Pune, 41% in Mumbai, 37% in Bengaluru and 33% in Chennai, from FY13 to the first quarter of FY17.

But this trend of resilient prices sits rather oddly with the tales of woe about the residential market doing the rounds in the last couple of years, which talk of slower sales and a stockpile of unsold homes.

The year 2016-17 saw a perfect storm of events come together to dampen demand for housing in India. First came demonetisation and the resulting purge of the cash component in real estate transactions. Then the Budget delivered a rude shock by capping the tax break from ‘loss on house property’ at ₹2 lakh a year, for second and subsequent homes. This effectively put paid to the ‘investment’ buying of homes, a key source of housing demand in Tier 1 cities. Cloudy job prospects, stingy increments and layoffs for the IT sector dampened purchases by this crucial segment too. The last nail in the coffin was the enactment of RERA (Real Estate Regulation Act) on May 1. The new law, which forces developers to segregate buyer advances and deploy it only in specific projects, was expected to result in a working capital crunch for developers. The industry was in go-slow mode in the run up to this event. Reports show that these events did, in fact, shake up the housing market. Consulting firm Knight Frank India noted in a recent review that the sales of residential homes in the top eight cities fell by a precipitous 48% in the second half of 2016, compared with the previous year. In January-June 2017, they climbed from that abyss, but home sales in these cities were still 11% below 2016 levels.

Q. Choose the word which is most opposite in meaning to the word segregate as used in passage.

Directions

One word is followed by five options. Select the option which seems nearest in meaning to the word mentioned in the question on the top. If none of the words seem close in meaning to the word, mark none of these as the answer.q

IMPLEMENT

Directions

One word is followed by five options. Select the option which seems nearest in meaning to the word mentioned in the question on the top. If none of the words seem close in meaning to the word, mark none of these as the answer.

DISPENSE

Directions

One word is followed by five options. Select the option which seems nearest in meaning to the word mentioned in the question on the top. If none of the words seem close in meaning to the word, mark none of these as the answer.

BACKFIRE